What we’re reading (12/17)

“Bitcoin ‘May Not Last That Much Longer,’ Academic Warns” (CNBC). “‘Bitcoin’s use of the blockchain technology is not very efficient,’ said [Prof. Eswar] Prasad, who is the author of ‘The Future of Money: How the Digital Revolution is Transforming Currencies and Finance.’ The cryptocurrency ‘uses a validation mechanism for transactions that is environmentally destructive’ and ‘doesn’t scale up very well,’ he explained. Indeed, bitcoin’s carbon footprint is bigger than the whole of New Zealand. Prasad said some of the newer cryptocurrencies use blockchain technology far more efficiently than bitcoin does.”

“America’s Future Depends On The Blockchain” (Jay Clayton, Wall Street Journal). “While securities trading and other financial transactions may appear instantaneous, many back-end processes still move at a snail’s pace in rigid sequences set decades ago. A mortgage payment isn’t completed when the funds leave the homeowner’s bank account. Those funds have many hands to go through before they come to rest, days or weeks later. Through tokenization, many of these cumbersome and costly processes can be streamlined with better market information, greater certainty and enhanced security.”

“AQR: The 60-40 Portfolio Won’t Protect Investors Anymore” (Institutional Investor). “While a mix of stocks and bonds has provided investors with solid diversification benefits over the last decade, that effect will likely be reduced in the coming years, according to a report by the investment firm AQR.”

“The Risk Of Avoiding Emerging Markets” (New York Times). “Numerous studies, including those by Vanguard and Morgan Stanley, show that over extended periods, the stock returns of emerging markets and developed countries like the United States don’t move in lock step most of the time. Over the long term, this low correlation means that adding emerging market exposure to predominantly American investments can reduce the overall portfolio’s volatility and enhance returns.”

“Smartphones Are A New Tax On The Poor” (Wired). “Smartphones and on-the-go internet access have made many of our working lives more efficient and flexible. But the requirement for constant connectivity isn’t only a fact of white-collar work—it has spread to workers up and down the income ladder. And while the requirement has spread, the resources that workers need to maintain it are not evenly distributed. Today, more than a quarter of low-income Americans depend solely on their phones for internet access.”

What we’re reading (12/16)

“The ‘To the Moon’ Crash Is Coming” (Vice). “The market today reminds [venture capitalist Josh] Wolfe in many ways of the same forces that were so prominent at the height of the dot com boom, and perhaps no single person better encapsulates the moment than the world’s richest man, Elon Musk. Motherboard spoke to Wolfe about the worrying signs he sees, and the downside of prioritizing hype over fundamentals.”

“Why Jerome Powell Pivoted On Inflation” (New York Times). “Inflation has been building for months. But it was over 13 days this fall that Jerome Powell, the Federal Reserve chair, decided the central bank needed to get more serious about trying to choke it off.”

“The Bank Of England Surprises Investors By Raising Interest Rates” (The Economist). “The Bank of England has sprung its second surprise in as many months. In November it failed to raise interest rates after it had steered markets to expect an increase. On December 16th it did raise rates after all, surprising investors—despite the most obvious change in the economic outlook being a worsening of the pandemic. The bank’s monetary policy-committee voted by a margin of eight to one to raise interest rates from 0.1% to 0.25%. That makes Britain the first big rich economy to experience interest-rate rises since the pandemic struck.”

“Inside Wall Street's Culture War With Gen Z” (Insider). “[M]ost Gen Z analysts and interns ‘are looking to have work-life balance. They're not willing to go through the hazing and the boot-camp type mentality,’ added [Patrick] Curtis, [former investment banker and] the founder of Wall Street Oasis, an online water cooler for the finance industry where insiders trade secrets and commiserate with one another.”

“Beware Prophecies Of Civil War” (The Atlantic). “[F]everish talk of civil war has the paradoxical effect of making the current reality seem, by way of contrast, not so bad. The comforting fiction that the U.S. used to be a glorious and settled democracy prevents any reckoning with the fact that its current crisis is not a terrible departure from the past but rather a product of the unresolved contradictions of its history. The dark fantasy of Armageddon distracts from the more prosaic and obvious necessity to uphold the law and establish political and legal accountability for those who encourage others to defy it.”

What we’re reading (12/15)

“How Millions Of Jobless Americans Can Afford To Ditch Work” (CNN Business). “One of the more insidious myths this year was that young people didn't want to work because they were getting by just fine on government aid. People had too much money, went the narrative. Only trouble is, the numbers don't back it up. Instead, early retirement — whether forced by the pandemic or made possible otherwise — is playing a big role in America's evolving labor market.”

“The Treasury Has A Bond Bargain For You” (Wall Street Journal). “Invest in U.S. Treasury I Bonds. These bonds pay a fixed rate for the life of the bond, plus the annualized CPI inflation rate. With the interest compounded semiannually, these I Bonds will pay a total annualized interest rate of 7.12% through April 2022, well in excess of any other safe yield obtainable. You can never receive a negative real yield, and the combined interest rate can never be less than zero even if the price level declines.”

“NFTs Explained: Why People Are Spending Millions Of Dollars On JPEGs” (CNET). “When you see a headline or a tweet about some preposterous sum being spent on an NFT, it's easy to become bewildered over how absurd that purchase would be for you. What's easy to forget is that very expensive things are almost exclusively bought by very rich people -- and very rich people spend a lot on status symbols.”

“Burying The Laissez-Faire Zombie” (Prof. Luigi Zingalez, Project Syndicate). “The main divide…is not between the state and markets, but between procompetitive and anticompetitive rules. And within the universe of anticompetitive rules, the key distinction is between those that are justified by a higher principle and those that are not.”

“‘15 Minutes To Save The World’: A Terrifying VR Journey Into The Nuclear Bunker” (The Guardian). “In 1979, the world came within minutes of nuclear war because someone had left a training tape simulating a Russian attack in the early warning system monitors. In September 1983, Russian computers erroneously showed incoming US missiles. Armageddon was only averted because the duty officer, Lieutenant Colonel Stanislav Petrov, went against protocols and decided not to act on the alert because his gut told him it was a glitch.”

What we’re reading (12/14)

“We Need To Do Hard But Necessary Things To Tackle Inflation” (Glenn Hubbard, New York Times). “The Fed must begin tapering asset purchases more aggressively now…[t]he Fed should also raise its benchmark federal funds rate in early 2022. This is a short-term interest rate at which banks borrow and lend reserve balances with one another. He should also be prepared to make further adjustments should macroeconomic conditions, including broader and longer-lasting inflation, demand it.”

“Surging US Producer Prices Add To Pressure On Fed To Accelerate Taper” (Financial Times). “The producer price index published by the Bureau of Labor Statistics on Tuesday jumped 0.8 per cent in November, for an annual increase of 9.6 per cent. That is the fastest year-over-year rate since the data were first collected in 2010.”

“The Federal Reserve Is Expected To Take A Very Big Step Toward Its First Rate Hike” (CNBC). “The Federal Reserve is expected to announce a dramatic policy shift Wednesday that will clear the way for a first interest rate hike next year. Markets are anticipating the Fed will speed up the wind-down of its bond buying program, changing the end date to March from June. That would free the central bank to start raising interest rates from zero, and Fed officials are expected to release a new forecast showing two to three interest rate hikes in 2022 and another three to four in 2023.”

“FOMC Preview: Is The Fed Behind The Curve On Inflation?” (Yahoo!Finance). “How fast does the Federal Reserve want to move on drawing down its pandemic-era stimulus? That’s the question that Fed officials will have to answer in its two-day meeting kicking off Tuesday, where the major discussion will focus on the pace of the central bank’s wind down of its asset purchase program.”

“Millennials Are Supercharging The Housing Market” (Wall Street Journal). “For years, conventional wisdom held that millennials, born from 1981 to 1996, would become the generation that largely spurned homeownership. Instead, since 2019, when they surpassed the baby boomers to become the largest living adult generation in the U.S., they have reached a housing milestone, accounting for more than half of all home-purchase loan applications last year.”

What we’re reading (12/13)

“US Small-Cap Stocks Trade At Historic Discount To Corporate Titans” (Financial Times). “Smaller US-listed companies are trading at a steep discount compared with their larger peers, highlighting how corners of the market remain relatively inexpensive despite the big rally from the depths of the coronavirus crisis. The S&P 600 gauge tracking the smallest stocks by market value on the index provider’s composite US equities barometer is priced at 14.5 times expected earnings over the next year, according to FactSet data. The valuation is well below the 21.3-times for the benchmark S&P 500 index, which tracks America’s corporate behemoths such as Apple, Facebook and Tesla.”

“‘We’re Starting To See’ Venture Capital Shift From Silicon Valley, AOL Co-Founder Explains” (Yahoo!Finance). “In 2021, more than $13 billion of Silicon Valley venture capital dollars flowed to regions outside of the Bay Area, New York, and Boston. That's the first time in a decade that less than 30% of venture capital has gone to Silicon Valley startups. As recently as 2017, that figure was above 50%. The report's authors found that the share of seed- and early-stage venture capital dollars going to startups in the Bay Area and the other two major tech hotspots has been declining over the past decade.”

“Vox Media, Group Nine Media In Advanced Talks To Merge” (Wall Street Journal). “The companies are discussing an all-stock transaction that would give Vox Media 75% ownership of the combined company, with the remaining 25% going to Group Nine Media, the people said. Vox Media Chief Executive Jim Bankoff would helm the company, the people said…[d]igital media executives say the industry is primed for consolidation. Many players believe they need more scale to compete effectively for online ad dollars and expand further in areas such as e-commerce, events and podcasting.”

“The Top 0.1% Got A Nearly 10% Percent Raise In 2020 — That’s Five Times More Than The Bottom 90%” (Insider). “ the top 1% of Americans earned 13.8% of wages in 2020, according to EPI's analysis of Social Security Administration data. Meanwhile, everyone else earned 60.2%. That was wage growth of 9.9% for the top 0.1% alone, compared to 1.7% for the bottom 90%. It's the latest acceleration of a trend that kicked off in 1979. Since then, the top 1% has seen their wages grow by 179.3%. And, if you're one of the few in the top 0.1%, your wages have gone up by 389.1% over the past four years alone.”

“Facebook: It’s Not Our Fault People Want COVID Misinformation” (Vanity Fair). “Speaking in an interview Sunday with Axios on HBO, longtime Facebook executive Andrew Bosworth brushed off responsibility for the platform’s role in allowing misinformation about public health and politics to proliferate, claiming that lies and conspiracy theories were problems with society and individuals rather than the company. ‘Individual humans are the ones who choose to believe or not believe a thing,’ Bosworth said. ‘They are the ones who choose to share or not share a thing.’”

What we’re reading (12/12)

“ETF Inflows Top $1 Trillion For First Time” (Wall Street Journal). “A historic surge of cash has swept into exchange-traded funds, spurring asset managers to launch new trading strategies that could be undone by a market downturn. This year’s inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year’s total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushed global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.”

“2021 Has Been A Record-Breaking Year For Venture Capital” (Insider). “While the year isn't over — fourth-quarter results have not been tallied — 2021 was the first year that global venture funding surpassed $100 billion in a quarter, and it did so in each of the first three quarters, according to Crunchbase. Funding reached $135 billion in the first quarter, $159 billion in the second, and $160 billion in the third, Crunchbase said.”

“Israeli Study Finds Pfizer Covid Booster Protects Against Omicron Variant” (CNBC). “Israeli researchers said on Saturday they found that a three-shot course of the Pfizer-BioNTech Covid-19 vaccine provided significant protection against the new omicron variant. The findings were similar to those presented by BioNTech and Pfizer earlier in the week, which were an early signal that booster shots could be key to protect against infection from the newly identified variant.”

“Retail CEOs Say Online Marketplaces Are Fueling ‘Flash Mob’ Robberies. They Want Congress To Step In.” (Washington Post). “In a letter signed by the chief executives of 20 retailers — including Best Buy, Target, Nordstrom, Home Depot and Dollar General — House and Senate leaders were urged to pass legislation that would make it harder for people to remain anonymous when they sell things online. Representatives of the Retail Industry Leaders Association, the trade group responsible for the letter, said every major online marketplace is regularly used to sell stolen items from fake online accounts.”

“Owner Of Private-Equity Firm Backed By Coors And Other Wealthy Families Is Accused Of Misusing Funds” (Wall Street Journal). “The Denver-area private-equity firm is owned and run by Hendrik Jordaan, a South African-born attorney…[t]he SEC investigation followed complaints to regulators that Mr. Jordaan was using seed money for a new fund to cover personal expenses and was charging fund investors for lavish travel costs, including for his wife, among other matters, according to the documents.”

What we’re reading (12/11)

“The Next Age Of The Internet Could Suck Power Away From Big Tech While Living On The Same Backbone As Cryptocurrencies. Here's What To Know About Web3.” (Insider). “In the next era of the internet, you won't have a social account for each platform. Instead, you'll have a single social account, able to move with it from Facebook and Twitter, to Google, shopping websites, and more. Your moves may be cataloged on the same digital backbone that supports cryptocurrencies like bitcoin — blockchain — instead of massive corporate servers like Amazon Web Services. And this new iteration of the internet won't be controlled by a central power, meaning no single entity will govern it as Facebook, Google, and others govern their own empires.”

“This Surprising Investing Strategy Crushes The Stock Market Without Examining A Single Financial Metric” (MarketWatch). “I am not a professional stock picker, but over the past decade my portfolio has beaten the stock market by a factor of three to one. Unlike Peter Lynch, who advocated investing in the makers of products you love and who, in my estimation, stands out as one of the greatest of all stock pickers, I did not examine a single financial metric to build my portfolio. Instead, I simply ranked competitors in each industry based on customer love and then bet on the winner. My portfolio has performed so well because the market undervalues the economic power of customer love.”

“Managing Across The Corporate Life Cycle: CEOs And Stock Prices!” (Prof. Aswath Damodaran, Musings On Markets). “The notion that there is a collection of characteristics that makes a person a great CEO for a company, no matter what its standing, is deeply held and fed into by both academics and practitioner…[but] [i]f there is a take away from bringing a life cycle perspective to assessing CEO quality, it is that one size cannot fit all, and that a CEO who succeeds at a company at one stage in the life cycle may not have the qualities needed to succeed at another.”

“Why Are Lawyers Doing The Work Of Lawmakers?” (DealBook). “For aficionados of high-stakes litigation, this legal 3-D chess can be pretty exciting. But how should others think about these kinds of lawsuits? Plaintiffs’ lawyers say that they step in to redress wrongs because, far too often, the government won’t — and because there is no other way to get compensation to victims. But critics contend that using class action suits is far from an ideal way to obtain justice. For one thing, they say, the potential multimillion-dollar fee is too often the main motivation for the lawyers. For another, the results are often uneven[.]”

“The Cultural Origins Of The Demographic Transition In France” (Guillaume Blanc, Brown University). “This research shows that secularization accounts for the early decline in fertility in eighteenth-century France. The demographic transition, a turning point in history and an essential condition for development, took hold in France first, before the French Revolution and more than a century earlier than in any other country. Why it happened so early is, according to Robert Darnton, one of the “big questions of history” because it challenges historical and economic interpretations and because of data limitations at the time. I comprehensively document the decline in fertility and its timing using a novel crowdsourced genealogical dataset.”

What we’re reading (12/10)

“U.S. Inflation Hit A 39-Year High In November” (Wall Street Journal). “U.S. inflation reached a nearly four-decade high in November, as strong consumer demand collided with pandemic-related supply constraints. The Labor Department said the consumer-price index—which measures what consumers pay for goods and services—rose 6.8% in November from the same month a year ago. That was the fastest pace since 1982 and the sixth straight month in which inflation topped 5%.”

“Why High Inflation Will Persist In America Well Into The New Year” (The Economist). “If these headlines about inflation highs seem like clockwork in America, that is because, to a significant extent, they now are. Such are the basic mathematics of year-on-year price trends. The surge in inflation since the start of 2021 means that it is guaranteed to remain elevated in annual terms for a while to come. A relatively optimistic forecast would have inflation returning to its pre-pandemic norm only at the very end of 2022.”

“Reasons For Optimism After A Difficult Year” (Bill Gates). “I am hopeful…that the end [of the pandemic] is finally in sight. It might be foolish to make another prediction, but I think the acute phase of the pandemic will come to a close some time in 2022.”

“A Better Deal For The World's Workers” (Dani Rodrik, Project Syndicate). “In developing countries, where standard economic theory predicted that workers would be the main beneficiary of the expanding global division of labor, corporations and capital again reaped the biggest gains. A forthcoming book by George Washington University’s Adam Dean shows that even where democratic governments prevailed, trade liberalization went hand in hand with repression of labor rights.”

“Do Portfolios Have A UAP Risk?” (Financial Times). “What’s curious, then, is the degree to which markets have thus far ignored what is becoming the transformation of one of the greatest unknown unknowns of all time into a known unknown. We are, of course, talking about the growing seriousness with which both Pentagon officials and Congress have starting taking the phenomenon of so-called Unidentified Aerial Phenomena (UAP) -- more colloquially known as UFOs.”

What we’re reading (12/9)

“Hedge Funds’ November Performance Worst Since March 2020” (Reuters). “Hedge funds posted their worst performance in 20 months in November, after a global market selloff sparked by concerns over the Omicron COVID variant, according to data from HedgeFund Research. Financial markets went into a tailspin in the final week of November with U.S. stocks losing nearly 4% in the last five trading sessions of the month, after news of the variant hit headlines. Currency and bond market volatility also jumped.”

“Investors Brace For The Highest Inflation Reading In Nearly 40 Years” (CNBC). “Wall Street expects the the index to reflect a 0.7% gain for the month, which would translate into a 6.7% increase from a year ago, according to Dow Jones estimates. Excluding food and energy, so-called core CPI is projected to rise 0.5% on a monthly basis and 4.9% on an annual basis. If those estimates are correct, it would be the highest year-over-year reading for headline CPI since June 1982[.]”

“Half A Billion In Bitcoin, Lost In The Dump” (The New Yorker). “Bitcoin is…easy to lose. Conventional money comes full of safeguards: paper currency is distinctively colored and has a unique feel; centuries of design have gone into folding wallets and zippered purses. And once your money is deposited in a bank you have a record of what you own. If you lose your statement, the bank will send you another. Forget your online password and you can reset it. The sixty-four-character private key for your bitcoin looks like any other computer rune and is nearly impossible to memorize.”

“The Best Way To Fix America’s Chip Shortage” (Pat Gelsinger, Intel CEO). “Federal support would even the playing field and unlock tens of billions of dollars in private investment here at home. That's why Congress must fund the CHIPS for America Act, which will invest $52 billion in domestic semiconductor capacity and capability. The bill would provide billions in funding for manufacturing and R&D grants, invest heavily in advanced manufacturing and semiconductor research, establish public-private partnerships focused on the development of advanced microelectronics, and secure supply chains.”

“Better.Com CEO Apologizes To Remaining Staff For Mass Layoffs Over Zoom” (New York Post). “In a Zoom call last Wednesday, Garg callously laid off some 900 employees — then slammed hundreds of the ex-workers for allegedly ‘stealing from our customers’ by not being productive. In the wake of the mass termination, which was posted on TikTok and YouTube, at least three top executives have resigned from the company, Insider first reported.”

What we’re reading (12/8)

“Pfizer Says Booster Neutralized Omicron But Variant May Elude Two Doses” (Wall Street Journal). “Pfizer Inc. and BioNTech SE said that a third dose of their Covid-19 vaccine neutralized the Omicron variant in lab tests but that the two-dose regimen was significantly less effective at blocking the virus. A third dose increased antibodies 25-fold compared with two doses against the Omicron variant, the companies said.”

“Americans’ Pandemic-Era ‘Excess Savings’ Are Dwindling for Many” (New York Times). “Infusions of government cash that warded off an economic calamity have left millions of households with bigger bank balances than before the pandemic — savings that have driven a torrent of consumer spending, helped pay off debts and, at times, reduced the urgency of job hunts. But many low-income Americans find their savings dwindling or even depleted. And for them, the economic recovery is looking less buoyant.”

“Where Are All The Gig Workers And What Are They Doing?” (Bloomberg). “The Great Resignation is turning into the biggest economic puzzle of our time. Quits are up and hires are down, and employers from investment banks to McDonald's Corp. are complaining they can’t find workers. Where have people gone? It could be they are trying something new: life as an independent contractor or gig worker.”

“The Stock Market’s Covid Pattern: Faster Recovery From Each Panic” (New York Times). “The stock market has often been a barometer for the path of the pandemic, tumbling after concerning milestones, and rising on advancements of vaccinations and new treatments. But the two haven’t always moved in lock step, and Wall Street’s performance has at times disregarded the human toll of the pandemic as it instead zeroed in on other factors that could drive corporate profits, like low interest rates and government spending.”

“NFT Project Sells For $91.8m, Debatably Achieving The Highest Price Ever For A Work By A Living Artist” (The Art Newspaper). “Sold from Thursday through Saturday in an open edition on the NFT platform Nifty Gateway, more than 28,000 buyers spent an eye-watering total of $91.8m to acquire 266,445 total units of mass (for those who did not join in on the sale, ‘mass’ is analogous to ‘digital token’ and allows for some interesting wordplay with the terms of the sale). According to Nifty Gateway that could make this sale the most expensive ever for a work by a living artist.”

What we’re reading (12/7)

“The Great Labor Market Shakeup” (Brad DeLong, Project Syndicate). “What is going on in the US labor market? In normal times, the current figures would suggest that America is dealing with a great shortage of jobs. And yet, workers’ outsized willingness to quit their jobs and look for something better indicates that these are not normal times.”

“BuzzFeed’s A Public Company. Now what?” (Vox). “It’s not nearly as sexy a story as it was six or seven years ago, when BuzzFeed’s existence — along with other publishers like the Huffington Post and my employer, Vox Media — worried the New York Times enough that the paper created a what-do-we-do-now internal report dedicated to fending off the insurgents…A more concrete way of putting it: As of last week, BuzzFeed was valued at $1.5 billion — less than the $1.7 billion investors thought it was worth back in 2016, even though it has since acquired both HuffPost and Complex, both big publishers in their own right.”

“AB InBev Chief Dismisses Notion Beer Is Losing Ground To Spirits” (Financial Times). “‘Beer is big, beer is profitable and beer is growing,’ said Michel Doukeris, who this year took charge of the group behind Budweiser, Stella Artois and Corona. ‘For too long there [have been] people saying the opposite without showing the data.’”

“The CIA Is Deep Into Cryptocurrency, Director Reveals” (Vice). “There's a long-running conspiracy theory among a small number of cryptocurrency enthusiasts that Bitcoin's anonymous inventor, Satoshi Nakamoto, was actually the CIA or another three-lettered agency. That fringe theory is having a fresh day in the sun after CIA Director William Burns said on Monday that the intelligence agency has ‘a number of different projects focused on cryptocurrency’ on the go.”

“CNN And Chris Cuomo Are On The Brink Of All-Out War” (Vanity Fair). “Both sides are lawyering up and issuing dueling statements, as the former host’s past comes under renewed scrutiny. CNN also needs to fill a gaping prime-time hole (don’t count on Jake Tapper), and one talent agent suggests a path for Cuomo: ‘He could start a YouTube channel like Megyn Kelly.’”

What we’re reading (12/6)

“Stock Market Trends For 2022” (U.S. News & World Report). “The rise in interest rates is going to be a change for the markets. But it won’t necessarily hurt the appetite for investing in stocks. Rather, it could degrade the performance of some corners of the market, particularly growth stocks, which would favor value-oriented names, says James Ragan, director of wealth management research at D.A. Davidson in Seattle.”

“Dow Climbs More Than 600 Points Amid Renewed Volatility” (CNN Business). “‘We have quadruple expiration [of contracts] a week from Friday so we see those portfolios being changed around,’ [TD Ameritrade Chief Market Strategist J.J.] Kinahan told CNN Business. ‘And at the same time, it's the end of the year. The Nasdaq had a good run and people are repositioning for 2022.’”

“Stocks Get a Boost As Omicron Concerns Ease” (Wall Street Journal). “The S&P 500 recouped nearly all its losses for all of last week on Monday, and the Dow Jones Industrial Average more than regained what it had lost. Oil prices and bond yields also rose. Markets have whipsawed in recent days because of rising concerns about the new variant, which has clouded the market with uncertainty.”

“Why the Fed Chair Won’t Call Inflation ‘Transitory’ Anymore” (New York Times). “You might think the new Omicron variant of the coronavirus would make Powell and his fellow rate-setters reluctant to remove monetary stimulus. But while Omicron might cause the economy to grow more slowly, it won’t necessarily curb inflation. It could even make it worse if it suppresses the supply of goods and services — say, by forcing manufacturers and shippers to curtail operations. Powell cited ‘increased uncertainty’ about inflation as a result of Omicron in his prepared congressional testimony.”

“Why Have Prices Of Cryptocurrencies, Such As Bitcoin, Fallen—Again?” (The Economist). “The price of bitcoin, the world’s most popular cryptocurrency, fell by almost 20% at the weekend, from around $57,000 on December 3rd to $45,000 the next day (it has since partially recovered, to around $49,000). Other popular coins, including Ethereum, shed a similar proportion of their value. The market capitalisation of all crypto assets fell by $400bn to $2trn, before picking up slightly. Why did prices fall, and what makes cryptocurrencies so volatile?”

What we’re reading (12/5)

“Small-Cap Stocks Hit Hard by Covid-19 Omicron Variant” (Wall Street Journal). “The emergence of the Covid-19 Omicron variant has pummeled small-cap stocks. The Russell 2000 benchmark has dropped 7.4% since Thanksgiving, when the fast-spreading new variant made headlines. Last week, the index fell into a correction, declining more than 10% from its November record. The S&P 500 large-cap index, by comparison, has shed 3.5% since the variant news.”

“Market History Says Omicron Volatility Isn’t A Reason For Investors To Sell” (CNBC). “[T]here isn’t any instance across the 19 biggest VIX spikes of the past three decades after which stocks weren’t positive a majority of the time one month, three months, six months, and one year later. One month later, stocks were only up an average of 1%, but were positive 70% of the time, and the numbers get better with time.”

“Argentina’s Losing Streak In U.S. Court Alive And Well” (Dealbreaker). “[I]t’s no wonder [Argentine Vice President Cristina Fernandez de] Kirchner’s closest allies wanted the ability to do to recalcitrant American jurists what Argentina does with them, and equally little wonder Paul Singer refused to have anything to do with those restructured bonds. It’s probably a great surprise to all of those hedge funds who thought Argentina’s defaulting days were passed it.”

“The Las Vegas Strip’s Latest $4.3 Billion Crypto-Friendly Hotel Has $15,000-A-Night ‘Villas’ And ‘Palaces’ — See What It’s Like To Stay In One” (Insider). “Viva Las Vegas — in June, Resorts World Las Vegas, the Strip's first new casino resort in over a decade, officially opened its doors as the hospitality industry began its COVID-19 recovery…[b]ut unlike many of the Strip predecessors, Resorts World's amenities have a tech-friendly twist, such as the option to pay with cryptocurrency.”

“True Colors: 72 Hours Inside The Spend-Athon At Art Basel Miami Beach 2021” (Vanity Fair). “The city is right now experiencing a perfect storm of profligate check-signing. There’s been two years of wealth creation at the tippy top of the economic mountain, and at the same time the remote-working finance bros and metaverse-inhabiting tech tycoons have stampeded to tax-break-happy Florida, making this year’s Miami edition of Basel the Super Bowl of branding and the Oscars of luxury sales. The seemingly overnight creation of a $10 billion NFT market is already rivaling the art market as a whole.”

What we’re reading (12/4)

“Is Private Equity Overrated?” (DealBook). “[P]rivate equity has become the hottest home for institutional money, whether that of pension funds, endowments or sovereign wealth funds…[b]ut private equity’s returns increasingly may not provide the stellar performance that investors have been sold — and the returns can be misleadingly calculated in a way that overstates success.”

“Personal Data Is Worth Billions. These Startups Want You To Get A Cut.” (Wall Street Journal). “In his [Frank McCourt’s] vision, blockchain software, not owned by any individual, would store indelible information about users’ social connections. After getting permission from users, social-media companies would draw from this same pool of data about users’ connections and interactions. Theoretically, this would allow users to move their data between networks and prevent a single company from becoming too powerful. Users could get paid in a cryptocurrency for the use of their data.”

“Traders Signal Fed Overshooting Outlook For Interest-Rate Hikes” (Bloomberg). “In one corner of the U.S. rates market, traders have begun to contemplate the possibility of Federal Reserve rate cuts in 2025. That’s what the eurodollar futures market is predicting, as short-term interest-rate traders are pricing in a substantially lower peak for the Fed’s policy rate than the central bank expects. In other words, they are saying that the U.S. economy can’t cope with the number of rate hikes Fed officials are forecasting.”

“More Than $100 Million Of Metaverse Land Was Sold In The Last Week Alone. The Co-Founder Of A Virtual Real Estate Company Breaks Down Why The Opportunity In Digital Properties Could Rise 200x In 16 Months.” (Insider). “The sudden boom in virtual real estate investing strikes many investors as speculative and unsustainable, yet [Metaverse Co-Founder Michael] Gord said the trend is early enough that purchasing virtual lands is almost equivalent to buying pixels of a website in the early days of the internet, which was not possible.”

“How To Generate Better, Cheaper, More Abundant Random Numbers” (The Economist). “Randomness is a valuable commodity. Computer models of complex systems ranging from the weather to the stockmarket are voracious consumers of random numbers. Cryptography, too, relies heavily on random numbers for the generation of unbreakable keys. Better, cheaper ways of generating and handling such numbers are therefore always welcome. And doing just that is the goal of a project with the slightly tongue-in-cheek name of coinflips, which allegedly stands for Co-designed Improved Neural Foundations Leveraging Inherent Physics Stochasticity.”

What we’re reading (12/3)

“Can the Fed Overcome Its Transitory Policy Mistake?” (Mohamed El-Erian, Project Syndicate). “Many rightly note that the Fed does not have the tools to unblock supply chains or increase labor-force participation. But if the Fed had maintained even longer this transitory inflation mindset, it risked unleashing another strong driver of future price increases – that of unanchored inflation expectations. And while this would not mean a return to the double-digit inflation rates of the 1970s, it would result in the persistence of inflation rates significantly above what the economy and financial markets are safely wired for.”

“3 Jobs Trends To Look Out For Next Year” (CNN Business). “Expect strong job growth in 2022, unless Omicron hits hard…[l]abor shortages and rapid wage growth will continue…[r]emote work's impact may be bigger than expected[.]”

“America Is Running On Fumes” (The Atlantic). “If you believe in the virtue of novelty, these are disturbing trends. Today’s scientists are less likely to publish truly new ideas, businesses are struggling to break into the market with new ideas, U.S. immigration policy is constricting the arrival of people most likely to found companies that promote new ideas, and we are less likely than previous generations to build institutions that advance new ideas.”

“Turkey’s Economic Turmoil Sends Desperation And Inflation Soaring” (The Atlantic). “The Turkish lira has lost as much as 45% of its value this year, making ordinary Turks poorer. The pandemic-era consumer-price increases that have plagued economies across the world are supersize in Turkey, where inflation stands at more than 21%. People here are rushing to trade their shrinking wages for dollars and gold, are eating out less and are having more trouble finding imported goods, including medicine.”

“Your Future Landlord Just Outbid You For That House” (New York Times). “During the third quarter of 2021, investors bought more than 18 percent of the homes sold in the United States — about 90,000 homes in all, for a total of about $64 billion. That’s the highest share and the largest number in any quarter on record, according to a new report by Redfin.”

What we’re reading (12/2)

“Stocks Finish Higher After Omicron-Driven Selloff” (Wall Street Journal). “Equities rose, with the S&P 500 and Dow Jones Industrial Average more than recouping Wednesday’s losses. Oil prices and bond yields rose. Investors already confronting rising inflation are now also evaluating the likelihood that Omicron could spur changes in government or monetary policy, which has led to pronounced volatility in recent sessions.”

“Do We Really Need A 24-Hour Economy?” (The Nation). “[R]unning West Coast ports 24/7 won’t solve the supply-chain problem, not when there aren’t enough truckers to carry that critical patio furniture to Home Depot. The shortage of such drivers arises because there’s more demand than ever before, and because many truckers have simply quit the industry. As The New York Times reports, ‘Long hours and uncomfortable working conditions are leading to a shortage of truck drivers, which has compounded shipping delays in the United States.’”

“The FAANG Market Is Fading” (Morningstar). “Heading into the final weeks of 2021, an important trend has emerged in the stock market: The hyper-concentration of returns that saw a handful of stocks responsible for much of the gains last year has faded. Some of the largest stocks in the market still dominate returns to a degree that's greater than in previous years…[b]ut the trend in 2021 has shifted toward a lesser degree of concentration of returns. For investors, this is a potentially healthier dynamic, with less risk for index-tracking funds and more opportunities for stock-pickers.”

“I Lost $400,000, Almost Everything I Had, On A Single Robinhood Bet” (Vice). “I just went all in on this one single stock option: The $200 strike price call option on Alibaba…I initially invested $300,000 in February, basically every single liquid asset in my account. Not retirement, but everything cash. I didn't have anything left. My thesis was I might not make a lot of money, but I won’t lose much. The downside seemed limited, and that if worse comes to worse, it would go down to like $280,000…in July, I put in another almost $100,000…[t]he whole $400,000 turned to almost zero.”

“Nobel-Winning Stock Market Theory Used To Help Save Coral Reefs” (The Guardian). “A Nobel prize-winning economic theory used by investors is showing early signs of helping save threatened coral reefs, scientists say. Researchers at Australia’s University of Queensland used modern portfolio theory (MPT), a mathematical framework developed by the economist Harry Markowitz in the 1950s to help risk-averse investors maximise returns, to identify the 50 reefs or coral sanctuaries around the world that are most likely to survive the climate crisis and be able to repopulate other reefs, if other threats are absent.”

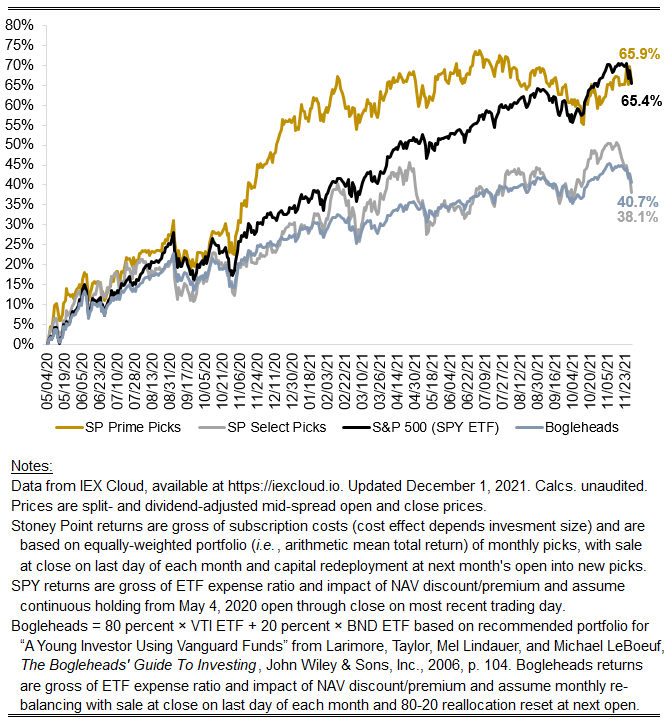

November 2021 performance update

Hi friends, here with a monthly performance update. Here are the monthly numbers:

Prime: +3.56%

Select: -5.94%

S&P 500-tracking “SPY” ETF: -1.03%

Bogleheads: -1.35%

November was a wild month:

A large number of companies reported quarterly earnings (including some of our picks)

Global supply chain issues remained pervasive globally ahead of the hugely important holiday season

The Bureau of Labor Statistics reported that consumer prices rose 6.2 percent (year-over-year) in October, the fastest increase in 30 years

The Fed announced plans to begin tapering asset purchases—and then, subsequently (on the last trading day of the month)—announced it would discuss the possibility of accelerating its tapering in its December meeting

The WHO declared the Omicron variant of the novel coronavirus a “variant of concern” on the third-to-last trading day of the month

Amid this chaotic news flow, equities as an asset class (but not the only asset class!) experienced elevated volatility, particularly in the last few trading sessions as markets digested the bits of information coming out about the new covid variant and assessed the valuation consequences of that information. To give a flavor of just how crazy the last few days have been, I took a look at the volatility (i.e., standard deviation) of daily returns of the SPY ETF since the start of Stoney Point back in May of 2020 excluding the last three days of November: 0.96 percent. In comparison, on Friday (11/26) of last week, Monday (11/29) of this week, and Tuesday (11/30) of this week, SPY was down 2.2 percent, up 1.2 percent, and down 1.9 percent, respectively.

The outperformance of Prime this month (up big) in comparison to the market (which was down by a smaller magnitude, but still a pretty significant one) against this backdrop was pretty exciting. Select giving up a good chunk of its gains from last month left something to be desired, of course. Stay tuned to see if we can close out the calendar year on a high note.

Stoney Point Total Performance History

What we’re reading (12/1)

“Markets Are Shrugging Off Omicron Worries. But The Variant Offers A Lesson Investors Should Heed.” (Washington Post). “Week after week, we’ve seen stocks make one high after another, and people who’ve put every dollar they could lay their hands on into stocks have done extremely well…[t]he market’s drop last Friday shows why it’s wise to keep a reasonable amount of cash on hand — ‘reasonable’ being a flexible term — rather than putting every penny you own and can borrow into stocks.”

“The Internet Is Not The Enemy” (Project Syndicate). “[W]hile many of the harms people ascribe to the internet are neither new nor caused by it, governments are seeking to regulate the internet as though they are. Before heading down that path, we had better be sure we are regulating the right thing.”

“Old Trucks For New Money” (The New Yorker). “While it’s keenly felt in Austin, the hunger for beautiful old trucks is a national phenomenon. Prices for vintage trucks rose more than fifty per cent in the past four years, twenty per cent more than the vintage-vehicle market as a whole, according to data from the collectible-car-insurance company Hagerty. The trend was evident well before the current microchip shortage sent used car prices through the roof…‘Everybody wants to be a cowboy, right?’”

“US Shale Patch’s Lackluster Recovery Is A Problem For The Post-COVID Oil Market” (Commodity Context). “In aggregate, the US shale patch production recovery has notably underperformed the recovery in crude prices. Whether that lackluster recovery has been driven by the fabled ‘producer cashflow discipline’, regulatory burden, or ubiquitous supply chain challenges is a question for a different day but we’ve already seen a considerable regional differentiation. The US shale patch is far from a monolith: in the Permian basin, for example, producers are setting fresh all-time highs, while the rest of the oil-dominant shale regions remain down 20-30%.”

“What Europe Can Teach Us About Jobs” (Paul Krugman, New York Times). “The problems with the U.S. approach are now becoming apparent. As I said, there’s no evidence that unemployment insurance has been significantly discouraging work. But where European labor support helped keep workers linked to their old jobs, facilitating a rapid return, U.S. policy allowed many of those links to be severed, making an employment recovery harder.”

December Prime + Select picks available now

The new Prime and Select picks for December are available starting now, based on a model run put through today (November 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Wednesday, December 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, December 31, 2021 (at the mid-spread closing price).

What we’re reading (11/30)

“Nervous Traders Track Gauges As Markets Wrestle With Omicron” (Bloomberg). “To Fiona Cincotta, senior financial markets analyst at City Index, a close above 4,650 -- near where the S&P is holding -- would be an encouraging sign. But any sight of 4,585 -- the lows from Friday -- being broken on the downside means deeper declines could be in the offing still.”

“Markets Aren’t That Spooked By Omicron” (DealBook). “Covid-related stock market drops are getting milder and shorter. Back in February 2020, the S&P 500 fell 3.4 percent in one day and then continued to slide for a month and a half. In October 2020, a resurgence of cases led to a one-day market drop of 3.5 percent, but markets rebounded within two weeks. Friday’s decline was 2.3 percent, with a rebound beginning the next trading day.”

“What Happens When You’re The Investment” (The Atlantic). “Say Taylor [Swift] had issued her own token—let’s call it $SWIFT—and say she had sold $SWIFT to her biggest fans. Say I was one such fan. Over time, as Taylor’s popularity grew, the value of $SWIFT would have appreciated. As an early believer, I would have shared in the financial upside of her growing fame. The $SWIFT I’d bought for $100 in 2007 might be worth $100,000 today.”

“Inside Zillow As Waves Of Layoffs Leave Employees Reeling” (Insider). “Three current employees and seven who recently left the company said they were still struggling to understand what went wrong with Zillow Offers and what the failure meant for the rest of the company. While some staff are enjoying retention pay bumps, morale on various teams has plummeted as employees hear mixed messages about further reorganization and worry about working themselves out of their jobs.”

“Your Political Views Are Not Your Own” (Marginal Revolution). Citing a new paper in Psychological Science: “In a unique sample of 394 adoptive and biological families with offspring more than 30 years old, biometric modeling revealed significant evidence for genetic and nongenetic transmission from both parents for the majority of seven political-attitude phenotypes. We found the largest genetic effects for religiousness and social liberalism, whereas the largest influence of parental environment was seen for political orientation and egalitarianism. Together, these findings indicate that genes, environment, and the gene–environment correlation all contribute significantly to sociopolitical attitudes held in adulthood, and the etiology and development of those attitudes may be more important than ever in today’s rapidly changing sociopolitical landscape.”