What we’re reading (2/12)

“After The Great Resignation, Tech Firms Are Getting Desperate” (Wired). “Amazon, PayPal, Intel, and Pinterest acknowledged that rejecting remote work will cost them dearly in the fight for talent, particularly as Facebook, Twitter, and Shopify have made it the norm. In Japan, where remote working still isn’t common, Yahoo has announced employees can work from anywhere in the country and it will pay for their flights if they ever need to come into the office.”

“Deals Are Booming, But Antitrust Scrutiny Has Deal Traders Worried” (Wall Street Journal). “Merger-arbitrage traders seek what is supposed to be safe money: They buy shares after deals are announced, hoping to capture the final bit of upside when the transaction closes. Delays associated with antitrust challenges hinder their ability to make a quick return, and hedging strategies run up their costs.”

“We Found The Real Names Of Bored Ape Yacht Club’s Pseudonymous Founders” (Buzz Feed). “Artistic value aside, the people behind BAYC are courting investors and running a business that is potentially worth billions.”

“Systemic Risk Regulation And The Myths Of The 2008 Financial Crisis” (Cato Institute). “In general, the large increase in securitization—issuing securities whose value is tied to pools of other assets, such as mortgages or consumer loans—that started in the late 1980s was driven primarily by [regulated commercial] banks. In 2012, a Federal Reserve report affirmed that ‘banks are by far the predominant force in the securitization market,’ and that banks were ‘a significant force in these shadow banking segments related to securitization all along.’”

“Is The Modern, Bank-Light Financial System Better Than The Old One?” (The Economist). “Robert Shiller of Yale University, who won a Nobel prize for his work on financial bubbles, sees parallels with the go-go years before the crash of 1929. Back then, ‘there was an explosion of fun things to do with stocks. I think we’re in a similar situation now.’ According to Mr Shiller’s surveys, over the past year the share of individual investors who think the market is overpriced has been higher than at any point since the turn of the millennium, before the dotcom bubble burst…[y]et at the same time their belief that stocks will rally if there is ever a fall has never been so high. This contradictory combination of fear of overvaluation and fear of missing out mirrors the dynamic in 1929.”

What we’re reading (2/11)

“Stocks Slide And Oil Surges On Renewed Fears Of Russia Invasion Of Ukraine” (CNN Business). “Stocks fell sharply Friday after the White House said Americans should leave Ukraine "immediately" due to worries about an imminent invasion by Russia. The Dow Jones Industrial Average fell a little more than 500 points, or 1.4%, after the Biden administration said it would be ready to respond if Russia invades. The S&P 500 and Nasdaq ended the day down 1.9% and 2.8%, respectively.”

“Fed Should Hold Immediate Meeting To End Asset Purchases, Summers Says” (Bloomberg). “‘The Fed should have a special meeting, right now, to end QE,’ Summers told Bloomberg Television’s ‘Wall Street Week’ with David Westin. ‘It is nothing short of preposterous that in an economy with 7.5% inflation, that in an economy with the tightest labor market we’ve seen in two generations, that the central bank is still as we speak growing its balance sheet.’”

“The Trouble With A Stock-Market Bubble” (Wall Street Journal). “We don’t have as much of the past as it seems. Prof. Shiller’s 10-year averages begin in 1881, providing only 14 nonoverlapping 10-year periods (1881 to 1890, 1891 to 1900, 1901 to 1910, and so on). What feels like such a long historical vista, then, is a small sample, full of noise. Yes, on average, stocks have delivered low future returns for 10-year stretches after their CAPE valuation was high, and superior performance after periods of low valuation—but not always.”

“Elizabeth Holmes Is the Exception: More Women On Boards Lead To Less Corporate Wrongdoing” (ProMarket). “Our forthcoming study…provides empirical evidence of the positive effects on corporate behavior of gender balancing in the boardroom. We examined 660 public corporations listed on the Tel Aviv Stock Exchange (TASE) between 2005 and 2017. During that period, the corporations or their top executives were involved in a total of 149 criminal or administrative violations of the law. Our analysis shows that corporations with a higher representation of women on the board were significantly less likely to be involved in corporate wrongdoing.”

“What Happens If A Cryptocurrency Exchange Files For Bankruptcy?” (Credit Slips). “[W]hat happens to a customer if an exchange files for bankruptcy? I think it ends very badly for the customers…I do not think customers understand the legal nature of the custodial relationships, and exchanges have no incentive to make the legal treatment clear to customers. In fact, the exchanges are lulling the consumers with language claiming that the consumer ‘owns’ the coins, when in fact the legal treatment is quite likely to be different in bankruptcy. In bankruptcy, it is likely to be treated as a debtor-creditor relationship, not a custodial (bailment) relationship. That means that customers are taking on real credit risk with the exchanges, which is a particular problem because of the opacity of the exchanges and their lack of regulation.”

Tell me the stock market is pretty efficient without telling me the stock market is efficient

From the WSJ:

Affirm closed down 21% at $58.68, a huge reversal from its performance earlier in the day, after the company accidentally tweeted some key quarterly results early. At one point, shares were up more than 12% at nearly $84…Investors initially cheered the abbreviated results, which seemed to punctuate Affirm’s breakout year [disclosing a 77% quarterly revenue jump and a big increase in transaction volume]…Investors were less impressed after they saw the full report, sending the shares down as much as 33% in afternoon trading. The company reported a wider loss in the latest quarter, and analysts raised concerns about the company’s profit margins and financial guidance.

What we’re reading (2/10)

“America's Annual Price Increase Was Worse Than Economists Had Forecast” (CNN Business). “A key measure of inflation climbed to a near-40-year high last month. Economists are hopeful that America will reach the peak of the pandemic-era price increases in the early months of 2022. Here's to hoping. The consumer price index rose 7.5% in the 12 months ending January, not adjusted for seasonal swings, the Bureau of Labor Statistics said Thursday. It was the steepest annual price increase since February 1982 and worse than economists had forecast.”

“Astra Stock Drops 26% After NASA Mission Fails Mid-Launch” (CNBC). “Shares of rocket builder Astra fell sharply Thursday, after the company’s latest mission failed to reach orbit. Astra’s stock fell 26% to close at $3.91 a share. The company confirmed there was an issue mid-flight that prevented the rocket from delivering a set of four cube satellites to orbit on a NASA-funded mission.”

“Brookfield Considers Spinning Off Its Asset Management Business” (Financial Times). “Brookfield Asset Management, one of the world’s largest alternative investment groups, is weighing a spin-off of its asset management business into a separate public company that one analyst said could be valued at more than $75bn. The manoeuvre would simplify the structure of the sprawling Toronto-based company, separating the division that manages $364bn in fee-bearing assets across real estate, infrastructure, renewable energy, credit and private equity on behalf of institutional investors from Brookfield’s $50bn of directly-owned net assets.”

“What Would Happen If Financial Markets Crashed?” (The Economist). “The mix of sky-high valuations and rising interest rates could easily result in large losses, as the rate used to discount future income rises. If big losses do materialise, the important question, for investors, for central bankers and for the world economy, is whether the financial system will safely absorb them or amplify them. The answer is not obvious, for that system has been transformed over the past 15 years by the twin forces of regulation and technological innovation.”

“SEC To Reduce The Number Of Things Private Equity Firms Can Lie About” (Dealbreaker). “So what exactly are those regulations that the alternative investments lobby thinks are so unnecessary and harmful. Well, for one, it would make it much more difficult for them to lie to their investors about performance and fees by requiring some standardized disclosures which the SEC would audit. But they would also be barred from charging some of those fees they so often like to elide the truth around.”

What we’re reading (2/9)

“Hipster Couple Charged In $4.5 Billion Crypto Heist Is Even Weirder Than You Think” (Daily Beast). “Bitcoin. NFTs. A PPP loan. And a rapping tech entrepreneur. A New York City couple were arrested Tuesday morning by federal agents on charges of laundering some $4.5 billion stolen in a massive 2016 cryptocurrency exchange breach. As might be expected in 2022, the latest federal law enforcement takedown features the buzziest of buzz-worthy themes—as well as some pretty awful rap lyrics.”

“Business Rapper Was Bad At Bitcoin Laundering” (Matt Levine, Money Stuff). There is a strange debate about crypto and money laundering. Crypto skeptics will often say ‘Bitcoin is mostly useful for money laundering’; crypto proponents…will instead say ‘no, Bitcoin is useless for money laundering because it creates a permanent public record of all transactions and why would you want to launder money that way.’ You might think that a federal criminal indictment for $4.5 billion of Bitcoin money laundering would be vindication of the ‘Bitcoin is for money launderers’ side, but I want to tell you: No it is not! What allegedly happened here is that hackers stole $4.5 billion of Bitcoin from a crypto exchange (and stealing from exchanges absolutely is a major function of crypto), and then they had a horrible time laundering it.”

“Pelosi Buckles, Pushes Stock-Trading Ban” (Axios). “House Speaker Nancy Pelosi (D-Calif.) is moving to ban stock trading on Capitol Hill, after having consistently opposed such a measure, Punchbowl News reports…Pelosi's imprimatur follows building momentum in both parties: Some progressive Democrats and MAGA Republicans have united on a proposal to ban sitting lawmakers from trading individual stocks, Axios reported last month.”

“Zillow: Our 2022 Housing Forecast Is Way Off—Home Prices Now Set To Spike 16%” (Fortune). “Back in December, the home listing site predicted that U.S. home values would climb 11% this year. Economists at Zillow now say that forecast is too conservative. Their latest forecast finds home prices are set to spike 16.4% between December 2021 and December 2022. If it comes to fruition, it would mark another brutal year for home shoppers.”

“SEC Seeks To Bolster Disclosure Rules For Private Equity And Hedge Funds” (Financial Times). “The Securities and Exchange Commission on Wednesday voted in favour of a string of proposed rules that would require annual audits of private funds, ban certain fees that buyout shops charge and prohibit preferential terms for certain investors. The watchdog also advanced a proposal that would accelerate the time it takes for stock and bond trades to be finalised.”

What we’re reading (2/8)

“Investors Gobble Up Dividend Stocks During Market Turbulence” (Wall Street Journal). “Boring companies have been hot during the stock market’s winter swoon. An early-year tumble in major U.S. stock indexes has some investors searching for safety by dumping shares of high-growth technology stocks for stodgier businesses that pay shareholders cash, including banks, oil companies and telecoms.”

“VC Valuations Climb Higher Still As Hedge Funds And Other Nontraditional Investors Pile In” (Institutional Investor). “Early-stage valuations, which includes series A and series B, have gotten so high that they are beginning to resemble the late-stage valuations of previous years. In 2021, the median early-stage pre-money valuation reached $45 million, a 50 percent increase from 2020, PitchBook said in its annual U.S. VC valuations report.”

“Peloton Is Replacing Its CEO And Cutting 2,800 Jobs” (CNN Business). “‘This restructuring program is the result of diligent planning to address key areas of the business and realign our operations so that we can execute against our growth opportunity with efficiency and discipline,’ the company said in a press release. Layoffs also begin Tuesday.”

“Tyson Foods Loves Inflation” (Financial Times). “$32bn Tyson Foods — America’s largest producer of chicken, pork and beef — announced its first-quarter results before the bell Monday morning. And they were blow out. Revenues grew 24 per cent year on year, coming in at a shade under $13bn, versus analyst’s expectations of $12bn. While earnings per share tripled to $3.70, comfortably exceeding the $1.94 Wall Street’s finest had pencilled in. In early trading, the shares are up 12 per cent at $98.64.”

“Netflix Economics And The Future Of Netflix” (Marginal Revolution). “Of course the company is still worth quite a bit, so my own view is no more or no less optimistic than what the market indicates. Still, it is worth asking what the equilibrium here looks like. There is also AppleTV, Disney, Showtime, HBOMax, Hulu, AmazonPrime, and more. I don’t think it quite works to argue that we all end up subscribing to all of them, so where are matters headed?”

What we’re reading (2/7)

“Bank of America Strategists Warn Fed Hikes In Pricey Market To End Poorly” (Bloomberg). “While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be ‘tightening into an overvalued market,’ the strategists led by Savita Subramanian wrote in a note. ‘The S&P 500 is more expensive ahead of the first rate hike than any other cycle besides 1999-00,’ they said.”

“Seven Hikes? Fast-Rising Wages Could Cause The Fed To Raise Interest Rates Even Higher This Year” (CNBC). “‘If I’m the Fed, I’m getting more nervous that it’s not just a few outliers’ that are driving wage increases, Ethan Harris, Bank of America’s head of global economics research, said in a media call Monday. ‘If I were the Fed chair ... I would have raised rates early in the fall. When we get this broad-based increase and it starts making its way to wages, you’re behind the curve and you need to start moving.’”

“Expect Markets To Be On A Wild Ride Until The Fed Really Starts Raising Rates” (CNN Business). “The dynamics behind this dilemma have been building for years. Between late 2008 and late 2015, the Fed kept interest rates at or near 0%, while pumping new cash into the banking system on Wall Street. These policies had the desired effect. All those new dollars were forced to find any new investment that would provide a good return (there was, after all, very little incentive to save the money when the Fed was holding interest rates so low). Wall Street speculators chased after a wide variety of assets in search of yield, bidding up prices for things like tech stocks and commercial real estate.”

“Earnings Are Driving The Market But It’s Not Clear Where” (New York Times). “[W]ith the market and the economy in shaky positions, the corporate comments during earnings calls are setting off sharp movements in individual shares and in the overall market. ‘The whiplash, and the extreme movements that we’re seeing, particularly on days when companies report earnings, is less about any extreme thing that is happening with those earnings and more about the background that the market lives in right now,’ said Liz Ann Sonders, chief investment strategist at Charles Schwab.”

“Peter Thiel To Retire From Meta Board Of Directors At 2022 Annual Shareholder Meeting” (Meta Platforms, Inc.). “Meta (NASDAQ: FB) announced today that Peter A. Thiel, Partner at Founders Fund and PayPal co-founder, has decided not to stand for re-election to the Board of Directors of the Company at the Company's 2022 Annual Meeting of Stockholders. Thiel has been a member of the company's board of directors since 2005 and will continue to serve as a director until the date of the Annual Meeting.”

What we’re reading (2/6)

“Facebook’s Faceplant On Wall Street Could Be Just The Beginning For Some Tech Stocks” (Washington Post). “Both the Fed and the International Monetary Fund warned in recent months that stock prices could be losing touch with their fundamental values. Relative to earnings forecasts, prices were at ‘the upper end’ of historical experience, the Fed said in November, adding: ‘Asset prices may be vulnerable to significant declines should risk appetite fall.’ Higher interest rates hurt companies with lofty stock prices based on the expectation of dramatic earnings growth years in the future, such as the high-tech favorites that dazzled Wall Street over the past two years.”

“A Big Tech Trade Is Losing Its Luster” (Wall Street Journal). “Gone, several investors said, are the days in which the stocks logged a simultaneous ascent and attracted crowds of fans. Some have become victims of rising interest rates, changing consumer tastes and stretched valuations. Those that have fallen short of high investor expectations have paid dearly in the market.”

“Why There’s No Need To Fear A Bear Market” (CNN Business). “[A] correction doesn't necessarily mean that an even worse pullback is coming. Few analysts are predicting a long, painful bear market ahead. That's when stocks drop more than 20% from recent highs.”

“The SEC Is Tightening Its Grip on Private Markets — But It May Be Disappointed” (Institutional Investor). “The SEC is concerned about two types of potential systemic risks from hedge funds — sales of distressed assets and the possibility that one fund’s problems could be transmitted to other parties, such as prime brokers, according to Mark Perlow, partner at law firm Dechert. There hasn’t been the same clarity on PE risks. ‘Even if these risks were valid, the SEC statements in the release were not able to articulate anything close to this for private equity funds,’ he said.”

“Archegos Cited In U.S. Watchdogs’ Warning About Hedge Fund Risks” (Bloomberg). “The Financial Stability Oversight Council -- a panel of top U.S. financial regulators that includes Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell and Securities and Exchange Commission Chair Gary Gensler -- agreed Friday to support ‘an interagency risk monitoring system to identify potential emerging financial stability risks posed by hedge funds’ and to consider options for dealing with the dangers as they arise.”

What we’re reading (2/5)

“Shooting Oil In A Barrel” (Doomberg). “With demand for oil and gas already surpassing pre-Covid levels and set to rip higher once the global economy fully reopens, the stage is set for an epic blowoff top in energy prices. The gap between suppressed supply and unquenchable demand could stretch to unthinkable levels, just as a sizable wedge of the world’s population sits on the cusp of a well-known and substantial step-up in demand.”

“Rate-Hike Bets Wipe Out $1.5 Trillion Of Sub-Zero Debt In A Day” (Bloomberg). “The world’s enormous pool of negative-yielding debt shrank by a record 20% in just a day, signaling that negative yields might be a thing of the past if ever-bolder bets on policy normalization pay out. In both Germany and Japan, the world’s major bastions of negative rates, five-year yields climbed above zero on Friday for the first time in years. In the U.S., 30-year real yields turned positive for the first time in eight months after jobs growth in January far exceeded economist estimates. They were once part of a pile of such debt, which has dwindled to $6.1 trillion, a three-year low.”

“The Last Sane Man on Wall Street” (New York Magazine). “[Nate] Anderson [of Hindenberg Research] belongs to a cranky cohort of ‘activist’ short sellers. They make money by taking positions in the stocks of shaky or shady companies, which pay off if the price goes down — an outcome the shorts hasten with public attacks, publishing investigations on their web platforms and blasting away at their targets (and sometimes at one another) on Twitter…[h]e used to poke around in shadowy corners, but lately he has been seeing fraud sitting right in the blazing light of day.”

“Why The 60/40 Portfolio Continues To Outlast Its Critics” (Morningstar). “To widespread surprise, the 60/40 portfolio promptly blitzed the competition [after 2011]. It didn’t surpass Yale’s return [the Yale University endowment] over the ensuing decade, thanks to David Swensen’s continued (and unrivaled) ability to identify, in advance, top-performing investment managers, but this time around the 60/40 strategy outgained Yale. That's an impressive achievement given that Yale was heavily invested in risky private-equity and leveraged-buyout funds.”

“Michael Lewis Revisits ‘Liar’s Poker’” (DealBook). “I vividly thought that I was trying to describe Brigadoon. It could never survive. They were willing to pay me probably millions of dollars, but certainly hundreds of thousands, to dish out financial advice when I certainly didn’t know what you should be doing with your money. I just thought, this is impossible. It felt like the end of an era. Michael Milken was going to jail. It was like one thing after another. Society is going to get its arms around Wall Street. And this financialization business is going to stop or be slowed. I was wrong about that.”

What we’re reading (2/4)

“SEC Response To Meme-Stock Mania Coming Next Week, Gensler Says” (Bloomberg). “SEC Chair Gary Gensler said Thursday that the agency is preparing to take up a range of policy changes starting next week that would deal with issues raised by last year’s market frenzy, including shortening the time it takes to settle stock trades. The inner-workings of the stock market have become a hot button issue in Washington since last year’s wild trading, prompting a series of congressional hearings.”

“Metamorphosis: Facebook And Big-Tech Competition” (The Economist). “Meta’s troubles reflect two kinds of competition. The first is within social media, where TikTok has become a formidable competitor…[t]he second kind of competition hurting Facebook is the intensifying contest between tech platforms as they diversify into new services and vie to control access to the customer. In Facebook’s case the problem is Apple’s new privacy rules, which allow users to opt out of ad-tracking[.]”

“Amazon, Other Potential Suitors Explore Peloton Deal” (Wall Street Journal). “Amazon has been speaking to advisers about a potential deal, some of the people said. There’s no guarantee the e-commerce giant will follow through with an offer or that Peloton, which is working with its own advisers, would be receptive. Other potential suitors are circling, these people said, but no deal is imminent and there may not be one at all.”

“How $323M In Crypto Was Stolen From A Blockchain Bridge Called Wormhole” (Ars Technica). “This is a story about how a simple software bug allowed the fourth-biggest cryptocurrency theft ever…A lengthy analysis posted on Twitter a few hours after the heist said that Wormhole’s backend platform failed to properly validate its guardian accounts. By creating a fake signature account, the hacker or hackers behind the heist minted 120,000 ETH coins—worth about $323 million at the time of the transactions—on the Solana chain. The hackers then made a series of transfers that dropped about 93,750 tokens into a private wallet stored on the Ethereum chain[.]”

“Cathie Wood's Ark Files For New Fund” (The Street). “Star investor Cathie Wood’s Ark Investment Management has filed for a new fund that would include private companies and would limit when investors can exit the fund. It’s called Ark Venture Fund, and it would require a minimum investment of $1,000, according to the filing, Bloomberg reports. That would make it easy for individual investors to participate.”

What we’re reading (2/3)

“Value Investing Is Back. But for How Long?” (Wall Street Journal). “Value investing—buying stocks that are cheap on measures such as earnings or book value—is having a renaissance. Up to last Thursday, large value stocks beat more expensive “growth” stocks by the most of any 50-day period since the technology bubble burst in 2000-01, with the exception of the post-vaccine rebound early last year. The big question for investors: Does this mark the rebirth of what was a dying strategy? Or was this just another spasm, already fading as technology stocks rebound?”

“Investors Are Turning To Active Managers — Even If ‘They Can’t Predict The Future’” (Institutional Investor). “Amid inflation worries and market volatility, a growing number of institutional investors are beginning to hand over the portfolio reins to active managers…Daniel Celeghin, managing director of the asset management consulting firm Indefi North America, said that while the diversification of uncorrelated assets is an evergreen task, the inclination to work with more skilled active managers is a reaction to market instability.”

“Meta’s Perfect Storm: Fleeing Users And Apple Privacy Changes Hit Ads Business” (Financial Times). “As more than $200bn was wiped off the value of Meta, chief executive Mark Zuckerberg focused blame for falling profits and users at Facebook’s parent company on a rival: TikTok, the viral short-form video app…[t]hat dramatic fall reflected how investors foresee an even grimmer future beyond just new competition from TikTok. Other Meta executives, such as chief financial officer Dave Wehner, admitted it faced a perfect storm of ‘headwinds’.”

“Cable News Networks Have A Serious Ratings Problem In The Age Of News Burnout” (Fast Company). “While most people would say 2020 was one of the worst years on record, the same might not be said by cable news executives. All the pandemic turmoil and election strife of 2020 saw audiences glued to cable news channels, leading to a surge in viewership. But 2021 saw a major reversal in the viewership fortunes of the major cable news networks...Fox Business: -47.5%…CNN: -40.5%…Fox News: -34.6%…MSNBC: -29.7%…CNBC: -19.0%.”

“The Real Cost Of 15 Minute Grocery Delivery” (The Journal). “A battle among fast grocery delivery companies is raging in New York and other U.S. cities. With millions of dollars of venture capital funding, startups are flocking to get products out to customers in under 20 minutes, but at what cost?”

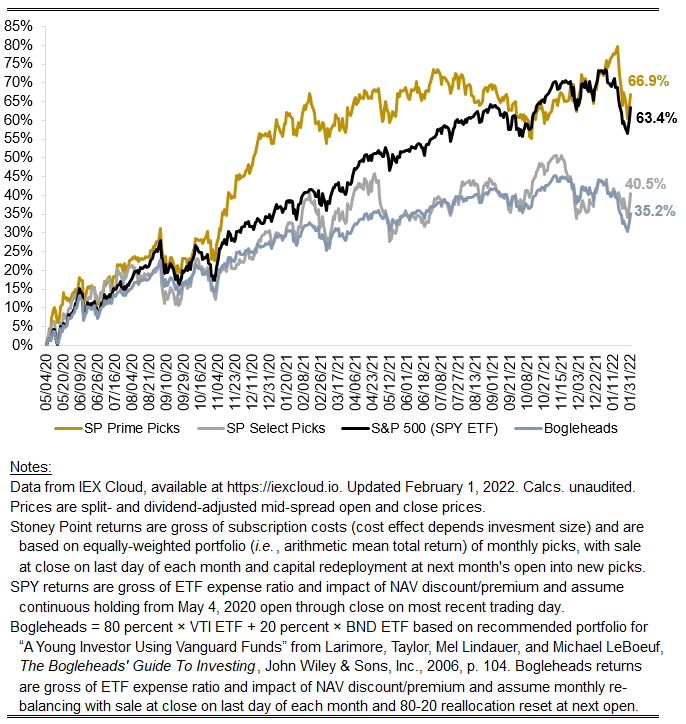

January 2022 performance results

[Hi friends, here with a January performance update. Overall, it was a great month for us with significant relative outperformance compared to benchmark indices. The key numbers:

Prime: -3.04%

Select: -1.49%

SPY ETF: -5.54%

Bogleheads: -5.52%

The Nasdaq fell 8.99 percent — nearly surpassing its worst one-month decline ever of 9.89 percent in 2008. Cathie Wood’s famous “Innovation” ETF (ticker ARKK) was down 20 percent. Bitcoin was also down 20 percent in its worst January since 2018, arguably blowing up the argument that crypto is fundamentally uncorrelated with other risk assets.

What happened in January—after what has undisputedly been an extraordinary, multi-year run for large-cap growth stocks—was, in my view, the collapse of a decade plus-long “free float” period in which the cost of debt-financed capital was essentially zero. Axiomatically, long-duration assets—assets where long-in-the-future cash flows contribute disproportionately to present value compared to nearer-term cash flows—disproportionately benefited from what has essentially been free money. Math dictates those asset would be hit hardest in a tighter monetary policy environment, and the transition to a new, higher-rate regime the likes of which the world has not seen since 2008 or earlier is indeed upon us.

It is no coincidence that “value”-oriented strategies, which tend to construct portfolios comprising lower-duration stocks, underperformed (compared to history) in the free-money environment of the last decade or so. A corollary, I think, is that they should outperform in a non-free-money environment. The important question is: which environment is “normal”, and therefore should be expected in the future. No doubt policymakers have realized the sky did not fall when rates were low, so it is possible we will find ourselves in periods of ultra-low rates in the future. But my bet is that negative real rates can't persist forever, and aren’t likely to systematically persist in the future.

One can see a bit of the “rotation” from growth to value in Stoney Point’s recent performance. The first chart below shows the substantial departure of Prime from the overall S&P 500 since the start of November. Note that market conviction that the Fed would start tightening policy arguably gained significant strength on November 3, 2021, when the Fed announced it would decelerate its asset purchases by $15 billion per month.

The second chart below shows our Select strategy breaking away from the market in January and converging with Prime, making up for its slower departure from the market benchmarks.

Nov. ‘21 Through Jan. ‘22 Performance

(Index: 11/2/21 = 100)

January Performance

(Index: 12/31/21 = 100)

As always, the chart below shows our total performance history.

Stoney Point Total Performance History

What we’re reading (2/1)

“An Army of Faceless Suits Is Taking Over the $4 Trillion Hedge Fund World” (Bloomberg). “A $1 million investment in Millennium’s multi-strategy pool at its launch in 1989 is worth about $67 million now. Citadel has turned a million dollars into about $236 million since its start in Nov. 1990. By contrast, $1m invested in the HFRI Fund Weighted Composite Index at the start of 1990, when the benchmark started, would be worth $18m…Multi-manager platforms ‘have in effect become the most efficient allocators of capital,’ said Caron Bastianpillai, who invests in a number of such funds at Switzerland-based NS Partners.”

“SEC Finds Some Private-Fund Managers Mislead Investors On Performance” (Wall Street Journal). “Private-fund managers sometimes give investors misleading information about fees and performance, said the Securities and Exchange Commission, which highlighted several types of violations found by examiners as the regulator considers stronger rules for private-equity and hedge-fund managers…[i]n presenting their investment performance to prospective investors, some managers ‘only marketed a favorable or cherry-picked track record’ and ‘presented inaccurate performance calculations,’ the regulator said.”

“The Inevitable Decline Of Growth Stocks (For Now)” (Equius). “[S]maller, lower-priced US companies [small-cap value] performed better than large, high-priced US companies [large-cap growth] for 9½ years after the market recovered in March 2009. It was only three years ago (March 2019) when performance crossed over and large growth stocks took the lead. The way things are going, it wouldn’t surprise us if those lines crossed over soon and the higher expected returns of small value stocks become higher actual returns.”

“The 19-Year-Old Tracking Elon Musk's Jet On Twitter Says The Billionaire Has Blocked Him” (Insider). “Protocol first reported that Musk had approached Sweeney late last year and offered $5,000 to get the account taken down, saying it posed a ‘security risk.’ […] Sweeney, who shared the Twitter private messages exchanged between himself and Musk with Insider, countered with an offer of $50,000. Musk declined, saying it didn't ‘feel right’ to pay for the account's removal…Sweeney told Insider last week Musk had introduced some measures he himself had recommended during their Twitter conversation, which make it harder to track the jet. Harder, Sweeney said, but not impossible. ‘I just have to work around it,’ Sweeney told Insider.”

“No, America Is Not On The Brink Of A Civil War” (The Guardian). “[P]olarized answers on polls and surveys often fail to reflect participants’ genuine views. Indeed, when respondents are provided with incentives to answer questions accurately…the difference between Democrats and Republicans on factual matters often collapses.”

What we’re reading (1/31)

“U.S. Stocks End January On High Note But Still Chalk Up Worst Month Since March 2020” (Washington Post). “Wall Street loathes uncertainty, and the first month of 2022 was threat-studded and unpredictable as investors assessed what the Federal Reserve had in store for rate hikes and historically high inflation, the pandemic’s grip over the economy, a tangle of rising geopolitical tensions and a global supply chain in deep distress. Corporate earnings — including blowout performances from Apple and Microsoft — have thus far failed to impress. Wall Street’s fear gauge, the Cboe Volatility Index, is up 75 percent year-to-date.”

“What May Be In Store As The Fed Cuts Back On The Easy Money” (New York Times). “The amounts involved in the Fed’s quantitative easing have been staggering. Back in 2008, the Fed’s balance sheet had assets of $820 billion. They reached $4.5 trillion — yes, trillion — in 2015 and dropped only as low as $3.76 trillion in the summer of 2019. With the coronavirus financial crisis, they have ballooned again, to $8.9 trillion, and may swell a bit more before the spigot shuts. Assets held by the Fed are already more than 10 times their size in 2008, and bigger, as a proportion of gross domestic product, than at any time since World War II.”

“Viking Hedge Fund Blames 2021 Losses On ‘Underestimating’ Covid” (Bloomberg). “fter posting its worst ever performance last year, Viking Global Investors is trying to explain its losses -- and it’s pinning the blame on the Covid-19 pandemic. The firm’s hedge fund, which invested in 2021 laggards such as Peloton Interactive Inc., Coupa Software Inc. and Adaptive Biotechnologies Corp., fell 4.5% in the year because it “underestimated the ongoing impact of Covid,” founder Andreas Halvorsen wrote in a letter to investors dated Jan. 18.”

“Bill Ackman Scored On Pandemic Shutdown And Bounceback” (Wall Street Journal). “As the coronavirus emerged, Bill Ackman made billions betting that the market was misjudging the virus’s economic toll. Then he did it again a year later. In two complex debt investments—one presaging the economy’s swift shutdown and the other its fevered reopening—Mr. Ackman made nearly $4 billion in profit on an outlay of about $200 million, according to fund documents and people familiar with the matter. In short, he called the pandemic’s economic fallout coming and going.”

“Warren Buffett Is Having The Last Laugh” (CNN Business). “Banks, energy firms and other value stocks have rallied this year, which is great news for Buffett since the Oracle of Omaha's conglomerate invests in many of these companies. Value stocks typically have lower price-to-earnings ratios, and they're definitely not trendy.”

February picks available now

The new Prime and Select picks for February are available starting now, based on a model run put through today (January 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, February 1, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, February, 28, 2022 (at the mid-spread closing price).

What we’re reading (1/30)

“Buy GameStop, Fight Injustice. Just Don’t Sell.” (New York Times). “As he dug deeper, spending hours reading what other traders had posted about GameStop, Mr. [Kunal] Gogna [a GameStop shareholders] became convinced that something far darker was going on. Several posts detailed what users were calling a plot by Wall Street, the Securities and Exchange Commission and a trade clearinghouse to create fake or ‘synthetic’ GameStop shares.”

“Rents Are Up 40 Percent In Some Cities, Forcing Millions To Find Another Place To Live” (Washington Post). “Rental prices across the country have been rising for months, but lately the increases have been sharper and more widespread, forcing millions of Americans to reassess their living situations. Average rents rose 14 percent last year, to $1,877 a month, with cities like Austin, New York and Miami notching increases of as much as 40 percent, according to real estate firm Redfin. And Americans expect rents will continue to rise — by about 10 percent this year — according to a report released this month by the Federal Reserve Bank of New York.”

“It’s Been Rough For Stocks, But The Outlook Is Still OK” (Morningstar). “Raheel Siddiqui, portfolio and quantitative strategist…says Monday’s steep declines weren’t driven by fundamental news, but rather a confluence of ‘technical’ factors, such as selling by trend-following futures traders, stock options traders, and ripples from leveraged exchange-traded funds. That coupled with a lack of ‘buy-the-dip’ support from individual investors helped create a void for the market to fall into to start the week. At the same time, there was an overhang of big, institutional investors heavily weighted in the very largest--and often most expensive--stocks who finally started cutting back on those positions.”

“Cathie Wood’s ARK Faces Loyalty Test After Tech-Stock Rout” (Wall Street Journal). “What happens next at the ARK Innovation fund, which goes by the ticker ARKK, and other risky investments like it will help tell the story of financial markets in 2022. The most speculative assets, ranging from ARK and many of its holdings to what are known as meme stocks like GameStop Corp. and AMC Entertainment Holdings Inc. to cryptocurrencies like bitcoin, soared during the pandemic thanks to the enormous sums governments and central banks poured into the economy to counter the impact of lockdowns. Now those gains are eroding as the Federal Reserve prepares to begin raising U.S. interest rates as soon as March, prompting a shift of investor behavior and a rethink of risk appetites.”

“The 60%-40% Portfolio Will Deliver Anemic Returns Over The Next Decade — Here’s How To Adapt” (MarketWatch). “We have entered a new paradigm of anemic return expectations for traditional asset-allocation models. The prospects of a lost decade ahead are uncomfortably high for portfolios that are 60% invested in stocks and 40% in bonds – particularly when adjusted for inflation, which is at levels not seen since the early 1980s. Investors have witnessed expensive stock markets and incredibly low interest rates. Seldom have we experienced both concurrently.”

What we’re reading (1/29)

“Are We In Another Housing Bubble?” (Paul Krugman, New York Times). “[T]he case for a bubble isn’t nearly as compelling as it was in 2005 or 2006. That doesn’t mean that all is well. Real estate people I know tell me that there’s still a feeling of unhealthy frenzy, and people who paid high prices for small-town houses may regret it once supply chains get unsnarled and more houses get built. But this time is different.”

“A Market Crash Will Depend On Which Bit Of The Equation Investors Got Wrong” (Financial Times). “Of the 29 business cycles in the US since 1881 only a few have ended in [periods of exterme valuations], according to Professor Russell Napier. But, while each has had its own peculiarities, the basic driver has been much the same: the ability of investors to believe absolutely in something that always turns out to be impossible. Namely that, thanks to some ‘marvels’ of technology, corporate profits will stay high (and probably rise) indefinitely and that interest rates will also stay low indefinitely. In most cycles investors do not think this. They assume cyclical normality — that fast economic growth will lead to capacity constraints and then to inflation and rate rises, something that would slow both economic growth and crimp corporate profits — bringing down valuations.”

“ARK Short Sellers Make $999 Million To Eclipse All Gains In 2021” (Bloomberg). “Rising bond yields and a hawkish pivot by the Federal Reserve have laid waste to the kind of speculative tech stock beloved by ARK in recent months, dragging down [Cathie] Wood’s funds and creating a bonanza for anyone betting against her. While a small bounce in U.S. stocks brought some temporary relief on Friday, her flagship ARK Innovation ETF (ticker ARKK) has still tumbled more than 25% year-to-date.”

“US Equity Factors Post Wide Range Of Losses So Far In 2022” (The Capital Spectator). “Although all the primary US equity factors are posting losses so far in 2022, in line with the broad market, the declines vary by a substantial degree. The market’s overall beta risk, in other words, has been minimized or exacerbated, suggesting that building portfolios based on factor offers investors more control over risk management compared with conventional diversification strategies.”

“Hedge Fund Melvin Lost $6.8 Billion In A Month. Winning It Back Is Taking A Lot Longer.” (Wall Street Journal). “At the worst point in January 2021, Melvin Capital Management was losing more than $1 billion a day as individual investors on online forums such as Reddit banded together to push up prices of stocks Melvin was betting against. ‘We were in a terrible position. Stared death in the face,’ Mr. Plotkin told employees in a Zoom meeting late that month. ‘But we’ve made it through.’ The damage, though, was severe. Melvin’s loss that month was 54.5%, or roughly $6.8 billion, one of the swiftest and steepest declines for a hedge fund since the financial crisis of 2008.”

February picks available soon

We’ll be publishing our Prime and Select picks for the month of February before Tuesday, February 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of January, as well as SPC’s cumulative performance, assuming the sale of the January picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Mon., January 31). Performance tracking for the month of February will assume the February picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Tuesday, February 1).

What we’re reading (1/27)

“It’s Jerome Powell Time — And One Wall Street Bank Warns The S&P 500 Could Fall Another 20%. Goldman Sachs Says The Bull Market Will Continue.” (MarketWatch). “The Barclays strategists led by Maneesh Deshpande are more pessimistic, saying it’s too early to buy the dip. Granted, the start of a Fed hike cycle historically hasn’t led to a major selloff, but this time, valuations are already too high and there is downside risk to earnings after the binge in consumption goods. Last week, they noted, there was a change in the selloff, which moved from high-valuation stocks and other speculative assets to a broader contagion.”

“Behind The Stock Market Turmoil: A High-Speed Investor U-Turn” (Wall Street Journal). “Girding themselves against the impact of tighter money, investors are shifting to investments that feel safer, such as dividend stocks and gold exchange-traded funds. Indeed, some high-dividend funds have outperformed this year, including the Invesco High Yield Equity Dividend Achievers ETF, which is flat so far in January.”

“It’s Hard To Tell When The Crypto Bubble Will Burst, Or If There Is One” (New York Times). “As stocks were sold off early this week, crypto prices also plunged. Bitcoin dropped nearly 13 percent before rebounding along with stocks. Ethereum’s own coin, Ether, was briefly down 15 percent. Their price declines have dragged down other digital asset prices, too. Analysts attribute the decline to investors who are pulling their money out of higher-growth, risky assets — including technology stocks — as interest rates are set to rise. That has put a dent in the argument, promoted by crypto boosters, that digital assets offer a hedge against losses in other markets.”

“Gold Is Shining Again As Stocks Wobble And Cryptos Melt down” (CNN Business). “‘Investors are starting to realize bitcoin is more of a risky asset. It's less of a portfolio diversification tool and more of an energy drink,’ [Robert] Minter [Director of ETF Investment Strategy at abrdn] said, referring to the big highs and equally epic pullbacks for crypto prices compared to far more stable moves in gold.”

“Why More Americans Than Ever Are Starting Their Own Businesses” (Vox). “The pandemic has, at least for the time being, halted — and perhaps reversed — a decadeslong decline in the pace of entrepreneurship. Americans applied for a record 5.4 million business ID numbers in 2021, according to census data that goes back to 2004. 2022 is already on track to be a record year as well, according to projections from QuickBooks. While data on true business formations is available only through 2019, growth in ID number applications is closely related to actual business formations.”

What we’re reading (1/26)

“Billionaire Hedge Fund Manager David Einhorn Said An Inflation-Induced Recession Is Imminent — Then The Fed Warned Prices Could Stay Higher For Longer” (Insider). “Star hedge fund manager David Einhorn said no matter what the Federal Reserve does, high-flying inflation will eventually induce a recession. The Greenlight Capital boss said Wednesday in an investor letter obtained by CNBC that his firm has already begun readying itself for an economic downturn as inflation soars to its highest in decades.”

“Drop Bitcoin As Legal Tender, IMF Urges El Salvador” (CNBC). “The International Monetary Fund is pushing El Salvador to ditch bitcoin as legal tender, according to a statement released on Tuesday. IMF directors ‘stressed that there are large risks associated with the use of bitcoin on financial stability, financial integrity, and consumer protection, as well as the associated fiscal contingent liabilities.’ The report, which was published after bilateral talks with El Salvador, went on to ‘urge’ authorities to narrow the scope of its bitcoin law by removing bitcoin’s status as legal money.”

“We Might Be In A Simulation. How Much Should That Worry Us?” (New York Times). “We may not be able to prove that we are in a simulation, but at the very least, it will be a possibility that we can’t rule out. But it could be more than that. [Philosopher David] Chalmers argues that if we’re in a simulation, there’d be no reason to think it’s the only simulation; in the same way that lots of different computers today are running Microsoft Excel, lots of different machines might be running an instance of the simulation. If that was the case, simulated worlds would vastly outnumber non-sim worlds — meaning that, just as a matter of statistics, it would be not just possible that our world is one of the many simulations but likely. Chalmers writes that ‘the chance we are sims is at least 25 percent or so.’”

“The Struggle Is Real For Zillow'“ (Wall Street Journal). “Agents seemed to pour money into Zillow’s platform over the last two years to take advantage of the scorching market…[t]he number of real-estate agents grew 7% in the U.S. last year compared with 2020, according to the National Association of Realtors, while Zillow’s research shows inventory fell almost 20% over that period to record lows. The combination has resulted in an unusually high ratio of real-estate agents to homes for sale. In red-hot Austin, Texas, CNN reported the ratio was eight-to-one as of May.”

“U.S. House Speaker Pelosi's Stock Trades Attract Growing Following Online” (Reuters). “Transaction reports are typically filed days after the actual purchases and sales, making it potentially difficult for traders aiming to mimic lawmakers' specific trades. ‘It's nonsense, it's very hard to replicate what other people are doing and gain some edge,’ said Sahak Manuelian, Managing Director of Trading at Wedbush Securities in Los Angeles.”