What we’re reading (6/19)

“Recession Probability Soars As Inflation Worsens” (Wall Street Journal). “Economists surveyed by The Wall Street Journal have dramatically raised the probability of recession, now putting it at 44% in the next 12 months, a level usually seen only on the brink of or during actual recessions.”

“Americans Are Starting To Pull Back On Travel And Restaurants” (Washington Post). “More Americans are beginning to hold off on booking flights, getting haircuts, building backyard pools and replacing old, leaky roofs — in some of the new signs that the consumer engine of U.S. economic growth could be losing steam.”

“This Is Going To Hurt” (New York Times). “Pay gains have been falling behind inflation for months. Credit card balances, which fell early in the pandemic, are rising toward a record high. Subprime borrowers — those with weak credit scores — are increasingly falling behind on payments on car loans in particular, credit bureau data show. Measures of hunger are rising, even with unemployment still low and the overall economy still strong. ‘It’s a grim picture already,’ said Elizabeth Ananat, an economist[.]”

“Recession Fears Roil Markets Amid Fed’s Inflation Fight: What To Know This Week” (Yahoo! Finance). “While the Fed's unprecedented action Wednesday reiterated its commitment to normalizing price levels, investors and economists fear this also increased the risk its inflation-fighting measures may tip the economy into a recession.”

“Three Years Ago, Her Art Sold For $400 At The Beach. Now It Fetches Up To $1.6 Million At Auction” (Wall Street Journal). “It has been a rocket-fueled rise to the top of the contemporary art world for Ms. Weyant—and far from her unassuming start in Calgary, Canada. Spotted on Instagram three years ago and quickly vouched for by a savvy handful of artists, dealers and advisers, Ms. Weyant is now internationally coveted for her paintings of vulnerable girls and mischievous women in sharply lit, old-master hues. Imagine Botticelli as a millennial, whose porcelain-skin beauties also pop one leg high like the Victoria Beckham meme or sport gold necklaces that read, ‘Ride or Die.’”

What we’re reading (6/16)

“A Brief History Of Hard And Soft Landings” (Cato Institute). “Whenever the rate increases stopped in time to avoid a recession, we call that a “soft landing.” Among postwar Federal Reserve interest rates cycles only four have been four soft landings, leaving eight hard landings so far.”

“Wall Street Sounds A Louder Recession Call After Fed Rate Hike” (Yahoo! Finance). “US retail sales fell for the first time in five months in May as higher prices hit consumer pocketbooks. Also on Wednesday, the Federal Reserve Bank of Atlanta cut its estimate for second quarter growth to 0%. And Guggenheim Chief Investment Officer Scott Minerd said the US may already be in a recession, given the slowdown in consumer spending.”

“Stock Market's Fall Has Wiped Out $3 Trillion In Retirement Savings This Year” (CBS). “The selloff has erased nearly $3 trillion from U.S. retirement accounts, according to Alicia Munnell, director of the Center for Retirement Research at Boston College. By her calculations, 401(k) plan participants have lost about $1.4 trillion from their accounts since the end of 2021. People with IRAs — most of which are 401(k) rollovers — have lost $2 trillion this year.”

“Housing Market Update: Share Of Homes With Price Drops Reaches New High As Mortgage Rates Top 2008 Levels” (Redfin). ““The housing market isn’t crashing, but it is experiencing a hangover as it comes down from an unsustainable high,” said Redfin deputy chief economist Taylor Marr. “Housing demand has already cooled significantly to the point that the industry has begun facing layoffs. This week’s rate hikes will further stretch homebuyers’ budgets to the point that many more may be priced out.”

“On Inflation, Economics Has Some Explaining To Do” (Wall Street Journal). “While all of these critics [Larry Summers, Olivier Blanchard, Michael Strain] got the direction of inflation right, their analyses can’t explain, at least using prepandemic relationships, the magnitude, i.e., how inflation suddenly shot from around 2% before the pandemic to 8.6% now—6% excluding food and energy. They explain why inflation rose more in the U.S. than Europe, but not why inflation rose so much in Europe.”

What we’re reading (6/15)

“Fed Raises Rates By 0.75 Percentage Point, Largest Increase Since 1994” (Wall Street Journal). “Officials agreed to a 0.75-percentage-point rate rise at their two-day policy meeting that concluded Wednesday, which will increase the Fed’s benchmark federal-funds rate to a range between 1.5% and 1.75%.”

“Inflation Isn’t Going to Bring Back The 1970s” (Ben Bernanke, New York Times). “Besides the Fed’s greater independence, a key difference from the ’60s and ’70s is that the Fed’s views on both the sources of inflation and its own responsibility to control the pace of price increases have changed markedly. Burns, who presided over most of the 1970s inflation, had a cost-push theory of inflation. He believed that inflation was caused primarily by large companies and trade unions, which used their market power to push up prices and wages even in a slow economy. He thought the Fed had little ability to counteract these forces, and as an alternative to raising interest rates, he helped persuade Nixon to set wage and price controls in 1971, which proved a spectacular failure.”

“Bitcoin Came Close To Falling Below $20,000 As Investors Continue To Flee Cryptocurrencies” (CNBC). “Bitcoin plunged as much as 10% to an intraday low of $20,166, according to Coinbase data. It was last trading at $21,544.37, down about 2.6%, around 4:24 p.m. ET. The world’s largest digital currency has plunged nearly 70% since the peak of the crypto craze in November 2021.”

“The Real Problem With Inflation” (Morningstar). “[T]he more insidious effect of rising inflation is that it fundamentally erodes trust. This is a highly destructive force that spills over into many different areas[.]”

“Accounting for (Rule) Differences” (Fisher Investments). “Among the lesser-seen worries in the cornucopia garnering investors’ ire lately hides S&P 500 Financials earnings’ -19.9% y/y plunge in Q1 2022—a highly unusual development during a stretch where most economic indicators are on an upswing and the vast majority of sectors are enjoying earnings growth. The culprit, as The Wall Street Journal examined last weekend, is both simple and complex: A relatively new accounting rule is distorting earnings math bigtime.”

What we’re reading (6/14)

“Crypto Is Crashing. It Deserves To.” (New York Magazine). “[S]omething feels different now: The fear is pervasive, the uncertainty is obvious, and the doubt is smart. And while there are plenty of threats from outsiders — like regulators threatening to rein in fraud, and countries like China shutting down the markets — the problems driving the recent declines appear to be largely self-inflicted. A lot of big players (Celsius and Saylor being just two, in addition to the recently imploded Luna project) seem to have put themselves in a dangerous position and made commitments they may not be able to keep.”

“Coinbase To Lay Off 18% Of Staff Amid Crypto Meltdown” (Wall Street Journal). “Further waves of reckoning swept through the cryptocurrency industry Tuesday, with exchange company Coinbase Global Inc. saying it would cut almost a fifth of its staff and crypto lender Celsius Network LLC hiring a law firm to examine restructuring options.”

“3 Signs The Labor Market Isn’t As Great As It Looks” (CNN Business). “While missing workers are a concern, there is another equally disturbing trend: the impact inflation has had on wages. Workers continued to see fatter paychecks, but rising prices mean they don’t go as far. For example, on a year-over-year basis, accounting for inflation, wage gains in real terms have been stuck in negative territory through April. With inflation still around its 40-year high, we expect the same in May.”

“Wall Street Is On A One Way Trip To Misery Until Fed Hikes Stop, Market Forecaster Jim Bianco Warns” (CNBC). “‘The Fed only has one tool to bring in inflation and that is they have to slow demand,’ the Bianco Research president told CNBC ‘Fast Money’ on Tuesday. ‘We may not like what’s happening, but over in the Eccles building in Washington, I don’t think they’re too upset with what they’ve seen in the stock market for the last few weeks.’”

“Market Rout Evokes Memories Of Trading Before Lehman Blowup” (Bloomberg). “‘Liquidity in the market is worse than it was leading up to Lehman,’ said Hoffmann, who worked at the firm that imploded back then, triggering the worst financial crisis since the Great Depression. It’s the kind of problem that can exacerbate losses in a big way. ‘That creates even more risk, because if the market doesn’t have liquidity, it can gap down very quickly.’”

What we’re reading (6/11)

“Private Equity Investors Want GPs to Put More Skin in The Game. GPs Might Have To Get Creative To Afford It.” (Institutional Investor). “For a lot of private equity investors, the best protection against losses is to make sure their general partners have enough invested in their own funds so that GPs won’t emerge unscathed from negative returns. The average GP commitment reached 4.8 percent in 2021, according to the latest GP trends survey from Investec. That’s already double the typical expectation of 1 to 2 percent.”

“Behind The Automation Boom Coming To The Hotel Industry, From 24-Hour Check-In To Texting For Towels” (CNBC). “‘The labor issue is a big driver for investments in technology,’ said Mark Haley, a partner at Prism Hospitality Consulting, which specializes in hospitality technology and marketing. ‘You can’t hire enough people. ... I would submit to you that to most hoteliers today, [labor] is a more profound and concerning issue than a pending economic slowdown.’”

“Apple Goes Deeper Into Finance With Buy Now, Pay Later Offering” (Wall Street Journal). “The tech giant is launching a buy now, pay later offering in the U.S. later this year that will allow consumers that shop with Apple Pay to split purchases into four payments every two weeks. Apple will underwrite the loans and fund them, which also means absorbing losses when borrowers fail to repay. An Apple subsidiary has obtained lending licenses in most states to offer the new payment plans, called Apple Pay Later.”

“Silicon Valley Braces For Tech Pullback After A Decade Of Decadence” (Washington Post). “After a decade of exuberance, Silicon Valley start-ups, venture capitalists and established tech companies alike are cutting investment and firing workers, prompting some in the tech world to openly predict a U.S. recession is on the way. Facebook and Amazon have slowed their frantic hiring paces, while highflying newer companies including scooter company Bird and email client Superhuman have laid off workers.”

“The Case For Economic Optimism Is Over” (New York Magazine). “[T]he Labor Department released its May consumer price index, and it’s ugly. Very ugly. Prices, on average, rose 8.6 percent, the highest annual increase during the Biden-era price surge and the most since December 1981. The report has effectively shattered the cautious optimism that the economy could actually turn in any meaningful way anytime soon. The rest of the year looks bad for the American consumer, and the reality is that there is very little anyone can do about it.”

What we’re reading (6/10)

“U.S. Inflation Hit 8.6% In May” (Wall Street Journal). “U.S. consumer inflation reached its highest level in more than four decades in May as surging energy and food costs pushed prices higher, with little indication of when the upward trend could ease.”

“Tesla Files For 3-For-1 Stock Split” (CNBC). “Tesla just filed its annual proxy statement with the SEC and revealed it plans a three-for-one stock split, and that board member Larry Ellison does not plan to stand for re-election.”

“State Street Agrees: Buying Credit Suisse Would Be Stupid” (Dealbreaker). “Would you like to buy a bank that’s issued six profit warnings in the last seven quarters? One nursing not one but two multi-billion dollar risk-management disasters, to which it responded with a bit of alleged collusion (that didn’t work) and the apparently shocked realization that a major global bank needs someone looking after counterparty risk, especially in not-especially-profitable business lines? One that’s essentially headquartered in court, where its track record is no better than its quarterlies? One where new executives are greeted on their first day by the police? One that does loads of spying, just not on the right people (despite a client list chockful of unsavory spymasters)? Whose reaction to the Russian sanctions was (allegedly) to kindly ask clients to shred everything? Whose shareholders are itching to sue the pants off of everybody involved? Whose own CEO thinks that buying it would be "really stupid"? Yea, State Street doesn’t, either. Even at this price.”

“One Way To Reduce The Hit Of Higher Mortgage Rates” (CNN Business). “The average 30-year fixed-rate mortgage has been hovering above 5% for more than a month, taking a toll on prospective homebuyers. While many hopeful buyers have bowed out of the market for now, some are exploring what once seemed like an unlikely option: adjustable rate mortgages, or ARMs.”

“Even Deep-Pocketed Buyers Are Starting To Back Away From The U.S. Housing Market” (Wall Street Journal). “‘There’s a sense that prices are frothy in many markets across the country,’ said Ryan Serhant, CEO of real-estate brokerage Serhant, who says the market is normalizing after a period of rapid appreciation, fueled by heightened demand. ‘You’re now starting to see buyers become a little hesitant to be caught at the top,’ he said.”

What we’re reading (6/8)

“US Stocks Fall As Investors Weigh An Economic Slowdown And Oil Surges To A 13-Week High” (Insider). “US stocks dropped Wednesday, as investors continued to fret over the prospect for the economy and as oil jumped to a 13-week high.”

“Tech’s Decade Of Stock-Market Dominance Ends, For Now” (Wall Street Journal). “The S&P 500’s information-technology sector has dropped 20% in 2022 through Wednesday, its worst start to a year since 2002. Its gap with the broader S&P 500, which is down 14%, is the largest since 2004. The declines have prompted investors to yank a record $7.6 billion this year from technology-focused mutual and exchange-traded funds through April[.]”

“Mortgage Demand Falls To The Lowest Level In 22 Years Amid Rising Rates And Slowing Home Sales” (CNBC). “Mortgage rates are back on the upswing, after a brief decline in May, and the housing market is still suffering from a lack of listings. As a result, mortgage demand continues to drop. Total mortgage application volume fell 6.5% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Demand hit the lowest level in 22 years.”

“Lumber Price Gets Chopped In Half Amid Chill In Housing Markets” (Bloomberg). “Lumber futures fell as low as $568.40 per 1,000 board feet in Chicago on Wednesday, extending a slump to about 50% this year. Higher interest rates and soaring home prices are starting to put the brakes on home sales, according to Bloomberg Intelligence.”

“Better.com Allegedly A Good Deal Worse Than It Told SPAC Investors” (Dealbreaker). “Unlike nearly 1,000 of her former colleagues, Sarah Pierce didn’t get canned by mortgage lender Better.com via mass Zoom call just before Christmas. Nor was she among those who found out they were unemployed via unexplained severance check three months later, because she had been fired the month before. And unlike those let go for “stealing” from the company by being lazy or because its rosy projections for itself weren’t panning out, Pierce says she got the heave-ho for gently suggesting that Better.com and CEO Vishal Garg not issue those projections simply to save its SPAC deal, because they were untrue.”

What we’re reading (6/7)

“From The Big Short To The Big Scam” (Paul Krugman, New York Times). “It sounds extreme and implausible to suggest that an asset class that has become so large, whose promoters have acquired so much political influence, could lack any real value — that it is a house built not on sand, but on nothing at all. But I remember the housing bubble and the subprime crisis. And if you ask me, it looks as if we’ve gone from the Big Short to the Big Scam.”

“Fed GDP Tracker Shows The Economy Could Be On The Brink Of A Recession” (CNBC). “A widely followed Federal Reserve gauge is indicating that the U.S. economy could be headed for a second consecutive quarter of negative growth, meeting a rule-of-thumb dSefinition for a recession. In an update posted Tuesday, the Atlanta Fed’s GDPNow tracker is now pointing to an annualized gain of just 0.9% for the second quarter.”

“Retail Investors Aren’t Trading Like They Expect A Recession Anytime Soon, Bank Of America Says” (Insider). “The bank looked at the fund flows of its client's trading activity, and found that retail investors are consistently buying riskier stocks over defensive stocks despite the economic warnings from major bank CEOs like Jamie Dimon of JPMorgan and Charlie Scharf of Wells Fargo.”

“Multistrats Weather The Storm” (Institutional Investor). “This has already been disastrous year for many growth-oriented long-short managers. But through May, several strategies have avoided the carnage and are solidly in the black for the year. These include multistrategy funds, which are mostly up in the low- to mid-single-digit range.”

“SEC’s Trading Shake-Up Expected To Face Heavy Opposition” (Wall Street Journal). “The agency is preparing to propose major changes to the stock market’s plumbing as soon as this fall, The Wall Street Journal reported Monday. SEC Chairman Gary Gensler is expected to outline some of the SEC’s plans Wednesday in a speech. The changes grew out of the frenzied trading in GameStop Corp. and other meme stocks in early 2021, which resulted in heavy scrutiny of the handling of individual investors’ trades.”

What we’re reading (6/6)

“Why Peak Inflation Is Near, According To Experts Who Bet On Short-Lived Price Rises” (Bloomberg). “[T]here remain plenty of economists who argue that the shock will soon fade, as supply blockages ease and energy costs stabilize. Some warn that central banks are in danger of making a big mistake by raising interest rates too aggressively even as price pressures show signs of peaking.”

“Why Adjustable-Rate Mortgages Are Still Risky” (New York Times). “‘There’s not much room to go down, and there’s a lot of room to go up,’ said Martin Seay, associate professor of personal financial planning at Kansas State University.”

“SEC Closes In On Rules That Could Reshape How Stock Market Operates” (Wall Street Journal). “Chairman Gary Gensler directed SEC staff last year to explore ways to make the stock market more efficient for small investors and public companies. While aspects of the effort are in varying stages of development, one idea that has gained traction is to require brokerages to send most individual investors’ orders to be routed into auctions where trading firms compete to execute them, people familiar with the matter said.”

“How Texas Monthly Chronicled The Eighties Oil Bust Via A Beloved Houston Clothier” (Houston Chronicle). “For Texans who were born in the last 30 years, or who moved to Texas since 1990, Sakowitz might be an unfamiliar name. But in its day, it was the department store where Texans bought clothes that expressed their desire to be recognized for their growing wealth and worldliness (along with its Dallas-based rival Neiman Marcus). Bobby Sakowitz was the embodiment of this desire. When, in 1969, he married a New York City ‘it’ girl, the New York Times wrote up his wedding. But the paper could not resist taking a dig at his provincialism in its headline: ‘Pam Zauderer Wed to Robert T. Sakowitz, Houston Merchant.’”

“One Good Thing: 107 Minutes Of Wall Street Traders Behaving Badly” (Vox). “The choice that CEO John Tuld ([Jeremy] Irons) makes in the middle of Margin Call, by contrast, is not a crime. When someone raises the prospects of ‘the feds’ stopping the move, executive Ramesh Shah (Aasif Mandvi), implied to be a lawyer, pushes back: ‘They can slow you down. They can’t stop you.’ This is a choice they can make in the course of doing business. It’s just part of being a banker. And it will hurt many, many people.”

What we’re reading (6/5)

“The Three Bears?” (Charles Schwab). “Stocks, bonds, and cash are all in a bear market or teetering on the edge of one—a very rare event. Over the past 72 years, there have only been two prior periods with a triple bear.”

“Which Stocks Do Best During High Inflation?” (Wall Street Journal). “To sum up: Shares in real-estate investment trusts or companies in the real-estate industry are not the best option. Stocks in the materials and energy industries outperform all others [during periods of high inflation] by a long shot, according to the findings of a study I conducted with my research assistants, Zihan Chen and Yiming Xie.”

“Crypto’s Volatility Premium” (Marginal Revolution). “In standard economic theory, investors are risk-averse, meaning they prefer more stable consumption patterns to less stable ones. That is usually true, but it does not mean investors always prefer more stable investment prices — a crucial distinction.”

“Why The Global Soil Shortage Threatens Food, Medicine And The Climate” (CNBC). “‘There are places that have already lost all of their topsoil,’ Jo Handelsman, author of ‘A World Without Soil,’ and a professor at the University of Wisconsin-Madison, told CNBC. The impact of soil degradation could total $23 trillion in losses of food, ecosystem services and income worldwide by 2050, according to the United Nations Convention to Combat Desertification.”

“Private Equity Is Kinda, Sorta A Bit Of A Light Ponzi Scheme” (Dealbreaker). “‘We are in a big bubble in the private markets,’ [CIO Vincent] Mortier said. ‘If I take an extreme analogy, for some parts, the private equity market may look like a Ponzi scheme, a pyramid, in a way….’”

What we’re reading (6/3)

“U.S. Stocks Are Trading at a Rarely Seen Discount” (Morningstar). “As of May 31, 2022, the price/fair value of a composite of the stocks covered by our equity analyst team was 0.87 times. Since 2011, on a monthly basis, there have only been a few other instances in which the markets have traded at such a large discount to our intrinsic valuation.”

“Corporate Executives Assess U.S. Economy As Clouds Form” (Wall Street Journal). “Over the past week, business leaders have laid out in the starkest terms yet that a period of universal strength in the U.S. economy has given way to a muddled outlook in which a labor shortage, soaring stock markets and a healthy consumer are no longer givens. Technology companies from Facebook parent Meta Platforms Inc. to Uber Technologies Inc. have sharply slowed hiring in recent weeks, and Elon Musk told staff at Tesla Inc. that he plans to cut 10% of its salaried jobs.”

“What’s Got Economists Rooting For A Slowdown” (DealBook). “Normally, when hiring slows it’s a troubling sign for the economy as a whole, but these are not normal times. With nearly twice as many open jobs as available workers and inflation running at its fastest pace in four decades, many economists and policymakers say a slowdown is just what the economy needs, reports The Times’s Ben Casselman.”

“Antitrust Vs. ESG” (Noahpinion). “if the U.S. moves toward an environment of increased competition, that will put more pressure on companies to focus purely on staying alive. And the recent stock crash and earnings squeeze will only increase this pressure.”

“Amazon CEO Of Worldwide Consumer Dave Clark Resigns” (CNBC). “Clark is one of a handful of the most important executives at Amazon, overseeing the company’s sprawling retail business, and a member of Jassy’s S-Team, a tight-knit group of over a dozen senior executives from almost all areas of Amazon’s business. He took over the role in 2020 after Jeff Wilke stepped down.”

May 2022 performance update

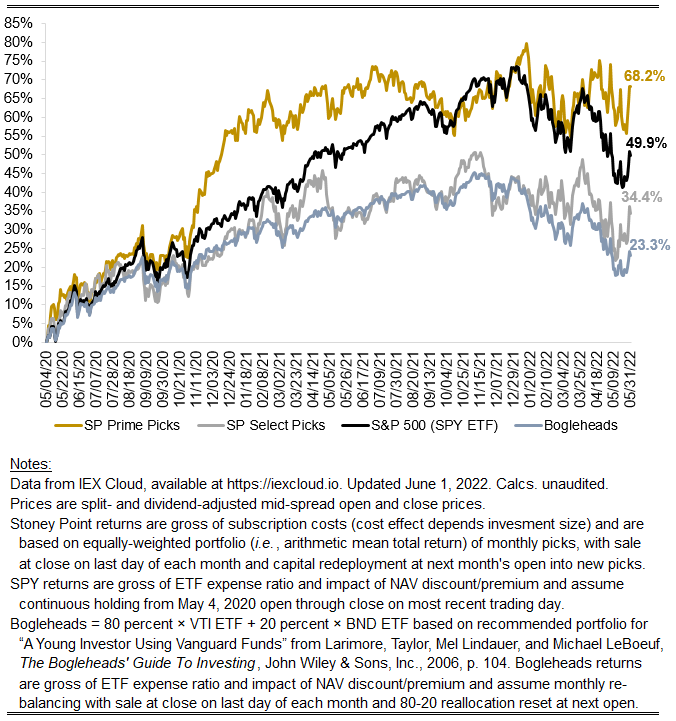

Hi friends, here with a performance update for May. The key numbers are:

Prime: +4.23%

Select: +4.79%

SPY ETF: +0.21%

Bogleheads portfolio (80% VTI, 20% BND): -0.12%

It was another crazy month as the market continued to anticipate future rate hikes and growth expectations softened considerably—at least in some corners of the market—at the same time. We are already seeing the effect of rates percolate through asset prices across economy, with some commodities coming back to earth, a noticeable deceleration in leading home price indicators, and, of course, much softer conditions for equities than in much of the last decade.

Notwithstanding that we blew out the market for a second straight month, with each of Prime and Select outperforming the S&P 500-tracking SPY ETF by more than 400 basis points. It is another encouraging sign that value is not dead, it has just been hibernating (relative to its historical outperformance of growth) during an anomalous, albeit prolonged, period in which money was not just free but, more recently, negatively priced.

As value investing continues to look like a promising strategy, I find it worth reminding myself that there really is no such thing as “value” stocks or a “growth” stocks. The core attributes that embody “value” and “growth” are not company fixed effects. Not long ago, for example, Meta and Twitter—two stocks generally characterized as “growth stocks”—regularly appeared in our Prime selections because, in my estimation (or rather my model’s estimation), they had characteristics at that time suggesting they were either underpriced or, alternatively, appropriately priced but at a level suggesting investors were demanding (and therefore the market expected) higher returns compared to other stocks. We have not held them for some time, as those characteristics changed.

Let’s see what June has in store.

Stoney Point Total Performance History

What we’re reading (6/2)

“The Perverse Politics Of Inflation” (Paul Krugman, New York Times). “[O]verheating isn’t unique to the United States. While some economists believe that European inflation is almost entirely due to transitory disruptions — something many people, myself included, wrongly believed about the United States a year ago — my read of recent European data suggests that it has also seen a rise in underlying inflation, despite not having pursued U.S.-type fiscal expansion.”

“Internal Documents Show Amazon's Dystopian System For Tracking Workers Every Minute Of Their Shifts” (Vice). “Infamously, Amazon punishes and sometimes fires warehouse workers who it believes are wasting time at work. A new filing obtained by Motherboard gives detailed insight into how Amazon tracks and records every minute of "time off task" (which it calls TOT) with radio-frequency handheld scanners that warehouse associates use to track customer packages.”

“Might I Suggest Not Listening To Famous People About Money?” (Vox). “Amid the current crypto crash, many people are a little miffed at the celebs who have been shilling for this stuff. Gwyneth Paltrow, Tom Brady, Reese Witherspoon, and even Larry David were all happy to assist in the mainstreaming of cryptocurrencies in recent months, only to go quiet now that the going has gotten a little tough. For Matt Damon, “fortune favors the brave” … who are apparently not brave enough to say maybe it was a bit of an oops to try to get regular people to gamble their hard-earned money on hyper-speculative assets.”

“Their Cryptocurrencies Crashed The Market. Now They’re Back At It.” (Washington Post). “When two cryptocurrencies crashed roughly three weeks ago, the effects were devastating. Their collapse sparked over $500 billion in losses in the broader crypto market. Numerous investors saw their life savings evaporate. Others contemplated suicide. People called for criminal investigations into the company behind it all and government regulation for the larger market. But now the team behind the failed coins are back at it.”

“What Are College Students Paying For?” (Quillette). “Today, many of the core works in any field can be found online for free. And many college lectures are available online to anyone. Students can often get much better guidance on navigating the books from the myriad free online sources than from the one person who happens to be their professor. Thus, the monopolies that colleges once had on publications and expertise have largely crumbled.”

What we’re reading (6/1)

“Where To Look For The Next Wall Street Blowup” (Wall Street Journal). “There are two new risks that history doesn’t help with. The first is the unprecedented amount of liquidity that has been pumped into finance by central banks buying bonds. A lack of liquidity is what usually creates financial problems, as it prevents debts being rolled over. As the Fed and other central banks drain liquidity, problems might reveal themselves. The second is that there’s a massive, and unknown, amount of private debt issued by lightly regulated shadow banks.”

“Fed’s Bullard Sees 3.5% Rates Setting Up Cuts In 2023 Or ‘24” (Bloomberg). “Federal Reserve Bank of St. Louis President James Bullard urged policy makers to raise interest rates to 3.5% this year to bring inflation down from near a four-decade high, adding that some of those hikes could be reversed late next year or in 2024.”

“Jamie Dimon Says U.S. Consumers Still Have Six To Nine Months Of Spending Power” (Wall Street Journal). “The head of the nation’s biggest bank said the recent drop in Americans’ savings rate hadn’t altered his view that the government’s pandemic stimulus is still padding consumers’ wallets. He estimated that some $2 trillion in extra funds are still waiting to be spent.”

“About 200 Years Ago, The World Started Getting Rich. Why?” (Vox). “The simplest answer is that economic growth occurred only after the rate of technological innovation became highly sustained. Without sustained technological innovation, any one-off economic improvement will not lead to sustained growth.”

“Jeez, If You Didn’t Know Any Better, You’d Almost Say Deutsche Bank Looks Like A Criminal Organization” (Dealbreaker). “Last time, four years had passed between police raids of Deutsche Bank’s headquarters in Frankfurt’s financial district. This time, it only took four weeks.”

What we’re reading (5/31)

“'This Is Not The Retirement I Envisioned.’ How Retirees Are Getting Hit by Inflation” (CNN Business). “Managing one's finances in retirement is always tricky. But with inflation pushing up the price of everything from gas to housing to eggs, many retirees are cutting back or eliminating certain costs altogether.”

“Tell Your Boss: Working From Home Is Making You More Productive” (Vox). “There is…objective data — like more calls per minute for call center workers, engineers submitting more changes to code, and Bureau of Labor Statistics data on growing output per hours worked — that has generally shown that people are, in fact, more productive working from home. But even the idea that people feel more productive is important…Interestingly, Slack’s Future Forum found that executives are more likely to say they want to work from the office than non-executives, but are less likely to be doing so full time.”

“What's Causing The Big Spike In Car Prices, And How Consumers Should React” (RealClear Markets). “As chief executive of a company that analyzes valuations of thousands of cars and trucks each year, I think consumers would be wise to consider how the economics of vehicle ownership have changed in the past two years of pandemic. They also shouldn’t expect these high prices to last.”

“How did the IR [International Relations] Community Get Russia/Ukraine So Wrong?” (Marginal Revolution). “In proper Tetlockian fashion, I thought I would look back and consider how well IR experts did in the time leading up to the current war in Ukraine. In particular, how many of them saw in advance that a war was coming? And I don’t mean a day or two before the war started, though there were still many commentators in denial at such a late point…Overall, on a scale of one to ten, how would we grade the performance of IR scholars on the Russia-Ukraine war? 2? 2.5?”

“President Biden, Fed Chairman Jerome Powell Meet With Inflation At Its Highest In 40 Years” (Wall Street Journal). “The Tuesday meeting highlighted how much the White House is relying on outside forces to help combat the highest inflation in four decades. Administration officials earlier had played down inflation worries while promoting the $1.9 trillion Covid-19 relief package in March 2021 and in seeking additional spending on healthcare, education and climate change last year.”

June picks available now

The new Prime and Select picks for June are available starting now, based on a model run put through today (May 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Wednesday, June 1, 2022 (at the mid-spread open price) through the last trading day of the month, Thursday, June 30, 2022 (at the mid-spread closing price).

What we’re reading (5/27)

“EY Split-Up Plan Exposes Rift Among Accounting Firms” (Wall Street Journal). “Ernst & Young’s plan for a possible world-wide split of its audit and consulting businesses, code-named Project Everest according to people familiar with the matter, was dismissed by major rivals Friday who said they would keep their firms in one piece.”

“How Influencers Hype Crypto, Without Disclosing Their Financial Ties” (New York Times). “In some cases, promoters like Mr. Paul have admitted that they failed to disclose personal or financial ties to projects advertised on their feeds, a potential violation of federal marketing regulations. And even before the crypto market’s recent downturn, a series of these influencer-backed ventures had crashed spectacularly, hurting amateur traders and prompting lawsuits that could force some celebrities to compensate investors for their losses.”

“Please Don’t Invest In This Crypto Scam Because Deepfake Elon Musk Told You To” (Gizmodo). “The video with deepfake Musk, which started popping up on some YouTube channels about a week ago, introduces a scam cryptocurrency platform called BitVex that, contrary to its claims, steals the cryptocurrency that users deposit into it. Scammers behind BitVex say the platform was started by Musk and developed ‘by the best mathematicians from Tesla,’ according to a poorly made YouTube video on BitVex’s channel with more than 90,000 views. (The channel itself has 112,000 subscribers).”

“This Market Rally Could Force The Fed To Raise Rates Higher” (Barron’s). “Based on the decline in interest rates and the recovery in equity prices this past week, the answer would appear to be yes. Indeed, since early May, fed-funds futures have discounted about two fewer quarter-point hikes by the first half of 2023, when the tightening is expected to peak. A top range of 2.75%-3% now is forecast by February, according to the CME FedWatch site.”

“Why Investors Are Increasingly Worried About Recession In America” (The Economist). “From January until early May, falling share prices could be put down to the effect of rising bond yields, as fixed-income markets responded to guidance from the Federal Reserve that interest rates would be going up a lot and fast. Higher interest rates reduce the present value of a stream of future company profits. Shares were marked down accordingly, especially those of technology firms whose profits could be projected furthest into the future. But in recent weeks share prices have kept falling, even as bond yields have dropped back. This combination points to fears of recession.”

What we’re reading (5/26)

“The Rise And Fall Of Wall Street’s Most Controversial Investor” (New York Magazine). “Morningstar, a fund-rating company that usually takes a dispassionate perspective, recently published an excoriating review of Wood’s performance, downgrading ARKK to “negative” from neutral. Though her fund had beaten all other U.S. stock funds in 2020, Wood was now looking more like a one-hit wonder. Wood’s returns, Morningstar wrote, had been “wretched,” making ARKK “one of the worst-performing” funds in the U.S. since 2020. Her ‘perilous approach’ and ‘haphazard’ disregard for risk — unlike other asset managers, ARK doesn’t employ any risk-management staff, Morningstar noted — was likely to ‘hurt’ investors, according to the analysis.”

“Every Bear Market Is Different” (Compound Advisors). “[W]hile not likely, a recession could be coming without stocks declining much more than they already have. Given the fear out there, it’s safe to say that most investors are probably not envisioning one of these more benign scenarios. They are more likely fearing something much worse, a repeat of the 50%+ recessionary bear markets of 2000-02 and 2007-09. While that’s certainly a possibility, so is a shallower decline accompanied with a recession, or no recession at all.”

“Wall Street’s Housing Grab Continues” (The Economist). “One group of buyers…remains unfazed: Wall Street. What began as an opportunistic bet on single-family housing during America’s subprime crash of 2007-10 has morphed into a mainstream asset class. Today all sorts of institutions—from private-equity firms to insurers and pension funds—are piling into the sector. They are unlikely to vacate it: being a rentier looks as appealing as ever.”

“SEC Sues Florida Firm That Raised $410 Million For IPO-Linked Fraud” (Reuters). “The SEC said StraightPath pitched its investment vehicles as a way for ordinary investors to own ‘highly coveted,’ hard-to-find pre-IPO shares in such companies as plant-based burger maker Impossible Foods and cryptocurrency exchange Kraken. But the SEC said the Jupiter, Florida-based firm often did not have the shares, made ‘Ponzi-like’ payments to some investors, and commingled investors’ assets with its own.”

“If There’s A Recession Coming, Not Even The Fed Could Stop It Now” (Barron’s). “t’s the latest version of the classic Trolley Problem. A train trolley is barreling down the tracks and people are stuck on the line up ahead. The Fed, in this example, is at the lever to change the course of the tracks, but that would put other people in danger. What should it do? The answer always depends on how you set up the dilemma. For the Fed, the important thing is that no matter what it does, innocent people are going to get hurt as the economy slows. If it stopped raising rates, or even started to cut, ever-faster inflation would crater consumer spending and upend company plans. That leads to a bad recession in and of itself.”

What we’re reading (5/25)

“Rising Rates Are Battering Mortgage Lenders” (Wall Street Journal). “Mortgage giants including Wells Fargo & Co. and Rocket Cos. have trimmed staff this spring. Online lender Better.com has laid off or offered buyouts to about half of its workforce since last December. While home prices continue to rise and Americans are still buying houses, the drop-off in refinancing activity is a giant blow because refinancings made up the bulk of U.S. mortgage originations throughout the pandemic. Some lenders are considering selling themselves, convinced it is the only way to make it through, according to industry executives and advisers.”

“What We Should Remember About Bear Markets” (Behavioural Investment). “Bear markets are an inescapable feature of equity investing. They are also the greatest challenge that investors will face. This is not because of the (hopefully temporary) losses that will be suffered, but the poor choices we are liable to make during them. Bear markets change the decision-making dynamic entirely. In a bear market, smart long-term decisions often look foolish in the short-term; whereas in a bull market foolish long-term decisions often look smart in the short-term.”

“Fed Minutes Point To More Rate Hikes That Go Further Than The Market Anticipates” (CNBC). “Federal Reserve officials earlier this month stressed the need to raise interest rates quickly and possibly more than markets anticipate to tackle a burgeoning inflation problem, minutes from their meeting released Wednesday showed. Not only did policymakers see the need to increase benchmark borrowing rates by 50 points, but they also said similar hikes likely would be necessary at the next several meetings.”

“Great Resignation Regret Is Sweeping The Nation As Workers Who Quit For More Money Quit Again: ‘It Sucks To Be Miserable’” (Insider). “LinkedIn found that among workers who started new jobs last year, the number who had been in their previous position for less than a year rose by 6.5% compared with the year before. That's the highest percentage of job migration the platform has recorded since it started tracking data in 2016.”

“After a Strong 2021, Hedge Funds Report Mixed Returns” (Institutional Investor). “After a strong year of performance in 2021, hedge funds fell back to earth in the early months of the year. The performance records are not surprising given the fallout from the Russia-Ukraine war, rising inflation, and the Federal Reserve’s moves to increase interest rates. Investors did well with hedge funds in 2021, particularly in credit, quantitative funds, and multi-strategy.”

What we’re reading (5/24)

“Tech Stocks Continue To Fall After Snap’s Profit Warning” (Wall Street Journal). “Other tech stocks that rely on digital advertising spending also fell. Google parent Alphabet Inc. slipped $110.36, or 5%, to $2,119.40, while Meta Platforms Inc. dropped $14.95, or 7.6%, to $181.28. Streaming-video company Roku Inc. was recently down $12.61, or 14%, to $79.16, while Twitter Inc., which last month agreed to be sold to Tesla Inc. Chief Executive Elon Musk, traded lower $2.10, or 5.6%, to $35.76.”

“What History Says Happens To Stocks If There’s A Recession” (Yahoo!Finance). “Using the historical average and median decline around recessions going back to 1948 (see chart below), [Truist Co-Chief Investment Officer] Lerner estimated that the S&P 500 has another 7% to 13% downside potential from current levels.”

“The Bull Market Minted Millions Of Day Traders. They’re In For A Rough Ride” (CNN Business). “‘I see a stock going up and I buy it. And I just watch it until it stops going up, and I sell it,’ says the user known as Chad. ‘I do it over and over and it pays for our whole lifestyle.’ Yes, Chad had discovered momentum trading. And it seemed to work out well for him. Like the millions of people who took up day trading during the pandemic, Chad was riding a thrilling bull market that was bingeing on ultra cheap money from the Federal Reserve”

“How Much Longer Can Google Own The Internet?” (Vox). “A group of lawmakers led by Sen. Mike Lee (R-UT) introduced the Competition and Transparency in Digital Advertising Act on Thursday. This bipartisan and bicameral legislation would forbid any company with more than $20 billion in digital advertising revenue — that’s Google and Meta, basically — from owning multiple parts of the digital advertising chain.”

“Spotting Talent” (City Journal). “High-status occupations are often extremely demanding, in part to select against people who are more interested in prestige than in the profession itself. The authors note that those who tend to do especially well in their careers prioritize improving their craft above other motives, such as the pursuit of prestige. In one of many unique insights throughout the book, Cowen and Gross provide a “quick window” into whether a person is more interested in ideas or obtaining social status. They state that in a group setting, ‘status-seekers focus on maximizing attention from the perceived elite. Idea-seekers, on the other hand, want to advance knowledge and stimulate curiosity.’”