What we’re reading (2/3)

“Value Investing Is Back. But for How Long?” (Wall Street Journal). “Value investing—buying stocks that are cheap on measures such as earnings or book value—is having a renaissance. Up to last Thursday, large value stocks beat more expensive “growth” stocks by the most of any 50-day period since the technology bubble burst in 2000-01, with the exception of the post-vaccine rebound early last year. The big question for investors: Does this mark the rebirth of what was a dying strategy? Or was this just another spasm, already fading as technology stocks rebound?”

“Investors Are Turning To Active Managers — Even If ‘They Can’t Predict The Future’” (Institutional Investor). “Amid inflation worries and market volatility, a growing number of institutional investors are beginning to hand over the portfolio reins to active managers…Daniel Celeghin, managing director of the asset management consulting firm Indefi North America, said that while the diversification of uncorrelated assets is an evergreen task, the inclination to work with more skilled active managers is a reaction to market instability.”

“Meta’s Perfect Storm: Fleeing Users And Apple Privacy Changes Hit Ads Business” (Financial Times). “As more than $200bn was wiped off the value of Meta, chief executive Mark Zuckerberg focused blame for falling profits and users at Facebook’s parent company on a rival: TikTok, the viral short-form video app…[t]hat dramatic fall reflected how investors foresee an even grimmer future beyond just new competition from TikTok. Other Meta executives, such as chief financial officer Dave Wehner, admitted it faced a perfect storm of ‘headwinds’.”

“Cable News Networks Have A Serious Ratings Problem In The Age Of News Burnout” (Fast Company). “While most people would say 2020 was one of the worst years on record, the same might not be said by cable news executives. All the pandemic turmoil and election strife of 2020 saw audiences glued to cable news channels, leading to a surge in viewership. But 2021 saw a major reversal in the viewership fortunes of the major cable news networks...Fox Business: -47.5%…CNN: -40.5%…Fox News: -34.6%…MSNBC: -29.7%…CNBC: -19.0%.”

“The Real Cost Of 15 Minute Grocery Delivery” (The Journal). “A battle among fast grocery delivery companies is raging in New York and other U.S. cities. With millions of dollars of venture capital funding, startups are flocking to get products out to customers in under 20 minutes, but at what cost?”

January 2022 performance results

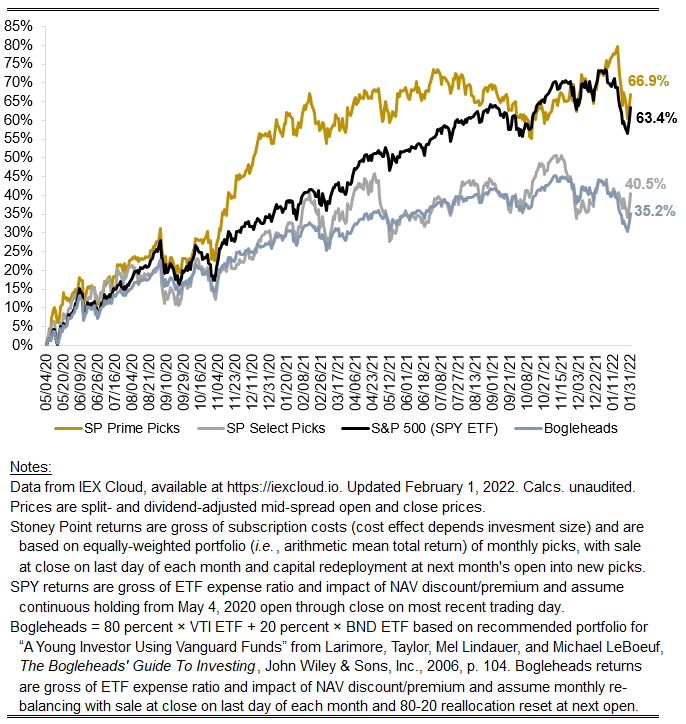

[Hi friends, here with a January performance update. Overall, it was a great month for us with significant relative outperformance compared to benchmark indices. The key numbers:

Prime: -3.04%

Select: -1.49%

SPY ETF: -5.54%

Bogleheads: -5.52%

The Nasdaq fell 8.99 percent — nearly surpassing its worst one-month decline ever of 9.89 percent in 2008. Cathie Wood’s famous “Innovation” ETF (ticker ARKK) was down 20 percent. Bitcoin was also down 20 percent in its worst January since 2018, arguably blowing up the argument that crypto is fundamentally uncorrelated with other risk assets.

What happened in January—after what has undisputedly been an extraordinary, multi-year run for large-cap growth stocks—was, in my view, the collapse of a decade plus-long “free float” period in which the cost of debt-financed capital was essentially zero. Axiomatically, long-duration assets—assets where long-in-the-future cash flows contribute disproportionately to present value compared to nearer-term cash flows—disproportionately benefited from what has essentially been free money. Math dictates those asset would be hit hardest in a tighter monetary policy environment, and the transition to a new, higher-rate regime the likes of which the world has not seen since 2008 or earlier is indeed upon us.

It is no coincidence that “value”-oriented strategies, which tend to construct portfolios comprising lower-duration stocks, underperformed (compared to history) in the free-money environment of the last decade or so. A corollary, I think, is that they should outperform in a non-free-money environment. The important question is: which environment is “normal”, and therefore should be expected in the future. No doubt policymakers have realized the sky did not fall when rates were low, so it is possible we will find ourselves in periods of ultra-low rates in the future. But my bet is that negative real rates can't persist forever, and aren’t likely to systematically persist in the future.

One can see a bit of the “rotation” from growth to value in Stoney Point’s recent performance. The first chart below shows the substantial departure of Prime from the overall S&P 500 since the start of November. Note that market conviction that the Fed would start tightening policy arguably gained significant strength on November 3, 2021, when the Fed announced it would decelerate its asset purchases by $15 billion per month.

The second chart below shows our Select strategy breaking away from the market in January and converging with Prime, making up for its slower departure from the market benchmarks.

Nov. ‘21 Through Jan. ‘22 Performance

(Index: 11/2/21 = 100)

January Performance

(Index: 12/31/21 = 100)

As always, the chart below shows our total performance history.

Stoney Point Total Performance History

What we’re reading (2/1)

“An Army of Faceless Suits Is Taking Over the $4 Trillion Hedge Fund World” (Bloomberg). “A $1 million investment in Millennium’s multi-strategy pool at its launch in 1989 is worth about $67 million now. Citadel has turned a million dollars into about $236 million since its start in Nov. 1990. By contrast, $1m invested in the HFRI Fund Weighted Composite Index at the start of 1990, when the benchmark started, would be worth $18m…Multi-manager platforms ‘have in effect become the most efficient allocators of capital,’ said Caron Bastianpillai, who invests in a number of such funds at Switzerland-based NS Partners.”

“SEC Finds Some Private-Fund Managers Mislead Investors On Performance” (Wall Street Journal). “Private-fund managers sometimes give investors misleading information about fees and performance, said the Securities and Exchange Commission, which highlighted several types of violations found by examiners as the regulator considers stronger rules for private-equity and hedge-fund managers…[i]n presenting their investment performance to prospective investors, some managers ‘only marketed a favorable or cherry-picked track record’ and ‘presented inaccurate performance calculations,’ the regulator said.”

“The Inevitable Decline Of Growth Stocks (For Now)” (Equius). “[S]maller, lower-priced US companies [small-cap value] performed better than large, high-priced US companies [large-cap growth] for 9½ years after the market recovered in March 2009. It was only three years ago (March 2019) when performance crossed over and large growth stocks took the lead. The way things are going, it wouldn’t surprise us if those lines crossed over soon and the higher expected returns of small value stocks become higher actual returns.”

“The 19-Year-Old Tracking Elon Musk's Jet On Twitter Says The Billionaire Has Blocked Him” (Insider). “Protocol first reported that Musk had approached Sweeney late last year and offered $5,000 to get the account taken down, saying it posed a ‘security risk.’ […] Sweeney, who shared the Twitter private messages exchanged between himself and Musk with Insider, countered with an offer of $50,000. Musk declined, saying it didn't ‘feel right’ to pay for the account's removal…Sweeney told Insider last week Musk had introduced some measures he himself had recommended during their Twitter conversation, which make it harder to track the jet. Harder, Sweeney said, but not impossible. ‘I just have to work around it,’ Sweeney told Insider.”

“No, America Is Not On The Brink Of A Civil War” (The Guardian). “[P]olarized answers on polls and surveys often fail to reflect participants’ genuine views. Indeed, when respondents are provided with incentives to answer questions accurately…the difference between Democrats and Republicans on factual matters often collapses.”

What we’re reading (1/31)

“U.S. Stocks End January On High Note But Still Chalk Up Worst Month Since March 2020” (Washington Post). “Wall Street loathes uncertainty, and the first month of 2022 was threat-studded and unpredictable as investors assessed what the Federal Reserve had in store for rate hikes and historically high inflation, the pandemic’s grip over the economy, a tangle of rising geopolitical tensions and a global supply chain in deep distress. Corporate earnings — including blowout performances from Apple and Microsoft — have thus far failed to impress. Wall Street’s fear gauge, the Cboe Volatility Index, is up 75 percent year-to-date.”

“What May Be In Store As The Fed Cuts Back On The Easy Money” (New York Times). “The amounts involved in the Fed’s quantitative easing have been staggering. Back in 2008, the Fed’s balance sheet had assets of $820 billion. They reached $4.5 trillion — yes, trillion — in 2015 and dropped only as low as $3.76 trillion in the summer of 2019. With the coronavirus financial crisis, they have ballooned again, to $8.9 trillion, and may swell a bit more before the spigot shuts. Assets held by the Fed are already more than 10 times their size in 2008, and bigger, as a proportion of gross domestic product, than at any time since World War II.”

“Viking Hedge Fund Blames 2021 Losses On ‘Underestimating’ Covid” (Bloomberg). “fter posting its worst ever performance last year, Viking Global Investors is trying to explain its losses -- and it’s pinning the blame on the Covid-19 pandemic. The firm’s hedge fund, which invested in 2021 laggards such as Peloton Interactive Inc., Coupa Software Inc. and Adaptive Biotechnologies Corp., fell 4.5% in the year because it “underestimated the ongoing impact of Covid,” founder Andreas Halvorsen wrote in a letter to investors dated Jan. 18.”

“Bill Ackman Scored On Pandemic Shutdown And Bounceback” (Wall Street Journal). “As the coronavirus emerged, Bill Ackman made billions betting that the market was misjudging the virus’s economic toll. Then he did it again a year later. In two complex debt investments—one presaging the economy’s swift shutdown and the other its fevered reopening—Mr. Ackman made nearly $4 billion in profit on an outlay of about $200 million, according to fund documents and people familiar with the matter. In short, he called the pandemic’s economic fallout coming and going.”

“Warren Buffett Is Having The Last Laugh” (CNN Business). “Banks, energy firms and other value stocks have rallied this year, which is great news for Buffett since the Oracle of Omaha's conglomerate invests in many of these companies. Value stocks typically have lower price-to-earnings ratios, and they're definitely not trendy.”

February picks available now

The new Prime and Select picks for February are available starting now, based on a model run put through today (January 31). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Tuesday, February 1, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, February, 28, 2022 (at the mid-spread closing price).

What we’re reading (1/30)

“Buy GameStop, Fight Injustice. Just Don’t Sell.” (New York Times). “As he dug deeper, spending hours reading what other traders had posted about GameStop, Mr. [Kunal] Gogna [a GameStop shareholders] became convinced that something far darker was going on. Several posts detailed what users were calling a plot by Wall Street, the Securities and Exchange Commission and a trade clearinghouse to create fake or ‘synthetic’ GameStop shares.”

“Rents Are Up 40 Percent In Some Cities, Forcing Millions To Find Another Place To Live” (Washington Post). “Rental prices across the country have been rising for months, but lately the increases have been sharper and more widespread, forcing millions of Americans to reassess their living situations. Average rents rose 14 percent last year, to $1,877 a month, with cities like Austin, New York and Miami notching increases of as much as 40 percent, according to real estate firm Redfin. And Americans expect rents will continue to rise — by about 10 percent this year — according to a report released this month by the Federal Reserve Bank of New York.”

“It’s Been Rough For Stocks, But The Outlook Is Still OK” (Morningstar). “Raheel Siddiqui, portfolio and quantitative strategist…says Monday’s steep declines weren’t driven by fundamental news, but rather a confluence of ‘technical’ factors, such as selling by trend-following futures traders, stock options traders, and ripples from leveraged exchange-traded funds. That coupled with a lack of ‘buy-the-dip’ support from individual investors helped create a void for the market to fall into to start the week. At the same time, there was an overhang of big, institutional investors heavily weighted in the very largest--and often most expensive--stocks who finally started cutting back on those positions.”

“Cathie Wood’s ARK Faces Loyalty Test After Tech-Stock Rout” (Wall Street Journal). “What happens next at the ARK Innovation fund, which goes by the ticker ARKK, and other risky investments like it will help tell the story of financial markets in 2022. The most speculative assets, ranging from ARK and many of its holdings to what are known as meme stocks like GameStop Corp. and AMC Entertainment Holdings Inc. to cryptocurrencies like bitcoin, soared during the pandemic thanks to the enormous sums governments and central banks poured into the economy to counter the impact of lockdowns. Now those gains are eroding as the Federal Reserve prepares to begin raising U.S. interest rates as soon as March, prompting a shift of investor behavior and a rethink of risk appetites.”

“The 60%-40% Portfolio Will Deliver Anemic Returns Over The Next Decade — Here’s How To Adapt” (MarketWatch). “We have entered a new paradigm of anemic return expectations for traditional asset-allocation models. The prospects of a lost decade ahead are uncomfortably high for portfolios that are 60% invested in stocks and 40% in bonds – particularly when adjusted for inflation, which is at levels not seen since the early 1980s. Investors have witnessed expensive stock markets and incredibly low interest rates. Seldom have we experienced both concurrently.”

What we’re reading (1/29)

“Are We In Another Housing Bubble?” (Paul Krugman, New York Times). “[T]he case for a bubble isn’t nearly as compelling as it was in 2005 or 2006. That doesn’t mean that all is well. Real estate people I know tell me that there’s still a feeling of unhealthy frenzy, and people who paid high prices for small-town houses may regret it once supply chains get unsnarled and more houses get built. But this time is different.”

“A Market Crash Will Depend On Which Bit Of The Equation Investors Got Wrong” (Financial Times). “Of the 29 business cycles in the US since 1881 only a few have ended in [periods of exterme valuations], according to Professor Russell Napier. But, while each has had its own peculiarities, the basic driver has been much the same: the ability of investors to believe absolutely in something that always turns out to be impossible. Namely that, thanks to some ‘marvels’ of technology, corporate profits will stay high (and probably rise) indefinitely and that interest rates will also stay low indefinitely. In most cycles investors do not think this. They assume cyclical normality — that fast economic growth will lead to capacity constraints and then to inflation and rate rises, something that would slow both economic growth and crimp corporate profits — bringing down valuations.”

“ARK Short Sellers Make $999 Million To Eclipse All Gains In 2021” (Bloomberg). “Rising bond yields and a hawkish pivot by the Federal Reserve have laid waste to the kind of speculative tech stock beloved by ARK in recent months, dragging down [Cathie] Wood’s funds and creating a bonanza for anyone betting against her. While a small bounce in U.S. stocks brought some temporary relief on Friday, her flagship ARK Innovation ETF (ticker ARKK) has still tumbled more than 25% year-to-date.”

“US Equity Factors Post Wide Range Of Losses So Far In 2022” (The Capital Spectator). “Although all the primary US equity factors are posting losses so far in 2022, in line with the broad market, the declines vary by a substantial degree. The market’s overall beta risk, in other words, has been minimized or exacerbated, suggesting that building portfolios based on factor offers investors more control over risk management compared with conventional diversification strategies.”

“Hedge Fund Melvin Lost $6.8 Billion In A Month. Winning It Back Is Taking A Lot Longer.” (Wall Street Journal). “At the worst point in January 2021, Melvin Capital Management was losing more than $1 billion a day as individual investors on online forums such as Reddit banded together to push up prices of stocks Melvin was betting against. ‘We were in a terrible position. Stared death in the face,’ Mr. Plotkin told employees in a Zoom meeting late that month. ‘But we’ve made it through.’ The damage, though, was severe. Melvin’s loss that month was 54.5%, or roughly $6.8 billion, one of the swiftest and steepest declines for a hedge fund since the financial crisis of 2008.”

February picks available soon

We’ll be publishing our Prime and Select picks for the month of February before Tuesday, February 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of January, as well as SPC’s cumulative performance, assuming the sale of the January picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Mon., January 31). Performance tracking for the month of February will assume the February picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Tuesday, February 1).

What we’re reading (1/27)

“It’s Jerome Powell Time — And One Wall Street Bank Warns The S&P 500 Could Fall Another 20%. Goldman Sachs Says The Bull Market Will Continue.” (MarketWatch). “The Barclays strategists led by Maneesh Deshpande are more pessimistic, saying it’s too early to buy the dip. Granted, the start of a Fed hike cycle historically hasn’t led to a major selloff, but this time, valuations are already too high and there is downside risk to earnings after the binge in consumption goods. Last week, they noted, there was a change in the selloff, which moved from high-valuation stocks and other speculative assets to a broader contagion.”

“Behind The Stock Market Turmoil: A High-Speed Investor U-Turn” (Wall Street Journal). “Girding themselves against the impact of tighter money, investors are shifting to investments that feel safer, such as dividend stocks and gold exchange-traded funds. Indeed, some high-dividend funds have outperformed this year, including the Invesco High Yield Equity Dividend Achievers ETF, which is flat so far in January.”

“It’s Hard To Tell When The Crypto Bubble Will Burst, Or If There Is One” (New York Times). “As stocks were sold off early this week, crypto prices also plunged. Bitcoin dropped nearly 13 percent before rebounding along with stocks. Ethereum’s own coin, Ether, was briefly down 15 percent. Their price declines have dragged down other digital asset prices, too. Analysts attribute the decline to investors who are pulling their money out of higher-growth, risky assets — including technology stocks — as interest rates are set to rise. That has put a dent in the argument, promoted by crypto boosters, that digital assets offer a hedge against losses in other markets.”

“Gold Is Shining Again As Stocks Wobble And Cryptos Melt down” (CNN Business). “‘Investors are starting to realize bitcoin is more of a risky asset. It's less of a portfolio diversification tool and more of an energy drink,’ [Robert] Minter [Director of ETF Investment Strategy at abrdn] said, referring to the big highs and equally epic pullbacks for crypto prices compared to far more stable moves in gold.”

“Why More Americans Than Ever Are Starting Their Own Businesses” (Vox). “The pandemic has, at least for the time being, halted — and perhaps reversed — a decadeslong decline in the pace of entrepreneurship. Americans applied for a record 5.4 million business ID numbers in 2021, according to census data that goes back to 2004. 2022 is already on track to be a record year as well, according to projections from QuickBooks. While data on true business formations is available only through 2019, growth in ID number applications is closely related to actual business formations.”

What we’re reading (1/26)

“Billionaire Hedge Fund Manager David Einhorn Said An Inflation-Induced Recession Is Imminent — Then The Fed Warned Prices Could Stay Higher For Longer” (Insider). “Star hedge fund manager David Einhorn said no matter what the Federal Reserve does, high-flying inflation will eventually induce a recession. The Greenlight Capital boss said Wednesday in an investor letter obtained by CNBC that his firm has already begun readying itself for an economic downturn as inflation soars to its highest in decades.”

“Drop Bitcoin As Legal Tender, IMF Urges El Salvador” (CNBC). “The International Monetary Fund is pushing El Salvador to ditch bitcoin as legal tender, according to a statement released on Tuesday. IMF directors ‘stressed that there are large risks associated with the use of bitcoin on financial stability, financial integrity, and consumer protection, as well as the associated fiscal contingent liabilities.’ The report, which was published after bilateral talks with El Salvador, went on to ‘urge’ authorities to narrow the scope of its bitcoin law by removing bitcoin’s status as legal money.”

“We Might Be In A Simulation. How Much Should That Worry Us?” (New York Times). “We may not be able to prove that we are in a simulation, but at the very least, it will be a possibility that we can’t rule out. But it could be more than that. [Philosopher David] Chalmers argues that if we’re in a simulation, there’d be no reason to think it’s the only simulation; in the same way that lots of different computers today are running Microsoft Excel, lots of different machines might be running an instance of the simulation. If that was the case, simulated worlds would vastly outnumber non-sim worlds — meaning that, just as a matter of statistics, it would be not just possible that our world is one of the many simulations but likely. Chalmers writes that ‘the chance we are sims is at least 25 percent or so.’”

“The Struggle Is Real For Zillow'“ (Wall Street Journal). “Agents seemed to pour money into Zillow’s platform over the last two years to take advantage of the scorching market…[t]he number of real-estate agents grew 7% in the U.S. last year compared with 2020, according to the National Association of Realtors, while Zillow’s research shows inventory fell almost 20% over that period to record lows. The combination has resulted in an unusually high ratio of real-estate agents to homes for sale. In red-hot Austin, Texas, CNN reported the ratio was eight-to-one as of May.”

“U.S. House Speaker Pelosi's Stock Trades Attract Growing Following Online” (Reuters). “Transaction reports are typically filed days after the actual purchases and sales, making it potentially difficult for traders aiming to mimic lawmakers' specific trades. ‘It's nonsense, it's very hard to replicate what other people are doing and gain some edge,’ said Sahak Manuelian, Managing Director of Trading at Wedbush Securities in Los Angeles.”

What we’re reading (1/25)

“Was Larry Summers Right All Along?” (New York Magazine). “Once the consummate Democratic insider, he had suffered the fate of so many left-wing wonks of yesteryear: to see one’s dissent derided as economically illiterate and politically treacherous. Progressive commentators declared him a ‘vindictive SOB’ whose caterwauling about inflation was really a bid to ‘spook the markets and crash the economy to punish the administration for shutting him out.’ The New Republic entertained the hope that, after three decades at the center of Democratic politics, Summers was finally ‘becoming irrelevant.’ Ten months later, times have changed.”

“Correction Or Pullback, January’s Swings Call For Calm” (Fisher Investments). “Magnitude aside, the downdraft to start 2022 looks a lot like a correction—and not much like a bear market. The lockdown-induced, warp-speed 2020 version aside, bear markets usually begin gradually—with long rolling tops early…Corrections are different. They normally begin with a bang, for any or even no reason, with stocks falling steeply from a prior high and plunging fast. Typically, they have some big fear or scare story associated with them many presume is driving the negativity. After a swift fall that has most expecting worse to come, stocks turn around and snap back higher—usually about as fast as they fell—with no warning.”

“But Are You Short The Market?” (Marginal Revolution). “‘But are you short the market?’ That is my favorite rejoinder to expressions of radical pessimism. It came to mind recently when I read an opinion piece suggesting that ‘the United States as we know it could come apart at the seams.’…Besides, shorting the market does not have to be impossibly risky. Just buy some unleveraged market puts each year until that position pays off. That’s not a great investment tactic for most people, but it makes sense for diehard pessimists. Are they even asking around about how to do this, the way you might ask for recommendations for a good restaurant or a masseuse?”

“Was The Market Sell-Off Overdone?” (New York Times). “The foundations supporting the market during the pandemic are looking less stable. That starts with the Fed, which has flooded the market with money and kept interest rates low. The unwinding of this stimulus is preoccupying market watchers, who are looking to the central bank this week for clues about its intentions (more on that below). Rising interest rates, combined with uncertain corporate earnings prospects and geopolitical tensions between Russia and Ukraine, form an ‘investor triple-whammy,’ Ben Laidler of eToro wrote in a research note.”

“Cryptocurrency Doesn’t Amount To Much” (Wall Street Journal). “[T]he crypto ecosystem merely mirrors, electronically and anonymously, the most rudimentary components of the regulated financial system. The putative gains are quickly dissipated by crypto’s many weaknesses. The convertibility of stablecoins like Tether to dollars at par is doubtful. People can’t judge credit risk the way banks can. As currently constructed, the crypto ecosystem lacks accountability and legal recourse, so there is little basis for trust. And bitcoin’s basic operations, for example, require enough electricity to power an industrialized nation.”

What we’re reading (1/24)

“When The Superbubble Bursts” (Protocol). “So what do we call what we have now? “Economist Jeremy Grantham says it’s a ‘superbubble’” which he defined as ‘simultaneous bubbles across all major asset classes’ in a report his investment firm, GMO, issued Thursday. Investors could lose $35 trillion if valuations retreated to historic norms, Grantham calculated.”

“Bold Policy Response Needed To Restore Fed Credibility On Inflation” (Mohamed El-Erian, Financial Times). “[T]he Fed needs immediately to stop its asset-purchase programme, guide markets towards expecting three and possibly more interest rises this year and bring forward to March the announcement of plans to reduce its balance sheet. It also needs to explain how it has managed to get its inflation call so wrong and why it is so late in reacting properly. Without that, it will struggle to regain the policy narrative and restore its credibility.”

“Activist Investors Assemble” (DealBook). “Unilever has faced pressure on multiple fronts for weeks, including pushback from shareholders over its now-abandoned pursuit of GlaxoSmithKline’s consumer business. Now the consumer goods giant must deal with a potentially bigger headache: Trian Partners, the activist investment firm run by Nelson Peltz. Trian has amassed a significant stake in Unilever, DealBook’s Michael de la Merced reports. It isn’t clear how big the firm’s holdings are, though Trian began buying shares before Unilever’s pursuit of the Glaxo business became public, according to a source.”

“How Will Europe Cope If Russia Cuts Off Its gas?” (The Economist). “Europe…has a secret weapon. Mr [Massimo] Di Odoardo [of Wood Mackenzie, a consultancy] points to its massive but little-discussed stores of “cushion gas”. For technical and safety reasons, regulators insist that storage units like salt caverns and aquifers maintain a huge amount of gas that is not normally available to put on the market. The analysts at Wood Mackenzie reckon that up to a tenth of this cushion can be used without problems. If regulators gave permission, as they might in a war-induced crisis, it would amount to well over a month’s worth of Russian imports.”

“Leon Black Blames Guy Who Didn’t Maintain Decades-Long Relationship With Notorious Sex Criminal For Trashing His Reputation” (Dealbreaker). “You might think that Apollo Global Management founder Leon Black’s downfall had something to do with his doggedly sticking by his convicted sex offender buddy, Jeffrey Epstein. You might think, whether you believe her to be telling the truth or not, that his alleged sexual abuse of his former mistress might be at fault. Black, as only a billionaire can, knows better. After all, as he and his ilk well know, no one ever enjoys his level of success is actually capable of wrongdoing.”

What we’re reading (1/23)

“How Much Stock Is Too Much in Retirement?” (New York Times). “[Vanguard] now says that some investors who have already entered retirement may be better off if they keep their stock holdings fairly high, retaining a 50 percent allocation to equities. The 50 percent stock retirement portfolio will be a new option available to companies with Vanguard target-date retirement funds in their plans. That is a big increase over the current allocation: just 30 percent stocks and 70 percent bonds.”

“Tech Rout Fueled By Bond-Market Turn” (Wall Street Journal). “Often referred to as real yields, yields on TIPS have been deeply negative since the early days of the Covid-19 pandemic, helping to fuel outsize stock-market gains by pushing investors into riskier assets in search of better returns. Even today they remain below zero, meaning holders are guaranteed to lose money on an inflation-adjusted basis if they hold the bonds to maturity.”

“Is The Market Crashing? No. Here’s What’s Happening To Stocks, Bonds As The Fed Aims To End The Days Of Easy Money, Analysts Say” (MarketWatch). “Underpinning the shift in bullish sentiment is a three-pronged approach by the Federal Reserve toward tighter monetary policy: 1) tapering market-supportive asset purchases, with an eye toward likely concluding those purchases by March; 2) raising benchmark interest rates, which currently stand at a range between 0% and 0.25%, at least three times this year, based on market-based projections; 3) and shrinking its nearly $9 trillion balance sheet, which has grown considerably as the central bank sought to serve as a backstop for markets during a swoon in March of 2020 caused by the pandemic rocking the economy.”

“How Hustle Culture Got America Addicted To Work” (Insider). “The way we glorify work in the United States is both a historical and geographical anomaly, a recent American invention. In Europe, industrialized nations have found a way to marry robust economic growth with dramatically shorter workweeks. And before you try to explain this away with some version of well, that's Europe, it's worth noting that from 1870 to the 1970s, Americans actually worked less than the Germans and the French. ‘While it may seem today that differences in work patterns are eternal aspects of European and American lifestyles,’ a study published by the National Bureau of Economic Research observed in 2005, ‘these differences are modern in origin.’”

“The Forgotten Medieval Habit Of ‘Two Sleeps’” (BBC). “Biphasic sleep was not unique to England…it was widely practised throughout the preindustrial world. In France, the initial sleep was the ‘premier somme’; in Italy, it was ‘primo sonno’. In fact, Eckirch found evidence of the habit in locations as distant as Africa, South and Southeast Asia, Australia, South America and the Middle East.”

What we’re reading (1/22)

“Nasdaq 100’s Unrelenting Declines Ring A Dot-Com Bust Alarm Bell” (Bloomberg). “[T]he Nasdaq 100 just did something it hasn’t done since the aftermath of the internet bubble: fall more than 1% in every session of a week. It doesn’t count as a superlative because Monday was a holiday. But for investors caught up in the selloff, it felt like something shifted…[i]nvestors appear to be paying up for near-term hedges as share prices spiraled down. The CBOE NDX Volatility Index, a gauge of cost options tied to the Nasdaq, jumped 8 points over the four days to 34.06, the highest level since last March.”

“Summers Says He Doubts U.S. Inflation Will Slow To 2% This Year” (Bloomberg). “Former Treasury Secretary Lawrence Summers said he remains worried that policy makers are complacent about inflation and he doubted U.S. consumer prices will return to a 2% pace of increases by the end of this year. With investors expecting the Federal Reserve to next week signal plans to raise interest rates in March, Summers said that ‘the gravity of our situation is still understated’ and that bottlenecks in China, rising oil costs, more expensive housing, tightening labor markets and low borrowing costs all pointed to continued price pressures.”

“Silicon Valley Won’t Own Up to Its China Problem” (Vanity Fair). “Over the weekend he [Chamath Palihapitiya] seemingly took his hell-raising a step too far when he said on his All-In podcast, in the midst of a discussion about human rights, that he simply didn’t care about the genocide of the Uyghurs, China’s predominantly Muslim minority group. ‘Nobody cares about what’s happening to the Uyghurs, okay,’ he said…[i]t’s estimated that China has secretly imprisoned at least a million Uyghurs in forced labor and prison camps. In December of last year, a public tribunal established by a prominent British human rights lawyer reportedly found that China had engaged in ‘crimes against humanity’ in its treatment of the Uyghurs, including ‘rape, enforced sterilization, torture, imprisonment, persecution, deportation, and enforced disappearance.’”

“What Happened (and Didn’t) When Davos Disappeared” (New York Times). “For the second year in a row, the annual in-person meeting in Davos was scrapped because of the pandemic. An IRL gathering was announced for late May, but the relatively last-minute cancellation makes it easier to assess what has until recently been a hypothetical debate: Would it matter if Davos just went away?”

“The Nanotechnology Revolution Is Here—We Just Haven’t Noticed Yet” (Wall Street Journal). “For decades, computer scientists and physicists speculated that, any minute now, nanotechnology was going to completely reshape our lives, unleashing a wave of humanity-saving inventions. Things haven’t unfolded as they predicted but, quietly, the nanotech revolution is under way. You can thank the microchip. Engineers and scientists are using the same technology perfected over decades to make microchips to create a variety of other miniature marvels, from submicroscopic machines to new kinds of lenses.”

What we’re reading (1/21)

“Nasdaq Tumbles 2% Friday, Notches Worst Week Since 2020 And Falls Deeper Into Correction Territory” (CNBC). “U.S. stocks tumbled on Friday, closing out a losing week and continuing a rough start to 2022. The Nasdaq Composite was hit the hardest with Friday’s selling sending the tech-heavy index to its worst week since 2020.”

“When Pandemic Stars’ Shines Dim” (DealBook). “The future path of the pandemic is uncertain, but investors may have already made up their minds about the prospects for companies that had prospered months earlier. Netflix and Peloton plunged late in the day yesterday, on signs that ‘stay at home’ stocks, which were already under pressure, could take a turn for the worse as people begin to venture out again.”

“We Should Turn Big Box Stores Into Solar Farms” (Gizmodo). “The U.S. has a lot of big box stores. There are more than 100,000 superstores across the country, which means about 7.2 billion square feet (670 million square meters) of rooftop space. Using data from the National Renewable Energy Laboratory, the report estimates that about two-thirds of that underutilized area could be used for solar panels. Fully equipping that space could generate 84.4 terawatt-hours of energy per year, which would save more than 52 million metric tons of carbon dioxide.”

“Crypto Crash Erases More Than $1 Trillion In Market Value” (Bloomberg). “With the Federal Reserve intending to withdraw stimulus from the market, riskier assets the world over have suffered. Bitcoin, the largest digital asset, lost more than 12% Friday and dropped below $36,000 to its lowest level since July. Since its peak in November, it has lost over 45% of its value. Other digital currencies have suffered just as much, if not more, with Ether and meme coins mired in similar drawdowns.”

“As Turkey’s Economy Struggles, Erdogan Goes It Alone” (Washington Post). “The severity of the crisis came into sharp relief this month when the government announced that the annual inflation rate had reached 36.1 percent, the highest since 2002. That rise was driven by the rapid depreciation of the Turkish lira, which lost more than 40 percent of its value last year, and, more broadly, by Erdogan’s push to cut interest rates based on his unorthodox belief that this would lower consumer prices.”

What we’re reading (1/20)

“Fed Opens Debate Over Possible Digital Currency” (Financial Times). “The Federal Reserve has for the first time launched a period of debate and public comment on the introduction of a central bank digital currency, as it seeks to keep pace with global financial innovation and maintain the supremacy of the dollar. After months of anticipation, the Fed on Thursday released a lengthy discussion paper that will serve as the basis of what is expected to be a heated and consequential debate at the heart of the central bank in the coming months — though it made clear it did not ‘favour any policy outcome’ at this point.”

“Why Isn't The Fed Doing Its Job?” (John Cochrane, Project Syndicate). “No wonder America is awash in debt. Everyone assumes that taxpayers will take on losses in the next downturn. Student loans, government pensions, and mortgages have piled up, all waiting their turn for Uncle Sam’s bailout. But each crisis requires larger and larger transfusions. Bond investors eventually will refuse to hand over more wealth for bailouts, and people will not want to hold trillions in newly printed cash. When the bailout that everyone expects fails to materialize, we will wake up in a town on fire – and the firehouse has burned down.”

“Stocks Fall After Giving Up Early Gains” (Wall Street Journal). “U.S. stocks fell on Thursday, as a late-afternoon selloff erased what had been an early rally, showing that investors are still concerned about the prospects of tightening monetary policy and slowing growth. The Nasdaq Composite Index dropped 186.23 points, or 1.3%, to 14154.02, a day after a tech selloff dragged down indexes. The index fell more than 3% from its intraday high to its low. It is now down nearly 12% from its November high.”

“Netflix Quietly Admits Streaming Competition Is Eating Into Growth” (CNBC). “The latest Netflix shareholder letter included a line heard around the world: ‘While this added competition may be affecting our marginal growth some...’ That clause doesn’t sound like much, but it’s Netflix’s strongest admission so far that streaming competition is affecting its subscriber growth.”

“John Deere Is Facing A Farmer Revolt” (Bloomberg). “Farm equipment giant John Deere boasted record profits in 2021 as the global pandemic made consumers and countries more reliant than ever on a functioning agricultural sector. Also last year, unionized workers demanded a piece of the company’s growing pie, and after a strike forced John Deere to provide better compensation to the men and women who make its products. But now the company has another, potentially bigger problem: farmers.”

What we’re reading (1/19)

“Nasdaq Falls More Than 1%, Entering Correction Territory” (Wall Street Journal). “Investors have stepped up bets that the Federal Reserve and other major central banks will tighten monetary policy in the coming months, withdrawing a pillar of support for markets. Mounting expectations of interest-rate rises follow evidence that the drivers of inflation have broadened beyond the supply-chain shock that fueled price gains for much of 2021. That has led to big swings, leaving many stocks in a bear market and stoking giant rotations among different sectors.”

“The Nasdaq Composite Just Logged Its 66th Correction Since 1971—Here’s What History Says Happens Next In The Stock Market” (MarketWatch). “Looking more broadly at the performance of the Nasdaq Composite over the past 65 times it has fallen 10% from a peak, it has finished positive on average, up 0.8%, in the week after, but returns over that first month are weak, until the benchmark breaks through into the three-month period and beyond, where average gains are 2.2%.”

“Wall Street Banks Eye ‘New Normal' For Trading Revenue” (Reuters). “A massive injection of cash into capital markets by the Federal Reserve led to unprecedented liquidity and trading activity through the pandemic as investors sought opportunities to cash in. But trading revenue at leading Wall Street banks fell in the fourth quarter as markets normalized and the Fed scaled back its asset purchases.”

“Congratulations And Commiserations, Derek Flowers” (Dealbreaker). ““Chief risk officer at Wells Fargo” sounds about as poisoned a chalice as exists in any c-suite anywhere. Not quite as unpalatable as, say, chief compliance officer of Credit Suisse (or Wells Fargo, for that matter), but no cup of tea all the same. Now, things aren’t quite as bad as they used to be, someone’s gotta do it, and Derek Flowers has already spent some time mulling over Wells’ precarities as chief credit and market risk officer, so, you know, in for a penny….”

“How Microsoft Bought Activision Blizzard” (DealBook). “In December, with Activision’s stock down sharply, Microsoft reached out to [Activision CEO Bobby] Kotick with a takeover bid. Kotick dismissed the offer, but — eager to steer his beleaguered company to a safe home — told the software giant to come back with a better offer. Microsoft did, beginning a weekslong sprint to hammer out an agreement.”

What we’re reading (1/18)

“Microsoft To Buy Activision Blizzard In All-Cash Deal Valued at $75 Billion” (Wall Street Journal). “The deal, if completed, would sharply expand Microsoft’s already sizable videogame operation, adding a stable of popular game franchises including Call of Duty, World of Warcraft and Candy Crush to Microsoft’s Xbox console business and its own games like Minecraft and Doom. Microsoft said the transaction would make it the world’s third-largest gaming company by revenue, behind China’s Tencent Holdings Ltd. and Japan’s Sony Group Corp.”

“Carlyle Co-Founder David Rubenstein Says ‘We’re Due For A Correction’” (Bloomberg). “‘We’re due for a correction,’ Rubenstein said Tuesday in an interview with Sonali Basak at the Bloomberg Year Ahead Summit in New York. ‘The markets have been very ebullient for quite some time. We’ve basically been having free money.’ Rubenstein said the U.S. economy is ‘generally in good shape,’ but with the Fed signaling four to five rate hikes this year, downward pressure on asset prices is inevitable.”

“After Another Great Year For Stocks, Peril Lingers” (New York Times). “‘There’s no place to hide,’ Melda Mergen, global head of equities at Columbia Threadneedle Investments, said during a presentation of the firm’s 2022 outlook. ‘Most of the markets are at the top of the bar in their current valuations.’”

“Europe’s Energy Crisis Will Trigger Its Worst Neuroses” (The Economist). “The gas-price horror movie is most terrifying for Eurocrats. The causes of the current energy snafu are hard to distil down to a single factor, says Georg Zachmann of Bruegel, a think-tank in Brussels. That leaves plenty of room to designate a scapegoat, and one candidate comes to mind. The European Commission regulates eu energy markets (mostly quite sensibly) and has made carbon neutrality a central plank of the bloc’s future (also sensible). Sound as its policy decisions may be, they have aggravated the current crisis. For example, shifting to coal to keep prices down is less of an option, since it would require buying expensive eu carbon-emissions credits.”

“Blackstone’s New Real Estate Play: The Rent-To-Buy Market” (Financial Times). “By promising tenants that they might one day own their own homes, [Lewis] Ranieri [of Liar’s Poker fame] and his team had created a rental business with economics like no other. Other corporate landlords had to hire legions of professionals to scout for properties to buy. But Ranieri set things up so that ‘the tenants were doing the sourcing for him’, says one person who heard the pitch.”

What we’re reading (1/16)

“Day Traders as ‘Dumb Money’? The Pros Are Now Paying Attention” (Wall Street Journal). “Fund managers who might have once derided small-time day traders as ‘dumb money’ are scouring social-media posts for clues about where the herd might veer next. Some 85% of hedge funds and 42% of asset managers are now tracking retail-trading message boards, according to a survey by Bloomberg Intelligence.”

“Toxic Culture Is Driving the Great Resignation” (M.I.T. Sloan Management Review). “We also analyzed the free text of more than 1.4 million Glassdoor reviews, using the Natural Employee Language Understanding platform developed by CultureX, a company two of us (Donald and Charles) cofounded…[i]n general, corporate culture is a much more reliable predictor of industry-adjusted attrition than how employees assess their compensation…[a] toxic corporate culture, for example, is 10.4 times more powerful than compensation in predicting a company’s attrition rate compared with its industry.”

“Price Controls Set Off Heated Debate As History Gets A Second Look” (New York Times). “As consumer prices soared this fall…a handful of mostly left-leaning economists reignited the long-dormant debate, arguing in opinion columns, policy briefs and social-media posts that the idea deserves a second look. Few if any are arguing for a return to the Nixon-era policies. Many say they aren’t yet ready to endorse price controls, and just want the idea to be taken seriously.”

“Mostly Wealthy ‘Boomerang Kids’ Moved Back Home During The Pandemic, And It's Intensifying The Wealth Gap” (Insider). “Analyzing the Current Population Survey, the [Federal Reserve] [B]ank [of Cleveland] found that 36% of boomerang kids are from families that earned more than $140,000 per year — the top 20% of the income quintile. Meanwhile, only 10% of boomerang kids are in the lowest income quintile of households earning less than $28,000 per year. And the majority of young adults who didn't live with their parents are from families earning incomes in the middle of this range.”

“Washington's Proposed Rules To Protect Investors Could Widen The Wealth Gap” (Time). “[T]he SEC says it wants to increase the financial transparency of large companies which raise money away from the public markets. In addition, the regulator wants to limit the ability of people with less than $200,000 in annual income or $1 million in net worth to invest in non-public companies. In short, the current system, which already excludes the vast majority of Americans, could get more restrictive.”

What we’re reading (1/15)

“The Yield Curve Is No Longer Sending A Don’t-Worry-Be-Happy Signal, Warns Bond King Jeffrey Gundlach” (MarketWatch). “DoubleLine CEO Jeffrey Gundlach…has unveiled his predictions for the year ahead….he sees headwinds for a stock market that has been ‘supported by QE” and now faces Fed tapering, with Powell sounding ‘more hawkish’ every time he speaks...[h]e said the yield curve had seen ‘pretty powerful flattening’ and was ‘approaching the point where it signals economic weakening. At this stage, the yield curve is no longer sending a don’t-worry-be-happy signal, says Gundlach. It is instead signaling investors to pay attention, he said.”

“The Fed Is About To See A Lot Of New Faces. What It Means For Banks, The Economy And Markets” (CNBC). “In what likely will be just a few months’ time, the Federal Reserve will look a lot different: Three new governors, a new vice chairman, a new banking chief and likely a couple new regional presidents. But while the parts of the institution’s upper echelon may change quite a bit, the whole could look pretty much the same. That’s because Fed-watchers think ideologically there probably will be little change, even if Sarah Bloom Raskin, Lisa Cook and Philip Jefferson are confirmed as new members on the Board of Governors. White House sources say President Joe Biden will nominate the trio in the coming days.”

“Elon Musk’s Tesla Asked Law Firm To Fire Associate Hired From SEC” (Wall Street Journal). “A partner at law firm Cooley LLP got an unexpected call late last year from a lawyer for one of the firm’s most famous clients, Elon Musk’s Tesla Inc., with an ultimatum. The world’s richest man wanted Cooley, which was representing Tesla in numerous lawsuits, to fire one of its attorneys or it would lose the electric-vehicle company’s business, people familiar with the matter said. The target of Mr. Musk’s ire was a former U.S. Securities and Exchange Commission lawyer whom Cooley had hired for its securities litigation and enforcement practice and who had no involvement in the firm’s work for Tesla.”

“Meme Stocks Are Fading As Retail Traders Rotate Into Cryptocurrencies And The Metaverse, Fintech CEO Says” (Insider). “Last January, millions of retail traders banded together to drive eye-popping rallies in highly shorted, nostalgic companies, like GameStop, AMC Theaters, and BlackBerry. Day traders minted a new asset class dubbed the "meme stock" and regularly added new companies to the basket over the course of the year. At one point a tiny Danish biotech company surged more than 1,300% in a day on interest from individual investors looking for the next short squeeze. But observers say those wild spikes are likely to subside as retail traders look to new horizons to replicate last year's massive gains.”

“When It Comes To Living With Covid, Businesses Are On Their Own” (New York Times). “As the federal government’s efforts to contain the coronavirus hit their limits — as the administration itself admits — employers are largely on their own. Business leaders must decide whether and how to use tools such as their own vaccine mandates, masking, distancing, and testing at their offices and other work sites. And more fundamentally, they must decide what kind of company they want to run: one that manages cases or one that manages risk.”