What we’re reading (10/9)

“Trump Raises Coronavirus Stimulus Offer To $1.8 Trillion, Then Says He Wants Bigger Bill Than Dems Or GOP” (CNBC). “The White House on Friday took a new coronavirus stimulus offer to Democrats, believed to cost $1.8 trillion, as the sides work to strike a deal before the 2020 election. The plan would mark an increase from the $1.6 trillion the Trump administration previously proposed. House Democrats passed a $2.2 trillion bill earlier this month, and the sides have struggled to find a consensus in between those figures.”

“Stocks Close Higher To Finish Best Week In Three Months” (Wall Street Journal). “The S&P 500 rose Friday, closing out its biggest weekly advance in three months as investors welcomed signs pointing to a decisive result in next month’s U.S. presidential election. A week that started with President Trump in the hospital being treated for the new coronavirus and former Vice President Joe Biden widening his lead in national polls finished as the best stretch for the index since the week of July 2.”

“What The Harvard Endowment’s Below-Average Grade Can Teach You About Index Funds And Your Investments” (MarketWatch). “Harvard’s University’s endowment’s return lagged the U.S. stock market — again. For the fiscal year ending June 30, Harvard’s endowment produced a 7.3% return, versus a 7.5% total return for the S&P 500. This marks the 12th year in a row in which the $42 billion portfolio fell behind the benchmark index. Also, as you can see from the accompanying chart, the endowment has lagged the S&P 500 over each of the 3-, 5-, 10- and 20-year horizons.”

“Swiss Quant Start-Up Vestun Opens Up Systematic US Equity Hedge Fund To External Money” (Hedgeweek). “Chayan Asli, Vestun’s founder and CEO, believes that relying on signals generated from statistical rules and back-testing history is not sustainable for delivering consistent long-term market outperformance. ‘Nowadays, everyone has access to the same financial datasets and machine learning models. If everyone uses the same smart systems with the same recipe for success, it will undermine the competitive advantage obtained by using computer-driven models to invest.’”

“Just 59 Americans Own More Wealth Than Half The Country, Data Shows” (New York Post). “The poorest 50 percent of Americans, or roughly 165 million people, collectively owned about $2.08 trillion in wealth in the second quarter of 2020, according to Federal Reserve data released last week. That’s less than the net worth of the nation’s 59 richest billionaires, who have a combined fortune of about $2.09 trillion, Bloomberg’s Billionaires Index shows — a number that’s grown this year despite the COVID-19 crisis kneecapping the global economy.”

What we’re reading (10/8)

“Stocks Look To Be Setting Up For A Year-End Rally Despite Election Worries And Lack Of Stimulus” (CNBC). “Even with election year volatility and no stimulus package in sight, it looks like the stars are aligning for a fourth quarter stock market rally. Technical analysts say they see underlying trends that signal strength and further gains, including broader groups of stocks participating, like small caps. The small cap Russell 2000 was up 5.6% week-to-date, compared to a 2.8% gain for the S&P 500.”

“Morgan Stanley To Buy Eaton Vance for $7 Billion” (Wall Street Journal). “Morgan Stanley said it is buying fund manager Eaton Vance Corp. for $7 billion, continuing the Wall Street firm’s shift toward safer businesses like money management. The deal comes just days after Morgan Stanley completed its $11 billion takeover of E*Trade Financial Corp., and is another leg in a decadelong turnaround project for Chief Executive James Gorman, who has closed risky trading operations and doubled down on wealth and asset management.”

“A New Activist Playbook” (Dealbook). “It isn’t often that an activist investor wants a company to spend more money on itself and less on shareholder payouts. But that’s precisely what the hedge fund billionaire Dan Loeb is pushing Walt Disney to do with its Disney+ streaming service.”

“What Takeovers Of Fund Managers Tell You About Markets” (The Economist). “Could a roll-up work in fund management? The question is often asked, only to be dismissed: you would have to be unusually daring (or smoking roll-ups of the jazz variety) to consider taking on such a challenge. So a few eyebrows were raised when it emerged last week that Trian, a hedge fund led by Nelson Peltz, a veteran agitator for corporate change, had taken stakes of almost 10% in two asset managers, Invesco and Janus Henderson. Asset management is undergoing significant change, noted Trian in its regulatory filings. Firms with scale and a breadth of products are better placed to succeed. So Trian has in mind ‘certain strategic combinations’ to generate value from its newly acquired stakes.”

“While Millions Lost Jobs, Some Executives Made Millions In Company Stock” (New York Times). “The pay gains are a result of the sharp rise in the stock prices of these companies, which investors are betting are well positioned to grow during the pandemic. Another reason these stock awards have appreciated so much is that some of the grants were made when the stock market was close to its lowest point for the year. Of course, many executives are also sitting on gains on stock they got in earlier years. But the surge in wealth also highlights how the compensation of senior executives is designed to give them enormous windfalls, which they have gotten even during one of the sharpest economic downturns in decades.”

What we’re reading (10/6)

“Dow Swings 600 Points After Trump Rejects Stimulus Plan” (CNN). “Stocks took a dive Tuesday afternoon after President Donald Trump said he ordered an end to stimulus negotiations until after the November election. The Dow (INDU) swung more than 600 points following the announcement and closed down 1.3%, or 376 points. The S&P 500 (SPX) tumbled 1.4%, and the Nasdaq Composite (COMP) finished down 1.6%. ‘I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business,’ Trump tweeted.”

“Despite Trump’s Move, Markets Are Still Expecting Stimulus And A Sizable One If Democrats Sweet” (CNBC). “Whoever wins the presidential election is likely to seek an infrastructure program next year, but if Democrats win the presidency and Congress, the program could be bigger and come faster.”

“GE Says It Has Received A ‘Wells Notice’ From SEC Relating To Accounting Investigation” (Wall Street Journal). “Federal securities regulators have warned General Electric Co. of a civil-enforcement action over…the company’s accounting for reserves related to an insurance business it has been trying to wind down for years. A Wells notice is a letter saying the SEC staff is recommending that the commission bring an enforcement action against the recipient and offers an opportunity to argue why the action shouldn’t be taken. It often serves to cap investigations that can drag on for years, as the final step before formal litigation begins.”

“A Quant Who Won Big In The 2008 Crisis Is Back With A 45% Gains” (Bloomberg). “The pandemic roller coaster is reviving the fortunes of a long-suffering quant trader who last won big in 2008. After shedding assets amid lackluster returns through much of the decade’s stock bull run, Roy Niederhoffer’s Diversified Fund has gained 45% this year through September—set for its best year since a 57% return notched in the global financial crisis. With a systematic program riding wild swings across futures markets, the virus mayhem is giving bragging rights to the 27-year-old fund which has long struggled in one-way bull regimes. Just last year, it lost 27%.”

“Luxury Real-Estate Market Surges In The Hamptons” (Forbes). “Nobody knew what was in store at the onset of the Covid-19 pandemic in March, but when schools and offices shut down and the threat of the virus in New York City was greater than ever, many wealthy families beelined to their Hamptons homes. Always a sought-after destination between Memorial Day Weekend and Labor Day Weekend, the Hamptons is relatively quiet in March and April and is nearly vacant in the winter months. With Covid-19 still a looming threat, many city dwellers are taking advantage of the seclusion in the Hamptons and renting in the off-season this winter and even up to a year.”

What we’re reading (10/5)

“JPMorgan Probe Revived By Regulators’ Data Mining” (Wall Street Journal). “Investigators probing whether traders at JPMorgan Chase & Co. rigged silver prices seven years ago decided there was no case to bring. Last week, the same agency hammered the megabank with a $920 million fine…[the settlement] shows the advances government has made in using data to uncover market manipulation, said James McDonald, enforcement director of the Commodity Futures Trading Commission. The data needed to uncover the eight-year market manipulation scheme came from Chicago-based CME Group Inc…The volume of data—including trades, orders and other messages flooding into CME’s computers—is so massive the CFTC couldn’t store or use it when Mr. McDonald began seeking it in 2017, he said. Five years of complete CME trading data amounts to 1.7 terabytes, or 127 million pages of information[.]”

“Walmart Signs Trio Of Drone Deals As It Races To Play Catch-Up With Amazon” (CNBC). “Over the past month, Walmart has announced three deals with drone operators to test different uses for the drones…[d]rones, once seen as futuristic or a novelty, have gained traction as a potentially mainstream way for retailers to deliver purchases to their customers. Growing e-commerce sales have intensified pressure on retailers to speed up deliveries and use quick turnaround times as a differentiator. More Americans have gotten used to drones, as they have seen them in the sky or bought a hobby drone of their own. And pandemic-related trends, such as shopping from the couch instead of the store aisle and limiting contact with strangers, could broaden their appeal, too.”

“The Owner Of Regal Cinemas Is Closing Its U.S. Theaters, With 40,000 Jobs At Stake” (New York Times). “The plight of the entertainment industry deepened on Monday as the British company Cineworld, which owns Regal Cinemas in the United States, said it would temporarily close all 663 of its movie theaters in the United States and Britain. The move was expected to affect 40,000 employees in the United States and 5,000 in Britain.”

“The Crypto State? How Bitcoin, Ethereum, And Other Technologies Could Point The Way To New Systems Of Governance” (City Journal). “Throughout history, world powers—Spain, the Netherlands, France, Britain—have found themselves routinely replaced by more dynamic rivals. Today, many speculate about whether the United States will cede place to China as the global superpower. What if this is the wrong way to look at the question, though—and what if we’re living through a more radical transition? What if all contemporary states are in the process of being replaced by a new kind of “state,” as different from existing governments as they themselves differed from ancient empires or primitive tribes? […] In an essay published in 2017, Mark Zuckerberg offers a philosophy of history to explain the rise of Facebook. The arc of that history moves from tribes to cities to nations—and now to something beyond.”

“The Sackler Family’s Plan To Keep Its Billions” (New Yorker). “Many pharmaceutical companies had a hand in creating the opioid crisis, an ongoing public-health emergency in which as many as half a million Americans have lost their lives. But Purdue, which is owned by the Sackler family, played a special role because it was the first to set out, in the nineteen-nineties, to persuade the American medical establishment that strong opioids should be much more widely prescribed—and that physicians’ longstanding fears about the addictive nature of such drugs were overblown. With the launch of OxyContin, in 1995, Purdue unleashed an unprecedented marketing blitz, pushing the use of powerful opioids for a huge range of ailments and asserting that its product led to addiction in “fewer than one percent” of patients. This strategy was a spectacular commercial success: according to Purdue, OxyContin has since generated approximately thirty billion dollars in revenue, making the Sacklers…one of America’s richest families.”

What we’re reading (10/3)

“The White House Hoped Testing Would Keep The Coronavirus Out — But It Didn’t” (CNBC). “The White House has for months relied on frequent, rapid coronavirus testing to keep its officials and staff safe, but President Donald Trump’s diagnosis shows how testing alone cannot stop the virus.”

“Regeneron Co-Founder On The Antibody Cocktail Trump Is Taking To Fight Coronavirus” (Fox News). “President Trump's physician is treating his coronavirus diagnosis with Regeneron's experimental treatment and his one infusion ‘seemed to go through very well’ and ‘will last a long time,’ the company's chief scientific officer explained to ‘CAVUTO Live’ Saturday.”

“Why, Despite The Coronavirus Pandemic, House Prices Continue To Rise” (The Economist). “During the global recession a decade ago, real house prices fell by an average of 10%, wiping trillions of dollars off the world’s largest asset class. Though the housing market has not been the trigger of economic woes this time, investors and homeowners still braced for the worst as it became clear that covid-19 would push the world economy into its deepest downturn since the Depression of the 1930s.”

“The Pirates Of The Highways” (Narratively). “On May 11, 2013, a semi cab made its way up Interstate 555 from Memphis, Tennessee, northwest to Jonesboro, Arkansas. The man driving — a career trucker from Memphis — was accompanied by his nephew, and the pair was bobtailing, meaning their truck wasn’t pulling a trailer. Drivers often have to travel between warehouses and shipping facilities to pick up a new load, and these two men were indeed in search of new cargo to haul. Only in this case, they weren’t looking to do it legally. They were cruising the truck stops along I-555 for unattended trailers to pick up and steal.”

“An 1804 Silver Dollar Is Worth More Than $3 Million” (Barron’s). “The 1804 silver dollar features Liberty’s bust on the front side, while the reverse has an American Eagle. It’s one of the finest of the 15 examples known to exist, and its last appearance was in 1997, when it was offered from the famed Louis Edward Eliasberg Collection, according to Brian Kendrella , president of Stack’s Bowers Galleries.”

September 2020 performance update

Hi folks, here with the latest performance update for the month of September.

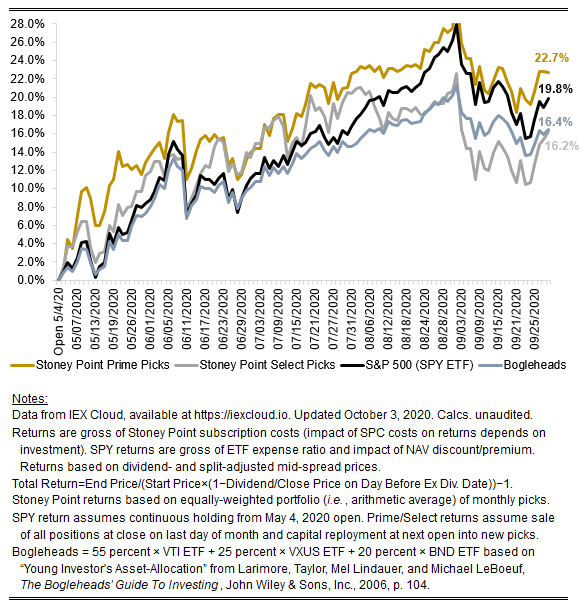

A month ago, I wrote that “it would be worthwhile to be very cautious extrapolating August’s results [which were great for the S&P 500] out in the future—which probably seems pretty sensible to anyone following events unfolding in the world outside of Wall Street.” September proved that right as the SPDR S&P 500-tracking SPY ETF was down about 4.37 percent in the month, losing much of August’s gains.

As for Stoney Point’s picks, both our Prime and Select portfolios beat the market by over 100 basis points (Prime’s return was -3.41 percent and Select’s return was -3.44 percent). Up is always better than down, but as I write fairly consistently here—supported by a huge academic literature (see, e.g., this classic paper from 1997)—it’s really hard to beat the market. In fact, our backtesting analytics generally suggest that, historically, in months when the market was down, Prime and Select would have typically performed similar to, or ever perhaps a bit worse than, SPY, if the strategies Prime and Select embody had been followed. So the fact that both of the portfolios beat SPY by a magnitude in excess of 100 bps is pretty satisfying.

As always, the chart below shows the cumulative total return return on our Prime and Selects (under the various implementation assumptions detailed in the footnotes and throughout this blog), as well as on SPY, since we started publishing picks.

One new feature this month: I’ve added a forth line that we’re going to call “Bogleheads” after the wildly popular website/blog/book dedicated to devotees of John Bogle, the Vanguard founder and index-fund champion. A friend of the blog suggested I add a benchmark along the lines of what the so-called “Bogleheads” (as well as other notable big-name investors) recommend for typical retail investors, which are generally portfolios comprising a selection of index funds of the sort that Vanguard offers. In particular, I selected a blend of Vanguard ETFs that correspond to what Larimore et al. (notable “Bogleheads”) call the “Young Investor’s Asset-Allocation” in their book: 55 percent domestic large-cap stocks, represented below by Vanguard’s VTI ETF (similar to Vanguard’s VTSMX mutual fund); 20 percent intermediate-term bonds, represented below by Vanguard’s BND ETF (similar to Vanguard’s VBMFX mutual fund); and 25 percent to other stocks, represented below by Vanguard’s VXUS ETF (similar to Vanguard’s VGTSX mutual fund). For the latter piece, the “Young Investor’s Asset-Allocation” actually proscribes using domestic mid-cap stocks, but I’ve replaced that with international exposure to capture some advice from other corners of the Bogle-sphere (see, e.g., here).

Caveat emptor: I may play a little bit with the asset allocation for the “Bogleheads” line in the future, as there are lots of Boglehead-recommend options depending on your risk-tolerance. Ultimately, what I’m trying to do here is show benchmarks that have risk-return characteristics similar to the types of investments my readers might otherwise be in in the absence of Stoney Point.

That’s all for now. You can check out the position-level September performance for our Prime and Select picks on our performance page and our picks for October here to get in on the action. Of course, if you haven’t already, follow Stoney Point on Twitter for the latest updates (@StoneyPointCap).

What we’re reading (10/2)

“Trump Taken To Walter Reed Medical Center And Will Be Hospitalized ‘For The Next Few Days’” (CNN). “President Donald Trump arrived Friday evening at Walter Reed National Military Medical Center, where the White House says he will remain hospitalized for ‘the next few days’” [after announcing he and the First Lady had tested positive for COVID-19].

“What We Know — And Don’t — About Trump’s Covid Case” (Politico). “President Donald Trump's coronavirus diagnosis has underscored the unpredictable nature of the disease — and how the oldest elected president in U.S. history, who's just above the CDC threshold for obesity, is at increased risk of developing complications.”

“Invincibility Punctured By Infection: How The Coronavirus Spread In Trump’s White House” (Washington Post). “The ceremony in the White House Rose Garden last Saturday was a triumphal flashback to the Before Times — before public health guidelines restricted mass gatherings, before people were urged to wear masks and socially distance. President Trump and first lady Melania Trump welcomed more than 150 guests as the president formally introduced Judge Amy Coney Barrett, his nominee for the Supreme Court.”

“Trump Receives Experimental Coronavirus Treatment As Drug Companies Seek The Right Approach To Mild And Moderate Forms Of COVID-19” (MarketWatch). “After testing positive for the coronavirus, President Donald Trump was given a dose of Regeneron Pharmaceuticals Inc.’s experimental neutralizing antibody cocktail, considered one of the most promising candidates to fill a major hole in COVID-19 treatment plans.”

“Here’s Everything We Know About The Unapproved Antibody Drug Trump Took To Combat Coronavirus” (CNBC). “Former Food and Drug Administration commissioner Dr. Scott Gottlieb told CNBC on Friday he believes the White House carefully considered all of its treatment options before it opted to give President Donald Trump the experimental coronavirus antibody cocktail from Regeneron Pharmaceuticals.”

What we’re reading (10/1)

“Inside eBay’s Cockroach Cult: The Ghastly Story Of A Stalking Scandal” (New York Times). “[O]n June 15, 2020, the U.S. Department of Justice charged six former eBay employees, all part of the corporate security team, with conspiring to commit cyberstalking and tamper with witnesses. Their alleged targets were almost comically obscure — a mom-and-pop blogging duo from a suburb of Boston and a Twitter gadfly who wrote often in their comments section. According to the government, their methods were juvenile and grotesque, featuring cockroaches, pornography, barely veiled threats of violence and death, physical surveillance and the weaponization of late-night pizza.”

“This Map Shows Where American Taxpayers Are Most Likely To Be Audited—And It’s Certainly Not Washington, D.C.” (MarketWatch). “The graphic first published in the industry journal Tax Notes last year and reported by ProPublica reveals that the five most audited counties in the country are all predominantly Black, rural areas in the Deep South. Audit rates are also very high in the largely Hispanic communities in south Texas, the counties with Native American reservations in South Dakota, as well as the poor, white counties in eastern Kentucky’s Appalachia region. In fact, the audit rates in these areas were more than 40% above the national average. But the states that tend to be home to middle-income, largely white populations, including New Hampshire, Wisconsin and Minnesota, have the lowest audit rates.”

“Techie Software Soldier Spy” (New York Magazine). “Smoking his pipe, just as he had when he testified to Congress 33 years ago about his role in facilitating covert arms sales to Iran, [John] Poindexter told me he had suggested to Karp and Thiel that they partner with one of the companies that worked on Total Information Awareness. But the two men weren’t interested. ‘They were a bunch of young, arrogant guys,” Poindexter said, “and they were convinced they could do it all.’ Seventeen years later, Palantir is seeking to cash in on its ability to ‘do it all.’”

“Cities Experiment With Remedy For Poverty: Cash, No Strings Attached” (Wall Street Journal). “Last year, Stockton, Calif., embarked on a civic experiment. For 18 months the city would send $500 a month to 125 randomly selected households in low-income neighborhoods. Researchers would compare the effect on participants’ health and economic situation to that of residents who didn’t get payments. The $3.8 million experiment is the brainchild of Stockton’s 30-year-old mayor, Michael Tubbs, made possible by the Economic Security Project—a group co-founded by Facebook co-founder Chris Hughes that funds guaranteed-income projects—and other donors.”

“Home Prices Rose 4.8% In July, According To Case-Shiller Index” (CNBC). “Strong demand from homebuyers in July, coupled with rock-bottom mortgage interest rates, caused home prices to accelerate in major markets across the nation. Nationally, home values rose 4.8% annually, up from a 4.3% gain in June, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index.”

October Prime + Select picks available now!

The new Prime and Select picks for October are available starting now, based on a model run put through last evening (September 29). As a note, we’ll be measuring the performance on these picks from the open on Thursday, October 1, 2020 (the first trading day of the month) through the last trading day of the month, Friday, October 30 (at the closing price). If you’re following the strategy perfectly, you’d want to close out your September positions by end-of-trading today, and re-balance at start-of-trading tomorrow (though some members do all of their re-balancing in one fell swoop).

You can check out the latest picks here here.

What we’re reading (9/30)

With the disclaimer that this isn’t a political blog, today’s WWR is exclusively devoted to coverage of last night’s putative U.S. presidential debate:

“With Cross Talk, Lies And Mockery, Trump Tramples Decorum In Debate With Biden” (New York Times). “The first presidential debate between President Trump and Joseph R. Biden Jr. unraveled into an ugly melee Tuesday, as Mr. Trump hectored and interrupted Mr. Biden nearly every time he spoke and the former vice president denounced the president as a ‘clown’ and told him to ‘shut up.’ In a chaotic, 90-minute back-and-forth, the two major party nominees expressed a level of acrid contempt for each other unheard-of in modern American politics.”

“Biden Campaign Faces Questions About Whether He Should Skip Next Debates” (Politico). “In the two men’s first head-to-head matchup, Trump bullied moderator Chris Wallace, blew past his time limits and repeatedly and loudly interrupted Biden. It resulted in a mockery of presidential debates, growing so chaotic that it was impossible to follow entire segments. The Biden campaign immediately shot down any notion the former vice president wouldn’t show up to debates in Miami and Nashville next month. But some Democrats wondered whether Biden should only participate if there are more stringent conditions placed on Trump to keep the night from devolving into chaos.”

“Trump, Biden Clash In Contentious First Debate” (Wall Street Journal). “President Trump and Joe Biden clashed over the Supreme Court, the coronavirus and the economy in a debate marked by interruptions and insults from both candidates Tuesday—with the Republican leader telling his rival that for ‘47 years you’ve done nothing’ and the Democratic challenger calling Mr. Trump ‘the worst president that America has ever had.’ The two candidates constantly spoke over each other in a number of contentious exchanges, more notable for rancor than policy nuance.”

“Trump Incessantly Interrupts And Insults Biden As They Spar In Acrimonious First Debate” (Washington Post). “The presidential campaign devolved into chaos and acrimony here [Cleveland] Tuesday night as President Trump incessantly interrupted and insulted Democratic nominee Joe Biden while the two sparred over the economy, the coronavirus pandemic, the Supreme Court and race relations in their first debate.”

“Presidential Debate: Trump And Biden Trade Insults In Chaotic Debate” (BBC). “Mr Trump frequently interrupted, prompting Mr Biden to tell him to "shut up" as the two fought over the pandemic, healthcare and the economy. The US president was challenged over white supremacist support and refused to condemn a specific far-right group. Opinion polls suggest Mr Biden has a steady single-digit lead over Mr Trump. But with 35 days until election day, surveys from several important states show a closer contest.”

“Joe Biden And Donald Trump Clash In Chaotic Presidential Debate” (Financial Times). “The first US presidential debate of 2020 degenerated into an ugly spectacle on Tuesday night as Donald Trump repeatedly interrupted Joe Biden and the Democratic challenger responded by calling the president a racist and telling him to ‘shut up.’”

October picks available soon

Reminder: we’ll be publishing our Prime and Select picks for the month of October on 9/30. As always, we’ll be measuring SPC’s performance for the month of September, as well as SPC’s cumulative performance, assuming the sale of the September picks at the closing price (at the mid-point of the closing bid and ask prices) on the last day of the month (Wednesday, September 30). Likewise, performance tracking for the month of October will assume the October picks are bought at the open price (at the mid-point of the opening bid and ask prices) the first trading day of the month.

Stay tuned for the new picks and the performance updates.

What we’re reading (9/28)

“This Week Is A Big Test For The IPO Market” (CNN Business). “Investors have shown rabid enthusiasm for new stocks this September. That's forced some strategists to wonder: Is this a repeat of the frenzy that led up to the dot-com crash at the turn of the millennium?”

“One Woman’s Journey From New York Bond Trader To Orthodontist” (Wall Street Journal). “In five years as a bond trader at Goldman Sachs, Chris Bonebreak knew that competitive suspicions often accompanied a departure: Was the person leaving to join a rival firm or a client? For what salary? Or to get an M.B.A.? If so, where? She wasn’t sure how her colleagues would react to her move from New York’s high-stakes world of high-yield debt to go to dental school.”

“The Pandemic Plutocrats: How Covid Is Creating New Fintech Bilionaires” (Forbes). “In 2015, Nick Molnar was living with his parents in Sydney, Australia, and selling jewelry from a desktop computer in his childhood bedroom…[t]hat same year, he teamed up with Anthony Eisen, a former investment banker who was 19 years his senior and lived across the street. They cofounded Afterpay, an online service that allows shoppers from the U.S., U.K., Australia, New Zealand and Canada to pay for small-ticket items like shoes and shirts in four interest-free payments over six weeks…[f]ive years later, Molnar and Eisen, who each own roughly 7% of the company, have become billionaires—during a pandemic.”

“The Stock Market's Next 20 years Will Be Defined By Technological Innovation — And The Most Likely Scenario Is 7% Annual Growth, DataTrek Says” (Business Insider). Pretty back-of-the-envelope, but, according to DataTrek, investors should expect equities to return 7 percent on average annually over the next 20 years. “First, investors can ‘safely’ eliminate the prospect of negative returns over the next 20 years because historical returns have never delivered a negative real return over a 20-year time period...[s]econd, historically high average annual returns of 14% have happened only 22% of the time, and happened during unusual periods when equity valuations start very low (the Great Depression) and include a powerful positive catalyst (post-World War II)…[t]herefore, investors can settle on a 0% to 14% range of average annual returns for the next 20 years, with a midpoint estimate of 7% the likely result.”

“Evidence For And Level Of Herd Immunity Against SARS-CoV-2 Infection: The Ten-Community Study” (MedRxiv). “Based on an extended range of epidemiological measures, active infection is rare in these [Qatari] communities with limited if any sustainable infection transmission for clusters to occur. At least some CMW communities in Qatar have reached or nearly reached herd immunity for SARS-CoV-2 infection at a proportion of ever infection of 65-70%.”

What we’re reading (9/27)

“Investors Ramp Up Bets On Market Turmoil Around Election” (Wall Street Journal). “Investors are betting on one of the most volatile U.S. election seasons on record, wagering on unusually large swings in everything from stocks to currencies as they brace for what could be a weekslong haul of unpredictable events.”

“The ‘Black Hole’ Of Unemployment Benefits: Six Months Into The Pandemic, Some Are Still Waiting For Aid” (CNBC). “A deluge of applications — unprecedented in both speed and volume — placed enormous stress on states’ ability to process and pay claims as officials shuttered broad segments of the economy starting in March to reduce the spread of Covid-19. More than 1 million Americans continue to file for benefits each week, between state and federal programs. Six months into the crisis, more than 26 million people continue to receive aid from week to week.”

“What’s Wrong With Social Science And How To Fix It: Reflects After Reading 2,578 Papers” (Fantastic Anachronism). More on the so-called “replication crisis” in Academia. “People within the academy don't want to rock the boat. They still have to attend the conferences, secure the grants, publish in the journals, show up at the faculty meetings: all these things depend on their peers. When criticising bad research it's easier for everyone to blame the forking paths rather than the person walking them. No need for uncomfortable unpleasantries. The fraudster can admit, without much of a hit to their reputation, that indeed they were misled by that dastardly garden, really through no fault of their own whatsoever, at which point their colleagues on [T]witter will applaud and say ‘ah, good on you, you handled this tough situation with such exquisite virtue, this is how progress happens! hip, hip, hurrah!’ What a ridiculous charade. Even when they do accuse someone of wrongdoing they use terms like ‘Questionable Research Practices’ (QRP). How about Questionable Euphemism Practices? The bottom line is this: if a random schmuck with zero domain expertise like me can predict what will replicate, then so can scientists who have spent half their lives studying this stuff. But they sure don't act like it.”

“Wall Street Is Shunning Trump. Campaign Donations To Biden Are Five Times Larger” (CNN). “President Trump is promising four more years of low taxes, light regulation and a laser-focus on the stock market. Yet professionals on Wall Street are shunning Trump and funneling staggering amounts of money to his opponent. The securities and investment industry donated just $10.5 million to Trump's presidential campaign and outside groups aligned with it, according to a new tally by OpenSecrets. It has sent nearly five times as much cash, $51.1 million, to Democratic presidential nominee Joe Biden.”

“Pasta, Wine And Inflatable Pools: How Amazon Conquered Italy In The Pandemic” (New York Times). “Amazon has been one of the biggest winners in the pandemic as people in its most established markets — the United States, Germany and Britain — have flocked to it to buy everything from toilet paper to board games. What has been less noticed is that people in countries that had traditionally resisted the e-commerce giant are now also falling into its grasp after retail stores shut down for months because of the coronavirus.”

What we’re reading (9/26)

“I Taught And Worked With Amy Coney Barrett. Here’s What People Get Wrong About Her Faith.” (Washington Post). “After she graduated from law school, I wrote a one-line letter of recommendation for her to Justice Antonin Scalia: ‘Amy Coney is the best student I ever had.’ He was wise to hire her as a clerk. […] I would be astonished if anyone were to oppose her nomination on the basis of character or intellect. Anxiety about her confirmation instead seems driven by the fear that her religious belief is somehow incompatible with the impartiality demanded of a judge…[but] the only thing our Constitution said on the subject of religion — before the First Amendment was added — was that ‘no religious Test shall ever be required as a Qualification to any Office or public Trust under the United States.’ That has, for more than two centuries, been a guarantee of a tolerant pluralism in our country. The Constitution invites Catholics, evangelicals, Mormons, Jews, Muslims and nonbelievers alike to serve their country, and promises them that they won’t be interrogated about the way they choose to love and serve God.”

“Market Volatility Expected To Continue In The Week Ahead With Presidential Debate And Jobs Report” (CNBC). “Stock market volatility, with sharp ups, downs and reversals, is likely to be the norm again in the week ahead, as investors await Friday’s jobs report and watch headlines from Washington and the presidential debate.”

“Wall Street’s Biggest 5 Stocks By Value Are On Track For Their Worst Month Ever” (MarketWatch). “It is shaping up to be an ugly month for the overall equity market, but it could be an even worst stretch for the cadre of stocks that have generated the most bullish momentum for Wall Street since March…[a]pproximately $817 billion of market value has been lost by the quintuplet of heavy weights [AMZN, AAPL, MSFT, GOOGL] so far in September, which puts the group on pace for the steepest monthly slump on record.”

“Is It Insane To Start A Business During Coronavirus? Millions Of Americans Don’t Think So.” (Wall Street Journal). It makes eminent sense to me: cheap capital + a disruptive shock to social habits = opportunity. “Americans are starting new businesses at the fastest rate in more than a decade, according to government data, seizing on pent-up demand and new opportunities after the pandemic shut down and reshaped the economy.”

“Michael Jordan’s Big Play In NASCAR Could Help Diversify Its Fan Base” (New York Times). “This week, Jordan announced that he is joining Denny Hamlin, one of the most lauded drivers in the sport, to form a NASCAR team with Darrell “Bubba” Wallace Jr., the lone Black driver on NASCAR’s top level. It will begin competition in the 2021 season.”

What we’re reading (9/25)

“Harvard’s Chetty Finds Economic Carnage In Wealthiest ZIP Codes” (Bloomberg). “By late June the gap had widened further, even though many businesses had reopened. In fact, the segment of Americans who are paid best had recovered almost all the jobs lost since the start of the pandemic. ‘The recession has essentially ended for high-income individuals,’ Chetty told Biden and Harris. Meanwhile, the bottom half of American workers represented almost 80% of the jobs still missing.”

“The Airlines Run Out Of Bailout Money In Six Days. Here’s What Happens Next: CNBC After Hours” (CNBC). The airlines’ bailout money is running out. Surprise! They want more.

“‘A Million Random Digits’ Was a Number-Cruncher’s Bible. Now One Has Exposed Flaws in the Disorder.” (Wall Street Journal). “For 65 years, Rand Corp.’s reference book “A Million Random Digits with 100,000 Normal Deviates” has enjoyed a reputation as the go-to source for random numbers. Until, on a random whim, Gary Briggs came along and ruined it all.”

“‘I Think It Sent The Right Message’ — Goldman Sachs CEO David Solomon Spent Every Day In The Office At Height Of Pandemic” (MarketWatch). “Goldman Sachs Chief Executive David Solomon said he spent every day in the office at the height of the coronavirus pandemic. ‘It wasn’t a decision, like I woke up one day and said, I’m going to be in the office every day during the pandemic,’ Solomon told The Boardroom: Out of Office podcast. ‘We were in the office and… even though we were sending people home — I just felt more comfortable — and I also think it sent the right message that the captain was kind of hands on the wheel of the ship,’ he said.”

“Publicly Traded Firms Paid Dividends, Bought Their Own Stock After Receiving PPP Loans to Pay Employees” (Washington Post). “Some publicly traded companies that received taxpayer-backed small business loans to pay their employees during the early weeks of the pandemic paid out millions to Wall Street investors in dividends and share buybacks, publicly available financial disclosures reviewed by The Washington Post show.”

What we’re reading (9/24)

“U.S. Unemployment Claims Hold Steady At 870,000” (Wall Street Journal). “The number of applications for unemployment benefits has held steady in September at just under 900,000 a week, suggesting the labor-market recovery is stalling as layoffs restrain hiring gains six months into the pandemic.”

“Junk Bond Jitters May Signal The Start Of A Stock Market Capitulation” (MarketWatch). Yikes. Let’s hope not. “[T]he biggest exchange-traded fund focused on sub-investment grade debt, the iShares High Yield Corporate Bond fund…was hit by nearly $1.06 billion of outflows on Monday, the largest single-day outflow since the start of the pandemic.”

“Pay Cuts Become Permanent For Many Americans During Pandemic” (Bloomberg). “Pay cuts introduced by U.S. employers in the early days of the coronavirus pandemic -- meant to stave off layoffs and retain key employees -- have proved less temporary than perhaps originally envisioned.”

“Dust Off Desks And Boot Up Terminals: Wall St. Returns, Fitfully” (Dealbook). “The fitful nature of the finance industry’s return highlights how the waning threat of the coronavirus in New York — at least for now — has done little to reduce uncertainty around when things will return to normal. With governmental guidance remaining nebulous, many Wall Street firms have made up return-to-office policies that reflect their business and their leaders’ philosophies. Large banks, where face time and long hours are considered virtues, are generally urging workers to come back. Many hedge funds…are not. Private-equity firms and asset managers, which have a mix of workers and deal with both long- and short-term investments, appear to be taking a middle path.”

“New Home Sales Crush Expectations, But The Supply Is Running Out” (CNBC). “Exceptional demand for new and existing homes, brought on by the stay-at-home culture of the coronavirus pandemic, has the housing market severely depleted. Sales of newly built homes jumped to the highest level in 14 years in August, but builders’ supply dropped to just 3.3 months’ worth at the current sales pace. A six-month supply is considered a balanced market. Supply was at 5.5 months in August 2019, according to the U.S. Census.”

What we’re reading (9/23)

“Pentagon Redirected Pandemic Funds To Defense Contractors” (Washington Post). “A $1 billion fund Congress gave the Pentagon in March to build up the country’s supplies of medical equipment has instead been mostly funneled to defense contractors and used to make things such as jet engine parts, body armor and dress uniforms.”

“How Nikola Stock Got Torched By A Short Seller” (Wall Street Journal). “It took research from Mr. Anderson, an unknown in the investing world, to cut Nikola’s market value. The company’s value has fallen to under $11 billion from as high as $30 billion earlier this month. ‘This is all happening because of his report,’ says Gabriel Grego, who runs hedge fund Quintessential Capital Management, which placed its own Nikola short positions after reading Hindenburg’s research.”

“Johnson & Johnson Enters Late-Stage Trial Testing Its Coronavirus Vaccine” (CNBC). “Johnson & Johnson said Wednesday it has begun its phase three trial testing its potential coronavirus vaccine. J&J is the fourth drugmaker backed by the Trump administration’s Covid-19 vaccine program Operation Warp Speed to enter late-stage testing. The others are Moderna, Pfizer and AstraZeneca. The trial will enroll up to 60,000 adult volunteers across 215 locations in the U.S. and other countries, according to the National Institute of Allergy and Infectious Diseases. Participants will be randomly selected to receive a dose of the potential vaccine or a placebo, according to details of the trial, which will determine whether the vaccine is safe and effective.”

“Justice Ginsburg Was A Leader In Protecting Intellectual Property Rights” (Real Clear Markets). “Ginsburg understood that innovation is what drives the free-market economy. In her nearly three decades on the bench, she adamantly defended their rights — working tirelessly to ensure that her rulings closed loopholes that left their property, ideas, and creations vulnerable.”

“Gangs, Labor Mobility and Development” (National Bureau of Economic Research). Fascinating new study: “We study how two of the world’s largest gangs—MS-13 and 18th Street—affect economic development in El Salvador. We exploit the fact that the emergence of these gangs was the consequence of an exogenous shift in American immigration policy that led to the deportation of gang leaders from the United States to El Salvador. Using a spatial regression discontinuity design, we find that individuals living under gang control have significantly less education, material wellbeing, and income than individuals living only 50 meters away but outside of gang territory. None of these discontinuities existed before the emergence of the gangs. The results are confirmed by a difference-in-differences analysis: after the gangs’ arrival, locations under their control started experiencing lower growth in nighttime light density compared to areas without gang presence. A key mechanism behind the results is that, in order to maintain territorial control, gangs restrict individuals’ freedom of movement, affecting their labor market options. The results are not determined by exposure to violence or selective migration from gang locations. We also find no differences in public goods provision.”

What we’re reading (9/22)

“Here’s Why Top Economics Are Not Worried About The National Debt, Now Worth Over $26 Trillion” (CNBC). Great quote from Krugman in this article: “Nobel laureate Paul Krugman was not impressed with the current choices of government spending, he was not concerned with the spending itself. He said ‘even though we’ve been running budget deficits that are kind of stupid, if you were going to run budget deficits, you should be using the money to build infrastructure to help education, to work on the future. And instead, we’ve been using it to get big windfalls to corporations and rich people.’”

“Banks’ Airtight Compliance Procedure Involves Laundering Money, Sending Report That Won’t Be Read, Collecting Fees, Laughing All The Way Back To Themselves” (Dealbreaker). Big news about big, big banks’ anti-money laundering compliance failures yesterday: “As we and everyone else who looks at them have noted, banks could really do a much, much better job of detecting, reporting and preventing money laundering. Well, BuzzFeed has got its hands on 2,100 suspicious activity reports filed by those banks, demonstrating that they have a pretty good handle on how and when $2 trillion worth of money laundering is happening. It’s just that, aside from filing those SARs, they don’t do anything about it, because, well, they don’t have to.” Wall Street at its finest.

“TikTok’s Zero Hour: Haggling With Trump, Doubts In China And A Deal In Limbo” (Wall Street Journal). “After months of maneuvering over the future of TikTok, it took a pair of 11th-hour phone calls with two of America’s most powerful executives to persuade President Trump to agree to a tentative deal.”

“Six Months Into The Pandemic, The US Economic Outlook Is Getting Gloomier” (CNN). “Six months. It may feel like an eternity, but that's how long it's been since states started enacting stay-at-home orders. We now know those actions were at least partially successful in slowing the spread of Covid-19. They also triggered an economic downturn deeper than any recession on record since at least the Great Depression.”

“Here’s What Wall Street Is Saying About Nikola Founder’s ‘Shocking’ Departure” (MarketWatch). It’s seem like plagiarizing (basically) the name of a company in the same business should generally be cause for concern. But setting that aside, watching some big-shorters come up big on what looks and walks like a fraud is always gratifying: “Milton’s departure comes roughly two weeks after a scathing report earlier this month by short seller Hindenburg Research that roiled the company’s shares, accusing Nikola of being an ‘intricate fraud’ built on lies told by Milton. The electric-vehicle maker fired back by saying the report was ‘false and misleading.’”

What we’re reading (9/21)

“Jeff Zucker Helped Create Donald Trump. That Show May Be Ending.” (New York Times). This isn’t exactly a new story—the New Yorker reported it in long form back in 2017—but worth the read anyway. “In speaking to dozens of people who know Mr. Zucker over the past few weeks, I heard two distinct theories of what is going on now: One is the current version of CNN — amped up outrage and righteousness — is just Mr. Zucker’s latest reflexive adaptation in search of ratings. The other is that Mr. Zucker, TV’s Dr. Frankenstein, has been willing to dent his network’s nonpartisan brand in order to kill his runaway monster, Mr. Trump.”

“What Would It Take For Herd Immunity To Stop The Coronavirus Pandemic” (Wall Street Journal). “For the pandemic to stop, the coronavirus has to run out of susceptible hosts to infect. Herd immunity occurs when enough people in a population develop an immune response, either through previous infection or vaccination, so that the virus can’t spread easily and even those who aren’t immune have protection. To reach herd immunity for Covid-19, public-health authorities estimate that around 60% to 70% of a given population would need to develop an immune response to the virus. Some epidemiologists and mathematicians now say herd effects might start to kick in before that point, at perhaps closer to 50%, suggesting potential protection could be achieved sooner.”

“What’s Next For The Stock Market? It’s Time To Consider ‘Babies That Have Gotten Thrown Out With The Bath Water,’ Strategist Says” (MarketWatch). Never a bad time to go hunting for value.

“The West Should Heed Napoleon’s Advice And Let China Sleep” (Financial Times). Not sure I agree. Alas: “Napoleon was right when he warned western nations to ‘let China sleep, for when she wakes, she will shake the world.’ Even more than in Turkey and India, there is a potential volcano of anti-western sentiment waiting to explode in China. Currently, the only political force strong enough to hold down these forces of Chinese nationalism is the Chinese Communist party.”

“Airline Workers Have Lower Rates Of COVID-19 Than The General Population — And Airline CEOs Says It’s Proof That Flying Is Safe” (Business Insider). “The coronavirus spreads when people are in close quarters for extended periods of time, breathing the same air with little space between them. So you might expect airplanes to be the perfect environment for the transmission. But some surprising data from airline workers show that is not the case. In fact, flight attendants and other airline workers have had a lower incidence of COVID-19 than the general population.”

What we’re reading (9/20)

“Storm Coming” (The Grumpy Economist). A very thoughtful, albeit disconcerting, post by Stanford economist (and author of one of the best asset pricing textbooks) John Cochrane. “[A]s an economist I predict people's behavior by asking what is natural given their incentives and the rules of the game as they are. That thinking leads to a dark place. […] Imagine, as seems quite possible, that Trump scores an early lead in the days after the election, with a narrow electoral college majority, though losing the popular vote, with 90% - 10% losses in the deep blue cities. Trump declares victory. Blue cities erupt in protest. As mail in votes come in and are tabulated, Biden gets closer and closer and by his party's count has won. But lawyers have already fanned out around the country. Every single smudged postmark, questionable signature is challenged by both sides […] What do you do if you are president with cities burning? You send in the troops. Republicans will call it ‘law and order,’ ‘protecting life, property and the rule of law.’ Democrats will decry this as ‘martial law,’ and a ‘coup.’ And with some justification: To their view, protesting such a presidential outcome is the same as protests all over the world, in Hong Kong, in Iran, in Belorussia, that aim to topple illegitimate regimes, though those regimes are ‘lawful’ by their laws and procedures for implementing those laws.”

“No Jobs, Loads Of Debt: Covid Upends Middle-Class Family Finances” (Wall Street Journal). “Millions of Americans have lost jobs during a pandemic that kept restaurants, shops and public institutions closed for months and hit the travel industry hard. While lower-wage workers have borne much of the brunt, the crisis is wreaking a particular kind of havoc on the debt-laden middle class.”

“Are You A Winner Or Loser Under Joe Biden’s 401(k) Plan”? (Investor’s Business Daily). “White House hopefuls Joe Biden and Kamala Harris are proposing 401(k) changes to turbocharge retirement planning and saving for people in the two lowest tax brackets. But if your income is above $400,000 — in the upper part of the 35% bracket or anywhere in the 37% — you would be hit with extra tax of up to $206 for every $1,000 you contribute to your 401(k) plan. Everyone in between? People in the 22%, 24%, 32% and most in the 35% brackets? The Biden campaign has said the changes would be structured so that taxes do not rise for people earning up to $400,000. They'd get a pass on the higher tax.”

“The Easy Part Of The U.S. Economic Recovery Is Over. Now Comes The Hard Part” (MarketWatch). “With confidence shaky, so many people out of work, and the coronavirus still spreading, the U.S. can’t recover more rapidly, economists say. Many businesses face ongoing restrictions on occupancy while millions of Americans continue to practice social distancing and shun normally crowded places such as airports, malls and hotels.”

“Sonoma’s Vaunted Wineries Embrace Online Sales, Budget Pricing To Woo Pandemic Drinkers” (Washington Post). “Grape growers that once focused on selling to high-end wineries are lowering their prices and supplying cheaper brands. Wineries that can no longer count on tourist visits are replacing in-person events with online campaigns. Restaurants that boasted of expansive wine lists now tout their to-go cups.”