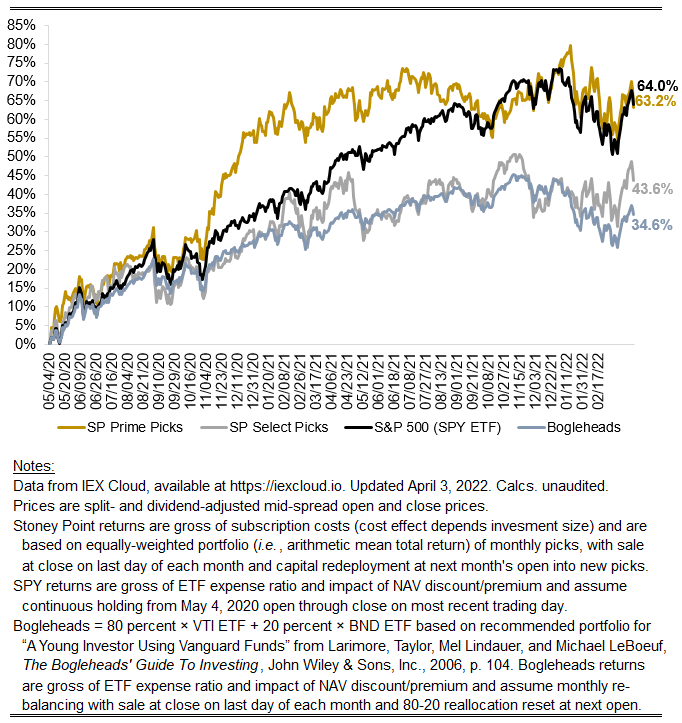

March 2022 performance results

Friends, here with the key numbers for the month:

Prime: +2.04%

Select: +2.15%

SPY ETF: +3.82%

Bogleheads portfolio: +1.90%

It was a spectacularly volatile month, with the daily volatility on the market about 1.5x it’s normal level going back to pandemic lows. The macroeconomic environment overall is abnormally chaotic with the start of the first significant rising rate cycle in a while, inflation running hotter than any point since the 1980s, and turmoil in commodities markets (and plenty of other markets, e.g., FX) as a result of Russia’s invasion of Ukraine. With that backdrop its tough for me to read to much into the performance of U.S. equities. Overall it was a good month, with SPY up nearly 4 percent, but that obscures that in Q1 overall most investors lost money in a big way. We were lighter this month, but at the same time beat big earlier in the quarter and also were up within the month relative to SPY by over 25 bps up until the last two trading days. With asset prices moving up and down so much each session, the standard error on relative results over any given 21-day trading session is statistically bound to be quite high. I think performance over subsequent months will prove more revealing provided the overall economic backdrop mean reverts to relative normalcy. We’ll see.