What we’re reading (10/18)

“Joseph Sullivan III Helped Create Chicago Options Exchange” (Wall Street Journal). “Mr. Sullivan, who was a Wall Street Journal reporter before moving to the Chicago exchange, was assigned to look into the feasibility of plywood futures. That idea flopped, but he embarked on a much more promising project: creating a new exchange to trade stock options, then an obscure corner of the financial markets. It took more than four years for Mr. Sullivan and colleagues to overcome skepticism and resolve all the technicalities. In 1972, he became president of the new Chicago Board Options Exchange. Trading began April 26, 1973, in what had been a smoking lounge next to the vast commodity trading floor…Mr. Sullivan, who had respiratory ailments and had apparently recovered from a bout with Covid-19 in August, died Oct. 2 at his home in Knoxville, Tenn. He was 82.

“Few People Are Flying. What Is An Airline To Do? Lots Of Fine-Tuning.” (New York Times). “Every airline is struggling, but each struggles in its own way…[w]hen the virus devastated travel in March and April, United took hundreds of planes out of circulation. Since July, it has brought back more than 150, including those flown by regional carriers, but about 450 are still stashed away.”

“Inflation Is Totally Out Of The Control Of Central Banks” (The Market). An interview with Nobel Laureate and the “father of modern finance” Eugene Fama. One quote getting a lot of attention: “[e]very day we hear a story about the movement of stock prices. But the story is different each day. So basically, these stories are made up after the fact. But when we look at it systematically, we don’t see a big effect of Fed actions on real activity or on stock prices or on anything else. That’s why I use to say that the business of central banks is like pornography: In essence, it’s just entertainment and it doesn’t have any real effects.”

“Warren Buffett Plowed $5 Billion Into Bank of America During The Debt Crisis. Here's The Story Of How The Investor Helped The Bank And Made A Fortune In The Process” (Business Insider). Funny introduction to this story: “Buffett was taking a bath in late August 2011, reflecting on his investments in American Express and Geico during difficult periods for both companies, when he had the idea to bet on Bank of America, Fortune reported. The investor tried to get through to the bank's CEO, Brian Moynihan, but was initially blocked by a call-center worker. ‘Warren asked to speak to me and of course they don't transfer everybody who calls the call centers to the CEO's line,’ Moynihan told David Rubenstein in a Bloomberg interview last year.”

“China’s Gulags” (The Economist). “‘IS THERE A God?’ Answer yes, and you will get a beating. As we report this week, that is just one of the humiliations inflicted on Uyghurs, a disaffected, mostly Muslim ethnic minority of 12m people in the far west of China. A handful have carried out terrorist attacks, but none since 2017. The Chinese state has in effect locked them all in a vast open-air prison. Many are in detention centres. Even those outside must attend indoctrination sessions. Evidence suggests that hundreds of thousands of children have been separated from their parents. Women have been forcibly sterilised. This persecution is a crime against humanity.”

Mid-October 2020 performance update

At the end of last month, I mentioned that I would be including a second comparison portfolio in Stoney Point’s performance updates (besides the SPY ETF). That second comparison portfolio would be based on a recommendation from the “Bogleheads”—that is, devotees of the investment philosophy embodied by the so-called “index” mutual funds introduced to investors by Jack Bogle and Vanguard decades ago. In particular, I mentioned that I would be including a comparison portfolio proffered by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf in The Bogleheads’ Guide To Investment (a book blessed by Jack Bogle himself, in as far as he wrote the forward) as “A Young Investor’s Asset-Allocation” and considered appropriate for a typical young investor. Per Larimore, et al., that portfolio comprises (1) domestic large-cap stocks, (2) intermediate-term bonds, and (3) domestic mid-cap stocks (I swapped out #3 with international stocks last month to capture some advice from other corners of the Bogle-sphere, see, e.g., here).

I think it’s worthwhile to say a little more about the Bogleheads’ index-investing philosophy and, in particular, why I’m including it as a comparison portfolio for Stoney Point’s Prime and Select models along with the S&P 500. In a nutshell, I interpret the Bogleheads’ investment philosophy to encapsulate, broadly speaking, the basic premise of passive index fund investing: that the most efficient portfolio is a perfectly diversified “market” portfolio. (Here, the notion of a portfolio being maximally efficient refers to maximizing expected excess returns for a given level or volatility, i.e., risk, or, equivalently, minimizing risk for a given expected excess return). Put simply: it’s really hard to beat the market, and most professional investment managers fail to do that once you include fees, especially over long periods of time. It’s worth noting that this premise is generally consistent with some of the earliest and most influential asset pricing theories and is also supported by a huge empirical literature finding that investors are often better off paying low fees and getting the “market return” than paying higher fees to some manager who probably can’t beat the market anyway.

But don’t take my word for it, here’s what the Bogleheads themselves say in the introduction to their book, describing Vanguard founder Jack Bogle:

What Jack Bogle has made possible for the individual investor is truly extraordinary. Thanks to his creation of no-load, low-cost, tax-efficient mutual funds, millions of investors enjoy significantly greater returns on their investment dollars than they otherwise would have. His introduction of the first index fund for retail investors was labeled Bogle’s Folly by its detractors. Today, that same fund, Vanguard’s 500 Index fund, is the largest mutual fund in the world. Thanks to Jack Bogle, more of each investor’s money is put to work for them instead of going into the pockets of brokers, fund managers, or the taxman. For the everyday investor this translates into items such as nicer homes for families, college educations for children, more enjoyable retirements for seniors, and more money to be passed on to loved ones and causes they care about. Although a few other investment fund families have joined the low-cost revolution, it was Jack Bogle who sounded the bugle and led the charge, and it’s Vanguard that continues to lead the way.

So why am I including the Bogleheads portfolio in the performance updates going forward? Clever readers may have noticed I’m using the term “comparison portfolio” instead of “benchmark” in this post to describe the portfolio. I may not always clearly make that distinction in future posts (so please forgive me in advance!), but I’m doing it now to convey the technical point that I’m not claiming the Bogleheads portfolio will be of comparable riskiness to Prime and Select portfolios. As I mentioned in the September performance update and discuss further below, the Bogleheads portfolio includes a 20 percent allocation to bonds, which by itself might reasonably lead to an expectation that the portfolio will be less risky and generate lower returns over the long term than either the Stoney Point portfolios or the S&P 500 (which are all-equity portfolios). The Bogleheads portfolio is, however, arguably a salient and plausible alternative investment portfolio for readers of this site, so it’s worth considering how Stoney Point’s portfolios stack up against it. Such is my aim going forward. It will simply be important to recall that the Bogleheads portfolio is likely less risky than the Stoney Point portfolios and the S&P 500 and therefore should, in principle, generate lower returns. To the extent that’s true, comparing the returns of the Bogleheads portfolio to these portfolios can seem a bit unfair to the Bogleheads, so, in the interest of transparency and clarity, we’ll be presenting some information periodically about how all of these portfolios compare on a risk-adjusted basis using Sharpe ratios.

One other quick, but important note about all this: at the end of last month I mentioned that I may play a little bit with the asset allocation for the “Bogleheads” portfolio. It wasn’t immediately clear what Larimore, et al. were recommending for a specific implementation of the “Young Investor’s Asset-Allocation” portfolio, as they only listed broad asset classes. Taking another look at the Larimore, et al., book, however, they do in fact offer a recommended portfolio for a “[y]oung [i]nvestor” based on specific Vanguard index mutual funds: a portfolio comprising an 80 percent allocation to Vanguard’s Total Stock Market Index Fund (VTSMX) and a 20 percent allocation to Vanguard’s Total Bond Market Index Fund (VBMFX). Going forward, I’m going to be using that portfolio as my representation of the Bogleheads’ expert recommendation, with one modification: mutual funds only trade once per day after the market close, unlike stocks and ETFs, so instead of VTSMX and VBMFX, I’m going to use their ETF analogues, VTI and BND, respectively, which will enable me to look at market-open and intraday pricing. Looking at market-open prices will be important because I’ll calculate the performance of the Bogleheads portfolio assuming re-balancing back into an 80-20 allocation at the beginning of each month (at the open price) for comparability with the re-balancing frequency of the Prime and Select portfolios.

Without further ado, below are some mid-month performance charts (current as of the close on October 16) so you can see what the structure of these tables will look like going forward.

Stoney Point Prime Performance

(10/1/20-10/16/20)

Stoney Point Select Performance

(10/1/20-10/16/20)

What we’re reading (10/17)

“Tech’s Influence Over Markets Eclipses Dot-Com Bubble Peak” (Wall Street Journal). “Technology companies are set to end the year with their greatest share of the stock market ever, topping a dot-com era peak in the latest illustration of their growing influence on global consumers. Companies that do everything from manufacturing phones to operating social-media platforms now account for nearly 40% of the S&P 500, on pace to eclipse a record of 37% from 1999, according to a Dow Jones Market Data analysis of annual market-value data going back 30 years.”

“More Volatility Is Likely Ahead As Rising Cases, Lack Of Stimulus Overshadow Strong Earnings” (CNBC). “Another volatile week may be in store for traders as coronavirus cases rise in the U.S. and Europe while Democrats and Republicans remain at an impasse over new fiscal aid. The Dow Jones Industrial Average and S&P 500 fell for three straight days this week. That slide was the longest losing streak for the averages since mid-September. The two market benchmarks eked out slight gains on Friday to snap their losing streak.”

“The ‘MAGA’ ETF Is Trailing The Market For One Major Reason” (CNN Business). “With less than three weeks until Election Day, President Trump is trailing Joe Biden in the polls. And an ETF whose ticker is the acronym for Trump's famous campaign slogan is lagging the market, too. The Point Bridge GOP Stock Tracker ETF (MAGA), which trades under the symbol MAGA, is down 8% this year -- in sharp contrast to the benchmark S&P 500, which is up 7%.”

“Earnings Were Supposed To Lift The Markets. What Happened?” (Fortune). “Global stocks and U.S. futures are moving in opposite directions with the latter pointing to a weak open. COVID and labor market jitters are weighing heavily on investor sentiment as the stimulus talks bog down. Earnings beats, so far, are failing to lift risk appetite.”

“Will New York Go For Another Wall Streeter As Mayor"?” (Dealbook). “The veteran deal-maker Ray McGuire announced Thursday that he was stepping down as Citigroup’s vice chairman to join the crowded race for New York City mayor. His fellow finance executives sing his praises, but it’s unclear whether that helps or hurts his bid to run a city whose voters have shifted away from the centrist politics of leaders like Mike Bloomberg toward the progressive views of Representative Alexandria Ocasio-Cortez.”

What we’re reading (10/16)

“Morgan Stanley Powers Through Coronavirus Recession With Higher Profit, Revenue” (Wall Street Journal). The banks seem to be doing OK. “Morgan Stanley on Thursday said its quarterly profit rose 25% from a year ago, another big U.S. bank to skate unscathed through the rockiest economy in years. Profit of $2.72 billion, or $1.66 a share, was higher than a year ago and beat analysts’ forecasts. Revenue rose 16% to $11.66 billion.”

“Walmart CEO Doug McMillan To Congress: Get A Stimulus Deal Done” (CNBC). “Walmart CEO Doug McMillon on Thursday called on Congress to work together and pass a stimulus deal to help American families and small businesses. ‘For both sides, I think what they need to keep in mind is that there are Americans that need them, that don’t really care about politics, aren’t really tied up in this election and they just need some help,’ he said, in an interview on CNBC’s ‘Squawk Box.’”

“Amazon Just Had Its Biggest Prime Day Ever. But This Year, It’s Not Hyping That Up” (CNN Business). “Each year Amazon has held Prime Day, the retailer has touted that the savings event shattered prior Black Friday or company sales records. But this year, Amazon took a different tack in its annual announcement on results from the shopping event, playing up how small businesses benefited from Prime Day instead. The change comes as Amazon faces intense scrutiny from lawmakers about its power over independent merchants that sell goods through its website and other tactics that critics argue stifle competition.”

“‘Young And Dumb’ Traders Have Created A ‘Total Nightmare’ In The Stock Market, Fund Manager Warns” (MarketWatch). Cole Smead at Smead Capital Management thinks Millennials are dumb. But—reminder!—the market is just the aggregation of tens of thousands of individual investors’ assessments. The “wisdom of the crowd”-type thinking suggests that when the market is doing one thing and you’re doing another, you should be very cautious in assuming it’s the market that’s wrong, instead of you.

“Flashy Global Law Firm Accused Of Bilking Trusting Nebraska Senior Citizen” (Dealbreaker). “There’s no older or more successful trick in the fraudster’s playbook than selling something worthless and/or nonexistent to a credulous senior. And so when the fast-talking cosmopolitan lawyers at Jones Day were charged with selling off a German pipe maker about to go belly-up, they (allegedly) knew exactly who to turn to [Warren Buffett]].”

What we’re reading (10/15)

“Goldman’s Pandemic Hot Streak Continues in Third Quarter” (Wall Street Journal). “Goldman’s quarterly profit of $3.62 billion on revenue of $10.78 billion was better than stock analysts had forecast and sharply higher from a year ago. Since then, the global economy has crashed, political turmoil has continued and interest rates have dropped to near zero—all things that should dent Wall Street profits. And yet the nation’s biggest banks remain profitable. Their securities-trading desks have, remotely, hummed back to life. Big corporate bankruptcies have leveled off. Depositors haven’t pulled their money.”

“A Horrifying Covid Chart Still Frightens Months Later” (Bloomberg). “In late June, I highlighted what I deemed a "horrifying" chart showing massive growth in new infections in the U.S. relative to the European Union. A key explanation for the discrepancy was that many U.S. states were moving forward with reopening despite high case counts, while many European countries had waited to ‘crush the curve’ and ensure infections were lower before loosening restrictions. Now, almost four months later, that same chart remains very scary — but in a different way. For the first time since March, the EU is reporting more new Covid-19 cases on a population-adjusted basis than the U.S.[.]”

“Your Portfolio Is Not As Diversified As You Think, Unless You Are Utilizing This Powerful Strategy” (MarketWatch). “With historically low interest rates, investors are cramming money into stocks, especially in large-cap technology companies including Microsoft Corp. and Facebook Inc. A simple way to diversify by asset class while cutting risk and benefitting from long-term stock gains is to own convertible bonds.”

“Capital Is Pumping Into ETFs” (Dealbreaker). “Through the first nine months of the year, investors have plowed $488 billion into ETFs compared with $349 billion during the same period in 2019, according to data provider ETFGI.”

“United Posts Another Huge Loss After Pandemic Guts Demand For Air Travel” (CNN Business). “United Airlines posted its third huge quarterly loss of the year, saying it is ready to ‘turn the page’ and prepare for a recovery from the worst financial crisis ever faced by the airline industry. The carrier posted a $2.4 billion loss excluding special items, slightly less the $2.6 billion it lost on that basis in the second quarter but a bit above analysts' forecasts. Its net loss of $1.8 billion also exceeded the previous quarter's loss.”

What we’re reading (10/14)

“Joe Biden Keeps Everyone Guessing On Wall Street Regulation” (Wall Street Journal). “Fifteen years ago, Joe Biden defended credit-card companies during a testy Senate exchange with Elizabeth Warren over legislation curtailing consumers’ ability to shed their debts in bankruptcy. This March, he adopted her argument entirely. Mr. Biden spent 36 years as a senator from the credit-card and corporate mecca of Delaware, where he built relationships and a voting record that provided ammunition for his opponents during a bruising Democratic presidential primary. Now, he is edging left on a range of issues from student debt to stock buybacks, leaving both progressives and Wall Street Democrats guessing whose side of the financial-regulation fight he is on.”

“The Man Who Speaks Softly—And Commands A Big Cyber Army” (Wired). “Over the next 15 years [after September 11, 2001], as America waged the resulting war on terror, Paul Nakasone became one of the nation's founding cyberwarriors—an elite group that basically invented the doctrine that would guide how the US fights in a virtual world. By 2016 he had risen to command a group called the Cyber National Mission Force, and he was hard at work waging cyberattacks against the Islamic State when the US suffered another ambush by a foreign adversary: the Kremlin's assault on the 2016 presidential election.”

“Walmart Divides Black Friday Deals Into 3 Separate Events That Kick Off Online” (CNBC). “For shoppers who can’t part with Black Friday traditions, Walmart said Wednesday that it still plans to have in-store events featuring deep discounts. Yet the holiday sales days will come with pandemic-related precautions. Stores will open at 5 a.m. local time. Customers must line up single-file before they enter. Stores will limit the number of people inside. Employees will distribute sanitized shopping carts. And some, dubbed health ambassadors, will greet shoppers and remind them to put on a mask.”

“COVID-19 Has Changed The Housing Market Forever. Here’s Where Americans Are Moving” (Forbes). “Thanks to the COVID-19 pandemic, more deep-seated, tectonic-sized questions beyond markets and interest rates are being asked this time around that no one really has the answers to yet—like will people feel safer living in the south and southwest where they can spend all year social distancing outside? What if companies let workers work remotely for the rest of their lives? Why go back to retail shopping when I’m already ordering everything online? What’s the point of living “downtown” if half of the restaurants, bars, and museums never open back up?”

“Corporate Taxation And The Distribution Of Income” (National Bureau of Economic Research). Interesting new paper. Here’s the abstract: “Higher corporate taxes reduce corporate business operations, replacing them with operations by noncorporate businesses that are risky and have undiversified ownership. This shift contributes to income dispersion, with effects so large that higher corporate taxes can increase income inequality even when the corporate tax burden falls entirely on capital owned disproportionately by the rich. Estimates suggest that the riskiness of U.S. noncorporate business increases by 12.3% the aggregate income of the top one percent, and that income dispersion created by a higher U.S. corporate tax rate offsets more than half of the distributional effects of reducing average returns to capital.”

What we’re reading (10/13)

“One Of The Year’s Worst Short Bets Defies Scathing Reports And An SEC Investigation” (Wall Street Journal). “No stock has been more heavily attacked by activist short sellers this year than GSX Techedu Inc., a New York-listed Chinese tutoring company. So far, GSX has come out on top. After quintupling this year, it is one of the world’s most valuable education businesses, with a market capitalization of $27.3 billion. ‘Shorting this, it has been just a nightmare,’ said Richard Smatt, a mathematics professor at Flagler College in St. Augustine, Fla., who said he is sitting on tens of thousands of dollars in unrealized losses on GSX.”

“Three Rockefellers Say Banks Must Stop Financing Fossil Fuels” (New York Times). “One hundred years ago, as a deadly influenza gripped the world and the stock market dropped precipitously, our great-grandfather John D. Rockefeller Jr. began investing in New York banks to diversify the family’s business away from fossil fuels in the midst of the economic uncertainty…The similarities today are striking. A pandemic has killed more than a million people across the world and shows no signs of abating, and unease surrounds the economy. But that anxiety is not merely a consequence of the pandemic. The long-term outlook for the economy is clouded by a warming climate and its foreseen consequences.”

“Tesla’s Debt Close To Investment Grade After S&P Upgrade” (MarketWatch). “S&P Global Ratings on Monday raised its Tesla Inc. debt ratings to BB-, from B+, leaving the Silicon Valley car maker’s bonds two notches from investment grade. ‘Improved execution, increasingly efficient production, and global expansion continue to strengthen the company’s competitive position,’ S&P said.”

“Invesco Is Launching A New Nasdaq ETF To Capitalize On The Tech Craze” (CNBC). “The Invesco QQQ Trust (QQQ) started tracking the NASDAQ-100 Index in 1999. Since then, it’s become the fifth-largest ETF listed in the U.S., with $135 billion in assets under management. Now Invesco is looking to capitalize on the interest in technology and growth stocks by offering a new ‘junior’ QQQ.”

“U.S. Inflation Gauge Increases At Slowest Pace In Four Months” (Bloomberg). “A key measure of U.S. consumer prices rose in September at the slowest pace in four months, signaling little threat of accelerating inflation as the economy recovers. The consumer price index rose 0.2% from the prior month after a 0.4% gain in August. Compared with a year earlier, the gauge increased 1.4%, after August’s 1.3% rise.”

What we’re reading (10/12)

“Nobel Prize In Economic Sciences Is Awarded To U.S. Academics” (Wall Street Journal). “U.S. academics Paul R. Milgrom and Robert B. Wilson shared the Nobel Prize in Economic Sciences for new insights into how auctions work, and how different auction designs can help buyers and sellers meet their goals…[b]oth winners are professors at Stanford University.” In a great summary of Milgrom’s work, GMU professor Tyler Cowen writes, “[b]asically Milgrom was the most important theorist of the 1980s, during the high point of economic theory and its influence… [a] very good choice and widely anticipated, in the best sense of that term.”

“New Questions About Leon Black’s Ties To Jeffrey Epstein” (Dealbook). “Shortly after Jeffrey Epstein was arrested last year on sex-trafficking charges, Leon Black, Apollo’s billionaire C.E.O., was asked about his decades-long ties with the financier. Mr. Black played it down, but The Times reports that the two had a far deeper relationship than previously known, in which Mr. Black paid tens of millions to Mr. Epstein over a decade.”

“Southwest Pilots’ Union Bristles At 10% Pay Cut Proposal” (CNBC). “Southwest Airlines pilots’ union is pushing back on a company proposal to cut pay by 10% to avoid furloughs through the end of next year, the latest wrinkle in the Dallas-based carrier’s efforts to cut costs in the pandemic. Southwest is trying to preserve its record of never having furloughed workers in its nearly 50 years of flying, but its CEO Gary Kelly warned earlier this month that it would seek concessions from the labor unions that make up the bulk of its workforce.”

“Wall Street Layoffs A Matter Of When, Not If, Sources Say” (New York Post). “With the markets near all-time highs, IPOs booming and dealmaking such as Morgan Stanley’s purchase of Eaton Vance picking up, it would seem like layoffs would be the last thing that big banks and investment houses are weighing. But those who run Wall Street never let a serious crisis go to waste. Cutting jobs is exactly what every major firm is looking at as the pandemic continues to ravage the US economy.”

“A Farewell To The NBA Bubble After Three Grueling And Exhilarating Months” (Washington Post). “The bubble opened with an overwhelming rush of media interest that mostly consisted of morbid curiosity and rubbernecking. I did countless interviews about my seven-day quarantine inside a hotel room, and everyone asked about what would happen if someone got sick or died. Once it became clear that the NBA’s stringent health protocols were working, the ambulance chasers moved on. Now, physical and mental exhaustion reign, and it has become clear that the bubble was meant for die-hards.”

What we’re reading (10/11)

“Investors Are Betting Corporate Earnings Have Turned A Corner” (Wall Street Journal). “Investors are entering third-quarter earnings season with brighter expectations for corporate profits, a bet they hope will propel the next leg of the stock market’s rally. Profits among companies in the S&P 500 are still expected to decline sharply from last year, but analysts have been lifting their estimates over the course of the quarter—a move that goes against the norm. Typically, earnings expectations decline as a quarter progresses.”

“HSBC Calls Start Of A ‘Great Rebalancing’ As The Global Economy Enters A Flatter Stage Of The Recovery” (CNBC). “A ‘great rebalancing’ of investor portfolios away from core government bonds and a ‘coupon clipping environment’ for markets are coming into view in the fourth quarter, according to HSBC Global Asset Management. In its quarterly outlook report, HSBC characterizes the global economy as entering the second, flatter, phase of a two-stage ‘swoosh-shaped’ recovery in which growth is set to moderate.”

“The Baby Boomer Bond Dilemma” (New York Times). “Today’s record low bond yields could not come at a worse time for many baby boomers. Owning U.S. Treasuries, the undisputed safest bond for retirees, means signing on for next to nothing in earnings for the next five to 10 years. That’s because the current yield of a Treasury bond is a solid estimate of future annual returns, and Treasuries that mature in 10 years or less currently have yields below 1 percent.”

“The US-China Trade War And Global Value Chains” (University of Minnesota). Interesting new paper from Yang Zhou at the University of Minnesota finding that “the [Trump] trade war costs China $35.2 billion, or 0.29% GDP, costs US $15.6 billion, or 0.08% GDP, and benefits Vietnam by $402.8 million, or 0.18% GDP.” According to Tyler Cowen at George Mason University, “[t]hose numbers should not come as a surprise, they do indicate that both countries are worse off, but they also show that a lot of the bargaining power does in fact reside on the side of the United States.”

“‘I’m Terrified, Frankly.’ Meet The People Who Are Counting On Another Stimulus Bill” (MarketWatch). “Most of the stimulus checks have long been disbursed and the supplemental federal benefits ended in July. Extra $300 unemployment benefits from the Federal Emergency Management Agency recently ended too. The September jobless rate was 7.9%. That’s off the double-digit rates of the spring after the pandemic’s initial shockwave. But September marked the smallest gain in employment since state economies started reopening; 700,000 people left the workforce because jobs are scarce.”

What we’re reading (10/10)

“How Citadel CEO Ken Griffin Built a $1 Billion Private Property Portfolio” (Wall Street Journal). “In the early 1900s, the country’s wealthiest businessmen including William Randolph Hearst and John D. Rockefeller built sprawling, gilded estates. Living at that kind of boundless scale fell out of favor with subsequent generations, however, and these kinds of estates were either subdivided or turned over to the state or to preservationists. Now, hedge-fund multibillionaire Ken Griffin appears to be mounting a single-handed campaign to bring that level of extravagance back into vogue. Over the past five years or so, Mr. Griffin, an ambitious 51-year-old businessman who started his initial trading business from his Harvard University dorm room as a freshman, has developed a reputation among real-estate insiders as the luxury market’s whale, racking up a string of purchases that tally up to over $1 billion.”

“How Big Tech Became Such A Big Target On Capitol Hill” (CNBC). “After a 16-month investigation into competitive practices at the largest U.S. tech companies, Democratic congressional staffers laid out their findings this week in a 449-page report. They concluded that Apple, Amazon, Facebook and Google enjoy monopoly power that needs to be reined in, whether that means breaking the companies up, blocking future acquisitions or forcing them to open their platforms.”

“Airline Miles Programs Sure Are Profitable. Are You The Loser?” (New York Times). “[A]s carriers have made their case to legislators in recent months, some have also been pitching banks — using their customers’ faith in free travel as a kind of collateral…[T]hey and their lenders think they have customers, over 100 million of us in each program, right where they want us. Take it from a Delta securities filing from last month, which called the foundational aspect of frequent-flier programs ‘the fundamental aspiration of earning a free flight.’ Because of our desire for freebies, Delta added, it can ‘manage costs by modifying inventory levels and value.’ In other words, the airline can raise the prices of trips and upgrades, in miles, at any time. And it believes it can do so with relative impunity from a passenger revolt or from intense protest by American Express cardholders.”

“The New Black Friday: Amazon, Target, Best Buy And Others Kicking Off Holiday Sales” (Washington Post). “Some of the nation’s largest retailers will begin rolling out Black Friday sales this weekend — earlier than ever and the latest sign of how the pandemic is reshaping the biggest shopping season of the year.”

“A Columnist Makes Sense Of Wall Street Like None Other (See Footnote)” (New York Times). “In financial news — a medium not known for cultivating eccentric or literary voices — there’s no other writer quite like Mr. Levine, a former Goldman Sachs banker whose deadpan style mixes technical elucidation and wit.”

What we’re reading (10/9)

“Trump Raises Coronavirus Stimulus Offer To $1.8 Trillion, Then Says He Wants Bigger Bill Than Dems Or GOP” (CNBC). “The White House on Friday took a new coronavirus stimulus offer to Democrats, believed to cost $1.8 trillion, as the sides work to strike a deal before the 2020 election. The plan would mark an increase from the $1.6 trillion the Trump administration previously proposed. House Democrats passed a $2.2 trillion bill earlier this month, and the sides have struggled to find a consensus in between those figures.”

“Stocks Close Higher To Finish Best Week In Three Months” (Wall Street Journal). “The S&P 500 rose Friday, closing out its biggest weekly advance in three months as investors welcomed signs pointing to a decisive result in next month’s U.S. presidential election. A week that started with President Trump in the hospital being treated for the new coronavirus and former Vice President Joe Biden widening his lead in national polls finished as the best stretch for the index since the week of July 2.”

“What The Harvard Endowment’s Below-Average Grade Can Teach You About Index Funds And Your Investments” (MarketWatch). “Harvard’s University’s endowment’s return lagged the U.S. stock market — again. For the fiscal year ending June 30, Harvard’s endowment produced a 7.3% return, versus a 7.5% total return for the S&P 500. This marks the 12th year in a row in which the $42 billion portfolio fell behind the benchmark index. Also, as you can see from the accompanying chart, the endowment has lagged the S&P 500 over each of the 3-, 5-, 10- and 20-year horizons.”

“Swiss Quant Start-Up Vestun Opens Up Systematic US Equity Hedge Fund To External Money” (Hedgeweek). “Chayan Asli, Vestun’s founder and CEO, believes that relying on signals generated from statistical rules and back-testing history is not sustainable for delivering consistent long-term market outperformance. ‘Nowadays, everyone has access to the same financial datasets and machine learning models. If everyone uses the same smart systems with the same recipe for success, it will undermine the competitive advantage obtained by using computer-driven models to invest.’”

“Just 59 Americans Own More Wealth Than Half The Country, Data Shows” (New York Post). “The poorest 50 percent of Americans, or roughly 165 million people, collectively owned about $2.08 trillion in wealth in the second quarter of 2020, according to Federal Reserve data released last week. That’s less than the net worth of the nation’s 59 richest billionaires, who have a combined fortune of about $2.09 trillion, Bloomberg’s Billionaires Index shows — a number that’s grown this year despite the COVID-19 crisis kneecapping the global economy.”

What we’re reading (10/8)

“Stocks Look To Be Setting Up For A Year-End Rally Despite Election Worries And Lack Of Stimulus” (CNBC). “Even with election year volatility and no stimulus package in sight, it looks like the stars are aligning for a fourth quarter stock market rally. Technical analysts say they see underlying trends that signal strength and further gains, including broader groups of stocks participating, like small caps. The small cap Russell 2000 was up 5.6% week-to-date, compared to a 2.8% gain for the S&P 500.”

“Morgan Stanley To Buy Eaton Vance for $7 Billion” (Wall Street Journal). “Morgan Stanley said it is buying fund manager Eaton Vance Corp. for $7 billion, continuing the Wall Street firm’s shift toward safer businesses like money management. The deal comes just days after Morgan Stanley completed its $11 billion takeover of E*Trade Financial Corp., and is another leg in a decadelong turnaround project for Chief Executive James Gorman, who has closed risky trading operations and doubled down on wealth and asset management.”

“A New Activist Playbook” (Dealbook). “It isn’t often that an activist investor wants a company to spend more money on itself and less on shareholder payouts. But that’s precisely what the hedge fund billionaire Dan Loeb is pushing Walt Disney to do with its Disney+ streaming service.”

“What Takeovers Of Fund Managers Tell You About Markets” (The Economist). “Could a roll-up work in fund management? The question is often asked, only to be dismissed: you would have to be unusually daring (or smoking roll-ups of the jazz variety) to consider taking on such a challenge. So a few eyebrows were raised when it emerged last week that Trian, a hedge fund led by Nelson Peltz, a veteran agitator for corporate change, had taken stakes of almost 10% in two asset managers, Invesco and Janus Henderson. Asset management is undergoing significant change, noted Trian in its regulatory filings. Firms with scale and a breadth of products are better placed to succeed. So Trian has in mind ‘certain strategic combinations’ to generate value from its newly acquired stakes.”

“While Millions Lost Jobs, Some Executives Made Millions In Company Stock” (New York Times). “The pay gains are a result of the sharp rise in the stock prices of these companies, which investors are betting are well positioned to grow during the pandemic. Another reason these stock awards have appreciated so much is that some of the grants were made when the stock market was close to its lowest point for the year. Of course, many executives are also sitting on gains on stock they got in earlier years. But the surge in wealth also highlights how the compensation of senior executives is designed to give them enormous windfalls, which they have gotten even during one of the sharpest economic downturns in decades.”

What we’re reading (10/6)

“Dow Swings 600 Points After Trump Rejects Stimulus Plan” (CNN). “Stocks took a dive Tuesday afternoon after President Donald Trump said he ordered an end to stimulus negotiations until after the November election. The Dow (INDU) swung more than 600 points following the announcement and closed down 1.3%, or 376 points. The S&P 500 (SPX) tumbled 1.4%, and the Nasdaq Composite (COMP) finished down 1.6%. ‘I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business,’ Trump tweeted.”

“Despite Trump’s Move, Markets Are Still Expecting Stimulus And A Sizable One If Democrats Sweet” (CNBC). “Whoever wins the presidential election is likely to seek an infrastructure program next year, but if Democrats win the presidency and Congress, the program could be bigger and come faster.”

“GE Says It Has Received A ‘Wells Notice’ From SEC Relating To Accounting Investigation” (Wall Street Journal). “Federal securities regulators have warned General Electric Co. of a civil-enforcement action over…the company’s accounting for reserves related to an insurance business it has been trying to wind down for years. A Wells notice is a letter saying the SEC staff is recommending that the commission bring an enforcement action against the recipient and offers an opportunity to argue why the action shouldn’t be taken. It often serves to cap investigations that can drag on for years, as the final step before formal litigation begins.”

“A Quant Who Won Big In The 2008 Crisis Is Back With A 45% Gains” (Bloomberg). “The pandemic roller coaster is reviving the fortunes of a long-suffering quant trader who last won big in 2008. After shedding assets amid lackluster returns through much of the decade’s stock bull run, Roy Niederhoffer’s Diversified Fund has gained 45% this year through September—set for its best year since a 57% return notched in the global financial crisis. With a systematic program riding wild swings across futures markets, the virus mayhem is giving bragging rights to the 27-year-old fund which has long struggled in one-way bull regimes. Just last year, it lost 27%.”

“Luxury Real-Estate Market Surges In The Hamptons” (Forbes). “Nobody knew what was in store at the onset of the Covid-19 pandemic in March, but when schools and offices shut down and the threat of the virus in New York City was greater than ever, many wealthy families beelined to their Hamptons homes. Always a sought-after destination between Memorial Day Weekend and Labor Day Weekend, the Hamptons is relatively quiet in March and April and is nearly vacant in the winter months. With Covid-19 still a looming threat, many city dwellers are taking advantage of the seclusion in the Hamptons and renting in the off-season this winter and even up to a year.”

What we’re reading (10/5)

“JPMorgan Probe Revived By Regulators’ Data Mining” (Wall Street Journal). “Investigators probing whether traders at JPMorgan Chase & Co. rigged silver prices seven years ago decided there was no case to bring. Last week, the same agency hammered the megabank with a $920 million fine…[the settlement] shows the advances government has made in using data to uncover market manipulation, said James McDonald, enforcement director of the Commodity Futures Trading Commission. The data needed to uncover the eight-year market manipulation scheme came from Chicago-based CME Group Inc…The volume of data—including trades, orders and other messages flooding into CME’s computers—is so massive the CFTC couldn’t store or use it when Mr. McDonald began seeking it in 2017, he said. Five years of complete CME trading data amounts to 1.7 terabytes, or 127 million pages of information[.]”

“Walmart Signs Trio Of Drone Deals As It Races To Play Catch-Up With Amazon” (CNBC). “Over the past month, Walmart has announced three deals with drone operators to test different uses for the drones…[d]rones, once seen as futuristic or a novelty, have gained traction as a potentially mainstream way for retailers to deliver purchases to their customers. Growing e-commerce sales have intensified pressure on retailers to speed up deliveries and use quick turnaround times as a differentiator. More Americans have gotten used to drones, as they have seen them in the sky or bought a hobby drone of their own. And pandemic-related trends, such as shopping from the couch instead of the store aisle and limiting contact with strangers, could broaden their appeal, too.”

“The Owner Of Regal Cinemas Is Closing Its U.S. Theaters, With 40,000 Jobs At Stake” (New York Times). “The plight of the entertainment industry deepened on Monday as the British company Cineworld, which owns Regal Cinemas in the United States, said it would temporarily close all 663 of its movie theaters in the United States and Britain. The move was expected to affect 40,000 employees in the United States and 5,000 in Britain.”

“The Crypto State? How Bitcoin, Ethereum, And Other Technologies Could Point The Way To New Systems Of Governance” (City Journal). “Throughout history, world powers—Spain, the Netherlands, France, Britain—have found themselves routinely replaced by more dynamic rivals. Today, many speculate about whether the United States will cede place to China as the global superpower. What if this is the wrong way to look at the question, though—and what if we’re living through a more radical transition? What if all contemporary states are in the process of being replaced by a new kind of “state,” as different from existing governments as they themselves differed from ancient empires or primitive tribes? […] In an essay published in 2017, Mark Zuckerberg offers a philosophy of history to explain the rise of Facebook. The arc of that history moves from tribes to cities to nations—and now to something beyond.”

“The Sackler Family’s Plan To Keep Its Billions” (New Yorker). “Many pharmaceutical companies had a hand in creating the opioid crisis, an ongoing public-health emergency in which as many as half a million Americans have lost their lives. But Purdue, which is owned by the Sackler family, played a special role because it was the first to set out, in the nineteen-nineties, to persuade the American medical establishment that strong opioids should be much more widely prescribed—and that physicians’ longstanding fears about the addictive nature of such drugs were overblown. With the launch of OxyContin, in 1995, Purdue unleashed an unprecedented marketing blitz, pushing the use of powerful opioids for a huge range of ailments and asserting that its product led to addiction in “fewer than one percent” of patients. This strategy was a spectacular commercial success: according to Purdue, OxyContin has since generated approximately thirty billion dollars in revenue, making the Sacklers…one of America’s richest families.”

What we’re reading (10/3)

“The White House Hoped Testing Would Keep The Coronavirus Out — But It Didn’t” (CNBC). “The White House has for months relied on frequent, rapid coronavirus testing to keep its officials and staff safe, but President Donald Trump’s diagnosis shows how testing alone cannot stop the virus.”

“Regeneron Co-Founder On The Antibody Cocktail Trump Is Taking To Fight Coronavirus” (Fox News). “President Trump's physician is treating his coronavirus diagnosis with Regeneron's experimental treatment and his one infusion ‘seemed to go through very well’ and ‘will last a long time,’ the company's chief scientific officer explained to ‘CAVUTO Live’ Saturday.”

“Why, Despite The Coronavirus Pandemic, House Prices Continue To Rise” (The Economist). “During the global recession a decade ago, real house prices fell by an average of 10%, wiping trillions of dollars off the world’s largest asset class. Though the housing market has not been the trigger of economic woes this time, investors and homeowners still braced for the worst as it became clear that covid-19 would push the world economy into its deepest downturn since the Depression of the 1930s.”

“The Pirates Of The Highways” (Narratively). “On May 11, 2013, a semi cab made its way up Interstate 555 from Memphis, Tennessee, northwest to Jonesboro, Arkansas. The man driving — a career trucker from Memphis — was accompanied by his nephew, and the pair was bobtailing, meaning their truck wasn’t pulling a trailer. Drivers often have to travel between warehouses and shipping facilities to pick up a new load, and these two men were indeed in search of new cargo to haul. Only in this case, they weren’t looking to do it legally. They were cruising the truck stops along I-555 for unattended trailers to pick up and steal.”

“An 1804 Silver Dollar Is Worth More Than $3 Million” (Barron’s). “The 1804 silver dollar features Liberty’s bust on the front side, while the reverse has an American Eagle. It’s one of the finest of the 15 examples known to exist, and its last appearance was in 1997, when it was offered from the famed Louis Edward Eliasberg Collection, according to Brian Kendrella , president of Stack’s Bowers Galleries.”

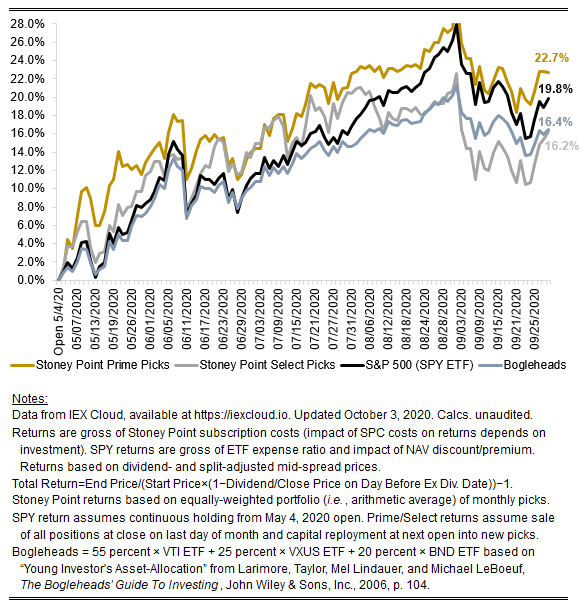

September 2020 performance update

Hi folks, here with the latest performance update for the month of September.

A month ago, I wrote that “it would be worthwhile to be very cautious extrapolating August’s results [which were great for the S&P 500] out in the future—which probably seems pretty sensible to anyone following events unfolding in the world outside of Wall Street.” September proved that right as the SPDR S&P 500-tracking SPY ETF was down about 4.37 percent in the month, losing much of August’s gains.

As for Stoney Point’s picks, both our Prime and Select portfolios beat the market by over 100 basis points (Prime’s return was -3.41 percent and Select’s return was -3.44 percent). Up is always better than down, but as I write fairly consistently here—supported by a huge academic literature (see, e.g., this classic paper from 1997)—it’s really hard to beat the market. In fact, our backtesting analytics generally suggest that, historically, in months when the market was down, Prime and Select would have typically performed similar to, or ever perhaps a bit worse than, SPY, if the strategies Prime and Select embody had been followed. So the fact that both of the portfolios beat SPY by a magnitude in excess of 100 bps is pretty satisfying.

As always, the chart below shows the cumulative total return return on our Prime and Selects (under the various implementation assumptions detailed in the footnotes and throughout this blog), as well as on SPY, since we started publishing picks.

One new feature this month: I’ve added a forth line that we’re going to call “Bogleheads” after the wildly popular website/blog/book dedicated to devotees of John Bogle, the Vanguard founder and index-fund champion. A friend of the blog suggested I add a benchmark along the lines of what the so-called “Bogleheads” (as well as other notable big-name investors) recommend for typical retail investors, which are generally portfolios comprising a selection of index funds of the sort that Vanguard offers. In particular, I selected a blend of Vanguard ETFs that correspond to what Larimore et al. (notable “Bogleheads”) call the “Young Investor’s Asset-Allocation” in their book: 55 percent domestic large-cap stocks, represented below by Vanguard’s VTI ETF (similar to Vanguard’s VTSMX mutual fund); 20 percent intermediate-term bonds, represented below by Vanguard’s BND ETF (similar to Vanguard’s VBMFX mutual fund); and 25 percent to other stocks, represented below by Vanguard’s VXUS ETF (similar to Vanguard’s VGTSX mutual fund). For the latter piece, the “Young Investor’s Asset-Allocation” actually proscribes using domestic mid-cap stocks, but I’ve replaced that with international exposure to capture some advice from other corners of the Bogle-sphere (see, e.g., here).

Caveat emptor: I may play a little bit with the asset allocation for the “Bogleheads” line in the future, as there are lots of Boglehead-recommend options depending on your risk-tolerance. Ultimately, what I’m trying to do here is show benchmarks that have risk-return characteristics similar to the types of investments my readers might otherwise be in in the absence of Stoney Point.

That’s all for now. You can check out the position-level September performance for our Prime and Select picks on our performance page and our picks for October here to get in on the action. Of course, if you haven’t already, follow Stoney Point on Twitter for the latest updates (@StoneyPointCap).

What we’re reading (10/2)

“Trump Taken To Walter Reed Medical Center And Will Be Hospitalized ‘For The Next Few Days’” (CNN). “President Donald Trump arrived Friday evening at Walter Reed National Military Medical Center, where the White House says he will remain hospitalized for ‘the next few days’” [after announcing he and the First Lady had tested positive for COVID-19].

“What We Know — And Don’t — About Trump’s Covid Case” (Politico). “President Donald Trump's coronavirus diagnosis has underscored the unpredictable nature of the disease — and how the oldest elected president in U.S. history, who's just above the CDC threshold for obesity, is at increased risk of developing complications.”

“Invincibility Punctured By Infection: How The Coronavirus Spread In Trump’s White House” (Washington Post). “The ceremony in the White House Rose Garden last Saturday was a triumphal flashback to the Before Times — before public health guidelines restricted mass gatherings, before people were urged to wear masks and socially distance. President Trump and first lady Melania Trump welcomed more than 150 guests as the president formally introduced Judge Amy Coney Barrett, his nominee for the Supreme Court.”

“Trump Receives Experimental Coronavirus Treatment As Drug Companies Seek The Right Approach To Mild And Moderate Forms Of COVID-19” (MarketWatch). “After testing positive for the coronavirus, President Donald Trump was given a dose of Regeneron Pharmaceuticals Inc.’s experimental neutralizing antibody cocktail, considered one of the most promising candidates to fill a major hole in COVID-19 treatment plans.”

“Here’s Everything We Know About The Unapproved Antibody Drug Trump Took To Combat Coronavirus” (CNBC). “Former Food and Drug Administration commissioner Dr. Scott Gottlieb told CNBC on Friday he believes the White House carefully considered all of its treatment options before it opted to give President Donald Trump the experimental coronavirus antibody cocktail from Regeneron Pharmaceuticals.”

What we’re reading (10/1)

“Inside eBay’s Cockroach Cult: The Ghastly Story Of A Stalking Scandal” (New York Times). “[O]n June 15, 2020, the U.S. Department of Justice charged six former eBay employees, all part of the corporate security team, with conspiring to commit cyberstalking and tamper with witnesses. Their alleged targets were almost comically obscure — a mom-and-pop blogging duo from a suburb of Boston and a Twitter gadfly who wrote often in their comments section. According to the government, their methods were juvenile and grotesque, featuring cockroaches, pornography, barely veiled threats of violence and death, physical surveillance and the weaponization of late-night pizza.”

“This Map Shows Where American Taxpayers Are Most Likely To Be Audited—And It’s Certainly Not Washington, D.C.” (MarketWatch). “The graphic first published in the industry journal Tax Notes last year and reported by ProPublica reveals that the five most audited counties in the country are all predominantly Black, rural areas in the Deep South. Audit rates are also very high in the largely Hispanic communities in south Texas, the counties with Native American reservations in South Dakota, as well as the poor, white counties in eastern Kentucky’s Appalachia region. In fact, the audit rates in these areas were more than 40% above the national average. But the states that tend to be home to middle-income, largely white populations, including New Hampshire, Wisconsin and Minnesota, have the lowest audit rates.”

“Techie Software Soldier Spy” (New York Magazine). “Smoking his pipe, just as he had when he testified to Congress 33 years ago about his role in facilitating covert arms sales to Iran, [John] Poindexter told me he had suggested to Karp and Thiel that they partner with one of the companies that worked on Total Information Awareness. But the two men weren’t interested. ‘They were a bunch of young, arrogant guys,” Poindexter said, “and they were convinced they could do it all.’ Seventeen years later, Palantir is seeking to cash in on its ability to ‘do it all.’”

“Cities Experiment With Remedy For Poverty: Cash, No Strings Attached” (Wall Street Journal). “Last year, Stockton, Calif., embarked on a civic experiment. For 18 months the city would send $500 a month to 125 randomly selected households in low-income neighborhoods. Researchers would compare the effect on participants’ health and economic situation to that of residents who didn’t get payments. The $3.8 million experiment is the brainchild of Stockton’s 30-year-old mayor, Michael Tubbs, made possible by the Economic Security Project—a group co-founded by Facebook co-founder Chris Hughes that funds guaranteed-income projects—and other donors.”

“Home Prices Rose 4.8% In July, According To Case-Shiller Index” (CNBC). “Strong demand from homebuyers in July, coupled with rock-bottom mortgage interest rates, caused home prices to accelerate in major markets across the nation. Nationally, home values rose 4.8% annually, up from a 4.3% gain in June, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index.”

October Prime + Select picks available now!

The new Prime and Select picks for October are available starting now, based on a model run put through last evening (September 29). As a note, we’ll be measuring the performance on these picks from the open on Thursday, October 1, 2020 (the first trading day of the month) through the last trading day of the month, Friday, October 30 (at the closing price). If you’re following the strategy perfectly, you’d want to close out your September positions by end-of-trading today, and re-balance at start-of-trading tomorrow (though some members do all of their re-balancing in one fell swoop).

You can check out the latest picks here here.

What we’re reading (9/30)

With the disclaimer that this isn’t a political blog, today’s WWR is exclusively devoted to coverage of last night’s putative U.S. presidential debate:

“With Cross Talk, Lies And Mockery, Trump Tramples Decorum In Debate With Biden” (New York Times). “The first presidential debate between President Trump and Joseph R. Biden Jr. unraveled into an ugly melee Tuesday, as Mr. Trump hectored and interrupted Mr. Biden nearly every time he spoke and the former vice president denounced the president as a ‘clown’ and told him to ‘shut up.’ In a chaotic, 90-minute back-and-forth, the two major party nominees expressed a level of acrid contempt for each other unheard-of in modern American politics.”

“Biden Campaign Faces Questions About Whether He Should Skip Next Debates” (Politico). “In the two men’s first head-to-head matchup, Trump bullied moderator Chris Wallace, blew past his time limits and repeatedly and loudly interrupted Biden. It resulted in a mockery of presidential debates, growing so chaotic that it was impossible to follow entire segments. The Biden campaign immediately shot down any notion the former vice president wouldn’t show up to debates in Miami and Nashville next month. But some Democrats wondered whether Biden should only participate if there are more stringent conditions placed on Trump to keep the night from devolving into chaos.”

“Trump, Biden Clash In Contentious First Debate” (Wall Street Journal). “President Trump and Joe Biden clashed over the Supreme Court, the coronavirus and the economy in a debate marked by interruptions and insults from both candidates Tuesday—with the Republican leader telling his rival that for ‘47 years you’ve done nothing’ and the Democratic challenger calling Mr. Trump ‘the worst president that America has ever had.’ The two candidates constantly spoke over each other in a number of contentious exchanges, more notable for rancor than policy nuance.”

“Trump Incessantly Interrupts And Insults Biden As They Spar In Acrimonious First Debate” (Washington Post). “The presidential campaign devolved into chaos and acrimony here [Cleveland] Tuesday night as President Trump incessantly interrupted and insulted Democratic nominee Joe Biden while the two sparred over the economy, the coronavirus pandemic, the Supreme Court and race relations in their first debate.”

“Presidential Debate: Trump And Biden Trade Insults In Chaotic Debate” (BBC). “Mr Trump frequently interrupted, prompting Mr Biden to tell him to "shut up" as the two fought over the pandemic, healthcare and the economy. The US president was challenged over white supremacist support and refused to condemn a specific far-right group. Opinion polls suggest Mr Biden has a steady single-digit lead over Mr Trump. But with 35 days until election day, surveys from several important states show a closer contest.”

“Joe Biden And Donald Trump Clash In Chaotic Presidential Debate” (Financial Times). “The first US presidential debate of 2020 degenerated into an ugly spectacle on Tuesday night as Donald Trump repeatedly interrupted Joe Biden and the Democratic challenger responded by calling the president a racist and telling him to ‘shut up.’”