What we’re reading (7/16)

“Bond King Jeff Gundlach Says There Is A Simple Reason Treasury Yields Are So Low Even As Inflation Surges” (MarketWatch). “Bond guru Jeffrey Gundlach of DoubleLine Capital said it is no mystery why U.S. Treasury yields are anchored lower despite evidence that inflation is rising in an economy attempting to rebound from a stultifying pandemic. Speaking to CNBC’s Halftime Report on Thursday, Gundlach said that the financial system remains awash with liquidity, i.e., willing buyers, who seem eager to purchase benchmark government debt, a factor that has been a key reason in driving prices up and yields commensurately lower. ‘Yields are this low because of all the liquidity in the system,’ Gundlach told the business network.”

“Homeowners Have Another Chance To Refinance As Mortgage Rates Fall Again” (CNN Business). “Homeowners who missed out on ultra-low interest rates earlier this year may have another chance. The average interest rate on a 30-year fixed-rate mortgage fell to 2.88%, according to Freddie Mac, the lowest level since mid-February and the third consecutive weekly drop. The 15-year fixed-rate mortgage dropped to 2.22%.”

“Wall Street Opens Back Up To Oil And Gas—But Not For Drilling” (Wall Street Journal). “Energy companies are raising money again from Wall Street at superlow borrowing costs, thanks in part to higher oil prices. The one thing most investors don’t want them to do with it is pump more crude. Speculative-grade energy companies, including oil producers, pipeline operators and refineries, have issued bonds in the U.S. at a record pace this year, raising about $34 billion so far, according to LCD, a unit of S&P Global Market Intelligence. Cash is primarily heading toward riskier borrowers in the shale patch, which by this time last year had raised about half as much from bond issuances.”

“Why Investors Are Worried About A Profits Squeeze In 2022” (The Economist). “Optimism about earnings has driven share prices higher in the past year. But financial markets are relentlessly forward-looking. And with bumper earnings already in the bag, they now have less to look forward to. A rally in bond prices since March and a sell-off in some cyclical stocks point to concerns about slower gdp growth. A plausible case can be made that the earnings outlook might worsen as quickly as it improved.”

“Small Hedge Fund Managers Are Feeling Optimistic As Launches Surge And Investors Seek Alternatives To The Industry's Biggest Names” (Business Insider). “Macro managers, stock-pickers, and distress players all were able to make money last year. And those who invest in hedge funds took notice. Starting in July 2020, there have been three consecutive quarters where more funds were launched than were liquidated — an impressive stat since fundraising meetings and conferences ground to a halt during the throes of the pandemic.”

What we’re reading (7/15)

“U.S. Weekly Jobless Claims Fall As Expected” (Reuters). “Initial claims for state unemployment benefits fell 26,000 to a seasonally adjusted 360,000 for the week ended July 10, the Labor Department said on Thursday. Economists polled by Reuters had forecast 360,000 applications for the latest week.”

“Many Jobs Lost During The Coronavirus Pandemic Just Aren’t Coming Back” (Wall Street Journal). “Job openings are at a record high, leaving the impression that employers are hiring like never before. But many businesses that laid off workers during the pandemic are already predicting they will need fewer employees in the future.”

“Wall Street Analysts See These Risks Causing A ‘Growth Scare’ For Global Markets” (CNBC). ‘With Covid-19 cases on the rise due to the surging delta variant and a range of macroeconomic shifts occurring, the global market narrative has moved from “goldilocks to growth scare,’ according to Barclays.”

“CEOs Made 299 Times More Than Their Average Workers Last Year” (CNN Business). “The average S&P 500 company CEO made 299 times the average worker's salary last year, according to AFL-CIO's annual Executive Paywatch report. Executives received $15.5 million in total compensation on average, marking an increase of more than $260,000 per year over the past decade. At the same time, the average production and nonsupervisory worker in 2020 earned $43,512, up just $957 a year over the past decade.”

“The Car Market Is Insane. It Might Stay That Way for a While.” (Slate). “The entire auto industry has been hobbled for months by the worldwide shortage of semiconductor chips, which has prevented manufacturers from producing enough vehicles to meet the demand from Americans eager to spend their pandemic savings and stimulus checks. As a result, many dealerships are practically barren of inventory, and new rides are fetching record prices…[and] shoppers will likely have to wait until 2022 for the auto industry to settle[.] […] Some of the pain, especially in the used car market, could begin to ease up earlier. But it could be well into next year before prices fall back to earth and customers see the sort of selection they’re used to at dealerships.”

What we’re reading (7/14)

“JPMorgan Has Big Wealth-Management Growth Plans” (Business Insider). “Private banking and wealth management are a key part of JPMorgan's future. In the past year, the bank has hired about 100 advisors for its private-bank division, which oversees more than $836 billion in client assets and caters to individuals worth at least $10 million. JPMorgan plans to hire as many as 1,500 new advisors over the next five years, doubling its current private-bank advisor head count, Private Bank CEO David Frame told Insider.”

“The Boomer Wealth Boom” (City Journal). “Over time, the rate at which Americans have saved for retirement has increased impressively. A 2016 study of gains in retirement savings over a 27-year period by Andrew Biggs of the American Enterprise Institute found that retirement savings of those aged 55 to 69 grew by 126 percent after inflation, to $448,292. The gains haven’t all been concentrated among the rich, either. As Biggs points out, even the retirement savings of middle-income Americans increased by 70 percent after inflation in that time. With these gains has come a sharp decline in poverty among seniors.”

“America’s Elite Law Firms Are Booming” (The Economist). “According to the American Lawyer, an industry journal, total revenues at the 100 biggest firms rose by 7% last year, to $111bn…average profit margins increased, from 40% to 43%. Profits per equity partner rose by over 13%, to an all-time high of nearly $2.2m. These went up at all but six of the top 100 firms. At the most lucrative ones, such as Davis Polk, Kirkland & Ellis or Sullivan & Cromwell, they surpassed $5m. Each equity partner at Wachtell, Lipton, Rosen & Katz, the richest of the lot, raked in $7.5m, up from $6.3m in 2019[.]”

“Lumber Wipes Out 2021 Gain With Demand Ebbing After Record Boom” (Bloomberg). “Lumber, which at one point was among the world’s best-performing commodities as the pandemic sent construction demand soaring and stoked fears of inflation, has officially wiped out all of its staggering gains for the year.”

“NYC Restaurant's French Fries Set Guinness World Record for Most Expensive” (NBC News). “Serendipity3, the iconic Upper East Side restaurant, set a Guinness World Records title for making the “Most Expensive French Fries'' -- just in time to celebrate National French Fry Day…Serendipity3’s Creative Director and Chef Joe Calderone and Corporate Executive Chef Frederick Schoen-Kiewert are the masterminds behind the ‘Creme de la Creme Pommes Frites,’ which cost a whopping $200.”

What we’re reading (7/13)

“Inflation Expectations Surge, Hitting New High For New York Fed Survey” (CNBC). “Despite the Federal Reserve’s assurance that current inflation pressures won’t last, consumers see things differently, according to a survey Monday from the central bank’s New York district. The June Survey of Consumer Expectations showed that median inflation expectations over the next 12 months jumped to 4.8%, a 0.8 percentage point rise from May and the highest reading in history for a series that goes back to 2013.”

“Inflation Threat May Be Boosted By Changes In Globalization, Demographics And E-Commerce” (Wall Street Journal). “For the past few decades, the Federal Reserve has succeeded in keeping inflation low—perhaps too low. It had an assist: Shifts in the global economy, including globalization, demographics and the rise of e-commerce, helped keep prices in check. Some economists say these so-called secular forces have begun to reverse in ways that the pandemic has intensified.”

“Inflation Is Rising But The Reasons Why Are Changing” (CNN Business). “Before the pandemic, inflation — which the Federal Reserve would like to have around 2% — had been stuck near rock bottom for years. Now, the Fed finds itself striking an increasingly difficult balance between supporting the recovery through ample stimulus while keeping inflation in check. As the recovery gathers steam, the items that are driving inflation up are changing. For example, people are spending more money dining out as pandemic restrictions are lifted, while the return to offices is prompting a work wardrobe refresh.”

“Investment In Fintech Booms As Upstarts Go Mainstream” (The Economist). “An air of hype habitually surrounds the founders of startups and their venture-capital backers: everyone is an evangelist for their latest project. But even allowing for that zeal, something astonishing is going on in fintech. Much more money is pouring into it than usual. In the second quarter of the year alone it attracted $34bn in venture-capital funding, a record, reckons CB Insights, a data provider...[o]ne in every five dollars invested by venture capital this year has gone into fintech.”

“Do People Want Their Pre-Pandemic Freedom Back?” (Reason). “When it comes to insanely restrictive (and, arguably, ineffective) pandemic measures, critics tend to point the finger at public officials and their appetite for power. But government functionaries may be no more of a danger to post-COVID freedom than some of our neighbors. Recent polling suggests that many among us not only approve of the lockdowns of the past year and foresee public health restrictions continuing into the indefinite future, but they also want the world to remain constrained by efforts to prevent illness—or maybe just constrained, and never mind the reason.”

What we’re reading (7/12)

“Earnings Kick Off With Sky-High Forecasts, Record Stock Market” (Wall Street Journal). “Wall Street is heading into earnings season this week with high expectations after strong profits fueled a stock market rally in the first half of the year. Money managers will be watching whether companies will again trounce Wall Street’s forecasts for earnings. The S&P 500 has gained 16% this year and notched 38 record closes, most recently on Friday.”

“This Company Sells Passports To Americans Looking For A Tax Break On Their Bitcoin Profits” (CNBC). “Russian expatriate Katie Ananina has spent the last three years helping people dodge taxes on their bitcoin gains. It is all part of her mission to stick it to the man, one case of tax avoidance at a time. As the name suggests, Plan B Passport offers crypto-rich clients a path to a second passport in their pick of seven, mostly tropical, tax-haven states, all of which are exempt from capital gains taxes on crypto holdings.”

“The Pandemic Has Widened The Wealth Gap. Should Central Banks Be Blamed?” (The Economist). “The global financial crisis of 2007-09 was socially divisive as well as economically destructive….[But] [t]he share of global wealth held by the top “one percent” actually fell in 2008. The pandemic has been different. Amid all the misery and mortality, the number of millionaires rose last year by 5.2m to over 56m, according to the Global Wealth Report published by Credit Suisse, a bank. The one percent increased their share of wealth to 45%, a percentage point higher than in 2019.”

“You Know, When Credit Suisse Really Thinks About It, Maybe It Should Have Someone Reviewing Counterparty Risk” (Dealbreaker). “Ideally, you’d hire a person to keep an eye on the risks your counterparties are taking before one of them costs you $5.5 billion, many legal bills, a great deal of talent, maybe an antitrust prosecution and the ire of the Swiss people. Of course, no one does this, and anyway Credit Suisse was spending that money keeping an eye on its own employees rather than on the likes of Archegos Capital Management which, it admits in retrospect, was a poor allocation of resources for a lot of reasons.”

“For A $12.50 Raffle Ticket, The Keys To Drug Lord El Chapo’s Seized Safe House In Mexico Await” (Washington Post). “The Mexican government is raffling off the site of Guzmán’s dramatic escape, along with seven other houses, seven apartments, five lots, a ranch, and a 20-seat viewing box at the Azteca Stadium in Mexico City. The prizes — confiscated assets from various criminal operations and now owned by the government — are valued at a total of $12.5 million. Lottery tickets cost 250 pesos ($12.50). Winning tickets will be drawn on Sept. 15, the day before Mexico’s Independence Day.”

What we’re reading (7/10)

“Investors Pile Into Longer-Dated Treasury ETFs As Bond Yields Fall” (Reuters). “Recent price rallies in U.S. government debt drove flows into exchange-traded funds tracking longer-dated Treasuries, according to BlackRock ETF provider iShares. The iShares 20+ year Treasury Bond ETF attracted $1.4 billion of inflows in the past three weeks to Thursday, with around $447 million added in the last week. Comparatively, investors pulled $547 million out of the iShares 7-10 year Treasury Bond ETF over the same period, according to iShares fixed income investment strategist Dhruv Nagrath.”

“Where Is My Patio Table? Supply Delays Leave Consumers Waiting.” (Christian Science Monitor). “The garden supply store in suburban Baltimore has been waiting six months for a shipping container from Vietnam full of $100,000 worth of wicker and aluminum furniture. Half of the container has already been sold by showing customers photographs. The container should have arrived in February, but it reached U.S. waters on June 3 and has just docked in Long Beach, California.”

“The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes” (ProPublica). A good primer on M&A accounting: “[Steve] Ballmer pays such a low rate, in part, because of a provision of the U.S. tax code. When someone buys a business, they’re often able to deduct almost the entire sale price against their income during the ensuing years. That allows them to pay less in taxes. The underlying logic is that the purchase price was composed of assets — buildings, equipment, patents and more — that degrade over time and should be counted as expenses.”

“A Little-Known ‘Back Door’ Trick For Boosting Your Roth Contributions” (Wall Street Journal). “Most people won’t ever get a chance to own pre-IPO stock. But the mega-backdoor Roth conversion strategy is available to many people with 401(k) accounts, so long as they have the means to save significant amounts of money. It lets those in 401(k) plans that allow after-tax contributions put up to $58,000 a year into a 401(k) account and convert some or all of the money to a Roth, with a minimal tax hit if executed well.”

“News Organizations Are Taking Different Approaches To How Often Employees Will Come Back To The Office” (CNBC). “Newsroom leaders are beginning to make decisions based on internal employee surveys and conversations, but they’re not all making the same choices. The decisions companies make could have major implications for how future employees select between potential employers. They’ll also be an industry-wide test for whether more flexible work arrangements can be long lasting.”

What we’re reading (7/9)

“We’re Looking At Stocks As Money Pots, And That’s Just Not In The Cards” (MarketWatch). “Consider by how much individual investors in the U.S. expect their portfolios to beat inflation in coming years. According to the 2021 Natixis Global Survey of Individual Investors, they on average expect their portfolios to produce an inflation-adjusted return of 17.3% annualized over the next decade. That’s nearly triple the U.S. stock market’s long-term average real total return of 6.1% annualized, and more than four times the bond market’s long-term average total return of 4.1% annualized[.]”

“Why Do We Buy What We Buy?” (Vox). “If you think about the particular things people want, it mostly has to do with being the kind of person that they think they are because there’s a consumption style connected with that. The role of what are called reference groups — the people we compare ourselves to, the people we identify with — is really key in that. It’s why, for example, I’ve [Prof. Juliet Schor of BC] found that people who have reference groups that are wealthier than they are tend to save less and spend more, and people who keep more modest reference groups, even as they gain in income and wealth, tend to save more.”

“The Stickiness Of Pandemic-Driven Economic Behavior” (Project Syndicate). “[T]he global disruption triggered by COVID-19 created a perfect storm in which some shifts in consumer behavior were matched by changes in business operations and government regulations. Many such behaviors in fact accelerated practices that held promise before the pandemic but had failed to gain traction because of cost concerns or widespread skepticism. The virus, by creating an opportunity to experiment with them, made their value much more apparent.”

“Levi Earnings Crush Estimates, Retailer Raises 2021 Forecast, Citing Strong Denim Sales” (CNBC). “Levi Strauss & Co. said Thursday that shoppers are stocking up on jeans in new sizes and styles in the U.S. and China as they emerge from their homes during the pandemic. The momentum both in stores and online boosted its fiscal second-quarter earnings and revenue ahead of analysts’ expectations. Although sales were still down 3% from 2019, the retailer anticipates fiscal third-quarter sales are on track to top pre-pandemic levels. That was something Levi previously didn’t expect to achieve until the fourth quarter.”

“Robinhood May Lose 81% Of Its Revenue, Still Going Public Anyway” (Dealbreaker). “When discussing the record-setting $70 million fine for its alleged technical, due-diligence and truth-telling failings that apparently served as the green light for going public, we noted that the Robinhood IPO prospectus’ “Risk Factors” chapter was likely to be on the long side…[t]hen, our focus was on the risks inherent in the hailstorm of user litigation, regulatory ire and skeptical oversight battering the company...[i]ncredibly, however, these pale in comparison to the threat that one day soon lawmakers and/or regulators will decide to take away the source of $420 million of the $522 million Robinhood made in the first quarter: payment for order flow.”

What we’re reading (7/8)

“Ransomware Attacks Will End, But Not Anytime Soon” (Bloomberg). “In economic terms, the private value of internet security is often less than the public value. A ransomware attack that results in only a slight decrease in profits for a business could translate into a major social inconvenience. One consolation is that hackers will almost certainly “overfish” the pool of victims. At some point there will be so many attacks that most institutions will have no choice but to respond with significant defensive measures.”

“Robinhood IPO Faces Threat Of Retail Snub On Reddit” (Reuters). “Online brokerage Robinhood Markets Inc, which helped enable the "meme stock" frenzy earlier this year and later attracted flak for its handling of the trading mania, is facing pushback on social media forums against its initial public offering. Many individual investors are planning to shun the stock market debut, and several posts in recent days urging users to not buy into the IPO have received thousands of upvotes, discussions in online forums on Reddit showed.”

“Iceland Tested A 4-Day Workweek. Employees Were Productive — And Happier, Researchers Say.” (Washington Post). “Several large-scale trials of a four-day workweek in Iceland were an ‘overwhelming success,’ with many workers shifting to shorter hours without affecting their productivity, and in some cases improving it, in what researchers called “groundbreaking evidence for the efficacy of working time reduction.”

“Cash-Laden Companies Are On A Mergers and Acquisitions Spree” (Wall Street Journal). “Businesses spent $1.74 trillion on mergers and acquisitions involving U.S. companies during the first six months of the year—the highest amount in more than four decades—as finance chiefs tapped into cheap funding options to acquire technologies, services and other assets.”

“TikTok Made Me Buy It” (Vox). “There’s now so much stuff that’s gone viral on TikTok that people have opened stores dedicated to it: A 15-year-old student opened a store in his local mall called ‘Viral Trends NY,’ which carries omnipresent TikTok doodads like Martinelli’s apple juice and Squishmallows stuffed animals…a similar shop also exists in Indiana. Downtown Manhattan has its own ‘TikTok Block,’ where two big TikTokers have opened shops with curated vintage clothing. There is now so much stuff that’s gone viral on TikTok that the factories producing those products have gotten on TikTok and now have a hand in making them go viral in the first place.”

What we’re reading (7/7)

“U.S. Treasury Yields Extend Steep Decline” (Wall Street Journal). “Yields on U.S. government bonds reached fresh multimonth lows on Wednesday, reflecting investors’ anxiety about the economic outlook and new concerns about the highly contagious Delta variant of Covid-19. In recent trading, the yield on the benchmark 10-year U.S. Treasury note was 1.313%, according to Tradeweb, compared with 1.369% on Tuesday.”

“Can Individual Investors Beat the Market?” (Coval, Joshua D., David Hirshleifer, and Tyler Shumway, Review of Asset Pricing Studies). An interesting new study: “We document persistent superior trading performance among a subset of individual investors. Investors classified in the top performance decile in the first half of our sample subsequently earn risk-adjusted returns of about 6% per year. These returns are not confined to stocks in which the investors are likely to have inside information, nor are they driven by illiquid stocks. Our results suggest that skilled individual investors exploit market inefficiencies (or perhaps conditional risk premiums) to earn abnormal profits, above and beyond any profits available from well-known strategies based on size, value, momentum, or earnings announcements.”

“Mortgage Applications Sink To Their Lowest Level Since Before The Pandemic Hit” (CNBC). “Mortgage demand fell for the second week in a row, as low inventory and high home prices continue to weigh on the housing market. Mortgage applications decreased 1.8% last week, according to the Mortgage Bankers Association’s seasonally adjusted index, falling to the lowest level since the beginning of 2020, before the coronavirus pandemic started to take a toll on the economy.”

“Which Airlines Will Soar After The Pandemic?” (The Economist). “Some airlines are struggling despite having cut costs, slashed fleets and shored up balance-sheets with commercial loans. Others are brimming with confidence. Big American and Chinese ones with large, increasingly virus-free domestic markets will return to profitability first. Frugal low-cost carriers that went into the pandemic in the black are close behind. By contrast, airlines that depend on lucrative long-haul routes may struggle if, as seems almost inevitable, business travellers substitute Zoom for at least some flights. Regional companies in places still ravaged by covid-19, such as India or Latin America, look precarious. And the airspace between those losers and the industry’s winners is widening.”

“Betting Against Meme Stocks Could Get You Seriously Burned” (CNN Business). “Many investors are still betting against top momentum and Reddit meme stocks — despite getting burned in the process. Richard Branson's space tourism company Virgin Galactic is one of the most heavily shorted stocks among customers of online broker TradeZero America. Shares of Virgin Galactic (SPCE) have nearly doubled this year due to optimism about the demand for suborbital travel.”

What we’re reading (7/6)

“Stocks Were Unusually Quiet In June. Traders Think That Is About To Change.” (Wall Street Journal). “After a notably quiet stretch, many analysts are anticipating a break in the lull. The simplest reason: Trading desks tend to become more lightly staffed during the summer as employees take off for the holidays. That generally means there is less liquidity in the markets. In turn, any surprising economic data, corporate news or monetary-policy news tends to ‘hit the market harder than they otherwise might,’ said Nicholas Colas, co-founder of DataTrek Research, in an emailed note.”

“Oil Prices Could ‘Very Easily’ Top $100 A Barrel, Says Former U.S. Energy Secretary” (CNBC). “OPEC and its allies, referred to collectively as OPEC+, twice failed to reach a deal on oil output last week. On Monday, another attempt to resume talks broke down, and discussions were put off indefinitely. The energy alliance, which includes Russia, had sought to increase supply by 400,000 barrels per day from August to December 2021 and proposed extending the duration of cuts until the end of 2022. Last year, to cope with lower demand due to the pandemic, OPEC+ agreed to curb output by almost 10 million barrels per day from May 2020 to the end of April 2022.”

“China Escalates Its Fight Against Big Tech” (DealBook). “On Sunday, Beijing officials ordered Didi, the ride-hailing app, to be removed from the country’s app stores over concerns about the handling of customer data, days after the company completed a blockbuster U.S. I.P.O. Yesterday, they suspended new user registrations for platforms run by two other Chinese companies that recently listed shares in New York, citing the need for cybersecurity reviews. Didi’s shares fell nearly 30 percent in premarket trading, below their I.P.O. price.”

“It Gets Ugly in US Office Markets, Working from Home Shows Up” (Wolf Street). “A nightmare has been unfolding. There were issues before working-from-home and ‘hybrid work models’ slashed current and future real-estate needs of office tenants in the major office markets in the US. And now office footprints got slashed, and companies put their leased but vacant office space on the sublease market, undercutting landlords that want to direct-lease vacant offices.”

“Gold Regains Shine After Central Bank Buying Drops To Decade Low” (Bloomberg). “Central banks may be regaining their appetite for buying gold after staying on the sidelines for the past year. Central banks from Serbia to Thailand have been adding to gold holdings and Ghana recently announced plans for purchases, as the specter of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases. A rebound in buying -- which had dropped to the lowest in a decade -- would bolster the prospects for gold prices as some other sources of demand falter.”

What we’re reading (7/5)

“Wages Are Finally Going Up And That’s Going To Have To Continue To Get People Back To Work” (CNBC). “American workers collectively saw a nice bump in their paychecks for June that may have to keep coming if conditions ever are going to get back to where they were before the pandemic hit. If there was one dark cloud over the month’s otherwise robust round of hiring, it was the tick higher in the unemployment rate and the stagnation of the U.S. labor force.”

“Travelers Are Getting Hit By Sticker Shock This Summer” (CNN Business). “American vacationers are finding just about everything significantly more expensive this summer. Hotel rooms? Up about 44% at the end of June compared to a year earlier, according to data from hotel research firm STR. Air fares? They were 24% higher in May than in the same month last year, according to the Consumer Price Index. Even so, many of the prices are still below where they stood in the summer of 2019, six months before the outbreak of the Covid-19 pandemic brought demand for travel to a near halt and sent prices plunging.”

“Retail Investors Power The Trading Wave With Record Cash Inflows” (Wall Street Journal). “Retail investors keep pouring money into markets, even as many of their favorite meme stocks and cryptocurrencies have languished. In June, so-called retail investors bought nearly $28 billion of stocks and exchange-traded funds on a net basis, according to data from Vanda Research’s VandaTrack, the highest monthly amount deployed since at least 2014. That even trumped the amount retail traders spent in January during the first meme-stock frenzy.”

“The SEC's Probe Into Charles Schwab's Robo-Advisor Is An Early Glimpse Of The Regulator's Fintech Crackdown” (Business Insider). “Schwab said its second-quarter earnings results will show a $200 million charge related to the [SEC’s] investigation. The company is cooperating with the SEC, and a Schwab spokesperson declined to comment beyond the filing. That cost appears to be the largest that a robo-advisor — the automated low- or no-cost investing tools that emerged after the financial crisis — has incurred over a public regulatory matter, experts say.”

“The Smart Home Isn't Worth It” (Gizmodo). “A smart home that responds to your every command and automates mundane tasks is a tantalizing dream. But the reality is that given the current limitations of technology, competing standards, and devices that quickly become obsolete, trying to make that dream a reality today just isn’t worth all the effort.”

What we’re reading (7/4)

“How Businesses Are Getting Billions In Cash Back From Government To Offset Hiring Costs” (CNBC). “That war for talent has been tough on small businesses still in the midst of trying to recover from losses during the coronavirus pandemic. But many are entitled to get money back from the government through a credit against the employment taxes they pay. Small and midsize businesses can get cash directly from the federal government through the Employee Retention Credit (ERC), which offers businesses money back on a percentage of wages paid to their employees.”

“The Future Of Silicon Valley Headquarters” (The Economist). “[T]ech temples had begun to seem anachronistic long before covid-19 washed up on California’s shores. Traffic was making the daily commute an insufferable two-hour ordeal. Most computer programmers came to the office but really worked elsewhere—in the cloud, managing projects with Trello, on Zoom and Slack. Designed to be lively, tech offices were often eerily quiet. Realising this, companies began to open more of them beyond the Valley, and to make more use of the virtual realm. The pandemic then gave the shifting equilibrium a shove, notes Nicholas Bloom of Stanford University. Although it is hard to predict where exactly all the bits will land, the contours of tech hqs of the future are coming into view.”

“Fed's Daly: Appropriate To Consider Tapering Later This Year” (Reuters). “Federal Reserve Bank of San Francisco President Mary Daly said the U.S. central bank may be able to start reducing ‘a little bit’ of its extraordinary support for the U.S. economy by the end of this year. ‘The economy is really shaping up nicely,’ Daly told the Associated Press in an interview, a recording of which was provided to Reuters by the San Francisco Fed.”

“For Some Millennials, A Starter Home Is Hard To Find” (Wall Street Journal). “The shortage of available starter homes feels like yet another hurdle blocking some millennials’ path to traditional money milestones…[t]he first rung on the homeownership ladder has long been an affordable ‘starter home.’ These houses, with their smaller footprints and selling prices, allowed young homeowners to build wealth and upsize as they started their families. But a number of factors are complicating this decadeslong trend. Supply of “entry-level housing”—which Freddie Mac defines as homes under 1,400 square feet—is at a five-decade low.”

“House Prices Are ‘Scary’: Summers” (Bloomberg). “Former U.S. Treasury Secretary Lawrence H. Summers, a Wall Street Week contributor, says the rise in home prices is ‘scary.’ He thinks the state of the heating of the housing market makes it difficult to justify the Fed's continued purchases of mortgage-backed securities.”

June 2021 performance update

Hi friends and happy 4th! Here with a performance update for last month’s picks.

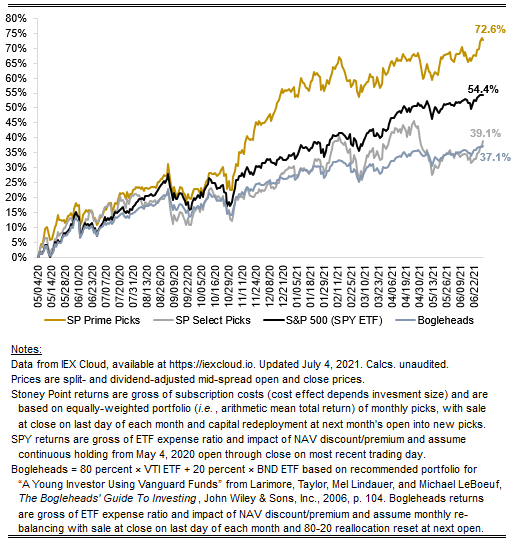

The key numbers for June were:

Prime: +2.29%

Select: also +2.29%

SPY ETF: 1.30%

Bogelheads portfolio (80% VTI + 20% BND): +1.36%

It was actually choppy waters out there for Prime and Select for most of the month, but, as you can see in the cumulative chart below, both delivered really strong performance in the last few days of the month.

I don’t have much of a macro update to deliver, other than to note that we should learn more about the Fed’s evolving views on consumer and asset prices this week, and whether there has been any movement on the anticipated path of interest rate hikes. The spread of the delta variant of the novel coronavirus “feels” like something to keep an eye on as well. With that said, the presence of these and other “known” risks doesn’t lead me (personally) to a conclusion that it makes sense to re-allocate en masse out of stocks into some other asset class, including cash, especially when focused on a 3- to 5-year investment horizon, which is the horizon of interest here at SPC. (That comes with all the usual caveats about having a well-diversified portfolio across asset classes and the like.)

That’s all for now. Check out the July Prime and Select picks here and have a very happy holiday.

Stoney Point Total Performance History

What we’re reading (7/3)

“What A Tech Breakup Could Mean For You” (Wall Street Journal). “Will my iPhone really become less secure, as Apple has claimed? Would the selection we’ve grown accustomed to on Amazon shrink, as the company has intimated? Would Facebook being forced to sell off Instagram and WhatsApp break those services, as Facebook would have us believe? And would the quality of Google search be degraded by its inability to feature its own services, such as Google Maps and YouTube videos, in results? Or, as the companies’ critics would have it, will life be better for users, competitors and society if all those things come to pass?”

“Hacking Wall Street” (DealBook). “Bank executives, security experts and federal officials have been planning for potentially devastating cyberattacks against the financial industry for at least a decade. But the issue has grown more urgent in recent years because of an increase in nation-state cyberattacks against critical infrastructure, such as the cyberattacks by Russia that took out part of Ukraine’s electric grid and the WannaCry worm linked to North Korea that hit the hospital and shipping industries. The Federal Reserve Chairman, Jerome Powell, recently told ‘60 Minutes’ that “the risk that we keep our eyes on the most now is cyber risk.”

“Attack Of The COVID Zombies” (Project Syndicate). “In both the United States and the European Union, corporate bankruptcies have declined during the 15 months of the pandemic, despite the severe accompanying recession. That decline is a result of rich-country governments – in their understandable desire to soften the pandemic’s economic blow – extending every possible safety net to firms. Often, however, they did so without even trying to separate those with good economic prospects from those with none.”

“Jeff Bezos Says Work-Life Balance Is A ‘Debilitating Phrase.’ He Wants Amazon Workers To View Their Career And Lives As A ‘Circle.’” (Business Insider). “Amazon founder Jeff Bezos isn't a fan of the phrase ‘work-life balance.’ […] at an April 2018 event hosted by Insider's parent company, Bezos said new Amazon employees shouldn't view work and life as a balancing act. Instead, Bezos said that it's more productive to view them as two integrated parts.”

“The ‘Juice Man’ And The Drug Scandal That Rocked Horse Racing” (Bloomberg). “The Jockey Club had pushed for reforms to address trackside deaths, but Janney was convinced that die-hards were staying away for another reason: the sport’s inability to curb doping. ‘People I trusted were becoming increasingly suspect of the results,’ Janney says. Trainers told him they were seeing horses become winners overnight. ‘Suddenly you’d have a horse that never got tired,’ he says. ‘As the others slowed down, they never did.’”

What we’re reading (7/2)

“IPO Boom Times: Public Markets Hit Record Highs” (Axios). “It's been a banner week for public markets. They're not only hitting new record highs, but they're also successfully allocating billions of dollars of fresh capital to a slew of companies going public in IPOs…[t]he current market is liquid and predictable enough for the bookrunners to be able to do their job well, allocating shares to institutional investors at a price just below where the market ends up valuing the company.”

“Robinhood Unveils Long-Awaited IPO Documents That Reveal Staggering Growth” (Business Insider). “Robinhood, the popular retail investing app, publicly filed for an IPO on Thursday. The company's S-1 document filed with the Securities and Exchange Commission revealed plans to be listed on the Nasdaq stock market under the ticker symbol HOOD…[i]n the filing, Robinhood revealed it had 18.5 million funded accounts and $80 billion in customer assets as of March 31[.]”

“Older Americans Stockpiled A Record $35 Trillion. The Time Has Come To Give It Away.” (Wall Street Journal). “The greatest wealth transfer in modern history has begun. Baby boomers and older Americans have spent decades accumulating an enormous stockpile of money…[n]ow they have started parceling it out…, unleashing a torrent of economic activity including buying homes, starting businesses and giving to charity. And many recipients are guided by different priorities and politics than their givers.”

“Fed Could Be A Surprise Catalyst For The Markets In Holiday Week” (CNBC). “The quiet holiday week ahead could hold some fireworks for investors if the Federal Reserve reveals its thinking on its bond buying program…[t]here are very few economic reports of note, aside from ISM services data on Tuesday. But the Fed’s minutes from its last meeting will be released Wednesday afternoon, and there is potential for the market to learn more about the central bank’s behind-the-scenes discussions on winding down its quantitative easing program.”

“Hedge Fund Launches Are Surging” (Institutional Investor). “In the first quarter of 2021, 189 new hedge funds were launched, the highest number since the end of 2017, according to data from Hedge Fund Research.”

What we’re reading (7/1)

“The Incredible S&P 500” (Axios). “Give it up for the U.S. stock market. The S&P 500 has surged 14.4% from the beginning of the year through June 30, marking one of the strongest first halves of the year in history…[t]he S&P has generated better returns only 16 other times since 1950, LPL Financial’s Ryan Detrick observed.”

“U.S. Jobless Claims Fell To 364,000 Last Week, A New Pandemic Low” (Wall Street Journal). “Worker filings for jobless benefits fell to 364,000 last week, reaching a new pandemic low as layoffs continue to recede. The Labor Department said Thursday initial jobless claims in the week ended June 26 fell by a seasonally adjusted 51,000 from the prior week’s revised total of 415,000. The drop brought the four-week moving average, which smooths out volatility in the weekly figures, down by 6,000 from the previous week’s average to 392,750, also a new pandemic low.”

“BuzzFeed And Vice Media’s Next Pivot: ‘Last Resort’ Efforts To Go Public” (Hollywood Reporter). “Their risky gambit? Go public to raise cash and roll up more of their competition through a special purpose acquisition company, or SPAC, a blank-check firm that raises money in an IPO, with the goal of merging with a private company to take them public. Yet the turn to SPACs by BuzzFeed, Vice, Bustle Digital Group and Group Nine, one financier tells The Hollywood Reporter, seems ‘like a last resort.’”

“N.J. Attorney General Is Appointed Director Of Enforcement At The S.E.C.” (New York Times). “Mr. Gensler, the S.E.C. chairman, announced on Tuesday that he had picked Gurbir Grewal, New Jersey’s attorney general since 2018, to run the all-important division at the nation’s top securities regulator. Mr. Grewal previously served as a federal prosecutor in Brooklyn and New Jersey, and was the chief prosecutor for Bergen County, one of New Jersey’s most populous counties.”

“The Internet Is Rotting” (The Atlantic). “Underpinning our vast and simple-seeming digital networks are technologies that, if they hadn’t already been invented, probably wouldn’t unfold the same way again. They are artifacts of a very particular circumstance, and it’s unlikely that in an alternate timeline they would have been designed the same way…the internet was a recipe for mortar, with an invitation for anyone, and everyone, to bring their own bricks.”

July Prime + Select picks available now

The new Prime and Select picks for July are available starting now, based on a model run put through today (June 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, July 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, July 30, 2021 (at the mid-spread closing price).

You can check out the latest picks here, and stay tuned for performance result for June.

What we’re reading (6/30)

“Robinhood Agrees To Pay $70 Million To Settle Regulatory Investigation” (Wall Street Journal). “Robinhood Financial LLC has agreed to pay nearly $70 million to resolve sweeping regulatory allegations that the brokerage misled customers, approved ineligible traders for risky strategies and didn’t supervise technology that failed and locked millions out of trading. The enforcement action is a blow to the fast-growing online brokerage, which was launched in 2014 and has won over users with commission-free trades and its sleek mobile app.”

“Retail Traders Account For 10% Of U.S. Stock Trading Volume - Morgan Stanley” (Reuters). “Retail investors currently account for roughly 10% of daily trading volume on the Russell 3000, the broadest U.S. stocks index, after peaking at 15% in September as lockdown boredom and extra savings triggered interest in stock markets, Morgan Stanley said on Wednesday.”

“Farmland Investing: Impact Beyond Returns” (Worth). “Farmland is the latest asset class to be revolutionized by the fintech wave. Whether it’s through REITs, like Farmland Partners, commodity ETFs or crowdfunding platforms, farmland sticks out among investors, both in terms of its attractive return on investment and its potential to increase the sustainability of the agriculture sector…Between 1992 and 2020, farmland returned an average of 11 percent per year while the stock market returned an average of 8 percent.”

“Investing During An Era Of Speculation” (Morningstar). “Such is the current condition in the United States. Luck, confidence, and wealth have created an age of speculation. Signs of economic aggression are everywhere. Stocks are soaring, thanks in part to record trading volume from retail investors. In addition, alternative investments are thriving. Cryptocurrencies, special-purpose acquisition companies, and nonfungible tokens have all sprung from dragons' teeth, although only the former marketplace yet rates as truly large.”

“America's Central Bank Helped Spark The US Housing Boom. Now It Fears It Created A Monster.” (Business Insider). “Some Fed officials see cause for concern. The mortgage-backed securities acquisitions could be having "some unintended consequences and side effects" that should be weighed against their benefits, Robert Kaplan, president of the Federal Reserve Bank of Dallas said on CNBC late last month.”

What we’re reading (6/29)

“Baird Suspends GameStop stock coverage, Citing Continued Reddit Influence And Lack Of Company Plan” (CNBC). “Baird is throwing in the towel on GameStop coverage, saying speculative trading by retail investors makes it hard to give “reasonable” recommendations on the stock. GameStop made headlines in January and earlier in June as individual traders flocking to Reddit’s WallStreetBets forum rallied around the meme stock. The shares have surged more than 1,000% in 2021, though the stock has dropped about 6% this month.”

“Regulators Must Get Ahead Of The Coming Wave Of Loan Defaults” (The Hill). “The 2008 financial crisis showed us how poorly prepared many lenders were to offer successful debt workouts. Distressed borrowers were steered toward so-called debt settlement companies, which would collect front-end fees without producing results. Now is the moment for policymakers and financial regulators to learn from their mistakes during the Great Recession in leaving people on their own to determine how to manage their debts. In a recent paper, we advocate for a public intervention in consumer debt contract modifications designed to steer people into affordable modifications or, if there are no affordable options, guide people to the consumer bankruptcy system.”

“Office Re-Entry Is Proving Trickier Than Last Year’s Abrupt Exit” (The Economist). “Some shareholders, including big institutional investors, are keen to promote flexible working not only to retain talent but also to burnish companies’ environmental, social and governance (ESG) credentials. S&P Global, an analytics firm, says that under its assessments, the ability to work from home is one measure of employees’ health and wellbeing, which can influence up to 5% of a company’s ESG score. This is roughly the same weighting attached to risk and crisis management for banks, or human-rights measures for miners. It may also affect things like gender and racial diversity. Studies find that mothers are likelier to favour work from home than fathers are. Research by Slack found that only 3% of black knowledge workers want to return to the office full-time in America, compared with 21% of their white counterparts.”

“America’s Workers Are Exhausted And Burned Out — And Some Employers Are Taking Notice” (Washington Post). “Employers across the country, from Fortune 500 companies such as PepsiCo and Verizon to boutique advertising firms and nonprofit organizations, are continuing pandemic benefits such as increased paid time off and child- or elder-care benefits as well as embracing flexible work schedules and remote work in recognition that a returning workforce is at high risk of burnout.”

“US Workers Are Quitting Jobs At Historic Rates, And Many Unemployed Are Not Coming Back Despite Record Job Openings” (Peterson Institute for International Economics). “Transitions from unemployment to employment have likely been reduced by several factors, many of which interact with each other, including time needed to find a job, the lingering effects of the pandemic and the pace of vaccinations, and increased and expanded unemployment insurance. The good news is that most of the factors holding back transitions from unemployment are probably temporary, and if the rate at which people are leaving unemployment for jobs returns to what would be expected given the overall strength of the economy, the pace of job growth could rise to 750,000 or more a month. There may be a speed limit on job growth, but it is likely to be well above the recent pace.”

What we’re reading (6/28)

“Record Stock Sales From Money-Losing Firms Ring The Alarm Bells” (Bloomberg). “ If you think a rush by companies to sell their shares is a bad omen for the market, imagine a scenario where most of the sales come from firms that don’t make money. It’s happening now. Since the end of March, almost 100 unprofitable companies, including GameStop Corp. and AMC Entertainment Holdings Inc., have raised money through secondary offerings, twice as many as coming from profitable firms, according to data compiled by Bloomberg.”

“The Future Of Psychedelic Medicine Might Skip The Trip” (Forbes). “Roth’s 30-person laboratory, which is perched four stories above the tree-lined campus, is powered by robots, ultra-large-scale computational chemistry and cryo-electron microscopy. His lab has discovered millions of new chemical structures of psychedelic compounds that target the serotonin 5-HT-2A receptor in the brain, just how tryptamines like magic mushrooms and LSD do. But Roth isn’t trying to find the next mind-bending molecule. ‘There are plenty out there and we don’t need anymore,’ he says. ‘The goal is to find compounds that are therapeutic and not psychedelic.’”

“Recent Retirements Throw Wrench Into Fed’s Economic Recovery Plans” (Wall Street Journal). “Full employment has always been notoriously hard to measure, but now it has gotten harder still. Officials look at a range of indicators, including the number of jobs created and the share of the adult population either working or looking for a job. The rapid rise in retirements translates to fewer people available to work—meaning the labor market could hit the full employment threshold at lower levels of employment and a lower labor-force participation rate than before the pandemic.”

“70% Of Millennials Are Living Paycheck To Paycheck, More Than Any Other Generation” (Business Insider). “Seventy percent of the generation said they're living paycheck to paycheck, according to a new survey by PYMNTS and LendingClub, which analyzed economic data and census-balanced surveys of over 28,000 Americans. It found that about 54% of Americans live paycheck to paycheck, but millennials had the biggest broke energy…[i]t's left even six-figure earning millennials struggling to get by. The survey found that 60% of millennials raking in over $100,000 a year said they're living paycheck to paycheck.”

“One in Five Young Adults Is Neither Working Nor Studying In U.S.” (Bloomberg). “Almost one in five young adults in the U.S. was neither working nor studying in the first quarter…[i]n the first three months of the year, about 3.8 million Americans age 20 to 24 were not in employment, education or training, known as the NEET rate, the Center for Economic Policy and Research said in a report. That’s up by 740,000, or 24%, from a year earlier, before many lost their jobs or opted to defer college enrollment as campuses shut down at the onset of the Covid-19 pandemic.”