A bubble in private markets?

I will go out on a limb and say that if there is one thing upon which the esteemed minds of empirical asset pricing agree, it might be that high ratios of market value to earnings (or cash flow, or book value, etc.) predict relatively lower subsequent returns (see, e.g., here). High valuation ratios don’t prove a bubble, of course, but they do offer a good place to look.

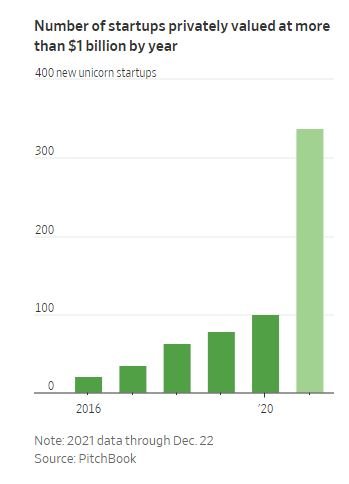

With that in mind, I was struck by the chart below from todays WSJ. Keep in mind, so-called “unicorns” often have de minimis earnings and cash flows, so the chart below may well be showing undefined or infinite valuation ratios, increasing higher still this year.

Are startups this year really worth that much more than they were last year? And if so, why startups? I haven’t put together a comparable chart examining public equities, but I suspect it wouldn’t look like this, with about 3.5x as many firms worth more than $1 billion than last year.

Is it more likely that the valuations captioned below reflect a rational pricing of expected cash flows and risk, or that some combination of chicanery and irrationality has funneled a ton of money into “growthy,” “tech-enabled” companies?

Anecdotally, I’ve been shocked at the amount of money I’ve seen raised (by people I know firsthand, no less!) for what seem like, at best, “OK” business plans. A relatively well-known venture capitalist active in this market once told me, “there’s no shortage of ideas [in Silicon Valley]. There’s just not enough execution.” One wonders if that might explain the chart below: there is a lot of money out there, and the money follows and prices the available “execution talent” in circulation. But good execution is hard to find, and when there is too much money chasing scarce good execution, the price of execution in general should rise, provided there is uncertainty about who the “good executors” are (or what the good “ideas” are). This is really just basic inflation dynamics, but with the pernicious influence of extra uncertainty: payoffs a long time in the future, obscure valuations not marked-to-market on a minute-by-minute basis (unlike public equities), and the promise of accessing investments “ordinary” investors can’t.

If this reasoning sounds fanciful, just recall that WeWork raised $13 billion from the most sophisticated investors on the planet on the back of its “community-adjusted EBITDA” before its valuation completely fell apart ahead of its initial stab at a public offering.

From Ramkumar, Amrith, and Eliot Brown, “The $900 Billion Cash Pile Inflating Startup Valuations,” Wall Street Journal, Dec. 27, 2021.

What we’re reading (12/27)

“The $900 Billion Cash Pile Inflating Startup Valuations” (Wall Street Journal). “The cash committed to venture-capital firms and private-equity firms focused on rapidly growing companies but not yet spent also is ballooning. So-called dry powder hit about $440 billion for venture capitalists and roughly $310 billion for growth-focused PE firms earlier this month, according to Preqin.”

“The Groundhog Day Stock Market Anomaly” (Shanaev, et al., Finance Research Letters). “This paper discovers a distinct calendar anomaly on the US stock market associated with the Groundhog Day prognostication tradition across 1928–2021. There are significant positive abnormal returns around the “prediction” of an early spring, while buy-and-hold returns around the “prediction” of a long winter are 2.78% lower. The results are robust in subsamples, to a set of placebo tests for international stock indices, and cannot be explained by January effect, the ‘halloween Indicator’, turn-of-the-month effect, or other seasonalities. The findings imply major and persistent irrational optimism of US investors revolving around Groundhog Day early spring prognostications.”

“Pandemic Migration Spurs Maine’s Biggest Population Growth In 2 Decades” (Bangor Daily News). “Maine saw more migration during the COVID-19 pandemic than almost all other states during the COVID-19 pandemic, leading to the greatest population growth here in nearly two decades. The sharp rise in population over the past two years comes on the heels of mostly anemic growth over the past decade, as Maine’s overall population rose just 2.6 percent between 2010 and 2020, compared with 7.4 percent growth nationally.”

“Tens Of Thousands Leave The Old Smoke In Biggest Exodus For A Generation” (The Times). “More than 90,000 Londoners quit the capital this year, the largest exodus for ‘at least a generation’, according to research published today by the estate agency Hamptons. A further 21,000 Londoners bought a second home, or a buy-to-let property, outside the M25.”

“Mick Jagger, Financial Planner Extraordinaire” (Wall Street Journal). “For more than half a century, as anyone even vaguely familiar with the history of rock ’n’ roll knows, the Stones have written and performed songs that provide sage investment advice for their fans. Bear in mind that Mick Jagger briefly attended the London School of Economics and was an early proponent of moving the Stones’ income to localities where they could escape the tax man.”

January picks available soon

We’ll be publishing our Prime and Select picks for the month of January before Monday, January 3 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of December, as well as SPC’s cumulative performance, assuming the sale of the December picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Fri., December 31). Performance tracking for the month of January will assume the January picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, January 3).

What we’re reading (12/26)

“Wall Street Bets S&P 500 Will Say Goodbye To Outsize Stock Gains In 2022” (Wall Street Journal). “U.S. stocks are on track to end 2021 with another year of outsize gains. Many investors aren’t expecting a repeat in 2022. The S&P 500 has climbed 26% so far in 2021, after rising 16% in 2020. Rip-roaring corporate profits and easy monetary policy have fueled the run. Earnings growth is expected to moderate next year, and the Federal Reserve is pursuing plans to raise interest rates, chipping away at key supports for the stock market’s rally.”

“Debranding Is The New Branding” (Bloomberg). “In recent years many major brands have taken a long, hard look in the mirror and hit reverse — discarding detail and depth to debrand. Burger King returned to a simpler, flatter identity…Rolling Stone shed its character stroke and drop shadow for a cleaner edge…[a]s much as brands aspire to be sui generis, branding has fashions that ebb and flow like skirt lengths or collar widths. This was as true of “jazz age” and “flower power” brands as of the recent effusion of “hipster” brands[.]”

“T Rowe Price Chief Warns Of ‘Free-Form Risk-Taking’ In Buoyant Markets” (Financial Times). “The outgoing head of one of the largest active US fund managers warned that investors should ‘step away from risk’ to avoid being burnt in an increasingly speculative market. Investors should not be overexposed to what has worked in the past year, or even three years, said Bill Stromberg, the chief executive of T Rowe Price, who will retire at the end of this year. ‘Even if they are a year too early. Because when the market unwinds, it will be areas of risk that unwind the most.’”

“Some Simple Game Theory Of Omicron” (Marginal Revolution). “Let’s say that everyone is totally reckless, and they go to Christmas Eve ‘Omicron parties.’ A week or two from now the virus has cleared their systems and I, who stay at home and blog, can then go out and frolic. Even if they stay sick, or if they die, they are removed as sources of potential infections for others (see below for new variants, possibly from the immunocompromised). If I know that is happening, I find it easy to stay at home for a week. I look forward to my pending freedom. In other words, right now my behavior becomes safer. I engage in intertemporal substitution.”

“Moving In Stereo: Churn And Rotations Causing Swings In Sentiment” (Charles Schwab). “This year has been a strong one for most major stock market averages; but with ample churn and sector volatility under the surface. Instead of trying to get ahead of these short-term swings, use them to your advantage via diversification, but also volatility/portfolio-based rebalancing in the interest of trimming into strength and adding into weakness. Keep a close eye on sentiment conditions, especially if they move back toward euphoria—and if not accompanied by breadth improvement.”

What we’re reading (12/25)

“Generation Z Is Lost In An Age When Nothing Matters” (Real Clear Markets). “How then can they think? The answer, of course, is that many do not. They feel - and react, based upon those feelings. Without thinking - the thinking being done for them, by those who have learned the value of thoughtlessness and passivity.”

“Almost One-Third Of Young Workers Are Making A Huge Retirement Mistake” (USA Today). “According to Goldman Sachs' recent report, 30% of workers under the age of 40 believe they will have to replace just 60% of their pre-retirement income -- or less -- after they've left the workforce for good. This means if they were making $70,000 when they left the workforce, they are assuming they'll only require a total of $42,000 at most once they've quit their jobs for good.”

“‘Mad Max,’ Crooked Insiders And A Wolf: Here’s What Some Of Wall Street’s Most Audacious Fraudsters Are Up To” (CNBC). “That can make the Street a fertile ground for fraud. Some of the most notorious financial crimes of all time have ties to the corner of Wall and Broad, and their impact — on victims, law enforcement, and future would-be crooks — lasts to this day. Let’s catch up with some of Wall Street’s most audacious fraudsters.”

“Commodities: Inflation Hedge Or Fool's Gold?” (Morningstar). “Investing in commodities always gains interest when the specter of inflation rears its ugly head. Research shows that commodities tend to be one of the asset classes that is most positively correlated with inflation, as calculated by the Consumer Price Index.”

“Travel Woes Deepen As Omicron Variant Hits Pilots And Flight Attendants” (Wall Street Journal). “Airlines have canceled more than 600 U.S. flights so far Friday, calling off hundreds more scheduled for Saturday, according to FlightAware, a flight-tracking site. Some European airlines and rail operators are also grappling with higher rates of illness among employees, in the latest sign of how the rapidly spreading Omicron variant is upending business even in industries with heavily vaccinated workforces.”

What we’re reading (12/23)

“What We’re Looking Forward To In 2022” (DealBook). “Americans are starting new businesses at the fastest pace in years. The pandemic helped end a multidecade slump in new start-ups that had both stumped and worried economists. This year, business applications in the U.S. are on track to surpass 5.4 million, up from 4.3 million last year. Why? Perhaps the pandemic gave people more time to think, and because the economic upheaval it wrought created opportunities for small new businesses. Technology has also made it easier to become an entrepreneur, and access to capital has expanded.”

“'Backdoor' Roth Restrictions Have Been Put On hold -- For Now” (CNN Business). “If you're a high earner who was scrambling to take advantage of a so-called backdoor Roth IRA or Roth 401(k) before new rules go into effect prohibiting you to do so, you just got a reprieve. Senator Joe Manchin's refusal to vote for the Build Back Better bill puts the future of that legislation in jeopardy. And, as a result, it also puts in jeopardy a revenue-raising provision in the bill that would restrict the ability of high-income savers to put money into Roth IRAs and Roth 401(k)s using a backdoor conversion method.”

“Wall Street Is So Desperate For Talent Some Firms Are Offering To Pay Out Rival Bankers' Year-End Bonuses” (Insider). “Wall Street's war for talent isn't letting up as the year winds down, as some investment banks are willing to pony up big money to poach bankers ahead of their year-end bonus payouts. It's a change from previous years, when hiring normally came to a standstill in the fourth quarter before talks resumed in January, recruiters said. ‘This year, people are giving out offers today in order to buy them out in 2022,’ Kevin Mahoney, a partner at Bay Street Advisors who leads the investment banking, private equity, and private credit practices, told Insider.”

“Should You Add Real Estate To Your Retirement Portfolio?” (Wall Street Journal). “Whether it is a physical property, such as an apartment building, or an investment in a real-estate investment trust or mutual fund, many financial-planning professionals say that income-producing real estate is an essential part of a well-performing retirement portfolio. However, while 75% of retirees have their money parked in bank accounts or CDs, just 12% own real estate other than their primary residence for investment, according to a survey conducted by the Transamerica Center for Retirement Studies between November 2020 and December 2020.”

“What Jack Dorsey’s Attack On Web3 Is Really About” (Slate). “Dorsey is essentially arguing that Web3 is doomed to break its promise of a more egalitarian and individualistic internet. Deep-pocketed venture capitalists, tech companies, and hedge funds are collectively pouring tens of billions of dollars into developing Web3 services and infrastructure. Just this month, a crypto firm called Hashed raised $200 million, Kraken Ventures Fund raised $65 million, and venture accelerator Brinc raised $130 million, all for Web3 investments.”

What we’re reading (12/22)

“Homes Sold In November At Fastest Pace In 10 Months” (Wall Street Journal). “Existing-home sales, which rose in November to the highest seasonally adjusted annual rate since January, are on track for their strongest year since 2006 as low mortgage-interest rates and a robust job market drive up demand.” [Note: emphasis added.]

“Idle Now, Pay Later” (City Journal). “Younger workers opting to work less or to put in only the minimum effort may pay a future price in terms of stagnation or downward mobility. Workers receive the most pay raises in their twenties and thirties. This is also when people acquire the skills and contacts that pay off for the rest of their careers. One’s early years are not an ideal time to stay away from work, even considering the challenges that today’s younger workers face.”

“How the 2020s Economy Could Resemble The 1980s” (New York Times). “[U]nderstanding the history of how the economy went from bust to boom in the early 1980s offers a surprising model for optimism about how the American economy could progress in the next couple of years. All it would take is for the Federal Reserve to pull off a delicate economic pivot that is the mirror image of the one it managed four decades ago.”

“If The Economy Is Doing So Well, Why Does It Feel Like a Disaster?” (Time). “The chasm between how our public understanding of what’s going on economically and what our numbers say is not just a feature of our present. At few points in the past twenty years have Americans felt good about the future for very long. At no point since the bursting of ‘90s tech bubble and the subsequent recession of 2000 have American felt as good about the economy as they did throughout the 1990s, and the high point after twenty years of ups and mostly downs was January of 2020, when confidence about the economic future reached about where it was in early 1990s.”

“Financial Regulator Takes Aim At ‘Buy Now, Pay Later’ Credit” (Washington Post). “Twenty percent of Americans said they had used a BNPL payment plan in the previous 12 months, according to a poll over the summer by SurveyMonkey. More than half of those making less than $50,000 a year said that they are interested in using the service because they would not have been able to afford their purchases otherwise, the SurveyMonkey poll found.”

What we’re reading (12/21)

“Wall Street Had A Red-Hot Year, But Can It Last?” (Wall Street Journal). “[A]nalysts are unconvinced that the banks’ heady pace of deal-making can continue. Goldman and Morgan Stanley have minted big trading revenue during the wild pandemic markets, but analysts are still trying to figure out what the new normal in trading looks like.”

“The New Get-Rich-Faster Job In Silicon Valley: Crypto Start-Ups” (New York Times). “[A] growing contingent of the tech industry’s best and brightest sees a transformational moment that comes along once every few decades and rewards those who spot the seismic shift before the rest of the world. With crypto, they see historical parallels to how the personal computer and the internet were once ridiculed, only to upend the status quo and mint a new generation of billionaires. Investors, too, have flooded in.”

“SEC Cracks Down On SPAC Claims As Electric Truck Maker Nikola Agrees To Pay $125 Million To Settle Fraud Charges” (CNBC). “Electric truck maker Nikola has agreed to pay the Securities and Exchange Commission $125 million to settle charges it defrauded investors by misleading them about its products, technical capacity and business prospects. SEC officials said they hoped the penalty would serve as a warning to all companies aiming to enter public markets via a merger deal with a special-purpose acquisition company, or SPAC. Specifically, officials said statements from companies hoping to tap public capital markets need to be true.”

“Turkey’s President Launches A Plan To Shore Up His Plummeting Currency” (The Economist). “When Recep Tayyip Erdogan speaks, the Turkish lira generally listens, shudders, and falls off a cliff. For once, something different happened. Facing a crisis of his own making, Turkey’s leader took a dramatic step to save the lira on December 20th, moments after the currency had plummeted to a new record low. The government, he announced, would guarantee bank deposits in lira, protecting them from swings in the exchange rate. The lira rebounded spectacularly on the news, moving from 18.36 to as low as 11.11 against the dollar, its biggest rally for nearly four decades.”

“American Workers Are Burned Out, And Bosses Are Struggling To Respond” (Wall Street Journal). “Over the past two decades, the length of the average American workday has increased by 1.4 hours, according to polling by Gallup Inc. For millions of Americans, as commutes disappeared and schedules grew more irregular, the pandemic lengthened days still further. In a survey this year, 16% of U.S. workers said they put in more than 60 hours a week, up from 12% in 2011.”

What we’re reading (12/20)

“Omicron Sweeps Across Nation, Now 73% Of New US COVID Cases” (Associated Press). “Omicron has raced ahead of other variants and is now the dominant version of the coronavirus in the U.S., accounting for 73% of new infections last week, federal health officials said Monday. The Centers for Disease Control and Prevention numbers showed nearly a six-fold increase in omicron’s share of infections in only one week.”

“Behind A New Pill To Treat Covid: A Husband-And-Wife Team And A Hunch” (Wall Street Journal). “The Holmans say they risked their own money on an unproven molecule that other potential investors had shown little interest in, and developed it in record time. ‘This was a compound nobody else really wanted to develop,’ said Dr. Holman, who declined to say how much money the Holmans have put into molnupiravir’s development. Ridgeback’s profits from molnupiravir will be put toward more biomedical research or companies, he said.”

“A Davos Deferred” (DealBook). “The World Economic Forum said this morning that it was postponing its annual meeting in Davos, Switzerland, from next month to “early summer,” citing the spread of the Omicron variant. The move suggests new uncertainties for business travel, yet another headache for C.E.O.s amid rising case counts and new questions about government efforts to contain the coronavirus. Meanwhile, U.S. stock futures are down sharply, following European and Asian markets.”

“In The Stock Market, The New Year May Start With A Bang” (MarketWatch). “With tumultuous declines in the past month, is this a contrarian ‘all-clear’ signal for further gains? Or, with the Federal Reserve accelerating its tapering of quantitative easing and potentially raising official interest rates in 2022, is this the end of the bull run that started in early 2020? For answers, we look to the major players: “passive” investors and the Fed.”

“Wonking Out: What Would A Hard Landing Look Like?” (Paul Krugman, New York Times). “It’s not totally clear whether this huge wave of unemployment [in the 1980s] was necessary [to bring down inflation]. Influential research using state-level data argues that the main factor in the Volcker disinflation was a big change in public expectations that could conceivably have happened without such a severe recession. But for now the working hypothesis for most economists is still that it took a nasty, sustained slump to end the inflation of the 1970s. Are we looking at something similar in our future? Probably not, for several reasons.”

What we’re reading (12/19)

“Innovation Stocks Are Not In A Bubble: We Believe They Are In Deep Value Territory” (Ark Invest). “Last year, as the equity market responded to the ugly reality of the coronavirus during March and April, quant and algorithmically driven strategies seemed to seize simplistically on two variables – level of cash on company balance sheets and rate of cash burn – and, in just a few weeks, they crushed many stocks by 50-75%. Momentum followers and market commentators embraced this “obvious” trade, but they were wrong. Many of those stocks were in the genomic space, their underlying technologies critical to tackling the coronavirus[.]”

“Sky-High Lumber Prices Are Back” (Wall Street Journal). “Lumber prices have shot up again in a rise reminiscent of a year ago, when high-climbing wood prices warned of the hinky supply lines and broad inflation to come. Futures for January delivery ended Friday at $1,089.10 per thousand board feet, twice the price for a prompt delivery in mid-November. Cash prices are way up as well. Pricing service Random Lengths said that its framing composite index, which tracks on-the-spot sales, has jumped 65% since October, to $915.”

“The U.S. Government Has A Massive, Secret Stockpile Of Bitcoin — Here’s What Happens To It” (CNBC). “For years, the U.S. government has maintained a side hustle auctioning off bitcoin and other cryptocurrencies. Historically, Uncle Sam has done a pretty lousy job of timing the market…[t]he government has obtained all that bitcoin by seizing it, alongside the usual assets one would expect from high-profile criminal sting operations. It all gets sold off in a similar fashion.”

“The Real Reason To Index” (Morningstar). “[F]uture active-passive contests will likely resemble the Vanguard/American Funds outcome rather than Bogle’s projections. Ironically, this will make Bogle wrong by being right. His critique about how most fund companies operated was entirely correct. However, through his efforts, Bogle taught investors to change their behavior. They no longer operate as they once did, which means index funds no longer enjoy such a significant cost advantage.”

“Candy Cane Shortage Fueled By COVID, Weak Peppermint Harvest” (New York Post). “It’s the great Candy Cane Crisis of 2021. Weakness in peppermint crops and COVID-caused logistical issues have created a problem for Big Candy…[p]eppermint production in the United States has declined nearly 25 percent over the past decade, according to the US Department of Agriculture.”

What we’re reading (12/17)

“Bitcoin ‘May Not Last That Much Longer,’ Academic Warns” (CNBC). “‘Bitcoin’s use of the blockchain technology is not very efficient,’ said [Prof. Eswar] Prasad, who is the author of ‘The Future of Money: How the Digital Revolution is Transforming Currencies and Finance.’ The cryptocurrency ‘uses a validation mechanism for transactions that is environmentally destructive’ and ‘doesn’t scale up very well,’ he explained. Indeed, bitcoin’s carbon footprint is bigger than the whole of New Zealand. Prasad said some of the newer cryptocurrencies use blockchain technology far more efficiently than bitcoin does.”

“America’s Future Depends On The Blockchain” (Jay Clayton, Wall Street Journal). “While securities trading and other financial transactions may appear instantaneous, many back-end processes still move at a snail’s pace in rigid sequences set decades ago. A mortgage payment isn’t completed when the funds leave the homeowner’s bank account. Those funds have many hands to go through before they come to rest, days or weeks later. Through tokenization, many of these cumbersome and costly processes can be streamlined with better market information, greater certainty and enhanced security.”

“AQR: The 60-40 Portfolio Won’t Protect Investors Anymore” (Institutional Investor). “While a mix of stocks and bonds has provided investors with solid diversification benefits over the last decade, that effect will likely be reduced in the coming years, according to a report by the investment firm AQR.”

“The Risk Of Avoiding Emerging Markets” (New York Times). “Numerous studies, including those by Vanguard and Morgan Stanley, show that over extended periods, the stock returns of emerging markets and developed countries like the United States don’t move in lock step most of the time. Over the long term, this low correlation means that adding emerging market exposure to predominantly American investments can reduce the overall portfolio’s volatility and enhance returns.”

“Smartphones Are A New Tax On The Poor” (Wired). “Smartphones and on-the-go internet access have made many of our working lives more efficient and flexible. But the requirement for constant connectivity isn’t only a fact of white-collar work—it has spread to workers up and down the income ladder. And while the requirement has spread, the resources that workers need to maintain it are not evenly distributed. Today, more than a quarter of low-income Americans depend solely on their phones for internet access.”

What we’re reading (12/16)

“The ‘To the Moon’ Crash Is Coming” (Vice). “The market today reminds [venture capitalist Josh] Wolfe in many ways of the same forces that were so prominent at the height of the dot com boom, and perhaps no single person better encapsulates the moment than the world’s richest man, Elon Musk. Motherboard spoke to Wolfe about the worrying signs he sees, and the downside of prioritizing hype over fundamentals.”

“Why Jerome Powell Pivoted On Inflation” (New York Times). “Inflation has been building for months. But it was over 13 days this fall that Jerome Powell, the Federal Reserve chair, decided the central bank needed to get more serious about trying to choke it off.”

“The Bank Of England Surprises Investors By Raising Interest Rates” (The Economist). “The Bank of England has sprung its second surprise in as many months. In November it failed to raise interest rates after it had steered markets to expect an increase. On December 16th it did raise rates after all, surprising investors—despite the most obvious change in the economic outlook being a worsening of the pandemic. The bank’s monetary policy-committee voted by a margin of eight to one to raise interest rates from 0.1% to 0.25%. That makes Britain the first big rich economy to experience interest-rate rises since the pandemic struck.”

“Inside Wall Street's Culture War With Gen Z” (Insider). “[M]ost Gen Z analysts and interns ‘are looking to have work-life balance. They're not willing to go through the hazing and the boot-camp type mentality,’ added [Patrick] Curtis, [former investment banker and] the founder of Wall Street Oasis, an online water cooler for the finance industry where insiders trade secrets and commiserate with one another.”

“Beware Prophecies Of Civil War” (The Atlantic). “[F]everish talk of civil war has the paradoxical effect of making the current reality seem, by way of contrast, not so bad. The comforting fiction that the U.S. used to be a glorious and settled democracy prevents any reckoning with the fact that its current crisis is not a terrible departure from the past but rather a product of the unresolved contradictions of its history. The dark fantasy of Armageddon distracts from the more prosaic and obvious necessity to uphold the law and establish political and legal accountability for those who encourage others to defy it.”

What we’re reading (12/15)

“How Millions Of Jobless Americans Can Afford To Ditch Work” (CNN Business). “One of the more insidious myths this year was that young people didn't want to work because they were getting by just fine on government aid. People had too much money, went the narrative. Only trouble is, the numbers don't back it up. Instead, early retirement — whether forced by the pandemic or made possible otherwise — is playing a big role in America's evolving labor market.”

“The Treasury Has A Bond Bargain For You” (Wall Street Journal). “Invest in U.S. Treasury I Bonds. These bonds pay a fixed rate for the life of the bond, plus the annualized CPI inflation rate. With the interest compounded semiannually, these I Bonds will pay a total annualized interest rate of 7.12% through April 2022, well in excess of any other safe yield obtainable. You can never receive a negative real yield, and the combined interest rate can never be less than zero even if the price level declines.”

“NFTs Explained: Why People Are Spending Millions Of Dollars On JPEGs” (CNET). “When you see a headline or a tweet about some preposterous sum being spent on an NFT, it's easy to become bewildered over how absurd that purchase would be for you. What's easy to forget is that very expensive things are almost exclusively bought by very rich people -- and very rich people spend a lot on status symbols.”

“Burying The Laissez-Faire Zombie” (Prof. Luigi Zingalez, Project Syndicate). “The main divide…is not between the state and markets, but between procompetitive and anticompetitive rules. And within the universe of anticompetitive rules, the key distinction is between those that are justified by a higher principle and those that are not.”

“‘15 Minutes To Save The World’: A Terrifying VR Journey Into The Nuclear Bunker” (The Guardian). “In 1979, the world came within minutes of nuclear war because someone had left a training tape simulating a Russian attack in the early warning system monitors. In September 1983, Russian computers erroneously showed incoming US missiles. Armageddon was only averted because the duty officer, Lieutenant Colonel Stanislav Petrov, went against protocols and decided not to act on the alert because his gut told him it was a glitch.”

What we’re reading (12/14)

“We Need To Do Hard But Necessary Things To Tackle Inflation” (Glenn Hubbard, New York Times). “The Fed must begin tapering asset purchases more aggressively now…[t]he Fed should also raise its benchmark federal funds rate in early 2022. This is a short-term interest rate at which banks borrow and lend reserve balances with one another. He should also be prepared to make further adjustments should macroeconomic conditions, including broader and longer-lasting inflation, demand it.”

“Surging US Producer Prices Add To Pressure On Fed To Accelerate Taper” (Financial Times). “The producer price index published by the Bureau of Labor Statistics on Tuesday jumped 0.8 per cent in November, for an annual increase of 9.6 per cent. That is the fastest year-over-year rate since the data were first collected in 2010.”

“The Federal Reserve Is Expected To Take A Very Big Step Toward Its First Rate Hike” (CNBC). “The Federal Reserve is expected to announce a dramatic policy shift Wednesday that will clear the way for a first interest rate hike next year. Markets are anticipating the Fed will speed up the wind-down of its bond buying program, changing the end date to March from June. That would free the central bank to start raising interest rates from zero, and Fed officials are expected to release a new forecast showing two to three interest rate hikes in 2022 and another three to four in 2023.”

“FOMC Preview: Is The Fed Behind The Curve On Inflation?” (Yahoo!Finance). “How fast does the Federal Reserve want to move on drawing down its pandemic-era stimulus? That’s the question that Fed officials will have to answer in its two-day meeting kicking off Tuesday, where the major discussion will focus on the pace of the central bank’s wind down of its asset purchase program.”

“Millennials Are Supercharging The Housing Market” (Wall Street Journal). “For years, conventional wisdom held that millennials, born from 1981 to 1996, would become the generation that largely spurned homeownership. Instead, since 2019, when they surpassed the baby boomers to become the largest living adult generation in the U.S., they have reached a housing milestone, accounting for more than half of all home-purchase loan applications last year.”

What we’re reading (12/13)

“US Small-Cap Stocks Trade At Historic Discount To Corporate Titans” (Financial Times). “Smaller US-listed companies are trading at a steep discount compared with their larger peers, highlighting how corners of the market remain relatively inexpensive despite the big rally from the depths of the coronavirus crisis. The S&P 600 gauge tracking the smallest stocks by market value on the index provider’s composite US equities barometer is priced at 14.5 times expected earnings over the next year, according to FactSet data. The valuation is well below the 21.3-times for the benchmark S&P 500 index, which tracks America’s corporate behemoths such as Apple, Facebook and Tesla.”

“‘We’re Starting To See’ Venture Capital Shift From Silicon Valley, AOL Co-Founder Explains” (Yahoo!Finance). “In 2021, more than $13 billion of Silicon Valley venture capital dollars flowed to regions outside of the Bay Area, New York, and Boston. That's the first time in a decade that less than 30% of venture capital has gone to Silicon Valley startups. As recently as 2017, that figure was above 50%. The report's authors found that the share of seed- and early-stage venture capital dollars going to startups in the Bay Area and the other two major tech hotspots has been declining over the past decade.”

“Vox Media, Group Nine Media In Advanced Talks To Merge” (Wall Street Journal). “The companies are discussing an all-stock transaction that would give Vox Media 75% ownership of the combined company, with the remaining 25% going to Group Nine Media, the people said. Vox Media Chief Executive Jim Bankoff would helm the company, the people said…[d]igital media executives say the industry is primed for consolidation. Many players believe they need more scale to compete effectively for online ad dollars and expand further in areas such as e-commerce, events and podcasting.”

“The Top 0.1% Got A Nearly 10% Percent Raise In 2020 — That’s Five Times More Than The Bottom 90%” (Insider). “ the top 1% of Americans earned 13.8% of wages in 2020, according to EPI's analysis of Social Security Administration data. Meanwhile, everyone else earned 60.2%. That was wage growth of 9.9% for the top 0.1% alone, compared to 1.7% for the bottom 90%. It's the latest acceleration of a trend that kicked off in 1979. Since then, the top 1% has seen their wages grow by 179.3%. And, if you're one of the few in the top 0.1%, your wages have gone up by 389.1% over the past four years alone.”

“Facebook: It’s Not Our Fault People Want COVID Misinformation” (Vanity Fair). “Speaking in an interview Sunday with Axios on HBO, longtime Facebook executive Andrew Bosworth brushed off responsibility for the platform’s role in allowing misinformation about public health and politics to proliferate, claiming that lies and conspiracy theories were problems with society and individuals rather than the company. ‘Individual humans are the ones who choose to believe or not believe a thing,’ Bosworth said. ‘They are the ones who choose to share or not share a thing.’”

What we’re reading (12/12)

“ETF Inflows Top $1 Trillion For First Time” (Wall Street Journal). “A historic surge of cash has swept into exchange-traded funds, spurring asset managers to launch new trading strategies that could be undone by a market downturn. This year’s inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year’s total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushed global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.”

“2021 Has Been A Record-Breaking Year For Venture Capital” (Insider). “While the year isn't over — fourth-quarter results have not been tallied — 2021 was the first year that global venture funding surpassed $100 billion in a quarter, and it did so in each of the first three quarters, according to Crunchbase. Funding reached $135 billion in the first quarter, $159 billion in the second, and $160 billion in the third, Crunchbase said.”

“Israeli Study Finds Pfizer Covid Booster Protects Against Omicron Variant” (CNBC). “Israeli researchers said on Saturday they found that a three-shot course of the Pfizer-BioNTech Covid-19 vaccine provided significant protection against the new omicron variant. The findings were similar to those presented by BioNTech and Pfizer earlier in the week, which were an early signal that booster shots could be key to protect against infection from the newly identified variant.”

“Retail CEOs Say Online Marketplaces Are Fueling ‘Flash Mob’ Robberies. They Want Congress To Step In.” (Washington Post). “In a letter signed by the chief executives of 20 retailers — including Best Buy, Target, Nordstrom, Home Depot and Dollar General — House and Senate leaders were urged to pass legislation that would make it harder for people to remain anonymous when they sell things online. Representatives of the Retail Industry Leaders Association, the trade group responsible for the letter, said every major online marketplace is regularly used to sell stolen items from fake online accounts.”

“Owner Of Private-Equity Firm Backed By Coors And Other Wealthy Families Is Accused Of Misusing Funds” (Wall Street Journal). “The Denver-area private-equity firm is owned and run by Hendrik Jordaan, a South African-born attorney…[t]he SEC investigation followed complaints to regulators that Mr. Jordaan was using seed money for a new fund to cover personal expenses and was charging fund investors for lavish travel costs, including for his wife, among other matters, according to the documents.”

What we’re reading (12/11)

“The Next Age Of The Internet Could Suck Power Away From Big Tech While Living On The Same Backbone As Cryptocurrencies. Here's What To Know About Web3.” (Insider). “In the next era of the internet, you won't have a social account for each platform. Instead, you'll have a single social account, able to move with it from Facebook and Twitter, to Google, shopping websites, and more. Your moves may be cataloged on the same digital backbone that supports cryptocurrencies like bitcoin — blockchain — instead of massive corporate servers like Amazon Web Services. And this new iteration of the internet won't be controlled by a central power, meaning no single entity will govern it as Facebook, Google, and others govern their own empires.”

“This Surprising Investing Strategy Crushes The Stock Market Without Examining A Single Financial Metric” (MarketWatch). “I am not a professional stock picker, but over the past decade my portfolio has beaten the stock market by a factor of three to one. Unlike Peter Lynch, who advocated investing in the makers of products you love and who, in my estimation, stands out as one of the greatest of all stock pickers, I did not examine a single financial metric to build my portfolio. Instead, I simply ranked competitors in each industry based on customer love and then bet on the winner. My portfolio has performed so well because the market undervalues the economic power of customer love.”

“Managing Across The Corporate Life Cycle: CEOs And Stock Prices!” (Prof. Aswath Damodaran, Musings On Markets). “The notion that there is a collection of characteristics that makes a person a great CEO for a company, no matter what its standing, is deeply held and fed into by both academics and practitioner…[but] [i]f there is a take away from bringing a life cycle perspective to assessing CEO quality, it is that one size cannot fit all, and that a CEO who succeeds at a company at one stage in the life cycle may not have the qualities needed to succeed at another.”

“Why Are Lawyers Doing The Work Of Lawmakers?” (DealBook). “For aficionados of high-stakes litigation, this legal 3-D chess can be pretty exciting. But how should others think about these kinds of lawsuits? Plaintiffs’ lawyers say that they step in to redress wrongs because, far too often, the government won’t — and because there is no other way to get compensation to victims. But critics contend that using class action suits is far from an ideal way to obtain justice. For one thing, they say, the potential multimillion-dollar fee is too often the main motivation for the lawyers. For another, the results are often uneven[.]”

“The Cultural Origins Of The Demographic Transition In France” (Guillaume Blanc, Brown University). “This research shows that secularization accounts for the early decline in fertility in eighteenth-century France. The demographic transition, a turning point in history and an essential condition for development, took hold in France first, before the French Revolution and more than a century earlier than in any other country. Why it happened so early is, according to Robert Darnton, one of the “big questions of history” because it challenges historical and economic interpretations and because of data limitations at the time. I comprehensively document the decline in fertility and its timing using a novel crowdsourced genealogical dataset.”

What we’re reading (12/10)

“U.S. Inflation Hit A 39-Year High In November” (Wall Street Journal). “U.S. inflation reached a nearly four-decade high in November, as strong consumer demand collided with pandemic-related supply constraints. The Labor Department said the consumer-price index—which measures what consumers pay for goods and services—rose 6.8% in November from the same month a year ago. That was the fastest pace since 1982 and the sixth straight month in which inflation topped 5%.”

“Why High Inflation Will Persist In America Well Into The New Year” (The Economist). “If these headlines about inflation highs seem like clockwork in America, that is because, to a significant extent, they now are. Such are the basic mathematics of year-on-year price trends. The surge in inflation since the start of 2021 means that it is guaranteed to remain elevated in annual terms for a while to come. A relatively optimistic forecast would have inflation returning to its pre-pandemic norm only at the very end of 2022.”

“Reasons For Optimism After A Difficult Year” (Bill Gates). “I am hopeful…that the end [of the pandemic] is finally in sight. It might be foolish to make another prediction, but I think the acute phase of the pandemic will come to a close some time in 2022.”

“A Better Deal For The World's Workers” (Dani Rodrik, Project Syndicate). “In developing countries, where standard economic theory predicted that workers would be the main beneficiary of the expanding global division of labor, corporations and capital again reaped the biggest gains. A forthcoming book by George Washington University’s Adam Dean shows that even where democratic governments prevailed, trade liberalization went hand in hand with repression of labor rights.”

“Do Portfolios Have A UAP Risk?” (Financial Times). “What’s curious, then, is the degree to which markets have thus far ignored what is becoming the transformation of one of the greatest unknown unknowns of all time into a known unknown. We are, of course, talking about the growing seriousness with which both Pentagon officials and Congress have starting taking the phenomenon of so-called Unidentified Aerial Phenomena (UAP) -- more colloquially known as UFOs.”

What we’re reading (12/9)

“Hedge Funds’ November Performance Worst Since March 2020” (Reuters). “Hedge funds posted their worst performance in 20 months in November, after a global market selloff sparked by concerns over the Omicron COVID variant, according to data from HedgeFund Research. Financial markets went into a tailspin in the final week of November with U.S. stocks losing nearly 4% in the last five trading sessions of the month, after news of the variant hit headlines. Currency and bond market volatility also jumped.”

“Investors Brace For The Highest Inflation Reading In Nearly 40 Years” (CNBC). “Wall Street expects the the index to reflect a 0.7% gain for the month, which would translate into a 6.7% increase from a year ago, according to Dow Jones estimates. Excluding food and energy, so-called core CPI is projected to rise 0.5% on a monthly basis and 4.9% on an annual basis. If those estimates are correct, it would be the highest year-over-year reading for headline CPI since June 1982[.]”

“Half A Billion In Bitcoin, Lost In The Dump” (The New Yorker). “Bitcoin is…easy to lose. Conventional money comes full of safeguards: paper currency is distinctively colored and has a unique feel; centuries of design have gone into folding wallets and zippered purses. And once your money is deposited in a bank you have a record of what you own. If you lose your statement, the bank will send you another. Forget your online password and you can reset it. The sixty-four-character private key for your bitcoin looks like any other computer rune and is nearly impossible to memorize.”

“The Best Way To Fix America’s Chip Shortage” (Pat Gelsinger, Intel CEO). “Federal support would even the playing field and unlock tens of billions of dollars in private investment here at home. That's why Congress must fund the CHIPS for America Act, which will invest $52 billion in domestic semiconductor capacity and capability. The bill would provide billions in funding for manufacturing and R&D grants, invest heavily in advanced manufacturing and semiconductor research, establish public-private partnerships focused on the development of advanced microelectronics, and secure supply chains.”

“Better.Com CEO Apologizes To Remaining Staff For Mass Layoffs Over Zoom” (New York Post). “In a Zoom call last Wednesday, Garg callously laid off some 900 employees — then slammed hundreds of the ex-workers for allegedly ‘stealing from our customers’ by not being productive. In the wake of the mass termination, which was posted on TikTok and YouTube, at least three top executives have resigned from the company, Insider first reported.”

What we’re reading (12/8)

“Pfizer Says Booster Neutralized Omicron But Variant May Elude Two Doses” (Wall Street Journal). “Pfizer Inc. and BioNTech SE said that a third dose of their Covid-19 vaccine neutralized the Omicron variant in lab tests but that the two-dose regimen was significantly less effective at blocking the virus. A third dose increased antibodies 25-fold compared with two doses against the Omicron variant, the companies said.”

“Americans’ Pandemic-Era ‘Excess Savings’ Are Dwindling for Many” (New York Times). “Infusions of government cash that warded off an economic calamity have left millions of households with bigger bank balances than before the pandemic — savings that have driven a torrent of consumer spending, helped pay off debts and, at times, reduced the urgency of job hunts. But many low-income Americans find their savings dwindling or even depleted. And for them, the economic recovery is looking less buoyant.”

“Where Are All The Gig Workers And What Are They Doing?” (Bloomberg). “The Great Resignation is turning into the biggest economic puzzle of our time. Quits are up and hires are down, and employers from investment banks to McDonald's Corp. are complaining they can’t find workers. Where have people gone? It could be they are trying something new: life as an independent contractor or gig worker.”

“The Stock Market’s Covid Pattern: Faster Recovery From Each Panic” (New York Times). “The stock market has often been a barometer for the path of the pandemic, tumbling after concerning milestones, and rising on advancements of vaccinations and new treatments. But the two haven’t always moved in lock step, and Wall Street’s performance has at times disregarded the human toll of the pandemic as it instead zeroed in on other factors that could drive corporate profits, like low interest rates and government spending.”

“NFT Project Sells For $91.8m, Debatably Achieving The Highest Price Ever For A Work By A Living Artist” (The Art Newspaper). “Sold from Thursday through Saturday in an open edition on the NFT platform Nifty Gateway, more than 28,000 buyers spent an eye-watering total of $91.8m to acquire 266,445 total units of mass (for those who did not join in on the sale, ‘mass’ is analogous to ‘digital token’ and allows for some interesting wordplay with the terms of the sale). According to Nifty Gateway that could make this sale the most expensive ever for a work by a living artist.”