What we’re reading (4/10)

“Is Larry Summers Really Right About Inflation And Biden?” (The New Yorker). “In defending his argument that excessive demand fuelled by Biden’s relief plan was the primary cause of the inflation spike, Summers pointed to the fact that the nominal G.D.P.—output not adjusted for price changes, which economists regard as a measure of demand—expanded by more than ten per cent in 2021. ‘If you have nominal G.D.P. growth at double-digit rates in an economy with any type of limitation on capacity, you are going to have excessive inflation,’ he said”

“Is The Fed Fisherian?” (The Grumpy Economist). “The Taylor rule says the interest rate should be 2% (inflation target), plus 1.5 times how much inflation exceeds 2%, plus the long run real rate. That means an interest rate of at least 2+1.5x(8-2) = 11%. Yet the Fed sits, and contemplates at most a percent or two over the summer. This reaction is unusually slow by historical precedent, not just by standard theory and received wisdom…[t]he Fed's current inaction is even more curious if we look at a longer history. In each spurt of inflation in the 1970s, the Fed did, promptly, raise interest rates, about one for one with inflation.”

“Recession Risk Is Rising, Economists Say” (Wall Street Journal). “Economists slashed their forecast for growth this year. On average they see inflation-adjusted gross domestic product rising 2.6% in the fourth quarter of 2022 from a year earlier, down a full percentage point from the average forecast six months ago, though still higher than the 2.2% average annual growth rate in the decade before the pandemic.”

“The S&P 500 Will Plunge 11% By The End Of 2022 As ‘Inflation Shock’ Sparks A Recession, Bank Of America Says” (Insider). “‘Inflation causes recessions,’ BofA stated bluntly, and right now, inflation is ‘out of control,’ according to the note…nearly all prior recessions have been preceded by inflation surges, including in the late 1960's, early 1970's, and in 2008. ‘Last dominos to drop in terms of recession expectations is higher yields and weaker dollar,’ BofA explained.”

“Bank Earnings, CPI Inflation, Retail Sales: What To Know This Holiday-Shortened Week” (Yahoo!Finance). “Despite a four-day trading session, with Wall Street closed for Good Friday, a pivotal week is underway for investors as mega-banks including JPMorgan Chase, Goldman Sachs, and Citigroup get the ball rolling on Q1 earnings season. On the economic data front, markets will get the latest gauge of U.S. inflation with Tuesday’s closely-watched Consumer Price Index (CPI) and the Producer Price Index (PPI) set for publication Wednesday.”

What we’re reading (4/9)

“Will Fighting Inflation In America Cause A Debt Crisis Abroad?” (Foreign Affairs). “[W]hatever the impact, rising interest rates will not just affect the United States. Higher U.S. rates raise the cost of borrowing in U.S. dollars on international markets. They also increase demand for U.S. dollar assets relative to assets in other currencies, and they can therefore cause those currencies to fall in value. For countries where external debt is denominated in U.S. dollars, debt repayment will become more expensive.”

“German Industry Prepares For Worst-Case Scenario” (Der Spiegel). “Germany is extremely ill-prepared for this worst-case scenario. A ‘Gas Emergency Plan for the Republic of Germany’ has been in place since September 2019. But it is based on a fundamental miscalculation: In the very first pages, it states that the natural gas supply situation in Germany is ‘highly secure and reliable.’ And that the likelihood of a massive supply crisis is ‘very low.’”

“Warren Buffett’s Protégé Is Building A Mini Berkshire” (Wall Street Journal). “Tracy Britt Cool spent a decade working for Warren Buffett. She now wants to buy the kinds of companies that might have interested the famed investor 30 or 40 years ago. Those are businesses typically run by founders or family owners that have solid performance and competitive “moats”—a favorite term of Mr. Buffett’s—yet aren’t big enough to draw Berkshire Hathaway Inc.’s attention today.”

“In This Part Of The U.S. Bond Market, 0% Is High And Alarming” (Bloomberg). “While all Treasury yields have climbed this year as the Fed began what’s expected to be an aggressive series of rate increases aimed throttling high inflation, in the past two weeks the baton has been passed to inflation-protected notes and bonds. Their yields are termed ‘real’ because they represent the rates investors will accept as long as they are paired with extra payments to offset inflation.”

“‘This Shouldn’t Happen’: Inside the Virus-Hunting Nonprofit At The Center Of The Lab-Leak Controversy” (Vanity Fair). “Chasing scientific renown, grant dollars, and approval from Dr. Anthony Fauci, Peter Daszak transformed the environmental nonprofit EcoHealth Alliance into a government-funded sponsor of risky, cutting-edge virus research in both the U.S. and Wuhan, China. Drawing on more than 100,000 leaked documents, a V.F. investigation shows how an organization dedicated to preventing the next pandemic found itself suspected of helping start one.”

What we’re reading (4/8)

“S&P 500, Nasdaq Fall While Bonds Extend Selloff” (Wall Street Journal). “All three major indexes ended the week with losses. The S&P 500 snapped a three-week winning streak that had sent it toward its best performance since November 2020, losing 1.3%. The Dow and Nasdaq lost 0.3% and 3.9%, respectively.”

“South America’s Newest Oil Boom Is Gaining A War Time Boost” (OilPrice.com). “Exxon estimates its discoveries in the Stabroek Block alone hold 10 billion barrels of recoverable oil resources, which have the potential for at least 10 development projects. As a result, analysts believe Guyana will be pumping over one million barrels of crude oil daily by 2027, which will deliver a tremendous economic windfall for one of South America’s most impoverished nations. Neighboring Suriname, which shares the Guyana Suriname Basin, is also poised to benefit from an oil boom of its own.”

“Recession-Proof Stocks Are Having A Moment” (CNN Business). “Health care companies in the S&P 500 are up 3.8% in April, while the broader index is down 0.7%. The utilities sector has climbed 3.1%, and companies that make consumer staples like food and hygiene products have risen 3.6%.”

“Morgan Stanley Plumping For All The Little Archegoses Out There” (Dealbreaker). “Family offices are all the rage these days. Who wants to put up with the bitching and kvetching of clients when you can just do whatever the hell you want, like let it all ride on SPACs and cryptos? So much more fun that way. So that’s, like, what Adelphi Capital’s Roderick Jack and Marcel Jongen—last seen dumping their short book as quickly as possible—are gonna do.”

“China's Yuan Is Replacing The Dollar And Euro In Russian Bank Accounts Amid Western Sanctions, Report Says” (Insider). “Russian banks are reportedly seeing sharp increases in the Chinese yuan in their clients' accounts as Western sanctions limit access to the dollar and euro.”

What we’re reading (4/5)

“‘Great Resignations’ Are Common During Fast Recoveries” (Federal Reserve Bank of San Francisco). “The record percentage of workers who are quitting their jobs, known as the “Great Resignation,” is not a shift in worker attitudes in the wake of the pandemic. Evidence on which workers are quitting suggests that it reflects the strong rebound of the demand for younger and less-educated workers. Historical data on quits in manufacturing suggest that the current wave is not unusual. Waves of job quits have occurred during all fast recoveries in the postwar period.”

“7 Workforce Trends Workers Can Expect In 2022” (FEE Stories). “The most sweeping and ongoing change that people are experiencing is the so-called ‘Great Resignation.’ According to surveys, 44% of employees are ‘job seekers.’ This means that almost half of employees are looking for a new job or plan to soon. Unemployment rates skyrocketed at the beginning of the pandemic when many businesses were shut down. Seemingly arbitrarily, many people found themselves without work depending on whether they were declared to be ‘essential’ or not.”

“Did Activision CEO Cover His Share Of Lunch With A Bit Of Inside Dirt?” (Dealbreaker). “It’s certainly suspicious when a CEO’s self-proclaimed ‘long time friend’ loads up on said CEO’s company’s shares just before those very beaten-down shares get a lucrative offer from a potential buyer. Still, suspicion is not beyond a reasonable doubt, and there are a hell of a lot of dots left to connect before you can say that Barry Diller committed insider trading with a sweet tip from his buddy, Activision Blizzard chief Bobby Kotick.”

“Credit Suisse Found Former Investment-Bank Chief Violated Code Of Conduct” (Wall Street Journal). “When Credit Suisse Group AG lost more than $5 billion a year ago in the Archegos Capital Management meltdown, investment bank head Brian Chin was among those forced out with docked pay. What wasn’t publicly known then is that the bank was investigating him and the securitized-products group he once ran, including for alleged mistreatment of women, according to people familiar with the matter.”

“Do Founders Outperform At Venture Capital?” (Paul A. Gompers and Vladimir Mukharlyamov via Marginal Revolution). “In this paper we explore whether or not the experience as a founder of a venture capital-backed startup influences the performance of founders who become venture capitalists (VCs). We find that nearly 7% of VCs were previously founders of a venture-backed startup. Having a successful exit and being male and white increase the probability that a founder transitions into a venture capital career. Successful founder-VCs have investment success rates that are 6.5 percentage points higher than professional VCs while unsuccessful founder-VCs have investment success rates that are 4 percentage points lower than professional VCs.”

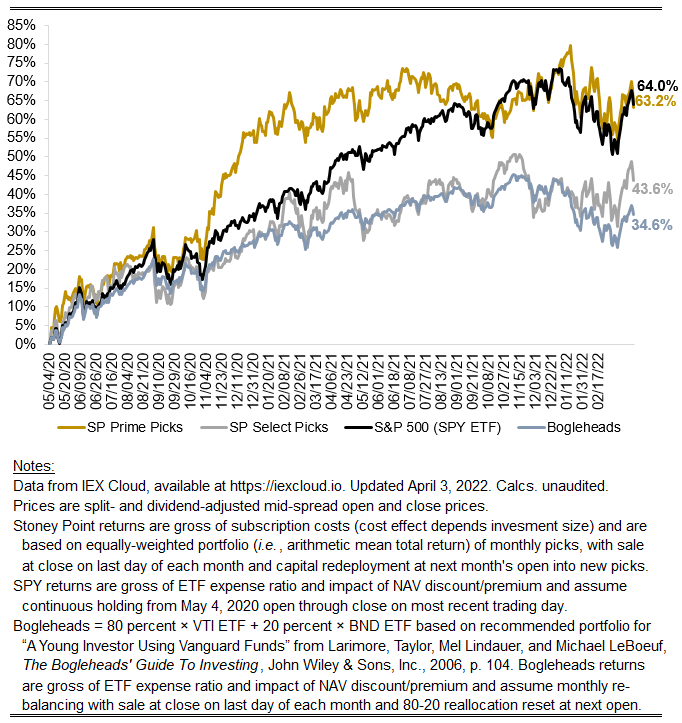

March 2022 performance results

Friends, here with the key numbers for the month:

Prime: +2.04%

Select: +2.15%

SPY ETF: +3.82%

Bogleheads portfolio: +1.90%

It was a spectacularly volatile month, with the daily volatility on the market about 1.5x it’s normal level going back to pandemic lows. The macroeconomic environment overall is abnormally chaotic with the start of the first significant rising rate cycle in a while, inflation running hotter than any point since the 1980s, and turmoil in commodities markets (and plenty of other markets, e.g., FX) as a result of Russia’s invasion of Ukraine. With that backdrop its tough for me to read to much into the performance of U.S. equities. Overall it was a good month, with SPY up nearly 4 percent, but that obscures that in Q1 overall most investors lost money in a big way. We were lighter this month, but at the same time beat big earlier in the quarter and also were up within the month relative to SPY by over 25 bps up until the last two trading days. With asset prices moving up and down so much each session, the standard error on relative results over any given 21-day trading session is statistically bound to be quite high. I think performance over subsequent months will prove more revealing provided the overall economic backdrop mean reverts to relative normalcy. We’ll see.

Stoney Point Total Performance History

What we’re reading (4/3)

“Is The US Dollar In Danger?” (CNN Business). “About 60% of the $12.8 trillion in global currency reserves are currently held in dollars, giving the US an exorbitant privilege over other countries. And that privilege pays: Because US government debt backed by the dollar is very attractive, interest rates are lower. The US gets to borrow from other countries in its own currency — so if the US dollar loses value, debt does too. American businesses can make international transactions in dollars without having to pay conversion fees.”

“Massive S&P Options Trade May Have Roiled U.S. Stocks On Thursday” (Reuters). “Traders are pointing to a massive quarterly options trade on Thursday they said was from a JPMorgan fund as one reason why the stock market took a nosedive late in the day, as options flows linked to the trade exacerbated market weakness. The S&P 500 Index fell 1.2% in the last hour of trading on Thursday, marking the largest hourly drop for the index in more than three weeks.”

“From Apple To Google, Big Tech Is Rushing To Build VR And AR Headsets” (The Economist). “Children are no longer the only ones excited about “extended reality”, a category which includes both fully immersive virtual reality (VR) and the newer technology of augmented reality (AR), in which computer imagery is superimposed onto the user’s view of the world around them. Nearly every large technology firm is rushing to develop a VR or AR headset, convinced that what has long been a niche market may be on the brink of becoming something much bigger.”

“Billionaire Trader Ken Griffin Navigates A Flock Of Black Swans” (Forbes). “There will be serious repercussions, with Russia, China and others seeing no option but to diversify away from the greenback. De-dollarization by a China-Russia-Iran-Brazil trading bloc could easily morph into the exclusion of American companies and investors from fast-growing markets. ‘Have we laid the seeds for the setting of the American era of technological superiority?’ Griffin asks.”

“How Microsoft Became Washington’s Favorite Tech Giant” (Wall Street Journal). “Mr. Smith, a Microsoft veteran of almost 30 years and president for seven, has maneuvered his company to an enviable position in a regulatory environment that is increasingly hostile toward tech titans. Once an antitrust pariah itself, Microsoft is now widely seen by regulators as the friendly party among today’s top tech companies, a status government officials and Microsoft insiders say flows largely from Mr. Smith’s cultivation of friends in Washington.”

What we’re reading (4/1)

“Stock Rally That Nobody Saw Coming Is Refusing To Go Quietly” (Bloomberg). “A final-hour surge Friday salvaged a third straight up week for the S&P 500 -- barely -- extending a run for U.S. equities that at times has ranked among the strongest in the past decade. The benchmark gauge has retraced well over half its tumble since the start of the year, a shock to institutional traders who spent most of the last three months slashing risk.”

“US Stocks Rally As The Solid March Jobs Report Points To The Fed Staying Aggressive With Rate Hikes” (Insider). “The S&P 500 bobbed in and out of positive territory late in the session before closing with a moderate gain. The Labor Department said the US economy added 431,000 jobs in March, below the forecast of 490,000, but February figures were upwardly revised to 750,000. The world's largest economy has now recovered 93% of the jobs it lost at the start of the coronavirus pandemic.”

“What Is A Yield Curve And Why Are Investors Worried?” (Morningstar). “[N]ot all yield curve-inversions lead to recessions, says Dominic Pappalardo, senior client portfolio manager at Morningstar Investment Management. (Economists sometimes joke that the yield curve has predicted 10 of the last five recessions.)”

“Wage Gains Show Signs of Slowing” (Wall Street Journal). “Wages continued to grow in March, but the pace has cooled slightly over the past few months, suggesting employers are feeling less pressure to offer pay increases as more people return to the workforce, which could ease inflation pressures.”

“Formative Experiences Matter Over Long Periods Of Time” (Christopher Severen and Arthur A. van Benthem, AEA via Marginal Revolution). “Formative experiences shape behavior for decades. We document a striking feature about those who came of driving age during the oil crises of the 1970s—they drive less in the year 2000. The effect is not specific to these cohorts; price variation over time and across states indicates that gasoline price changes between ages 15–18 generally shift later-life travel behavior. Effects are not explained by recessions, income, or costly skill acquisition and are inconsistent with recency bias, mental plasticity, and standard habit-formation models.”

What we’re reading (3/31)

“Losing 5% Was Best You Could Do In Stocks And Bonds This Quarter” (Bloomberg). “Across equity and fixed-income markets broadly, the least-bad performance among U.S. assets were declines of 4.9% in the S&P 500 and speculative credit. They were followed by a 5.6% fall in Treasuries and a 7.8% slide in investment grade. Not since 1980 has the best return among those four categories been so paltry, data compiled by Bloomberg show.”

“Stocks on Pace for Worst Quarter In Two Years Despite Strong Finish” (Wall Street Journal). “The action reflects a sense of dislocation shared by many traders and portfolio managers who are confronting challenges not seen in years. Yet their unease has been offset in part by a fierce determination among many investors to take advantage of any price declines to add to positions in stocks, bonds and commodities.”

“The Fed’s Preferred Inflation Gauge Rose 5.4% In March, The Highest Since 1983” (CNBC). “The Federal Reserve’s favorite inflation measure showed intensifying price pressures in February, rising to its highest annual level since 1983, the Commerce Department reported Thursday. Excluding food and energy prices, the personal consumption expenditures price index increased 5.4% from the same period in 2021, the biggest jump going back to April 1983.”

“Barclays Faces $590 Million Hit, Scrutiny Over Sales Slip-Up” (Reuters). “British bank Barclays faces an estimated 450 million pound ($592 million) loss and regulatory scrutiny for exceeding a U.S. limit on sales of structured products, some of which have surged in popularity since Russia’s invasion of Ukraine.”

“What We Learned About Venture Funding During The 2008 Financial Crisis And The Pandemic As The Markets Face Fresh Turmoil” (Crunchbase News). “As we head into the second quarter of 2022 with concerns about potentially overvalued companies, pandemic-era purchasing trends that might be waning, supply chain issues, inflation and a slowdown in the public markets, there is anxiety that we are heading toward another slackening in private financing. But funds raised by venture and private equity firms in 2022 have not yet slowed down.”

April picks available now

The new Prime and Select picks for April are available starting now, based on a model run put through today (March 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Friday, April 1, 2022 (at the mid-spread open price) through the last trading day of the month, Friday, April 29, 2022 (at the mid-spread closing price).

What we’re reading (3/30)

“Real-Time Market Monitoring Finds Signs Of Brewing U.S. Housing Bubble” (Federal Reserve Bank of Dallas). “The gap between the actual price-to-rent ratio and its fundamental-based level in the U.S. has grown rapidly during the pandemic—comparable to the run-up of the last housing boom—and started showing signs of exuberance in 2021. The exuberance statistic confirms that recent increases are far from ordinary.”

“Under Unprecedented Sanctions, How Is The Russian Economy Faring?” (The Economist). “A battery of policies has helped stabilise the markets. Some are orthodox. The central bank has raised interest rates from 9.5% to 20%, encouraging people to hold interest-bearing Russian assets. Other policies are less conventional. The government has decreed that exporters must convert 80% of their foreign-exchange proceeds into roubles. Trading on the Moscow stock exchange has become, to use the central bank’s euphemism, ‘negotiated’. Short-selling is banned, and non-residents cannot offload stocks until April 1st.”

“Big Stock Sales Are Supposed To Be Secret. The Numbers Indicate They Aren’t.” (Wall Street Journal). “[B]lock trades…are supposed to be a secret between the selling shareholders and the investment banks they hire to execute the trades. But a Wall Street Journal analysis of nearly 400 such trades over three years indicates that information about the sales routinely leaks out ahead of time—a potentially illegal practice that costs those sellers millions of dollars and benefits banks and their hedge-fund clients.”

“Best Mutual Funds That Keep Topping The Market” (Investor’s Business Daily). “Why was it tougher for diversified stock funds to outperform? ‘Equity leadership was concentrated in megacap growth stocks, which mathematically makes it harder to outperform,’ said Jurrien Timmer, global head of macro for Fidelity Investments. "An investor would need to have even bigger concentrations in already very big names." Many megacap outperformers were tech stocks.”

“‘Mystifying’ U.S. Stock Rally Defies Economic Unease” (Reuters). “Many have taken heart from Fed Chairman Jerome Powell's assessment of the U.S. economy as strong enough to handle an aggressive pace of rate increases and may be cheering a Fed that now appears to be tackling sky-high inflation head on, analysts said.”

What we’re reading (3/29)

“8/9. That's The Fed’s Record On Triggering A Recession While Trying To Fix Inflation.” (Politico). “Nine times since 1961, the central bank has embarked on a series of interest rate increases to rein in inflation. Eight times a recession followed. The only true ‘soft landing’ — as significant rate hikes with no subsequent slumps are called — occurred in 1994, according to a March 25 report by investment bank Piper Sandler. Not a sterling track record.”

“Home-Price Growth Accelerated In January” (Wall Street Journal). “The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, rose 19.2% in the year that ended in January, compared with an 18.9% annual gain the prior month.”

“Tesla, Amazon Stock Splits Trigger Retail Stampede” (Bloomberg). “Tesla surged 8% Monday, adding about $84 billion to the company’s market value, after saying it’s planning a second stock split in less than two years. Amazon jumped more than 5% the day after announcing a 20-for-1 split this month and the stock has been on a tear ever since. In theory, this shouldn’t happen. A split doesn’t affect a company’s business fundamentals, and investors averse to a stock’s high price tag can simply buy fractional shares instead. Yet splits are causing day traders to pile in, fueling rallies in these companies’ shares.”

“I Keep Hoping Larry Summers Is Wrong. What If He’s Not?” (New York Times). “I’m probably as apprehensive about the prospects for a soft landing of the U.S. economy as I have been any time in the last year. Probably actually a bit more apprehensive. In a way, the situation continues to resemble the 1970s […]. In the late ‘60s and in the early ‘70s, we made mistakes of excessive demand expansion that created an inflationary environment. And then we caught really terrible luck with bad supply shocks from OPEC, bad supply shocks from elsewhere. And it all added up to a macroeconomic mess. And in many ways, that’s the right analogy for now.”

“Weekly Market Pulse: The Cure For High Prices” (Alhambra Investments). “The economy right this minute is not in danger of recession, at least based on the indicators we follow. We have seen some early warnings such as the inversion of the 10/7-year Treasury yields but that is generally a very early warning of recession. Of course, at the rate prices and interest rates are rising recently, that may not prove true this time but we would still expect to see other indicators turn negative prior to the onset of recession. Other parts of the curve would still invert and credit spreads would still widen. And right before recession, the yield curve would probably steepen as short-term rates fall rapidly; the market will not wait for the Fed to start lowering rates before rendering its own verdict on the economy.”

What we’re reading (3/28)

“US Stocks Edge Higher As Oil Prices Come Down And Bond Yields Waver” (Insider). “US stocks closed higher Monday after the Dow Jones Industrial Average and the S&P 500 reversed losses late in the trading session. The Nasdaq in particular made a strong gain, as Tesla jumped 8% on news of a coming stock-split. The rally came even as the Biden administration is seeking to slow stock repurchases by limiting when executives can sell shares. The proposal is part of a 2023 budget that would also hike taxes on the ultra-rich and add more defense spending.”

“Goldman, JPMorgan Strategists Say Equities Can Weather Bond Rout” (Bloomberg). “‘Recessions don’t typically start ahead of the curve inverting, and the lead-lag could be very substantial, as long as 2 years,’ JPMorgan strategists led by Mislav Matejka wrote in a note. ‘Further, over this timeframe, equities tended to beat bonds handsomely,’ they said, adding that the peak in equity markets historically takes place around a year after the inversion.”

“Tesla To Request Shareholder Approval For Stock Split” (Wall Street Journal). “Tesla Inc. said it would request shareholder approval at its annual meeting for an increase in the number of shares of the electric-car maker to enable a stock split, though the company didn’t specify when such a split would take place or what the ratio of shares would be. Tesla shares closed Monday at $1,091.84, up 8%. The auto maker typically holds its shareholder meeting in the fall.”

“Farmers On The Brink” (Doomberg). “While the concept of a perfect storm is often too casually assigned in popular culture, it is difficult to find a more apt description of what has been unfolding in the global agriculture markets over these past several months. The tempest caused by the European energy disaster has merged with the hurricane of consequences flowing from Russia’s invasion of Ukraine, forming the genesis of a generational crisis in food that will leave few unaffected.”

“The Bull Market Turns Two” (LPL Research). “We expect the bull market to continue, but some bumps in the road are normal. As the bull ages, year three could provide some of those bumps.”

What we’re reading (3/27)

“When Will Rate Hikes Really Start Punishing You?” (CNN Business). “Higher interest rates may not just cause an economic downturn. It likely will lead to a slump in profit growth, too. That could be bad for investors who have gotten used to (some might even say spoiled by) interest rates at zero. ‘What has held up the stock market over the past few years is monetary stimulus. Full stop,’ said Mark Yusko, CEO and chief investment officer of Morgan Creek Capital Management.”

“The Riskiest Bets In The Stock Market Are The Most Popular” (Wall Street Journal). “The history of riskier exchange-traded products is dotted with blowups that have left traders with big losses. A product that bet against the VIX, the VelocityShares Daily Inverse VIX Short Term exchange-traded note, abruptly shut down in 2018 after a bout of volatility, spurring havoc in the derivatives market.”

“U.S. Big Cap Stocks Turn Into World’s Top Haven As Risk Rises” (Bloomberg). “The S&P 500 Index is up more than 8% over the past two weeks, recouping all of its losses since the Russian invasion on Feb. 24. Meanwhile, the tech-heavy Nasdaq 100 has gained almost 11% over the same span. With earnings looking strong and corporate outlooks improving, there are reasons to think these gains can hold despite the myriad risks facing global equities.”

“Why High-Yield Bonds Should Outperform In 2022” (Morningstar). “Factors favoring high-yield bonds should be an economy that remains strong even as it cools off from last year’s post-pandemic surge, high yield’s lower sensitivity to rising interest rates, and of course, their yield advantage over higher-quality corporate and government bonds.”

“Who’s Buying Russian Stocks?” (DealBook). “The Russian stock market was never as important to its national economy as its counterparts in the United States, Europe and elsewhere are to theirs. Today, the total value of Russia’s market is about $400 billion, or roughly the same as Walmart. Trading in Moscow is — or was — dominated by foreign investors, who own the majority of shares that are available to trade.”

April picks available soon

We’ll be publishing our Prime and Select picks for the month of April before Friday, April 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of March, as well as SPC’s cumulative performance, assuming the sale of the March picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Thurs., March 31). Performance tracking for the month of April will assume the March picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Friday, April 1).

What we’re reading (3/26)

“The Bond Market Losing $2.6 Trillion Is Actually Good News” (Washington Post). “most investors expect —and market indicators such as breakeven rates on bonds corroborate — that the recent and expected future rate increases by the Federal Reserve will bring slow inflation to the long-term benefit of bondholders. There is a nightmare scenario for bonds in which the Fed cannot control inflation, leading to steep price declines in bonds and sharply reduced purchasing power of the income generated by bonds. But this is a feared future loss, not the past loss. And if you fear it, unhedged foreign bonds are an attractive option

“Big Oil Is No Longer ‘Unbankable’” (OilPrice.com). “It’s an open secret within energy circles that the eventual death of oil and thermal coal won’t come from environmentalists or even directly from renewable energy, but rather when big banks decide to stop financing it…[b]ut the lure of those juicy oil and gas dollars amid an energy boom has been proving hard for Wall Street banks to resist, leading to many throwing their ESG pledges out of the window.”

“U.S. Oil Boom Towns Risk Ghost Town Future” (Bloomberg). “For America’s small oil communities, getting the timing right can mean the difference between losing out on the last great boom and turning into a ghost town. At stake is not only hundreds of thousands of U.S. jobs, but also more than $138 billion generated annually through tax revenues for localities, states, tribes, and the federal government.”

“Scientist Who Predicted Arab Spring: Skyrocketing Wheat Prices Are Creating A Global ‘Regime of Risk’” (Vice). “[In 2010] Dr. Yaneer Bar-Yam, president of the Cambridge, Massachusetts-based New England Complex Systems Institute, sent a note to the U.S. government predicting exactly that a wave of protests would unfold in the Middle East in response to sudden spikes in global food prices. By mapping a range of factors that influence social unrest, he and his team tracked earlier riots to peaks in global food prices, identifying a price threshold above which protests become likely, and delivered an ominous message that a tipping point into conflict was near.”

“SEC Climate Disclosure Proposal Looms As Litigation Risk” (Wall Street Journal). “A U.S. Securities and Exchange Commission proposal that would mandate strict climate reporting from public companies could dramatically increase the exposure of these businesses to costly securities litigation. Lawyers that represent corporations and investors said that the proposal, released earlier this week, could be a potent source of securities fraud litigation, which targets companies over alleged lies or even half-truths told to the investing public.”

What we’re reading (3/25)

“How High Inflation Will Come Down” (New York Times). “Things are very different now. Back then almost everyone expected persistent high inflation; now few people do. Bond markets expect inflation eventually to return to prepandemic levels. While consumers expect high inflation over the next year, their longer-term expectations remain ‘anchored’ at fairly moderate levels. Professional forecasters expect inflation to moderate next year.”

“Clients Plead With Top Custodian Banks To Stay In Russia” (Reuters). “Global banks including Citigroup Inc, JPMorgan Chase & Co and Societe Generale face pressure to commit to remaining as custodian banks in Russia, as rivals and funds fret they may lose services critical to future investment in the country.”

“Veteran Investor Jeremy Grantham Says Putin's Behavior Has Him Reconsidering His Near-Term Market Forecasts” (Insider). “‘[W]hen a war starts, everything is scrambled, and it multiplies all the uncertainties,’ he said. ‘We were certainly in the Vampire Phase. But I'm humble enough to say that when a war of this magnitude occurs — with ramifications that could extend beyond that — all bets are off.’”

“Behind The Scenes, The IPO Playbook Is Changing” (Wall Street Journal). “The IPO market has frozen over. When it thaws, it could look much different. So far this year, just 22 companies have gone public in traditional initial public offerings, raising a combined $2.3 billion through Tuesday, according to Dealogic. That is a huge downshift from last year, when 79 companies had raised nearly $36 billion by this point.”

“A Big Swing At Big Tech” (New York Times). “The European Union has just agreed on one of the world’s most far-reaching laws to rein in the power of tech companies. The Digital Markets Act is aimed at stopping the largest tech platforms from using their interlocking services and considerable resources to box in users and squeeze emerging rivals. It could potentially reshape app stores, online advertising, e-commerce, messaging services and other everyday digital tools, in Europe and beyond.”

What we’re reading (3/24)

“Fidelity Launches Business Mimicking Hedge-Fund Strategies” (Bloomberg). “Fidelity Investments is jumping into liquid alternatives, products that offer regular investors access to hedge-fund like strategies and are raking in billions of dollars amid rising interest rates and increased market volatility. The money-manager has started a new unit, Fidelity Diversifying Solutions, which is hiring staff and rolling out offerings, according to a statement from the entity’s president, Vadim Zlotnikov. The segment also filed to register two funds at the end of last year, Fidelity Global Macro Opportunities and Fidelity Risk Parity.”

“A Top Prosecutor, A Short Seller’s Confession, And A Columbia Professor Offer Clues To The DOJ Probe Of Short Sellers” (Institutional Investor). “Last June, a relatively obscure short seller shook the financial world by settling a defamation lawsuit regarding his 2018 short of Farmland Partners, a real estate investment trust. Such settlements are rare, but in this case, Quinton Mathews, a Dallas-based researcher writing under the pseudonym Rota Fortunae, admitted making false statements about Farmland in a Seeking Alpha blogpost and profiting from short-dated put options ahead of its publication.”

“Morgan Stanley Replaces Executive Tied To Block-Trade Probe” (Bloomberg). “Morgan Stanley tapped Arnaud Blanchard to replace Pawan Passi, the executive put on leave amid a sweeping U.S. probe into how Wall Street handles big stock trades…Passi was placed on leave in November as U.S. authorities examined his involvement in block trades as part of an investigation into whether banks improperly alerted certain clients to market-moving transactions, Bloomberg News reported.”

“Why Energy Insecurity Is Here To Stay” (The Economist). “The longer-term question being asked by many is: how fast can they abandon fossil fuels altogether? The energy strategy announced this month by the eu envisages independence from Russia by 2030—in part by finding new sources of gas, but also by doubling down on renewables. As the folly of relying on Russia becomes clear, nuclear power is back in fashion.”

“War In Ukraine Forces European Bulls To Unwind Bets” (Wall Street Journal). “European stock indexes have clawed back most of the losses suffered since President Vladimir Putin sent Russian troops into Ukraine. That doesn’t necessarily mean traders are feeling optimistic. Investors around the world say they are still looking skeptically at investing within the European continent, even though the pan-continental Stoxx Europe 600 is down just 0.2% from where it closed the day before the invasion.”

What we’re reading (3/23)

“Day Traders Finally Retreat After Standing Firm Amid Stock Market Rout” (Bloomberg). “In what looks increasingly like an uncharacteristic bout of bad timing, retail investors who hung tough during the selloff in January and February are now taking money off the table just as stocks are rallying. Evidence of a retail pullback was visible in data from several Wall Street banks and the U.S. options clearing agency. Data from JPMorgan Chase & Co. showed their flows have slowed from a torrid pace earlier this year. Bank of America Corp.’s retail clients were net sellers of U.S. stocks for the first time this year.”

“Russian Stock Market, Crushed By War, Will Partially Reopen” (ABC News). “Russia plans to reopen its stock market for limited trading on Thursday, nearly one month after shares plunged and the exchange was shut down following the invasion of Ukraine. There will be heavy restrictions on trading intended to prevent the kind of massive selloff that took place on Feb. 24 in anticipation of crushing financial and economic sanctions from Western nations.”

“How ‘Shock Therapy’ Created Russian Oligarchs And Paved The Path For Putin” (NPR). “[Mass privatization] entailed transforming a nation whose almost entire economy consisted of state-controlled industries — manufacturing plants, oil refineries, mines, media outlets, biscuit factories, you name it — into private enterprises. It was, to date, surely the biggest transfer of state assets to private owners in world history.”

“Chinese Stocks: The Road To Nowhere” (Morningstar). “Whether Chinese equities have lost money in real terms, as MSCI’s numbers indicate, or have eked out a modest profit, as reported by S&P/IFCI, matters not. The key point is that, despite the country’s unprecedented economic boom, its stocks have flopped. Investors were better off owning U.S. Treasury notes.”

“An Alleged Fraud Uncovered By A Short Seller Ends In Gunfire” (Wall Street Journal). “The strategy promoted by Mr. Judd was ‘the most obvious Ponzi scheme we’ve ever seen,’ said Nate Anderson, founder of the investment firm that investigated it. In a notice seeking out victims of the alleged fraud, the FBI also called it a Ponzi scheme. Ponzi schemes are investment frauds where early investors are paid with funds raised from later investors. The money raised is generally not invested.”

What we’re reading (3/22)

“The Stock Market Is Set For More Short-Term Upside After Wall Street's Fear Gauge Falls 5 days In A Row, Quant Trading Firm Says” (Insider). “There could be more short-term upside ahead in the stock market based on the five-day decline in Wall Street's fear gauge, according to Chris Murphy of Susquehanna International Group. The VIX, which is a volatility index that helps measure investor fear on Wall Street, has fallen five days in a row to below the 25 level. According to Murphy, that setup has led to strong short-term gains in the stock market, looking back over the past 30 years.”

“‘A Very Significant Moment for Business’” (DealBook). “The S.E.C. voted yesterday on sweeping rule changes that would require public companies to disclose climate-related risks and greenhouse gas emissions. Though many already report some of this information, no mandatory standard exists, making it hard for investors to compare data across companies.”

“When Being One Of—If Not The—First Call A Banker Makes Is Not Such A Great Thing” (Dealbreaker). “[U]nbeknownst to [Frank] Fu [formerly of Laurion Capital Management], the year before he left Laurion the Securities and Exchange Commission and Justice Department began taking a little look at the world of block trades to see if, say, shorting the hell out of a name that the equity syndicate desk at, say, Morgan Stanley just floated as one that might just potentially be on the block might well just constitute insider trading[.]”

“Koch Industries, Built On Oil, Bets Big On U.S. Batteries” (Wall Street Journal). “A Koch Industries unit has made at least 10 investments worth at least $750 million in the U.S. battery supply chain and electric vehicles in the past 18 months, regulatory filings, news releases and FactSet data show. Koch’s battery investments are among the biggest from outside the auto industry, analysts say.”

“The Education-Innovation Gap” (Biasi and Ma, NBER). “Comparing the text of 1.7M syllabi and 20M academic articles, we construct the ‘education-innovation gap,’ a syllabus’s relative proximity to old and new knowledge. We show that courses differ greatly in the extent to which they cover frontier knowledge. More selective and better funded schools, and those enrolling socio-economically advantaged students, teach more frontier knowledge. Instructors play a big role in shaping course content; research-active instructors teach more frontier knowledge. Students from schools teaching more frontier knowledge are more likely to complete a PhD, produce more patents, and earn more after graduation.”

What we’re reading (3/21)

“The Stock Market Liked The Fed’s Plan To Raise Interest Rates. It’s Wrong.” (Larry Summers). “The central principle of anti-inflationary monetary policy is that to reduce inflation it is necessary to raise real rates. Equivalently, it is necessary to raise interest rates by more than the inflation being counteracted and above a neutral level that neither speeds nor slows growth….[y]et because of upward revisions in the inflation forecast, the Fed’s predicted real rates have actually declined in recent months. In other words, the FOMC’s plans do not even call for keeping up with the rising inflationary gap. It is hard to see how interest rates that even three years from now will be about 2 percentage points less than current rates of inflation can reasonably be regarded as providing sufficient restraint.”

“Powell Says Fed Will Consider More-Aggressive Interest-Rate Increases To Reduce Inflation” (Wall Street Journal). “Federal Reserve Chairman Jerome Powell said the central bank was prepared to raise interest rates in half-percentage-point steps and high enough to deliberately slow the economy if it concluded such steps were warranted to bring down inflation.”

“Bonds Extend Drop After Fed Sparks One Of Worst Days in Decade” (Bloomberg). “The U.S. bond market reeled further on Tuesday, extending Monday’s declines after Federal Reserve Chair Jerome Powell’s aggressive rate hike comments drove yields on short-dated Treasuries to one of their biggest daily jumps of the past decade.

“JPMorgan’s Quant Guru Says He's Still Bullish On Stocks But Admits Risks Are Building And Lowers S&P 500 Price Target” (Insider). “‘With positioning light, sentiment weak and geopolitical risks likely to ease over time, we believe risks are skewed to the upside...That said, we revised down some year-end targets to reflect macro and geopolitical risks, which should ease into the second half of the year,’ [Marko] Kolanovic said.”

“Want to Outperform In VC? Don’t Invest In Alumni.” (Institutional Investor). “New research shows that direct investments in university-affiliated startups can result in far fewer successful exits, including initial public offerings and acquisitions, compared to backing independent ventures.”