August picks available soon

We’ll be publishing our Prime and Select picks for the month of August before Monday, August 2 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of July, as well as SPC’s cumulative performance, assuming the sale of the July picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Fri., July 30). Performance tracking for the month of August will assume the August picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Mon., August 2).

What we’re reading (7/22)

“Fed Chief Powell Enjoys Support For Reappointment, But He’s Not a Lock” (Wall Street Journal). “President Biden’s selection of the next Federal Reserve chair is likely to be a choice between keeping the current chief, who enjoys broad support in markets and among lawmakers from both parties, or replacing him with one of his well-regarded colleagues. Chairman Jerome Powell, whose term expires in February, is viewed by some inside and many outside the administration as the front-runner for the job.”

“The Bond Market Is Torn Over The Potential For Higher Inflation And Lower Growth” (CNBC). “A volatile environment for government bonds is reflecting a highly uncertain future for the U.S. economy, pointing to both slower growth and stubborn inflation. After a burst higher earlier this year that scared markets, Treasury yields have fallen back sharply as investors have switched their focus from worries about price increases to the potential that the rapid burst in post-pandemic activity could start to slow down.”

“AMC And Other Meme Stocks Flipped The Way Markets Usually Work” (MSNBC). “[W]hile most market observers, including me, thought that the meme-stock bubble would quickly burst, leaving many retail investors holding the bag, it has proved shockingly resilient. GameStop's stock, for instance, is still up by almost 1,000 percent in 2021, while AMC's stock is up by more than 1,800 percent. Now meme-stock traders are doing something even more surprising: using their power to reshape corporate decision-making.”

“JPMorgan Awards Jamie Dimon Surprise Retention Bonus” (Wall Street Journal). Present value? $50 million. And with “one exit strategy open for Mr. Dimon: He can exercise them if he leaves the bank for an elected or unelected government job, according to the regulatory filing.” SPC’s view: seen him in person, wasn’t impressed. And his return-to-office commentary has been embarrassing and totally out-of-touch.

“Why Should They Call Us ‘Professors’?” (Marginal Revolution). “Some of the strongest norms are around the title ‘Doctor.’ Just about everyone calls their physician ‘Doctor,’ though the esteemed profession of lawyer does not receive similar treatment. As a Ph.D.-toting academic, I’ve even had people say to me — correctly — ‘You’re not a real doctor.’ I fear that by ceding this unique authority status to doctors we are making it easier for them to oversell us medical care, a major problem in the U.S. If your doctor suggests that you need a procedure done, it can be hard to say no, especially if you have been deferring to that person for years through the use of an honorific title.”

What we’re reading (7/21)

“Options Trader Bets On A Huge Rebound For Nordstrom” (CNBC). “Nordstrom may have lost more than 3% in Monday’s washout — but that price action emboldened, rather than deterred — at least one options trader to make a very bullish bet on the retailer’s stock. As of Monday’s close, Nordstrom had lost 13% in the last week of trading. This trader looks to be betting that the bottom is in, and that the stock could jump as much as 34% by August expiration.”

“Why The Markets Worry About The Delta Variant” (DealBook). “Last week, analysts at Goldman Sachs told clients that the potential economic impact of the Delta variant of the coronavirus would be “modest.” Even if that turns out to be the case, investors look nervous as infections spread because of the highly contagious strain. Yesterday [Monday], the S&P 500 recorded its steepest one-day drop since May and European stocks had their worst day of the year.”

“Now Hiring: White Castle—Four Years After You Applied” (Wall Street Journal). “When Abigail Ezzell applied for a server position at Cracker Barrel, she was in high school. She was in college when she finally heard back. The email landed last month, three years after she submitted it. ‘It was like, hey, Abigail, so glad to see you applied! They gave me a date and time to come in for an interview,’ says Ms. Ezzell, 20. When Ms. Ezzell applied, she had been looking for an after-school job in Mount Airy, N.C. She’s now living in San Francisco, where she’s an undergraduate studying political science. ‘I definitely did not email them back,’ she says. Cracker Barrel declined to comment.”

“Comcast, ViacomCBS Rumors Said To Include Talk Of Something Bigger” (Forbes). “Executives for ViacomCBS and Comcast Corp. have been holding discussions that some interpret as laying the groundwork for something bigger. Speculation about a potential deal has been brewing since before this month’s Allen & Co. retreat for tech and media moguls in Sun Valley, Idaho, where ViacomCBS Chairwoman Shari Redstone and Comcast CEO Brian Roberts were among the notable attendees. Both companies have been under pressure to achieve greater scale, as competitors have struck major deals to propel their streaming services.”

“Haiti vs. the Dominican Republic: Why The Big Divergence?” (Noahpinion). “The countries of Haiti and the Dominican Republic together form the island of Hispaniola in the Caribbean. Haiti comprises roughly the western third of the island, while the D.R. makes up the eastern two-thirds. The economic divergence between these two countries is one of the most remarkable in the world, perhaps surpassed only by North and South Korea. As recently as 1960, the two countries had similar standards of living. Today, the D.R., by some measures, is eight times as rich as Haiti, while Haiti’s standard of living hasn’t advanced at all since 1950.”

What we’re reading (7/20)

“OPEC+ Is Boosting Oil Production, Ending Dispute That Shook Energy Markets” (CNN Business). “OPEC+ agreed to increase oil production Sunday, as demand roars back and prices surge, ending a dispute between the United Arab Emirates and Saudi Arabia. Oil prices soared about two weeks ago after major producers, including Saudi Arabia and the UAE, fell out over plans to increase production in the face of rising global demand.”

“UBS Profit Jumps On Wealth Management Boom” (Wall Street Journal). “The booming business of managing rich people’s money boosted results for UBS Group AG, raising hopes that the Swiss banking giant will return more money to shareholders. On Tuesday, Switzerland’s biggest bank said net profit jumped to $2 billion from $1.23 billion a year earlier, outpacing analyst expectations of $1.34 billion.”

“71% Of Institutional Investors Say They Will Buy Or Invest In Digital Assets In The Future - And Over Half Already Do, Survey Finds” (Business Insider). “Investors in Asia are leading the way in terms of adoption of digital assets, but US and European institutions are following suit, by expanding their crypto-based offerings, according to the survey, which is part of Fidelity Digital Assets' 2021 Institutional Investor Digital Assets Study.”

“The Looming Stagflationary Debt Crisis” (Nouriel Roubini, Project Syndicate). “The warning signs are already apparent in today’s high price-to-earnings ratios, low equity risk premia, inflated housing and tech assets, and the irrational exuberance surrounding special purpose acquisition companies (SPACs), the crypto sector, high-yield corporate debt, collateralized loan obligations, private equity, meme stocks, and runaway retail day trading. At some point, this boom will culminate in a Minsky moment (a sudden loss of confidence), and tighter monetary policies will trigger a bust and crash.”

“The Pandemic-Induced Renaissance Of Malls” (Axios). “For the last decade or so, malls have been dying. Surprisingly, the pandemic may save them…[a] year and a half of isolation has reignited a desire to gather in public spaces — and spruced-up, futuristic malls could make billions off of a cooped-up America. ‘The pandemic has definitely made people appreciate public spaces more, so there is scope for malls to capitalize on this trend,’ says Neil Saunders, managing director of GlobalData Retail.”

What we’re reading (7/19)

“Amid Mega-Mergers And Acquisitions, ViacomCBS May Be In Play” (New York Post). “The cliché describes those preliminary M&A powwows between CEOs that are so commonplace, you probably shouldn’t label them ‘deal discussions.’ Except on those occasions when they deserve that designation, which is why Shari Redstone, the matron of the ViacomCBS media empire, caused such a stir two weeks ago at the Allen & Co. media conference in Sun Valley, Idaho. People who attended the event say Redstone was “talking to everyone,” which again may or may not lead to a deal.”

“Bill Ackman’s Deal Machine Must Try Again” (DealBook). “When Bill Ackman’s jumbo-sized SPAC, Pershing Square Tontine Holdings, struck a deal last month to buy a 10 percent stake in Universal Music Group, it did so with a highly complex transaction that took a lot of explaining. Now, pushback from the S.E.C. has forced Ackman to change course.”

“Cathie Wood's Flagship ARK Fund Shows Dot-Com Bubble Traits And May Be Luring Investors Into A ‘Bull Trap,’ JPMorgan Strategist Says” (Business Insider). “In a note dated July 15, [JPM analyst Shawn] Quigg wrote that a second-half pick-up in Treasury yields and a shift in the growth dynamic of the economy could trigger a bull-trap reversal of shares in the exchange-traded fund. ‘A looming rise in yields could be a catalyst to accelerate ARKK shares lower, in addition to the continued outperformance of large staple-tech stocks over disruptive-tech stocks, and pressing ARKK into the capitulation phase,’ he wrote.”

“Robinhood Is Seeking A Market Valuation As High As $35 Billion In Upcoming IPO” (CNBC). “The stock trading app will attempt to sell its share at a range of $38 to $42 per share, according to the updated prospectus. Robinhood is looking to sell 55 million shares at that range to raise as much as $2.3 billion. Robinhood’s last private market valuation was $11.7 billion as of September.”

“Taming Wildcat Stablecoins” (Gary Gorton, Jeffery Zhang, working paper). “Cryptocurrencies are all the rage, but there is nothing new about privately produced money. The goal of private money is to be accepted at par with no questions asked. This did not occur during the Free Banking Era in the United States—a period that most resembles the current world of stablecoins…Based on lessons learned from history, we argue that privately produced monies are not an effective medium of exchange because they are not always accepted at par and are subject to runs. We present proposals to address the systemic risks created by stablecoins, including regulating stablecoin issuers as banks and issuing a central bank digital currency.”

What we’re reading (7/18)

“Red-Hot U.S. Economy Expected To Cool From Here” (Wall Street Journal). “The U.S. economy’s 2021 growth surge likely peaked in the spring, according to economists who expect to see a slower but still-strong expansion into next year. Widespread business reopenings, rising vaccination rates and a big infusion of government pandemic aid this spring helped propel rapid gains in consumer spending—the economy’s main driver. But that burst of economic growth is starting to ebb, economists say.”

“Biden To Reappoint Jerome Powell As Fed Chair, Say Economists” (Reuters). “U.S. President Joe Biden will reappoint current Federal Reserve Chair Jerome Powell for a second four-year term starting February next year, according to an overwhelming majority of economists polled by Reuters this week.”

“Still Working Remotely? Your 2021 Taxes May Be More Complicated Than Your 2020 Return” (CNBC). “Of those who were still doing their jobs remotely in late 2020, about 30% said they were working in a different state than where they had lived and worked pre-pandemic, according to a survey done by the Harris Poll on behalf of the American Institute of CPAs…[d]ifferent states have different approaches for when they expect you to report income earned there, and the rules don’t necessarily mean you’ll be paying more overall in taxes because most states provide a tax credit to eliminate double taxation (although that isn’t always the case).”

“Nobody Knows If Beefing Up The IRS Will Really Pay Off. We Should Do It Anyway.” (Washington Post). “Anyone who pays attention knows that the IRS staff has been shrinking for years, that it’s almost impossible for an average person to get IRS people on the phone to answer questions, and that the IRS back-office is a total mess. All this ought to be fixed, regardless of whether it produces financial gains for taxpayers. What I hadn’t realized until I delved into the Treasury’s May report was how much IRS audits of big companies — those with more than $20 billion of assets — have fallen in recent years.”

“Musk Waxes Lyrical On Cybertruck, Says It Looks Like It Was ‘Made By Aliens From The Future’” (NBC News). “[Musk] wrote [on Twitter], ‘To be frank, there is always some chance that Cybertruck will flop, because it is so unlike anything else. I don’t care. I love it so much even if others don’t. Other trucks look like copies of the same thing, but Cybertruck looks like it was made by aliens from the future.’”

What we’re reading (7/17)

“Regulators Feel Torn About Cryptocurrencies” (DealBook). “Cryptocurrencies have ‘completely failed’ to become a legitimate payment system, the Fed chair, Jay Powell, said yesterday at a Senate hearing. He added that so-called stablecoins — cryptocurrencies whose value is pegged to the dollar or another asset like gold, with the idea of making them a predictable means of exchange — are dangerously unregulated. Central banks could step in and develop digital versions of their currencies, but Powell is ‘legitimately undecided’ about the benefits of doing so, he told senators.”

“Wall Street Is Paying Bankers More Than Ever To Cloak A Brutal Work Life” (Bloomberg). “[R]ates of turnover and burnout among young workers are accelerating. Banks have tried to turn the tide with raises, bonuses, vacations and even free Pelotons. All that means it’s never been more lucrative to be a young banker in the U.S. The problem though is that it’s also never been more lucrative for aspirants to work outside the gilded world of finance. And the gap between banks and other employers like technology firms has narrowed. ‘Is it the best time to be a banker in terms of making money? Sure,’ says executive recruiter Dan Miller of True Search. ‘Is it a horrible time in terms of lifestyle? Absolutely.’”

“Staffing Firms Look Beyond The Pandemic” (The Economist). “A year ago employers were furloughing staff. Now many of them are desperately looking for more. The rapid bounce-back in some bits of the labour market—notwithstanding the risk of a new pandemic flare-up—has been good news for workers angling for a pay rise. It is also a boon for staffing agencies, which match firms with potential hires. Beyond short-term dislocations to the workforce, the changing way in which people want to work should keep the recruiters busy.”

“Investors Are Very Scared Even With Stocks Near Record Highs” (CNN Business). “The Dow and S&P 500 are both up about 15% in 2021 and are each about a percent away from their all-time highs. But as Friday's market sell-off showed, investors remain extremely nervous about the market. The CNN Business Fear & Greed Index, which looks at seven different measures of market sentiment, is showing signs of Extreme Fear. Four of the seven indicators are in bearish territory.”

“What Makes A Champion? Early Multidisciplinary Practice, Not Early Specialization, Predicts World-Class Performance” (Güllich, et al., Perspectives on Psychological Science). “What explains the acquisition of exceptional human performance? Does a focus on intensive specialized practice facilitate excellence, or is a multidisciplinary practice background better? We investigated this question in sports…adult world-class athletes engaged in more childhood/adolescent multisport practice, started their main sport later, accumulated less main-sport practice, and initially progressed more slowly than did national-class athletes…[w]e illustrate parallels from science: Nobel laureates had multidisciplinary study/working experience and slower early progress than did national-level award winners. The findings suggest that variable, multidisciplinary practice experiences are associated with gradual initial discipline-specific progress but greater sustainability of long-term development of excellence.”

What we’re reading (7/16)

“Bond King Jeff Gundlach Says There Is A Simple Reason Treasury Yields Are So Low Even As Inflation Surges” (MarketWatch). “Bond guru Jeffrey Gundlach of DoubleLine Capital said it is no mystery why U.S. Treasury yields are anchored lower despite evidence that inflation is rising in an economy attempting to rebound from a stultifying pandemic. Speaking to CNBC’s Halftime Report on Thursday, Gundlach said that the financial system remains awash with liquidity, i.e., willing buyers, who seem eager to purchase benchmark government debt, a factor that has been a key reason in driving prices up and yields commensurately lower. ‘Yields are this low because of all the liquidity in the system,’ Gundlach told the business network.”

“Homeowners Have Another Chance To Refinance As Mortgage Rates Fall Again” (CNN Business). “Homeowners who missed out on ultra-low interest rates earlier this year may have another chance. The average interest rate on a 30-year fixed-rate mortgage fell to 2.88%, according to Freddie Mac, the lowest level since mid-February and the third consecutive weekly drop. The 15-year fixed-rate mortgage dropped to 2.22%.”

“Wall Street Opens Back Up To Oil And Gas—But Not For Drilling” (Wall Street Journal). “Energy companies are raising money again from Wall Street at superlow borrowing costs, thanks in part to higher oil prices. The one thing most investors don’t want them to do with it is pump more crude. Speculative-grade energy companies, including oil producers, pipeline operators and refineries, have issued bonds in the U.S. at a record pace this year, raising about $34 billion so far, according to LCD, a unit of S&P Global Market Intelligence. Cash is primarily heading toward riskier borrowers in the shale patch, which by this time last year had raised about half as much from bond issuances.”

“Why Investors Are Worried About A Profits Squeeze In 2022” (The Economist). “Optimism about earnings has driven share prices higher in the past year. But financial markets are relentlessly forward-looking. And with bumper earnings already in the bag, they now have less to look forward to. A rally in bond prices since March and a sell-off in some cyclical stocks point to concerns about slower gdp growth. A plausible case can be made that the earnings outlook might worsen as quickly as it improved.”

“Small Hedge Fund Managers Are Feeling Optimistic As Launches Surge And Investors Seek Alternatives To The Industry's Biggest Names” (Business Insider). “Macro managers, stock-pickers, and distress players all were able to make money last year. And those who invest in hedge funds took notice. Starting in July 2020, there have been three consecutive quarters where more funds were launched than were liquidated — an impressive stat since fundraising meetings and conferences ground to a halt during the throes of the pandemic.”

What we’re reading (7/15)

“U.S. Weekly Jobless Claims Fall As Expected” (Reuters). “Initial claims for state unemployment benefits fell 26,000 to a seasonally adjusted 360,000 for the week ended July 10, the Labor Department said on Thursday. Economists polled by Reuters had forecast 360,000 applications for the latest week.”

“Many Jobs Lost During The Coronavirus Pandemic Just Aren’t Coming Back” (Wall Street Journal). “Job openings are at a record high, leaving the impression that employers are hiring like never before. But many businesses that laid off workers during the pandemic are already predicting they will need fewer employees in the future.”

“Wall Street Analysts See These Risks Causing A ‘Growth Scare’ For Global Markets” (CNBC). ‘With Covid-19 cases on the rise due to the surging delta variant and a range of macroeconomic shifts occurring, the global market narrative has moved from “goldilocks to growth scare,’ according to Barclays.”

“CEOs Made 299 Times More Than Their Average Workers Last Year” (CNN Business). “The average S&P 500 company CEO made 299 times the average worker's salary last year, according to AFL-CIO's annual Executive Paywatch report. Executives received $15.5 million in total compensation on average, marking an increase of more than $260,000 per year over the past decade. At the same time, the average production and nonsupervisory worker in 2020 earned $43,512, up just $957 a year over the past decade.”

“The Car Market Is Insane. It Might Stay That Way for a While.” (Slate). “The entire auto industry has been hobbled for months by the worldwide shortage of semiconductor chips, which has prevented manufacturers from producing enough vehicles to meet the demand from Americans eager to spend their pandemic savings and stimulus checks. As a result, many dealerships are practically barren of inventory, and new rides are fetching record prices…[and] shoppers will likely have to wait until 2022 for the auto industry to settle[.] […] Some of the pain, especially in the used car market, could begin to ease up earlier. But it could be well into next year before prices fall back to earth and customers see the sort of selection they’re used to at dealerships.”

What we’re reading (7/14)

“JPMorgan Has Big Wealth-Management Growth Plans” (Business Insider). “Private banking and wealth management are a key part of JPMorgan's future. In the past year, the bank has hired about 100 advisors for its private-bank division, which oversees more than $836 billion in client assets and caters to individuals worth at least $10 million. JPMorgan plans to hire as many as 1,500 new advisors over the next five years, doubling its current private-bank advisor head count, Private Bank CEO David Frame told Insider.”

“The Boomer Wealth Boom” (City Journal). “Over time, the rate at which Americans have saved for retirement has increased impressively. A 2016 study of gains in retirement savings over a 27-year period by Andrew Biggs of the American Enterprise Institute found that retirement savings of those aged 55 to 69 grew by 126 percent after inflation, to $448,292. The gains haven’t all been concentrated among the rich, either. As Biggs points out, even the retirement savings of middle-income Americans increased by 70 percent after inflation in that time. With these gains has come a sharp decline in poverty among seniors.”

“America’s Elite Law Firms Are Booming” (The Economist). “According to the American Lawyer, an industry journal, total revenues at the 100 biggest firms rose by 7% last year, to $111bn…average profit margins increased, from 40% to 43%. Profits per equity partner rose by over 13%, to an all-time high of nearly $2.2m. These went up at all but six of the top 100 firms. At the most lucrative ones, such as Davis Polk, Kirkland & Ellis or Sullivan & Cromwell, they surpassed $5m. Each equity partner at Wachtell, Lipton, Rosen & Katz, the richest of the lot, raked in $7.5m, up from $6.3m in 2019[.]”

“Lumber Wipes Out 2021 Gain With Demand Ebbing After Record Boom” (Bloomberg). “Lumber, which at one point was among the world’s best-performing commodities as the pandemic sent construction demand soaring and stoked fears of inflation, has officially wiped out all of its staggering gains for the year.”

“NYC Restaurant's French Fries Set Guinness World Record for Most Expensive” (NBC News). “Serendipity3, the iconic Upper East Side restaurant, set a Guinness World Records title for making the “Most Expensive French Fries'' -- just in time to celebrate National French Fry Day…Serendipity3’s Creative Director and Chef Joe Calderone and Corporate Executive Chef Frederick Schoen-Kiewert are the masterminds behind the ‘Creme de la Creme Pommes Frites,’ which cost a whopping $200.”

What we’re reading (7/13)

“Inflation Expectations Surge, Hitting New High For New York Fed Survey” (CNBC). “Despite the Federal Reserve’s assurance that current inflation pressures won’t last, consumers see things differently, according to a survey Monday from the central bank’s New York district. The June Survey of Consumer Expectations showed that median inflation expectations over the next 12 months jumped to 4.8%, a 0.8 percentage point rise from May and the highest reading in history for a series that goes back to 2013.”

“Inflation Threat May Be Boosted By Changes In Globalization, Demographics And E-Commerce” (Wall Street Journal). “For the past few decades, the Federal Reserve has succeeded in keeping inflation low—perhaps too low. It had an assist: Shifts in the global economy, including globalization, demographics and the rise of e-commerce, helped keep prices in check. Some economists say these so-called secular forces have begun to reverse in ways that the pandemic has intensified.”

“Inflation Is Rising But The Reasons Why Are Changing” (CNN Business). “Before the pandemic, inflation — which the Federal Reserve would like to have around 2% — had been stuck near rock bottom for years. Now, the Fed finds itself striking an increasingly difficult balance between supporting the recovery through ample stimulus while keeping inflation in check. As the recovery gathers steam, the items that are driving inflation up are changing. For example, people are spending more money dining out as pandemic restrictions are lifted, while the return to offices is prompting a work wardrobe refresh.”

“Investment In Fintech Booms As Upstarts Go Mainstream” (The Economist). “An air of hype habitually surrounds the founders of startups and their venture-capital backers: everyone is an evangelist for their latest project. But even allowing for that zeal, something astonishing is going on in fintech. Much more money is pouring into it than usual. In the second quarter of the year alone it attracted $34bn in venture-capital funding, a record, reckons CB Insights, a data provider...[o]ne in every five dollars invested by venture capital this year has gone into fintech.”

“Do People Want Their Pre-Pandemic Freedom Back?” (Reason). “When it comes to insanely restrictive (and, arguably, ineffective) pandemic measures, critics tend to point the finger at public officials and their appetite for power. But government functionaries may be no more of a danger to post-COVID freedom than some of our neighbors. Recent polling suggests that many among us not only approve of the lockdowns of the past year and foresee public health restrictions continuing into the indefinite future, but they also want the world to remain constrained by efforts to prevent illness—or maybe just constrained, and never mind the reason.”

What we’re reading (7/12)

“Earnings Kick Off With Sky-High Forecasts, Record Stock Market” (Wall Street Journal). “Wall Street is heading into earnings season this week with high expectations after strong profits fueled a stock market rally in the first half of the year. Money managers will be watching whether companies will again trounce Wall Street’s forecasts for earnings. The S&P 500 has gained 16% this year and notched 38 record closes, most recently on Friday.”

“This Company Sells Passports To Americans Looking For A Tax Break On Their Bitcoin Profits” (CNBC). “Russian expatriate Katie Ananina has spent the last three years helping people dodge taxes on their bitcoin gains. It is all part of her mission to stick it to the man, one case of tax avoidance at a time. As the name suggests, Plan B Passport offers crypto-rich clients a path to a second passport in their pick of seven, mostly tropical, tax-haven states, all of which are exempt from capital gains taxes on crypto holdings.”

“The Pandemic Has Widened The Wealth Gap. Should Central Banks Be Blamed?” (The Economist). “The global financial crisis of 2007-09 was socially divisive as well as economically destructive….[But] [t]he share of global wealth held by the top “one percent” actually fell in 2008. The pandemic has been different. Amid all the misery and mortality, the number of millionaires rose last year by 5.2m to over 56m, according to the Global Wealth Report published by Credit Suisse, a bank. The one percent increased their share of wealth to 45%, a percentage point higher than in 2019.”

“You Know, When Credit Suisse Really Thinks About It, Maybe It Should Have Someone Reviewing Counterparty Risk” (Dealbreaker). “Ideally, you’d hire a person to keep an eye on the risks your counterparties are taking before one of them costs you $5.5 billion, many legal bills, a great deal of talent, maybe an antitrust prosecution and the ire of the Swiss people. Of course, no one does this, and anyway Credit Suisse was spending that money keeping an eye on its own employees rather than on the likes of Archegos Capital Management which, it admits in retrospect, was a poor allocation of resources for a lot of reasons.”

“For A $12.50 Raffle Ticket, The Keys To Drug Lord El Chapo’s Seized Safe House In Mexico Await” (Washington Post). “The Mexican government is raffling off the site of Guzmán’s dramatic escape, along with seven other houses, seven apartments, five lots, a ranch, and a 20-seat viewing box at the Azteca Stadium in Mexico City. The prizes — confiscated assets from various criminal operations and now owned by the government — are valued at a total of $12.5 million. Lottery tickets cost 250 pesos ($12.50). Winning tickets will be drawn on Sept. 15, the day before Mexico’s Independence Day.”

What we’re reading (7/10)

“Investors Pile Into Longer-Dated Treasury ETFs As Bond Yields Fall” (Reuters). “Recent price rallies in U.S. government debt drove flows into exchange-traded funds tracking longer-dated Treasuries, according to BlackRock ETF provider iShares. The iShares 20+ year Treasury Bond ETF attracted $1.4 billion of inflows in the past three weeks to Thursday, with around $447 million added in the last week. Comparatively, investors pulled $547 million out of the iShares 7-10 year Treasury Bond ETF over the same period, according to iShares fixed income investment strategist Dhruv Nagrath.”

“Where Is My Patio Table? Supply Delays Leave Consumers Waiting.” (Christian Science Monitor). “The garden supply store in suburban Baltimore has been waiting six months for a shipping container from Vietnam full of $100,000 worth of wicker and aluminum furniture. Half of the container has already been sold by showing customers photographs. The container should have arrived in February, but it reached U.S. waters on June 3 and has just docked in Long Beach, California.”

“The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes” (ProPublica). A good primer on M&A accounting: “[Steve] Ballmer pays such a low rate, in part, because of a provision of the U.S. tax code. When someone buys a business, they’re often able to deduct almost the entire sale price against their income during the ensuing years. That allows them to pay less in taxes. The underlying logic is that the purchase price was composed of assets — buildings, equipment, patents and more — that degrade over time and should be counted as expenses.”

“A Little-Known ‘Back Door’ Trick For Boosting Your Roth Contributions” (Wall Street Journal). “Most people won’t ever get a chance to own pre-IPO stock. But the mega-backdoor Roth conversion strategy is available to many people with 401(k) accounts, so long as they have the means to save significant amounts of money. It lets those in 401(k) plans that allow after-tax contributions put up to $58,000 a year into a 401(k) account and convert some or all of the money to a Roth, with a minimal tax hit if executed well.”

“News Organizations Are Taking Different Approaches To How Often Employees Will Come Back To The Office” (CNBC). “Newsroom leaders are beginning to make decisions based on internal employee surveys and conversations, but they’re not all making the same choices. The decisions companies make could have major implications for how future employees select between potential employers. They’ll also be an industry-wide test for whether more flexible work arrangements can be long lasting.”

What we’re reading (7/9)

“We’re Looking At Stocks As Money Pots, And That’s Just Not In The Cards” (MarketWatch). “Consider by how much individual investors in the U.S. expect their portfolios to beat inflation in coming years. According to the 2021 Natixis Global Survey of Individual Investors, they on average expect their portfolios to produce an inflation-adjusted return of 17.3% annualized over the next decade. That’s nearly triple the U.S. stock market’s long-term average real total return of 6.1% annualized, and more than four times the bond market’s long-term average total return of 4.1% annualized[.]”

“Why Do We Buy What We Buy?” (Vox). “If you think about the particular things people want, it mostly has to do with being the kind of person that they think they are because there’s a consumption style connected with that. The role of what are called reference groups — the people we compare ourselves to, the people we identify with — is really key in that. It’s why, for example, I’ve [Prof. Juliet Schor of BC] found that people who have reference groups that are wealthier than they are tend to save less and spend more, and people who keep more modest reference groups, even as they gain in income and wealth, tend to save more.”

“The Stickiness Of Pandemic-Driven Economic Behavior” (Project Syndicate). “[T]he global disruption triggered by COVID-19 created a perfect storm in which some shifts in consumer behavior were matched by changes in business operations and government regulations. Many such behaviors in fact accelerated practices that held promise before the pandemic but had failed to gain traction because of cost concerns or widespread skepticism. The virus, by creating an opportunity to experiment with them, made their value much more apparent.”

“Levi Earnings Crush Estimates, Retailer Raises 2021 Forecast, Citing Strong Denim Sales” (CNBC). “Levi Strauss & Co. said Thursday that shoppers are stocking up on jeans in new sizes and styles in the U.S. and China as they emerge from their homes during the pandemic. The momentum both in stores and online boosted its fiscal second-quarter earnings and revenue ahead of analysts’ expectations. Although sales were still down 3% from 2019, the retailer anticipates fiscal third-quarter sales are on track to top pre-pandemic levels. That was something Levi previously didn’t expect to achieve until the fourth quarter.”

“Robinhood May Lose 81% Of Its Revenue, Still Going Public Anyway” (Dealbreaker). “When discussing the record-setting $70 million fine for its alleged technical, due-diligence and truth-telling failings that apparently served as the green light for going public, we noted that the Robinhood IPO prospectus’ “Risk Factors” chapter was likely to be on the long side…[t]hen, our focus was on the risks inherent in the hailstorm of user litigation, regulatory ire and skeptical oversight battering the company...[i]ncredibly, however, these pale in comparison to the threat that one day soon lawmakers and/or regulators will decide to take away the source of $420 million of the $522 million Robinhood made in the first quarter: payment for order flow.”

What we’re reading (7/8)

“Ransomware Attacks Will End, But Not Anytime Soon” (Bloomberg). “In economic terms, the private value of internet security is often less than the public value. A ransomware attack that results in only a slight decrease in profits for a business could translate into a major social inconvenience. One consolation is that hackers will almost certainly “overfish” the pool of victims. At some point there will be so many attacks that most institutions will have no choice but to respond with significant defensive measures.”

“Robinhood IPO Faces Threat Of Retail Snub On Reddit” (Reuters). “Online brokerage Robinhood Markets Inc, which helped enable the "meme stock" frenzy earlier this year and later attracted flak for its handling of the trading mania, is facing pushback on social media forums against its initial public offering. Many individual investors are planning to shun the stock market debut, and several posts in recent days urging users to not buy into the IPO have received thousands of upvotes, discussions in online forums on Reddit showed.”

“Iceland Tested A 4-Day Workweek. Employees Were Productive — And Happier, Researchers Say.” (Washington Post). “Several large-scale trials of a four-day workweek in Iceland were an ‘overwhelming success,’ with many workers shifting to shorter hours without affecting their productivity, and in some cases improving it, in what researchers called “groundbreaking evidence for the efficacy of working time reduction.”

“Cash-Laden Companies Are On A Mergers and Acquisitions Spree” (Wall Street Journal). “Businesses spent $1.74 trillion on mergers and acquisitions involving U.S. companies during the first six months of the year—the highest amount in more than four decades—as finance chiefs tapped into cheap funding options to acquire technologies, services and other assets.”

“TikTok Made Me Buy It” (Vox). “There’s now so much stuff that’s gone viral on TikTok that people have opened stores dedicated to it: A 15-year-old student opened a store in his local mall called ‘Viral Trends NY,’ which carries omnipresent TikTok doodads like Martinelli’s apple juice and Squishmallows stuffed animals…a similar shop also exists in Indiana. Downtown Manhattan has its own ‘TikTok Block,’ where two big TikTokers have opened shops with curated vintage clothing. There is now so much stuff that’s gone viral on TikTok that the factories producing those products have gotten on TikTok and now have a hand in making them go viral in the first place.”

What we’re reading (7/7)

“U.S. Treasury Yields Extend Steep Decline” (Wall Street Journal). “Yields on U.S. government bonds reached fresh multimonth lows on Wednesday, reflecting investors’ anxiety about the economic outlook and new concerns about the highly contagious Delta variant of Covid-19. In recent trading, the yield on the benchmark 10-year U.S. Treasury note was 1.313%, according to Tradeweb, compared with 1.369% on Tuesday.”

“Can Individual Investors Beat the Market?” (Coval, Joshua D., David Hirshleifer, and Tyler Shumway, Review of Asset Pricing Studies). An interesting new study: “We document persistent superior trading performance among a subset of individual investors. Investors classified in the top performance decile in the first half of our sample subsequently earn risk-adjusted returns of about 6% per year. These returns are not confined to stocks in which the investors are likely to have inside information, nor are they driven by illiquid stocks. Our results suggest that skilled individual investors exploit market inefficiencies (or perhaps conditional risk premiums) to earn abnormal profits, above and beyond any profits available from well-known strategies based on size, value, momentum, or earnings announcements.”

“Mortgage Applications Sink To Their Lowest Level Since Before The Pandemic Hit” (CNBC). “Mortgage demand fell for the second week in a row, as low inventory and high home prices continue to weigh on the housing market. Mortgage applications decreased 1.8% last week, according to the Mortgage Bankers Association’s seasonally adjusted index, falling to the lowest level since the beginning of 2020, before the coronavirus pandemic started to take a toll on the economy.”

“Which Airlines Will Soar After The Pandemic?” (The Economist). “Some airlines are struggling despite having cut costs, slashed fleets and shored up balance-sheets with commercial loans. Others are brimming with confidence. Big American and Chinese ones with large, increasingly virus-free domestic markets will return to profitability first. Frugal low-cost carriers that went into the pandemic in the black are close behind. By contrast, airlines that depend on lucrative long-haul routes may struggle if, as seems almost inevitable, business travellers substitute Zoom for at least some flights. Regional companies in places still ravaged by covid-19, such as India or Latin America, look precarious. And the airspace between those losers and the industry’s winners is widening.”

“Betting Against Meme Stocks Could Get You Seriously Burned” (CNN Business). “Many investors are still betting against top momentum and Reddit meme stocks — despite getting burned in the process. Richard Branson's space tourism company Virgin Galactic is one of the most heavily shorted stocks among customers of online broker TradeZero America. Shares of Virgin Galactic (SPCE) have nearly doubled this year due to optimism about the demand for suborbital travel.”

What we’re reading (7/6)

“Stocks Were Unusually Quiet In June. Traders Think That Is About To Change.” (Wall Street Journal). “After a notably quiet stretch, many analysts are anticipating a break in the lull. The simplest reason: Trading desks tend to become more lightly staffed during the summer as employees take off for the holidays. That generally means there is less liquidity in the markets. In turn, any surprising economic data, corporate news or monetary-policy news tends to ‘hit the market harder than they otherwise might,’ said Nicholas Colas, co-founder of DataTrek Research, in an emailed note.”

“Oil Prices Could ‘Very Easily’ Top $100 A Barrel, Says Former U.S. Energy Secretary” (CNBC). “OPEC and its allies, referred to collectively as OPEC+, twice failed to reach a deal on oil output last week. On Monday, another attempt to resume talks broke down, and discussions were put off indefinitely. The energy alliance, which includes Russia, had sought to increase supply by 400,000 barrels per day from August to December 2021 and proposed extending the duration of cuts until the end of 2022. Last year, to cope with lower demand due to the pandemic, OPEC+ agreed to curb output by almost 10 million barrels per day from May 2020 to the end of April 2022.”

“China Escalates Its Fight Against Big Tech” (DealBook). “On Sunday, Beijing officials ordered Didi, the ride-hailing app, to be removed from the country’s app stores over concerns about the handling of customer data, days after the company completed a blockbuster U.S. I.P.O. Yesterday, they suspended new user registrations for platforms run by two other Chinese companies that recently listed shares in New York, citing the need for cybersecurity reviews. Didi’s shares fell nearly 30 percent in premarket trading, below their I.P.O. price.”

“It Gets Ugly in US Office Markets, Working from Home Shows Up” (Wolf Street). “A nightmare has been unfolding. There were issues before working-from-home and ‘hybrid work models’ slashed current and future real-estate needs of office tenants in the major office markets in the US. And now office footprints got slashed, and companies put their leased but vacant office space on the sublease market, undercutting landlords that want to direct-lease vacant offices.”

“Gold Regains Shine After Central Bank Buying Drops To Decade Low” (Bloomberg). “Central banks may be regaining their appetite for buying gold after staying on the sidelines for the past year. Central banks from Serbia to Thailand have been adding to gold holdings and Ghana recently announced plans for purchases, as the specter of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases. A rebound in buying -- which had dropped to the lowest in a decade -- would bolster the prospects for gold prices as some other sources of demand falter.”

What we’re reading (7/5)

“Wages Are Finally Going Up And That’s Going To Have To Continue To Get People Back To Work” (CNBC). “American workers collectively saw a nice bump in their paychecks for June that may have to keep coming if conditions ever are going to get back to where they were before the pandemic hit. If there was one dark cloud over the month’s otherwise robust round of hiring, it was the tick higher in the unemployment rate and the stagnation of the U.S. labor force.”

“Travelers Are Getting Hit By Sticker Shock This Summer” (CNN Business). “American vacationers are finding just about everything significantly more expensive this summer. Hotel rooms? Up about 44% at the end of June compared to a year earlier, according to data from hotel research firm STR. Air fares? They were 24% higher in May than in the same month last year, according to the Consumer Price Index. Even so, many of the prices are still below where they stood in the summer of 2019, six months before the outbreak of the Covid-19 pandemic brought demand for travel to a near halt and sent prices plunging.”

“Retail Investors Power The Trading Wave With Record Cash Inflows” (Wall Street Journal). “Retail investors keep pouring money into markets, even as many of their favorite meme stocks and cryptocurrencies have languished. In June, so-called retail investors bought nearly $28 billion of stocks and exchange-traded funds on a net basis, according to data from Vanda Research’s VandaTrack, the highest monthly amount deployed since at least 2014. That even trumped the amount retail traders spent in January during the first meme-stock frenzy.”

“The SEC's Probe Into Charles Schwab's Robo-Advisor Is An Early Glimpse Of The Regulator's Fintech Crackdown” (Business Insider). “Schwab said its second-quarter earnings results will show a $200 million charge related to the [SEC’s] investigation. The company is cooperating with the SEC, and a Schwab spokesperson declined to comment beyond the filing. That cost appears to be the largest that a robo-advisor — the automated low- or no-cost investing tools that emerged after the financial crisis — has incurred over a public regulatory matter, experts say.”

“The Smart Home Isn't Worth It” (Gizmodo). “A smart home that responds to your every command and automates mundane tasks is a tantalizing dream. But the reality is that given the current limitations of technology, competing standards, and devices that quickly become obsolete, trying to make that dream a reality today just isn’t worth all the effort.”

What we’re reading (7/4)

“How Businesses Are Getting Billions In Cash Back From Government To Offset Hiring Costs” (CNBC). “That war for talent has been tough on small businesses still in the midst of trying to recover from losses during the coronavirus pandemic. But many are entitled to get money back from the government through a credit against the employment taxes they pay. Small and midsize businesses can get cash directly from the federal government through the Employee Retention Credit (ERC), which offers businesses money back on a percentage of wages paid to their employees.”

“The Future Of Silicon Valley Headquarters” (The Economist). “[T]ech temples had begun to seem anachronistic long before covid-19 washed up on California’s shores. Traffic was making the daily commute an insufferable two-hour ordeal. Most computer programmers came to the office but really worked elsewhere—in the cloud, managing projects with Trello, on Zoom and Slack. Designed to be lively, tech offices were often eerily quiet. Realising this, companies began to open more of them beyond the Valley, and to make more use of the virtual realm. The pandemic then gave the shifting equilibrium a shove, notes Nicholas Bloom of Stanford University. Although it is hard to predict where exactly all the bits will land, the contours of tech hqs of the future are coming into view.”

“Fed's Daly: Appropriate To Consider Tapering Later This Year” (Reuters). “Federal Reserve Bank of San Francisco President Mary Daly said the U.S. central bank may be able to start reducing ‘a little bit’ of its extraordinary support for the U.S. economy by the end of this year. ‘The economy is really shaping up nicely,’ Daly told the Associated Press in an interview, a recording of which was provided to Reuters by the San Francisco Fed.”

“For Some Millennials, A Starter Home Is Hard To Find” (Wall Street Journal). “The shortage of available starter homes feels like yet another hurdle blocking some millennials’ path to traditional money milestones…[t]he first rung on the homeownership ladder has long been an affordable ‘starter home.’ These houses, with their smaller footprints and selling prices, allowed young homeowners to build wealth and upsize as they started their families. But a number of factors are complicating this decadeslong trend. Supply of “entry-level housing”—which Freddie Mac defines as homes under 1,400 square feet—is at a five-decade low.”

“House Prices Are ‘Scary’: Summers” (Bloomberg). “Former U.S. Treasury Secretary Lawrence H. Summers, a Wall Street Week contributor, says the rise in home prices is ‘scary.’ He thinks the state of the heating of the housing market makes it difficult to justify the Fed's continued purchases of mortgage-backed securities.”

June 2021 performance update

Hi friends and happy 4th! Here with a performance update for last month’s picks.

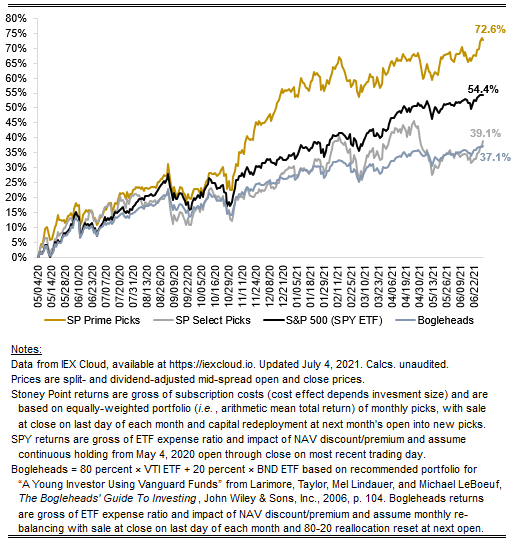

The key numbers for June were:

Prime: +2.29%

Select: also +2.29%

SPY ETF: 1.30%

Bogelheads portfolio (80% VTI + 20% BND): +1.36%

It was actually choppy waters out there for Prime and Select for most of the month, but, as you can see in the cumulative chart below, both delivered really strong performance in the last few days of the month.

I don’t have much of a macro update to deliver, other than to note that we should learn more about the Fed’s evolving views on consumer and asset prices this week, and whether there has been any movement on the anticipated path of interest rate hikes. The spread of the delta variant of the novel coronavirus “feels” like something to keep an eye on as well. With that said, the presence of these and other “known” risks doesn’t lead me (personally) to a conclusion that it makes sense to re-allocate en masse out of stocks into some other asset class, including cash, especially when focused on a 3- to 5-year investment horizon, which is the horizon of interest here at SPC. (That comes with all the usual caveats about having a well-diversified portfolio across asset classes and the like.)

That’s all for now. Check out the July Prime and Select picks here and have a very happy holiday.