June 2021 performance update

Hi friends and happy 4th! Here with a performance update for last month’s picks.

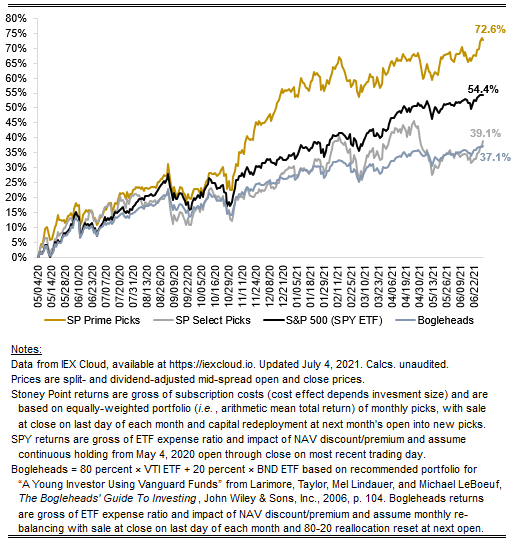

The key numbers for June were:

Prime: +2.29%

Select: also +2.29%

SPY ETF: 1.30%

Bogelheads portfolio (80% VTI + 20% BND): +1.36%

It was actually choppy waters out there for Prime and Select for most of the month, but, as you can see in the cumulative chart below, both delivered really strong performance in the last few days of the month.

I don’t have much of a macro update to deliver, other than to note that we should learn more about the Fed’s evolving views on consumer and asset prices this week, and whether there has been any movement on the anticipated path of interest rate hikes. The spread of the delta variant of the novel coronavirus “feels” like something to keep an eye on as well. With that said, the presence of these and other “known” risks doesn’t lead me (personally) to a conclusion that it makes sense to re-allocate en masse out of stocks into some other asset class, including cash, especially when focused on a 3- to 5-year investment horizon, which is the horizon of interest here at SPC. (That comes with all the usual caveats about having a well-diversified portfolio across asset classes and the like.)

That’s all for now. Check out the July Prime and Select picks here and have a very happy holiday.