November 2021 performance update

Hi friends, here with a monthly performance update. Here are the monthly numbers:

Prime: +3.56%

Select: -5.94%

S&P 500-tracking “SPY” ETF: -1.03%

Bogleheads: -1.35%

November was a wild month:

A large number of companies reported quarterly earnings (including some of our picks)

Global supply chain issues remained pervasive globally ahead of the hugely important holiday season

The Bureau of Labor Statistics reported that consumer prices rose 6.2 percent (year-over-year) in October, the fastest increase in 30 years

The Fed announced plans to begin tapering asset purchases—and then, subsequently (on the last trading day of the month)—announced it would discuss the possibility of accelerating its tapering in its December meeting

The WHO declared the Omicron variant of the novel coronavirus a “variant of concern” on the third-to-last trading day of the month

Amid this chaotic news flow, equities as an asset class (but not the only asset class!) experienced elevated volatility, particularly in the last few trading sessions as markets digested the bits of information coming out about the new covid variant and assessed the valuation consequences of that information. To give a flavor of just how crazy the last few days have been, I took a look at the volatility (i.e., standard deviation) of daily returns of the SPY ETF since the start of Stoney Point back in May of 2020 excluding the last three days of November: 0.96 percent. In comparison, on Friday (11/26) of last week, Monday (11/29) of this week, and Tuesday (11/30) of this week, SPY was down 2.2 percent, up 1.2 percent, and down 1.9 percent, respectively.

The outperformance of Prime this month (up big) in comparison to the market (which was down by a smaller magnitude, but still a pretty significant one) against this backdrop was pretty exciting. Select giving up a good chunk of its gains from last month left something to be desired, of course. Stay tuned to see if we can close out the calendar year on a high note.

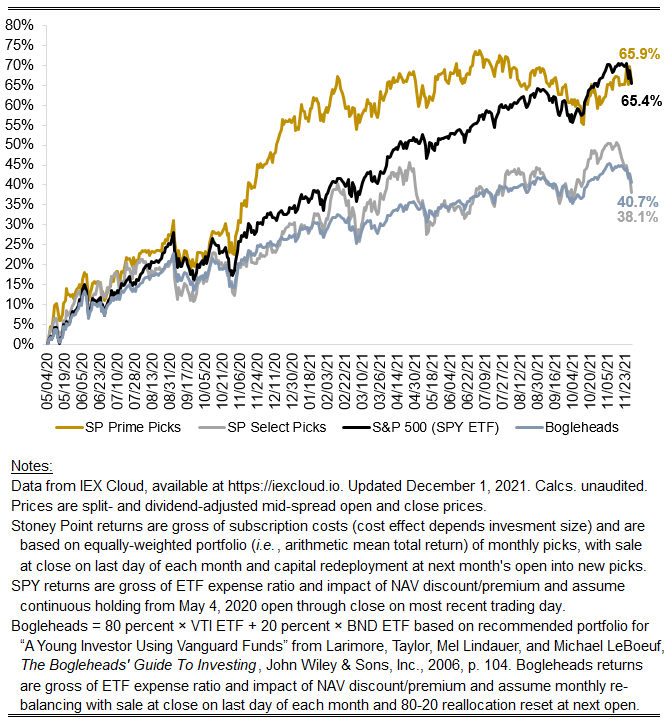

Stoney Point Total Performance History

What we’re reading (12/1)

“Markets Are Shrugging Off Omicron Worries. But The Variant Offers A Lesson Investors Should Heed.” (Washington Post). “Week after week, we’ve seen stocks make one high after another, and people who’ve put every dollar they could lay their hands on into stocks have done extremely well…[t]he market’s drop last Friday shows why it’s wise to keep a reasonable amount of cash on hand — ‘reasonable’ being a flexible term — rather than putting every penny you own and can borrow into stocks.”

“The Internet Is Not The Enemy” (Project Syndicate). “[W]hile many of the harms people ascribe to the internet are neither new nor caused by it, governments are seeking to regulate the internet as though they are. Before heading down that path, we had better be sure we are regulating the right thing.”

“Old Trucks For New Money” (The New Yorker). “While it’s keenly felt in Austin, the hunger for beautiful old trucks is a national phenomenon. Prices for vintage trucks rose more than fifty per cent in the past four years, twenty per cent more than the vintage-vehicle market as a whole, according to data from the collectible-car-insurance company Hagerty. The trend was evident well before the current microchip shortage sent used car prices through the roof…‘Everybody wants to be a cowboy, right?’”

“US Shale Patch’s Lackluster Recovery Is A Problem For The Post-COVID Oil Market” (Commodity Context). “In aggregate, the US shale patch production recovery has notably underperformed the recovery in crude prices. Whether that lackluster recovery has been driven by the fabled ‘producer cashflow discipline’, regulatory burden, or ubiquitous supply chain challenges is a question for a different day but we’ve already seen a considerable regional differentiation. The US shale patch is far from a monolith: in the Permian basin, for example, producers are setting fresh all-time highs, while the rest of the oil-dominant shale regions remain down 20-30%.”

“What Europe Can Teach Us About Jobs” (Paul Krugman, New York Times). “The problems with the U.S. approach are now becoming apparent. As I said, there’s no evidence that unemployment insurance has been significantly discouraging work. But where European labor support helped keep workers linked to their old jobs, facilitating a rapid return, U.S. policy allowed many of those links to be severed, making an employment recovery harder.”

December Prime + Select picks available now

The new Prime and Select picks for December are available starting now, based on a model run put through today (November 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Wednesday, December 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, December 31, 2021 (at the mid-spread closing price).

What we’re reading (11/30)

“Nervous Traders Track Gauges As Markets Wrestle With Omicron” (Bloomberg). “To Fiona Cincotta, senior financial markets analyst at City Index, a close above 4,650 -- near where the S&P is holding -- would be an encouraging sign. But any sight of 4,585 -- the lows from Friday -- being broken on the downside means deeper declines could be in the offing still.”

“Markets Aren’t That Spooked By Omicron” (DealBook). “Covid-related stock market drops are getting milder and shorter. Back in February 2020, the S&P 500 fell 3.4 percent in one day and then continued to slide for a month and a half. In October 2020, a resurgence of cases led to a one-day market drop of 3.5 percent, but markets rebounded within two weeks. Friday’s decline was 2.3 percent, with a rebound beginning the next trading day.”

“What Happens When You’re The Investment” (The Atlantic). “Say Taylor [Swift] had issued her own token—let’s call it $SWIFT—and say she had sold $SWIFT to her biggest fans. Say I was one such fan. Over time, as Taylor’s popularity grew, the value of $SWIFT would have appreciated. As an early believer, I would have shared in the financial upside of her growing fame. The $SWIFT I’d bought for $100 in 2007 might be worth $100,000 today.”

“Inside Zillow As Waves Of Layoffs Leave Employees Reeling” (Insider). “Three current employees and seven who recently left the company said they were still struggling to understand what went wrong with Zillow Offers and what the failure meant for the rest of the company. While some staff are enjoying retention pay bumps, morale on various teams has plummeted as employees hear mixed messages about further reorganization and worry about working themselves out of their jobs.”

“Your Political Views Are Not Your Own” (Marginal Revolution). Citing a new paper in Psychological Science: “In a unique sample of 394 adoptive and biological families with offspring more than 30 years old, biometric modeling revealed significant evidence for genetic and nongenetic transmission from both parents for the majority of seven political-attitude phenotypes. We found the largest genetic effects for religiousness and social liberalism, whereas the largest influence of parental environment was seen for political orientation and egalitarianism. Together, these findings indicate that genes, environment, and the gene–environment correlation all contribute significantly to sociopolitical attitudes held in adulthood, and the etiology and development of those attitudes may be more important than ever in today’s rapidly changing sociopolitical landscape.”

What we’re reading (11/29)

“Jack Dorsey Steps Down As Twitter CEO, Board Unanimously Appoints CTO Parag Agrawal As Successor” (Twitter). “Twitter, Inc. […] today announced that Jack Dorsey has decided to step down as Chief Executive Officer and that the Board of Directors has unanimously appointed Parag Agrawal as CEO and a member of the Board, effective immediately. Dorsey will remain a member of the Board until his term expires at the 2022 meeting of stockholders. Bret Taylor was named the new Chairman of the Board, succeeding Patrick Pichette who will remain on the Board and continue to serve as chair of the Audit Committee. Agrawal has been with Twitter for more than a decade and has served as Chief Technology Officer since 2017.”

“Half Of This Year’s Big IPOs Are Trading Below Listing Price” (Financial Times). “Half of the companies that raised more than $1bn at initial public offerings this year are trading below their listing price, despite robust stock markets around the world…[t]heir weak performance has raised questions about the valuations pinned to companies by large investors such as SoftBank and Warburg Pincus and leading underwriters including Goldman Sachs and Morgan Stanley.”

“Airlines Avoid Thanksgiving Pitfalls As Daily Passengers Top Two Million” (Wall Street Journal). “Sunday was set to be the busiest travel day since the onset of the coronavirus pandemic, with the Transportation Security Administration predicting some 2.4 million people would pass through U.S. airports. Daily airport passenger volumes exceeded two million people for seven straight days through Wednesday, Nov. 24. After more muted volumes Thursday and Friday, TSA screened over 2.2 million people on Saturday.”

“The Job Market Is Looking Way Better. It’s Still Playing Catch-Up” (CNN Business). “More than 20 months into the pandemic, the US job market has reached a milestone. What's happening: Weekly claims for unemployment benefits fell to 199,000 last week after seasonal adjustments, their lowest level since 1969. They hit a peak of 6.15 million in April 2020. So, does that mean employment conditions are back to normal? Not quite.”

“Not That Seventies Inflation” (Project Syndicate). “Are the United States and other advanced economies experiencing stagflation, the unfortunate combination of high inflation and low growth in output and employment that characterized the mid-1970s? At least in America’s case, the answer is no. What the US is facing now is moderate inflation, without the stagnation part. That recalls the 1960s, not the decade that followed.”

What we’re reading (11/28)

“Fauci: Omicron Variant Will “Inevitably” Be Found In U.S.” (Axios). “Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, cautioned on Sunday that the COVID-19 Omicron variant will ‘inevitably’ be found in the United States…He also said the variant looked likely to be highly transmissible, but officials need more data. ‘It has the molecular characteristics that would strongly suggest that it would be transmissible,’ Fauci said.”

“Wall St Week Ahead COVID-19 Fears Reappear As A Threat To Market” (Reuters). “With little known about the new variant, longer term implications for U.S. assets were unclear. At least, investors said signs that the new strain is spreading and questions over its resistance to vaccines could weigh on the so-called reopening trade that has lifted markets at various times this year. The new strain may also complicate the outlook for how aggressively the Federal Reserve normalizes monetary policy to fight inflation.”

“Black Friday Rout Shows Dangers Of Margin Borrowing” (Wall Street Journal). “Friday’s global retreat from riskier assets exposes a vulnerability of the broad market advance of the past year and a half: the rising use of leverage, or borrowed money…[b]orrowings against portfolios of stocks and bonds, broadly called margin debt, have grown as individual investors have become major players in the stock market. So too have concerns that debt-fueled buying could be a sign of overexuberance, setting the stage for tumultuous trading periods such as Friday’s, when the Dow Industrials posted their largest-ever Black Friday decline and the U.S. oil price dropped 13%.”

“Oil’s Black Friday: Algos And Options Turn A Tumble Into A Crash” (Bloomberg). “Black Friday turned red very quickly for global oil markets…[t]hen the options market kicked in. When prices fall heavily, banks often sell futures contracts in order to hedge themselves against losses from put options -- contracts that grant the right to sell at a particular price. Banks often sell puts to producers who want to protect against a bear market. This feedback loop, known as negative gamma to options traders, was seen as a factor on Friday.”

“How to Generate Alpha From Hidden Earnings Data” (Institutional Investor). “‘Core Earnings: New Data and Evidence,’ a report authored by Professor Ethan Rouen and Eric So of the MIT Sloan School of Management and Professor Charles Wang of Harvard Business School, explains that the primary challenge for analysts is to quantify and distinguish core-earnings items — those that stem from companies’ recurring central activities — from non-core-earnings items, which are related to “ancillary business activities or transitory shocks.”

December picks available soon

We’ll be publishing our Prime and Select picks for the month of December before Wednesday, December 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of November, as well as SPC’s cumulative performance, assuming the sale of the November picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Tues., November 30). Performance tracking for the month of December will assume the December picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Wednesday, December 1).

What we’re reading (11/27)

“Elon Musk And The Dangers Of Another Stock Bubble” (The New Yorker). “ Tesla now has a market capitalization of almost $1.2 trillion. That figure surpasses the capitalizations of Toyota, Volkswagen, General Motors, Ford, Daimler, BMW, Stellantis, Honda, Kia, and Hyundai combined. If you suspect that these figures are a bit crazy, you’re right. But the real clue to the current mind-set in the stock market is what has been happening to the stocks of Ford, General Motors, and other old-line auto companies. If Tesla, Rivian, Lucid, and other E.V. startups are going to dominate the global auto industry in the coming decades, the logical corollary is that the legacy carmakers are headed for the scrap heap. But, lo and behold, the market valuations of Ford and G.M. have been rising sharply, too.”

“Hertz-Tesla Deal Signals Broad Shift To EVs For Rental-Car Companies” (Wall Street Journal). “Car-rental customers could soon see more electric-vehicle options on airport lots and other places where they are looking to reserve a ride. The rental-car industry, long a big bulk-purchaser of new models in the car business, is sharpening efforts to add more battery-powered vehicles to fleets, the latest in a broader global shift among companies embracing greener technologies to cut their greenhouse-gas emissions.”

“The Value Of Nothing: Capital Versus Growth” (American Affairs). “[T]he U.S. economy is, to a unique extent, organized around maximizing asset values and returns on capital independently of growth—in terms of corporate behavior, financial market incentives, and government and central bank policy. This may seem obvious or even tautological: what is capitalism if not a system aimed at maximizing returns on capital? But the disconnect that has emerged between returns on U.S. financial assets and underlying economic performance—and even corporate profits—over the last few decades should raise deeper questions about basic economic policy assumptions and their theoretical foundations.”

“The Market’s Black Friday Freakout About The New Variant Shows How A Reactionary Wall Street Rules American Life And Politics” (Insider). “The moment echoes that seen over the summer, when the first headlines of the emerging Delta strain put a damper on the global recovery. Subsequent research showed vaccines are effective against Delta, and continued vaccination has helped put the world economy back on track for a full recovery, but the immediate reaction was strong enough to halt many companies' planned returns to their offices in the fall, and that decision resulted in months of weaker hiring before the boom recommenced.”

“Crypto-Trading Hamster That Outperformed Warren Buffett Has Died” (Fortune). “Mr. Goxx, whose real name was Max, gained prominence in September as a social experiment demonstrating the randomness of the crypto markets. Adjoined to his regular cage, the hamster had a fully equipped office from which he ran his trading firm, Goxx Capital.”

What we’re reading (11/26)

“Classification of Omicron (B.1.1.529): SARS-CoV-2 Variant of Concern” (World Health Organization). “This variant has a large number of mutations, some of which are concerning. Preliminary evidence suggests an increased risk of reinfection with this variant, as compared to other VOCs. The number of cases of this variant appears to be increasing in almost all provinces in South Africa. Current SARS-CoV-2 PCR diagnostics continue to detect this variant. Several labs have indicated that for one widely used PCR test, one of the three target genes is not detected (called S gene dropout or S gene target failure) and this test can therefore be used as marker for this variant, pending sequencing confirmation. Using this approach, this variant has been detected at faster rates than previous surges in infection, suggesting that this variant may have a growth advantage.”

“Countries Are Scrambling To Stop A New Covid Variant” (The Economist). “If the mutations in Omicron turn out to make covid vaccines less potent, the jabs may have to be tweaked. On November 26th Pfizer and BioNTech, makers of the covid jab that is most widely used in Western countries, said that they would be able to rework their mRNA vaccine within six weeks and ship the first batches within 100 days. The mutations in Omicron do not appear to be a threat to the efficacy of antiviral medicines for covid, but they could defeat some antibody therapies, which are given to people unable to mount an immune response.”

“Dow Tumbles 900 Points For Worst Day Of Year On Fears Of New Covid Variant, S&P 500 Drops 2%” (CNBC). “U.S. stocks dropped sharply on Friday as a new Covid variant found in South Africa triggered a global shift away from risk assets. The downward moves came after World Health Organization officials on Thursday warned of a new Covid-19 variant that’s been detected in South Africa. The new variant contains more mutations to the spike protein, the component of the virus that binds to cells, than the highly contagious delta variant.”

“Covid-19 Variant Upends Investor Bets On Rate Increases” (Wall Street Journal). “Investors piled into government bonds and quickly recalibrated their expectations for interest-rate increases in response to the new Covid-19 variant first identified in South Africa. The yield on the 10-year U.S. Treasury note dropped to 1.484% Friday, according to Tradeweb, from 1.644% at Wednesday’s close. That marks the largest trading-session decline since March 2020, at the start of the coronavirus pandemic. Yields fall as bond prices rise.”

“Oil Prices Drop More Than 10% As Virus Variant Threatens Blow To Demand” (Financial Times). “Oil prices plunged more than 10 per cent on Friday as reports of a virulent new coronavirus variant sparked fears of more pandemic lockdowns and another blow to fuel demand, just as the US plans to release more supplies on to the market. West Texas Intermediate, the American oil benchmark, dropped by 13 per cent to settle at $68.15 a barrel as US traders returned following the Thanksgiving holiday.”

What we’re reading (11/25)

“Thanksgiving Feasts Return In Force But At A More Expensive Price” (Financial Times). “Led by jumps in prices for wheat, turkey, potatoes and corn, the prices of food commodities typically included in a Thanksgiving dinner were on average 25 per cent higher than pre-pandemic levels in 2019, a Financial Times analysis shows. The cost of travelling to see family and friends is also higher, with the US price of petrol up more than 50 per cent since the start of the year.”

“What Inflation? Small Investors Keep Piling Into Flashy Growth Stocks” (Wall Street Journal). “Growth stocks are typically companies—often tech firms—that are expected to deliver faster-than-average profit growth in the future. They tend to flourish in a low-rate environment, including over the past year and a half. Investors are typically willing to pay higher prices for such companies when they don’t see many alternatives for making sizable profits.”

“The Reddit Reckoning Had Short-Sellers Scrambling. Now They're Back With A Vengence: ‘I Gave These Meme Guys, These Reddit Guys Too Much Credit’“ (Insider). “[I]t turns out the demise of short-sellers has been greatly exaggerated. The real story of short-sellers in 2021 is a more complicated picture of diverging fortunes…[t]otal activist short campaigns have declined this year, but shares of their targets are down an impressive 25% on average for the first three quarters of 2021, according to research from the data and analytics company Breakout Point.”

“Adventure Capitalism” (The Economist). “Now capitalism’s dream machine is itself being scaled up and transformed, as an unprecedented $450bn of fresh cash floods into the vc scene. This turbocharging of the venture world brings significant risks, from egomaniacal founders torching cash to pension pots being squandered on overvalued startups. But in the long run it also promises to make the industry more global, to funnel risk capital into a wider range of industries, and to make vc more accessible to ordinary investors. A larger pool of capital chasing a bigger universe of ideas will boost competition, and is likely to boost innovation, leading to a more dynamic form of capitalism.”

“When People Thought The First Thanksgiving Was Too Woke” (Politico). “Reflecting the sharp polarization in national politics [in 1863], many Democrats and peace proponents refused to acknowledge the president’s [Lincoln’s] proclamation of the new holiday, and some even denounced it as an attempt to impose a particular brand of New England fanaticism on the whole country. Lincoln’s proclamation unleashed the social resentments of many voters who resisted the growing influence of evangelical churches and the concurrent growth of social reform movements — from abolitionism and temperance to Sabbatarianism and women’s rights.”

What we’re reading (11/24)

“Bill Ackman’s $1 Billion Inflation Bet” (Institutional Investor). “[A]fter making $2.6 billion on his big Covid-19 short in 2020, this year another macro short of his is panning out: a $170 million bet on inflation that is now worth $1 billion…Pershing Square made its bet with options, taking a notional short position principally in shorter-dated maturities of U.S. Treasuries, as well as some longer ten-year dated debt, Ackman said.”

“JPMorgan's Dimon Says He Regrets China Communist Party Comment” (Reuters). “JPMorgan Chase Chief Executive Jamie Dimon said on Wednesday he regretted his remarks that the Wall Street bank would last longer than China's Communist Party, moving quickly to avoid any longer-term fallout.”

“More Chips Will Be Made In America Amid A Global Spending Surge” (Wall Street Journal). “The new factories won’t be operational for years. But the investment promises to boost America’s production foothold in advanced chip making after decades of ceding ground to locations in Asia like Taiwan, South Korea and China. It comes at a time, though, when chip makers are investing heavily in these locations, too”

“Rivian’s IPO Enriched Hedge Fund Third Point” (Barron’s). “The Financial Times reported that Dan Loeb’s hedge fund Third Point has made hundreds of millions of dollars on its stake in electric-truck startup Rivian Automotive. Early investors making a mint isn’t all that surprising. But it does show the benefits of being a well-placed institutional investor. Third Point has made an estimated profit of as much as $300 million, according to the report.”

“Wall Street Grudgingly Allows Remote Work As Bankers Dig In” (New York Times). “Wall Street is in revolt. Across the financial industry, at firms big and small, workers are slow-walking their return to the office. Bankers for whom working from home was once unfathomable now can’t imagine going back to the office full-time. Parents remain worried about transmitting the coronavirus to their children. Suburban dwellers are chafing at the thought of resuming long commutes. And many younger employees prefer to work remotely.”

What we’re reading (11/23)

“U.S. Business Activity Slows Moderately In Mid-November - IHS Markit Survey” (Reuters). “U.S. business activity slowed moderately in November amid labor shortages and raw material delays, contributing to prices continuing to soar halfway through the fourth quarter…[d]ata firm IHS Markit said on Tuesday its flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to a reading of 56.5 in mid-November from 57.6 in October. A reading above 50 indicates growth in the private sector.”

“US Bond Bulls Hold Their Ground In Face Of Red-Hot Inflation” (Financial Times). “For some longtime bond bulls, the market’s nonchalance in the face of surging prices — typically kryptonite for debt investors — is a vindication of the view that inflation will not leave a lasting dent on the market and, when the dust settles on the economic recovery, the pre-pandemic landscape of low interest rates will be largely unchanged.”

“Biden Authorizes Use Of Strategic Oil Reserves To Combat High U.S. Gasoline Prices” (Washington Post). “The Biden administration on Tuesday said it was tapping U.S. oil reserves in an effort to combat high gasoline prices, the White House’s second move in a week to try to address rising energy costs at a time when millions of Americans are preparing to hit the road. The administration said the Department of Energy will release 50 million barrels of oil from the Strategic Petroleum Reserve — an emergency pool kept by the United States — in conjunction with similar actions by several other countries.”

“Turkish Lira Crashes To ‘Insane’ Historic Low After President Erdogan Sparks Sell-Off” (CNBC). “Turkey’s currency has been in a downward slide since early 2018, thanks to a combination of geopolitical tensions with the West, current account deficits, shrinking currency reserves, and mounting debt — but most importantly, a refusal to raise interest rates to cool inflation…[i]nvestors fear the lack of independence of Turkey’s central bank, whose monetary policies are seen as being largely controlled by Erdogan. He has fired three central bank chiefs in roughly two years over policy differences.”

“Here’s How Institutional Investors’ Bets On Crypto Are Performing” (Institutional Investor). “[P]ublic pension funds and other big investors, including insurance companies, are dipping their toes into crypto and new research shows they’re having some success — at least in the short term. Those that have started to put capital to work in transparent exchange-traded funds tracking cryptocurrencies have outperformed their peers by 2.8 percent on an annualized basis between March 2018 and March 2020, the research found.”

What we’re reading (11/22)

“Ray Dalio Says, ‘If You Worry, You Don’t Have To Worry’” (DealBook). “Today, Mr. Dalio is most concerned about the end of the American Empire and the beginning of another Chinese Empire, a transition he believes could lead to war. He writes that Americans misunderstand the Chinese and their own place in history…Ultimately he concludes that ‘[i]f the US continues to decline and China continues to rise, what matters most is whether or not each can do so gracefully.’”

“American Inflation: Global Phenomenon Or Homegrown Headache?” (The Economist). “Although consumer prices in America rose by 6.2% in October compared with the year before, faster than in other big rich economies, year-on-year comparisons are flawed because of variations across countries in the timing of their pandemic-induced slowdowns and recoveries. The clearest comparison is instead to look at prices today and those 24 months ago. On this basis, consumer prices are up by about 7.5% in America, more than two percentage points higher than anywhere else in the G7 group of rich countries[.]”

“Fed Looks Likely To Consider Faster Drawdown In Asset Purchases” (Bloomberg). “A faster reduction in the so-called quantitative easing program would give policy makers an earlier opportunity to lift interest rates from near zero should they deem that necessary to keep the economy from overheating. Officials have vouchsafed a reluctance to raise rates and tighten credit at the same time they’re pumping money into the economy though bond buying.”

“Bank Stocks Poised For Best Year Since Global Financial Crisis” (Financial Times). “An MSCI benchmark tracking global bank shares — measured in US dollars — has jumped by around 30 per cent so far in 2021, a stronger performance than the roughly 20 per cent rise for the index provider’s all-sector gauge…US banks in particular have been buoyed by healthy volumes in their trading businesses in recent months, along with ‘extraordinary’ deal advisory activity and the release of reserves set aside to cover bad debts, said Scott Ruesterholz, a fund manager at Insight Investment. ‘It’s a phenomenal environment to be operating in.’”

“Chobani Is Going Public. Its ‘Anti-CEO’ Founder Won’t Be The Only Employee Who Could See A Big Payday” (Forbes). “For most people, big payouts from initial public offerings call to mind software engineers—not yogurt factory workers. But when Chobani goes public, some of its hourly workers could stand to make $1 million or more in stock awards, an uncommon outcome in an industry rarely lauded for its treatment of workers.”

What we’re reading (11/21)

“Supply-Chain Problems Show Signs Of Easing” (Wall Street Journal). “In Asia, Covid-related factory closures, energy shortages and port-capacity limits have eased in recent weeks. In the U.S., major retailers say they have imported most of what they need for the holidays. Ocean freight rates have retreated from record levels.”

“Don’t Let Them Tell You Inflation Is Good For The Poor. It’s Not” (Fortune). “[T]he working class depends on wages and salaries staying above inflation, which is difficult to obtain in practice once an inflationary spiral takes hold. Indeed, rising inflation has already eroded the early pandemic wage gains of American workers, and real worker compensation is now lower than its pre-pandemic trend.”

“Monetary Theory And Crypto” (Medium). “[T]ake the field [monetary theory] in general — has it had anything interesting to say about crypto developments? I don’t expect it to have predicted crypto…[b]ut surely monetary theory should be able to help us better understand crypto? And its price. How much has it succeeded in that endeavor? Or are you better off reading “amateur” pieces on Medium and other sources cited on Twitter? What should we infer from your answer to these questions?”

“The Weirdness Of Government Variation In COVID-19 Responses” (Richard Hanania, Substack). “Usually, countries and regions that share a cultural legacy and the same political system don’t differ too much in the ways in which they respond to events in the real world…[b]ut imagine at the start of the pandemic, someone had said to you ‘Everyone will face the existence of the same disease, and have access to the exact same tools to fight it. But in some EU countries or US states, people won’t be allowed to leave their house and have to cover their faces in public. In other places, government will just leave people alone. Vast differences of this sort will exist across jurisdictions that are similar on objective metrics of how bad the pandemic is at any particular moment.’ I would’ve found this to be a very unlikely outcome!”

“‘When Has There Ever Been A Moment Of Calm At Facebook?’: The Great Employee Exodus That Wasn’t” (Vanity Fair). “Outside the company, the scandal was huge; internally…it didn’t have nearly the same gravitas that it did to those who don’t work there. Now, as weeks have gone by, all of the speculation about an employee exodus and advertiser migration has not really borne out…there still has not been the mass exodus of engineering talent that some had envisioned happening as a result of the Facebook Files.”

What we’re reading (11/20)

“Top Fed Official Opens Door To Faster ‘Taper’ Of Bond-Buying Programme” (Financial Times). “The vice-chair of the US Federal Reserve on Friday opened the door to a faster withdrawal of its massive bond-buying programme, suggesting the central bank could take earlier-than-expected action to tame inflation. Richard Clarida said the Federal Open Market Committee could consider discussing the pace of the planned ‘taper’ at its upcoming policy meeting in December.”

“IPOs Keep Jumping Higher. How Long Will The Ride Last?” (Wall Street Journal). “The number of publicly listed companies in the U.S. rose above 4,000 for the first time in more than a decade, according to the Center for Research in Security Prices LLC. The reasons ranged from a surge of cash provided by Washington, D.C., to a search for new and bigger returns as interest rates hovered near zero. Startups that desperately needed cash added more fuel to the frenzy, as did newly popular ‘blank-check’ companies whose only purpose was to acquire a private target and take it public.”

“Has Anyone Considered That Maybe We’re Not In A Stock Bubble?” (Dealbreaker). “Are we in a stock market bubble? Maybe. Or maybe we’re just in an economy where businesses are doing well because Americans sitting on a large pile of cash they’ve accumulated over the course of the pandemic are now doing their darndest to spend it. My money’s on the latter.”

“Hostility Towards Private Equity’s Push Into Property Is Misguided” (The Economist). “This injection of capital should be welcomed, not scorned. The investors want to make money, naturally, but they see a gap in the market that needs filling and they are doing something about it. Demand for rental housing has never been higher. In Britain less than one in ten homes were rented in the mid-1990s. The share today is closer to one in five. A third of households in America are rented. Falling home ownership rates across the rich world mean that decent quality housing in the private rented market is more sought-after than ever. Yet tenancies are insecure and the supply of rental homes has failed to keep up with demand. A number of countries face chronic shortages.”

“Young Wall Streeters Are Pumping Their Bonus Checks Into Crypto. Here's An Inside Look At How They're Making Trades — And What Their Firms’ Compliance Departments Have To Say About It.” (Insider). “Wall Street firms generally have detailed policies around what employees are allowed to invest in personally to prevent insider trading and conflicts of interest. And while these policies vary by firm and division — traders, dealmakers, and others with client-facing relationships are subject to more restrictions than retail bankers, for instance — most securities traded via brokerage accounts require clearance from compliance.”

What we’re reading (11/19)

“The Return Of The Bond Market Conundrum” (Pragmatic Capitalism). “It feels an awful lot like the 2000’s scenario where the Fed will want to raise rates, but if they do they risk inverting the curve and crashing the economy. But this time, if they start raising rates they don’t have 5% of wriggle room before they invert. They have barely any room at all. As of now it looks like the long end of the curve seems to be staunchly in the “inflation is transitory” camp which means that Conundrum 2.0 looks to be on the table here.”

“Turkey Currency Crisis Threatens Economy, Posing Challenge To Erdogan Rule” (Wall Street Journal). “The Turkish lira hit a record low against the dollar on Thursday after the Central Bank cut a key rate by one percentage point. The currency has lost more than a third of its value since March and is the worst-performing major emerging market currency this year so far. The depreciating lira is a self-inflicted wound for Mr. Erdogan, who has pushed for lower interest rates as part of an unconventional economic strategy that he argues will encourage growth. Thursday’s rate cut was the third in three months and came after the president fired a series of senior officials who opposed his unorthodox economic vision.”

“Cathie Wood Says We Are In A Strong Bull Market And As Long As There Is No Recession, ‘We Will Probably Be Fine’” (Insider). “Cathie Wood believes the bull market for stocks has shown its strength by shrugging off mounting price pressures, and unless an economic downturn hits, it'll probably keep up its winning ways. The Ark Invest chief acknowledged the "wall of worry" being climbed by investors faced with hot-running inflation, speaking in an interview with Barrons on Wednesday. But Wood pointed to how equity markets shrugged off bond moves earlier this year.”

“Biden’s Bank Regulator Pick At Risk After Tough Senate Grilling” (Financial Times). “The most intense and personal grilling came from Republican senators who accused her of being a communist. ‘I don’t know whether to call you ‘professor’ or ‘comrade’,’ quipped John Kennedy, the Republican senator from Louisiana. Pat Toomey, the top Republican on the panel, said she would “end banking as we know it” and criticised Omarova’s undergraduate thesis on Karl Marx as evidence that she was a ‘radical’ choice.”

“Zillow Tried to Make Less Money” (Matt Levine, Bloomberg). “I don’t know, it’s a weird story about technology and scale, about how many businesses — in particular, many public companies — aim to maximize not profit but size. In concept, a business model like ‘send everyone in America a bid on their house that is too low, and then buy the houses from the minority of suckers who take your bid’ seems … obviously … lucrative? Like, I would be happy to do that business? I don’t have the capital for it, but I’m sure there are hedge funds who would do this business if they could.”

What we’re reading (11/18)

“Pandemic Stocks Have Become Passé” (DealBook). “As the economy reopens and markets look forward to life without pandemic restrictions, many “stay at home” stocks are no longer paying off for investors. Peloton, the maker of connected exercise bikes, said yesterday that it would raise $1 billion in cash from selling stock, just weeks after it said it didn’t need more capital. The company’s stock is down more than 60 percent this year.”

“What Went Wrong With Zillow? A Real-Estate Algorithm Derailed Its Big Bet” (Wall Street Journal). “The first quarter delivered home-sale profits that were more than twice as high as anticipated, the company said. Zillow expected to make money primarily from transaction fees and from services such as title insurance—not from making a killing on the flip. The company’s algorithm, which was supposed to predict housing prices, didn’t seem to understand the market. Zillow was also behind on its target for home purchases. By the summer, it had the opposite problem, the company later acknowledged. It was paying too much money for homes, and buying too many of them, just when price increases were starting to slow.”

“In Praise of . . . Enron?” (Texas Monthly). “Twenty years later, however, Clemmons isn’t alone in waxing nostalgic about Enron. Interviews with nearly a dozen former employees paint a similarly rosy picture. Working there was “an amazing experience,” one said. “An awesome place to be a young person,” said another. Still, their memories contain contradictions. Enron was an invigorating, dynamic workplace (managed by unapologetic criminals). The company fearlessly pioneered several new markets and industries (while looting others).”

“Investors Know They Own Too Much Tech. This Analysis Shows That It’s Worse Than They Think.” (Institutional Investor). “Because pension funds and other big institutions have adopted index funds for at least part of their stock portfolios, many of them now face new risks. One of the criticisms of funds that track indices such the S&P 500, which is weighted by the market capitalization of its stocks, is that the benchmark has gotten concentrated in the most expensive constituents — think Alphabet, Apple, and Microsoft, for example. Investors, as a result, are less diversified than they think and more exposed to a potential decline in these stocks. “

“Don’t Mock The Metaverse” (The Economist). “Google Maps already offers a virtual space that contains the real world’s stations, shops and streets. The video-game industry—the only type of entertainment fully exposed to the compounding power of Moore’s law—has been selling virtual worlds for years. “EverQuest”, an online game launched in 1999, had half a million subscribers at its peak. (Players quickly co-opted it for socialising, and even weddings, as well as dragon-slaying.) “World of Warcraft”, which arrived five years later, hit 12m. These days 200m people a month hang out on “Roblox”, a video-game-cum-construction-set. Many spend their real money on virtual goods. It is hard to argue that an idea will never catch on when, for millions of people, it already has.”

What we’re reading (11/17)

“Biden Says Fed Chair Pick Could Be Unveiled This Week” (Wall Street Journal). “Mr. Biden is considering whether to reappoint Fed Chairman Jerome Powell when his four-year term expires in February or to pick Fed governor Lael Brainard for the position. Mr. Biden interviewed both candidates on Nov. 4, and he isn’t considering other individuals, according to a person familiar with the matter.”

“Retail Sales Rise Faster Than Expected In October Even As Inflation Pushes Prices Higher” (CNBC). “U.S. shoppers accelerated their level of spending in October even as the prices of goods jumped at their fastest pace since the 1990s, the Commerce Department reported Tuesday. Retail sales, a measure of how much consumers spent on goods ranging across categories from autos to sporting goods and food and gas, increased 1.7% for October, compared with 0.8% the previous month.”

“Market Is Wrong To Price In Mid-2022 Fed Hike, TD’s Misra Says” (Bloomberg). “TD doesn’t expect the Fed to raise rates until late 2023. The call runs counter to recent trading in the U.S. Treasury market, where the spread between 2- and 10-year yields narrowed to 97 basis points last week, the tightest since August, with traders pulling forward bets on Fed rate increases.”

“Why Conglomerates Break Themselves Up” (Axios). “GE, Johnson & Johnson, and Toshiba weren't the last of the conglomerates. Giants both old and new remain. (Think 3M, or Softbank.) In today's financially-optimized stock market, however, the arguments for internal diversification have mostly lost the day…[i]n the era of index funds, investors can get diversification easily from ETFs; they don't need corporate managers to do that for them.”

“46 Members Of Congress Have Violated A Law Designed To Stop Insider Trading And Prevent Conflicts-Of-Interest” (Insider). “Insider and several other news organizations have this year identified 46 members of Congress who've failed to properly report their financial trades as mandated by the Stop Trading on Congressional Knowledge Act of 2012, also known as the STOCK Act.”

What we’re reading (11/16)

“Why The Chip Shortage Drags On And On…And On” (Ars Technica). “[T]he semiconductor supply chain has become stretched in new ways that are deeply rooted and difficult to resolve. Demand is ballooning faster than chipmakers can respond, especially for basic-yet-widespread components that are subject to the kind of big variations in demand that make investments risky.”

“Credit Card Companies Acknowledge Their Biggest Fear - Competition” (Real Clear Markets). “In a recent article, the chairman of a credit card industry coalition expressed his members’ worst fear about bringing competition to who gets to process trillions of dollars in transactions each year. Doing so would result in a situation ‘in which credit card networks are forced to lower their prices to compete.’ Welcome to the real world!”

“Berkshire Cuts Visa, Mastercard Bets, Trims Some Drug Stakes” (Bloomberg). “Warren Buffett’s Berkshire Hathaway Inc. cut two of its payments bets -- holdings in Visa Inc. and Mastercard Inc. -- as it also pulled back on investments in pharmaceutical giants AbbVie Inc. and Bristol Myers-Squibb Co.”

“AQR Hedge Fund Parts With 5 Top Managers And Closes Struggling Division” (Financial Times). “Computer-powered hedge fund group AQR Capital Management is to remove five partners from its ranks and trim its bond arm, continuing to retrench operations after several lean years for many systematic trading strategies. The $137bn investment group led by Clifford Asness has been a pioneer of ‘quantitative’ investment strategies that attempt to profit from long-term market signals, rather than traditional human traders and fund managers.”

“The Good News About The Great Resignation” (Fortune). “[P]erhaps what’s really behind the Great Resignation is a collective shift in our mindset fueled by the pandemic—one in which many have reevaluated the very idea of what it means to work. Millions around the world have decided that life is simply too short to do work that risks their sanity, their safety, or their soul. For them, this moment has led to a desire for more meaningful, more impactful, purpose-driven work—work that might actually change the world.”

What we’re reading (11/15)

“Inflation Is Killing The Dollar Carry Trade In Emerging Markets” (Bloomberg). “A short-lived reprieve for emerging-market carry trades funded in dollars looks to be over, with an upsurge in U.S. inflation making the outlook increasingly treacherous. A Bloomberg index of these bets has dropped more than 4% in the past two months, the biggest slide since March 2020 for a strategy of borrowing in the greenback and investing in developing-nation currencies. The quickest U.S. inflation in three decades is putting pressure on the Federal Reserve to tighten, raising the prospect of higher costs for dollar borrowers, and less extra yield -- or carry.”

“Fed’s Kashkari Expects Higher Inflation Continuing Over Next Few Months” (Reuters). “Minneapolis Federal Reserve Bank President Neel Kashkari said on Sunday he expects higher inflation continuing over the next few months but warned that the U.S. central bank should not overreact to elevated inflation as it is likely to be temporary. ‘The math suggests we're probably going to see somewhat higher readings over the next few months before they likely start to taper off,’ Kashkari told CBS News’ “Face the Nation” in an interview on Sunday.”

“As American Workers Leave Jobs In Record Numbers, A Closer Look At Who Is Quitting” (Wall Street Journal). “American workers’ stampede toward the exits hasn’t let up. New data puts a finer point on who, exactly, is leaving jobs these days. Workers resigned from a record 4.4 million jobs in September, according to Labor Department data, and new surveys show that low-wage workers, employees of color and women outside the management ranks are those most likely to change roles. The findings signal that turnover isn’t evenly spread across the U.S. workforce even as employers across industries struggle to fill a variety of roles.”

“The Rise Of The Anti-Woke ETFs” (Bloomberg Quint). “A new batch of ETFs seeks to appeal to right-leaning investors who want an alternative to ‘woke’ Corporate America and ESG activism. While political-themed ETFs aren't a new idea, they've never really managed to attract meaningful assets. With Americans more polarized than ever before, could this be the moment that these ETFs actually find an audience?”

“Americans Are Still Buying Up A Storm” (CNN Business). “Consumer spending continues to power the US economy. Whether it's to buy a new house or just a Squid Game plush toy from Amazon (AMZN), people still seem willing to shell out their hard earned cash for stuff. Retail sales in the United States soared more than expected in September and figures for August were revised higher to show a bigger jump than initially reported. October numbers will be released Tuesday. More healthy gains are expected, despite lingering worries about rising prices and supply chain disruption.”