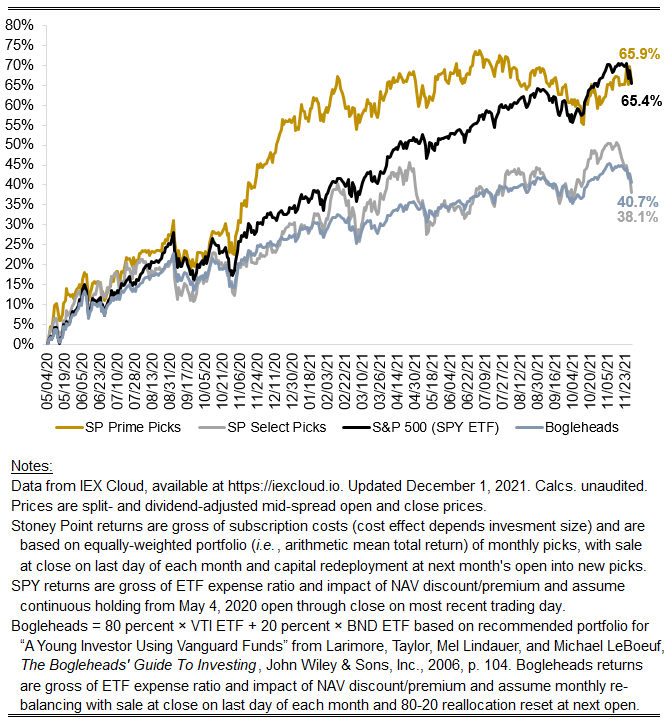

November 2021 performance update

Hi friends, here with a monthly performance update. Here are the monthly numbers:

Prime: +3.56%

Select: -5.94%

S&P 500-tracking “SPY” ETF: -1.03%

Bogleheads: -1.35%

November was a wild month:

A large number of companies reported quarterly earnings (including some of our picks)

Global supply chain issues remained pervasive globally ahead of the hugely important holiday season

The Bureau of Labor Statistics reported that consumer prices rose 6.2 percent (year-over-year) in October, the fastest increase in 30 years

The Fed announced plans to begin tapering asset purchases—and then, subsequently (on the last trading day of the month)—announced it would discuss the possibility of accelerating its tapering in its December meeting

The WHO declared the Omicron variant of the novel coronavirus a “variant of concern” on the third-to-last trading day of the month

Amid this chaotic news flow, equities as an asset class (but not the only asset class!) experienced elevated volatility, particularly in the last few trading sessions as markets digested the bits of information coming out about the new covid variant and assessed the valuation consequences of that information. To give a flavor of just how crazy the last few days have been, I took a look at the volatility (i.e., standard deviation) of daily returns of the SPY ETF since the start of Stoney Point back in May of 2020 excluding the last three days of November: 0.96 percent. In comparison, on Friday (11/26) of last week, Monday (11/29) of this week, and Tuesday (11/30) of this week, SPY was down 2.2 percent, up 1.2 percent, and down 1.9 percent, respectively.

The outperformance of Prime this month (up big) in comparison to the market (which was down by a smaller magnitude, but still a pretty significant one) against this backdrop was pretty exciting. Select giving up a good chunk of its gains from last month left something to be desired, of course. Stay tuned to see if we can close out the calendar year on a high note.