September 2020 performance update

Hi folks, here with the latest performance update for the month of September.

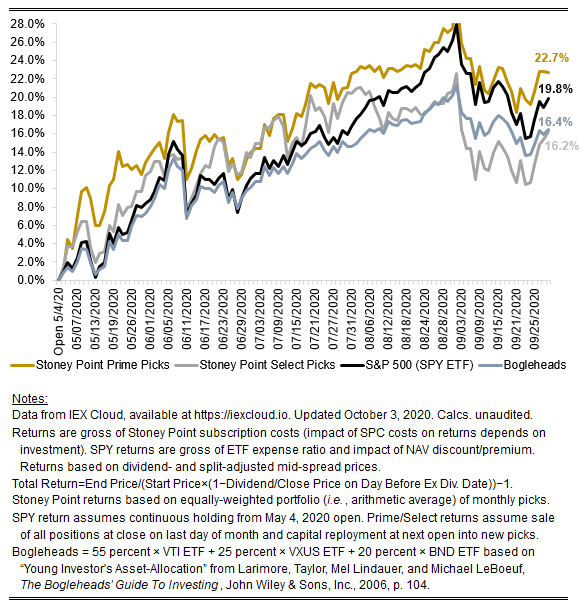

A month ago, I wrote that “it would be worthwhile to be very cautious extrapolating August’s results [which were great for the S&P 500] out in the future—which probably seems pretty sensible to anyone following events unfolding in the world outside of Wall Street.” September proved that right as the SPDR S&P 500-tracking SPY ETF was down about 4.37 percent in the month, losing much of August’s gains.

As for Stoney Point’s picks, both our Prime and Select portfolios beat the market by over 100 basis points (Prime’s return was -3.41 percent and Select’s return was -3.44 percent). Up is always better than down, but as I write fairly consistently here—supported by a huge academic literature (see, e.g., this classic paper from 1997)—it’s really hard to beat the market. In fact, our backtesting analytics generally suggest that, historically, in months when the market was down, Prime and Select would have typically performed similar to, or ever perhaps a bit worse than, SPY, if the strategies Prime and Select embody had been followed. So the fact that both of the portfolios beat SPY by a magnitude in excess of 100 bps is pretty satisfying.

As always, the chart below shows the cumulative total return return on our Prime and Selects (under the various implementation assumptions detailed in the footnotes and throughout this blog), as well as on SPY, since we started publishing picks.

One new feature this month: I’ve added a forth line that we’re going to call “Bogleheads” after the wildly popular website/blog/book dedicated to devotees of John Bogle, the Vanguard founder and index-fund champion. A friend of the blog suggested I add a benchmark along the lines of what the so-called “Bogleheads” (as well as other notable big-name investors) recommend for typical retail investors, which are generally portfolios comprising a selection of index funds of the sort that Vanguard offers. In particular, I selected a blend of Vanguard ETFs that correspond to what Larimore et al. (notable “Bogleheads”) call the “Young Investor’s Asset-Allocation” in their book: 55 percent domestic large-cap stocks, represented below by Vanguard’s VTI ETF (similar to Vanguard’s VTSMX mutual fund); 20 percent intermediate-term bonds, represented below by Vanguard’s BND ETF (similar to Vanguard’s VBMFX mutual fund); and 25 percent to other stocks, represented below by Vanguard’s VXUS ETF (similar to Vanguard’s VGTSX mutual fund). For the latter piece, the “Young Investor’s Asset-Allocation” actually proscribes using domestic mid-cap stocks, but I’ve replaced that with international exposure to capture some advice from other corners of the Bogle-sphere (see, e.g., here).

Caveat emptor: I may play a little bit with the asset allocation for the “Bogleheads” line in the future, as there are lots of Boglehead-recommend options depending on your risk-tolerance. Ultimately, what I’m trying to do here is show benchmarks that have risk-return characteristics similar to the types of investments my readers might otherwise be in in the absence of Stoney Point.

That’s all for now. You can check out the position-level September performance for our Prime and Select picks on our performance page and our picks for October here to get in on the action. Of course, if you haven’t already, follow Stoney Point on Twitter for the latest updates (@StoneyPointCap).