What we’re reading (7/12)

“Euro Buyers Fend Off Dollar Parity In Last-Gasp Defense” (Bloomberg). “Traders mounted a last-ditch push on Tuesday to stop those options contracts from triggering after the shared currency slid to within a whisker of a pure one-for-one rate. It’s a border that could quickly collapse if fresh concern over Russian natural-gas supplies or signs of a relatively more hawkish Federal Reserve drive the euro lower.”

“Founders Of Bankrupt Crypto Hedge Fund 3AC Go Missing, As Investors Try To Recoup Assets” (CNBC). “Lawyers representing the creditors say the physical whereabouts of Zhu Su and Kyle Davies, who started Three Arrows in 2012, are “currently unknown”…[t]he documents, filed Friday evening, also allege that the founders have not yet begun to cooperate with the liquidation process ‘in any meaningful manner.’ On Monday, lawyers requested the court keep the identity of the creditors anonymous.”

“Amid All The Uncertainty, Can You Blame Millennials For Embracing ‘Meme’ Stocks?” (Real Clear Markets). “Millennials are the first generation to have less wealth than the previous generation, a fact that does not bode well for an economic model dependent on consumption growth. Contrary to previous generations, they cannot just save and invest as wage growth has not kept up with inflation.”

“Are Cryptocurrencies On Their Last Legs? Hedge Fund Managers Certainly Don’t Think So.” (Institutional Investor). “Thirty-two percent of hedge fund managers think that digital assets will offer the largest alpha-generating opportunity over the next three years, topping equities (18 percent) and fixed income (15 percent), according to the latest report from SigTech, a quantitative technologies provider. Twenty-three percent of hedge fund managers plan to dramatically increase their allocations to digital assets, while 60 percent plan to increase slightly.”

“Advanced E.V. Batteries Move From Labs To Mass Production” (New York Times). “For years, scientists in laboratories from Silicon Valley to Boston have been searching for an elusive potion of chemicals, minerals and metals that would allow electric vehicles to recharge in minutes and travel hundreds of miles between charges, all for a much lower cost than batteries available now. Now a few of those scientists and the companies they founded are approaching a milestone.”

What we’re reading (7/11)

“U.S. Stocks End Lower Ahead Of Inflation Data, Earnings Season” (Wall Street Journal). “All three major indexes opened lower, regained some ground and then lost steam into the close. The S&P 500 fell 44.95 points, or 1.2%, to 3854.43. The blue-chip Dow Jones Industrial Average lost 164.31 points, or 0.5%, to finish at 31173.84. The Nasdaq Composite Index shed 262.71, or 2.3%, to 11372.60 as technology stocks lost ground.”

“US Job Market Provides Hopeful Signs Against Recession And Inflation, But Other Data Are Worrisome” (Jason Furman and Wilson Powell, The Peterson Institute). “The employment report strongly suggests that the economy was not in recession in the first half of 2022. At the same time, however, it provides only limited reassurance about the future because previous recessions were not always evident in the employment data several months prior to the peak.”

“Is South Florida's Housing Market Too Hot?” (Reason). “Already in 2019, some were sounding the alarm about Miami's rising housing prices. One study commissioned by the housing group Miami Houses for All in collaboration with city and county officials found that Miami was the third-most expensive metropolitan area in the entire country for housing costs. The same study found that over 50 percent of households in Miami were spending more than they could afford on rents and mortgage payments.”

“Homebuyers Are Canceling Deals At The Highest Rate Since The Start Of The Pandemic” (CNBC). “The share of sale agreements on existing homes canceled in June was just under 15% of all homes that went under contract, according to a new report from Redfin. That is the highest share since early 2020, when homebuying paused immediately, albeit briefly. Cancelations were at about 11% one year ago.”

“Is The Stock Market Slump A Buying Opportunity?” (Dealbreaker). “Savvy investors know that time after time, again and again, a bad stock market inevitably turns itself around and surges back into the black. When that will happen is anyone’s guess. It could be coming faster than you might think though, especially if the Fed successfully engineers that soft landing they’ve been shooting for. When the stock market recovery does come, you definitely don’t want to be left behind. So, stick in there, stay with it, and try not to give in to all the economic gloom.”

What we’re reading (7/10)

“Twitter Didn’t Seek A Sale. Now Elon Musk Doesn’t Want To Buy. Cue Strange Legal Drama.” (Wall Street Journal). “Elon Musk’s showdown with Twitter Inc. has set the stage for what could become one of the most unusual courtroom battles in corporate-takeover history—a spurned acquisition target that never sought to be bought potentially trying to force the buyer who soured on the deal to see it through.”

“What’s Next In The Elon Musk-Twitter Saga? A Court Battle” (New York Times). “Now that Elon Musk has signaled his intent to walk away from his $44 billion offer to buy Twitter, the fate of the influential social media network will be determined by what may be an epic court battle, involving months of expensive litigation and high-stakes negotiations by elite lawyers on both sides.”

“Uber Broke Laws, Duped Police And Secretly Lobbied Governments, Leak Reveals” (The Guardian). “The unprecedented leak to the Guardian of more than 124,000 documents – known as the Uber files – lays bare the ethically questionable practices that fuelled the company’s transformation into one of Silicon Valley’s most famous exports.”

“How Many F-Bombs Trigger An R Rating? An Obscure Movie Industry Panel Decides” (CNBC). “How many F-bombs can a movie have before it’s rated R? That’s up to Kelly McMahon and a secretive panel of raters that is charged with dishing out the movie industry’s five all-important designations — G, PG, PG-13, R and the extremely rare NC-17. Though it toils in relative obscurity, the panel’s ratings for about 700 movies each year can help determine whether films are suitable for children and have a big impact on a movie’s box office performance.”

“The S&P 500 Will Eke Out A Small Gain This Year As The Index Recovers First Half Losses On The Back Of A Solid Economy, Oppenheimer Says” (Insider). “Oppenheimer this week slashed its outlook for the S&P 500, stating that the benchmark index will do worse than the firm had expected but will still jump 25% through the rest of the year to end 2022 with a small gain.”

What we’re reading (7/9)

“Twitter, Elon Musk Set For Unprecedented Legal Battle Over Deal Collapse” (Wall Street Journal). “With Elon Musk attempting to terminate his $44 billion takeover of Twitter Inc. and the company vowing to force him to follow through, the social-media powerhouse and the world’s richest person appear headed for a messy” courtroom battle. The company says it plans legal action and is any day expected to file a lawsuit in the Delaware Court of Chancery, arguing he is required to close the agreed-upon deal.”

“The Housing Market, At Last, Appears To Be Cooling Off” (Washington Post). “The slowdown has, so far, provided little relief to buyers. Instead, analysts say, a growing affordability crisis ― driven by the collision of inflation and rising interest rates ― is forcing many would-be buyers to walk away.”

“Big-Sounding Job Titles Are Feeding Egos In Tight Labor Market” (Bloomberg). “The tight US labor market isn’t just boosting wages, it’s also bidding up job descriptions. Once prevalent mostly with startups, job-title inflation has gone increasingly mainstream, said Shawn Cole, president of Cowen Partners, a nationwide executive search firm. It ‘exploded’ during the pandemic as companies competed for talent in the Covid-19 economy and more of them leveraged titles to entice experienced workers. ‘Entire careers of job titles are being condensed into a decade, 10 years worth of titles are being condensed into five, so new titles have had to be invented,’ Cole said. ‘Firms can only offer so much money.’”

“Tech Giants Like Meta And Snap Are Facing A ‘Perfect Storm’ Of Weak Growth Prospects That Could Lead To Limited Upside For Stocks Already Down More Than 50% This Year” (Insider). “‘We think this cocktail of events is likely to generate the lowest growth rate for the sector in years,’ Barclays said, adding that current valuations only partially reflect this scenario. Barclays expects 3% year-over-year growth for the industry this year.”

“US Will Plunge Into Recession — But It Didn’t Have To, Former IMF Chief Economist Says” (CNN Business). “It's ‘almost impossible’ for the Fed to tamp down inflation without tipping the US economy into a recession, says Former IMF Chief Economist Ken Rogoff. ‘[The Fed] would have to be very lucky,’ Rogoff told CNN's Christine Romans on Early Start. ‘They have to decide: Do they have to have inflation get down quickly, or are they going to throw us into a recession? I think they are saying that they will get inflation down. I think they will blink,’ Rogoff said he thinks the Fed will "blink" and slow down aggressive rate hikes.”

What we’re reading (7/8)

“Musk Backs Out Of $44 Billion Twitter Deal Over Bot Accounts” (Bloomberg). “Elon Musk is trying to end an agreement to buy Twitter Inc. for $44 billion and take it private, alleging that the company misrepresented user data and setting the stage for an arduous court brawl.”

“How The FBI Wiretapped The World” (Vice). “For years criminal organizations around the world were buying a special phone called Anom. The pitch was that it was completely anonymous and secure, a way for criminals to do business without authorities watching over their shoulder. It turned out that the whole thing was an elaborate honeypot and that the FBI and law enforcement agencies around the world were listening in. They’d help develop the phones themselves.”

“How Will We Know If We’re In A Recession?” (Vox). “By many measures, the economy still looks pretty resilient. In June, employers added a robust 372,000 jobs to the economy. Job openings have dipped slightly, but at 11.3 million, they still remain well above pre-pandemic levels. Wage growth continues to climb in certain sectors, and new jobless claims are low. The unemployment rate stands at 3.6 percent, just slightly above its level before the pandemic, which was at a 50-year low.”

“Start Investing Early And Stick With It, Especially When Stocks Fall” (New York Times). “Consider what would have happened if you had started to invest in the first commercially available stock index fund, the Vanguard 500 stock index fund, in July 1980. You would have experienced a nasty bear market that began in November 1980 and lasted until mid-August 1982. The S&P 500 index lost 27.1 percent in that stretch. You might have been tempted to sell all your shares and forget about stock investing entirely. But suppose that you had stuck with it, not only through that bear market but through the six others that followed over the next 40 years, including this one. According to FactSet, your initial investment would have grown 6,600 percent, including reinvested dividends.”

“Bankers Go Behind Closed Doors To Sell Junk Debt In Big Shake-Up” (Bloomberg Law). “Struggling to launch high-yield deals as recession fears swirl, investment bankers in Europe are conducting more business behind closed doors in order to sell big chunks of corporate debt in a market that’s increasingly closed.”

What we’re reading (7/7)

“Big Cities Can’t Get Workers Back To The Office” (Wall Street Journal). “The problem is most pronounced in America’s biggest cities. Nationally, office use hit a pandemic-era high of 44% in early June, while cities like Philadelphia, Chicago, San Francisco and New York have lagged behind, according to Kastle Systems, which collects data on how many workers swipe into office buildings each day.”

“Even Bosses Are Joining The Great Resignation” (Vox). “Data shows that managers are leaving their jobs at elevated levels, and that even though resignation rates for workers overall have declined from their peak, lots of people are still quitting their jobs. The breadth of quits could exacerbate an already tight labor market as quits in one area precipitate quits in another, and this cycle could ensure that the Great Resignation — also known as the Great Reshuffling or Great Reconsideration — won’t stop anytime soon.”

“The Big 4’s Tax Problem” (New York Times). “Regulators are turning up the heat on the Big 4, the largest accounting firms in the U.S. — Deloitte, PwC, EY and KPMG. Increasingly, their size and the variety of services they offer, like tax consulting, are raising questions about the independence of their audits and landing the firms in hot water, writes The Times’s Jesse Drucker.”

“Luxury Brand Tom Ford Hires Goldman Sachs To Explore Potential Sale” (Financial Post). “A deal could value the company at several billion dollars and may include an option that would give any new owner of Tom Ford the right to work with its founder after the sale, one of the people said.”

“Guy Who Policed Insider Trading Before Claiming Insider Trading Doesn’t Exist Pleads Guilty To Insider Trading” (Dealbreaker). “You might expect that enforcing a company’s insider-trading policies would give a person a pretty good insight into how one might evade them. And, to be fair to him, Gene Levoff did a pretty decent job: He managed to get away with it for five years, possibly because he aimed fairly low—earning just $220,000 and skirting just $377,000 in losses trading on tidbits he gleaned reviewing the company’s draft results—or possibly because as the person charged with holding Apple employees to the relevant blackout periods, he chose to exempt himself from scrutiny. But unfortunately for Levoff, he didn’t do quite as good a job as he undoubtedly hoped[.]”

What we’re reading (7/6)

“Inflation Fears Drove Larger Fed Rate Increase In June” (Wall Street Journal). “Since last month’s meeting several Fed bank presidents and governors have endorsed a 0.75-point rate rise this month. ‘We’re not getting traction on inflation in a way that I had hoped,’ said San Francisco Fed President Mary Daly in comments to reporters on June 24 explaining her support for the larger rate rise.”

“After Tough Second Quarter, U.S. Stocks Look Cheap” (Morningstar). “Based on a composite of the intrinsic valuation of all the stocks we cover that trade on U.S. exchanges, we calculate that the broad U.S. stock market is trading at a price/fair value of 0.83 times. Growth stocks are the most undervalued, trading at a price/fair value of 0.78, followed by the value category trading at 0.83. Core stocks are trading closer to fair value at 0.91 times.”

“The Stock Market Is Gearing Up For A Strong Recovery In The 2nd Half As ‘Transitory’ Inflation Begins To Cool, Fundstrat Says” (Insider). “Concerns of elevated inflation will likely abate over the coming months as surging prices prove to be more transitory than structural, according to Fundstrat's Tom Lee. That means the stock market is poised for a strong second half recovery, as lower inflation will give the Federal Reserve breathing room in its current interest rate hike cycle, Lee argued in a Wednesday note.”

“The Virtue Of Complexity In Return Prediction” (Bryan Kelly, Semyon Malamud, and Kangying Zhou, NBER Working Paper). “The extant literature predicts market returns with “simple” models that use only a few parameters. Contrary to conventional wisdom, we theoretically prove that simple models severely understate return predictability compared to “complex” models in which the number of parameters exceeds the number of observations. We empirically document the virtue of complexity in US equity market return prediction. Our findings establish the rationale for modeling expected returns through machine learning.”

“The Shift To Remote Work Lessens Wage-Growth Pressures” (Jose Maria Barrero, Nicholas Bloom, Steven Davis, Brent Myers, and Emil Mihaylov). “The recent shift to remote work raised the amenity value of employment. As compensation adjusts to share the amenity-value gains with employers, wage-growth pressures moderate. We find empirical support for this mechanism in the wage-setting behavior of U.S. employers, and we develop novel survey data to quantify its force. Our data imply a cumulative wage-growth moderation of 2.0 percentage points over two years.”

What we’re reading (7/5)

“Cryptoverse: The Bonfire Of The NFTs” (Reuters). “The market shone gloriously last year as crypto-rich speculators spent billions of dollars on the risky assets, pumping up prices and profits. Now, six months into 2022, it's looking ugly. Monthly sales volume on the largest NFT marketplace, OpenSea, plunged to $700 million in June, down from $2.6 billion in May and a far cry from January's peak of nearly $5 billion.”

“Crypto Crashed. Wall Street Won.” (DealBook). “Unlike in the 2008 crisis, the fortunes of Wall Street and Main Street have diverged. Plunging digital asset prices have left some retail investors with large losses. Lured by the promise of quick returns and astronomical wealth, many individuals bought new digital currencies or stakes in funds that held these assets. That’s not the case for most banks, which generally don’t own crypto or run funds that invest in it. Nor have they lent much into the emerging market for new money.”

“Euro Slides To 20-Year Low Against The Dollar As Recession Fears Build” (CNBC). “The euro fell to its lowest level in two decades on Tuesday as fears of a recession in the euro zone ramped up, with gas prices soaring and the Ukraine war showing no signs of abating. The euro shed around 1.3% for the session to hit $1.029 by mid-afternoon in Europe, having earlier been as low as $1.028.”

“Why Consumers’ Inflation Psychology Is Stoking Anxiety At The Fed” (Wall Street Journal). “Recessions are painful because millions of people lose their jobs. But central bankers, scarred by the experience of the 1970s, think high inflation is worse because it distorts economic behavior and is likely to lead to a more severe downturn later. High inflation became entrenched in the 1970s after high inflation expectations took hold. In the early 1980s, the Fed delivered shock therapy with punishing rate increases that brought down inflation but triggered recessions that featured the highest unemployment rates since the Great Depression.”

“How much do interest rates help?” (John Cochrane, The Grumpy Economist). “inducing recessions is not particularly effective at lowering inflation…[p]erhaps counting on the Fed to stop inflation all by itself is not such a great idea…[a] few Twitter commenters say that we really don't get much out of ‘normal times’ and we have to look to big ‘regime shifts.’ 1980 is an example, and the results with and without 1980 are telling. But that is perhaps the point. If so, then it will take a ‘regime shift’ to tame inflation not the usual ‘tools.’”

What we’re reading (7/4)

Happy Fourth!

“How Crazy Prices And Yearslong Wait Times Could Doom The Electric-Car Experiment” (Vanity Fair). “According to Cars.com, which tracks sales across the U.S., demand is so high that dealer inventory of all new vehicles has plummeted by 70% over the past three years: Car dealers had 3.4 million vehicles available for sale in April 2019; by this April, that number had dropped to just over one million. The consumer-research company J.D. Power reported in April that the average number of days a new car sits at a dealership before it’s purchased was on pace to be only three weeks, compared to 49 days just a year prior.”

“Today’s Global Economy Is Eerily Similar To The 1970s, But Governments Can Still Escape A Stagflation Episode” (Brookings). “The stagflation of that era [the 1970s] ended with a global recession and a series of financial crises in EMDEs [emerging market and developing economies]. In light of the lessons of that stagflation episode, these economies need to do a quick rethink of policies to cope with the consequences of rapidly tightening global financing conditions.”

“If The U.S. Is In A Recession, It’s A Very Strange One” (Wall Street Journal). “Today, something highly unusual is happening. Economic output fell in the first quarter and signs suggest it did so again in the second. Yet the job market showed little sign of faltering during the first half of the year. The jobless rate fell from 4% last December to 3.6% in May. It is the latest strange twist in the odd trajectory of the pandemic economy, and a riddle for those contemplating a recession. If the U.S. is in or near one, it doesn’t yet look like any other on record.”

“What To Do Now To Prepare For The Next Recession” (The New York Times). “Perhaps the program most obviously in need of changes is unemployment insurance. Congress acted to shore up the program in the early days of the pandemic, expanding benefit eligibility to people typically left out, like tipped restaurant workers and gig workers, adding weeks of benefits and increasing them by $600 a week. Without those emergency actions, however, many Americans would most likely have gotten very little pay for a paltry number of weeks — or been unable to qualify at all.”

“Another Crypto Lender Vauld Pauses Withdrawals As Market Crash Takes Its Toll” (CNBC). “Crypto lender Vauld on Monday paused all withdrawals, trading and deposits on its platform and is exploring potential restructuring options, the company said.”

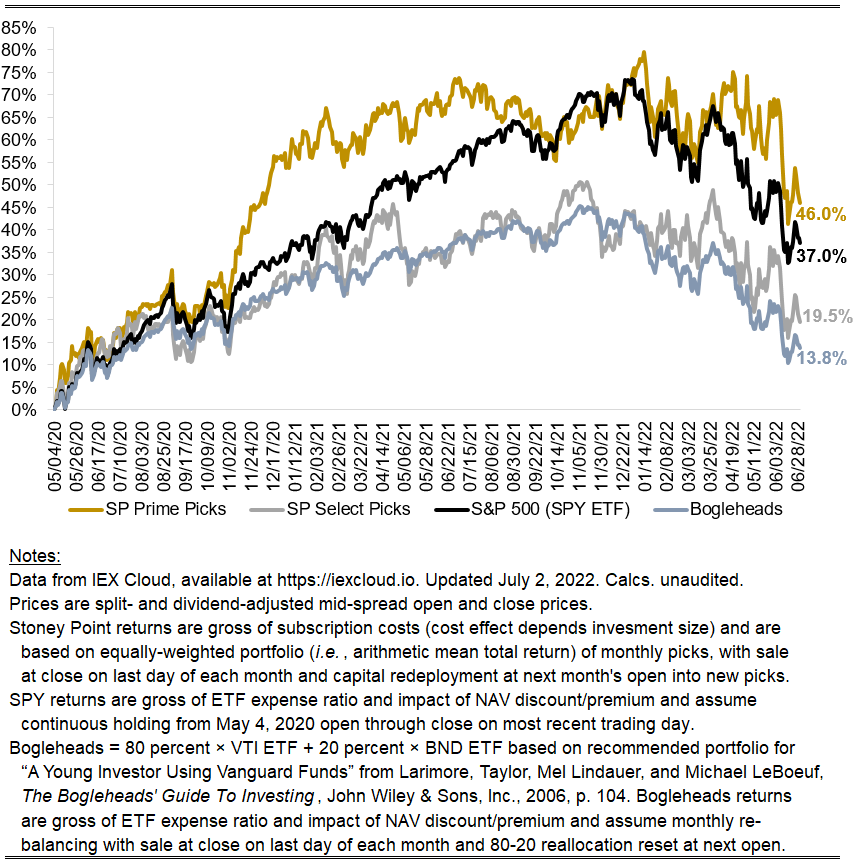

June 2022 performance update

Hi friends,

Here with the numbers for June.

Prime: -13.07%

Select: -11.00%

SPY ETF: -8.74%

Bogleheads portfolio (80% VTI, 20% BND): -7.39%

Not a great month for the market overall (down nearly 9 percent), which was a fitting end to the worst first half of trading in 50 years.

This month’s results for Prime were incrementally weighed down to a great extent by Micron Technologies, which many readers will know is economically similar to a closed-end bitcoin fund. The bitcoin crash has (rightfully) punished the stock, which was down nearly 26 percent last month. That the company chooses to hold a lot of crypto on its balance sheet does not make it unsuitable for Stoney Point, however. As longtime readers will know, my model selects stocks mechanistically as a function of the ratio of earnings (and a variety of other fundamental cash flow drivers) relative to price, and is generally agnostic as to how the firm generates those earnings. On that basis, Micron was attractive at the start of the month, and is likewise attractive for the current month, as the stock remains a Prime pick. There were a couple of other big losers that, to my eye, were similarly idiosyncratically affected by one-off events one either would not expect to continue indefinitely or would not expect to affect average performance significantly.

Stoney Point Total Performance History

What we’re reading (7/2)

“Markets Had A Terrible First Half Of 2022. It Can Get Worse.” (Wall Street Journal). “Almost any economic outcome is likely to prove a fresh surprise. If there’s a soft landing, stocks should do well as the recent recession panic reverses. If there’s a recession, there could easily be a big loss still to come, since only the drop of recent weeks appears to be related to recession risk.”

“Stocks And Bonds Hurt Alike Under Stagflation” (American Institute of Economic Research). “When bonds and stocks decline a lot and simultaneously it suggests inflation is rising rapidly even as the economy is stagnating or contracting (or will soon do so). For most economists today, that combination is near-impossible. Trained in Keynesian demand-side models – and taught to ignore or ridicule supply-side models – they deny that higher inflation is likely to accompany a weakening, let alone stagnating or contracting economy.”

“10-year Treasury Yield Falls To Lowest Level Since May” (CNBC). “U.S. Treasury yields fell Friday as recession fears and disappointing economic data left investors looking for safety. The yield on the benchmark 10-year Treasury note traded lower by 8 basis points at 2.889%, near its lowest level since late May. Meanwhile, the yield on the 30-year Treasury bond slid less than 1 basis point to 3.116%.”

“‘How Quickly The Tables Have Turned’: Falling Mortgage Rates Have Homebuyers So Emboldened They’re Asking Sellers For Cash” (MoneyWise). “The lower rate on a 30-year fixed mortgage is a relief for home shoppers who have been watching rates climb, but it’s also a sign that a recession could very well be around the corner as the market slows. Rates tend to mirror 10-year Treasury yields, which have fallen as investors seek safer, more stable assets in the face of higher inflation and slower economic growth.”

“Crypto’s Systemic Stress Test” (Axios). “Much of the current crypto winter is a function of two familiar markets phenomena — failed arbitrages and commingling of customer funds.”

What we’re reading (7/1)

“U.S. Stocks Finish Higher After Worst Start To Year In Decades” (Wall Street Journal). “The S&P 500 was up around 1.1% in 4 p.m. trading Friday, offering investors a respite after a downbeat second quarter that reflected fears that the Federal Reserve’s efforts to tame inflation could tip the economy into a recession.”

“Crypto Billionaire Sam Bankman-Fried Says More Exchanges Will Fail: ‘There Are Companies That Are Basically Too Far Gone’” (CNBC). “There are ‘some third-tier exchanges that are already secretly insolvent,’ Bankman-Fried told Forbes. The 30-year-old’s own fortune has taken a significant cut this year as crypto has crashed, but still sits at $8.1 billion, according to Bloomberg.”

“Layoffs Are Coming. The Outsourcing Industry Will Benefit.” (Institutional Investor). “The outsourcing industry ‘was basically born out of crisis,’ Lych explained. The industry, which she defined as including both back-office and investment services, has grown tremendously since the GFC, because outsourcing is often used as a strategy for cost-cutting.”

“Apple Ex-Corporate Law Chief Admits Years Of Insider Trading” (Bloomberg). “Gene Levoff, Apple’s former director of corporate law, pleaded guilty on Thursday to six counts of securities fraud between 2011 and 2016. Levoff, 48, was co-chairman of the company’s disclosure committee, which allowed him to see Apple’s revenue and earnings statements before they were filed with the Securities and Exchange Commission.”

“‘Cryptoqueen’ Ruja Ignatova Has Been Added To FBI’s 10 Most Wanted List” (New York Post). “Ruja Ignatova, who is accused of defrauding investors of more than $4 billion, was added to the federal bureau’s Ten Most Wanted Fugitive list, the law enforcement agency announced Thursday. The 42-year-old joins a list of sought after suspects that includes alleged killers and accused drug cartel leaders.”

What we’re reading (6/30)

“Markets Post Worst First Half Of A Year In Decades” (Wall Street Journal). “Accelerating inflation and rising interest rates fueled a monthslong rout that left few markets unscathed. The S&P 500 fell 21% through Thursday, suffering its worst first half of a year since 1970, according to Dow Jones Market Data. Investment-grade bonds, as measured by the iShares Core U.S. Aggregate Bond exchange-traded fund, lost 11%—posting their worst start to a year in history.”

“After Stock Market’s Worst Start In 50 Years, Some See More Pain Ahead” (New York Times). “Wall Street set records in the first half of the year, none of them good. The economy is on the cusp of a recession, battered by high inflation and rising interest rates, which eat into paychecks, dent consumer confidence and lead to corporate cutbacks. As it has teetered, markets have tanked.”

“The Fed’s Preferred Inflation Gauge Hints At Moderation In May.” (New York Times). “The Personal Consumption Expenditures price measure, which the Fed officially targets when it aims for 2 percent inflation on average over time, climbed by 6.3 percent in the year through May, matching the April increase. Over the past month, it picked up 0.6 percent, a rapid pace of increase as gas prices rose.”

“7 Things Investors Should Know About A Bear Market” (U.S. News & World Report). “Historically, bear markets have provided investors with excellent opportunities to buy high-quality stocks at a discounted valuation. When the entire stock market falls, even most high-quality stocks are dragged down with it. Assuming the overall market eventually recovers, this downdraft in stock valuations provides investors with periodic opportunities to scoop up shares of some of the best stocks in the market at a cheap price relative to their longer-term earnings and cash flow outlooks.”

“Prevalence Of Psychological Distress Among Working-Age Adults In The United States, 1999–2018” (Michael Daly, American Journal of Public Health). “The prevalence of psychological distress in the past 30 days increased from 16.1% in 1999–2000 to 22.6% in 2017–2018, an increase of 6.5 percentage points (95% confidence interval [CI] = 5.6, 7.3) or 40% from 1999–2000 levels. Statistically significant increases in the prevalence of distress were observed across all age, gender, race/ethnicity, and educational attainment subgroups examined. Rates of serious psychological distress increased from 2.7% in 1999–2000 to 4% in 2017–2018, an increase of 1.3 percentage points (95% CI = 0.9, 1.6).”

July picks available now

The new Prime and Select picks for July are available starting now, based on a model run put through today (June 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Friday, July 1, 2022 (at the mid-spread open price) through the last trading day of the month, Friday, July 29, 2022 (at the mid-spread closing price).

What we’re reading (6/29)

“Stocks Finish Lower After Weak Consumer-Confidence Reading” (Wall Street Journal). “U.S. stocks slumped Tuesday, giving up early gains and falling for a second consecutive day as investors parsed fresh economic figures for clues about the pace of monetary-policy tightening.”

“Coinbase Sinks as Goldman Downgrades to Sell After 75% Rout” (Bloomberg). “Shares of the firm slumped 11% to $55.96 on Monday, extending their decline this year to 78% as Bitcoin trades at less than half its value from just six months ago. Goldman analyst William Nance cited the “continued downdraft in crypto prices” and the broader drop in activity levels across the industry. Coinbase had fallen 75% this year prior to the downgrade.”

“Energy-Hungry Data Centers Are Quietly Moving Into Cities” (MIT Technology Review). “In 1930, the telegraph giant Western Union put the finishing touches on its new crown jewel: a 24-story art deco building located at 60 Hudson Street in lower Manhattan. Soon after, over a million telegraphs each day shuttled in and out, carried by a network of cables, pneumatic tubes, and 30 employees in roller skates who sped across the building’s linoleum floors. Today, much of it is home to vast halls of computer servers.”

“Shareholders Of America’s Worst Bank Amply Rewarded For, Uh, Well, We’re Not Sure, Exactly” (Dealbreaker). “Jamie Dimon’s fear and loathing have extended to JPMorgan Chase’s dividend. Citigroup has seen fit to hold the line there, as well, to keep a bit extra in the kitty for its next fat finger/Revlon-related disaster. Wells Fargo? The same Wells Fargo coughing up yet another anti-money laundering fine, facing down an employee rebellion, dealing with a criminal investigation into its allegedly racist hiring practices, facing a squeeze on its mortgage business and generally unable to fix any of the things that ail it? Yea, it feels like it can swing a dividend hike.”

“Democrats Race To Revive Economic Package As Inflation Spikes” (Washington Post). “[Recent] economic peril has fueled new urgency on Capitol Hill, where Democrats hope to resolve their differences, re-craft their agenda and deliver before fall on at least some of the promises they made in the last election.”

What we’re reading (6/27)

“Nike Earnings Top Wall Street’s Expectations, Despite Inflation In The U.S. And Covid Lockdowns In China” (CNBC). “Nike on Monday said demand for sneakers and sportswear largely held up in the fiscal fourth-quarter, despite a Covid lockdown in China and a tougher consumer environment in the U.S.”

“Meme Stocks Were Too Good To Robinhood” (Matt Levine, Bloomberg). “Last week the US House Financial Services Committee released a report about that week at the end of January 2021, and it is fascinating reading. It is mostly about Robinhood, and specifically it is about the tension inside Robinhood between the fact that it [the last week of January 2021] was a great week and the fact that it almost blew up Robinhood.”

“All The Recession Warning Signs This Week” (CNN Business). “It’s the question everyone is asking: Are we about to enter a recession? A tepid stock market, soaring inflation, and rising interest rates have left Americans less than optimistic about the state of the economy. Consumer sentiment has plunged to a record low, according to a University of Michigan survey released last week, fueled by frustration over high prices.”

“Elon Musk Fuels Record C.E.O. Paydays” (DealBook). “In 2018, Elon Musk unveiled a groundbreaking compensation plan that was composed entirely of an enormous stock grant tied to Tesla’s performance. The plan linked his compensation to the future value of Tesla and the electric vehicle company’s ability to hit hugely ambitious targets for sales and operating profit. The gamble seems to have paid off: Musk has so far received shares for the award worth just over $60 billion. But it’s not only Musk that has profited: Compensation experts say they see the influence of Mr. Musk’s deal everywhere.”

“Biotech Wizard Left a Trail of Fraud—Prosecutors Allege It Ended in Murder” (Wall Street Journal). “He started out in biotechnology with only his ideas. One of the first was curing HIV with a one-time cell transplant to block production of a protein used by the virus to penetrate human cells. The idea had been tried before but failed because patients’ bodies rejected the transplanted cells. He claimed to have come up with a way to make it work.”

What we’re reading (6/27)

“Stock Futures Rise Slightly Following A Major Comeback Week For Stocks” (CNBC). “U.S. stock futures rose slightly on Sunday night following a major rebound last week from this year’s steep declines. Despite the bounce, Wall Street is preparing to wrap up the worst first half for stocks in decades.”

“Stocks Pace Towards Worst Start Since 1970: What To Know This Week” (Yahoo! Finance). “‘As bad as [this year] has been for investors, the good news is previous years that were down at least 15% at the midway point to the year saw the final six months higher every single time, with an average return of nearly 24%,’ LPL Financial chief market strategist Ryan Detrick noted earlier this week.”

“Sanctions Push Russia To First Foreign Default Since Bolshevik Revolution” (Wall Street Journal). “Russia was poised to default on its foreign debt for the first time since 1918, pushed into delinquency not for lack of money but because of punishing Western sanctions over its invasion of Ukraine. Russia missed payments on two foreign-currency bonds as of late Sunday, according to holders of the bonds. The day marks the expiration of a 30-day grace period since the country was due to pay the equivalent of $100 million in dollars and euros to bondholders.”

“The West Wants To Go Further On Russian Oil. Inflation Is Making That Difficult” (CNN Business). “Europe and the United States have barred the import of Russian oil to cut off a crucial revenue source for the Kremlin. But the plan to pile pain on President Vladimir Putin, forcing him to reconsider his war in Ukraine, hasn’t worked.”

“Beware The Dangers Of Sado-Monetarism” (Paul Krugman, New York Times). “But aside from the sado-monetarists themselves, who currently expects inflation to remain persistently high (as opposed to staying high for, say, the next year)? Not the financial markets. On Wednesday, the five-year breakeven inflation rate — a measure derived from the spread between U.S. government bonds that are and that aren’t protected against inflation — was only 2.74 percent. And part of that reflects expectations of near-term price rises that investors don’t expect to continue; the markets expect inflation to fade.”

What we’re reading (6/25)

“What To Expect From A Recession ‘Everyone’ Sees Coming” (Yahoo! Finance). “And if so many people believe that a recession is inevitable does that make it, well, inevitable? Or does it mean that a recession won’t occur? Or that any recession will at least be mild in nature? Ask this question enough ways and we're quickly into late-night dorm territory: What even is the economy?”

“Night Moves: Is The Overnight Drift The Grandmother of All Market Anomalies” (Haghani, Ragulin, Dewey, working paper). “The overnight effect refers to the fact that, over at least the past three decades, investors have earned 100% or more of the return on a wide range of risky assets when the markets are closed, and, as sure as day follows night, have earned zero or negative returns for bearing the risk of owning those assets during the daytime, when markets are open. The effect is seen over a wide range of assets, including the broad stock market, individual stocks (particularly those popular with retail investors, and Meme stocks most of all), many ETFs, and cryptocurrencies.”

“What It Takes To Buy Your First Home Now” (Wall Street Journal). “First-time home buyers are facing an exceptionally difficult housing market, threatening to lock younger households out of homeownership and the wealth-building it can provide. Even with prices rising, homeownership became more affordable for many families in late 2020 and early 2021 due to record-low interest rates. But now rates have shot upward, and prices are still climbing.”

“Self-Employed? Weird Credit Profile? Unconcerned By Soaring Inflation And Mortgage Rates? Venkat Would Like To Get You Into A Nice New Semi-Detached” (Dealbreaker). “Seemingly all are agreed: Mortgages are a bad business to be in right now, what with the rising rates and inflation and generally pervasive sense of economic anxiety ringing the world. And the Bank of England has made clear that it doesn’t look to kindly on the growing concentration of the U.K. mortgage market in the hands of big banks. Which means, on both counts, Barclays is right on cue.”

“They Don’t Sell Corn Dogs At Royal Ascot” (Vanity Fair). “You can’t find a corn dog at Royal Ascot. England’s preeminent thoroughbred event is nothing like the horse races I grew up around in Georgia. Order a Diet Coke and get lectured on social graces by a guy who is visibly inebriated at 10 a.m. Ask if they have chicken tenders instead of Peking duck salad and it’s as if you picked up after your dog with a Union Jack.”

July picks available soon

We’ll be publishing our Prime and Select picks for the month of July before Friday, July 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of June, as well as SPC’s cumulative performance, assuming the sale of the June picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thurs., June 30). Performance tracking for the month of July will assume the July picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Fri., July 1).

What we’re reading (6/24)

“Fed Confronts A ‘New World’ Of Inflation” (New York Times). “[The Fed] is making those decisions [rate hikes and reducing its balance sheet] without much of an established game plan, given the surprising ways in which the economy is behaving. ‘We’ve spent a lot of time — as a committee, and I’ve spent a lot of time personally — looking at history,’ Patrick Harker, president of the Federal Reserve Bank of Philadelphia, said in an interview on Wednesday. ‘Nothing quite fits this situation.’”

“Ray Dalio Says Stagflation Is Coming” (Institutional Investor). “Says Dalio: ‘The only way to raise living standards over the long term is to raise productivity, and central banks don’t do that.’”

“Another Recession Warning: Falling Copper Prices” (CNN Business). “Some investors look to copper prices as a bellwether for the global economy. If you’re one of them, you have good reason to be worried. What’s happening: Copper prices hit 16-month lows on Thursday as traders dumped the metal. They’ve dropped more than 11% in two weeks.”

“The Strange Art Of Asking People How Much Inflation They Expect” (Wall Street Journal). “Inflation has become a national preoccupation, hitting levels not seen in 40 years. That’s sparked renewed interest in the Michigan survey because expected inflation is, in some sense, a self-fulfilling prophecy. If people expect it to continue, they might raise prices for their businesses or ask for raises at their jobs, fueling continuing price increases.”

“Why Are Some Nations More Entrepreneurial Than Others? The Role Of National Culture In Organizational Founding Rates” (Assenova and Amit, working paper). “This study examines the cultural antecedents of cross-national variation in the rates of organizational founding. It argues that some nations became more entrepreneurial than others through their adaptive response to ecological adversity. Nations that historically faced low ecological adversity developed cultural systems that favored rule-breaking versus rule-following (cultural looseness versus tightness).”