What we’re reading (7/6)

“Are Stock Investors ‘Irrationally Exuberant’ Again?” (Wall Street Journal). Objective measures of investor sentiment suggest the market today is nowhere near as frothy/bubbly/irrationally exuberant as it was during the internet-stock boom. The article looks at the number of IPOs/average first-day returns, the extent to which companies are raising equity versus debt capital (in a bubbly market, you should see more equity raises), performance of dividend-paying versus non-dividend-paying stocks, and the average closed-end-fund discount (note: this last one relates to the NAV discount/premium concept we talked about in a prior post on transaction costs).

“ETFs Tracking the Work-From-Home Boom: Just a Fad or Here to Stay?” (CNBC). We actually think “here to stay” (not because we think the particular ETFs mentioned in this article are necessarily winners, we just think working-from-home in general ought to, and will, become more prevalent).

“This is the Simple Reason You Can’t Believe the P/E Ratio for the Russell 2000 Right Now” (MarketWatch). A pretty interesting article that points out why you need to look under the “hood” of how ratios and financial metrics reported by third-parties are calculated. Specifically, some research firms exclude index constituent companies with negative earnings when computing the average price-to-earnings (“P/E”) ratio for the overall index, thereby understating the true ratio (the “E” in the denominator should be lower than they report, making the true overall P/E ratio higher). We’re drawing an additional conclusion here: investors should exercise great caution in using simple ratios (like price-to-earnings, market value-to-book value, etc.) as proxies for assessing whether a company or index is a good “value” investment. We explicitly try to capture the “value” concept in our model, but we don’t use these simple proxies to do it.

“J.P. Morgan Launches Two Actively Managed Equity ETFs—What You Need to Know” (CNBC). We already commented on this “actively managed ETF” thing when Fidelity launched its own vehicles a few weeks ago (see here). And we’re equally dismayed now to see others getting in on the action. We look forward to looking at how these funds perform going forward and comparing them to SP’s Prime and Select picks.

“Nation’s 30-Year-Olds Pool Money To Buy 2-Bedroom Bungalow Together” (Onion). A nice little real estate update: “Admitting they would never be able to afford a place without sharing expenses, the nation’s 30-year-olds announced Friday that they had pooled all their resources to buy a 1,100-square-foot, two-bedroom bungalow together. ‘It may not seem like much for a few million people, but we can finish the basement and maybe add another bedroom, plus it’s nicer than all our old places,’ said Zach Bartley, 30, who noted that the house had some plumbing issues and a really outdated kitchen, but that it still felt nice to finally own a piece of property.”

What we’re reading (7/5)

“And the No. 1 Stock-Fund Manger Is…” (Wall Street Journal). Morgan Stanley’s Dennis Lynch nabbed some big gains in the last 12 months. Per Lynch: “Our strategy has been to collect a portfolio of unique companies that have a strong competitive position and offer big growth opportunities over the long term. We don’t try to make any shorter-term predictions.” That’s a sensible strategy, but it’s awfully broad and could describe hundreds of companies. When it comes to stock selection, the devil is in the details, and we’ll go ahead and go out on a limb and say Mr. Lynch is very unlikely to replicate his performance next year—tough to do it when your strategy is “trust our subjective judgment, we pick good stocks” instead of “we apply a bias-free model to stocks in a broad universe and rigorously test that model against the available historical data.” Like monkeys randomly clacking on a typewriter, with enough monkeys and enough time, eventually one will clack out the Iliad.

“With Department Stores Disappearing, Malls Could Be Next” (New York Times). Malls still exist?

“Keep Running!” (Collaborative Fund). This is a really important article, and one we may devote an entire blog post to because the concept it articulates is fundamental to the way we value stocks and fundamental to why we think Wall Street broadly systematically mis-values stocks (side note: we aren’t total Wall Street outsiders—we cut our proverbial teeth there and know how IB analysts are trained and, by extension, how almost the entire hierarchy at many long-short equity hedge funds was trained to value stocks). The punch line: probability of extinction/bankruptcy (both in nature and in business) is basically independent of age—there is no “safe” age at which you can feel comfortable the business is sufficiently “on top of it” to be inoculated from big risks. Alternative punch line for the finance crowd: if the return on new invested capital in your model is not assumed to converge to the cost of capital because of competitive pressures, you’re modelling stocks wrong.

“How Well Has Socially Responsible Investing Performed? (Charles Schwab). Socially responsible investing (SRI) is definitely “in.” But, according to Schwab, and despite the insistence by some that SRI funds actually outperform other funds, their performance is pretty much the same. But that may be good enough with the added utility that comes from actually feeling good about your investments (unlike your airline investments, which definitely don’t fit the SRI bill in our opinion on account of (1) consuming fossil fuels with reckless abandon and (2) treating their customers like shit).

“John Paulson, Who’s Effectively Been Running A Family Office For Years, Makes It Official” (Dealbreaker). Paulson & Co. is returning all external capital and converting to a family office. Paulson struck gold in the 2008-09 crisis. Another example of “old”-style investment funds—that rely on winning once or twice without providing investors any basis to think they can do it consistently—making way for newer, better uses of capital

June 2020 performance update*

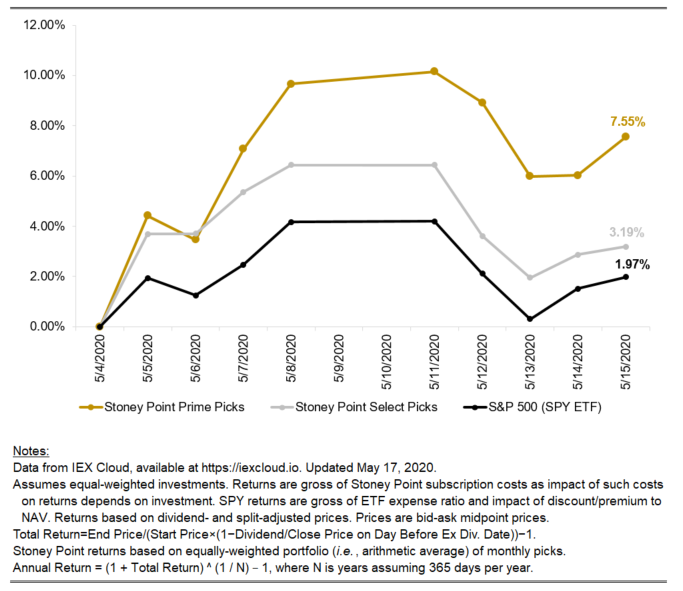

We’ve crunched the numbers for June. On the whole, June was a relatively flattish month compared to the absurd rise in equities in May. The S&P 500-tracking “SPY” ETF gained about 2.02* percent during the month, compared to over 8 percent in the prior month. Likewise, our subscribers-only Prime picks were up 0.28 percent after gaining almost 13 percent in May and our (literally) free Select picks were up 2.27 percent after gaining over 11 percent in May. Check out the details for our Prime and Select picks in June on our performance page.

All told, after only two months publishing our picks, both our Prime picks and our Select picks are both outperforming the S&P 500-tracking “SPY” ETF by over 288* basis points to date. Let’s process that for a second: if you put $10K to work in either of our Prime picks or our Select picks two months ago, you’d be almost* $300 richer than you would have been just buying “the market”; and if you’d put $100K to work following either sets of picks, you’d be almost* $3,000 richer than you would have been buying the market—in only two months.

We’re amped for July. Stay tuned on Twitter (@StoneyPointCap) and, of course, check out our latest picks here.

*Restated on Sep. 3, 2020 to correctly account for contribution of SPY June dividends to SPY’s June total return. Prime and Select returns unaffected.

Prime and Select Picks v. SPY*

(May 4 - June 30, 2020)

What we’re reading (7/4)

After a two-day holiday hiatus, some fresh finds:

“U.S. Treasury Reaches Loan Agreements with Five Major Airlines” (Wall Street Journal). Airlines starting to tap into major “loans” from taxpayers. Uncle Sam is requiring warrants, equity, or senior debt in exchange.

“How the Black Death Made the Rich Richer” (BBC). “The sudden loss of at least a third of Europe’s population didn’t lead to an even redistribution of wealth for everyone else. Instead, people responded to the devastation by keeping money within the family. Wills became highly specific and wealthy businessmen, in particular, went to great lengths to ensure that their patrimony was no longer divided up after death, replacing the previous tendency to leave a third of all their resources to charity. Their descendants benefited from a continued concentration of capital into a smaller and smaller number of hands.”

“The Mystery of High Stock Prices” (New York Times). Steve Rattner argues the Fed’s massive intervention in capital markets in the last few months is driving the disconnect between stock prices and economic fundamentals. He points out that the S&P 500’s dividend yield is currently higher than the current yield on AAA corporate bonds.

“We’re Forecasting a Strong Long-Run Economic Recovery” (Morningstar). A bit of an alternative view to the last article. According to Morningstar, “[w]hile many investors are wondering if the market is exhibiting irrational exuberance, we think the rebound has been broadly warranted, as we forecast a strong long-run recovery in the U.S. economy.” Markets price future cash flows, so “high” forward-looking stock prices are not irreconcilable with weak current/backward-looking economic fundamentals.

“‘Black Wall Street’: The History of the Wealthy Black Community and the Massacre Perpetrated There” (CNBC). Fascinating (brief) history of Black Wall Street in Tulsa and the community there before the massacre of 1921.

What we’re reading (7/1)

“The Mixed Case for Private Equity in Retirement Plans” (Wall Street Journal). New labor department guidance allows 401(k) plans to offer private equity in diversified retirement plans, opening up a huge source of capital for PE funds and, potentially, other alternative asset managers. The downside: extra fees.

“These 5 Giant Stocks Are Driving the U.S. Market Now, But Watch Out Down the Road” (MarketWatch). Per a Dimensional Fund Advisors study, dominant stocks tend to lose steam eventually. From a “corporate lifecyle” standpoint, that completely makes sense.

“A Viral Market Update X: A Corporate Life Cycle Perspective” (Musings on Markets). Speaking of the corporate life cycle, this recent, thorough post by the “Dean of Wall Street” (NYU finance professor Aswath Damodaran) comprehensively lays out the connection between the life cycle theory and the market turbulence of late. What we’re seeing, according to Prof. Damodaran, is “a redistribution of value from older, low growth, more capital intensive companies to younger, high growth companies.”

“Hidden Wine Cave, $110 Million Parking Bill: Energy Collapse Wasn’t Only Thing That Sank Chesapeake” (CNBC). Chesapeak’s bankruptcy followed a “financial mess that included no budgets, a massive wine collection and a nine-figure bill for parking garages, sources told CNBC’s David Faber.” You’ll be pleased to know Stoney Point’s model has some bells and whistles to weed out companies like this.

“AQR Boasts Multiplicity Of Factors For Terrible Performance” (Dealbreaker). We like AQR. As pioneering factor-investing firm that does quantamental-type stuff it’s one of the hedge funds in the equities world we don’t endeavor to destroy. But apparently their value factor isn’t working out so well (lately). Could just be anomalous. Could be how they measure “value.”

New Prime + Select picks available

The new Prime and Select picks for July are available starting now, based on a model run put through this morning (June 30). As a note, we’ll be measuring the performance on these picks from Wednesday, July 1, 2020 (tomorrow, at the open price) through Friday, July 31 (at the closing price). If you’re following the strategy perfectly, you’d want to close out your June positions by end-of-trading today, and re-balance at start-of-trading tomorrow (though some members do all of their re-balancing in one fell swoop).

You can check out the latest picks here here.

What we’re reading (6/30)

“Be Careful When Declaring an Asset Class Is Dead. It Might Just Come Roaring Back” (Institutional Investor). A new practitioner study points out that “‘pundits, prognosticators, and even investment boards’ are quick to [incorrectly] declare an asset class or investment strategy broken based on backward-looking data.”

“The (Near) Cashless Society Arrives” (Axios). ATM use is down 32 percent and active credit card use in e-commerce is up 30 percent per Visa. 63 percent of consumers say they’re using less cash. So-called “contactless cards” are purportedly the next big thing in payments.

“‘Black Swan’ Author Says That if Investors Don’t Use a ‘Tail Hedge’ He Recommends ‘Not Being in the Market’: ‘We’re Facing a Huge Amount of Uncertainty’” (MarketWatch). Taleb told CNBC that investors need to be especially worried about a potential “black swan” event right now. But if said black swan event is predictable now, ex ante, isn’t is not a black swan event by definition?

“Chesapeake Pushed Into Bankruptcy by Plunging Energy Prices” (Bloomberg). This is ostensibly a story about energy markets, but it is also a story about prudent investments behave broadly. The combination of (1) highly leveraged investments in (2) highly volatile assets without (3) strong liquidity safeguards is (4) a very deadly mix. Don’t borrow to buy risky assets unless you have the reserves to service your debt through downturns. That goes for buying a home, for managing your own portfolio, et cetera.

“If You Get An IRS Letter That Says Your Tax Payment Is Overdue, Don’t Panic” (Washington Post). Confusing, but good to know.

What we’re reading (6/29)

“Robeco Hires Trio of Specialists in Hong Kong” (Finews.Asia). Among a few other senior hires, Dutch asset manager Robeco hires new director of client portfolio management to work on asian-focused quant equity strategies. Punchline: the “smart money” is continuing to build out its quant investing capabilities. We think there’s much more of this to come.

“The Market Partied Like it Was 1932” (New York Times). NYT points out that there is only one other instance in the history of U.S. stock markets when the market was down at least 20 percent one quarter and then up 20 percent the next—1932, during the Depression. A la Robert Shiller, U.S. stocks experienced dramatic fits and starts in the Depression, and didn’t reach their 1929 peak (and stay there) on a dividend- and inflation-adjusted basis for 20 years.

“‘Flying Blind into A Credit Storm’: Widespread Deferrals Mean Banks Can’t Tell Who’s Creditworthy” (Wall Street Journal). Banks have pulled way back on consumer lending in recent months, apparently in part because they can’t tell who is creditworthy (missed payments not showing up on credit scores because credit reporting is prohibited by the coronavirus stimulus bill in my cases).

“Trust the Experts! Lessons From the Front Lines” (City Journal). A funny take on “expertise” and the the apparent “plummeting confidence” in it. “As a confused friend recently asked: ‘Wasn’t it just a couple of months ago you were all constitutional scholars?’ He added: ‘How’d you all get to be epidemiologists?’”

“Pharmaceutical Giants Have Added $51 Billion to Their Market Value in 2020 as They Scramble to Develop a Coronavirus Vaccine” (Business Insider). A look at how the stocks of Gilead, Moderna, AstraZeneca, Roche, Sanofi, and BioNTech have performed during the pandemic. Could probably impute the probabilities the market is assigning to each of winning the race.

What we’re reading (6/28)

The latest:

“Dollar General is Cheap, Popular and Spreading Across America. It’s Also a Robbery Magnet, Policy Says” (CNN). DG’s stock profits have quintupled and its stock has risen 800 percent since 2010, but apparently it’s a hotbed of armed crime. ‘“It’s a low margin business, so you have to have low labor [costs] to make a profit,” said one of the former executives. “Putting more labor in stores took away from the profit, or you have to raise prices. And there was no appetite to raise prices because it’s a low-price business.”’

“Americans' Paychecks are Getting Smaller, but Their Spending is Soaring. Huh?” (CNN). April spending was down (read: fear), but can only cut so much so month-over-month May was way up.

“‘We Are Definitely Not Out of the Woods” (DealBook). Per Gita Gopinath, Chief IMF economist, “[t]his is a crisis like no other and will have a recovery like no other.” That follows a GDP forecast cut by the Fund, which issues closely-watched global growth projections.

“Credit Card Industry Reins in Balance-Transfer Offers as Banks from JPMorgan to Amex Fear Defaults” (CNBC). Banks have traditionally offered special temporary zero-interest payment periods to credit card customers willing to transfer funds to their bank as a credit card promotion option. These options have been “sharply reduced” lately at the likes of JPMorgan Chase, Citi, BofA, Barclays, and CapOne (Amex dropped it altogether) after they got burned in the last crisis by customers transferring and subsequently defaulting.

“Zuckerberg Loses $7 Billion as Firms Boycott Facebook Ads” (MSN Money). A little more coverage of American enterprises urging a private entity to policy speech on its private platform. Apparently, FB down +8 percent on Friday means Zuck lost 8 big ones. Tough nuggies, Zuck!

What we’re reading (6/27)

Some fresh finds:

“The Hard Truth About Facebook Ad Boycott: Nothing Matters But Zuckerberg” (CNN). Some heavy ad spenders want Facebook to regulate speech on it’s platform with a heavier hand. As an aside, one can’t help but think some of Facebook’s rival media platforms (of the traditional TV and print sort) agree based on their coverage, which, by the way, is a peculiar position for those outlets to adopt—since when does the press want opinion and information to be more, rather than less, tightly restricted? In any case, it’s tough to imagine the reduced ad spend at FB being anything more than opportunistic and temporary. Given COVID, a lot of brands need to cut their ad budgets. The economics of cutting at Facebook, rather than elsewhere, have improved a little recently: given the collective aversion to “wrongspeak” in certain cultural confines at the moment, the pain of cutting at FB is little offset by the value of the virtue signal to said clienteles. As evidence for the proposition that this is really about ad budgets and not about taking a principled stand against misinformation on digital media platforms, note that Unilever also cut its ad spend on Twitter, which is actually on the “rightspeak” side of things here, and TWTR was down just about as much as FB on Friday.

“Can Consumers Sustain A Spending Splurge? (Wall Street Journal). The April boost in personal income “will likely be one-off” as aid programs expire without Congressional approval of new assistance and the improvements in unemployment claims have been “sluggish,” signaling slim prospects for a quick recovery.

“Brokers Will Have to Tell You a Lot More About What They Are Advising You to Buy Starting Next Week” (CNBC). Regulation “Best Interest” goes into effect 6/30, requiring your broker-dealer (the people who buy and sell securities on your behalf) to…get this…”act in the best interest of their clients and to identify conflicts of interest, including financial incentives they may have with the products they are selling.” Seems like this reg probably should have already been in place. Would’ve thought the Panic of 1907 would’ve yielded some rules like this, but I guess it took another 11 decades. In any case, a welcomed development.

“Regulators Unceremoniously Dump Volcker Rule Into Crude Ditch Next to its Author” (Dealbreaker). More on the financial regulatory front: “There’s no time like a financial crisis even worse than the last one to gut the signature regulation stemming from said previous financial crisis, or so it seems to those in charge of enforcing it, who have finalized the demolition of the Volcker Rule at a time when very little else is going [on].”

“Pros And Cons Of D.C. Statehood” (The Onion). On the pro side, “[c]onfers all the benefits of having state bird.” On the other hand, “[s]lippery slope to giving statehood to Delaware.”

What we’re reading (6/26)

Some new reading material for your Saturday:

“Covid-19 is a Puzzle that Wall Street Can’t Solve” (Wall Street Journal). A summary of how different market segments performed in the first half of 2020, which “by many accounts” was “the most tumultuous stretch for financial markets in recent history.” Per the WSJ, 1H 2020 is a story of surprising resilience—and a humbling reminder that sometimes the thing that winds up tipping financial markets over the edge is a black swan event that no Wall Street firm sees coming before it happens.”

“Still Reeling From Oil Plunge, Texas Faces New Threat: Surge in Virus Cases” (New York Times). The “wildcatters” in the Texas oil industry are natural optimists, but “the current crisis is fundamentally different because the pandemic has kept demand suppressed even at low prices.”

“Have Markets Gone Young, Wild and Free?” (Fisher Investments). Brokerages are, indeed, reporting huge numbers of new accounts in 2020, and younger/first-time investors are probably behind lot of these new accounts. But that doesn’t explain the rally in equities since March.

“Consumer Spending Rebounds a Record 8.2 Percent in May Even as Incomes Slide” (Washington Post). Huge increase in consumer spending—the backbone of U.S. GDP—in May. Apparently, autos, recreational goods, and food services are at the heart of it.

“Filling my PC with Beans and Hiring a Repairman to Fix it” (RossCreations). Special recommendation from VIP Prime member (and Stoney Point Capital LLC advisor) Brent in L.A. You’ll watch it again and again.

What we’re reading (6/25)

“Jeff Bezos Just Sold $1.8 billion Worth of Amazon Stock. Here’s Why” (CNN). Apparently, to fund Blue Origin.

“Chuck E. Cheese Hits Ch. 11 Following COVID-19 Closures” (Law360). Bold claim for the CEO of a restaurant that offers, as its central value proposition, a garage band fronted by an animatronic rat: he and the cheezemeisters over at C.E.C. think they have an angle to “delight” families “for generations to come.” We’re not talking about their financial situation (about which we know nothing)—we’re talking about the product itself.

“Wirecard Files for Insolvency After Revealing Accounting Hole” (Wall Street Journal). More on Wirecard — shares down 70 percent.

“Biotech IPOs are Booming — But It’s Not All About Covid-19” (CNN). Interesting article, but doesn’t exactly prove beyond a reasonable doubt that it’s not all about Covid.

“The COVID Shock to the Dollar” (Project Syndicate). U.S. savings rate allegedly going negative.

“Can Older Men Wear Vintage Clothing?” (Wall Street Journal). Yes, according to The Journal. We cautiously agree.

“ServiceNow (Ticker Symbol: NOW) Recently Broke $400 and Is Up 37% in 2020. Meet CEO Bill McDermott, Who Survived A Near-Fatal Accident That Took An Eye (But Not His Vision)” (Forbes). Fascinating interview with Bill McDermott. Shoutout to “rapid ROI”—that’s not just CEO-speak nonsense—it’s key to our own stock-selection model.

What we’re reading (6/24)

A few of the things we’re perusing today:

“‘Crush This Lady.’ Inside eBay’s Bizarre Campaign Against a Blog Critic” (Wall Street Journal). “Security employees allegedly orchestrated deliveries of live cockroaches, pornographic videos and a mask of a bloody pig’s head.” Allegedly! Let’s hope Stoney Point doesn’t ever end up on the wrong side of eBay. With that said, our model thinks their stock sucks (ranked 162 in our universe in May).

“Wirecard: No End to Stock Frauds in China and Europe?” (Real Clear Markets). More on the Wirecard saga. How does $2B disappear?

“Jim Cramer: 2 Worrisome Signs I See With This Market” (Real Money). According to Cramer: “I am thrilled that there are a lot of new traders coming into the market. I am thrilled because I am hoping to try to transform them into investors so this doesn't all end in tears as my great friend Lee Cooperman recently said on my friend Scott Wapner's show. But so far I have not seen much evidence of genuine study time being put in.” He clearly doesn’t know us. And it’s pretty rich for a guy who has spent decades peddling pure puffery and speculation to characterize himself as a builder-of-“investors.”

“Here’s a Scientific Way to Make Better Investment Decisions” (CNBC). Here’s another scientific way to make better investment decisions: subscribe to Stoney Point. Article summary: human perceptions are often skewed by events being (1) vivid and (2) recent. Does not just apply to investing.

“Why Your First Five Years of Retirement Are Critical” (MarketWatch). Per the article, citing a CFPB study, only about half of retirees are able to maintain their pre-retirement lifestyle during the first five years of retirement. Per Stoney Point: the 40 years before retirement are pretty critical too.

“Are Companies More Productive in a Pandemic?” (New York Times). Our opinion: yes. The article: “Companies…are discovering that processes and procedures they previously took for granted — from lengthy meetings to regular status updates — are less essential than once imagined.”

“Retooling Your Investment Portfolio Amid the Turmoil” (U.S. News & World Report). Some common-sense recommendations. We’d add “check out some upstart quantamental strategies” to the list of to-dos too.

What we’re reading (6/23)

Here’s a few things we’re reading today:

“The Missing Piece for Quants” (Institutional Investor) (here), an article describing a forthcoming paper that purports to address some problems many factor investors run into—namely, how to assign weights to different factors. In other words, if you rank stocks based on momentum and value, how much should a stock’s ranking on momentum affect how highly you rank the stock overall? Likewise, how much should the stock’s ranking on value alone affect how highly you rank the stock overall? Note, the interviewee in the article claims the performance of value generally has been flattish for about the last 20 years. Presumably, he’s talking about “value” as measured by book-to-market ratios, which is how “value” has traditionally been measured (high book-to-market = good value). We don’t disagree about the performance of book-to-market-based stock selection measures lately. But we do disagree that that’s the right way to measure “value”. In our view, alternative measures have performed much better.

“Want to Remove Human Biases in Your Investment? Try Quant Funds” (Economic Times Markets) (here), a pretty good overview about what exactly quant investing is (doesn’t focus on quantamental so much, in particular, but rather the broader quant umbrella). The article covers a lot of the topics we’ve been talking about at a high level: removing human bias from investing decision-making, backtesting, testing models out-of-sample, avoiding “data mining” and overfitting. It’s a good primer for the newbies.

“Taleb-Asness Black Swan Spat Is a Teaching Moment” (Bloomberg) (here), a summary of a recent Twitter feud between two of the preeminent thinkers in financial markets today, Cliff Asness (of AQR Capital Management fame) and Nassim Nicholas Taleb (of Fooled By Randomness and Black Swan fame). Their debate apparently pertains to avoiding (or hedging against) really adverse and highly unexpected outcomes. Besides the article, we recommend reading pretty much all of Asness et al.’s papers, and certainly recommending reading Taleb’s books (at least the one’s we’ve mentioned here).

“Wirecard’s Former CEO Markus Braun Is Arrested,” (Wall Street Journal) (here), the WSJ’s detailed look at the unraveling of saga at Wirecard AG, the German payments processor, in which ~$2 billion disappeared from the company’s balance sheet, ultimately leading to the former CEO’s arrest this week.

“Stiglitz Urges Capitalism Rethink As Roubini Invokes Stagflation,” (Bloomberg) (here). Per the preamble: “[t]he global economy faces a bleak future in which capitalism could take a beating unless governments get their policy responses just right, two prominent economists warned.”

“Share Madness,” (City Journal) (here). Brokerage accounts at Schwab, TD Ameritrade, Etrade, and Robinhood are up 170 percent this year, largely due to huge numbers of Millennials investing for the first time who, besides just being new to capital markets, are reportedly causing elevated volatility with their supposedly wild and speculative bets. But, according to the article, “[c]oncern that the new, inexperienced traders are distorting markets is absurd, however.”

“The American Press Is Destroying Itself,” (Matt Taibbi) (here). This is an important (and, for some, perhaps uncomfortable) read from a prominent journalist and thinker discussing troubling trends in the media industry. Taibbi offers a detailed look at the “new movement…replacing traditional liberal beliefs about tolerance, free inquiry, and even racial harmony with ideas so toxic and unattractive that they eschew debate, moving straight to shaming, threats, and intimidation.” Anyone who cares about about radical transparency, truth-seeking, and objective analysis (all investors should) will find Taibbi’s commentary harrowing.

How Stoney Point sorts stocks

In our last post, we documented the performance of our Prime and Select strategies over our first month. But as we’ve said repeatedly (see here and here), it’s not just returns that matter. Investors should care about risk-adjusted returns. That is, investors should care about how their stock picks perform relative to the risk they assumed in selecting those stocks.

By returns what we mean is the change, over a particular period of time, in the realizable market value of the stocks, as well as the value of any dividends in the period as a percentage of the initial investment. By risk what we mean is the typical variation of the returns (the standard deviation). One simple way of getting at risk-adjusted returns is to take a stock’s total return and scale it by the quantum of risk.

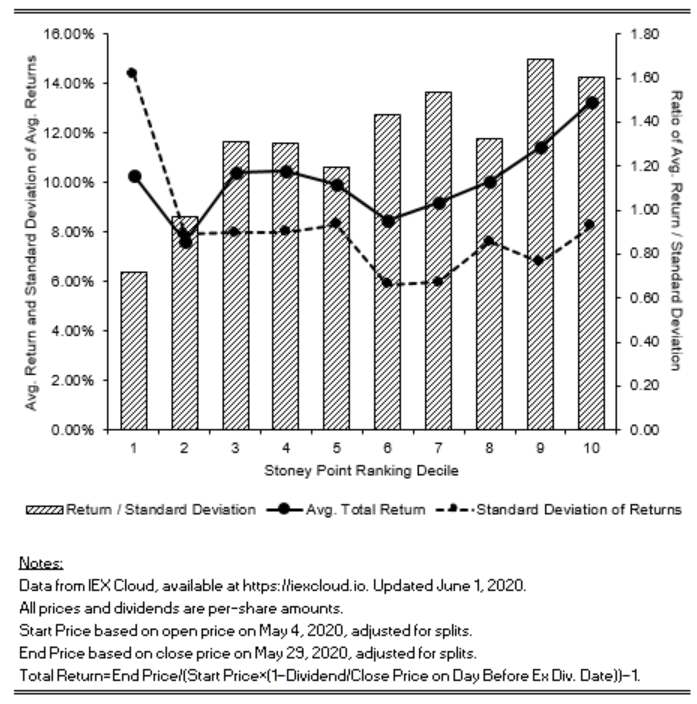

The figure below shows what happens when you take the stocks in the universe from which we draw our picks and sort them into deciles. Decile 1 includes the 10 percent of stocks in the universe that our model ranked as worst in the universe. Likewise, Decile 10 includes the 10 percent of stocks in the universe that our model ranked as best. If our model does a good of sorting stocks over time, the risk and return measures discussed above should correlate pretty well with our ranking—that is, Decile 1 should have a relatively lower average return and a higher average volatility (standard deviation), while Decile 10 should have a relatively higher average return and lower volatility. As the figure below suggests, our model did a pretty good job sorting stocks on May 2nd (when we ran the model) into groups that would ultimately exhibit relatively lower risk and relatively higher returns (e.g., Decile 10) and groups that would ultimately exhibit relatively higher risk and relatively lower returns (e.g., Decile 1) in the subsequent May 4-May 29 period.

Stay tuned for more updates and, as always, don’t forget to follow us on Twitter (@StoneyPointCap).

Our first month

It’s now been a full month of trading since we published our inaugural set of 10 free Select picks and 10 subscribers-only Prime picks, which makes it time for you to re-balance your Prime and Select portfolios, selling any picks no longer on the Prime and Select lists, and replacing them with the new names on the lists. Note that with the month coming to a close, we’ve already published our picks for next month. You can check them out here.

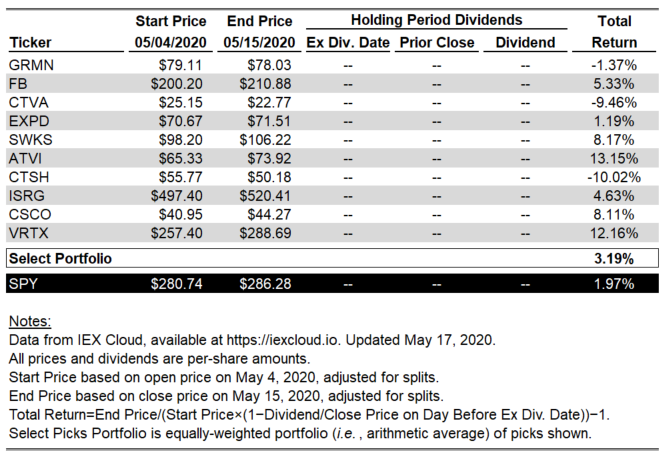

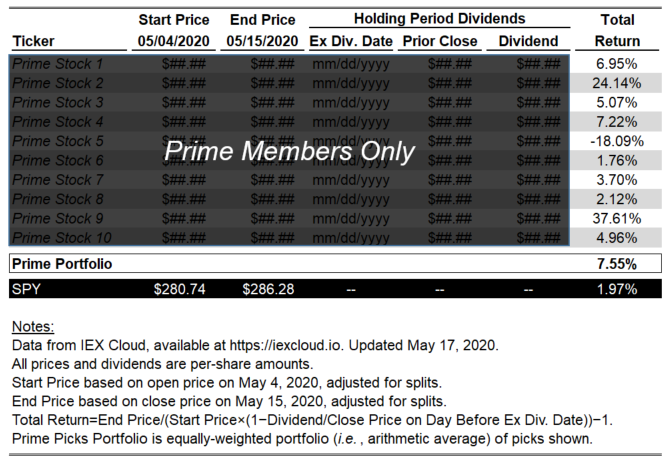

It’s also an opportune time to look back on how our Prime and Select picks performed over our first month. As in our prior posts, the charts below illustrate the performance of equally weighted portfolios comprising our 10 free Select picks and 10 subscribers-only Prime picks, respectively, which we published on May 2nd, against the U.S. equity market-tracking SPY ETF. Returns are calculated as described in the chart footnotes, and our May 23rd post on transaction costs can help you think about/calculate the costs of achieving the returns shown below (both SPY’s and Stoney Point’s).

In short, it was an explosive month for the U.S. stock market in general. By our calculations, the total gross return on an investment in SPY from the open on May 4 to the close on May 29 was 8.40%, which is north of the market’s historical average annual return, by many measures. But it was more explosive for both our Prime and Select picks. As shown below, the total gross returns of equally weighted portfolios of our Prime and Select picks over the same time period were 12.88 percent and 11.43 percent, respectively. At no point in the month was the total return on SPY from the start of the month higher than either our Select picks portfolio or our Prime picks portfolio.

Stay tuned for more analysis and be sure to re-balance now that the new picks are out. And, as always, don’t forget to follow up on Twitter (@StoneyPointCap).

Select picks

(month one)

Prime picks

(month one)

Our first three weeks

Two weeks ago, we published an update on the performance of Stoney Point’s Prime and Select picks over the course of our first week. Last week, we updated the numbers to reflect the performance of our picks over our second week. Today, as we close in on the end of the month and approach the publication of our next set of monthly picks, we’re updating the analysis again, to reflect the performance of our picks over our third week. As before, the tables below show the gross returns of our Prime and Select picks from the time we published them through today.

If you haven’t already, check out our latest post on how to think about transaction costs, and be sure to follow us on Twitter (@StoneyPointCap).

Select picks

(first three weeks)

Prime picks

(first three weeks)

Our first two weeks

About a week ago, we published an update on the performance of Stoney Point’s Prime and Select picks over the course of our first week. Since then, we’ve published some additional statistical analysis of the hypothetical historical performance of our model when backtested against some typical risk models common in the academic literature. If you have read those posts, we highly encourage it (see here, here, and here). Today, we’re updating the post from a week ago to incorporate our picks’ returns over the prior week. Along those lines, the tables below show the gross returns of our Prime and Select picks from the time we published them through today.

If you haven’t already, be sure to follow us on Twitter (@StoneyPointCap).

Select picks (first two weeks)

Prime picks (first two weeks)

Our first week

It’s now been five full trading days since we published our inaugural set of monthly Prime picks and Select picks. Of course, a week is just a blip in the lifecycle of an investment strategy, but we’re just too excited about this whole operation to not take a look back at how our picks of played out since last weekend.

First, in case you hadn’t noticed, the market in general was up (by our calculations, SPDR’s S&P 500-tracking exchange traded fund (“ETF”), SPY, was up 4.17 percent this week). We’ll explain more in a future post why we think the S&P 500 is a relevant benchmark for our investment strategy, in particular, but in general it’s uncontroversial to say that it’s a widely followed measure of the overall performance of U.S. equities (see, e.g., the mast head of CNBC.com, which reports the S&P’s performance in real time). Besides that, we think it’s a reasonable first guess at what most investors “could readily get” investing more or less “passively” (either through any number of mutual funds that use the S&P 500 as a benchmark by way of, for example, their 401(k) accounts, or through ETF’s on their individual investment accounts). The S&P 500-tracking SPY ETF is, after all, the single largest ETF in the world, with over $300 billion in assets and average daily trading volume of 60.6 million shares as of February 2020, according to ValueWalk).

That the market was up is well and good and we should all be pleased about that (if you have a 401(k), it’s very likely it performed similarly this week). But our objective here at Stoney Point is to do better than that. We fundamentally believe regular investors can systematically do better than just “buying the index,” and that belief is the very premise of this newsletter.

This week, at least, we did exactly that. By our calculations, our Select picks—which we offer free to literally anyone—outperformed the market by 227 basis points, appreciating 6.44 percent. Better yet, our Prime picks—available to subscribers—outperformed the market by 549 basis points, appreciating 9.66 percent, more than double the market’s performance.

Of course, there’s a lot of ballgame left in May. On top of that, it’s earnings season and the middle of an unprecedented viral pandemic, so things are arguably moving a little more than normal and we aren’t extrapolating these results out into the future (though it’s worth noting that, a priori, earnings results and pandemic-related developments could have amplified performance in either direction, good or bad). In any case, needless to say, we’re feeling encouraged.

P.S. Don’t forget to follow us on Twitter (@StoneyPointCap).

Select picks (week 1)

Prime picks (week 1)

Note: we corrected a typo to add the word “days” to the first sentence above on 5/17/2020.