May 2022 performance update

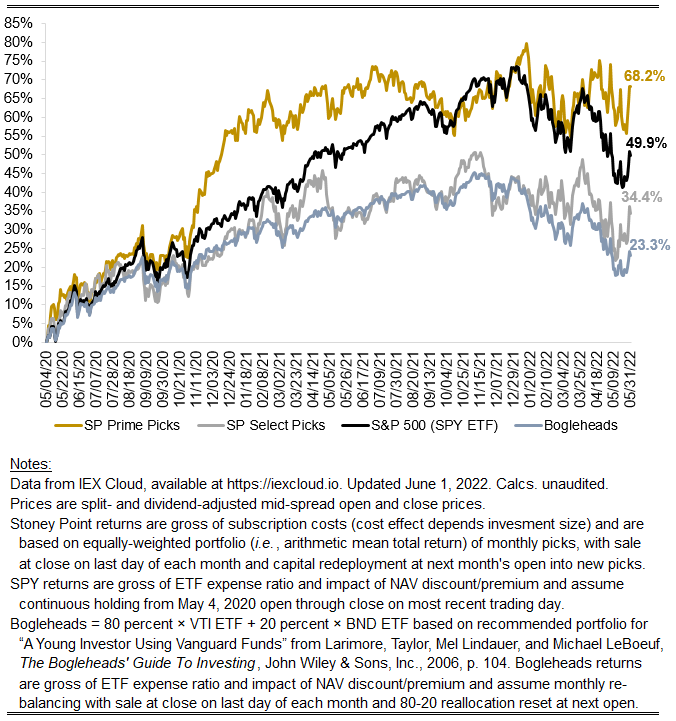

Hi friends, here with a performance update for May. The key numbers are:

Prime: +4.23%

Select: +4.79%

SPY ETF: +0.21%

Bogleheads portfolio (80% VTI, 20% BND): -0.12%

It was another crazy month as the market continued to anticipate future rate hikes and growth expectations softened considerably—at least in some corners of the market—at the same time. We are already seeing the effect of rates percolate through asset prices across economy, with some commodities coming back to earth, a noticeable deceleration in leading home price indicators, and, of course, much softer conditions for equities than in much of the last decade.

Notwithstanding that we blew out the market for a second straight month, with each of Prime and Select outperforming the S&P 500-tracking SPY ETF by more than 400 basis points. It is another encouraging sign that value is not dead, it has just been hibernating (relative to its historical outperformance of growth) during an anomalous, albeit prolonged, period in which money was not just free but, more recently, negatively priced.

As value investing continues to look like a promising strategy, I find it worth reminding myself that there really is no such thing as “value” stocks or a “growth” stocks. The core attributes that embody “value” and “growth” are not company fixed effects. Not long ago, for example, Meta and Twitter—two stocks generally characterized as “growth stocks”—regularly appeared in our Prime selections because, in my estimation (or rather my model’s estimation), they had characteristics at that time suggesting they were either underpriced or, alternatively, appropriately priced but at a level suggesting investors were demanding (and therefore the market expected) higher returns compared to other stocks. We have not held them for some time, as those characteristics changed.

Let’s see what June has in store.