What we’re reading (4/26)

“3 Recession Indicators Are Flashing Red…Here’s Why You Shouldn’t Panic” (RiskHedge). “Here’s something I bet you didn’t know about recessions. Stocks typically eke out a small gain during recessions. The S&P 500 rose in seven of the past 13 recessions[.]”

“A Major Recession Is Coming, Deutsche Bank Warns” (CNN Business). “Deutsche Bank raised eyebrows earlier this month by becoming the first major bank to forecast a US recession, albeit a ‘mild’ one. Now, it's warning of a deeper downturn caused by the Federal Reserve's quest to knock down stubbornly high inflation. ‘We will get a major recession,’ Deutsche Bank economists wrote in a report to clients on Tuesday.”

“Alphabet Earnings Show Slowing Sales Growth On Digital-Ad Tumult” (Wall Street Journal). “The company said first-quarter sales rose 23% from the year-ago period, the lowest rate for the tech giant since late 2020. In the interim, the company saw a period of massive sales growth, as small and large businesses alike flooded into the ad market seeking to win customers who spent the early period of the pandemic sequestered in their homes. Company sales advanced 41% last year.”

“Credit Funds Lay Low And Even Prosper In A Tough First Quarter” (Institutional Investor). “Fresh off their best year in about a decade, credit funds were mostly flat or barely back in the black in the first quarter. But given the economic environment, things could have been worse.”

“The Age Of The Tyrannical Boss Is Over — And Managers Who Don't Give Employees More Freedom Will Face A Talent Reckoning” (Insider). “Over the past few years, white-collar workers have started to see their job as many blue-collar, hourly workers already do: an economic transaction where they are being paid to do work assigned to them and deliver a product. What they think a lot less about are things like company loyalty and being a member of a white-collar ‘family’ — ideas that benefit management more than workers.”

What we’re reading (4/25)

“Twitter Accepts Elon Musk’s Offer To Buy Company In $44 Billion Deal” (Wall Street Journal). “The [$44 billion] takeover, if it goes through, would mark one of the biggest acquisitions in tech history and will likely have global repercussions for years to come, including possibly reshaping how billions of people use social media. Mr. Musk will bring his commitment to a more hands-off approach on speech to a company that has struggled to reconcile freewheeling conversation with content that appeals to advertisers.”

“Elon Closes In” (Matt Levine, Bloomberg). “Incidentally, the legal standard here is a bit odd. Roughly speaking, the way Delaware law works is that a board can reject a cash acquisition for stakeholder-y reasons, but it can’t really accept one for those reasons. ‘We will not sell to Elon Musk because it would be bad for the world for him to own Twitter, even though the price is right,’ is a controversial but possible thing for the board to say. ‘We will sell to Elon Musk because it would be good for the world for him to own Twitter, even though the price is wrong,’ would not be okay.”

“It’s Not Just High Oil Prices. It’s A Full-Blown Energy Crisis.” (Helen Thompson, New York Times). “Americans are worrying about their gas prices. Germans are turning down their heating. Peru has seen violent protests — and a violent crackdown on them — over rising fuel costs. Nigeria’s national energy grid recently collapsed. And that’s just this spring. Focused on the future, the United Nations Intergovernmental Planet on Climate Change warned in a report on April 4 that too much investment is going into fossil fuels and too little into the energy transition that could prevent a devastating increase in global temperatures.”

“The Gathering Stagflationary Storm Will Rattle Markets, Economies And Societies” (Nouriel Roubini, Project Syndicate). “The new reality with which many advanced economies and emerging markets must reckon is higher inflation and slowing economic growth. And a big reason for the current bout of stagflation is a series of negative aggregate supply shocks that have curtailed production and increased costs. This should come as no surprise.”

“Prosecutors Spoof Spoofer Into Guilty Plea For Spoofing” (Dealbreaker). “Federal prosecutors and authorities more generally have spent the better part of the last few years trying to demonstrate that spoofing—goosing the market you actually intend to trade in with a raft of rather large orders you have no intention of actually executing—is, in fact, illegal. And, like, properly, prison-worthy illegal, whatever those bleeding hearts at the U.S. Probation Office say.”

What we’re reading (4/21)

“The Gap Between The Best And Worst Hedge Fund Strategies Just Widened” (Institutional Investor). “Hedge fund investors might be having wildly different performance experiences. Take managed futures funds, for example, which have turned in monthly performance numbers that haven’t been this good since 2003. In fact, if 2022 were to end in March, the category’s 9.7 percent return would be its best calendar year since 2014. On the other end of the performance spectrum, the equity sector index returned – 7.6 percent for the first three months of the year. If 2022 ended now, equity sector funds would have had their worst calendar year since 2008.”

“Fed’s Powell Seals Expectations Of Half-Point Rate Rise in May” (Wall Street Journal). “A rate increase in May, following the Fed’s decision to lift rates from near zero by a quarter percentage point last month, would mark the first time since 2006 that the central bank increased its policy rate at back-to-back meetings. A half-point increase would be the first such move since 2000.”

“How America’s Farmers Got Cut Out Of The Supply Chain” (New York Times). “Beyond a logistical torment, the crisis assailing almond producers is inflicting deep financial consequences, from diminished revenues to higher costs for storage. The same can be said for a broad array of other American agricultural exporters — from wheat growers in North Dakota to soybean producers in Nebraska — as shipping crops to customers has become maddening to the point of futility.”

“Rising Gas Prices Alter The Notion Of The Car, Moke Will Alter Your View Of EV” (RealClearMarkets). “It doesn’t take an automotive engineer or a crystal ball to conclude that the hit on American wallets every time consumers fill up will likely result in greater interest in electric vehicles (EVs). But the switch towards EVs isn’t just about gas prices. Momentum has been building for a while and EVs are playing an increasing part in the overall automotive equation.”

“Blackstone’s Jonathan Gray Doubles Down On Logistics And Rental Housing As Real Estate Sectors That Will ‘Outrun’ Inflation” (Insider). “Over the past year, Blackstone's $280 billion real estate business — the largest portion of a $880 billion investment portfolio — has been focused on three key types of real estate it says will come out ahead of inflation: rental housing, logistics real estate and buildings tailored for life sciences businesses.”

What we’re reading (4/19)

“After Getting Inflation So Wrong, Can The Fed Now Get It Right?” (The Economist). “Many factors explain the latest burst in inflation, with snarled supply chains, tight job markets, generous fiscal policy, loose monetary policy and, more recently, the war in Ukraine all part of the fabric. But one thread runs through them all. Investors, analysts and, crucially, central bankers believed that high inflation in America had been consigned to history, a problem more for academic studies than for current policy.”

“What If The Future Of Work Is Exactly The Same?” (Vox). “But what does the future of work actually look like for the majority of Americans whose jobs require them to show up in person? Despite all the buzz about high-profile union efforts last year, union membership actually fell in 2021. Wages aren’t going up as fast as they were, and any hope for an increase in the federal minimum wage is, at least for now, dead. Many of the circumstances that have made the current moment possible, including unprecedented support from the federal government, are fading or already have expired in the super-speed recovery.”

“Twitter Stock Swings Sharply As Individual Investors Pile In” (Wall Street Journal). “The social-media company’s stock has been on a head-spinning ride since the Tesla Inc. chief executive took a stake in the company and said he was angling to take it private in a $43 billion deal. The shares, which were trading below $40 before he disclosed his position, jumped 27% in a single session on the news.”

“The World May Dodge Another Recession. But Risks Are Growing” (CNN Business). “As the World Bank and the International Monetary Fund kick off their spring meetings this week, both are sounding a warning: The global economy, they say, is quickly losing steam. What's happening: The World Bank has slashed its forecast for global growth in 2022 to 3.2% from 4.1%, anticipating a sharp deceleration from estimated growth of 5.5% in 2021. The IMF's latest outlook arrives later Tuesday.”

“Netflix Is Bleeding Subscribers For The First Time In Over A Decade — And It's Expecting To Lose Another 2 Million Subscribers In Coming Months” (Insider). “Netflix's earnings report revealed subscriber losses for the first time in over a decade. The earnings miss sent the stock plummeting 21% in after-hours trading as Wall Street reacted to Netflix losing 200,000 subscribers in the first quarter and predicting further losses in the second quarter.”

What we’re reading (4/18)

“Portfolio Diversification: Harder Than It Used to Be?” (CFA Institute). “In theory, ever-greater access to world equity markets should have made it easier for investors to build and harvest the benefits of diversified global stock portfolios. But has it really? Has diversifying across world equity indices actually helped reduce portfolio risk?”

“Cathie Wood's Ark Invest Says Tesla Stock Will More Than Quadruple In Price By 2026 If It Can Deliver A Network Of Self-Driving Taxis” (Insider). “Ark's bullish thesis on Tesla hinges on the company's ability to successfully develop and roll out a network of self-driving robo taxis. That network of taxis would operate an Uber-like service of shuttling people to and from different destinations, according to the research published by Ark.”

“Apollo Global Considers Participating In A Bid For Twitter” (Wall Street Journal). “Apollo, one of the world’s largest buyout firms, has held discussions about backing a possible deal for Twitter and could provide Mr. Musk or another bidder like private-equity firm Thoma Bravo LP with equity or debt to support an offer, the people said.”

“Gary Gensler Reflects On His First Year As S.E.C. Chair” (DealBook). “As the nation’s top markets regulator, Mr. Gensler was always going to be busy. But he was nominated during the unexpected trading frenzy in so-called meme stocks like GameStop and AMC Entertainment, which was driven in part by commission-free trading apps. He was confirmed for a five-year term on the day the crypto exchange Coinbase went public, a sign that the once-fringe industry was rapidly moving into the mainstream.”

“A Russian Default Is Looming. A Bitter Fight Is Likely To Follow.” (New York Times). “The coming fight, which would probably pit Russia against big investors from around the world, raises murky questions over who gets to decide if a nation has actually defaulted in the rare case where sanctions have curbed a country’s ability to pay its debts.”

What we’re reading (4/17)

“The Biggest Risk To The Global Economy No One Is Talking About” (CNN Business). “Nearly 400 million people across 45 cities in China are under full or partial lockdown as part of China's strict zero-Covid policy. Together they represent 40%, or $7.2 trillion, of annual gross domestic product for the world's second-largest economy, according to data from Nomura Holdings.Analysts are ringing warning bells, but say investors aren't properly assessing how serious the global economic fallout might be from these prolonged isolation orders.”

“Bond Rout Promises More Pain For Investors” (Wall Street Journal). “Battered by high inflation readings and sharp messages from Federal Reserve officials about the need for interest-rate increases, bond prices have tumbled this year at a pace investors have rarely seen. In the first quarter, the Bloomberg U.S. Government bond index returned minus 5.5%, its worst performance since 1980. This month, it has lost another 2.4%.”

“Buyout Funds Are Unlikely To Escape Inflation’s Pain” (Institutional Investor). “After a banner year for the mergers and acquisitions markets, dealmakers have slowly found themselves trapped in an environment in which rising prices pose real threats to the valuations of their target companies. And without valuation certainty, they’re in no rush to make deals happen.”

“Bitcoin Risk-Reward Calculation Is Being Upended By Rising Rates” (Bloomberg). “The aggregate 30-day moving-average volume for Bitcoin across Coinbase, Bitfinex, Kraken and Bitstamp is at its lowest level since August 2021, according to data compiled by Strahinja Savic at FRNT Financial. Over the last month, the aggregate daily volume on those venues has averaged just over $1 billion. That reading stood at $2.57 billion in May 2021, a nearly 60% decline.”

“The State Of Globalization In 2022” (Harvard Business Review). “[G]lobal cross-border flows have rebounded strongly since the early part of the pandemic. In our view, the war [in Ukraine] will likely reduce many types of international business activity and cause some shifts in their geography, but it will not lead to a collapse of international flows.”

What we’re reading (4/16)

“The Sky-High Pandemic Housing Market Finds Gravity Does Exist” (New York Times). “[T]here are so few homes for sale that even a slower market is unlikely to create enough inventory to satisfy demand anytime soon. For years the United States has suffered from a chronically undersupplied housing market. Home building plunged after the Great Recession and remained at a recessionary pace long after the economy and job market had recovered. Even today, the pace of home building remains below the heights of the mid-2000s[.]”

“Decade-High Mortgage Rates Pose Threat To Spring Housing Market” (Wall Street Journal). “‘We’ve never seen a time where mortgage rates have risen as quickly as they have and the market hasn’t cooled off,’ said Ralph McLaughlin, chief economist at Kukun, a real-estate data firm…‘If half of our buyers got priced out of the market, we would still have eight buyers for every listing,’ said Nick Painz, managing broker at Re/Max Alliance in Westminster, Colo., a suburb of Denver. ‘The people that think it’s got to stop somewhere, I think they’re in for a rude awakening.’”

“Housing Market Fever Starts To Break In Boise” (Bloomberg). “If you’re wondering where the U.S. real estate market might start to show its first cracks, keep an eye on Boise, Idaho. The pandemic work-from-anywhere revolution transformed it into one of the hottest markets in the U.S., but home prices are leveling off there. Typical home values in Boise rose just 0.4% last month, down from a 4.1% monthly pace in June, according to Zillow data. That makes it the first of the country’s top 100 housing markets to flirt with falling prices this year.”

“The End Of An Economic Illusion” (John Cochrane, Project Syndicate). “Inflation’s return marks a tipping point. Demand has hit the brick wall of supply. Our economies are now producing all that they can. Moreover, this inflation is clearly rooted in excessively expansive fiscal policies. While supply shocks can raise the price of one thing relative to others, they do not raise all prices and wages together. A lot of wishful thinking will have to be abandoned, starting with the idea that governments can borrow or print as much money as they need to spray at every problem.”

“U.S. Bond Market Gives Notice It’s No Longer A One-Way Street” (Bloomberg). “‘It’s an awkward period at the moment for the bond market,’ said Gregory Faranello, head of U.S. rates trading and strategy for AmeriVet Securities. ‘Inflation is at extreme levels and we just don’t know what level it declines to from the peak.’”

What we’re reading (4/14)

“Elon Musk Offers To Buy Rest Of Twitter At A Valuation Of More Than $43 Billion” (Wall Street Journal). “On Thursday, Mr. Musk reiterated Twitter’s potential to be the platform for free speech, saying the company ‘will neither thrive nor serve this societal imperative in its current form.’”

“Is Elon Musk Really Going To Buy Twitter For $43 billion?” (Vox). “Musk has offered $54.20 per share for Twitter, which was trading for $45 per share Thursday morning before his offer became public. But Twitter was trading for more than $70 per share a year ago. Investors may simply decide that Musk’s offer isn’t good enough, and nothing else happens.”

“Elon Musk Makes Totally Serious, Good Faith Offer To Buy Twitter” (Dealbreaker). “Even given the extra time he awarded himself, Elon Musk wasn’t able to buy up every Twitter share ahead of announcing his passive stake/pressure point/practical joke. But now the richest man on earth would like to rectify that oversight and, instead of simply joining the board of the social media platform he loves to hate and hates to love, become the board unto himself.”

“Even in A Hot Economy, Wages Aren’t Keeping Up With Inflation” (Jason Furman, Wall Street Journal). “In addition to spurring inflation that outpaces wage growth, moving from a hot economy to an overheated one, as we have done, can also threaten the sustainability of job growth itself. Some combination of the Federal Reserve’s skill and luck may save the day. Next time, let’s remember that it’s better to heat the economy by putting one log on the fire at a time instead of throwing them all on at once.”

“The Great Billionaire Space Caper” (Matt Taibbi). “Whoever comes out of the Artemis capsule first, a primary winner of the mission will be a billionaire with his teeth in your wallet. Maybe two, if congress gets its way.”

What we’re reading (4/13)

“Valuation Bloat In Stocks And Bonds Is Catching Up With The Bull Market” (Bloomberg). “The economic cycle is advancing to a point where valuations may finally matter again for stock and bond investors. Fortress-like in their refusal to bend for the better part of a decade, both asset classes have come under pressure thanks to the ever-stiffening resolve of central banks to restore order to the global economy. The S&P 500 has dropped in five of the last six days while yields on 10-year Treasury notes is set to break a streak of seven straight increases.”

“The Fed Is Going To Have To Curb Economic Activity To Bring Down Soaring Inflation, Fed's James Bullard Says” (Insider). “‘There's a bit of a fantasy, I think, in current policy in central banks,’ Bullard told the FT in an interview published Wednesday. ‘Neutral is not putting downward pressure on inflation. It's just ceasing to put upward pressure on inflation.’”

“JPMorgan CEO Jamie Dimon Says ‘Powerful Forces’ Threaten U.S. Economy” (Wall Street Journal). “Chief Executive Jamie Dimon said the economy is strong and growing, citing double-digit growth in card spending, low delinquencies and healthy household and consumer balance sheets. But the bank surprised Wall Street by setting aside $900 million in new funds to prepare for economic turmoil; a year ago, it freed up $5.2 billion it had reserved for potential loan losses in the pandemic’s early months.”

“The Reports Of American Decline Are Greatly Exaggerated” (The Week). “What we are lacking a sense of self-belief, of confidence in our competence. We believe we are powerless and so become powerless. If you believe you will fail before you start, you probably will.”

“Anonymous Buyer Pays Over $1 Million For A Piece Of Invisible Art” (Smithsonian Magazine). “Before NFTs upended the art world, the artist Yves Klein sold nothing in exchange for solid gold. One of the key figures of the nouveau réalisme (New Realism) movement, Klein was a pioneer of conceptual art. Between 1959 and his death in 1962, he made one of the most outrageous artistic statements of his career, selling a series of receipts for invisible “zones” and accepting payment only in gold bullion. Now, six decades later, one of those receipts has sold for over $1 million at auction.”

What we’re reading (4/12)

“The Safe Investment That Will Soon Yield Almost 10%” (Wall Street Journal). “There’s no such thing as a free lunch in finance. Except maybe this: The interest rate on inflation-adjusted U.S. savings bonds will approach 10% beginning in May. U.S. Treasury Series I Bonds, or I Bonds, will offer annual interest payments of 9.6%, based on the bond’s latest inflation rate calculation, which is tied to March’s consumer-price index. Prices rose by 8.5% year over year in March, the fastest pace since December 1981, according to the Bureau of Labor Statistics.”

“'Recession shock’ Is Coming, Bank Of America Warns” (CNN Business). “Bank of America is warning that high inflation poses a credible threat to the economic recovery that began just two years ago. “‘Inflation shock’ worsening, ‘rate shock’ just beginning, ‘recession shock’ coming,” Bank of America chief investment strategist Michael Hartnett wrote in a note to clients on Friday.”

“Lumber Falls To Fresh 2022 Lows As Spike In Mortgage Rates Cools Housing Demand And Inflation Puts Dent In Home Renovations” (Insider). “Lumber prices fell more than 6% to $829 per 1,000 board feet on Tuesday, representing a fresh lows for the commodity in 2022 as rising mortgage rates and higher prices take a bite out of the housing market.”

“PE Activity Is Slowing Down. Investors Appear ‘Unfazed.’” (Institutional Investor). “The first sign of a moderation in activity came from a drop in fundraising. In the first quarter of 2022, global private equity firms raised a total of $116 billion, down 10 percent from last quarter and down 38 percent from the same period last year, according to the latest private equity report by Preqin. In particular, deal activity in Europe cooled down, with the number of buyout deals in the first quarter declining 29 percent year-on-year, according to the report.”

“Report: Saudi Arabia Concluded Jared Kushner’s Investment Firm Was A Joke, Gave Him $2 Billion Anyway” (Vanity Fair). “[T]he cash alone is not even the funniest part, and by funniest we mean insanely unethical and wildly corrupt. No, the unethical and corrupt part is that the people who perform due diligence for the Saudis’ Public Investment Fund concluded Kushner’s firm was a joke and that he might make them look bad…and then the board, headed by MBS, gave him the money anyway. Because…y’know.”

What we’re reading (4/11)

“Investors Turn Cautious On Consumer Debt” (Wall Street Journal). “Buyers of bonds backed by subprime car loans or credit cards are demanding the highest premiums over interest-rate benchmarks since mid-2020. Meanwhile, investors have punished shares of some financial-technology companies that helped fuel a recent surge in consumer borrowing, such as Affirm Holdings and Upstart Holdings.”

“You Get The Government You Pay For” (City Journal). “No one likes to see employees of a dysfunctional government handsomely rewarded. But the idea [of capping government employee pay] is extraordinarily bad. Limiting spending on upper-level staff is a penny-wise, pound-foolish method of controlling government spending that is sure to produce worse and more wasteful government, one that will remain in thrall to special interests such as government contractors and industry lobbyists.”

“Always Buy High Uncertainty. Certainty In The Stock Market Is Very Expensive” (Ken Fisher, Real Clear Markets). “The old adage that stocks hate uncertainty is true—but only partially. Stocks hate high and rising uncertainty. High but falling uncertainty, however, is the absolutely best stock market fuel anyone could ever ask for. And that is dead ahead now.”

“Welp, Maybe This Is How We Get Truck Guys To Buy Electric Vehicles” (Slate). “The electric resurrection of the Hummer, first announced in 2020, has produced a vehicle that does not emit the carbon pollution that overheats the planet, nor many of the other toxins that routinely kill thousands of Americans—and millions worldwide—who inhale befouled air. But in many ways it still pushes the boundaries of absurdity. The vehicle weighs more than 4.5 tons, a bulk closer to that of a small bulldozer than the sort of cars that were typically seen on American streets a decade or so ago. The huge Ultium battery that powers the vehicle is nearly 3,000 pounds, about the same weight as two grand pianos. The wheels look like they could traverse Mars.”

“A 4-Year Degree Isn’t Quite The Job Requirement It Used To Be” (New York Times). “In the last few years, major American companies in every industry have pledged to change their hiring habits by opening the door to higher-wage jobs with career paths to people without four-year college degrees...[m]ore than 100 companies have made commitments, including the Business Roundtable’s Multiple Pathways program and OneTen, which is focused on hiring and promoting Black workers without college degrees to good jobs.”

What we’re reading (4/10)

“Is Larry Summers Really Right About Inflation And Biden?” (The New Yorker). “In defending his argument that excessive demand fuelled by Biden’s relief plan was the primary cause of the inflation spike, Summers pointed to the fact that the nominal G.D.P.—output not adjusted for price changes, which economists regard as a measure of demand—expanded by more than ten per cent in 2021. ‘If you have nominal G.D.P. growth at double-digit rates in an economy with any type of limitation on capacity, you are going to have excessive inflation,’ he said”

“Is The Fed Fisherian?” (The Grumpy Economist). “The Taylor rule says the interest rate should be 2% (inflation target), plus 1.5 times how much inflation exceeds 2%, plus the long run real rate. That means an interest rate of at least 2+1.5x(8-2) = 11%. Yet the Fed sits, and contemplates at most a percent or two over the summer. This reaction is unusually slow by historical precedent, not just by standard theory and received wisdom…[t]he Fed's current inaction is even more curious if we look at a longer history. In each spurt of inflation in the 1970s, the Fed did, promptly, raise interest rates, about one for one with inflation.”

“Recession Risk Is Rising, Economists Say” (Wall Street Journal). “Economists slashed their forecast for growth this year. On average they see inflation-adjusted gross domestic product rising 2.6% in the fourth quarter of 2022 from a year earlier, down a full percentage point from the average forecast six months ago, though still higher than the 2.2% average annual growth rate in the decade before the pandemic.”

“The S&P 500 Will Plunge 11% By The End Of 2022 As ‘Inflation Shock’ Sparks A Recession, Bank Of America Says” (Insider). “‘Inflation causes recessions,’ BofA stated bluntly, and right now, inflation is ‘out of control,’ according to the note…nearly all prior recessions have been preceded by inflation surges, including in the late 1960's, early 1970's, and in 2008. ‘Last dominos to drop in terms of recession expectations is higher yields and weaker dollar,’ BofA explained.”

“Bank Earnings, CPI Inflation, Retail Sales: What To Know This Holiday-Shortened Week” (Yahoo!Finance). “Despite a four-day trading session, with Wall Street closed for Good Friday, a pivotal week is underway for investors as mega-banks including JPMorgan Chase, Goldman Sachs, and Citigroup get the ball rolling on Q1 earnings season. On the economic data front, markets will get the latest gauge of U.S. inflation with Tuesday’s closely-watched Consumer Price Index (CPI) and the Producer Price Index (PPI) set for publication Wednesday.”

What we’re reading (4/9)

“Will Fighting Inflation In America Cause A Debt Crisis Abroad?” (Foreign Affairs). “[W]hatever the impact, rising interest rates will not just affect the United States. Higher U.S. rates raise the cost of borrowing in U.S. dollars on international markets. They also increase demand for U.S. dollar assets relative to assets in other currencies, and they can therefore cause those currencies to fall in value. For countries where external debt is denominated in U.S. dollars, debt repayment will become more expensive.”

“German Industry Prepares For Worst-Case Scenario” (Der Spiegel). “Germany is extremely ill-prepared for this worst-case scenario. A ‘Gas Emergency Plan for the Republic of Germany’ has been in place since September 2019. But it is based on a fundamental miscalculation: In the very first pages, it states that the natural gas supply situation in Germany is ‘highly secure and reliable.’ And that the likelihood of a massive supply crisis is ‘very low.’”

“Warren Buffett’s Protégé Is Building A Mini Berkshire” (Wall Street Journal). “Tracy Britt Cool spent a decade working for Warren Buffett. She now wants to buy the kinds of companies that might have interested the famed investor 30 or 40 years ago. Those are businesses typically run by founders or family owners that have solid performance and competitive “moats”—a favorite term of Mr. Buffett’s—yet aren’t big enough to draw Berkshire Hathaway Inc.’s attention today.”

“In This Part Of The U.S. Bond Market, 0% Is High And Alarming” (Bloomberg). “While all Treasury yields have climbed this year as the Fed began what’s expected to be an aggressive series of rate increases aimed throttling high inflation, in the past two weeks the baton has been passed to inflation-protected notes and bonds. Their yields are termed ‘real’ because they represent the rates investors will accept as long as they are paired with extra payments to offset inflation.”

“‘This Shouldn’t Happen’: Inside the Virus-Hunting Nonprofit At The Center Of The Lab-Leak Controversy” (Vanity Fair). “Chasing scientific renown, grant dollars, and approval from Dr. Anthony Fauci, Peter Daszak transformed the environmental nonprofit EcoHealth Alliance into a government-funded sponsor of risky, cutting-edge virus research in both the U.S. and Wuhan, China. Drawing on more than 100,000 leaked documents, a V.F. investigation shows how an organization dedicated to preventing the next pandemic found itself suspected of helping start one.”

What we’re reading (4/8)

“S&P 500, Nasdaq Fall While Bonds Extend Selloff” (Wall Street Journal). “All three major indexes ended the week with losses. The S&P 500 snapped a three-week winning streak that had sent it toward its best performance since November 2020, losing 1.3%. The Dow and Nasdaq lost 0.3% and 3.9%, respectively.”

“South America’s Newest Oil Boom Is Gaining A War Time Boost” (OilPrice.com). “Exxon estimates its discoveries in the Stabroek Block alone hold 10 billion barrels of recoverable oil resources, which have the potential for at least 10 development projects. As a result, analysts believe Guyana will be pumping over one million barrels of crude oil daily by 2027, which will deliver a tremendous economic windfall for one of South America’s most impoverished nations. Neighboring Suriname, which shares the Guyana Suriname Basin, is also poised to benefit from an oil boom of its own.”

“Recession-Proof Stocks Are Having A Moment” (CNN Business). “Health care companies in the S&P 500 are up 3.8% in April, while the broader index is down 0.7%. The utilities sector has climbed 3.1%, and companies that make consumer staples like food and hygiene products have risen 3.6%.”

“Morgan Stanley Plumping For All The Little Archegoses Out There” (Dealbreaker). “Family offices are all the rage these days. Who wants to put up with the bitching and kvetching of clients when you can just do whatever the hell you want, like let it all ride on SPACs and cryptos? So much more fun that way. So that’s, like, what Adelphi Capital’s Roderick Jack and Marcel Jongen—last seen dumping their short book as quickly as possible—are gonna do.”

“China's Yuan Is Replacing The Dollar And Euro In Russian Bank Accounts Amid Western Sanctions, Report Says” (Insider). “Russian banks are reportedly seeing sharp increases in the Chinese yuan in their clients' accounts as Western sanctions limit access to the dollar and euro.”

What we’re reading (4/5)

“‘Great Resignations’ Are Common During Fast Recoveries” (Federal Reserve Bank of San Francisco). “The record percentage of workers who are quitting their jobs, known as the “Great Resignation,” is not a shift in worker attitudes in the wake of the pandemic. Evidence on which workers are quitting suggests that it reflects the strong rebound of the demand for younger and less-educated workers. Historical data on quits in manufacturing suggest that the current wave is not unusual. Waves of job quits have occurred during all fast recoveries in the postwar period.”

“7 Workforce Trends Workers Can Expect In 2022” (FEE Stories). “The most sweeping and ongoing change that people are experiencing is the so-called ‘Great Resignation.’ According to surveys, 44% of employees are ‘job seekers.’ This means that almost half of employees are looking for a new job or plan to soon. Unemployment rates skyrocketed at the beginning of the pandemic when many businesses were shut down. Seemingly arbitrarily, many people found themselves without work depending on whether they were declared to be ‘essential’ or not.”

“Did Activision CEO Cover His Share Of Lunch With A Bit Of Inside Dirt?” (Dealbreaker). “It’s certainly suspicious when a CEO’s self-proclaimed ‘long time friend’ loads up on said CEO’s company’s shares just before those very beaten-down shares get a lucrative offer from a potential buyer. Still, suspicion is not beyond a reasonable doubt, and there are a hell of a lot of dots left to connect before you can say that Barry Diller committed insider trading with a sweet tip from his buddy, Activision Blizzard chief Bobby Kotick.”

“Credit Suisse Found Former Investment-Bank Chief Violated Code Of Conduct” (Wall Street Journal). “When Credit Suisse Group AG lost more than $5 billion a year ago in the Archegos Capital Management meltdown, investment bank head Brian Chin was among those forced out with docked pay. What wasn’t publicly known then is that the bank was investigating him and the securitized-products group he once ran, including for alleged mistreatment of women, according to people familiar with the matter.”

“Do Founders Outperform At Venture Capital?” (Paul A. Gompers and Vladimir Mukharlyamov via Marginal Revolution). “In this paper we explore whether or not the experience as a founder of a venture capital-backed startup influences the performance of founders who become venture capitalists (VCs). We find that nearly 7% of VCs were previously founders of a venture-backed startup. Having a successful exit and being male and white increase the probability that a founder transitions into a venture capital career. Successful founder-VCs have investment success rates that are 6.5 percentage points higher than professional VCs while unsuccessful founder-VCs have investment success rates that are 4 percentage points lower than professional VCs.”

March 2022 performance results

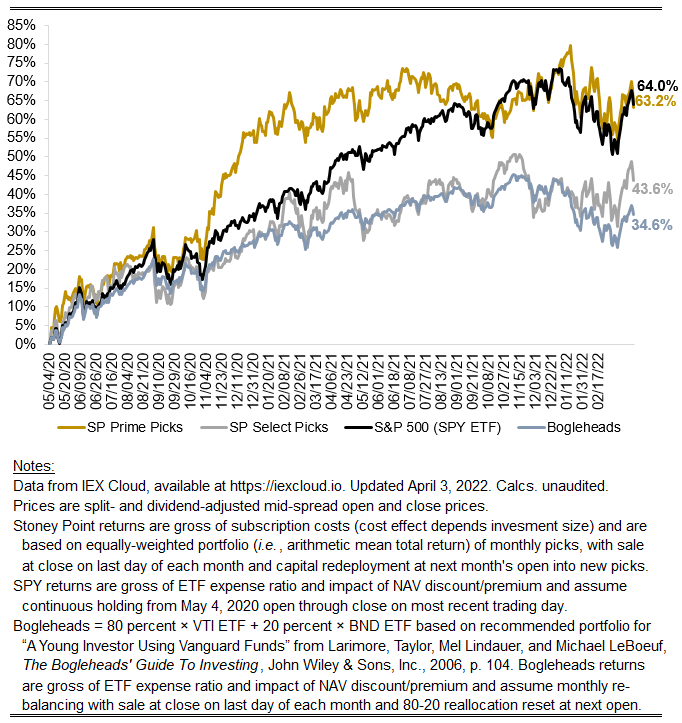

Friends, here with the key numbers for the month:

Prime: +2.04%

Select: +2.15%

SPY ETF: +3.82%

Bogleheads portfolio: +1.90%

It was a spectacularly volatile month, with the daily volatility on the market about 1.5x it’s normal level going back to pandemic lows. The macroeconomic environment overall is abnormally chaotic with the start of the first significant rising rate cycle in a while, inflation running hotter than any point since the 1980s, and turmoil in commodities markets (and plenty of other markets, e.g., FX) as a result of Russia’s invasion of Ukraine. With that backdrop its tough for me to read to much into the performance of U.S. equities. Overall it was a good month, with SPY up nearly 4 percent, but that obscures that in Q1 overall most investors lost money in a big way. We were lighter this month, but at the same time beat big earlier in the quarter and also were up within the month relative to SPY by over 25 bps up until the last two trading days. With asset prices moving up and down so much each session, the standard error on relative results over any given 21-day trading session is statistically bound to be quite high. I think performance over subsequent months will prove more revealing provided the overall economic backdrop mean reverts to relative normalcy. We’ll see.

Stoney Point Total Performance History

What we’re reading (4/3)

“Is The US Dollar In Danger?” (CNN Business). “About 60% of the $12.8 trillion in global currency reserves are currently held in dollars, giving the US an exorbitant privilege over other countries. And that privilege pays: Because US government debt backed by the dollar is very attractive, interest rates are lower. The US gets to borrow from other countries in its own currency — so if the US dollar loses value, debt does too. American businesses can make international transactions in dollars without having to pay conversion fees.”

“Massive S&P Options Trade May Have Roiled U.S. Stocks On Thursday” (Reuters). “Traders are pointing to a massive quarterly options trade on Thursday they said was from a JPMorgan fund as one reason why the stock market took a nosedive late in the day, as options flows linked to the trade exacerbated market weakness. The S&P 500 Index fell 1.2% in the last hour of trading on Thursday, marking the largest hourly drop for the index in more than three weeks.”

“From Apple To Google, Big Tech Is Rushing To Build VR And AR Headsets” (The Economist). “Children are no longer the only ones excited about “extended reality”, a category which includes both fully immersive virtual reality (VR) and the newer technology of augmented reality (AR), in which computer imagery is superimposed onto the user’s view of the world around them. Nearly every large technology firm is rushing to develop a VR or AR headset, convinced that what has long been a niche market may be on the brink of becoming something much bigger.”

“Billionaire Trader Ken Griffin Navigates A Flock Of Black Swans” (Forbes). “There will be serious repercussions, with Russia, China and others seeing no option but to diversify away from the greenback. De-dollarization by a China-Russia-Iran-Brazil trading bloc could easily morph into the exclusion of American companies and investors from fast-growing markets. ‘Have we laid the seeds for the setting of the American era of technological superiority?’ Griffin asks.”

“How Microsoft Became Washington’s Favorite Tech Giant” (Wall Street Journal). “Mr. Smith, a Microsoft veteran of almost 30 years and president for seven, has maneuvered his company to an enviable position in a regulatory environment that is increasingly hostile toward tech titans. Once an antitrust pariah itself, Microsoft is now widely seen by regulators as the friendly party among today’s top tech companies, a status government officials and Microsoft insiders say flows largely from Mr. Smith’s cultivation of friends in Washington.”

What we’re reading (4/1)

“Stock Rally That Nobody Saw Coming Is Refusing To Go Quietly” (Bloomberg). “A final-hour surge Friday salvaged a third straight up week for the S&P 500 -- barely -- extending a run for U.S. equities that at times has ranked among the strongest in the past decade. The benchmark gauge has retraced well over half its tumble since the start of the year, a shock to institutional traders who spent most of the last three months slashing risk.”

“US Stocks Rally As The Solid March Jobs Report Points To The Fed Staying Aggressive With Rate Hikes” (Insider). “The S&P 500 bobbed in and out of positive territory late in the session before closing with a moderate gain. The Labor Department said the US economy added 431,000 jobs in March, below the forecast of 490,000, but February figures were upwardly revised to 750,000. The world's largest economy has now recovered 93% of the jobs it lost at the start of the coronavirus pandemic.”

“What Is A Yield Curve And Why Are Investors Worried?” (Morningstar). “[N]ot all yield curve-inversions lead to recessions, says Dominic Pappalardo, senior client portfolio manager at Morningstar Investment Management. (Economists sometimes joke that the yield curve has predicted 10 of the last five recessions.)”

“Wage Gains Show Signs of Slowing” (Wall Street Journal). “Wages continued to grow in March, but the pace has cooled slightly over the past few months, suggesting employers are feeling less pressure to offer pay increases as more people return to the workforce, which could ease inflation pressures.”

“Formative Experiences Matter Over Long Periods Of Time” (Christopher Severen and Arthur A. van Benthem, AEA via Marginal Revolution). “Formative experiences shape behavior for decades. We document a striking feature about those who came of driving age during the oil crises of the 1970s—they drive less in the year 2000. The effect is not specific to these cohorts; price variation over time and across states indicates that gasoline price changes between ages 15–18 generally shift later-life travel behavior. Effects are not explained by recessions, income, or costly skill acquisition and are inconsistent with recency bias, mental plasticity, and standard habit-formation models.”

What we’re reading (3/31)

“Losing 5% Was Best You Could Do In Stocks And Bonds This Quarter” (Bloomberg). “Across equity and fixed-income markets broadly, the least-bad performance among U.S. assets were declines of 4.9% in the S&P 500 and speculative credit. They were followed by a 5.6% fall in Treasuries and a 7.8% slide in investment grade. Not since 1980 has the best return among those four categories been so paltry, data compiled by Bloomberg show.”

“Stocks on Pace for Worst Quarter In Two Years Despite Strong Finish” (Wall Street Journal). “The action reflects a sense of dislocation shared by many traders and portfolio managers who are confronting challenges not seen in years. Yet their unease has been offset in part by a fierce determination among many investors to take advantage of any price declines to add to positions in stocks, bonds and commodities.”

“The Fed’s Preferred Inflation Gauge Rose 5.4% In March, The Highest Since 1983” (CNBC). “The Federal Reserve’s favorite inflation measure showed intensifying price pressures in February, rising to its highest annual level since 1983, the Commerce Department reported Thursday. Excluding food and energy prices, the personal consumption expenditures price index increased 5.4% from the same period in 2021, the biggest jump going back to April 1983.”

“Barclays Faces $590 Million Hit, Scrutiny Over Sales Slip-Up” (Reuters). “British bank Barclays faces an estimated 450 million pound ($592 million) loss and regulatory scrutiny for exceeding a U.S. limit on sales of structured products, some of which have surged in popularity since Russia’s invasion of Ukraine.”

“What We Learned About Venture Funding During The 2008 Financial Crisis And The Pandemic As The Markets Face Fresh Turmoil” (Crunchbase News). “As we head into the second quarter of 2022 with concerns about potentially overvalued companies, pandemic-era purchasing trends that might be waning, supply chain issues, inflation and a slowdown in the public markets, there is anxiety that we are heading toward another slackening in private financing. But funds raised by venture and private equity firms in 2022 have not yet slowed down.”

April picks available now

The new Prime and Select picks for April are available starting now, based on a model run put through today (March 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Friday, April 1, 2022 (at the mid-spread open price) through the last trading day of the month, Friday, April 29, 2022 (at the mid-spread closing price).