What we’re reading (7/6)

“Stocks Were Unusually Quiet In June. Traders Think That Is About To Change.” (Wall Street Journal). “After a notably quiet stretch, many analysts are anticipating a break in the lull. The simplest reason: Trading desks tend to become more lightly staffed during the summer as employees take off for the holidays. That generally means there is less liquidity in the markets. In turn, any surprising economic data, corporate news or monetary-policy news tends to ‘hit the market harder than they otherwise might,’ said Nicholas Colas, co-founder of DataTrek Research, in an emailed note.”

“Oil Prices Could ‘Very Easily’ Top $100 A Barrel, Says Former U.S. Energy Secretary” (CNBC). “OPEC and its allies, referred to collectively as OPEC+, twice failed to reach a deal on oil output last week. On Monday, another attempt to resume talks broke down, and discussions were put off indefinitely. The energy alliance, which includes Russia, had sought to increase supply by 400,000 barrels per day from August to December 2021 and proposed extending the duration of cuts until the end of 2022. Last year, to cope with lower demand due to the pandemic, OPEC+ agreed to curb output by almost 10 million barrels per day from May 2020 to the end of April 2022.”

“China Escalates Its Fight Against Big Tech” (DealBook). “On Sunday, Beijing officials ordered Didi, the ride-hailing app, to be removed from the country’s app stores over concerns about the handling of customer data, days after the company completed a blockbuster U.S. I.P.O. Yesterday, they suspended new user registrations for platforms run by two other Chinese companies that recently listed shares in New York, citing the need for cybersecurity reviews. Didi’s shares fell nearly 30 percent in premarket trading, below their I.P.O. price.”

“It Gets Ugly in US Office Markets, Working from Home Shows Up” (Wolf Street). “A nightmare has been unfolding. There were issues before working-from-home and ‘hybrid work models’ slashed current and future real-estate needs of office tenants in the major office markets in the US. And now office footprints got slashed, and companies put their leased but vacant office space on the sublease market, undercutting landlords that want to direct-lease vacant offices.”

“Gold Regains Shine After Central Bank Buying Drops To Decade Low” (Bloomberg). “Central banks may be regaining their appetite for buying gold after staying on the sidelines for the past year. Central banks from Serbia to Thailand have been adding to gold holdings and Ghana recently announced plans for purchases, as the specter of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases. A rebound in buying -- which had dropped to the lowest in a decade -- would bolster the prospects for gold prices as some other sources of demand falter.”

What we’re reading (7/5)

“Wages Are Finally Going Up And That’s Going To Have To Continue To Get People Back To Work” (CNBC). “American workers collectively saw a nice bump in their paychecks for June that may have to keep coming if conditions ever are going to get back to where they were before the pandemic hit. If there was one dark cloud over the month’s otherwise robust round of hiring, it was the tick higher in the unemployment rate and the stagnation of the U.S. labor force.”

“Travelers Are Getting Hit By Sticker Shock This Summer” (CNN Business). “American vacationers are finding just about everything significantly more expensive this summer. Hotel rooms? Up about 44% at the end of June compared to a year earlier, according to data from hotel research firm STR. Air fares? They were 24% higher in May than in the same month last year, according to the Consumer Price Index. Even so, many of the prices are still below where they stood in the summer of 2019, six months before the outbreak of the Covid-19 pandemic brought demand for travel to a near halt and sent prices plunging.”

“Retail Investors Power The Trading Wave With Record Cash Inflows” (Wall Street Journal). “Retail investors keep pouring money into markets, even as many of their favorite meme stocks and cryptocurrencies have languished. In June, so-called retail investors bought nearly $28 billion of stocks and exchange-traded funds on a net basis, according to data from Vanda Research’s VandaTrack, the highest monthly amount deployed since at least 2014. That even trumped the amount retail traders spent in January during the first meme-stock frenzy.”

“The SEC's Probe Into Charles Schwab's Robo-Advisor Is An Early Glimpse Of The Regulator's Fintech Crackdown” (Business Insider). “Schwab said its second-quarter earnings results will show a $200 million charge related to the [SEC’s] investigation. The company is cooperating with the SEC, and a Schwab spokesperson declined to comment beyond the filing. That cost appears to be the largest that a robo-advisor — the automated low- or no-cost investing tools that emerged after the financial crisis — has incurred over a public regulatory matter, experts say.”

“The Smart Home Isn't Worth It” (Gizmodo). “A smart home that responds to your every command and automates mundane tasks is a tantalizing dream. But the reality is that given the current limitations of technology, competing standards, and devices that quickly become obsolete, trying to make that dream a reality today just isn’t worth all the effort.”

What we’re reading (7/4)

“How Businesses Are Getting Billions In Cash Back From Government To Offset Hiring Costs” (CNBC). “That war for talent has been tough on small businesses still in the midst of trying to recover from losses during the coronavirus pandemic. But many are entitled to get money back from the government through a credit against the employment taxes they pay. Small and midsize businesses can get cash directly from the federal government through the Employee Retention Credit (ERC), which offers businesses money back on a percentage of wages paid to their employees.”

“The Future Of Silicon Valley Headquarters” (The Economist). “[T]ech temples had begun to seem anachronistic long before covid-19 washed up on California’s shores. Traffic was making the daily commute an insufferable two-hour ordeal. Most computer programmers came to the office but really worked elsewhere—in the cloud, managing projects with Trello, on Zoom and Slack. Designed to be lively, tech offices were often eerily quiet. Realising this, companies began to open more of them beyond the Valley, and to make more use of the virtual realm. The pandemic then gave the shifting equilibrium a shove, notes Nicholas Bloom of Stanford University. Although it is hard to predict where exactly all the bits will land, the contours of tech hqs of the future are coming into view.”

“Fed's Daly: Appropriate To Consider Tapering Later This Year” (Reuters). “Federal Reserve Bank of San Francisco President Mary Daly said the U.S. central bank may be able to start reducing ‘a little bit’ of its extraordinary support for the U.S. economy by the end of this year. ‘The economy is really shaping up nicely,’ Daly told the Associated Press in an interview, a recording of which was provided to Reuters by the San Francisco Fed.”

“For Some Millennials, A Starter Home Is Hard To Find” (Wall Street Journal). “The shortage of available starter homes feels like yet another hurdle blocking some millennials’ path to traditional money milestones…[t]he first rung on the homeownership ladder has long been an affordable ‘starter home.’ These houses, with their smaller footprints and selling prices, allowed young homeowners to build wealth and upsize as they started their families. But a number of factors are complicating this decadeslong trend. Supply of “entry-level housing”—which Freddie Mac defines as homes under 1,400 square feet—is at a five-decade low.”

“House Prices Are ‘Scary’: Summers” (Bloomberg). “Former U.S. Treasury Secretary Lawrence H. Summers, a Wall Street Week contributor, says the rise in home prices is ‘scary.’ He thinks the state of the heating of the housing market makes it difficult to justify the Fed's continued purchases of mortgage-backed securities.”

June 2021 performance update

Hi friends and happy 4th! Here with a performance update for last month’s picks.

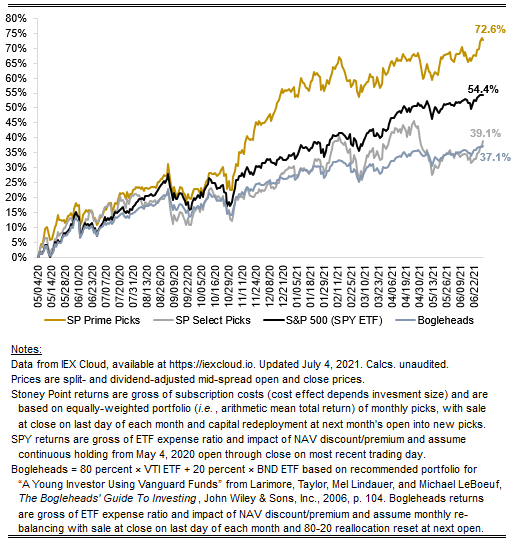

The key numbers for June were:

Prime: +2.29%

Select: also +2.29%

SPY ETF: 1.30%

Bogelheads portfolio (80% VTI + 20% BND): +1.36%

It was actually choppy waters out there for Prime and Select for most of the month, but, as you can see in the cumulative chart below, both delivered really strong performance in the last few days of the month.

I don’t have much of a macro update to deliver, other than to note that we should learn more about the Fed’s evolving views on consumer and asset prices this week, and whether there has been any movement on the anticipated path of interest rate hikes. The spread of the delta variant of the novel coronavirus “feels” like something to keep an eye on as well. With that said, the presence of these and other “known” risks doesn’t lead me (personally) to a conclusion that it makes sense to re-allocate en masse out of stocks into some other asset class, including cash, especially when focused on a 3- to 5-year investment horizon, which is the horizon of interest here at SPC. (That comes with all the usual caveats about having a well-diversified portfolio across asset classes and the like.)

That’s all for now. Check out the July Prime and Select picks here and have a very happy holiday.

Stoney Point Total Performance History

What we’re reading (7/3)

“What A Tech Breakup Could Mean For You” (Wall Street Journal). “Will my iPhone really become less secure, as Apple has claimed? Would the selection we’ve grown accustomed to on Amazon shrink, as the company has intimated? Would Facebook being forced to sell off Instagram and WhatsApp break those services, as Facebook would have us believe? And would the quality of Google search be degraded by its inability to feature its own services, such as Google Maps and YouTube videos, in results? Or, as the companies’ critics would have it, will life be better for users, competitors and society if all those things come to pass?”

“Hacking Wall Street” (DealBook). “Bank executives, security experts and federal officials have been planning for potentially devastating cyberattacks against the financial industry for at least a decade. But the issue has grown more urgent in recent years because of an increase in nation-state cyberattacks against critical infrastructure, such as the cyberattacks by Russia that took out part of Ukraine’s electric grid and the WannaCry worm linked to North Korea that hit the hospital and shipping industries. The Federal Reserve Chairman, Jerome Powell, recently told ‘60 Minutes’ that “the risk that we keep our eyes on the most now is cyber risk.”

“Attack Of The COVID Zombies” (Project Syndicate). “In both the United States and the European Union, corporate bankruptcies have declined during the 15 months of the pandemic, despite the severe accompanying recession. That decline is a result of rich-country governments – in their understandable desire to soften the pandemic’s economic blow – extending every possible safety net to firms. Often, however, they did so without even trying to separate those with good economic prospects from those with none.”

“Jeff Bezos Says Work-Life Balance Is A ‘Debilitating Phrase.’ He Wants Amazon Workers To View Their Career And Lives As A ‘Circle.’” (Business Insider). “Amazon founder Jeff Bezos isn't a fan of the phrase ‘work-life balance.’ […] at an April 2018 event hosted by Insider's parent company, Bezos said new Amazon employees shouldn't view work and life as a balancing act. Instead, Bezos said that it's more productive to view them as two integrated parts.”

“The ‘Juice Man’ And The Drug Scandal That Rocked Horse Racing” (Bloomberg). “The Jockey Club had pushed for reforms to address trackside deaths, but Janney was convinced that die-hards were staying away for another reason: the sport’s inability to curb doping. ‘People I trusted were becoming increasingly suspect of the results,’ Janney says. Trainers told him they were seeing horses become winners overnight. ‘Suddenly you’d have a horse that never got tired,’ he says. ‘As the others slowed down, they never did.’”

What we’re reading (7/2)

“IPO Boom Times: Public Markets Hit Record Highs” (Axios). “It's been a banner week for public markets. They're not only hitting new record highs, but they're also successfully allocating billions of dollars of fresh capital to a slew of companies going public in IPOs…[t]he current market is liquid and predictable enough for the bookrunners to be able to do their job well, allocating shares to institutional investors at a price just below where the market ends up valuing the company.”

“Robinhood Unveils Long-Awaited IPO Documents That Reveal Staggering Growth” (Business Insider). “Robinhood, the popular retail investing app, publicly filed for an IPO on Thursday. The company's S-1 document filed with the Securities and Exchange Commission revealed plans to be listed on the Nasdaq stock market under the ticker symbol HOOD…[i]n the filing, Robinhood revealed it had 18.5 million funded accounts and $80 billion in customer assets as of March 31[.]”

“Older Americans Stockpiled A Record $35 Trillion. The Time Has Come To Give It Away.” (Wall Street Journal). “The greatest wealth transfer in modern history has begun. Baby boomers and older Americans have spent decades accumulating an enormous stockpile of money…[n]ow they have started parceling it out…, unleashing a torrent of economic activity including buying homes, starting businesses and giving to charity. And many recipients are guided by different priorities and politics than their givers.”

“Fed Could Be A Surprise Catalyst For The Markets In Holiday Week” (CNBC). “The quiet holiday week ahead could hold some fireworks for investors if the Federal Reserve reveals its thinking on its bond buying program…[t]here are very few economic reports of note, aside from ISM services data on Tuesday. But the Fed’s minutes from its last meeting will be released Wednesday afternoon, and there is potential for the market to learn more about the central bank’s behind-the-scenes discussions on winding down its quantitative easing program.”

“Hedge Fund Launches Are Surging” (Institutional Investor). “In the first quarter of 2021, 189 new hedge funds were launched, the highest number since the end of 2017, according to data from Hedge Fund Research.”

What we’re reading (7/1)

“The Incredible S&P 500” (Axios). “Give it up for the U.S. stock market. The S&P 500 has surged 14.4% from the beginning of the year through June 30, marking one of the strongest first halves of the year in history…[t]he S&P has generated better returns only 16 other times since 1950, LPL Financial’s Ryan Detrick observed.”

“U.S. Jobless Claims Fell To 364,000 Last Week, A New Pandemic Low” (Wall Street Journal). “Worker filings for jobless benefits fell to 364,000 last week, reaching a new pandemic low as layoffs continue to recede. The Labor Department said Thursday initial jobless claims in the week ended June 26 fell by a seasonally adjusted 51,000 from the prior week’s revised total of 415,000. The drop brought the four-week moving average, which smooths out volatility in the weekly figures, down by 6,000 from the previous week’s average to 392,750, also a new pandemic low.”

“BuzzFeed And Vice Media’s Next Pivot: ‘Last Resort’ Efforts To Go Public” (Hollywood Reporter). “Their risky gambit? Go public to raise cash and roll up more of their competition through a special purpose acquisition company, or SPAC, a blank-check firm that raises money in an IPO, with the goal of merging with a private company to take them public. Yet the turn to SPACs by BuzzFeed, Vice, Bustle Digital Group and Group Nine, one financier tells The Hollywood Reporter, seems ‘like a last resort.’”

“N.J. Attorney General Is Appointed Director Of Enforcement At The S.E.C.” (New York Times). “Mr. Gensler, the S.E.C. chairman, announced on Tuesday that he had picked Gurbir Grewal, New Jersey’s attorney general since 2018, to run the all-important division at the nation’s top securities regulator. Mr. Grewal previously served as a federal prosecutor in Brooklyn and New Jersey, and was the chief prosecutor for Bergen County, one of New Jersey’s most populous counties.”

“The Internet Is Rotting” (The Atlantic). “Underpinning our vast and simple-seeming digital networks are technologies that, if they hadn’t already been invented, probably wouldn’t unfold the same way again. They are artifacts of a very particular circumstance, and it’s unlikely that in an alternate timeline they would have been designed the same way…the internet was a recipe for mortar, with an invitation for anyone, and everyone, to bring their own bricks.”

July Prime + Select picks available now

The new Prime and Select picks for July are available starting now, based on a model run put through today (June 30). As a note, we’ll be measuring the performance on these picks from the first trading day of the month, Thursday, July 1, 2021 (at the mid-spread open price) through the last trading day of the month, Friday, July 30, 2021 (at the mid-spread closing price).

You can check out the latest picks here, and stay tuned for performance result for June.

What we’re reading (6/30)

“Robinhood Agrees To Pay $70 Million To Settle Regulatory Investigation” (Wall Street Journal). “Robinhood Financial LLC has agreed to pay nearly $70 million to resolve sweeping regulatory allegations that the brokerage misled customers, approved ineligible traders for risky strategies and didn’t supervise technology that failed and locked millions out of trading. The enforcement action is a blow to the fast-growing online brokerage, which was launched in 2014 and has won over users with commission-free trades and its sleek mobile app.”

“Retail Traders Account For 10% Of U.S. Stock Trading Volume - Morgan Stanley” (Reuters). “Retail investors currently account for roughly 10% of daily trading volume on the Russell 3000, the broadest U.S. stocks index, after peaking at 15% in September as lockdown boredom and extra savings triggered interest in stock markets, Morgan Stanley said on Wednesday.”

“Farmland Investing: Impact Beyond Returns” (Worth). “Farmland is the latest asset class to be revolutionized by the fintech wave. Whether it’s through REITs, like Farmland Partners, commodity ETFs or crowdfunding platforms, farmland sticks out among investors, both in terms of its attractive return on investment and its potential to increase the sustainability of the agriculture sector…Between 1992 and 2020, farmland returned an average of 11 percent per year while the stock market returned an average of 8 percent.”

“Investing During An Era Of Speculation” (Morningstar). “Such is the current condition in the United States. Luck, confidence, and wealth have created an age of speculation. Signs of economic aggression are everywhere. Stocks are soaring, thanks in part to record trading volume from retail investors. In addition, alternative investments are thriving. Cryptocurrencies, special-purpose acquisition companies, and nonfungible tokens have all sprung from dragons' teeth, although only the former marketplace yet rates as truly large.”

“America's Central Bank Helped Spark The US Housing Boom. Now It Fears It Created A Monster.” (Business Insider). “Some Fed officials see cause for concern. The mortgage-backed securities acquisitions could be having "some unintended consequences and side effects" that should be weighed against their benefits, Robert Kaplan, president of the Federal Reserve Bank of Dallas said on CNBC late last month.”

What we’re reading (6/29)

“Baird Suspends GameStop stock coverage, Citing Continued Reddit Influence And Lack Of Company Plan” (CNBC). “Baird is throwing in the towel on GameStop coverage, saying speculative trading by retail investors makes it hard to give “reasonable” recommendations on the stock. GameStop made headlines in January and earlier in June as individual traders flocking to Reddit’s WallStreetBets forum rallied around the meme stock. The shares have surged more than 1,000% in 2021, though the stock has dropped about 6% this month.”

“Regulators Must Get Ahead Of The Coming Wave Of Loan Defaults” (The Hill). “The 2008 financial crisis showed us how poorly prepared many lenders were to offer successful debt workouts. Distressed borrowers were steered toward so-called debt settlement companies, which would collect front-end fees without producing results. Now is the moment for policymakers and financial regulators to learn from their mistakes during the Great Recession in leaving people on their own to determine how to manage their debts. In a recent paper, we advocate for a public intervention in consumer debt contract modifications designed to steer people into affordable modifications or, if there are no affordable options, guide people to the consumer bankruptcy system.”

“Office Re-Entry Is Proving Trickier Than Last Year’s Abrupt Exit” (The Economist). “Some shareholders, including big institutional investors, are keen to promote flexible working not only to retain talent but also to burnish companies’ environmental, social and governance (ESG) credentials. S&P Global, an analytics firm, says that under its assessments, the ability to work from home is one measure of employees’ health and wellbeing, which can influence up to 5% of a company’s ESG score. This is roughly the same weighting attached to risk and crisis management for banks, or human-rights measures for miners. It may also affect things like gender and racial diversity. Studies find that mothers are likelier to favour work from home than fathers are. Research by Slack found that only 3% of black knowledge workers want to return to the office full-time in America, compared with 21% of their white counterparts.”

“America’s Workers Are Exhausted And Burned Out — And Some Employers Are Taking Notice” (Washington Post). “Employers across the country, from Fortune 500 companies such as PepsiCo and Verizon to boutique advertising firms and nonprofit organizations, are continuing pandemic benefits such as increased paid time off and child- or elder-care benefits as well as embracing flexible work schedules and remote work in recognition that a returning workforce is at high risk of burnout.”

“US Workers Are Quitting Jobs At Historic Rates, And Many Unemployed Are Not Coming Back Despite Record Job Openings” (Peterson Institute for International Economics). “Transitions from unemployment to employment have likely been reduced by several factors, many of which interact with each other, including time needed to find a job, the lingering effects of the pandemic and the pace of vaccinations, and increased and expanded unemployment insurance. The good news is that most of the factors holding back transitions from unemployment are probably temporary, and if the rate at which people are leaving unemployment for jobs returns to what would be expected given the overall strength of the economy, the pace of job growth could rise to 750,000 or more a month. There may be a speed limit on job growth, but it is likely to be well above the recent pace.”

What we’re reading (6/28)

“Record Stock Sales From Money-Losing Firms Ring The Alarm Bells” (Bloomberg). “ If you think a rush by companies to sell their shares is a bad omen for the market, imagine a scenario where most of the sales come from firms that don’t make money. It’s happening now. Since the end of March, almost 100 unprofitable companies, including GameStop Corp. and AMC Entertainment Holdings Inc., have raised money through secondary offerings, twice as many as coming from profitable firms, according to data compiled by Bloomberg.”

“The Future Of Psychedelic Medicine Might Skip The Trip” (Forbes). “Roth’s 30-person laboratory, which is perched four stories above the tree-lined campus, is powered by robots, ultra-large-scale computational chemistry and cryo-electron microscopy. His lab has discovered millions of new chemical structures of psychedelic compounds that target the serotonin 5-HT-2A receptor in the brain, just how tryptamines like magic mushrooms and LSD do. But Roth isn’t trying to find the next mind-bending molecule. ‘There are plenty out there and we don’t need anymore,’ he says. ‘The goal is to find compounds that are therapeutic and not psychedelic.’”

“Recent Retirements Throw Wrench Into Fed’s Economic Recovery Plans” (Wall Street Journal). “Full employment has always been notoriously hard to measure, but now it has gotten harder still. Officials look at a range of indicators, including the number of jobs created and the share of the adult population either working or looking for a job. The rapid rise in retirements translates to fewer people available to work—meaning the labor market could hit the full employment threshold at lower levels of employment and a lower labor-force participation rate than before the pandemic.”

“70% Of Millennials Are Living Paycheck To Paycheck, More Than Any Other Generation” (Business Insider). “Seventy percent of the generation said they're living paycheck to paycheck, according to a new survey by PYMNTS and LendingClub, which analyzed economic data and census-balanced surveys of over 28,000 Americans. It found that about 54% of Americans live paycheck to paycheck, but millennials had the biggest broke energy…[i]t's left even six-figure earning millennials struggling to get by. The survey found that 60% of millennials raking in over $100,000 a year said they're living paycheck to paycheck.”

“One in Five Young Adults Is Neither Working Nor Studying In U.S.” (Bloomberg). “Almost one in five young adults in the U.S. was neither working nor studying in the first quarter…[i]n the first three months of the year, about 3.8 million Americans age 20 to 24 were not in employment, education or training, known as the NEET rate, the Center for Economic Policy and Research said in a report. That’s up by 740,000, or 24%, from a year earlier, before many lost their jobs or opted to defer college enrollment as campuses shut down at the onset of the Covid-19 pandemic.”

Lab leak and the say-so of serious people

Dr. Anthony Fauci joined Kara Swisher of the New York Times on her “Sway” podcast recently for a wide-ranging conversation about, among other things, his recently published emails, including his correspondence with Mark Zuckerberg, the long-evolving federal guidance on face masks, and the lab leak hypothesis positing that the novel coronavirus may have escaped from a lab. You can read the whole transcript here.

As everyone should know by now, Dr. Fauci is an eminent immunologist and clearly a dutiful public servant. Having spent the past year and a half helping to guide the U.S. government’s response to the coronavirus pandemic, he has been at the center of the public’s attention and surely unfairly maligned in certain corners of the political ecosphere. This blog has no current view on the U.S. government’s policy response to the pandemic, or on Dr. Fauci’s job performance during the pandemic more generally. I note that he seems like a nice guy.

The conversation with Kara Swisher was revealing, however, of just how commonplace and accepted a certain fallacious form of reasoning is in the public discourse more broadly. It goes by many names: “argument from authority,” “appealing to authority,” ipse dixit (“say-so”), etc. Because it is fallacious reasoning, it can lead you to conclusions that are not likely true; or, equally, direct you away from conclusions that are likely true. Investors, participating as we are in an activity that essentially amounts to competing to identify truths that other people get wrong, ought to care a lot about this.

Here’s a good example of the logical form I’m talking about, from the website Logically Fallacious:

According to person 1, who is an expert on the issue of Y, Y is true.

Therefore, Y is true.

In this case, Y may indeed be true. But it also may not be true. The problem is that the reasoning used to support the proposition that Y is true actually provides no basis to conclude that Y is, in fact, true. To put a finer point on it, the validity of the proposition that Y is true does not depend on who says it. This is shocking to a lot of people because we (society, the media) simply mess this up all the time. Consider, for example, how often you hear arguments like “95% of scientists agree on Y” advanced in serious fora by serious people as a valid basis to conclude that Y is true.

The problem is more obvious and intuitive when you replace Y in the example above with a simple, self-evidently false proposition about which few would disagree. For example, you can formally prove that the reasoning above is wrong by replacing Y with the proposition that 1+1=3:

According to person 1, who is an endowed professor of mathematics, 1+1=3.

Therefore, 1+1=3.

Absurd! 1+1 does not equal 3! But if the say-so of supposed experts was a valid basis for identifying true statements, we would be compelled to conclude that 1+1 does in fact equal 3. Alas, the validity of the similar true claim that 1+1 equals 2 does not depend on who says it or their credentials. It is not the person saying it that makes the statement true, but rather the principals of addition—accessible to any reasoning person—which render it true by definition.

Back to the Swisher-Fauci interview. In the interview, Dr. Fauci appealed to authority numerous times on the topic of the lab leak hypothesis and the all-over-the-map guidance on face masks during the pandemic (emphasis added in the quotations below):

“I feel, as do the overwhelming majority of scientists who have knowledge of virology and knowledge of evolutionary biology, that the most likely explanation for this is a natural leap from an animal reservoir to a human”

“…we all want to find out, really, what the origins were. But again, I get back to saying if you talk to the scientists with knowledge about viruses…”

“…again, I’m not an evolutionary virologist, but those who are look at the virus, and they say it’s absolutely totally compatible with something that evolved from bat viruses because of the closeness to"…”

“At the time that I said to Sylvia that you don’t necessarily need to wear a mask and where I even said publicly you don’t need to wear a mask, you know who agreed with me? The entire Centers for Disease Control and Prevention, the C.D.C, and the Surgeon General of the United States.”

Importantly, this isn’t to say that, on the lab leak specifically, the opposite conclusion (that it came from a lab), must be true. It’s just to say that the claim that ‘a bunch of experts think it jumped zoonotically’ isn’t good enough or dispositive enough as a purely logical matter to rule out the alternative in the way that supposedly credible authorities suggested over the past year and a half. This really shouldn’t be controversial even if all experts were saying the same thing, because expert consensus can, and often is, wrong (e.g., North Vietnamese resolve, Iraq WMDs, the electability of Donald Trump, the list goes on ad infinitum).

But it especially should not be controversial in light of the fact that other credible experts were, in fact, saying it could have come from a lab the whole time. Quite obviously, a lack of authoritative consensus obviates any argument premised on, well, consensus among authorities.

Kara Swisher pressed Dr. Fauci on this point, noting that other reputable scientists and epidemiologists like Dr. Ralph Baric and Dr. Marc Lipsitch “seem to think it’s possible it originated in a lab, or at least, they think the theory is worth checking out[.]” This was an epistemologically productive moment in the interview because it elicited from Dr. Fauci an actual argument—rather than ipse dixit—about why arguments supporting the lab leak hypothesis are less reliable than some think. To wit:

I mean, even when they’re [the Chinese government] not hiding anything, they act that way. I mean, if you look at the first SARS in 2002, they were not particularly forthcoming in what was going on. And what it was, was proven of being a natural occurrence. Yet if you look the way they acted early on, that’s the nature of the way the Chinese, when they have something that goes on in their own country, they just act in a very put-offish way. They’re not forthcoming with information. Does that mean that they’re really lying and hiding something? I don’t know.

So there you have it. Setting aside the say-so of experts, one reason we should discount the lab leak theory, per Dr. Fauci, is because one of the major arguments supporting the theory—the “what are they hiding” argument—isn’t very compelling when you consider that the Chinese government censors information in the ordinary course of affairs.

That seems like a good point and it may be true. Most importantly for this discussion, though, the validity of the point does not depend in any way on the credentials of its purveyor. It is just a plain argument, premised on basic reasoning and logic skills that all humans possess. Swisher’s Q&A revealed that what was initially proffered as a point of view well-supported by technical, definitive, expertise and specialized analysis really might not be that.

It seems plausible then, that what we’re left with here at the end of the day is a sleight-of-hand that is used regularly in public policy debates: a perfectly debatable contention, accessible to any thinking person to assess and evaluate, disguised under a veil of credentials and authority having the effect of inoculating the argument from inspection. Investors, take notice.

A bit of an aside here, but one wonders if the scientific/medical establishment could be particularly vulnerable to this type of errant reasoning. It’s a bit counterintuitive, because one would expect esteemed practitioners of science to be the most rigorous and skeptical people when it comes to popular consensus about uncertain questions. Scientific inquiry is, after all, just applied epistemology, the act of asking over and over again: “do we really know what we think we know and, if so, how?”

But it’s also possible the institutional factors that govern who is allowed into the “guild” could have the opposite effect. There are high licensing barriers, and years (decades?) of study must be done before one is permitted entry. The credentials that accompany those efforts must confer special authority (and cover from critique) to justify the efforts in the first place, separating the “in” from the “out”. Similar dynamics exist in many other places to be sure (rising publications standards for tenure at universities, rising revenue standards for becoming law firm and consulting firm partners, prohibitive zoning rules put in place by home owners on zoning boards to make new building activity in the area prohibitively expensive) — once people are in the club, they tend to make the walls higher and the moats wider for others behind them.

That’s not to say those efforts are pointless — surely they are not! Surely, people who have spent years or decades studying particularly topics are better positioned to advance strong, sound arguments on matters in their domain of expertise than are other people. But they still have to make the argument and it needs to be logically coherent. No argument is immune from examination. The smartest people in the world have always known this: if it’s too complicated for the expert to explain, there’s a chance the proverbial emperor has no clothes.

Lay folks interested in truth (or investors betting on it), should keep it in mind.

July picks available soon

We’ll be publishing our Prime and Select picks for the month of July before Thursday, July 1 (the first trading day of the month). As always, we’ll be measuring SPC’s performance for the month of June, as well as SPC’s cumulative performance, assuming the sale of the June picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wed., June 30). Performance tracking for the month of July will assume the June picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thurs., July 1).

What we’re reading (6/27)

“The Stock Market Hasn’t Been This Placid in Years” (Wall Street Journal). “The U.S. stock market is as calm as can be on the surface, while churning underneath more than it has in decades. The S&P 500 is so quiet it is almost disconcerting. The index hasn’t had a 5% correction based on closing prices since the end of October; no wonder the new day traders who started buying shares in lockdown think the market only goes up. The last time the S&P was this serene for so long was in 2017, a period of calm that ended with the volatility crash early in 2018—although back then it was even quieter for much longer.”

“Renaissance Suffers $11 Billion Exodus With Meager Quant Returns” (Bloomberg). “Disgruntled by subpar returns, clients have now redeemed -- or asked to redeem -- more than a quarter of the capital that Renaissance manages in hedge funds with outside money, according to investor documents seen by Bloomberg. The firm now is mostly managing its own internal capital, a person with knowledge of the matter said.”

“Interview: Marc Andreesen, VC And Tech Pioneer” (Noahpinion). “[from Marc Andreesen:] [I]t’s hard to overstate the positive shock that remote work works. Remote work isn’t perfect, there are problems, but virtually every CEO I’ve talked to over the last year marvels at how well it works. And remote work worked under the extreme duress of a pandemic, with all of the human impact of lockdowns and children unable to go to school and people being unable to see their friends and extended families. It will work even better out of COVID. Companies of all shapes, sizes, and descriptions are retooling their assumptions on geographic footprint, where jobs are located, where employees are located, how offices are configured, and if there should be offices at all. Combining these factors, it’s possible that we’ll see a huge surge in productivity growth over the next 5 years.”

“Big miners’ capital discipline is good news for investors” (The Economist). “The big five miners [Anglo American, BHP, Glencore, Rio Tino, and Vale] consolidated their market power with a spate of huge mergers in the 2000s, just in time for China’s emergence as a voracious consumer of metals. The result was a 15-year supercycle of high prices. Miners splurged around $1trn chasing higher volumes and mega-projects. Many proved disastrous—perhaps a fifth of that investment was returned to shareholders, according to one estimate. After a round of firings, a new generation of mining bosses promised to do better. In the past few years value, not volume, became the industry’s watchword. ‘We will never lose our capital discipline,’ vows Eduardo Bartolomeo, boss of Vale.”

“Investment Banking's Labor Crunch: A Junior Banker Shortage Is Forcing Rainmakers To Do Grunt Work And Firms Are Lowering The Bar For New Hires” (Business Insider). “Many US industries are confronting a surfeit of jobs and having difficulty filling vacancies…[a]nd while investment banking might seem a far cry from the retail industry, which has been one of the hardest hit sectors by labor shortages, financial firms have not been immune. For banks, it's not just struggling to boost the lackluster number of juniors. They're also expecting further losses, PwC partner Julia Lamm told Insider. ‘Companies are bracing for higher turnover numbers than ever before, staffing up the recruiting teams,’ and getting external recruiting agencies ‘geared up for more recruiting,’ said Lamm, who is a workforce strategy partner in the firm's financial services people and organization practice.”

What we’re reading (6/26)

“Meet The Short Seller Who Hopes Stocks Crash And Burn” (CNN Business). “It should be no surprise to hear that the founder of an investment firm named after the Hindenburg is looking for stocks that will crash and burn. Nate Anderson, founder of Hindenburg Research, has made a name for himself in the past few years by targeting companies that he thinks are overvalued and have suspect financials. In other words: looming stock market blowups resembling the infamous German zeppelin that crashed in New Jersey in 1937.”

“Lumber Prices Have Bottomed Out, But Are Likely To Stay Double The Historical Average For At Least The Next 5 Years, A Lumber Trader Says” (Business Insider). “‘My argument is the new normal is going to be significantly higher than the old normal while others think we're going to go back to pre-COVID price ranges,’ [Stinson] Dean [CEO and founder of Deacon Trading] said. After an intense run-up in the beginning of the year, Lumber has fallen nearly 50% from May's record high of over $1,700 per thousand board feet.”

“Remote Work Is The New Signing Bonus” (Wall Street Journal). “Marc Cenedella, founder and chief executive of Ladders, a job-search site for roles that pay north of $100,000 a year, says greater flexibility is shaping up as a perk that companies can wield to poach talented people. ‘Remote is going to be the new signing bonus,’ he says. ‘Instead of dangling, ‘We’ll give you $10,000 if you sign for this job,’ it’ll be: ‘Instead of having to commute 35 minutes every day, go to work, and get in your car and drive 35 minutes home, you can work from your home office all the time.’”

“The Miami Condo Collapse Is A Devastating Reminder Of America's Artificial Land Problem” (The Week). “It is not yet known for certain what caused the collapse, but one probable culprit was the fact that the building had been built on reclaimed wetland, and as a result, had been sinking into the ground for decades…[e]ven if some other factor was the proximate cause, the sinking surely made it worse — a building in such a situation can easily develop cracks in its foundation or other problems that compromise its structure. It's illustrative of a major problem in many American cities: reclaimed land. Big chunks of almost all American coastal cities are built on reclaimed land that will likely turn to soup as climate change causes ocean levels to rise.”

“Mongooses Solve Inequality Problem” (ScienceDaily). “Mothers in banded mongoose groups all give birth on the same night, creating a ‘veil of ignorance’ over parentage in their communal crèche of pups. In the new study, led by the universities of Exeter and Roehampton, half of the pregnant mothers in wild mongoose groups were regularly given extra food, leading to increased inequality in the birth weight of pups. But after giving birth, well-fed mothers gave extra care to the smaller pups born to the unfed mothers -- rather than their own pups -- and the pup size differences quickly disappeared.”

What we’re reading (6/25)

“Key Inflation Indicator Posts Biggest Year-Over-Year Gain In Nearly Three Decades” (CNBC). “A key inflation indicator that the Federal Reserve uses to set policy rose 3.4% in May, the fastest increase since the early 1990s, the Commerce Department reported Friday. Though the gain was the biggest since April 1992, it met the Dow Jones estimate and markets reacted little to the news. The stock market posted mostly solid gains, while government bond yields were moderately higher.”

“Hotels’ and Restaurants’ Rebound Summer Held Back By Shortages Of Everything” (Wall Street Journal). “Summer looked like the on-ramp to a big recovery for the leisure and hospitality industry, hard hit by the pandemic and its lockdowns and propped up with billions in government aid. Instead, restaurants, theme parks, hotels and tourist attractions are finding themselves squeezed from multiple sides: rising costs, worker shortages, unpredictable supplies of some foods and, in some cases, demand so overwhelming it’s difficult to avoid leaving customers dissatisfied.”

“Why Washington Can’t Quit Listening to Larry Summers” (New York Times). “Many people who have served in top government jobs do stick around, commenting favorably on how their former team is doing. Others, like the former Treasury secretaries Timothy F. Geithner and Steven Mnuchin, fade out of the limelight. Few remain as front and center as Mr. Summers, or as apolitical and provocative. ‘He’s driven toward trying to find out what’s true rather than to give the politically correct answers,’ said Ray Dalio, founder of Bridgewater Associates, the world’s largest hedge fund. ‘That’s caused him a lot of trouble, but I like it.’”

“US Banks Get All-Clear On Resuming Limit-Free Share Buybacks After Passing Fed Stress Tests” (Business Insider). “Major US banks no longer have to deal with pandemic-related restrictions on stock buybacks and dividend payments after the US Fed gave them the greenlight to return to normalcy on Thursday. The central bank released results of its latest stress test showing that 23 of the largest banks could withstand more than $470 billion in losses under hypothetical doomsday scenarios, but they would still be left with twice as much capital as required by Fed rules.”

“How Peter Thiel turned $2,000 In A Roth IRA Into $5,000,000,000” (MarketWatch). “Thiel and other entrepreneurs have used their Roth IRAs slightly differently from the manner in which the average investor would, ProPublica found. For example, Thiel bought 1.7 million shares of PayPal in 1999 for $0.001 per share, or $1,700, ProPublica reported. With this strategy, investors are able to buy a large number of shares in a startup at fractions of a penny per share. When those investments garner large gains, investors can use the proceeds from these investments still inside the Roth IRA to make other investments. Substantial gains could be derived if the company goes public and its share price skyrockets.”

What we’re reading (6/24)

“The Green Wave Is Here…Don’t Get Left Behind” (American Consequences). “Whether or not you agree with the climate-change movement is irrelevant as an investor. The reality is the so-called “cool kids” – from Justin Trudeau, Emmanuel Macron, and Angela Merkel… to Mario Draghi and Yoshihide Suga… to Prime Minister Boris Johnson and President Biden – have designated this as their project du jour. And you want to be poised to benefit from the increased investments in the sector.”

“Restaurants Can Solve Their Staffing Crisis, But Higher Pay Alone Isn’t The Answer” (Dallas Morning News). “Anyone who believes that higher pay or federal policy changes alone will solve the industry’s hiring issues is missing the point…[i]n 2007, I founded Edwins, a French restaurant and culinary institute in Cleveland that employs and educates formerly incarcerated people. Of those leaving Edwins, 95% walk straight into new jobs, and less than 1% ever go back to prison. (Compare that to the national recidivism rate after three years, which is higher than 50%.)…unlike our struggling friends in the industry…we’re not experiencing labor shortages.”

“U.S. Power Reliability: Are We Kidding Ourselves?” (T&DWorld). “The average U.S. customer loses power for 214 minutes per year. That compares to 70 in the United Kingdom, 53 in France, 29 in the Netherlands, 6 in Japan, and 2 minutes per year in Singapore. These outage durations tell only part of the story. In Japan, the average customer loses power once every 20 years. In the United States, it is once every 9 months, excluding hurricanes and other strong storms.”

“What Crypto People Get Wrong” (Tyler Cowen, Bloomberg). “The irony is that so many of the arguments made by crypto types imply especially low pecuniary rates of return on crypto. To the extent crypto is useful as collateral or for liquidity purposes, people will be more willing to hold crypto at lower pecuniary rates of return…If we eventually arrive at a world in which equities are expected to rise by say 5% to 7% a year, and Bitcoin by say 1%, then that will be a sign crypto has made it. The more general point is that while crypto has been a highly unusual asset class for its entire history, it won’t act like an unusual asset class forever.”

“Signs That We Face An Epistemological Crisis: Book Titles, 2021” (askblog). “[W]hat does it say about contemporary culture that so many heavyweights are writing on epistemology? This seems to me an indictment of: social media, certainly; political discourse, certainly; higher education, probably; journalism, probably. This may fit with a historical pattern. The barbarians sack the city, and the carriers of the dying culture repair to their basements to write.”

What we’re reading (6/23)

“Investment Firms Aren’t Buying All the Houses. But They Are Buying the Most Important Ones.” (Slate). “It’s not exactly accurate that investors are ‘buying every single-family house they can find,’ as some have suggested…[t]hey’re really buying up the stock of relatively inexpensive single-family homes built since the 1970s in growing metro areas. They mostly ignore bigger and more expensive houses, especially ones that are move-in ready: Wealthy boomers and the nation’s finance and tech bros nab those properties. And they’re also ignoring cities with stable or shrinking populations, like Providence and Pittsburgh.”

“U.S. Existing-Home Prices Hit Record High in May” (Wall Street Journal). “U.S. home prices in May experienced their biggest annual increase in more than two decades, as a shortage of properties and low borrowing rates fueled demand. The median existing-home sales price in May topped $350,000 for the first time, the National Association of Realtors said Tuesday. The figure was nearly 24% higher than a year ago, the biggest year-over-year price increase NAR has recorded in data going back to 1999.”

“WeWork's Top Tech Exec Is Leaving After Two Years Amid A Reorganization, A Leaked Memo Reveals” (Business Insider). “WeWork's top tech executive is leaving and the tech team is reorganizing, just before the coworking company starts trading publicly, Insider has learned. Ken Watson, who joined WeWork two years ago as vice president of engineering before he was promoted to chief technology officer, is leaving for ‘other opportunities,’ per a Monday internal email reviewed by Insider.”

“Scoop: The Hill Ramps Up Sale Talks” (Axios). “The Hill, a Beltway-based print publication that receives significant national traffic to its digital website, is being more aggressively shopped by its owner Jimmy Finkelstein, sources tell Axios. It’s held recent talks with broadcasting giant Nexstar Media Group, a source tells Axios.”

“How Tiger Global is changing Silicon Valley” (The Economist). “SoftBank is being upstaged by another brash outsider. Between January and May Tiger Global Management, a New York hedge fund that also invests in private tech firms, ploughed money into 118 startups, ten times more than it backed in the same period in 2020, according to Crunchbase, a data provider. Its portfolio now counts more than 400 firms, including several behind some of the past year’s most eye-catching IPOs, for example Coinbase, a cryptocurrency exchange, and Roblox, a video-game maker.”

What we’re reading (6/22)

“Share Buybacks Are Back At A Record Pace” (Axios). “Why it matters: Last year, stock buyback activity fell sharply as companies were hanging onto cash amid extreme uncertainty. The about-face shows that confidence is up, along with earnings. By the numbers: S&P 500 companies have approved plans for a whopping $567 billion worth of stock buybacks since the beginning of the year through mid-June, according to a new Goldman Sachs report. This is a record for this part of the year. It’s worth noting that Apple and Alphabet accounted for $90 billion and $50 billion, respectively, of those announcements.”

“Blackstone Bets $6 Billion on Buying and Renting Homes” (Wall Street Journal). “Blackstone Group Inc. has agreed to buy a company that buys and rents single-family homes in a $6 billion deal that’s a sign Wall Street believes the U.S. housing market is going to stay hot. The giant investment firm has reached a deal to acquire Home Partners of America Inc., according to people familiar with the matter. Home Partners owns more than 17,000 houses throughout the U.S., which it bought, rents out and offers its tenants the chance to eventually buy.”

“Meme Stock Investors Head To Oil Patch As Shale Producer Soars” (Investor’s Business Daily). “Meme stock traders are headed to the oil patch as Torchlight Energy Resources (TRCH) comes into focus. TRCH stock soared Monday. The Plano, Texas-based exploration and production company has assets in top shale plays like the Permian Basin and Eagle Ford formation.”

“Airlines Face A Bailout Backlash” (DealBook). “American Airlines confirmed yesterday that, amid delays trying to keep up with surging demand, it would cut nearly 1,000 flights in the first half of July…The airline’s move adds fuel to the debate about labor shortages. American said it had cut flights because of a shortage of pilots and airport workers. Critics said the airline should raise wages to attract more workers, especially since it received billions in government aid during the pandemic.”

“Investors Really Want A Bitcoin ETF, Van Eck CEO Says After SEC Delays Approval Again” (CNBC). “Van Eck’s bitcoin ETF proposal has hit yet another bump in the road, but its CEO isn’t backing down. The Securities and Exchange Commission said in a Wednesday filing that it will delay its decision on whether to approve the VanEck Bitcoin Trust a second time, extending its review process and requesting comment from interested parties on how the rule change could impact markets. Approval may only be a matter of time given the demand for the product, Van Eck Associates CEO Jan van Eck told CNBC’s ‘ETF Edge’ on Monday.”

What we’re reading (6/21)

“The Death Of Car Ownership: This $30 Trillion Trend Could Kill The Auto Industry” (OilPrice.Com). “The idea of recurring revenue has been around a long time, but the past three years have seen it become a huge megatrend. When you apply it to the auto industry, you could get a serious disruptor of our views of car ownership. Just like Adobe made it possible for so many more people to use its high-end software packages, so might car subscription services make it that much easier for people to drive a car--or a second (or third) vehicle.”

“Global Markets Adapt To A Change In The Federal Reserve’s Tone” (The Economist). “[I]nvestors will ask whether the shift signalled by the Fed warranted such strong reactions. It is possible that markets overdid it. When many investors hold the same portfolio of positions, they can be forced to bail out in a hurry if markets move violently against them. This liquidation of positions can exacerbate volatility. In fact, there are reasons to think the great reflation trade has further to run: the full reopening of the American economy is still in its early stages and the end of 2022 is a long way off.”

“An Inflation Storm Is Coming For The U.S. Housing Market” (MarketWatch). “The primary solution to address runaway inflation in housing will be to build more homes — something that’s easier said than done…[the] challenges run the gamut from the high cost of lumber to the lack of skilled workers to complete construction projects. Another factor: Zoning regulations across the country prevent the construction of more dense housing in many cities, effectively driving up home prices and rents in the process.”

“American Airlines Canceling Hundreds Of Flights Through Mid-July In Part Due To Labor Shortages” (CNN Business). “American Airlines is canceling hundreds of flights through at least mid-July as the company strives to maintain service in the midst of massively increasing travel demand while the coronavirus pandemic continues to recede in the United States, according to a spokesperson from the airline.”

“IRS: Ransomware Payments May Be Deductible” (Axios). “The federal government for years has recommended that companies do not pay criminals during ransomware attacks, but the feds have a consolation for those who do pay: the ransoms may be tax deductible…[t]he IRS offers no formal guidance on ransomware payments. But multiple tax experts interviewed by AP said deductions are usually allowed under law and established guidance.”