What we’re reading (6/3)

“U.S. Stocks Are Trading at a Rarely Seen Discount” (Morningstar). “As of May 31, 2022, the price/fair value of a composite of the stocks covered by our equity analyst team was 0.87 times. Since 2011, on a monthly basis, there have only been a few other instances in which the markets have traded at such a large discount to our intrinsic valuation.”

“Corporate Executives Assess U.S. Economy As Clouds Form” (Wall Street Journal). “Over the past week, business leaders have laid out in the starkest terms yet that a period of universal strength in the U.S. economy has given way to a muddled outlook in which a labor shortage, soaring stock markets and a healthy consumer are no longer givens. Technology companies from Facebook parent Meta Platforms Inc. to Uber Technologies Inc. have sharply slowed hiring in recent weeks, and Elon Musk told staff at Tesla Inc. that he plans to cut 10% of its salaried jobs.”

“What’s Got Economists Rooting For A Slowdown” (DealBook). “Normally, when hiring slows it’s a troubling sign for the economy as a whole, but these are not normal times. With nearly twice as many open jobs as available workers and inflation running at its fastest pace in four decades, many economists and policymakers say a slowdown is just what the economy needs, reports The Times’s Ben Casselman.”

“Antitrust Vs. ESG” (Noahpinion). “if the U.S. moves toward an environment of increased competition, that will put more pressure on companies to focus purely on staying alive. And the recent stock crash and earnings squeeze will only increase this pressure.”

“Amazon CEO Of Worldwide Consumer Dave Clark Resigns” (CNBC). “Clark is one of a handful of the most important executives at Amazon, overseeing the company’s sprawling retail business, and a member of Jassy’s S-Team, a tight-knit group of over a dozen senior executives from almost all areas of Amazon’s business. He took over the role in 2020 after Jeff Wilke stepped down.”

May 2022 performance update

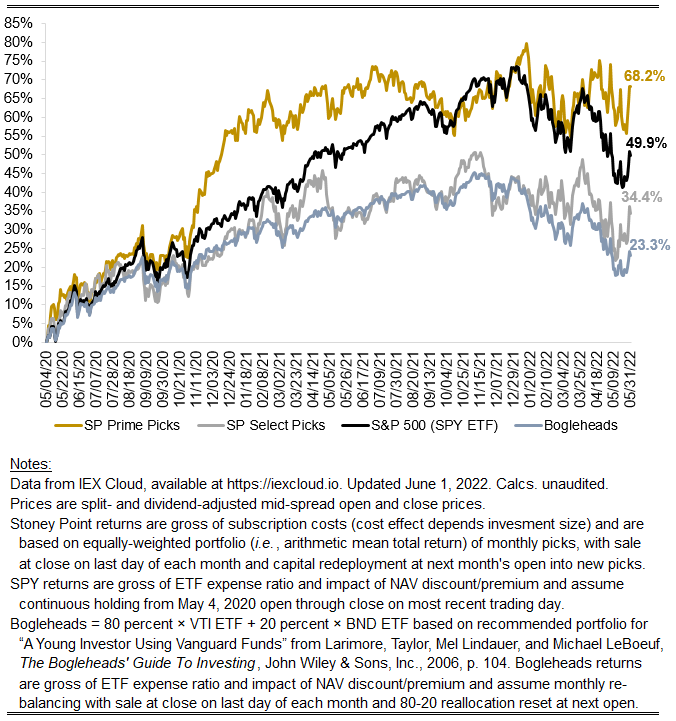

Hi friends, here with a performance update for May. The key numbers are:

Prime: +4.23%

Select: +4.79%

SPY ETF: +0.21%

Bogleheads portfolio (80% VTI, 20% BND): -0.12%

It was another crazy month as the market continued to anticipate future rate hikes and growth expectations softened considerably—at least in some corners of the market—at the same time. We are already seeing the effect of rates percolate through asset prices across economy, with some commodities coming back to earth, a noticeable deceleration in leading home price indicators, and, of course, much softer conditions for equities than in much of the last decade.

Notwithstanding that we blew out the market for a second straight month, with each of Prime and Select outperforming the S&P 500-tracking SPY ETF by more than 400 basis points. It is another encouraging sign that value is not dead, it has just been hibernating (relative to its historical outperformance of growth) during an anomalous, albeit prolonged, period in which money was not just free but, more recently, negatively priced.

As value investing continues to look like a promising strategy, I find it worth reminding myself that there really is no such thing as “value” stocks or a “growth” stocks. The core attributes that embody “value” and “growth” are not company fixed effects. Not long ago, for example, Meta and Twitter—two stocks generally characterized as “growth stocks”—regularly appeared in our Prime selections because, in my estimation (or rather my model’s estimation), they had characteristics at that time suggesting they were either underpriced or, alternatively, appropriately priced but at a level suggesting investors were demanding (and therefore the market expected) higher returns compared to other stocks. We have not held them for some time, as those characteristics changed.

Let’s see what June has in store.

Stoney Point Total Performance History

What we’re reading (6/2)

“The Perverse Politics Of Inflation” (Paul Krugman, New York Times). “[O]verheating isn’t unique to the United States. While some economists believe that European inflation is almost entirely due to transitory disruptions — something many people, myself included, wrongly believed about the United States a year ago — my read of recent European data suggests that it has also seen a rise in underlying inflation, despite not having pursued U.S.-type fiscal expansion.”

“Internal Documents Show Amazon's Dystopian System For Tracking Workers Every Minute Of Their Shifts” (Vice). “Infamously, Amazon punishes and sometimes fires warehouse workers who it believes are wasting time at work. A new filing obtained by Motherboard gives detailed insight into how Amazon tracks and records every minute of "time off task" (which it calls TOT) with radio-frequency handheld scanners that warehouse associates use to track customer packages.”

“Might I Suggest Not Listening To Famous People About Money?” (Vox). “Amid the current crypto crash, many people are a little miffed at the celebs who have been shilling for this stuff. Gwyneth Paltrow, Tom Brady, Reese Witherspoon, and even Larry David were all happy to assist in the mainstreaming of cryptocurrencies in recent months, only to go quiet now that the going has gotten a little tough. For Matt Damon, “fortune favors the brave” … who are apparently not brave enough to say maybe it was a bit of an oops to try to get regular people to gamble their hard-earned money on hyper-speculative assets.”

“Their Cryptocurrencies Crashed The Market. Now They’re Back At It.” (Washington Post). “When two cryptocurrencies crashed roughly three weeks ago, the effects were devastating. Their collapse sparked over $500 billion in losses in the broader crypto market. Numerous investors saw their life savings evaporate. Others contemplated suicide. People called for criminal investigations into the company behind it all and government regulation for the larger market. But now the team behind the failed coins are back at it.”

“What Are College Students Paying For?” (Quillette). “Today, many of the core works in any field can be found online for free. And many college lectures are available online to anyone. Students can often get much better guidance on navigating the books from the myriad free online sources than from the one person who happens to be their professor. Thus, the monopolies that colleges once had on publications and expertise have largely crumbled.”

What we’re reading (6/1)

“Where To Look For The Next Wall Street Blowup” (Wall Street Journal). “There are two new risks that history doesn’t help with. The first is the unprecedented amount of liquidity that has been pumped into finance by central banks buying bonds. A lack of liquidity is what usually creates financial problems, as it prevents debts being rolled over. As the Fed and other central banks drain liquidity, problems might reveal themselves. The second is that there’s a massive, and unknown, amount of private debt issued by lightly regulated shadow banks.”

“Fed’s Bullard Sees 3.5% Rates Setting Up Cuts In 2023 Or ‘24” (Bloomberg). “Federal Reserve Bank of St. Louis President James Bullard urged policy makers to raise interest rates to 3.5% this year to bring inflation down from near a four-decade high, adding that some of those hikes could be reversed late next year or in 2024.”

“Jamie Dimon Says U.S. Consumers Still Have Six To Nine Months Of Spending Power” (Wall Street Journal). “The head of the nation’s biggest bank said the recent drop in Americans’ savings rate hadn’t altered his view that the government’s pandemic stimulus is still padding consumers’ wallets. He estimated that some $2 trillion in extra funds are still waiting to be spent.”

“About 200 Years Ago, The World Started Getting Rich. Why?” (Vox). “The simplest answer is that economic growth occurred only after the rate of technological innovation became highly sustained. Without sustained technological innovation, any one-off economic improvement will not lead to sustained growth.”

“Jeez, If You Didn’t Know Any Better, You’d Almost Say Deutsche Bank Looks Like A Criminal Organization” (Dealbreaker). “Last time, four years had passed between police raids of Deutsche Bank’s headquarters in Frankfurt’s financial district. This time, it only took four weeks.”

What we’re reading (5/31)

“'This Is Not The Retirement I Envisioned.’ How Retirees Are Getting Hit by Inflation” (CNN Business). “Managing one's finances in retirement is always tricky. But with inflation pushing up the price of everything from gas to housing to eggs, many retirees are cutting back or eliminating certain costs altogether.”

“Tell Your Boss: Working From Home Is Making You More Productive” (Vox). “There is…objective data — like more calls per minute for call center workers, engineers submitting more changes to code, and Bureau of Labor Statistics data on growing output per hours worked — that has generally shown that people are, in fact, more productive working from home. But even the idea that people feel more productive is important…Interestingly, Slack’s Future Forum found that executives are more likely to say they want to work from the office than non-executives, but are less likely to be doing so full time.”

“What's Causing The Big Spike In Car Prices, And How Consumers Should React” (RealClear Markets). “As chief executive of a company that analyzes valuations of thousands of cars and trucks each year, I think consumers would be wise to consider how the economics of vehicle ownership have changed in the past two years of pandemic. They also shouldn’t expect these high prices to last.”

“How did the IR [International Relations] Community Get Russia/Ukraine So Wrong?” (Marginal Revolution). “In proper Tetlockian fashion, I thought I would look back and consider how well IR experts did in the time leading up to the current war in Ukraine. In particular, how many of them saw in advance that a war was coming? And I don’t mean a day or two before the war started, though there were still many commentators in denial at such a late point…Overall, on a scale of one to ten, how would we grade the performance of IR scholars on the Russia-Ukraine war? 2? 2.5?”

“President Biden, Fed Chairman Jerome Powell Meet With Inflation At Its Highest In 40 Years” (Wall Street Journal). “The Tuesday meeting highlighted how much the White House is relying on outside forces to help combat the highest inflation in four decades. Administration officials earlier had played down inflation worries while promoting the $1.9 trillion Covid-19 relief package in March 2021 and in seeking additional spending on healthcare, education and climate change last year.”

June picks available now

The new Prime and Select picks for June are available starting now, based on a model run put through today (May 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Wednesday, June 1, 2022 (at the mid-spread open price) through the last trading day of the month, Thursday, June 30, 2022 (at the mid-spread closing price).

What we’re reading (5/27)

“EY Split-Up Plan Exposes Rift Among Accounting Firms” (Wall Street Journal). “Ernst & Young’s plan for a possible world-wide split of its audit and consulting businesses, code-named Project Everest according to people familiar with the matter, was dismissed by major rivals Friday who said they would keep their firms in one piece.”

“How Influencers Hype Crypto, Without Disclosing Their Financial Ties” (New York Times). “In some cases, promoters like Mr. Paul have admitted that they failed to disclose personal or financial ties to projects advertised on their feeds, a potential violation of federal marketing regulations. And even before the crypto market’s recent downturn, a series of these influencer-backed ventures had crashed spectacularly, hurting amateur traders and prompting lawsuits that could force some celebrities to compensate investors for their losses.”

“Please Don’t Invest In This Crypto Scam Because Deepfake Elon Musk Told You To” (Gizmodo). “The video with deepfake Musk, which started popping up on some YouTube channels about a week ago, introduces a scam cryptocurrency platform called BitVex that, contrary to its claims, steals the cryptocurrency that users deposit into it. Scammers behind BitVex say the platform was started by Musk and developed ‘by the best mathematicians from Tesla,’ according to a poorly made YouTube video on BitVex’s channel with more than 90,000 views. (The channel itself has 112,000 subscribers).”

“This Market Rally Could Force The Fed To Raise Rates Higher” (Barron’s). “Based on the decline in interest rates and the recovery in equity prices this past week, the answer would appear to be yes. Indeed, since early May, fed-funds futures have discounted about two fewer quarter-point hikes by the first half of 2023, when the tightening is expected to peak. A top range of 2.75%-3% now is forecast by February, according to the CME FedWatch site.”

“Why Investors Are Increasingly Worried About Recession In America” (The Economist). “From January until early May, falling share prices could be put down to the effect of rising bond yields, as fixed-income markets responded to guidance from the Federal Reserve that interest rates would be going up a lot and fast. Higher interest rates reduce the present value of a stream of future company profits. Shares were marked down accordingly, especially those of technology firms whose profits could be projected furthest into the future. But in recent weeks share prices have kept falling, even as bond yields have dropped back. This combination points to fears of recession.”

What we’re reading (5/26)

“The Rise And Fall Of Wall Street’s Most Controversial Investor” (New York Magazine). “Morningstar, a fund-rating company that usually takes a dispassionate perspective, recently published an excoriating review of Wood’s performance, downgrading ARKK to “negative” from neutral. Though her fund had beaten all other U.S. stock funds in 2020, Wood was now looking more like a one-hit wonder. Wood’s returns, Morningstar wrote, had been “wretched,” making ARKK “one of the worst-performing” funds in the U.S. since 2020. Her ‘perilous approach’ and ‘haphazard’ disregard for risk — unlike other asset managers, ARK doesn’t employ any risk-management staff, Morningstar noted — was likely to ‘hurt’ investors, according to the analysis.”

“Every Bear Market Is Different” (Compound Advisors). “[W]hile not likely, a recession could be coming without stocks declining much more than they already have. Given the fear out there, it’s safe to say that most investors are probably not envisioning one of these more benign scenarios. They are more likely fearing something much worse, a repeat of the 50%+ recessionary bear markets of 2000-02 and 2007-09. While that’s certainly a possibility, so is a shallower decline accompanied with a recession, or no recession at all.”

“Wall Street’s Housing Grab Continues” (The Economist). “One group of buyers…remains unfazed: Wall Street. What began as an opportunistic bet on single-family housing during America’s subprime crash of 2007-10 has morphed into a mainstream asset class. Today all sorts of institutions—from private-equity firms to insurers and pension funds—are piling into the sector. They are unlikely to vacate it: being a rentier looks as appealing as ever.”

“SEC Sues Florida Firm That Raised $410 Million For IPO-Linked Fraud” (Reuters). “The SEC said StraightPath pitched its investment vehicles as a way for ordinary investors to own ‘highly coveted,’ hard-to-find pre-IPO shares in such companies as plant-based burger maker Impossible Foods and cryptocurrency exchange Kraken. But the SEC said the Jupiter, Florida-based firm often did not have the shares, made ‘Ponzi-like’ payments to some investors, and commingled investors’ assets with its own.”

“If There’s A Recession Coming, Not Even The Fed Could Stop It Now” (Barron’s). “t’s the latest version of the classic Trolley Problem. A train trolley is barreling down the tracks and people are stuck on the line up ahead. The Fed, in this example, is at the lever to change the course of the tracks, but that would put other people in danger. What should it do? The answer always depends on how you set up the dilemma. For the Fed, the important thing is that no matter what it does, innocent people are going to get hurt as the economy slows. If it stopped raising rates, or even started to cut, ever-faster inflation would crater consumer spending and upend company plans. That leads to a bad recession in and of itself.”

What we’re reading (5/25)

“Rising Rates Are Battering Mortgage Lenders” (Wall Street Journal). “Mortgage giants including Wells Fargo & Co. and Rocket Cos. have trimmed staff this spring. Online lender Better.com has laid off or offered buyouts to about half of its workforce since last December. While home prices continue to rise and Americans are still buying houses, the drop-off in refinancing activity is a giant blow because refinancings made up the bulk of U.S. mortgage originations throughout the pandemic. Some lenders are considering selling themselves, convinced it is the only way to make it through, according to industry executives and advisers.”

“What We Should Remember About Bear Markets” (Behavioural Investment). “Bear markets are an inescapable feature of equity investing. They are also the greatest challenge that investors will face. This is not because of the (hopefully temporary) losses that will be suffered, but the poor choices we are liable to make during them. Bear markets change the decision-making dynamic entirely. In a bear market, smart long-term decisions often look foolish in the short-term; whereas in a bull market foolish long-term decisions often look smart in the short-term.”

“Fed Minutes Point To More Rate Hikes That Go Further Than The Market Anticipates” (CNBC). “Federal Reserve officials earlier this month stressed the need to raise interest rates quickly and possibly more than markets anticipate to tackle a burgeoning inflation problem, minutes from their meeting released Wednesday showed. Not only did policymakers see the need to increase benchmark borrowing rates by 50 points, but they also said similar hikes likely would be necessary at the next several meetings.”

“Great Resignation Regret Is Sweeping The Nation As Workers Who Quit For More Money Quit Again: ‘It Sucks To Be Miserable’” (Insider). “LinkedIn found that among workers who started new jobs last year, the number who had been in their previous position for less than a year rose by 6.5% compared with the year before. That's the highest percentage of job migration the platform has recorded since it started tracking data in 2016.”

“After a Strong 2021, Hedge Funds Report Mixed Returns” (Institutional Investor). “After a strong year of performance in 2021, hedge funds fell back to earth in the early months of the year. The performance records are not surprising given the fallout from the Russia-Ukraine war, rising inflation, and the Federal Reserve’s moves to increase interest rates. Investors did well with hedge funds in 2021, particularly in credit, quantitative funds, and multi-strategy.”

What we’re reading (5/24)

“Tech Stocks Continue To Fall After Snap’s Profit Warning” (Wall Street Journal). “Other tech stocks that rely on digital advertising spending also fell. Google parent Alphabet Inc. slipped $110.36, or 5%, to $2,119.40, while Meta Platforms Inc. dropped $14.95, or 7.6%, to $181.28. Streaming-video company Roku Inc. was recently down $12.61, or 14%, to $79.16, while Twitter Inc., which last month agreed to be sold to Tesla Inc. Chief Executive Elon Musk, traded lower $2.10, or 5.6%, to $35.76.”

“What History Says Happens To Stocks If There’s A Recession” (Yahoo!Finance). “Using the historical average and median decline around recessions going back to 1948 (see chart below), [Truist Co-Chief Investment Officer] Lerner estimated that the S&P 500 has another 7% to 13% downside potential from current levels.”

“The Bull Market Minted Millions Of Day Traders. They’re In For A Rough Ride” (CNN Business). “‘I see a stock going up and I buy it. And I just watch it until it stops going up, and I sell it,’ says the user known as Chad. ‘I do it over and over and it pays for our whole lifestyle.’ Yes, Chad had discovered momentum trading. And it seemed to work out well for him. Like the millions of people who took up day trading during the pandemic, Chad was riding a thrilling bull market that was bingeing on ultra cheap money from the Federal Reserve”

“How Much Longer Can Google Own The Internet?” (Vox). “A group of lawmakers led by Sen. Mike Lee (R-UT) introduced the Competition and Transparency in Digital Advertising Act on Thursday. This bipartisan and bicameral legislation would forbid any company with more than $20 billion in digital advertising revenue — that’s Google and Meta, basically — from owning multiple parts of the digital advertising chain.”

“Spotting Talent” (City Journal). “High-status occupations are often extremely demanding, in part to select against people who are more interested in prestige than in the profession itself. The authors note that those who tend to do especially well in their careers prioritize improving their craft above other motives, such as the pursuit of prestige. In one of many unique insights throughout the book, Cowen and Gross provide a “quick window” into whether a person is more interested in ideas or obtaining social status. They state that in a group setting, ‘status-seekers focus on maximizing attention from the perceived elite. Idea-seekers, on the other hand, want to advance knowledge and stimulate curiosity.’”

June picks available soon

We’ll be publishing our Prime and Select picks for the month of June before Wednesday, June 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of May, as well as SPC’s cumulative performance, assuming the sale of the May picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Tues., May 31). Performance tracking for the month of June will assume the June picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Wed., June 1).

What we’re reading (5/22)

“'The Democratization Of Investing’: Index Funds Officially Overtake Active Managers” (Yahoo! Finance). “For the first time in history, retail investors’ index fund holdings exceed their holdings in actively-managed funds, according to new numbers from Morningstar Direct. As of March 31, Morningstar says, retail investors had $8.53 trillion invested in index mutual funds, while $8.34 trillion worth of assets were invested in actively-managed funds.”

“Stock Market Bottom Remains Elusive Despite Deepening Decline” (Wall Street Journal). “Data have continued to suggest that this year’s selloff, while painful, hasn’t yet resulted in the type of shifts in investing behavior seen in prior downturns. Investors continue to have a hefty chunk of their portfolios in the stock market. Bank of America Corp. said this month that its private clients have an average of 63% of their portfolios dedicated to stocks—far more than after the 2008 financial crisis, when they had just 39% of their portfolios in stocks.”

“Davos Is Back And The World Has Changed. Have The Global Elite Noticed?” (CNN Business). “The last two years have dramatized and clarified what has been true for some time now, which is an elite plutocratic class is not just leaving the rest of the world behind, but is thriving precisely by stepping on the necks of everybody else," said Anand Giridharadas, author of the book ‘Winners Take All: The Elite Charade of Changing the World.’”

“If You Expected Bitcoin to Mimic Gold, You Haven't A Clue About Gold” (RealClear Markets). “[G]old has long been viewed as the inflation hedge par excellence. If the conventional wisdom about gold is to be believed, the rising prices that some deem inflation instigate a rush into the yellow metal that exists as a safe haven of sorts against rising prices; investors once again rushing to gold’s safety on the way to bidding it up. The seeming mystery here is why Bitcoin hasn’t outperformed gold.”

“Doom and Gloom: When Will It End?” (Charles Schwab). “There is no perfect signal of when bear markets end. What we do know is that in bear markets, from a technical perspective, support becomes less relevant and resistance becomes more relevant. Assessing technicians' consensus, as an example, resistance sits somewhere between 4330 and 4400 on the S&P 500, a range (for now) that represents a key hurdle.”

What we’re reading (5/19)

“Stock Markets Finish Volatile Session Lower As S&P 500 Extends Decline” (Wall Street Journal). “U.S. stocks and bond yields fell, with the S&P 500 flirting with a bear market, in a continuing selloff driven by investor fears that the economy could be pitched into a recession. The major indexes dipped early in Thursday’s session, a day after tumbling 4%, before recovering ground. They ultimately finished lower, with all three on track for weekly losses of at least 2.9%. Concerns about consumer spending, which helped lift the market out of pandemic lows, have weighed on stocks and bond yields.”

“Markets Haven’t Acted Like This Since 1981 — And Here’s How That Played Out” (MarketWatch). “‘Just like today, the world’s central banks were obsessed with ‘breaking the back’ of inflation, which, like a monster in a horror movie, kept appearing to die before coming back with second and third winds,’ says Dhaval Joshi, chief strategist for BCA Research’s Counterpoint. ‘Just like today, the central banks were desperate to repair their badly damaged credibility in managing the economy.’”

“The Key 10-Year Treasury Yield Is Tumbling To Its Lowest Point In Weeks As Softening Economic Conditions Fuel Speculation Of A ‘Fed Pivot’ On Rates” (Insider). “On Thursday, data from the Philadelphia Fed showed a considerable slowdown in manufacturing activity in the mid-Atlantic region. The Philly Fed Index dropped by 15 points in May to 2.6, well below the Econoday consensus estimate of 16.1. Last week, consumer sentiment fell to its lowest since 2011, with the University of Michigan's May gauge driving down 9% to 59.1.”

“Goldman, JPMorgan Strategists See Recession Fears As Overblown” (Bloomberg). “Goldman Sachs Group Inc.’s David J. Kostin and JPMorgan Chase & Co.’s Marko Kolanovic say investor fears of imminent recession in the US are overblown -- leaving room for an equities recovery as the year progresses, in Kolanovic’s view. The benchmark S&P 500 has slumped 18% from its January record, approaching bear market territory.”

“Elon Musk’s Next Target” (DealBook). “Elon Musk is the latest prominent figure to push back on one of the hottest trends on Wall Street and in corporate America: E.S.G., the idea of valuing companies based on how they follow environmental, social and governance principles, rather than just chasing profits. Musk called E.S.G. a “scam” after S&P Global, the manager of a popular E.S.G. index, publicized that it had kicked Musk’s electric car company Tesla out of the index[.]”

What we’re reading (5/18)

“Will US Inflation Lead To Recession?” (Project Syndicate). “Rapid consumer price inflation in the United States is masking signs of an economic slowdown that could threaten the longevity of current growth. While nominal personal consumption spending grew by 3.4% between October 2021 and March 2022 (the most recent month for which data are available), accounting for higher prices shows that personal consumption spending was flat overall. And inflation-adjusted retail sales look even worse, having been flat since March 2021.”

“Cautionary Tales From Cryptoland” (Harvard Business Review). “My overwhelming feeling is that Web3 projects seem to be a solution in search of a problem. It often seems like project creators knew they wanted to incorporate blockchains somehow and then went casting around for some problem they could try to solve with a blockchain without much thought as to whether it was the right technology to address it, or even if the problem was something that could or should be solved with technology at all.”

“Wave Of Layoffs At Startups Foretell A Slow Summer For Venture Investing” (Forbes). “‘It just dried up overnight,’ venture investor Dharmesh Thakker told Forbes. It’s left many founders in a state of shock, said Thakker, a general partner at Battery Ventures in Menlo Park, California. It’s also left many startup employees without jobs. So far this month, more than 5,400 workers have been let go, according to data from Layoffs.fyi, a website that tracks tech employment.”

“Melvin Capital To Close Funds, Return Cash To Investors” (Wall Street Journal). “Melvin Capital plans to close its funds and return the cash to its investors, capping a stunning reversal for a firm that lost big on the surge in meme stocks last year and on wagers on growth stocks this year. In a letter to investors that was reviewed by The Wall Street Journal, Gabe Plotkin, Melvin’s founder, wrote that he reached his decision after conferring with Melvin’s board of directors during a monthslong process of reassessing his business.”

“‘Pharma Bro’ Martin Shkreli has been released from prison early and sent to a halfway house” (Insider). “Shkreli posted a selfie on his Facebook page Wednesday with the caption: ‘Getting out of real prison is easier than getting out of Twitter prison.’ He was likely referencing his 2017 suspension from the platform for harassing a journalist.”

What we’re reading (5/17)

“The Fed Has A New Plan To Avoid Recession: Party Like It's 1994” (CNN Business). “The history of central bank rate hikes does appear to support the inevitability of an economic downturn, but there have been rare instances when the Fed has made a soft landing: Once in 1965, and again in 1984 and 1994.”

“Powell Says Fed Has Resolve To Bring U.S. Inflation Down” (Wall Street Journal). “‘Restoring price stability is a nonnegotiable need. It is something we have to do,’ Mr. Powell said in an interview Tuesday during The Wall Street Journal’s Future of Everything Festival. ‘There could be some pain involved.’”

“Ben Bernanke Sees ‘Stagflation’ Ahead” (New York Times). “‘Even under the benign scenario, we should have a slowing economy,’ he said. ‘And inflation’s still too high but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high,’ he predicted. ‘So you could call that stagflation.’”

“AQR Gets Rewarded For Its ‘Sins’” (CityWire). “Asness’s Greenwich, Connecticut-based quant shop AQR has nine mutual funds across various alternative categories sitting top or near top of their peer groups. In some cases, they are ahead of the competition by an eye-watering margin…much of the firm’s outperformance is down to what Asness has previously described as a ‘sinning a little’ – namely factor timing, specifically overweighting value.”

“What Is The Point Of Crypto?” (Vox). “The claims proponents have long made about cryptocurrency — that it’s an inflation hedge, that it’s digital gold — appear increasingly dubious. Well before the current downturn, a lot of what was going on was fishy. Hackers have stolen tens of millions of dollars in crypto, and the sector is rife with stories about various scams. One big trend in the space might pretty blatantly be a Ponzi scheme.”

What we’re reading (5/16)

“Wall Street Is Heading Into A Summer From Hell — And Top Investors Say It's Going To Bring A Near-Biblical Reckoning To The Market” (Insider). “After years of inflating, it's becoming clear that the ‘everything bubble’ has burst. Since the start of 2022, the S&P 500 has fallen by more than 18%, and the tech-heavy Nasdaq is down almost 30%. A punishing combination of still hot inflation, hiked interest rates, war in Europe, lockdowns in China, unprofitable companies facing reality, and recession fears is making it clear that this isn't just a short-term drawdown — it's a pivotal shift for markets.”

“For Tech Startups, The Party Is Over” (Wall Street Journal). “Last year, e-commerce startup Thrasio LLC was expected to be valued at $10 billion or more in a funding deal that would have led to the four-year-old company going public. The deal didn’t happen, and Thrasio, which buys and aggregates retailers that sell on Amazon.com Inc., continues to burn through the more than $3.4 billion of debt and equity it had raised. In recent weeks Thrasio has cut close to 20% of its workforce, announced a new CEO, tapped the brakes on acquisitions and scaled back engineering projects, according to former employees and an internal company memo reviewed by The Wall Street Journal.”

“Bitcoin, NFTs, SPACs, Meme Stocks — All Those Pandemic Investment Darlings Are Crashing” (Los Angeles Times). “Over the last few weeks and months, almost every financial asset has come hurtling back to Earth after high-altitude flights…fad assets such as cryptocurrencies, nonfungible tokens (NFTs), blank-check companies (or SPACs), and meme stocks such as GameStop, have taken the biggest hits.”

“Crypto Plunge Exposes The Folly Of Taxing Unrealized Gains” (RealClear Markets). “[It’s been] a tough break for people with a great deal of exposure to the cryptocurrency market, but it would have been far tougher had they already had to pay taxes on gains that have since been wiped out. After all, someone who bought Bitcoin at its value of about $30,000 in July of 2021 would have ended the year with about $17,000 in unrealized gains per Bitcoin — “gains” which have since disappeared.”

“SPACs Are Sputtering. Desperate New Terms Could Send Them Into A Death Spiral.” (Institutional Investor). “The stock prices bear out the analysis. More than 300 companies that have gone public via SPAC mergers since the start of 2018 have averaged a loss of about 33 percent from the IPO price of the SPAC, versus an average loss of 2 percent for the 1,000 other companies that chose to go public through a traditional IPO as of mid-April, according to Renaissance Capital, which tracks IPOs. Compared with the S&P 500, which gained more than 50 percent during that time, the SPAC numbers are little short of a disaster.”

What we’re reading (5/15)

“Global Growth Is Slowing, But Not Stopping—Yet” (The Economist). “[S]o far, what people say and what people do seem to be different things. Global restaurant bookings on OpenTable, a reservations website, are still above the pre-pandemic norm. In America hotel occupancy still shows sign of improvement. A high-frequency measure of Britons’ spending habits, constructed by the Office of National Statistics and the Bank of England, shows little sign that people are holding off on social activities, or on purchases that could be deferred.”

“Ex-Goldman CEO Blankfein Says Recession Possibility Is ‘Very High Risk Factor’” (CNBC). “‘There’s a path. It’s a narrow path,’ said Blankfein, who retired from Goldman Sachs several years ago and now holds the title of senior chairman. ‘But I think the Fed has very powerful tools. It’s hard to finely tune them, and it’s hard to see the effects of them quickly enough to alter it, but I think they’re responding well. It’s definitely a risk.’”

“Investors Stay Put, Because They Can’t Think Of Better Options” (Wall Street Journal). “Many traders say they are on the prowl for other investments, but even tried-and-true alternatives have lost their allure. A dash for cash—a usual strategy during turmoil—looks less appealing when inflation is hovering above 8%, chipping away at purchasing power. Investing in real estate can feel like a nonstarter when mortgage rates are rising and home prices have soared to records. The only option, some investors say? Sitting tight.

“Panic In The Crypto Marker Has Janet Yellen’s Attention” (CNN Business). “Investors in stocks, bonds and commodities are all on edge right now. But in the market for cryptocurrencies, unease has morphed into full-on panic, catching the attention of regulators in Washington tasked with maintaining financial stability.”

“Is There A Housing Shortage Or Not?” (Construction Physics). “We…can’t infer much from the fact that US homebuilding rates per capita are lower than they were in the past, because we would expect that to happen at some point soon regardless.”

What we’re reading (5/12)

“Crash Of TerraUSD Shakes Crypto. ‘There Was A Run On The Bank.’” (Wall Street Journal). “The cryptocurrency TerraUSD had one job: Maintain its value at $1 per coin. Since it launched in 2020, it had mostly done that, rarely straying more than a fraction of a penny from its intended price. That made it an island of stability, a place where traders and investors could stash their funds in between forays into the otherwise frenzied crypto market. This week TerraUSD became part of the frenzy too, slumping by more than a third on Monday and then tumbling as low as 23 cents on Wednesday.”

“Bitcoin Is Increasingly Acting Like Just Another Tech Stock” (New York Times). “The growing correlation helps explain why those who bought the cryptocurrency last year, hoping it would grow more valuable, have seen their investment crater. And while Bitcoin has always been volatile, its increasing resemblance to risky tech stocks starkly shows that its promise as a transformative asset remains unfulfilled.”

“Shaky Stocks Send S&P 500 To The Bear Market Brink And Back” (Bloomberg). “More hair-raising volatility in the S&P 500 pushed the index within spitting distance of a 20% drop, a decline that puts markets on covers of newspapers and holds ominous meaning for the economy. Down as much as 1.9% Thursday and 30 points from a bear market before a last-hour rally, the benchmark appears destined to decrease for a sixth straight week, something it hasn’t done since June 2011.”

“Investors Haven’t Begun To Price In Recession: Here’s How Far The S&P 500 Could Fall” (MarketWatch). “The battered S&P 500 index is not pricing in a recession, according to DataTrek Research. ‘At 4,000, the recession odds imbedded in S&P are close to zero,’ said DataTrek co-founder Nicholas Colas in a note emailed Tuesday. The S&P 500 (SPX) a stock benchmark measuring the performance of large U.S. companies, has dropped more than 16% this year after closing Monday at 3,991.24.”

“The Forgotten Stage Of Human Progress” (The Atlantic). “Many books about innovation and scientific and technological progress are just about people inventing stuff. The takeaway for most readers is that human progress is one damn breakthrough after another…But the insistence on invention often overlooks the fact that we’re running low on the capacity to deploy the tech we already have.”

What we’re reading (5/11)

“Inflation Slipped In April, But Upward Pressures Remain” (Wall Street Journal). “The Labor Department’s consumer-price index reading last month marked the first drop for inflation in eight months, down from an 8.5% annual rate in March. The decline came primarily from a slight easing in April gasoline prices, which have since reached a new high. Broadly, the report offered little evidence that inflation was cooling.”

“For Tens Of Millions Of Americans, The Good Times Are Right Now” (New York Times). “‘Maybe it’s easier to focus on the negative, but a huge number of people, maybe 40 million households, have been doing pretty well,’ said Dean Baker, an economist who was a co-founder of the liberal-leaning Center for Economic and Policy Research. ‘You’d have to go back to the late 1990s to find a similar era. Before that, the 1960s.’”

“Fed Confronts Why It May Have Acted Too Slowly On Inflation” (New York Times). “Several current and former Fed officials have suggested in recent days that, in hindsight, the central bank should have reacted more quickly and forcefully last fall, but that both profound uncertainty about the future and the Fed’s approach to setting policy slowed it down.”

“The Stock Market Is Freaking Out Because Of The End Of Free Money. It All Has To Do With Something Called ‘The Fed put’” (Fortune). “It took a while to sink in after last week, but investors had a full freak-out from Friday through Monday when they realized just how serious the Federal Reserve is about fighting inflation.”

“Fed’s Barkin Says ‘Volcker-Like Recession’ Unnecessary To Bring Inflation Down” (Market Watch). “The Federal Reserve doesn’t need to engineer a ‘Volcker-style recession’ to get inflation under control, said Richmond Fed President Tom Barkin on Tuesday. With the Fed’s benchmark policy rate at 83 basis points, ‘we are still far from the level of interest rates that constrains the economy,’ Barkin said.”

What we’re reading (5/10)

“NFTs Are Plunging In Popularity? Yeah, That Makes Sense.” (MSNBC). “two problems the market is facing. First, the number of active traders has plummeted from almost a million accounts at the start of the year to about 491,000, NBC News reported Thursday. A lack of new interest or sustained interest in an asset is rarely a good sign for its longevity. Second, there’s been a flood of supply. “There are about five NFTs for every buyer, according to data from analytics firm Chainalysis,” the [Wall Street] Journal reported.”

“I Bonds: The Nearly Risk-Free Asset Yielding 9.6%” (U.S. News & World Report). “The U.S. Department of the Treasury recently announced that I bonds will pay a 9.62% interest rate through October 2022, their highest yield since they were first introduced back in 1998. These I bonds are protected against inflation and backed by the U.S. government, making them essentially risk-free investments – the only way these investments fail is if Uncle Sam doesn't pay his debts.”

“‘Buy The Dip’ Believers Are Tested By Market’s Downward Slide” (Wall Street Journal). “Individuals’ willingness to backstop markets throughout this year’s selloff demonstrates that the group—for now—has been more resilient than analysts and trading professionals anticipated. Few were surprised when individual investors pounced on small dips as the market churned higher last year, helping the S&P 500 cruise to 70 records and rewarding those who waded in.”

“A Legal Test For Evaluating Modern Corporate-Executive Self Dealing” (RealClear Markets). “Corporate executives increasingly proudly proclaim that they’re acting in the interests of parties – ‘stakeholders’ – other than their shareholder bosses, creating an agency problem…[t]o be sure, they usually append a line asserting that their actions are also in the long-term interests of shareholders, in some nebulous and ill-defined way. But if these self-serving assertions are sufficient…then the self-dealing exception to the business-judgment rule has been eliminated, and the ability of shareholders to have even the most tenuous control over the actions of their managers has been eliminated.”

“Data And Market Power” (Jan Eeckhout and Laura Veldkamp, NBER). “[W]e craft a model in which economies of scale in data induce a data-rich firm to invest in producing at a lower marginal cost and larger scale. However, the model uncovers much richer interactions between data, welfare and market power. Data affects risk, firm size and the composition of the goods firms produce, all of which affect markups.”