September picks available now

The new Prime and Select picks for September are available starting now, based on a model run put through Today (August 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, September 2, 2024 (at the mid-spread open price) through the last trading day of the month, Monday, September 30, 2024 (at the mid-spread closing price).

September picks available soon

I’ll be publishing the Prime and Select picks for the month of September before Monday, September 2 (the first trading day of the month). As always, SPC’s performance measurement for the month of September, as well as SPC’s cumulative performance, will assume the sale of the August picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, August 30). Performance tracking for the month of September will assume the September picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, September 2).

What we’re reading (8/29)

“Feuding Founders Of Two Sigma Hedge Fund Stepping Down” (Wall Street Journal). “The founders of mega hedge fund Two Sigma are stepping down as co-chief executives in a bid to resolve a yearslong clash that had riven the $60 billion quant-trading powerhouse. Disagreements between John Overdeck and David Siegel, first reported by The Wall Street Journal, were so intense and distracting that they inhibited decision-making, according to people at the firm. Things got so bad Two Sigma felt compelled to disclose the strife to investors. Over the years, the relationship between the two had evolved “from irritation to cold war to hot war,” according to a person familiar with them.”

“SpaceX’s Risky Mission Will Go Farther Into Space Than We’ve Been In 50 Years” (Vox). “The team will spend five days aboard SpaceX’s Crew Dragon vessel, and will travel 870 miles away from Earth, in the farthest crewed mission since 1972’s Apollo 17 spaceflight to the moon. That distance will put the craft more than 200 miles inside the Van Allen radiation belts — regions in space that encircle the planet and are highly radioactive. They were detected on the first US space mission, in 1958, and their highly charged, energetic particles can damage spacecraft instruments.”

“What’s Going On With Leveraged Treasury Trades” (Capital Flows and Asset Markets). “Reading the excellent article by Brian Meehan of Bloomberg Intelligence, ‘Basis Trade Growth Is Massive’, I was reminded just how stupid clearinghouses really are. If you ever meet a head of a clearinghouse, I can assure it was not brains that got them to this key position in global finance. As the article points out, their is now a USD 1.2 trillion notional short position in US treasury futures. You should not read this as the market being bearish on treasuries. It is a levered trade to make a ‘risk free’ return on the difference in price between off the run treasuries and treasury future positions. For every short position in the treasury futures, there should be a long position in the physical market.”

“Wobbling Trump Trades, Harris Rise Have Wall Street Rethinking Bets” (Bloomberg). “Indexes from Goldman Sachs Group Inc. that track trading strategies for each party show the Democratic one started outperforming the Republican one right around the time Biden stepped down as candidate. And options positioning shows traders are paying more for protection against volatility around Election Day, even though overall volatility is expected to remain below the long-term average.”

“Fare Evasion Surges On N.Y.C. Buses, Where 48% Of Riders Fail To Pay” (New York Times). “Every weekday in New York City, close to one million bus riders — roughly one out of every two passengers — board without paying. The skipped fares are a crucial and growing loss of revenue for the Metropolitan Transportation Authority, which is under severe financial pressure. New York’s long-running fare evasion problem, among the worst of any major city in the world, has intensified recently; before the pandemic, only about one in five bus riders skipped the fare.”

What we’re reading (8/25)

“U.S. Treasuries Not The Safe Bet They Once Were, Research Says” (Reuters). “Long touted as hands-down the world's "safe haven" securities, the behavior of U.S. Treasuries during and after the COVID-19 pandemic calls that label into question, suggesting they are little different from the debt issued by the likes of Germany, Britain, France, or even big corporations. That's the key finding of new research presented at the Kansas City Fed's annual research conference in Jackson Hole, Wyoming. It examines a shift in investor behavior in that period that raises questions about the ‘exorbitant privilege’ the U.S. government has long enjoyed to borrow broadly on the global market even as federal budget gaps grow ever wider.”

“Mortgage Relief Is Coming” (Calafia Beach Pundit). “[T]he market expects the funds rate to fall 200 bps over the next 12 months. Thanks to these anticipated cuts, the 10-yr Treasury yield has fallen to 3.8%, down significantly from a high of 5.0% last October. 30-yr fixed mortgage rates—which are driven primarily by the 10-yr Treasury yield—have fallen from a high of 7.8% last October to just under 6.5% today.”

“Don’t Get Your Hopes Up About The Housing Market” (Business Insider). “[T]he impact of lower rates on affordability is complicated. On the one hand, lower borrowing costs would likely make mortgages cheaper for buyers and encourage builders to construct desperately needed new homes. But in the short term, a rate cut could trigger a rush of buyers to enter the market, overwhelming any new supply and driving up competition and prices. A rate cut ‘would probably result in more competition because demand would grow more than supply would,’ Daryl Fairweather, chief economist at Redfin, told Business Insider.”

“Why Is Rent So High? The Justice Dept. Blames A Tech Firm’s Algorithm.” (Washington Post). “The Justice Department and attorneys general from eight states are suing a Texas-based software company accused of using complex algorithms to enable widespread collusion in rents by landlords.”

“The Summer Is So Hot, Workers Are Wearing High-Tech Ice Packs” (Wall Street Journal). “New technologies for keeping people cool no matter the conditions are growing in popularity and sophistication. Used by soldiers on patrol, fast-food workers or mascots in costumes, what they have in common is simplicity, affordability and ease of use—all factors that have limited the deployment of this technology to date. These real-life Earth suits have the potential to keep people from suffering heat injury when the weather outside exceeds the temperature and humidity at which the human body can effectively cool itself.”

What we’re reading (8/24)

“How Costco Hacked The American Shopping Psyche” (New York Times). “In 2019, one quarter of U.S. consumers shopped at Costco. Today it is nearly one-third. Costco is the third-largest retailer in the world, behind only Amazon and Walmart. But the success of Costco goes far beyond hoarding. The company has hacked the psyche of the American consumer, appealing to both the responsible-shopping superego (‘Twelve cans of tuna for $18!’) and the buy-it-now id (‘I deserve that 98-inch flat screen’).”

“Preliminary Benchmark Revisions Wipe Out 30% Of Jobs Growth In The Past 16 Months” (Angry Bear). “Every month I write about the Jobs Report. But while it is timely, it is only an estimate. There is an actual census of over 95% of all employers that also gets reported, called the QCEW, and it is the “gold standard” of actual jobs growth (or loss). Its two drawbacks are that it is not seasonally adjusted, and it is reported almost 6 months after the end of the quarter it updates. Which is a lengthy introduction to saying that it was just reported through March of this year this morning. More importantly, the BLS preliminarily re-benchmarked all of its data beginning in March of last year. And which is a further introduction to saying that, as expected, job growth was a lot less late last year and earlier this year than we originally thought.”

“What We Know About Kamala Harris’s $5 Trillion Tax Plan So Far” (New York Times). “In a campaign otherwise light on policy specifics, Vice President Kamala Harris this week quietly rolled out her most detailed, far-ranging proposal yet: nearly $5 trillion in tax increases over a decade.”

“The Hell Of Self-Service Checkouts Is Becoming Kafkaesque” (The Telegraph). “The cost of living crisis hasn’t helped and supermarket chains are responding [to theft] with ever-more Kafkaesque security measures. For example, there are now shops where you can’t pass through an exit barrier until you’ve swiped your receipt. A friend recently went into a branch of Sainsbury’s on a futile quest for avocados, only to find she couldn’t leave as there were no assistants in sight and she had not forked out money. In the end, she had to buy some crisps solely to exit, which was effectively blackmail.”

“Messing Up The Closest Thing To A Sure Thing In The Stock Market” (Wall Street Journal). “Over the 10 years ended Dec. 31, 2023, Morningstar found, investors in the aggregate earned an average of 6.3% annually, or 1.1 percentage points less than the mutual funds and ETFs they owned. That echoes earlier findings from Morningstar and several academic and other studies. The consensus is clear: Investors typically underperform their investments, not just in mutual funds and ETFs, but in hedge funds and stocks as well.”

What we’re reading (8/19)

“Coming To A Cash-Strapped Company Near You: Creditor-On-Creditor Violence” (Wall Street Journal). “Grand alliances. Secret pacts. Betrayal. It’s all in a day’s work in the booming market for low-rated corporate debt. U.S. companies that struggle to repay their below-investment-grade bonds and loans have increasingly squeezed concessions from lenders by pitting them against one another. The private-equity firms and wealthy individuals who own most of the companies call the deals ‘liability management exercises,’ or LMEs. Debt investors call them ‘creditor-on-creditor violence.’”

“Alex Karp Has Money And Power. So What Does He Want?” (New York Times). “He’s not a household name, and yet Mr. Karp is at the vanguard of what Mark Milley, the retired general and former chairman of the Joint Chiefs of Staff, has called ‘the most significant fundamental change in the character of war ever recorded in history.’ In this new world, unorthodox Silicon Valley entrepreneurs like Mr. Karp and Elon Musk are woven into the fabric of America’s national security.”

“If The World Had A Hyperscale Datacenter Capital, It Would Be... Northern Virginia” (The Register). “If the internet can be said to have a geographic location, then perhaps it is Northern Virginia, which has the largest share of the hyperscale datacenter capacity within which the world's data is stored. Hyperscale companies accounted for 41 percent of the entire global bit barn presence last year, and this share is increasing, as The Register reported recently. Figures from Synergy Research Group show that Northern Virginia – close to Washington DC, and where the CIA is headquartered, FYI – accounts for nearly 15 percent of that entire hyperscale capacity – at least double that of where the next largest concentration can be found in Beijing, China.”

“Home Depot Issues A Warning About The Economy” (CNN Business). “The home improvement giant, a bellwether of consumer spending and the housing market, lowered its sales expectations for the year. It said customers were spending less on home improvement projects, pressured by higher interest rates and concerns that the economy is getting worse. Home Depot’s business is closely tied to the housing market, and high interest rates are putting a brake on housing turnover and consumers financing larger projects.”

“Private-Equity Firms Desperate For Cash Turn To A Familiar Trick” (Wall Street Journal). “Private-equity firms eager to pay their investors are returning to an old habit: loading up companies with risky debt. The rush into junk debt is letting buyout firms deliver payments to investors—and themselves—during a sharp slowdown in deals that is making it hard to sell portfolio companies. The transactions, which rely on low-rated debt, are known on Wall Street as dividend recapitalizations.”

What we’re reading (8/18)

“The CEO Who Made A Fortune While His Hospital Chain Collapsed” (Wall Street Journal). “Steward Health Care System was in such dire straits before its bankruptcy that its hospital administrators scrounged each week to find cash and supplies to keep their facilities running. While it was losing hundreds of millions of dollars a year, Steward paid at least $250 million to its chief executive officer, Dr. Ralph de la Torre, and to his other companies during the four years he was the hospital chain’s majority owner.”

“How A.I. Can Help Start Small Businesses” (New York Times). “[F]or some entrepreneurs, generative A.I. is already a game changer. It is helping them write intricate code, understand complex legal documents, create posts on social media, edit copy and even answer payroll questions. The result, they say, is that A.I. allowed them to get their companies off the ground more quickly, and more efficiently, than they would have without it.”

“Perspective Into The Pentagon’s U.F.O. Hunt” (New York Times). “Luis Elizondo made headlines in 2017 when he resigned as a senior intelligence official running a shadowy Pentagon program investigating U.F.O.s and publicly denounced the excessive secrecy, lack of resources and internal opposition that he said were thwarting the effort. Elizondo’s disclosures at the time created a sensation. They were buttressed by explosive videos and testimony from Navy pilots who had encountered unexplained aerial phenomena, and led to congressional inquiries, legislation and a 2023 House hearing in which a former U.S. intelligence official testified that the federal government has retrieved crashed objects of nonhuman origin. Now Elizondo, 52, has gone further in a new memoir. In the book he asserted that a decades-long U.F.O. crash retrieval program has been operating as a supersecret umbrella group made up of government officials working with defense and aerospace contractors. Over the years, he wrote, technology and biological remains of nonhuman origin have been retrieved from these crashes.”

“‘Dr Doom’ Files To Launch ETF Based On His Calamitous Outlook” (Financial Times). “Nouriel Roubini, aka Dr Doom, has been dishing up his downbeat takes on the global economy and markets for decades. Now investors will finally get the chance to see how his gloomy insights translate into financial returns as Roubini, who earned his Dr Doom moniker for foreseeing the 2008 global financial crisis, turns to managing money for the first time at the age of 66.”

“Insider Trading By Other Means” (Harvard Business Law Review). “For more than thirty years, one of the most prevalent strategies for insider trading has gone undetected and unaddressed. This Article uncovers the techniques by which executives and directors sell overvalued stock worth more than $100 billion per year, shifting losses to ordinary investors. The basic idea is that insiders conceal their suspicious trades by publicly reporting them (as they are required to do) in ways that confuse or discourage investigators. We develop a taxonomy of concealment strategies, complete with suggestive examples. We then empirically test our taxonomy using a database of essentially all stock trades since 1992. We find that insiders who trade using the subterfuges we describe outperform the market by up to 20% on average. Worse yet, we find evidence that this simple subterfuge works. Essentially no one has ever been prosecuted for undertaking one of these suspicious trades. Nor do journalists or scholars seem to appreciate them. Accordingly, we call for scholars and prosecutors to cast a wider net in their studies and market surveillance, then discuss implications for the design of insider-trading reporting requirements and related legal rules.”

What we’re reading (8/17)

“The Extreme Renters Who Own Nothing, Not Even Their Jeans” (Wall Street Journal). “Brittany Catucci rents everything she can. Like lots of 20-somethings, she doesn’t own the place where she lives, a three-story townhouse in Emeryville, Calif. But she and her boyfriend, Eric Markley, also rent their queen-size bed, Catucci’s work clothes and repair tools from Home Depot or AutoZone.”

“New Real Estate Rules Sow Confusion, At Least in Short Term” (New York Times). “The changes that went into effect this weekend decouple the two commissions: Sellers are no longer expected to pay buyers’ commissions, though they can still choose to do so, and the proposed commission split can no longer be advertised on the online database commonly used to sell homes, the M.L.S.”

“Inside The $93 Million Wall Street Heist That Stemmed From Russia” (CNBC). “The money Vladislav Klyushin made from stolen financial information literally piled up, filling a safe with stacks of hundred-dollar bills. At one point, he was hoarding over $3 million in illegal gains. In less than three years, Klyushin’s cybersecurity scam amassed more than $93 million. His company, M-13, acted as a front for Russian hackers to steal information under the guise of protecting it, getting their hands on American corporate earnings reports before the rest of the world could see them. Then, they traded based on that insight, buying and selling stock from well-known American companies like Skechers, Snapchat and Roku.”

“Alleged Ponzi Scheme Salesman Either A Bad Speller Or A Literate Masochist” (Dealbreaker). “There are some notable things about the nine-figure fraud allegedly perpetrated by St. Augustine’s Russell Todd Burkhalter. For one, his Drive Planning’s pitch deck noted that the “bridge loan opportunities” offered were backed by $113 million in cash and real estate—in other words, one-third of the money he raised, such that he could conceivably have actually backed those “opportunities” with that amount of collateral and still had nearly $200 million to spend on Ponzi payments and other things.”

“Democratic Favor Channel” (Dealbreaker). “A large body of literature in economics and political science examines the impact of democracy and political freedoms on various outcomes using cross-country comparisons. This paper explores the possibility that any positive impact of democracy observed in these studies might be attributed to powerful democratic nations, their allies, and international organizations treating democracies more favorably than nondemocracies, a concept I refer to as democratic favor channel. Firstly, after I control for being targeted by sanctions from G7 or the United Nations and having military confrontations and cooperation with the West, most of the positive effects of democracy on growth in cross-country panel regressions become insignificant or negatively significant.”

What we’re reading (8/15)

“Stock Indexes Rally After Data Calm Economic-Slowdown Fears” (Wall Street Journal). “The S&P 500 climbed 1.6% Thursday, rising for a sixth consecutive session. The tech-heavy Nasdaq Composite added 2.3%, while the Dow Jones Industrial Average rose 1.4%, or about 550 points. A trio of fresh data points reassured investors that consumer spending, the backbone of the U.S. economy, is holding up.”

“Investors Are Piling Into This Area Of Fixed Income For Protection Against Election And Market Volatility — And For Lower Taxes” (Business Insider). “Dan Close, head of municipals at the $1.2 trillion global investment manager Nuveen, is seeing increased appetite for these government-backed debt instruments. While 2022 and 2023 saw large net outflows from the muni market, 2024 has seen $12 billion of inflows year-to-date.”

“The Change That Realtors’ Powerful Trade Group Resisted For Decades Is Finally Happening” (CNN Business). “Starting this Saturday, the days of the standard 6% commission — two to three times what agents make in other developed economies — are effectively over. Sellers, who historically have paid both the listing agent and the buyer’s Realtor, will be on the hook for their agent’s fee. Buyers and their agents will negotiate a compensation plan upfront. ‘It’s a partial deregulation of a marketplace that was regulated not by government, but by the industry,’ said Stephen Brobeck, senior fellow at the Consumer Federation of America, a nonprofit advocacy group. ‘In the long run, it’s going to be a very good thing.’”

“The Unraveling Of A Crypto Dream” (New York Times). “But Mr. Pierce’s vision of a crypto-fueled economic turnaround has yet to materialize, according to hundreds of pages of court records and interviews with more than two dozen people familiar with his efforts in Puerto Rico. His business partners have turned on him, and some colleagues say he is running out of cash. There is no clear evidence that the arrival of tech entrepreneurs has helped the local economy.”

“Tax-Free Tips” (Marginal Revolution). “If the demand for labor is inelastic, the value of a wage subsidy is captured primarily by the employer. The wage subsidy arrives, and the employer does not start trying to hire more labor as a consequence. After all, the demand for labor is inelastic. Since the demand for labor has not gone up, the net wage does not go up in the final equilibrium. The employer can just keep the subsidy, or if the subsidy is given to the worker, the employer can lower wages (or the quality of working conditions), leaving the previous net wage intact and the worker will not leave. So if you think minimum wage hikes are a decent idea, you also ought to think that non-taxed tips will benefit the boss, not the workers.”

What we’re reading (8/14)

“Venture Capital’s New Reality Check: ‘A Ton Of People Looking To Get Out Everywhere’” (Business Insider). “During the zero-interest-rate years, the ranks of the VC industry swelled…Now, the market downturn has cast many aspects of the industry in a harsh light. Rising interest rates, delayed initial public offerings, and a slump in public markets have hit the venture industry hard…Poor fund performance has made carry worthless, a growth-stage principal said. Many investors received meaningful carry in funds only a few years ago. But funds from the pandemic years didn't perform well because many companies were overvalued.”

“Mars’ Biggest Deal Clinched By Secretive, Deep-Pocketed Family” (Reuters). “A running joke among residents of McLean, Virginia is that the most secretive organization headquartered in their Washington D.C. suburb is not the Central Intelligence Agency, but rather a confectionery and pet products company. Here, the second-richest U.S. family runs Mars Inc, maker of M&M's candies and Pedigree pet food, out of a nondescript building with no corporate logo or any other identifying signage. The CIA's offices, on the other hand, even have a parkway exit sign…Mars, flush with cash and dominant in the food categories it is active in, decided to place its biggest ever bet on expansion -- the $36 billion acquisition of snack and cereal maker Kellanova it announced on Wednesday.”

“In Mars Megadeal, Big Food Wants To Get Bigger” (Wall Street Journal). “The agreement, one of the biggest on record among food makers, comes as consumers are balking at higher grocery prices and scrutiny is growing over the potential health impacts from processed food. Conditions are ripe for a fresh wave of consolidation as food companies’ sales growth slows and their stock-market valuations are depressed, according to Wall Street analysts and consultants. Pandemic-era pantry stocking and sharp price increases that continued in its aftermath fueled a sales boom for food companies. That growth has cooled, prompting executives to search for new ways to boost their businesses and cut expenses.”

“What Should We Do About Google?” (New York Times). “[C]onsider the remedies imposed on AT&T, the greatest tech monopoly of the 20th century. In 1956, the Justice Department settled a major antitrust suit against AT&T by requiring the company to stay out of computing — and to license, free, all of its 7,820 patents.”

“Temasek Spent Billions On US Tech Stocks Before July Selloff” (Yahoo! Finance). “Temasek increased the value of its holdings in 11 big tech firms by $3.3 billion in the three months ended June 30, according to an analysis of its two most recent 13F filings. The vast bulk of the increase — some $3.2 billion — went into six of those firms: Microsoft Corp., Apple Inc., Nvidia Corp., Alphabet Inc., Meta Platforms Inc. and Amazon.com Inc. By the end of July, however, most of those companies saw their stocks slide amid concern about the extent of AI-related gains and fears of a recession. Alphabet and Amazon’s share prices have fallen by about 12% since the end of June, while Microsoft’s are down around 7% over that period.”

What we’re reading (8/13)

“Markets Might Have Recovered. Investors’ Nerves Haven’t.” (Wall Street Journal). “[M]y guess is last Monday’s plunge shifted the psychology again. That’ll mean sellers appear more quickly when prices rise, and buyers are more reluctant to join in when prices fall. Watch out below.”

“Wall Street’s ‘Fear Gauge’ Might Be Lying To You About Last Week’s Market Turmoil” (Financial Times). “Based on the CBOE VIX’s intraday peak of 65.73, the market event that has been branded the ‘Summer Selloff’…was, as wags have been keen to point out, apparently one of the most significant volatility events to have ever hit US stocks. So was Monday August 5th really an event on par with the Covid-19 crash, the heights of the Notorious GFC, or Black Monday?”

“Starbucks Replaces CEO Laxman Narasimhan With Chipotle CEO Brian Niccol” (CNBC). “Starbucks announced Tuesday it’s replacing CEO Laxman Narasimhan with Chipotle CEO Brian Niccol, sending its stock soaring 24.5%, its best day ever. Chipotle’s stock fell over 10% on the news that Niccol would leave after a successful tenure at the burrito chain.”

“How To Read A Riot” (Financial Times). “What makes somebody riot? Why do people throw bricks at police while being filmed by dozens of phones, knowing it could get them a jail sentence that ruins their lives? Their decision may be political…[b]ut in fact, riots are not purely political events. They are more emotional than that. To understand them as a simple matter of rational actors calling for specific policies is to miss out a lot about why riots start, how they spread, and how authorities should respond.”

“Reservoir Of Liquid Water Found Deep In Martian Rocks” (BBC). “Scientists have discovered a reservoir of liquid water on Mars - deep in the rocky outer crust of the planet. The findings come from a new analysis of data from Nasa’s Mars Insight Lander, which touched down on the planet back in 2018. The lander carried a seismometer, which recorded four years' of vibrations - Mars quakes - from deep inside the Red Planet. Analysing those quakes - and exactly how the planet moves - revealed ‘seismic signals’ of liquid water.”

What we’re reading (8/8)

“S&P 500 Jumps 2.3% in Best Day Since 2022” (Wall Street Journal). “The S&P 500 posted its best day in nearly two years after a better-than-expected jobless claims report helped ease fears that the labor market is weakening. U.S. stock futures and Treasury yields rose immediately after the release of data showing initial jobless claims, a proxy for layoffs, were 233,000 during the week ended Aug. 3, down from the prior week’s recent high of 250,000. That helped alleviate some of the concern about a U.S. labor-market slowdown that rattled markets after last week’s weaker-than-expected jobs report.”

“U.S. Mortgage Rates Drop Sharply, With 30-Year At 6.47%” (New York Times). “Mortgage rates have fallen to their lowest level in more than a year, a balm for prospective home buyers and sellers in a challenging real estate market. The average rate on 30-year mortgages, the most popular home loan in the United States, dropped to 6.47 percent this week, Freddie Mac reported on Thursday.”

“Is There An AI Bubble — And Is It About To Pop?” (Vox). “How much is the future worth? Usually to answer that question, you’d need to ask philosophers or economists. But if you’re a tech CEO, you have an actual number: about $1 trillion. That’s how much the tech industry as a whole is set to spend building out the artificial intelligence industry over the coming years. And even in Silicon Valley, where several companies have market capitalizations that start with ‘T,’ a trillion dollars is a lot of money. And while you won’t find more fervent evangelists for AI anywhere than in the C-suite of companies like Google and Microsoft, eventually, all that money has to be recouped. The alternative would be an economic meltdown of the sort we haven’t experienced for years.”

“Paramount’s TV Networks Are Collapsing In A $6 Billion Hole” (Business Insider). “On Wednesday, Warner Bros. Discovery told investors its TV business was in free-fall, and that it would take a $9 billion writedown on those assets. On Thursday, it was Paramount's turn: The entertainment conglomerate, which is about to be acquired by David Ellison and a consortium of investors, just took a $6 billion charge on its TV business. For context: Public investors value all of Paramount's equity at $7 billion.”

“Not To Be Sniffed At: Dolce & Gabbana Launches Luxury Dog Perfume” (HNGN). “No need to wrestle your dog into the bath anymore. Italian luxury fashion house Dolce & Gabbana has launched a new perfume for canine companions. The ‘alcohol-free scented mist for dogs’ is on sale for 99 euros ($108 USD) and comes with a free collar -- but also a warning from animal rights activists, who say it could cause pets distress.”

July (and June) performance update

Here with an overdue performance update (I was delayed in dealing with data provider issues for about a month or so — in short, IEX Cloud shut down its API for good).

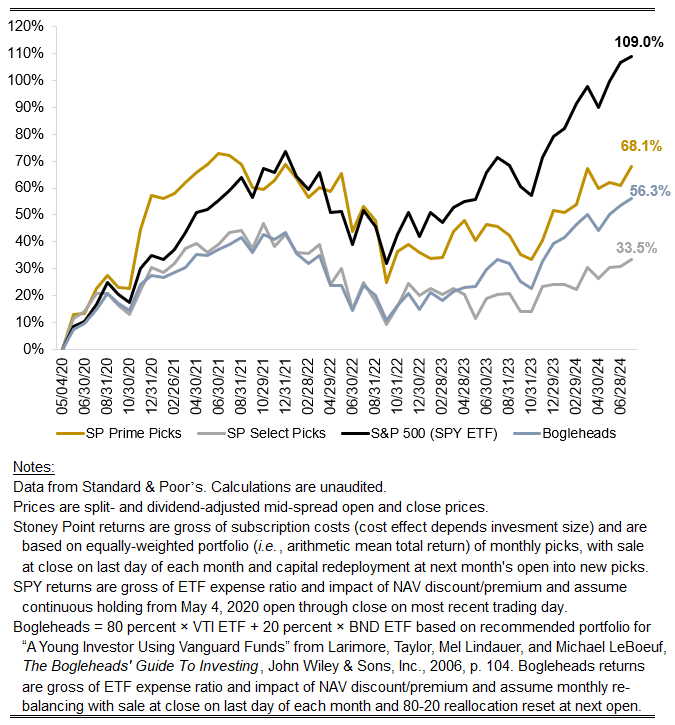

For July:

Prime: +4.42%

Select: +2.06%

SPY ETF: +0.95%

Bogleheads Portfolio (80% VTI + 20% BND): +1.76%

For June:

Prime: -0.60%

Select: +0.14%

SPY ETF: +3.25%

Bogleheads Portfolio (80% VTI + 20% BND): +2.21%

June was another weak month for Prime and Select, but the rotation is July was notable and widely discussed. The AI megatrend driving the largest names in the S&P 500 seemed to deflate a bit and small-cap gains were explosive after years of weak returns relative to larger stocks. Those factors alone would not be likely to explain the outperformance of Prime and Select in July, but an improved outlook for value strategies more generally would.

August has been a bloodbath across U.S. equities so far, so let’s see how the rest of the month plays out.

Total Performance History

August picks available now

The new Prime and Select picks for August are available starting now, based on a model run put through Today (July 31). As a note, I will be measuring the performance on these picks from the first trading day of the month, Thursday, August 1, 2024 (at the mid-spread open price) through the last trading day of the month, Friday, August 30, 2024 (at the mid-spread closing price).

What we’re reading (7/30)

“It’s Not The End Of The World If The Fed Doesn’t Cut Rates Tomorrow” (CNN Business). “The Federal Reserve is all but certain to hold interest rates steady at its meeting this week. But a growing crowd of economists — among them, former Fed Vice Chair Alan Blinder and Nobel prize-winner Paul Krugman — are urging central bankers to cut now rather than at September’s meeting, when it is widely expected to do so.”

“Microsoft Has Investors Really Freaking Out About Big Tech’s AI Spending” (Business Insider). “Analysts had big expectations for Microsoft's cloud growth this quarter — and the tech giant seems to have fallen short of them even as it pumps money into its AI plans. Microsoft released its Q4 earnings Tuesday afternoon, and the company grew its Azure cloud unit's revenue by 29%. That came in slightly shy of Wedbush analysts' expectations for 30% growth in this ‘most important metric.’ Shares dropped in postmarket trading.”

“How YouTube Took Over Our Television Screens” (New York Times). “YouTube consistently ranks as the most popular streaming service on U.S. televisions, surpassing the companies it once tried to emulate. The platform’s unlikely ascent to the top of the leaderboard shows that more than a decade into the streaming era, the internet has continued to change the nature of TV and the habits of viewers.”

“OpenAI Rolls Out Voice Mode After Delaying It For Safety Reasons” (Washington Post). “OpenAI’s fans and customers have clamored for the voice mode, with some complaining online when the company delayed the launch in June. The new feature will be available to a small number of users at first, and the company will gradually open it up to all of OpenAI’s paying customers by the fall.”

“American Consumers Feeling More Confident In July As Expectations Of Future Improve” (Associated Press). “American consumers felt more confident in July as expectations over the near-term future rebounded. However, in a reversal of recent trends, feelings about current conditions weakened. The Conference Board, a business research group, said Tuesday that its consumer confidence index rose to 100.3 in July from a downwardly revised 97.8 in June. The index measures both Americans’ assessment of current economic conditions and their outlook for the next six months.”

What we’re reading (7/29)

“Investors On Alert For Fed Signals Of September Rate Cut” (Wall Street Journal). “The big question going into the Federal Reserve’s meeting Wednesday comes down to how strongly officials signal their desire to cut rates. The central bank is widely expected to hold its benchmark short-term interest rate steady—in a range between 5.25% and 5.5%, a two-decade high—while setting the table to begin a series of reductions at the next meeting in mid-September.”

“McDonald’s Earnings, Revenue Miss Estimates As Consumer Pullback Worsens” (CNBC). “Company executives acknowledged that diners considered their prices too high and said that they are taking a ‘forensic approach’ to evaluating value offerings and working with franchisees to make the necessary adjustments.”

“Texas Crude Oil Pipelines Full To The Brim, Getting Worse” (Bloomberg). “Crude oil pipelines connecting the busiest Texas oil fields to a critical export hub across the state are nearly out of space, threatening to cap US oil exports at a time when the world needs more.”

“Ethiopia Floats Its Currency In A Bid To Secure Loans” (Semafor). “Ethiopia’s government has allowed its currency to be traded on the open market instead of at a fixed rate as part of reforms aimed at securing loans from international lenders to stabilize its economy. The birr’s value against the dollar fell by 30% after it was allowed to float on Monday, said the country’s biggest lender, Commercial Bank of Ethiopia. Removing the central bank’s fixed rate is part of sweeping reforms aimed at easing the chronic shortage of foreign currency that have plagued its economy.”

“The Problem Of The Tariff In American Economic History, 1787–1934” (CATO Institute). “‘The pursuit of free trade as national policy in the United States predates the Constitution. Responding to a Spanish government inquiry in 1780, John Jay expressed the fledgling nation’s commitment to a principle of unimpeded exchange: “every man being then at liberty, by the law, to cultivate the earth as he pleased, to raise what he pleased, to manufacture as he pleased, and to sell the produce of his labor to whom he pleased, and for the best prices, without any duties or impositions whatsoever.’ Jay’s sentiments captured the Founding generation’s unease with Britain’s habit of manipulating its colonies’ trading patterns through political interventions—a stated grievance of the Declaration of Independence some four years prior.”

August picks available soon

I’ll be publishing the Prime and Select picks for the month of August before Thursday, August 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of August, as well as SPC’s cumulative performance, will assume the sale of the July picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Wednesday, July 31). Performance tracking for the month of August will assume the August picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Thursday, August 1).

What we’re reading (7/22)

“Nike Is In Trouble. Can the Olympics Save It?” (Newsweek). “Nike is going for gold this summer as an official supplier for Team USA's competition uniforms for the Paris 2024 Olympic following a string of problems with the company, including poor financial performance, job cuts and criticism over its products. The sportswear brand took a kicking this spring for its Major League Baseball uniforms, with players complaining of color mismatches, see-through pants and fabric that changed after coming into contact with sweat.”

“Paul Singer Thinks There’s More That Sucks About Starbucks Than The Coffee” (Dealbreaker). “He may have been annoyed that the bacon-egg-and-gouda sandwich he’d been craving to go alongside cinnamon dolce latte was out of stock. Perhaps he popped in to one of a recent trip to China and noticed how empty it was compared the growing number of competing roasteries around it. That or, like founder Howard Schultz, he noticed that its stock was down by nearly a quarter this year and decided it was Starbucks itself rather than his own swimming head that required a pick-me-up.”

“The Spectacular Rise And Surprising Staying Power Of The George Foreman Grill” (The Hustle). “This year marks the 30-year anniversary of the grill, officially known as the George Foreman Lean Mean Fat Reducing Grilling Machine. After a slow start, it became an indelible part of ‘90s consumer culture and the world’s most popular product for cooking hamburgers, hot dogs, salmon, and just about everything else (Oprah Winfrey preferred it for bacon).”

“Global Computer Collapse Is A Chilling Look At What’s To Come” (New York Post). “In recent years, there have been an increasing number of widescale internet outages, whether from Amazon’s cloud platform collapsing, misconfigurations in fundamental network infrastructure, or actual hardware. The CrowdStrike outage was worse than any of these because it didn’t just hit the backbone of the internet, but individual endpoint computers, knocking out crucial services not just from a central failure, but by taking down everything it touches.”

“The 401(k) Rollover Mistake That Costs Retirement Savers Billions” (Wall Street Journal). “Workers miss out on billions in investment gains by pulling retirement savings out of the stock market after switching jobs—often without meaning to. When people roll 401(k) balances from their old company’s plan into an individual retirement account, the money is frequently held as cash until they select new investments. Many never do, according to new research from Vanguard Group. Nearly a third who rolled savings into IRAs at Vanguard in 2015 still had the balance sitting in cash seven years later.”

What we’re reading (7/21)

“A Stock Market Rotation Of Historic Proportions Is Taking Shape” (Wall Street Journal). “The stock market has suddenly turned upside down. The market’s laggards have sprung to life in recent days, while the seemingly impervious “Magnificent Seven” group of technology stocks has stumbled. Investors are even more focused than usual on corporate earnings as they try to anticipate what comes next. The Russell 2000 index of smaller stocks beat the S&P 500 over the seven days through Wednesday by the largest margin during a period of that length in data going back to 1986, according to Dow Jones Market Data. The Russell 1000 Value index, meanwhile, notched its biggest lead over its growth-stock counterpart since April 2001, after the dot-com bubble burst.”

“History Says The Wild Small-Cap Stock Rally Isn’t Going To Last” (Inc Magazine). “Small-cap stocks have been the big surprise in markets this month, fueled by a combination of rate cut expectations and rising odds for a second Trump presidency. That said, the group's blistering rally has fallen off as abruptly as it began. While the market's strength does seem to be broadening beyond mega-cap tech names, that does not mean small-caps will keep marching higher. From July 1 to July 16, the S&P 600 small-cap index recorded a 10.2 percent gain. In the last two days, however, the index fell about two percent.”

“RIP Hedge Fund Superstars” (Insider). “What is clear is that hedge funds run by an individual star, by one prodigious mind, are not raising the massive money they used to. Clients who once were proud to hand their money to a specific person are pushing back; they want to pay lower fees and see less-volatile returns. The funds that have survived rely on a stable of faceless traders testing out different ideas, brokering transactions, and harvesting the returns for the collective. Quant strategies — which are built on algorithmic trading — have also become more popular with the ultrawealthy. More robots, fewer people, lower overhead.”

“Apple Should Buy HBO” (Spyglass). “Two problems: Apple needs content, Warner Bros Discovery needs money. One solution: Apple has money, WBD has content. Come on folks, this isn't rocket science. It's not any kind of science. It's business. Well, as much as show business actually is still a legitimate business. A distinction which seems tenuous at best for most companies these days.”

“Costs From The Global Outage Could Top $1 Billion – But Who Pays The Bill Is Harder To Understand” (CNN Business). “Experts largely agree it’s too early to get a firm handle on the price tag for Friday’s global internet breakdown. But those costs could easily top $1 billion, said Patrick Anderson, CEO of Anderson Economic Group, a Michigan research firm that specializes in estimating the economic cost of events like strikes and other business disruptions.”

What we’re reading 7/20

“Where Do Economists Think We’re Headed? These Are Their Predictions” (Wall Street Journal). “The Wall Street Journal’s latest quarterly survey of business and academic economists shows forecasters remain firmly optimistic about the economic outlook, despite some hints of weakness in recent data.”

“Can Value Stocks Really Make A Comeback?” (Morningstar). “For value stock investors, 2024 looked like another “Wait ‘til next year” scenario, with mega-sized technology stocks driving the market higher. However, after months of lagging behind growth stocks (especially those riding the artificial intelligence wave), value stocks surged ahead this past week. A prime catalyst came from geopolitical concerns threatening the AI-driven boom in semiconductor stocks. At the same time, growing confidence that Federal Reserve rate cuts are finally on their way has the potential to make the dividends offered by many value stocks more attractive.”

“‘Greatest Bubble’ Nearing Its Peak, Says Black Swan Manager” (Wall Street Journal). “‘[Universa Investments’ Mark] Spitznagel predicts an even worse shakeout than a quarter-century ago because the excesses are more extreme—the “greatest bubble in human history.’ High public indebtedness and valuations make a Washington-led rescue harder to pull off. He sees today’s benign slowdown in inflation overshooting and says the U.S. economy could enter a recession by the end of the year.”

“What Presidential Election? So Far, The Stock Market Doesn’t Care.” (New York Times). “The stock market…is remarkably indifferent to the nation’s political fortunes. On Monday there were big moves in stocks perceived as benefiting from a Trump presidency, but that exuberance didn’t last. Instead, the market seems to be focused on issues that have little to do with politics, like the possibility of a Federal Reserve rate cut, heartening corporate earnings reports or the allure of artificial intelligence stocks.”

“Microsoft’s Global Sprawl Comes Under Fire After Historic Outage” (Washington Post). “A cascading computer outage that grounded planes, stymied hospitals and disrupted critical public services exposed the depth of the global economy’s dependence on a single company: Microsoft. Regulators and lawmakers across the political spectrum raised alarm that the sprawling outage that knocked out Windows showcases the danger of so much power concentrating into one firm, which drives governments, businesses and critical infrastructure around the world.”