What we’re reading (6/23)

Here’s a few things we’re reading today:

“The Missing Piece for Quants” (Institutional Investor) (here), an article describing a forthcoming paper that purports to address some problems many factor investors run into—namely, how to assign weights to different factors. In other words, if you rank stocks based on momentum and value, how much should a stock’s ranking on momentum affect how highly you rank the stock overall? Likewise, how much should the stock’s ranking on value alone affect how highly you rank the stock overall? Note, the interviewee in the article claims the performance of value generally has been flattish for about the last 20 years. Presumably, he’s talking about “value” as measured by book-to-market ratios, which is how “value” has traditionally been measured (high book-to-market = good value). We don’t disagree about the performance of book-to-market-based stock selection measures lately. But we do disagree that that’s the right way to measure “value”. In our view, alternative measures have performed much better.

“Want to Remove Human Biases in Your Investment? Try Quant Funds” (Economic Times Markets) (here), a pretty good overview about what exactly quant investing is (doesn’t focus on quantamental so much, in particular, but rather the broader quant umbrella). The article covers a lot of the topics we’ve been talking about at a high level: removing human bias from investing decision-making, backtesting, testing models out-of-sample, avoiding “data mining” and overfitting. It’s a good primer for the newbies.

“Taleb-Asness Black Swan Spat Is a Teaching Moment” (Bloomberg) (here), a summary of a recent Twitter feud between two of the preeminent thinkers in financial markets today, Cliff Asness (of AQR Capital Management fame) and Nassim Nicholas Taleb (of Fooled By Randomness and Black Swan fame). Their debate apparently pertains to avoiding (or hedging against) really adverse and highly unexpected outcomes. Besides the article, we recommend reading pretty much all of Asness et al.’s papers, and certainly recommending reading Taleb’s books (at least the one’s we’ve mentioned here).

“Wirecard’s Former CEO Markus Braun Is Arrested,” (Wall Street Journal) (here), the WSJ’s detailed look at the unraveling of saga at Wirecard AG, the German payments processor, in which ~$2 billion disappeared from the company’s balance sheet, ultimately leading to the former CEO’s arrest this week.

“Stiglitz Urges Capitalism Rethink As Roubini Invokes Stagflation,” (Bloomberg) (here). Per the preamble: “[t]he global economy faces a bleak future in which capitalism could take a beating unless governments get their policy responses just right, two prominent economists warned.”

“Share Madness,” (City Journal) (here). Brokerage accounts at Schwab, TD Ameritrade, Etrade, and Robinhood are up 170 percent this year, largely due to huge numbers of Millennials investing for the first time who, besides just being new to capital markets, are reportedly causing elevated volatility with their supposedly wild and speculative bets. But, according to the article, “[c]oncern that the new, inexperienced traders are distorting markets is absurd, however.”

“The American Press Is Destroying Itself,” (Matt Taibbi) (here). This is an important (and, for some, perhaps uncomfortable) read from a prominent journalist and thinker discussing troubling trends in the media industry. Taibbi offers a detailed look at the “new movement…replacing traditional liberal beliefs about tolerance, free inquiry, and even racial harmony with ideas so toxic and unattractive that they eschew debate, moving straight to shaming, threats, and intimidation.” Anyone who cares about about radical transparency, truth-seeking, and objective analysis (all investors should) will find Taibbi’s commentary harrowing.

How Stoney Point sorts stocks

In our last post, we documented the performance of our Prime and Select strategies over our first month. But as we’ve said repeatedly (see here and here), it’s not just returns that matter. Investors should care about risk-adjusted returns. That is, investors should care about how their stock picks perform relative to the risk they assumed in selecting those stocks.

By returns what we mean is the change, over a particular period of time, in the realizable market value of the stocks, as well as the value of any dividends in the period as a percentage of the initial investment. By risk what we mean is the typical variation of the returns (the standard deviation). One simple way of getting at risk-adjusted returns is to take a stock’s total return and scale it by the quantum of risk.

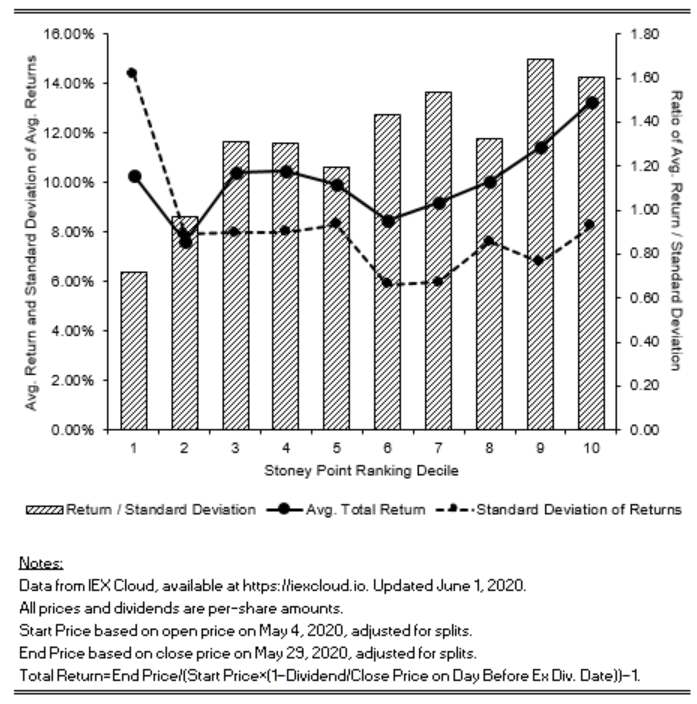

The figure below shows what happens when you take the stocks in the universe from which we draw our picks and sort them into deciles. Decile 1 includes the 10 percent of stocks in the universe that our model ranked as worst in the universe. Likewise, Decile 10 includes the 10 percent of stocks in the universe that our model ranked as best. If our model does a good of sorting stocks over time, the risk and return measures discussed above should correlate pretty well with our ranking—that is, Decile 1 should have a relatively lower average return and a higher average volatility (standard deviation), while Decile 10 should have a relatively higher average return and lower volatility. As the figure below suggests, our model did a pretty good job sorting stocks on May 2nd (when we ran the model) into groups that would ultimately exhibit relatively lower risk and relatively higher returns (e.g., Decile 10) and groups that would ultimately exhibit relatively higher risk and relatively lower returns (e.g., Decile 1) in the subsequent May 4-May 29 period.

Stay tuned for more updates and, as always, don’t forget to follow us on Twitter (@StoneyPointCap).

Our first month

It’s now been a full month of trading since we published our inaugural set of 10 free Select picks and 10 subscribers-only Prime picks, which makes it time for you to re-balance your Prime and Select portfolios, selling any picks no longer on the Prime and Select lists, and replacing them with the new names on the lists. Note that with the month coming to a close, we’ve already published our picks for next month. You can check them out here.

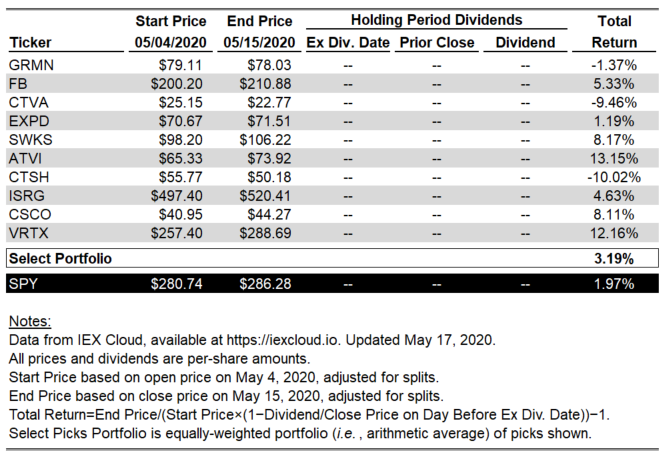

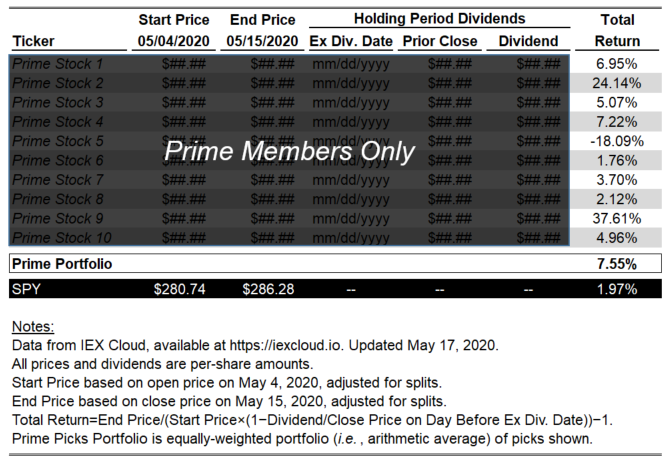

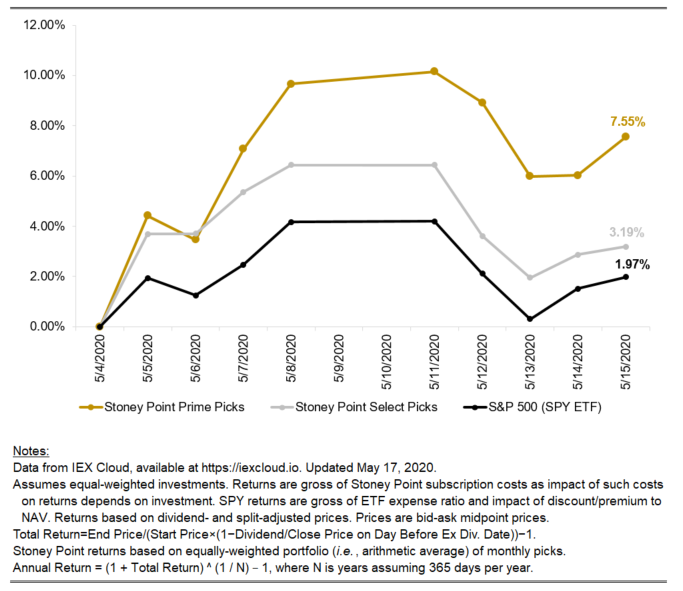

It’s also an opportune time to look back on how our Prime and Select picks performed over our first month. As in our prior posts, the charts below illustrate the performance of equally weighted portfolios comprising our 10 free Select picks and 10 subscribers-only Prime picks, respectively, which we published on May 2nd, against the U.S. equity market-tracking SPY ETF. Returns are calculated as described in the chart footnotes, and our May 23rd post on transaction costs can help you think about/calculate the costs of achieving the returns shown below (both SPY’s and Stoney Point’s).

In short, it was an explosive month for the U.S. stock market in general. By our calculations, the total gross return on an investment in SPY from the open on May 4 to the close on May 29 was 8.40%, which is north of the market’s historical average annual return, by many measures. But it was more explosive for both our Prime and Select picks. As shown below, the total gross returns of equally weighted portfolios of our Prime and Select picks over the same time period were 12.88 percent and 11.43 percent, respectively. At no point in the month was the total return on SPY from the start of the month higher than either our Select picks portfolio or our Prime picks portfolio.

Stay tuned for more analysis and be sure to re-balance now that the new picks are out. And, as always, don’t forget to follow up on Twitter (@StoneyPointCap).

Select picks

(month one)

Prime picks

(month one)

Our first three weeks

Two weeks ago, we published an update on the performance of Stoney Point’s Prime and Select picks over the course of our first week. Last week, we updated the numbers to reflect the performance of our picks over our second week. Today, as we close in on the end of the month and approach the publication of our next set of monthly picks, we’re updating the analysis again, to reflect the performance of our picks over our third week. As before, the tables below show the gross returns of our Prime and Select picks from the time we published them through today.

If you haven’t already, check out our latest post on how to think about transaction costs, and be sure to follow us on Twitter (@StoneyPointCap).

Select picks

(first three weeks)

Prime picks

(first three weeks)

Our first two weeks

About a week ago, we published an update on the performance of Stoney Point’s Prime and Select picks over the course of our first week. Since then, we’ve published some additional statistical analysis of the hypothetical historical performance of our model when backtested against some typical risk models common in the academic literature. If you have read those posts, we highly encourage it (see here, here, and here). Today, we’re updating the post from a week ago to incorporate our picks’ returns over the prior week. Along those lines, the tables below show the gross returns of our Prime and Select picks from the time we published them through today.

If you haven’t already, be sure to follow us on Twitter (@StoneyPointCap).

Select picks (first two weeks)

Prime picks (first two weeks)

Our first week

It’s now been five full trading days since we published our inaugural set of monthly Prime picks and Select picks. Of course, a week is just a blip in the lifecycle of an investment strategy, but we’re just too excited about this whole operation to not take a look back at how our picks of played out since last weekend.

First, in case you hadn’t noticed, the market in general was up (by our calculations, SPDR’s S&P 500-tracking exchange traded fund (“ETF”), SPY, was up 4.17 percent this week). We’ll explain more in a future post why we think the S&P 500 is a relevant benchmark for our investment strategy, in particular, but in general it’s uncontroversial to say that it’s a widely followed measure of the overall performance of U.S. equities (see, e.g., the mast head of CNBC.com, which reports the S&P’s performance in real time). Besides that, we think it’s a reasonable first guess at what most investors “could readily get” investing more or less “passively” (either through any number of mutual funds that use the S&P 500 as a benchmark by way of, for example, their 401(k) accounts, or through ETF’s on their individual investment accounts). The S&P 500-tracking SPY ETF is, after all, the single largest ETF in the world, with over $300 billion in assets and average daily trading volume of 60.6 million shares as of February 2020, according to ValueWalk).

That the market was up is well and good and we should all be pleased about that (if you have a 401(k), it’s very likely it performed similarly this week). But our objective here at Stoney Point is to do better than that. We fundamentally believe regular investors can systematically do better than just “buying the index,” and that belief is the very premise of this newsletter.

This week, at least, we did exactly that. By our calculations, our Select picks—which we offer free to literally anyone—outperformed the market by 227 basis points, appreciating 6.44 percent. Better yet, our Prime picks—available to subscribers—outperformed the market by 549 basis points, appreciating 9.66 percent, more than double the market’s performance.

Of course, there’s a lot of ballgame left in May. On top of that, it’s earnings season and the middle of an unprecedented viral pandemic, so things are arguably moving a little more than normal and we aren’t extrapolating these results out into the future (though it’s worth noting that, a priori, earnings results and pandemic-related developments could have amplified performance in either direction, good or bad). In any case, needless to say, we’re feeling encouraged.

P.S. Don’t forget to follow us on Twitter (@StoneyPointCap).

Select picks (week 1)

Prime picks (week 1)

Note: we corrected a typo to add the word “days” to the first sentence above on 5/17/2020.