What we’re reading (1/18)

“Microsoft To Buy Activision Blizzard In All-Cash Deal Valued at $75 Billion” (Wall Street Journal). “The deal, if completed, would sharply expand Microsoft’s already sizable videogame operation, adding a stable of popular game franchises including Call of Duty, World of Warcraft and Candy Crush to Microsoft’s Xbox console business and its own games like Minecraft and Doom. Microsoft said the transaction would make it the world’s third-largest gaming company by revenue, behind China’s Tencent Holdings Ltd. and Japan’s Sony Group Corp.”

“Carlyle Co-Founder David Rubenstein Says ‘We’re Due For A Correction’” (Bloomberg). “‘We’re due for a correction,’ Rubenstein said Tuesday in an interview with Sonali Basak at the Bloomberg Year Ahead Summit in New York. ‘The markets have been very ebullient for quite some time. We’ve basically been having free money.’ Rubenstein said the U.S. economy is ‘generally in good shape,’ but with the Fed signaling four to five rate hikes this year, downward pressure on asset prices is inevitable.”

“After Another Great Year For Stocks, Peril Lingers” (New York Times). “‘There’s no place to hide,’ Melda Mergen, global head of equities at Columbia Threadneedle Investments, said during a presentation of the firm’s 2022 outlook. ‘Most of the markets are at the top of the bar in their current valuations.’”

“Europe’s Energy Crisis Will Trigger Its Worst Neuroses” (The Economist). “The gas-price horror movie is most terrifying for Eurocrats. The causes of the current energy snafu are hard to distil down to a single factor, says Georg Zachmann of Bruegel, a think-tank in Brussels. That leaves plenty of room to designate a scapegoat, and one candidate comes to mind. The European Commission regulates eu energy markets (mostly quite sensibly) and has made carbon neutrality a central plank of the bloc’s future (also sensible). Sound as its policy decisions may be, they have aggravated the current crisis. For example, shifting to coal to keep prices down is less of an option, since it would require buying expensive eu carbon-emissions credits.”

“Blackstone’s New Real Estate Play: The Rent-To-Buy Market” (Financial Times). “By promising tenants that they might one day own their own homes, [Lewis] Ranieri [of Liar’s Poker fame] and his team had created a rental business with economics like no other. Other corporate landlords had to hire legions of professionals to scout for properties to buy. But Ranieri set things up so that ‘the tenants were doing the sourcing for him’, says one person who heard the pitch.”

What we’re reading (1/16)

“Day Traders as ‘Dumb Money’? The Pros Are Now Paying Attention” (Wall Street Journal). “Fund managers who might have once derided small-time day traders as ‘dumb money’ are scouring social-media posts for clues about where the herd might veer next. Some 85% of hedge funds and 42% of asset managers are now tracking retail-trading message boards, according to a survey by Bloomberg Intelligence.”

“Toxic Culture Is Driving the Great Resignation” (M.I.T. Sloan Management Review). “We also analyzed the free text of more than 1.4 million Glassdoor reviews, using the Natural Employee Language Understanding platform developed by CultureX, a company two of us (Donald and Charles) cofounded…[i]n general, corporate culture is a much more reliable predictor of industry-adjusted attrition than how employees assess their compensation…[a] toxic corporate culture, for example, is 10.4 times more powerful than compensation in predicting a company’s attrition rate compared with its industry.”

“Price Controls Set Off Heated Debate As History Gets A Second Look” (New York Times). “As consumer prices soared this fall…a handful of mostly left-leaning economists reignited the long-dormant debate, arguing in opinion columns, policy briefs and social-media posts that the idea deserves a second look. Few if any are arguing for a return to the Nixon-era policies. Many say they aren’t yet ready to endorse price controls, and just want the idea to be taken seriously.”

“Mostly Wealthy ‘Boomerang Kids’ Moved Back Home During The Pandemic, And It's Intensifying The Wealth Gap” (Insider). “Analyzing the Current Population Survey, the [Federal Reserve] [B]ank [of Cleveland] found that 36% of boomerang kids are from families that earned more than $140,000 per year — the top 20% of the income quintile. Meanwhile, only 10% of boomerang kids are in the lowest income quintile of households earning less than $28,000 per year. And the majority of young adults who didn't live with their parents are from families earning incomes in the middle of this range.”

“Washington's Proposed Rules To Protect Investors Could Widen The Wealth Gap” (Time). “[T]he SEC says it wants to increase the financial transparency of large companies which raise money away from the public markets. In addition, the regulator wants to limit the ability of people with less than $200,000 in annual income or $1 million in net worth to invest in non-public companies. In short, the current system, which already excludes the vast majority of Americans, could get more restrictive.”

What we’re reading (1/15)

“The Yield Curve Is No Longer Sending A Don’t-Worry-Be-Happy Signal, Warns Bond King Jeffrey Gundlach” (MarketWatch). “DoubleLine CEO Jeffrey Gundlach…has unveiled his predictions for the year ahead….he sees headwinds for a stock market that has been ‘supported by QE” and now faces Fed tapering, with Powell sounding ‘more hawkish’ every time he speaks...[h]e said the yield curve had seen ‘pretty powerful flattening’ and was ‘approaching the point where it signals economic weakening. At this stage, the yield curve is no longer sending a don’t-worry-be-happy signal, says Gundlach. It is instead signaling investors to pay attention, he said.”

“The Fed Is About To See A Lot Of New Faces. What It Means For Banks, The Economy And Markets” (CNBC). “In what likely will be just a few months’ time, the Federal Reserve will look a lot different: Three new governors, a new vice chairman, a new banking chief and likely a couple new regional presidents. But while the parts of the institution’s upper echelon may change quite a bit, the whole could look pretty much the same. That’s because Fed-watchers think ideologically there probably will be little change, even if Sarah Bloom Raskin, Lisa Cook and Philip Jefferson are confirmed as new members on the Board of Governors. White House sources say President Joe Biden will nominate the trio in the coming days.”

“Elon Musk’s Tesla Asked Law Firm To Fire Associate Hired From SEC” (Wall Street Journal). “A partner at law firm Cooley LLP got an unexpected call late last year from a lawyer for one of the firm’s most famous clients, Elon Musk’s Tesla Inc., with an ultimatum. The world’s richest man wanted Cooley, which was representing Tesla in numerous lawsuits, to fire one of its attorneys or it would lose the electric-vehicle company’s business, people familiar with the matter said. The target of Mr. Musk’s ire was a former U.S. Securities and Exchange Commission lawyer whom Cooley had hired for its securities litigation and enforcement practice and who had no involvement in the firm’s work for Tesla.”

“Meme Stocks Are Fading As Retail Traders Rotate Into Cryptocurrencies And The Metaverse, Fintech CEO Says” (Insider). “Last January, millions of retail traders banded together to drive eye-popping rallies in highly shorted, nostalgic companies, like GameStop, AMC Theaters, and BlackBerry. Day traders minted a new asset class dubbed the "meme stock" and regularly added new companies to the basket over the course of the year. At one point a tiny Danish biotech company surged more than 1,300% in a day on interest from individual investors looking for the next short squeeze. But observers say those wild spikes are likely to subside as retail traders look to new horizons to replicate last year's massive gains.”

“When It Comes To Living With Covid, Businesses Are On Their Own” (New York Times). “As the federal government’s efforts to contain the coronavirus hit their limits — as the administration itself admits — employers are largely on their own. Business leaders must decide whether and how to use tools such as their own vaccine mandates, masking, distancing, and testing at their offices and other work sites. And more fundamentally, they must decide what kind of company they want to run: one that manages cases or one that manages risk.”

What we’re reading (1/14)

“Wage Inflation Has Arrived In A Big Way And Jamie Dimon Says CEOs ‘Shouldn’t Be Crybabies About It’” (CNBC). “Shares of JPMorgan fell more than 6% on Friday after the bank said that expenses will climb 8% to roughly $77 billion this year, driven by wage inflation and technology investments. Higher expenses will likely push the bank’s returns in 2022 and 2023 below recent results and the lender’s 17% return-on-capital target, according to CFO Jeremy Barnum.”

“Pandemic Profits Begin To Ebb At America’s Biggest Banks” (Wall Street Journal). “Banks have enjoyed unparalleled growth during the pandemic, buoyed by a deal-making boom, market volatility that supercharged trading arms and a housing market that made mortgage lending more profitable than ever. At the same time, the doomsday scenarios that banks girded against in the pandemic’s early days never materialized, which freed up additional profits. Bad loans remain near record lows, and consumer and commercial customers alike have weathered the pandemic with, on average, plenty of cash on hand. Now, some of the forces that pushed bank profits to new records are starting to weaken.”

“Texas Oil Ponzi Schemes Allegedly Funded Private Jets, Luxury Cars, And A Wedding On The Queen Mary” (Gizmodo). “A wedding on a cruise ship, investments in the jade industry in Guatemala, and a private jet: Those are just some of the things investors who thought they were getting rich in the oil industry paid for instead. Two Securities and Exchange Commission lawsuits filed last month against Ponzi-style scammers selling fraudulent investments in the biggest oilfield in the U.S. show how the American oil and gas boom really is the Wild West.”

“Bridgewater’s Return To Co-CEO Model Rekindles Management Concerns” (Financial Times). “‘I think he’s trying to figure out what to do. He’s either lost his mojo, or just doesn’t want to do it any more,’ said one senior former Bridgewater employee of Dalio. ‘He basically has a firm that is not really structured to be sustainable without him, but isn’t really sustainable with him either.’ The promotion of a youthful former Israeli soldier and a veteran insurance executive to lead what is the world’s biggest hedge fund raised eyebrows in the industry. Nir Bar Dea only joined Bridgewater in 2015, before which he was an adviser to the Israeli UN mission, and an entrepreneur. Although he has an MBA from Wharton in 2014, 40-year old Bar Dea had no experience in finance before starting at Bridgewater, having served in the Israeli Defence Force and risen to the rank of major.”

“The Subversive Genius Of Extremely Slow Email” (The Atlantic). “Every day, the mail still comes. My postal carrier drives her proud van onto the street and then climbs each stoop by foot. The service remains essential, but not as a communications channel. I receive ads and bills, mostly, and the occasional newspaper clipping from my mom. For talking to people, I use email and text and social networking. The mail is a ritual but also a relic. That relic is also the model for a new personal-communication app called Pony Messenger. Think of it as email, if email arrived by post: You compose a message and put it in an outbox; once a day (you can choose morning, afternoon, or evening “pickups”), Pony picks up your outbound dispatches and delivers your inbounds. That’s it. It’s postal-service cosplay. It’s slow email.”

What we’re reading (1/13)

“Four Reasons To Keep Worrying About Inflation” (Jason Furman, Wall Street Journal). “Those who imagine that inflation will be lower argue that the huge burst of fiscal policy is behind us, supply chains will unsnarl, consumers will shift from buying goods to services, workers will return, and prices for commodities like oil will continue to fall. Some of their arguments are overstated, while others are likely wrong. And if we focus only on reasons that inflation should be lower in 2022, we risk ignoring four countervailing forces that will push toward higher inflation this year.”

“Soaring Used Car Prices Are Pushing Inflation Higher, And There’s Not Much The U.S. Can Do About It” (CNBC). “In the past 20 years used cars’ contribution to inflation averaged zero. It’s now more than 1% on a year-over-year basis, according to data from the U.S. Bureau of Labor Statistics.”

“China's Bitcoin Crackdown Is Good For America” (Reason). “The Chinese bitcoin mining ban was great for bitcoin and the United States. The network withstood a fifty percent hashrate shock with little disruption. Mining infrastructure quickly recalibrated and relocated to other more welcoming locations. Now that a similar dynamic is occurring in Kazakhstan, seasoned bitcoin users don't need to fear that the network will be disrupted (even though weak hands may see this as a reason to sell). In terms of uptime, bitcoin keeps on delivering. The great mining migration of 2021 is a fantastic opportunity for the United States.”

“Libor, Long The Most Important Number In Finance, Dies At 52” (New York Times). “Known as Libor, the interest-rate benchmark once underpinned more than $300 trillion in financial contracts but was undone after a yearslong market-rigging scandal came to light in 2008. It turned out that bankers had been coordinating with one another to manipulate the rate…by skewing the number higher or lower for their banks’ gain.”

“Private Equity Firm TPG Hits $10bn Valuation On First Day Of Trading” (Financial Times). “TPG is the largest company to go public in the US so far this year, and its successful listing comes as the wider IPO market grapples with poor performance and rising volatility…In going public, TPG is preparing to dramatically expand its platform, which has $109bn in assets, by launching new funds and investment products and striking acquisitions. TPG raised $1bn in the IPO.”

What we’re reading (1/12)

“Inflation At 40-Year High Pressures Consumers, Fed And Biden” (Associated Press). “Inflation jumped at its fastest pace in nearly 40 years last month, a 7% spike from a year earlier that is increasing household expenses, eating into wage gains and heaping pressure on President Joe Biden and the Federal Reserve to address what has become the biggest threat to the U.S. economy.”

“Inflation Means Interest Rates Could Rise. Higher Interest Rates Will Make The National Debt More Expensive.” (Reason). “With today's higher inflation and rising interest rates (perhaps with more to come), the Congressional Budget Office (CBO) estimates that the interest cost of public debt is $413 billion in 2021, stated in current dollars. Obviously, any dollar spent on interest cannot be spent on government benefits or services.”

“If Prices Keep Rising, A Nightmare Scenario For The US Economy Is A Real Possibility” (CNN Business). “‘There's always the risk of a policy error. The Fed is carrying a monetary policy nuclear football with them, so there is a potential for a mistake,’ said Kristina Hooper, Invesco's chief global market strategist.”

“No, Dollar Strength Doesn’t Mean Weak Stocks” (Fisher Investments). “Arguing pending rate hikes create material upside in long-term yields from here is tantamount to arguing markets aren’t efficient at all. In our experience, that is usually the losing side of the debate. With that said, range-bound long-term rates might still attract overseas capital, but here, too, currency markets are extremely liquid and efficient—and Treasury yields’ premium over their European and Japanese counterparts is also well known and likely priced in. That doesn’t preclude short-term swings, but we think it argues against a sustained move higher.”

“Congress Could Finally Rein In Its Own Controversial Stock Trading” (Vanity Fair). “[S]ome lawmakers have called for a Congress-wide trading ban. House Minority Leader Kevin McCarthy recently expressed interest in ‘instituting new limits or an outright ban on lawmakers holding and trading stocks and equities if Republicans take the majority in November,’ according to Punchbowl News. While McCarthy’s plan is still in its infancy, he’s considering forcing lawmakers ‘to hold only professionally managed mutual funds’ or banning lawmakers ‘from holding stocks in companies or industries their committees oversee,’ the news outlet reported.”

What we’re reading (1/11)

“Cathie Wood’s Rollercoaster Performance Offers A Familiar Lesson About Volatility” (Forbes). “ARKK’s ETF flows indicate the average investor in the fund is underwater. StoneX market strategist, Vincent Deluard, summed up why in a recent report. ‘The ARK Innovation ETF has returned 346% since its inception but no value has been created due to flows’ poor timing,’ he writes.”

“AQR Quant Fund Kicks Off The Year With 10% Gain After 2021 Rebound” (Financial Times). “A computer-powered investment fund run by AQR posted double-digit gains in the opening days of 2022, building on a strong performance last year that has bolstered industry hopes that the long ‘quant winter’ has finally passed.”

“Jamie Dimon Says The US Economy Is Booming, Inflation Will Stay Hot, And The Fed May Have To Hike Rates Hard...” (Insider). “‘I'd personally be surprised if it's just four increases next year. I think that four increases of 25 basis points is a very, very little amount and very easy for the economy to absorb,’ referring to how times the Fed will hike interest rates in 2022.”

“Fed’s Powell Says Economy No Longer Needs Aggressive Stimulus” (Wall Street Journal). “Mr. Powell said he was optimistic that supply-chain bottlenecks would ease this year to help bring down inflation as the Fed takes its foot off the gas pedal. But he told lawmakers at his Senate confirmation hearing that if inflation stayed elevated, the Fed would be ready to step on the brakes. “If we have to raise interest rates more over time, we will,” he said.”

“Washington, D.C., Has An Insider-Trading Problem” (New York Magazine). “A surprisingly large number of Congress members also appeared to have been able to use their inside knowledge for financial gain while unemployed Americans were lining up at food banks. Four senators were probed by the Department of Justice for insider trading, and at least one of them is still part of an active SEC investigation.”

What we’re reading (1/10)

“Tech Stocks Tumble, Extending Last Week’s Losses” (Wall Street Journal). “The tech-heavy Nasdaq Composite was down 1.8% in afternoon trading. Last week the benchmark posted its biggest one-week percentage decline since February, as rising bond yields punctured tech valuations. The S&P 500 slid 1.3% on Monday, on track for its fifth consecutive day of losses. The Dow Jones Industrial Average fell 1%, or about 375 points. Chip maker Nvidia, one of 2021’s best-performing stocks, slumped 3.9%, while Facebook parent Meta Platforms retreated 2.7%. Apple, Microsoft and Twitter all declined more than 1%.”

“The Fed’s Doomsday Prophet Has A Dire Warning About Where We’re Headed” (Politico). “While Hoenig was concerned about inflation, that isn’t what solely what drove him to lodge his string of dissents. The historical record shows that Hoenig was worried primarily that the Fed was taking a risky path that would deepen income inequality, stoke dangerous asset bubbles and enrich the biggest banks over everyone else. He also warned that it would suck the Fed into a money-printing quagmire that the central bank would not be able to escape without destabilizing the entire financial system. On all of these points, Hoenig was correct. And on all of these points, he was ignored. We are now living in a world that Hoenig warned about.”

“The Federal Reserve Needs To Get A Lot More Hawkish” (Former NYFRB President Bill Dudley, Bloomberg). “In an economy with above-trend growth pushing unemployment below the level consistent with stable prices, the median forecast has inflation melting away, falling to 2.6% in 2022, 2.3% in 2023 and 2.1% in 2024…[t]his is a remarkable, even surreal forecast: Inflation won’t be a problem, even if the Fed does little to rein it in. How high might rates go? If inflation is running above the Fed’s 2% target, they must adjust both to compensate for higher inflation and to achieve tight monetary policy. So if inflation subsides to 2.5% to 3% as supply chain issues dissipate, then a federal funds rate peak in the 3%-to-4% range seems reasonable.”

“Nearly A Quarter Of Workers Plan To Quit In 2022, Report Shows” (Protocol). “The Great Resignation will likely continue into 2022. About one-quarter of workers are looking to get a new job this year, according to a report from ResumeBuilder.com released earlier this week. Of those employees, some want to move into tech-related industries such as IT, business and finance.”

“My First Impressions Of Web3” (Moxie Marlinspike). “Given the history of why web1 became web2, what seems strange to me about web3 is that technologies like ethereum have been built with many of the same implicit trappings as web1. To make these technologies usable, the space is consolidating around… platforms…I think this is very similar to the situation with email. I can run my own mail server, but it doesn’t functionally matter for privacy, censorship resistance, or control – because GMail is going to be on the other end of every email that I send or receive anyway. Once a distributed ecosystem centralizes around a platform for convenience, it becomes the worst of both worlds: centralized control, but still distributed enough to become mired in time.”

What we’re reading (1/9)

“Risk Bubbles Are Deflating Everywhere, Some Market Watchers Say” (Bloomberg). “To Bank of America strategists including Michael Hartnett, a bubble is “simultaneously popping” in assets including cryptocurrencies, palladium, long-duration technology stocks, and other historically risky areas of the market. The winding down in speculative areas comes as investors brace for the U.S. Federal Reserve to pick up the pace of policy tightening.”

“Reddit Taps Morgan Stanley, Goldman Sachs For IPO - Source” (Reuters). “Reddit had confidentially filed for an IPO in December and is aiming for a valuation of over $15 billion at the time of its flotation. It was valued at $10 billion in a private fundraising round led by Fidelity Management in August.”

“Americans’ Finances Got Stronger In The Pandemic—Confounding Early Fears” (Wall Street Journal). “The personal saving rate—a measure of how much money people have left over after spending and taxes—hit a record 33.8% in April 2020, according to the Bureau of Economic Analysis. The rate averaged just under 8% for the two years before the pandemic began.”

“Data Update 1 for 2022: It is Moneyball Time!” (Musings on Markets). Some good reminders from the “Dean of Wall Street” along with his annual data update: “1. More data is not always better than less data…2. Data does not always provide direction…3. Mean Reversion works, until it does not…4. The consensus can be wrong.”

“The Market For Prestige Whiskeys Is Drawing Scammers And Counterfeits As Coveted Bottles Sell For Thousands Of Dollars” (Insider). “Counterfeiters are taking advantage of the boom in domestic sales of super-premium American whiskey, or bottles valued at more than $50. Demand is well-outstripping supply at the very high end of the market where bottles sell for at least $500 and the demand has created a thriving secondary market.”

What we’re reading (1/8)

“The Rise Of Personalised Stock Indices” (The Economist). “In 2001 Andrew Lo, a professor at the Massachusetts Institute of Technology, predicted that technological advances would one day allow investors to create their own personal indices designed to meet their financial aims, risk preferences and tax considerations. Such an idea ‘may well be science fiction today’, Mr Lo wrote, but ‘it is only a matter of time.’ More than 20 years later, that time may have come.”

“Rocket Grew Into America’s Biggest Mortgage Lender, But Now Comes The Hard Part” (Wall Street Journal). “No nonbank has grown as fast as Rocket. Its assembly-line method for making mortgages helps it handle lots of loans at once. The company spends aggressively on advertising, including Super Bowl ads in four of the past six years. But for Rocket to overcome the expected drop in refinancings, it will have to become something different. Like other nonbanks, it gets almost all of its revenue from mortgages, but it has been more aggressive about trying to expand beyond refinancings.”

“Fixed Mortgage Rates Hit 20-Month High As Long-Term Bond Yields Rise” (Washington Post). “What a difference a year makes. One year ago this week, the 30-year fixed mortgage rate sank to its lowest level in history. This week, fixed mortgage rates followed long-term bond yields and rose to their highest levels in 20 months.”

“The Athletic’s Sale Is Yet Another Sign That The Great Media Consolidation Is Upon Us” (Vanity Fair). “As a nearly two-year-old sports media start-up, The Athletic sold itself as a vulture hovering over the carcasses of local newspapers left to die in the digital age. The website’s cofounder Alex Mather went so far as to claim that The Athletic’s goal was to hasten the extinction of local news by poaching the most talented beat reporters from local sports sections—one of the few areas in which these antiquated publications continue to thrive.”

“The Background Level Of Stress” (Marginal Revolution). “That is a physiological or biological concept, or it may appear in the other sciences. It rarely plays a direct role in economics, though I think it is important for understanding regime shifts…I think a great deal about what the forthcoming level of background stress will be, but I am quite uncertain about any prediction. I do know I read a great number of people who either treat it as absurdly high (e.g., the climate doomsayers), or who are implicitly sure it will be quite low. I believe this concept of background stress, if nothing else, helps you to see what a lot of apparently reasonable predictions can end up being proven wrong.”

What we’re reading (1/7)

“The Best Investment For This Coming Crazy Year” (Wall Street Journal). “I think the best investment of 2022 is likely to be discipline. With the course of the coronavirus pandemic unclear, inflation expected to keep spiking and the Federal Reserve poised to raise interest rates, anything can happen—and probably will. What’s more, the things that feel most certain aren’t as obvious as they seem—so investors need to beware of taking drastic actions that, later on, they will wish they could undo.”

“How To Invest When There’s Nowhere To Hide” (Contrarian Edge). “I don’t know what straw will break the feeble back of this market or what will cause the music to stop (there, you got two analogies for the price of none). We are in an environment where there are very few good options. If you do nothing, your savings will be eaten away by inflation. If you do something, you find that most assets, including the stock market as a whole, are incredibly overvalued.”

“Is It Time To Fight The Fed? This Veteran Strategist Says The Central Bank Won’t Risk A 20% Drop In House Prices And A 30% Slide In Stocks.” (MarketWatch). “David Rosenberg, chief economist and strategist at Rosenberg Research and the former chief North American economist at Merrill Lynch, isn’t buying the tough talk from the Fed. ‘One should be skeptical of the Fed’s forecasts, given the poor track record, even though investors treat them (and the dot plots and FOMC minutes) as gospel,’ he says.”

“Layoffs Watch: Credit Suisse Prime Brokers” (Dealbreaker). “Luckily for those unlucky 69, they’ve gotten their walking papers at perhaps the most fortuitous moment in history for the laid off, a time when people are voluntarily leaving their jobs in droves, new jobs are springing up everywhere, and even Jamie Dimon finds himself forced to accept that the snowflakes these days just need more time at home.”

“Cities Whose Residents Make the Most Passive Income” (Chamber of Commerce). “At the regional level, households on the West Coast, Northeast, and Florida tend to earn more passive income. These differences vary based on total household income and other demographic factors. California and Florida residents earn the most, with median passive income of $7,000 and $6,000 per year, respectively. Whereas California has one of the highest median total household incomes of any state, Florida is home to a larger share of retirees who tend to depend on passive income to cover their living expenses.”

What we’re reading (1/6)

“Cathie Wood’s Flagship Ark ETF Off To A Rough Start In 2022 — Down 45% From Its Peak” (Yahoo!Finance). “With every new year comes a clean slate. For Cathie Wood’s Ark Invest, that doesn’t seem to be the case. The firm’s beaten-down Ark Innovation Fund has hit a new low in 2022 — already. After shedding 7% in Wednesday’s sell-off, the fund is down 9% this week so far and 45% from its peak in February 2021, with the decline marking its worst drawdown since inception in 2014.”

“Mortgage Rates Hit Highest Levels Since Spring 2020” (Wall Street Journal). “Ultralow interest rates have been a major force in the housing boom of the last two years. Households that kept their jobs and saved money during the pandemic seized on low borrowing costs to buy bigger homes that could accommodate working or schooling from home. Second-home purchases and investor demand for rental properties also surged.”

“Crypto Sell-Off Fuelled By Fed Worries Wipes Out Almost $900m Of Bets” (Financial Times). “Bitcoin traders suffered their worst day in a month after turbulence in traditional markets spilled into digital asset trading and caused almost $900m worth of bets to turn sour. The liquidations that hit leveraged traders come after the US Federal Reserve signalled that it could tighten monetary sooner than many investors had expected to combat rising inflation. The prospect of rising interest rates has caused prices to tumble in equity markets and pushed yields higher on government bonds.”

“Hedge Funds Are Selling Tech Shares At Their Fastest Pace In A Decade As Rates Spike” (CNBC). “The hedge fund community dumped tech stocks in the four sessions between Dec. 30 and Tuesday as interest rates spiked. The four-session tech unloading marked the biggest sale in dollar terms in more than 10 years, reaching a record since Goldman Sachs’ prime brokerage started tracking the data.”

“A Fed Official’s 2020 Trade Drew Outcry. It Went Further Than First Disclosed.” (New York Times). “Corrected disclosures show that Vice Chair Richard H. Clarida sold a stock fund, then swiftly repurchased it before a big Fed announcement…’It undermines the claim that this was portfolio rebalancing,’ said Peter Conti-Brown, a Fed historian at the University of Pennsylvania. ‘This is deeply problematic.’”

What we’re reading (1/5)

“Interest-Rate Worries Batter Stock Market” (Wall Street Journal). “Major U.S. stock indexes fell Wednesday as investors worried that the Federal Reserve might respond more aggressively to rising inflation than previously anticipated…The minutes of the Federal Reserve’s December policy meeting, released Wednesday afternoon, indicated that officials might lift short-term interest rates as soon as March. U.S. equities fell broadly after the minutes were released. Bond yields rose to their highest levels since early April.”

“Hedge Funds Struggle To Lure New Money As Performance Lags” (Financial Times). “Hedge funds gained 8.7 per cent on average from January to November 2021, according to data provider HFR…[h]edge fund managers argue their portfolios are not designed to match an index but rather to do well in all market conditions, but the size of the underperformance last year has nevertheless raised some concerns. Goldman Sachs analysts noted that while hedge funds did not necessarily aim to beat the S&P 500, last year’s returns were also ‘weak on an absolute basis’.”

“Oh, No: Adam Neumann Wants To Be A Landlord Again” (Curbed). “It seems safe to say that when Neumann himself eventually comes out of quasi seclusion to speak about his new venture, there will be lots of self-regarding over-the-top rhetoric (WeGrow once vowed to revolutionize elementary school via ‘elevating the collective consciousness of the world by expanding happiness and unleashing every human’s superpowers’).”

“The NFT Craze Has Stopped Being Funny” (The Week). “As an NFT skeptic, some guy getting scammed out of his collection of objectively hideous procedurally-generated ape cartoons was amusing. But it's all getting steadily less funny. Real non-rich people are putting a lot of money into these things, and there are good reasons to think sooner or later most of them are going to lose their shirts.”

“The Price Of Nails since 1695: A Window Into Economic Change” (Daniel Sichel, NBER). “First, from the late 1700s to the mid 20th century real nail prices fell by a factor of about 10 relative to overall consumer prices. These declines had important effects on downstream industries, most notably construction. Second, while declining materials prices contribute to reductions in nail prices, the largest proximate source of the decline during this period was multifactor productivity growth in nail manufacturing, highlighting the role of the specialization of labor and re-organization of production processes. Third, the share of nails in GDP dropped back from 0.4 percent of GDP in 1810—comparable to today’s share of household purchases of personal computers—to a de minimis share more recently; accordingly, nails played a bigger role in American life in that earlier period. Finally, real nail prices have increased since the mid 20th century, reflecting in part an upturn in materials prices and a shift toward specialty nails in the wake of import competition, though the introduction of nail guns partly offset these increases for the price of installed nails.”

What we’re reading (1/4)

“Don’t Tell Anyone, But 2021 Was Pretty Amazing” (Paul Krugman, New York Times). “[T]here’s a good chance that once time has passed and we’ve had a chance to regain perspective, we’ll consider 2021 to have been a very good year, at least in some ways. In particular, although nobody seemed to notice, it was a year of spectacular economic recovery — and one in which many dire warnings failed to come true.”

“10 Predictions For 2022” (The Irrelevant Investor). “Large value will outperform large growth by 20%. One of the stories that went under the radar last year was the return of small value. While small growth returned 2.5% in 2021, small value gained 28%. This same dynamic did not take place in large stocks. As the economy reopened over the first three months of last year, large value returned 11% while large growth fell 1%. It looked like the tide was changing, but the endzone dance was premature. Growth came roaring back, returning 29% through the rest of the year, while large value gained just 12% over the same time.”

“This Was The Year When Finance Jumped The Doge” (Wired). “When Lasse Heje Pedersen, a finance professor at Copenhagen Business School, researched the GameStop incident, he noticed something unexpected. A lot of those seemingly crusading investors were not dumping the stock at the end of the ride, as one would expect from predators ready to collect their loot; in fact, they were clinging to their GameStonks. ‘They didn’t just drive it up and then dump the stock: they were actually holding it for quite a long time,’ Pedersen says. ‘They didn’t seem to be buying it just to hurt somebody else.’ What happened in January 2021 was not simply a rebellion against Wall Street—it was something else. Call it, if you like, the rise of meme finance.”

“4 Charts On Apple's $3 Trillion Market Cap” (Morningstar). “Comparisons with fruit production and trips to Mars aside, Apple's size is massive even when measured against global stock markets. Apple's current market cap is greater than the market caps of entire countries. All public companies that operate in Canada, for example, added up to a total market cap of $2.64 trillion as of year-end 2020, $360 billion less than Apple.”

“The Verdict Is In On Elizabeth Holmes” (DealBook). “Elizabeth Holmes, the founder of the failed blood testing start-up Theranos, was found guilty of fraud yesterday, in a high-profile case that came to symbolize the perils of Silicon Valley hype and hubris. The case was not open-and-shut. Jurors, after a 15-week trial, returned a mixed verdict, finding Holmes guilty on four of 11 charges. All of the counts that she was convicted of related to defrauding investors. She was found not guilty of four counts of defrauding patients, and jurors were unable to agree on three counts related to financial fraud.”

What we’re reading (1/3)

“Apple Briefly Tops $3 Trillion Market Cap” (Wall Street Journal). “The move marked the latest milestone in a pandemic-era surge that carried shares of Apple and other large technology companies to unprecedented highs. Its share price has more than tripled since the pandemic lows of March 2020, adding around $2 trillion in market capitalization.”

“Wall Street Is Getting Greedy Again” (CNN Business). “The CNN Business Fear & Greed Index, which measures seven indicators of Wall Street's mood, is now showing signs of Greed, with three of the indicators at Extreme Greed levels. Just over a week ago, the index was flashing Fear warnings — and a month ago, it was in Extreme Fear territory.”

“Start The New Year By Asking For That Overdue Pay Raise” (New York Post). “The consensus among compensation experts is that this is the time to speak up.”

“FDIC Chair Intends To Resign In February, Giving Biden More Say Over Bank Regulation” (CNBC). “Jelena McWilliams, the head of the Federal Deposit Insurance Corporation and a holdover Trump appointee, said Friday she intends to leave her position in early 2022. In a surprise announcement, McWilliams said she is resigning effective Feb. 4. The move gives President Joe Biden another opportunity to strengthen his hand over bank regulation.”

“Will The Cloud Business Eat The 5G Telecoms Industry?” (The Economist). “Dish’s network is to be the first in America that would live almost entirely in a computing cloud. Except for antennas and cables, it is mostly a cluster of code that runs on Amazon Web Services (AWS), the e-commerce giant’s cloud-computing arm. As such, the roll-out is a test of the extent to which computing clouds will “eat” the telecoms industry, as software has eaten everything from taxis to Tinseltown.”

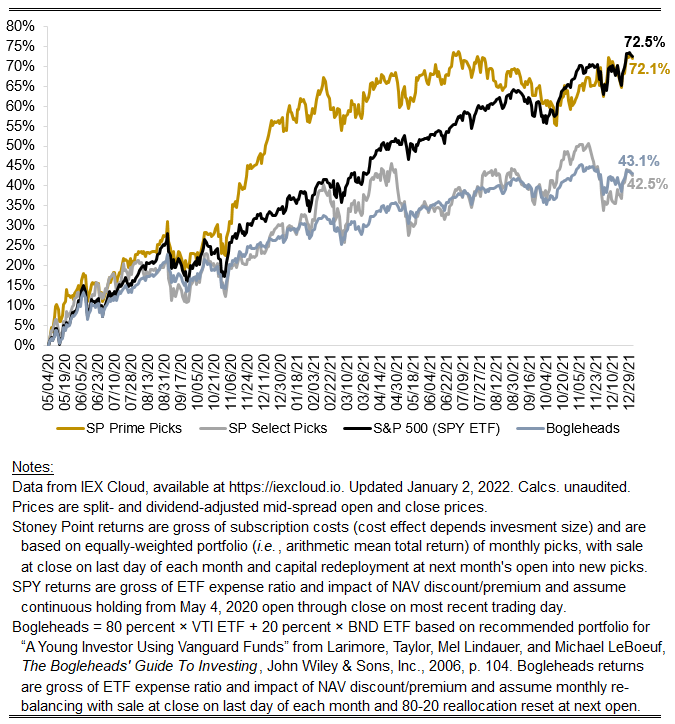

December 2021 performance update

2021 has officially come to a close with December rounding out a generally solid year for U.S. equities. Here are the key numbers for the month:

Prime: +3.69 percent

Select: +3.19 percent

SPY ETF: +3.25 percent

Bogleheads (80 percent VTI, 20 percent BND): +1.67 percent

Over the whole year, our Prime and Select returns were good, at 9.55 and 9.17 percent, respectively, relative to the base historical U.S. equity rate of return of around 5-8 percent (7.98 percent since 1928 for the S&P 500 index, according to these data). Our returns dramatically underperformed the benchmark S&P 500 index in the year itself, however (as discussed yesterday, the median U.S. equity-focused fund reporting data to Bloomberg returned 13.05 percent for the year, before management and performance fees). Hence, we start 2022 at about parity with the market as a whole on a cumulative basis, with both the SPY ETF and our Prime strategy appreciating by about 72 percent since we began.

I think there is cause for optimism about a strategy like Stoney Point’s for the year ahead.

First, conditions are such that it is very unlikely the S&P 500’s high returns of late will persist long into the future. As mentioned above, the long-term historical total return for the S&P 500 is 7.98 percent since 1928. Annualized returns for the index in 2019, 2020, and 2021 were 28.88 percent, 16.26 percent, and 26.89 percent, respectively (according to these data, which I think do not incorporate dividends, by the way). Relative to history, cumulative returns for the index in the last three years have been a 1.9-standard deviation event (a very rare occurrence).

Notably, the largest five constituents—Apple, Microsoft, Amazon, Meta (f.k.a. Facebook), and Alphabet (owner and issuer of Google)—represented 23 percent of the index in market value terms as of Dec. 29. The next two—Tesla and Nvidia—represented an additional 6 percent. That is to say that nearly 30 cents of every dollar invested in proxies for the S&P 500 is a directional bet on seven technology-adjacent companies. While Amazon was flattish, Alphabet, Microsoft, Meta, and Apple returned 65 percent, 51 percent, 34 percent, and 23 percent in the year. Tesla was up 36 percent. Devotion to these names paid off handsomely in 2021, but they are now trading at arguably euphoric levels. In P/E terms, Apple, Microsoft, Amazon, Meta, Alphabet, Tesla, and Nvidia are trading at 31.65x, 37.62x, 65.25x, and 24.07x, 27.88x, 345.13x, and 90.69x. High multiples imply the market is anticipating a great deal of future growth, but mathematically it also renders these valuations relatively more sensitive to the potential for a disruption in expectations around discount rates. Surely, the market is rationally pricing its expectations of the path of future rate hikes, but that says nothing about the standard error, or certainty, around the market’s expectations and whether or not that standard error is larger today than it has been in the past. Reality will manifest in one form or another, and if it departs from expectations in an adverse way, the market’s valuation of these growthy names should rationally come down farther than others. Big trees fall hard.

Second, and relatedly, this seems like a fortuitous time to be long “value” strategies—strategies that are inherently skeptical of high valuation multiples like the P/E’s cited above (in essence, Stoney Point’s stock selection algorithm selects stocks on the basis of a relatively novel measure of “value”). To at least some degree, all value investors believe in the notion that valuation multiples should be stationary (not increasing or decreasing monotonically) over the long term, and therefore should mean-revert when they are too high or two low. This is so because the numerators of these multiples are economically linked to the denominators in some fundamental, inexorable way. Consider price/rent ratios in the residential real estate market. When price/rent multiples are high relative to history, buyers get a better deal by renting and, all else equal, demand should flow to rentable units, raising rents and lowering purchase prices. In the process, the price/rent multiple should come down until it is “right” or until it has overshot the right level to such an extent that the reverse process occurs. This story fits both common sense and historical observation across asset classes. In my view, believing in the story does not require believing there is some big “correction” coming. It merely requires believe that, in probabilistic terms, higher-multiple assets are more likely to underperform lower-multiples assets for some period in the future.

When valuation multiples are about at their historical level, whether one believes multiples should mean-revert probably matters less. But valuation multiples today are historically high. This is not only true of U.S. stocks, but also true across a range of assets. It is true of residential real estate, where median home prices have risen 30 percent in the last decade while incomes (the basic ingredient for buying houses) rose only 11 percent. It is likewise true in the earliest-stage corner of private equities, where startup valuations in 2021 nearly doubled their level in 2020. Choosing to invest in anything in this environment requires taking a stand (consciously or unconsciously) on whether you believe the basic premise of value investing is true.

Stoney Point Total Performance History

What we’re reading (1/2)

“Stocks Face Rockier Path In 2022 As Fed Rate Increases Loom” (Wall Street Journal). “[F]ew investors expect 2022 to go as well as 2021, with the Federal Reserve on the verge of raising interest rates, a new Covid-19 variant sweeping the country and government aid to families dwindling. Already, oil prices have slipped 11% since their highs in late October, reflecting traders’ concern about slowing demand for fuel. The S&P 500 spent much of the past two months trading sideways, while some speculative investments, such as shares of smaller, fast-growing tech companies, fell sharply—hurt by fears that they would be especially vulnerable to tighter monetary policies.”

“Among 2021's Best-Performing Hedge Funds: Citadel” (Crain’s). “Deep-pocketed investors have been flocking to private companies because stakes can be acquired relatively cheaply…[a] reliance on private investments should give investors pause, said Chris Walvoord, global head of alternatives research at Aon Plc. ‘Everybody needs to be careful shifting into this direction,’ he said, noting that funds more heavily weighted with illiquid private investments are at greater risk if something goes wrong. ‘If a quarter of your investors ask for their money back, you’re going to have to shut things down, because it’s going to completely unbalance the portfolio.’”

“Bitcoin Has Plunged 32% From Its All-Time High This Year. But Investors Can Take Advantage Of A Tax Loophole While They Wait For The Cryptocurrency's Comeback.” (Insider). “One advantage crypto has over stocks is that the wash sale rule doesn't apply to it. A wash sale is when a security is sold at a loss and repurchased shortly after. When this is done with securities, any losses incurred are not deductible. Some seasoned crypto traders purposely sell their digital assets below the purchase price and then buy them back at the same or similar price to take advantage of this tax-loss harvesting rule.”

“Fed Repo Facility Use Jumps To Record High On Final Day of 2021” (Yahoo!Finance). “More than 100 participants on Friday put a total of $1.905 trillion at the Fed’s overnight reverse repurchase agreement facility, in which counterparties like money-market funds can place cash with the central bank. The previous record, set on Dec. 20, was $1.758 trillion. Friday’s $208 billion leap was the biggest one-day increase in usage since June 17 after the central bank increased the offering yield to 0.05%. That compares to the last trading day of 2020 when a mere 15 counterparties tapped the facility for $9.65 billion.”

“A Booming Startup Market Prompts An Investment Rush For Ever-Younger Companies” (Wall Street Journal). “Blank Street has a simple business: It sells coffee—sometimes in carts, usually in small stores. It launched its first location 17 months ago, before it began dotting Manhattan and Brooklyn with baristas…in today’s booming market for early-stage startups, the New York-based company has received commitments for its third funding round in a year. The $35 million investment comes just three months after the still-fledgling company received $25 million, said Vinay Menda, Blank Street’s chief executive.”

What we’re reading (1/1)

“Money Has Never Felt More Fake” (Vox). “If NFTs and crypto, as a concept, prevail, it’s unlikely all of the current projects and fads will. Everybody’s hoping they’ve got a golden ticket, or at least a gold-plated ticket, that they can sell before everyone else realizes what they’ve got is a fraud. Some people in the industry acknowledge that most of this stuff is likely to implode.”

“An Engineer's Hype-Free Observations On Web3 (And Its Possibilities)” (PSL). “The history of the Internet is, in part, the history of the birth, adoption, and stewardship of distributed protocols by the broader community. Blockchains follow in this tradition, but also break radically from it: they are the first protocols to arrive with an asset class attached. Protocols like SMTP (1981; email), TCP (1983; reliable packet transmission), HTTP (1991; web), and XMPP (1999; chat) all created immense value while capturing little for their inventors. Blockchains upend this, allowing inventors to capture considerable value for themselves.”

“71 Years Of Stock Market Data Reveals Investors May Be Happy In The New Year” (Yahoo!Finance). “Truist Advisory Services co-chief investment officer Keith Lerner found that going back to 1950, when the S&P 500 had a total return of at least 25% in a year, stocks usually rose in the following year. The outcome during that 71 year stretch: stocks advanced 82% of the time, or 14 out of 17 instances. “

“The Impact Of The COVID-19 Vaccine Distribution On Mental Health Outcomes” (Agrawal, et. al, NBER Working Paper). “While vaccines are primarily aimed at reducing COVID-19 transmission and mortality risks, they may have important secondary benefits…[w]e estimate that COVID-19 vaccination reduces anxiety and depression symptoms by nearly 30%. Nearly all the benefits are private benefits, and we find little evidence of spillover effects, that is, increases in community vaccination rates are not associated with improved anxiety or depression symptoms among the unvaccinated. We find that COVID-19 vaccination is associated with larger reductions in anxiety or depression symptoms among individuals with lower education levels, who rent their housing, who are not able to telework, and who have children in their household.”

“Who Won in Afghanistan? Private Contractors” (Wall Street Journal). “Since the Sept. 11, 2001 attacks, military outsourcing helped push up Pentagon spending to $14 trillion, creating opportunities for profit as the wars in Afghanistan and Iraq stretched on…[t]he Pentagon spent $6 million on a project that imported nine Italian goats to boost Afghanistan’s cashmere market. The project never reached scale. The U.S. Agency for International Development gave $270 million to a company to build 1,200 miles of gravel road in Afghanistan. The USAID said it canceled the project after the company built 100 miles of road in three years of work that left more than 125 people dead in insurgent attacks…[b]y the time President Donald Trump left office four years later, 18,000 contractors remained in Afghanistan, along with 2,500 troops.”

What we’re reading (12/31)

“In A Wild Year For Markets, Stocks Pull Off Big Gains” (Wall Street Journal). “Even with the recent turbulence from the Omicron coronavirus variant, the S&P 500 saw a 27% advance for 2021 and has hit 70 highs. It is the third straight year of double-digit gains for the broad index, and the second in the midst of the Covid-19 pandemic. The Dow Jones Industrial Average and Nasdaq Composite have gained 19% and 21%, respectively, this year, helping send the major indexes to their best three-year performance since 1999.”

“Stocks Surged in 2021, As Wall Street Rolled Its Eyes At Covid” (CNN Business). “It was an incredibly resilient year for the market, with stocks continuing to rally despite an alarming uptick in cases of the Omicron variant of Covid-19 around the globe. Optimism about the effectiveness of vaccines helped fuel investor enthusiasm though, as did the steady hand of the Federal Reserve and other central banks, which have mostly pledged to tread cautiously as they look to normalize monetary policy and slowly begin raising interest rates.”

“The Fed’s Moves Pumped Up Stocks. In 2022, It May Pull The Plug.” (New York Times). “‘The nightmare scenario is: The Fed tightens and it doesn’t help,’ said Aaron Brown, a former risk manager of AQR Capital Management who now manages his own money and teaches math at New York University’s Courant Institute of Mathematical Sciences. Mr. Brown said that if the Fed could not orchestrate a ‘soft landing’ for the economy, things could start to get ugly — fast. And then, he said, the Fed may have to take ‘very aggressive action like a rate hike to 15 percent, or wage and price controls, like we tried in the ’70s.’”

“Billionaire Chamath Palihapitiya Says Visa And Mastercard Will Be The Biggest Business Failures In 2022, Losing Out To Altcoin-Linked Projects” (Insider). “‘Be short these companies and anybody that basically lives off of this 2 or 3% (transaction) tax, and be long well-thought-out, Web3 crypto projects that are rebuilding payments infrastructure in a completely decentralized way,’ he said.”

“The Hidden ‘Replication Crisis’ Of Finance” (Financial Times). “It may sound like a low-budget Blade Runner rip-off, but over the past decade the scientific world has been gripped by a ‘replication crisis’ — the findings of many seminal studies cannot be repeated, with huge implications. Is investing suffering from something similar? That is the incendiary argument of Campbell Harvey, professor of finance at Duke university. He reckons that at least half of the 400 supposedly market-beating strategies identified in top financial journals over the years are bogus. Worse, he worries that many fellow academics are in denial about this.”

January Prime + Select picks available now

The new Prime and Select picks for January are available starting now, based on a model run put through today (December 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Monday, January 3, 2022 (at the mid-spread open price) through the last trading day of the month, Monday, January, 31, 2022 (at the mid-spread closing price).