What we’re reading (7/9)

“Powell Inches The Fed Closer To Cutting Rates” (Wall Street Journal). “Federal Reserve Chair Jerome Powell made a subtle but important shift that moved the central bank closer to lowering interest rates when he suggested Tuesday that a further cooling in the labor market could be undesirable.”

“What Happens When Your Bank Isn’t Really a Bank And Your Money Disappears?” (New York Times). “The promise of bank insurance — a tenet of U.S. consumer protection since the Great Depression — is now being tested by a crisis swirling around online-only lenders with hundreds of millions of dollars of deposits between them. Customer accounts have been frozen, preventing people from cashing out their life savings. Most depositors have little clue where their money has gone, and whether they will get any of it back. The turmoil was set off this spring with the bankruptcy of Synapse Technology, the kind of company you’ve probably never heard of unless you suffered through all the fine print of your account statements. It operated banking software for fast-growing online lenders with names like Juno, Yieldstreet and Yotta.”

“It Suddenly Looks Like There Are Too Many Homes For Sale. Here’s Why That’s Not Quite Right. (CNBC). “The numbers…are deceiving due to the unprecedented dynamics of today’s housing market, which can be traced back two decades to another unprecedented time in housing, the subprime mortgage boom. All of it is precisely why home prices, which usually cool off when supply is high, just continue to rise.”

“A Bank Created Fake Accounts, Forced Clients Into Unnecessary Car Insurance And Repossessed Vehicles When They Didn’t Pay. Now It Has Agreed To $20 Million In Penalties” (CNN Business). “Fifth Third Bank on Tuesday said it agreed to pay $20 million in penalties imposed by the Consumer Financial Protection Bureau to settle a CFPB investigation into its auto insurance practices, and a 2020 lawsuit the agency filed pertaining to the bank’s creation of fake customer accounts.”

“The Precipitous Fall Of The Japanese Yen” (The Week). “There are several factors, but it is mainly a ‘product of divergent monetary policy between the Bank of Japan and its developed-market peers — particularly the Federal Reserve,’ said Barron's. This is the result of a wide difference in interest rates between the U.S. and Japan; the Bank of Japan ‘has only just begun to ease off intense monetary stimulus, while the Fed and other central banks are years into tightening cycles.’”

What we’re reading (7/8)

“Why Your Fund Manager Can’t Beat Today’s Stock Market” (Wall Street Journal). “[T]raditional measures like correlation and dispersion have lost much of their meaning and nearly all of their relevance. The 10 biggest stocks own the market right now, and anyone who doesn’t own them is left out in the cold—at least for the time being.”

“How A New York Short-Seller Took On One Of The World’s Richest People, Wiped Out $150 Billion In Market Value, And Barely Made Any Money” (Insider). “Nate Anderson, the chief mind behind activist short-seller Hindenburg Research, has had an eventful past 18 months. In January 2023, he accused the Indian conglomerate owned by Gautam Adani — one of the world's richest people — of fraud, subsequently wiping out $153 billion in market value from its associated companies. This led Indian regulators to his doorstep and forced him into defensive mode. A war of words has persisted ever since. A year and a half later, the battle continues. And based on new information released by Hindenburg, one might wonder whether it was all worth it.”

“The Intense Battle To Stop AI Bots From Taking Over The Internet” (The Independent). “A number of companies have taken major steps to stop scrapers from attempting to take their text. It is the latest front in an ongoing and apparently escalating battle between websites that allow people to read text and the AI companies that wish to use it to build their new tools.”

“Property Fraud Allegations Snowball As Commercial Real-Estate Values Fall” (Wall Street Journal). “Regulators and federal prosecutors say that property loans based on doctored building financials and valuations have been rising. This type of fraud became more widespread between the mid-2010s and 2021, federal investigators and real-estate brokers say, when commercial property prices surged to new highs and landlords had much to gain from such maneuvers. Now, the drop in property values caused by higher interest rates and a rise in defaults are exposing more of these schemes, dealing another blow to a commercial real-estate market suffering through its worst stretch since the 2008-09 financial crisis.”

“The American Elevator Explains Why Housing Costs Have Skyrocketed” (New York Times). “Through my research on elevators, I got a glimpse into why so little new housing is built in America and why what is built is often of such low quality and at high cost. The problem with elevators is a microcosm of the challenges of the broader construction industry — from labor to building codes to a sheer lack of political will. These challenges are at the root of a mounting housing crisis that has spread to nearly every part of the country and is damaging our economic productivity and our environment.”

July picks available now

The new Prime and Select picks for July are available starting now, based on a model run put through Today (June 30). As a note, I will be measuring the performance on these picks from the first trading day of the month, Monday, July 1, 2024 (at the mid-spread open price) through the last trading day of the month, Wednesday, July 31, 2024 (at the mid-spread closing price).

What we’re reading (6/28)

“Wall Street Seems Calm. A Closer Look Shows Something Else.” (New York Times). “A widely tracked measure of bets on more volatility to come is close to its lowest-ever level. But a look beneath the surface reveals much greater turbulence. Nvidia, for example, whose rising stock price helped it become the most valuable public company in America last week, is up more than 150 percent this year. The price has also repeatedly had deep plunges in the last six months, shaving billions of dollars of market value each time.”

“Diversity Was Supposed To Make Us Rich. Not So Much.” (Wall Street Journal). “When management consulting firm McKinsey declared in 2015 that it had found a link between profits and executive racial and gender diversity, it was a breakthrough. The research was used by investors, lobbyists and regulators to push for more women and minority groups on boards, and to justify investing in companies that appointed them. Unfortunately, the research doesn’t show what everyone thought it showed.”

“Inside The New Job Stress Test” (Business Insider). “Purporting to be the "only sports evaluation that scientifically measures an athlete's game-speed cognitive abilities down to a millisecond level," these tests — which feel like a cross between playing Pong and taking an eye exam — have fast become part and parcel of how many scouts find the next billion-dollar athlete. More than 52 colleges and universities and 16 of the NFL's 32 teams pay S2 to administer tests to prospective signees and to keep the results confidential.”

“Mark Zuckerberg Warns AI Companies Are ‘Trying To Create God’ In Stark Warning – But He Has The Key To Save Us All” (The U.S. Sun). “‘I find it a pretty big turnoff when people in the tech industry kind of talk about building this one true AI,’ Zuckerberg said. ‘It's almost as if they think they're creating God or something. And it's like, that's not what we're doing.’ The tech tycoon sat down for an interview with YouTube creator Kane Kallaway to discuss the future of AI and tease the tools in development at Meta.”

“Layoffs Watch ’24: Baupost Group” (Dealbreaker). “Seth Klarman thinks things are gonna get pretty bad, which means they’re already bad for one in five members of his Baupost Group’s investing team. Eleven of them have been given their walking papers, the largest layoff in the Boston hedge fund’s history, and its first significant reduction since pandemic days.”

July picks available soon

I’ll be publishing the Prime and Select picks for the month of July before Monday, July 1 (the first trading day of the month). As always, SPC’s performance measurement for the month of May, as well as SPC’s cumulative performance, will assume the sale of the June picks at the closing price (at the mid-point of the closing bid and ask prices) on the last trading day of the month (Friday, June 28). Performance tracking for the month of July will assume the July picks are bought at the open price (at the mid-point of the opening bid and ask prices) on the first trading day of the month (Monday, July 1).

What we’re reading (6/25)

“Americans Chasing High Interest Rates Risk Falling Into A ‘Cash Trap’” (Wall Street Journal). “Americans have poured money into cash-like investments since the Fed began raising interest rates, driving assets in money-market funds to a record $6.12 trillion earlier this month, according to the Investment Company Institute. Now, Wall Street traders are betting rates have peaked and those investors face a choice: keep sitting on their cash as interest payments shrink, or figure out how to redeploy the money.”

“Bond Traders Boldly Bet On 300 Basis Points Of Fed Cuts By March” (Bloomberg). “Traders in the US rates options market are embracing a nascent wager on the Federal Reserve’s interest-rate path: a whopping 3 percentage points worth of cuts in the next nine months. Over the past three sessions, positioning in the options market linked to the Secured Overnight Financing Rate shows an increase in bets that stand to benefit if the central bank reduces its key rate to as low as 2.25% by the first quarter of 2025.”

“Fed Officials Are Talking Down The Chance Of Rate Cut This Year” (CNN Business). “At the beginning of the year, Federal Reserve officials projected they would cut interest rates three times this year. By June, they had lowered that projection to just one cut. Now some key policymakers say it won’t happen at all. On Tuesday morning, Fed governor Michelle Bowman said that she’s expecting no rate cuts this year.”

“Julian Assange Pleads Guilty To Espionage Charge, Ending Years Of Legal Deadlock” (Washington Post). “WikiLeaks founder Julian Assange pleaded guilty Tuesday to a felony charge of violating the Espionage Act after his organization obtained and published classified military and diplomatic documents in 2010.”

“Elon Musk Argues Twitter Flip-Flopping Not Manipulation Because His Legal Case Was So Bad” (Dealbreaker). “Late last week, Elon Musk’s attorneys from Quinn Emanuel offered a new theory for tossing an investor suit claiming that his public bad-mouthing and eventual litigation over his Twitter acquisition was an effort to drive down the share price: no one reasonably could be dumb enough to believe him.”

What we’re reading (6/24)

“Hedge Funds Made A Killing On FTX—Then It Got Complicated” (Wall Street Journal). “Hedge funds and other distressed investors rejoiced last month when bankruptcy managers said the corporate carcass of FTX, Sam Bankman-Fried’s collapsed crypto exchange, had enough assets to more than make its creditors whole. Since FTX’s 2022 implosion, hedge funds had scooped up the rights to customers’ frozen accounts for pennies on the dollar, with five firms alone buying claims with a combined face value of about $2.4 billion. That meant a huge payday was in store. But collecting these winnings won’t be straightforward. Investors are mired in legal battles with some of the original owners of the claims. They allege those former FTX customers abruptly reneged on trades and are suffering from an age-old affliction: seller’s remorse.”

“After Surpassing Microsoft, Can Chipmaker Nvidia Remain World’s Most Valuable Company?” (New York Post). “This week, chipmaker Nvidia soared to a market capitalization of more than three trillion dollars, surpassing Microsoft as the most valuable company on the planet. The historic run-up has drawn comparisons to the headier days of the dot-com era nearly three decades ago. Are they correct? When it comes to Nvidia, we’re probably not in a bubble — at least not yet. Indeed, investors have good reason to remain optimistic about the chip-maker’s prospects.”

“Nvidia’s Shares Are On Fire. The Broader Market Looks Less Rosy” (CNN Business). “The S&P 500 index has jumped nearly 15% so far in 2024, notching 31 new peaks along the way. Much of those returns have been driven by the mega-cap Magnificent Seven stocks, which have seen explosive growth as investors pour cash into the burgeoning artificial intelligence boom. But beyond that cohort of tech stocks, the market is looking less rosy. The S&P 500 equal-weighted index, which gives every stock the same weighting, has risen just 4% this year.”

“Uh-Oh: A Story Of SpaghettiOs And Forgotten History” (Snack Stack). “Beyond the shape, the new products sold well because they capitalized on the broader trend of Italian (and Italian-inspired) foods made for an American audience. Goerke was surfing that wave. A decade earlier, newspapers identified had identified part of the rising fad of “Continental” food, and pizza and pasta and their ilk were becoming ubiquitous. (Go read Ian McCellan’s Red Sauce if you’d like a deep dive.)”

“One Index, Two Publishers And The Global Research Economy” (David Mills, Oxford Review of Education). “The emergence of a global science system after the second world war was spurred by transformations in academic publishing and information science. Amidst Russian-American technological rivalries, funding for science expanded rapidly. Elsevier and Pergamon internationalised journal publishing, whilst tools such as the Science Citation Index changed the way research was measured and valued. This paper traces the connections between the post-war expansion of academic research, new commercial publishing models, the management of research information and Cold War geopolitics. Today, the analysis and use of research metadata continues to revolutionise science communication. The monetisation of citation data has led to the creation of rival publishing platforms and citation infrastructures. The value of this data is amplified by digitisation, computing power and financial investment. Corporate ownership and commercial competition reinforce geographical and resource inequalities in a global research economy, marginalising non-Anglophone knowledge ecosystems as well as long-established scholar-led serials and institutional journals. The immediate future for academic publishing will be shaped by a growing divide between commercial and ‘community-owned’ open science infrastructures.”

What we’re reading (6/23)

“Can The Dollar Stay On Top?” (The Week). “‘The big threat to dollar dominance is American dysfunction,’ Steven B. Kamin and Mark Sobel said at Financial Times. The dollar gets its strength from the size of the American economy, which produces 25% of global GDP. That could all go away, though, if "U.S. political dysfunction continues to run amok’ and politicians continue to add to the national debt at unsustainable rates. ‘If the U.S. doesn’t keep its house in better order, dollar dominance will be the least of our worries.’”

“Apple, Meta Have Discussed An AI Partnership” (Wall Street Journal). “In its hustle to catch up on AI, has been talking with a longtime rival: Meta. Facebook’s parent has held discussions with Apple about integrating Meta Platforms’ generative AI model into Apple Intelligence, the recently announced AI system for iPhones and other devices, according to people familiar with the matter. Meta and other companies developing generative AI are hoping to take advantage of Apple’s massive distribution through its iPhones—similar to what Apple offers with its App Store on the iPhone.”

“Evidence Of A Log Scaling Law For Political Persuasion With Large Language Models” (Hackenburg, et al.). “Large language models can now generate political messages as persuasive as those written by humans, raising concerns about how far this persuasiveness may continue to increase with model size…Our findings are twofold. First, we find evidence of a log scaling law: model persuasiveness is characterized by sharply diminishing returns, such that current frontier models are barely more persuasive than models smaller in size by an order of magnitude or more. Second, mere task completion (coherence, staying on topic) appears to account for larger models' persuasive advantage. These findings suggest that further scaling model size will not much increase the persuasiveness of static LLM-generated messages.”

“AI Is Exhausting The Power Grid. Tech Firms Are Seeking A Miracle Solution.” (Washington Post). “The mighty Columbia River has helped power the American West with hydroelectricity since the days of FDR’s New Deal. But the artificial intelligence revolution will demand more. Much more. So near the river’s banks in central Washington, Microsoft is betting on an effort to generate power from atomic fusion — the collision of atoms that powers the sun — a breakthrough that has eluded scientists for the past century. Physicists predict it will elude Microsoft, too.”

“After Almost 30 Years, Amazon’s Original Book Business Is Booming, Leaked Document Shows” (Business Insider). “Amazon got its start in 1994 by selling books. Decades later, this original business is thriving and massively outperforming its digital cousin, e-books. This is according to a detailed internal document obtained by Business Insider that discloses a host of new information and insights about Amazon’s book business and the broader publishing landscape.”

What we’re reading (6/23)

“America’s Top Export May Be Anxiety” (The Atlantic). “Smartphones are a global phenomenon. But apparently the rise in youth anxiety is not. In some of the largest and most trusted surveys, it appears to be largely occurring in the United States, Great Britain, Canada, Australia, and New Zealand. ‘If you’re looking for something that’s special about the countries where youth unhappiness is rising, they’re mostly Western developed countries,’ says John Helliwell, an economics professor at the University of British Columbia and a co-author of the World Happiness Report. ‘And for the most part, they are countries that speak English.’”

“These Hot New Funds Are ‘Boomer Candy’ For Retirees” (Wall Street Journal). “Baby boomers who aren’t ready to walk away from the stock market are flocking to a hot new class of funds. They are pouring billions of dollars into exchange-traded funds that use derivatives to produce extra dividend income or protect against losses. Such funds, which were almost nonexistent four years ago, give retirees and other investors the chance to chase stock returns while also protecting against a potential market slide. The funds have almost $120 billion in assets and have taken in at least $31 billion of new investor money over the past 12 months, according to FactSet.”

“The Stock Market Is In Its Longest Stretch Without A 2% Sell-Off Since The Financial Crisis” (CNBC). “Wall Street’s climb to record highs has come with conspicuously little volatility. The S&P 500 has gone 377 days without a 2.05% sell-off. That’s the longest stretch for the benchmark since the great financial crisis, according to FactSet data compiled by CNBC. The index hasn’t experienced a gain of at least 2.15% in that time either.”

“Going After The Middleman” (New York Times). “Business leaders have been combing through comments and transcripts to try to understand the pending priorities of regulators like Lina Khan, the chair of the Federal Trade Commission, and Assistant Attorney General Jonathan Kanter, the head of the Justice Department’s antitrust division. They’ve zeroed in on what may sound like a nerdy legal theory, but one that could have huge implications: the tyranny of the intermediary, middleman companies that abuse their role by squeezing out competition or creating artificially expensive moats. The Justice Department has already made one high-profile strike along these lines, suing to break up Ticketmaster and Live Nation.”

“Americans’ Spending Patterns Are Flashing A Warning Of A Possible Consumer-Led Recession” (Business Insider). “Consumers are finally starting to rein in their spending habits, which could weigh on the economy after a long period of robust spending has propped up economic growth over the past few years. Retail spending ticked 0.1% higher in May, but sales volume has dropped 1.3% year-over-year over the last three months, US Census data shows.”

What we’re reading (6/21)

“Under Armour To Pay $434 Million To Settle 2017 Shareholder Lawsuit” (CNBC). “Under Armour on Friday said it has agreed to pay $434 million to settle a 2017 class action lawsuit accusing the sports apparel maker of defrauding shareholders about its revenue growth in order to meet Wall Street forecasts. The proposed settlement, subject to court approval, averts a scheduled July 15 trial in Baltimore federal court.”

“Paul Singer Can Wait.” (Dealbreaker). “Paul Singer has been called a vulture. Told to go fuck himself, and undoubtedly, over a long career triggering migraines in adversaries, much worse. So we doubt that being compared to Yahwa Sinwar, Tim McVeigh and their like is going to do much to move him…In fairness, not everyone would agree that the such a terme de guerre is hyperbolic. And Singer has never been one to bow down before the bigger boys, be they Rupert Murdoch, Warren Buffett or an actual sovereign nation. So the fact that Veritas’ owner, the Carlyle Group, is a great deal bigger than Elliott Management’s own private equity business isn’t likely to concern Singer much.”

“Will Debt Sink The American Empire?” (Wall Street Journal). “History, however, offers some cautionary notes about the consequences of swimming in debt. Over the centuries and across the globe, nations and empires that blithely piled up debt have, sooner or later, met unhappy ends. Historian Niall Ferguson recently invoked what he calls his own personal law of history: ‘Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.’”

“The Economist Who Figured Out What Makes Workers Tick” (Wall Street Journal). “David Autor cut a peripatetic path through most of his 20s as a one-time college dropout and self-taught mechanic, before he stumbled into economics. ‘I fell into it assbackwards,’ he said. Today, his work is helping shape how the White House is approaching the biggest labor issues from responding to the threat of a ‘China Shock 2.0’ to thinking about the economic impacts of artificial intelligence. Autor has shown how the rise of the computer was hurting middle-class jobs. He sounded the alarm that workers in the South were getting pulverized by Chinese imports, years before Donald Trump was elected president, playing off this fear. Now, Autor’s research has taken an unexpectedly optimistic turn: He has shown how, after the pandemic struck, low-wage workers have started catching up. He holds a hopeful view of AI, arguing that it could help low-skilled workers. ‘To me, the labor market is the central institution of any society,’ said Autor, 60 years old. ‘The fastest way to improve people’s welfare is to improve the labor market.’”

“Political Expression of Academics on Social Media” (Prashant Garg and Thiemo Fetzer). “This paper describes patterns in academics' expression online found in a newly constructed global dataset covering over 100,000 scholars linking their social media content to academic record. We document large and systematic variation in politically salient academic expression concerning climate action, cultural, and economic concepts. We show that these appear to often diverge from general public opinion in both topic focus and style”

What we’re reading (6/21)

“Nvidia’s Success Is The Stock Market’s Problem” (Wall Street Journal). “The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and has made no progress at all this year. In the S&P 500, which includes the biggest companies, the average stock is about where it was at the start of 2022, and more than half of the current constituents are down since then. Worse still, only 198 have managed gains this month, even as the index reached new intraday highs on 11 out of 13 trading days.”

“OpenAI Competitor Anthropic Announces Its Most Powerful AI Yet” (CNBC). “OpenAI competitor Anthropic on Thursday announced Claude 3.5 Sonnet, its most powerful artificial intelligence model yet. Claude is one of the chatbots that, like OpenAI’s ChatGPT and Google’s Gemini, has exploded in popularity in the past year. Anthropic, which was founded by ex-OpenAI research executives, has backers including.”

“Transcendence: Generative Models Can Outperform The Experts That Train Them” (Zhang, et al.). “Generative models are trained with the simple objective of imitating the conditional probability distribution induced by the data they are trained on. Therefore, when trained on data generated by humans, we may not expect the artificial model to outperform the humans on their original objectives. In this work, we study the phenomenon of transcendence: when a generative model achieves capabilities that surpass the abilities of the experts generating its data. We demonstrate transcendence by training an autoregressive transformer to play chess from game transcripts, and show that the trained model can sometimes achieve better performance than all players in the dataset. We theoretically prove that transcendence is enabled by low-temperature sampling, and rigorously assess this experimentally. Finally, we discuss other sources of transcendence, laying the groundwork for future investigation of this phenomenon in a broader setting.”

“New York Governor Signs Bill Regulating Social Media Algorithms, In A US First” (CNN Business). “Big changes are coming for New York’s youngest social media users after Gov. Kathy Hochul signed two bills into law Thursday clamping down on digital platforms’ algorithms and use of children’s data. The unprecedented move makes New York the first state to pass a law regulating social media algorithms amid nationwide allegations that apps such as Instagram or TikTok have hooked users with addictive features. Hochul’s signature comes days after US Surgeon General Vivek Murthy called for warning labels to be applied to social media platforms, fueling a debate about social media’s potential impact on the mental health of users, particularly teens.”

“America's Middle Class Is Shrinking” (Newsweek). “America's middle class, traditionally considered the backbone of the nation and its economic engine, has been shrinking for the past 50 years, according to a recent Pew Research Center survey. A study based on government data released by the Washington-based nonpartisan fact tank in late May found that the share of Americans living in middle-class households dropped from 61 percent in 1971 to 51 percent in 2023. During the same time, the share of Americans living in lower income households rose from 27 percent to 30 percent, while that of individuals living in upper income households rose from 11 percent to 19 percent.”

What we’re reading (6/16)

“Investors Fear Long Stretch Of Calm in Markets Can’t Last” (Wall Street Journal). “Investors look sanguine, and analysts say they have good reason. The economy has remained stronger than almost anyone predicted after the Federal Reserve began raising interest rates. Corporate profits are rising again. Inflation cooled more than expected in last week’s consumer prices report, and Fed officials signaled that they expect to cut benchmark rates later this year.”

“What Is A ‘Zombie Mortgage’?” (New York Times). “For most buyers, mortgages are the cornerstone of purchasing a home. Sometimes a second mortgage is necessary, too, to cover the down payment, for instance. But what happens if that second mortgage seems to have been forgiven but actually still exists? Introducing: the ‘zombie mortgage.’ These aren’t creatures from the underworld, but mortgages that homeowners forgot about or lenders said they would write off, but didn’t, only to reappear years later, according to the Consumer Financial Protection Bureau.”

“The Media’s Role In Fracturing Sports” (Washington Post). “The pursuit of truth now competes with the desire for attention. It’s no contest, sadly. Instead of reporting, instead of wondering and scrutinizing, instead of building trust and gaining insight and providing context, we exhaust too many diminishing resources to facilitate screaming. There is seldom enough fresh information to react to, so we regurgitate arguments, only louder, all in the name of provocation.”

“Meta VPs Are Getting Squeezed Out Amid Mark Zuckerberg's ‘Permanent’ Efficiency Mode” (Business Insider). “As CEO Mark Zuckerberg makes what was a year of efficiency — in which more than 20,000 Meta employees were laid off — into a "permanent part" of how Meta operates, executives are not being shielded from tougher performance standards and ongoing reorganizations that are leading to incremental cuts to teams.”

“What Frank Lloyd Wright Tells Us About Late Bloomers” (Financial Times). “Many of Wright’s most significant buildings, including Fallingwater in Pennsylvania, the first Jacobs House in Wisconsin and the Guggenheim Museum, which still stands out futuristically in Manhattan, are the product of a late, unexpected period in his career. At 60, he was in decline; at 80, he was in the ascendant. He did more than half his work in the last quarter of his life. His final decade was his most productive. In other words, Wright was a late bloomer. Prior to his second act, he had been written off by an architecture establishment that could no longer see his potential. So many late bloomers hide in the open like this: among them Harry Truman, Margaret Thatcher and Katharine Graham. Jonathan Yeo, who produced the portrait of King Charles, only began to paint in his twenties. Penelope Fitzgerald wrote her first novel at 60. Young stars may be more visible, more celebrated, but late bloomers lurk among us.”

What we’re reading (6/15)

“The Good Economic News This Week Was Just That … Good News” (CNN Business). “When economic reports are released that are solid, they have all too often been clouded with concerns that good news for the economy actually means a longer wait before the Federal Reserve rolls out rate cuts. This week, a string of good news was actually good news: Closely watched inflation gauges showed prices had cooled more than anticipated; Americans’ financial outlooks were rosier than they have been in years while their inflation expectations dipped; and, on Friday, US import prices reversed course and fell sharply, adding fuel to the disinflationary fire.”

“Southwest Changed Flying. Now It Can’t Change Fast Enough.” (Wall Street Journal). “Elliott Investment Management, the influential New York hedge fund, says Southwest is stuck in the past. The activist investor says it has amassed a $1.9 billion stake, which amounts to an approximately 11% economic interest in the airline, making it one of Southwest’s biggest shareholders—and its most vocal critics. This past week it demanded Southwest oust its CEO, overhaul the board, and consider shaking up its business model. Southwest became the biggest U.S. airline by domestic passengers by doing things its own way. Trouble is, that’s no longer working so well.”

“The AI Bill That Has Big Tech Panicked” (Vox). “If I build a car that is far more dangerous than other cars, don’t do any safety testing, release it, and it ultimately leads to people getting killed, I will probably be held liable and have to pay damages, if not criminal penalties. If I build a search engine that (unlike Google) has as the first result for ‘how can I commit a mass murder’ detailed instructions on how best to carry out a spree killing, and someone uses my search engine and follows the instructions, I likely won’t be held liable, thanks largely to Section 230 of the Communications Decency Act of 1996. So here’s a question: Is an AI assistant more like a car, where we can expect manufacturers to do safety testing or be liable if they get people killed? Or is it more like a search engine?”

“How Jeff Bezos Is Trying To Fix The Washington Post” (New York Times). “Mr. Bezos, aware of the growing business problems, started paying more attention to his purchase last year. In June, the company announced that Fred Ryan, the chief executive since 2014, would be stepping down and that Patty Stonesifer, a veteran technology executive and a confidante of Mr. Bezos, would temporarily take over.”

“Wells Employees, So Adept At Forging Signatures And Altering Time Stamps Discover Power Automate” (Dealbreaker). “For years, Wells Fargo has been very clear: It does the screwing over of other people/places/things. It does not get screwed over itself! Not by its vendors, and certainly not by its employees. And yet those employees continue to (allegedly) find new ways to screw Wells Fargo over.”

What we’re reading (6/14)

“Hot Funds And The Curse Of ‘Self-Inflated Returns’” (Wall Street Journal). “What your exchange-traded fund owns is important. Who else owns your ETF might be even more important. That’s because a fund’s returns often don’t depend merely on the behavior of the investments it buys, but also on the behavior of the investors who buy the fund. Hot money—a sudden influx of cash from people trying to get rich quick—can overheat an ETF and create what new research calls ‘self-inflated returns.’ The result, sooner or later, is self-inflicted losses. Fortunately, you can protect yourself with some common sense.”

“Larry Summers Isn’t Second-Guessing The Government On Inflation” (New York Times). “Dissatisfaction with high interest rates and the unavailability of consumer credit explains why consumer sentiment is worse than would be expected given current levels of inflation and unemployment, Lawrence Summers, the former Treasury secretary and Harvard president, wrote in February in a working paper with three other economists…You might be surprised, then, that Summers is not arguing for the Bureau of Labor Statistics to put interest rates in the Consumer Price Index. ‘I don’t think the purpose of the C.P.I. is to predict people’s sentiment,’ he told me this week. ‘The purpose is to measure the cost of goods and services.’”

“Caught You Faking: Wells Fargo Firings Expose Workplace Surveillance Dilemma” (Axios). “Wells Fargo’s decision to fire more than a dozen employees for ‘simulation of keyboard activity’ points to a simmering tension in the post-pandemic workplace…Major employers are using surveillance tools to ensure that no matter where people work, they're at their computers — but polls suggest doing so is risky for morale…Wells Fargo didn't say whether the employees — from the company's wealth- and investment-management unit — were working remotely, or how they were faking the ‘impression of active work,’ Bloomberg reports.”

“Why The Stock Market Has Risen Even With No Fed Rate Cuts” (New York Times). “The Federal Reserve has disappointed investors this year, but no matter. The markets have adjusted. Even without any interest rate cuts so far in 2024 — and with the likelihood of just one meager rate reduction by the end of the year — the stock market has been purring along. That’s quite an achievement, given the expectation in January that the Fed would trim rates six or seven times in 2024 — and that interest rates throughout the economy would be much lower by now.”

“Roaring Kitty Becomes The 4th Largest GameStop Shareholder After Nearly Doubling His Position To 9 Million Shares” (Business Insider). “Keith Gill, better known as Roaring Kitty on social media, appears to have nearly doubled his position in GameStop stock. According to a screenshot of his E*Trade portfolio posted to Reddit on Thursday, Gill now owns nine million shares of GameStop. Gill had previously owned 5 million shares of GameStop and 120,000 call option contracts with a $20 strike price that were set to expire next week. With Gill's massive options position in the money, he partially sold the options and exercised some to acquire an additional 4 million shares at $20 each.”

What we’re reading (6/10)

“Apple Is Bringing One Of iPhone Owners’ ‘Most Requested’ Features To Text Messages” (Business Insider). “Apple’s iOS 18 update will come with the ability to schedule text messages to be sent at a later time, it announced Monday at its annual WWDC event. It’s among the ‘most requested’ features and can come in handy for things like sending a reminder or remembering to wish a friend happy birthday, Ronak Shah, Apple’s director of internet-technologies product marketing, said.”

“Gen Z Plumbers And Construction Workers Are Making #BlueCollar Cool” (Wall Street Journal). “Skepticism about the cost and value of four-year degrees is growing, and enrollment in vocational programs has risen as young people pursue well-paying jobs that don’t require desks or so much debt, and come with the potential to be your own boss. The number of students enrolled in vocational-focused community colleges rose 16% last year to its highest level since the National Student Clearinghouse began tracking such data in 2018.”

“A New Measure Shows C.E.O. Pay At Even More Astronomical Levels” (New York Times). “Twelve years after the enactment of Dodd-Frank, the Securities and Exchange Commission approved additional rules for assessing C.E.O. pay. Virtually all publicly traded companies have been subject to these ‘compensation actually paid’ rules this year. The new approach is supposed to help shareholders determine whether an executive’s compensation is aligned with their company’s stock market return. It emphasizes the annual changes in value of an executive’s current and potential stock holdings, in contrast with the traditional approach, which provides a snapshot of the estimated value of a pay package when it is granted.”

“OpenAI Hires New CFO And Product Chief, Announces Apple Deal To Integrate ChatGPT” (CNBC). “OpenAI on Monday hired two top executives and announced a partnership with Apple that includes a ChatGPT-Siri integration, the company announced in two blog posts. The company said Sarah Friar, previously CEO of Nextdoor and finance chief at Square, is joining as chief financial officer. Friar co-chairs the Stanford Digital Economy Lab. ‘She will lead a finance team that supports our mission by providing continued investment in our core research capabilities, and ensuring that we can scale to meet the needs of our growing customer base and the complex and global environment in which we are operating,’ OpenAI wrote in a blog post. OpenAI also hired Kevin Weil, an ex-president at Planet Labs, as its new chief product officer, according to the blog post.”

“Walmart Store Closures Are A Warning Sign Of Retail Apocalypse With Other Chains Also Facing Threat, Expert Says” (The U.S. Sun). “Walmart, which operates 5,000 stores in the US, is also reportedly laying off hundreds of corporate employees as the company urges remote workers to come into work. Retail analyst Neil Saunders told Yahoo that Walmart's closures in 2016, captured by retail photographer Nicholas Eckhart, were the beginning of a pattern in store cuts. ‘The blunt truth is that while stores remain a vital part of the retail mix, they are not quite as relevant as they used to be,’ the expert told the outlet.”

What we’re reading (6/9)

“A Crypto Bull’s Big Tax Settlement” (DealBook). “The attorney general for the District of Columbia has reached a $40 million settlement with the billionaire Bitcoin investor Michael Saylor and MicroStrategy, the software company he founded, over tax fraud, DealBook’s Lauren Hirsch is first to report. Officials say the agreement is the biggest-ever income tax fraud recovery in the district. It’s also the first lawsuit under the district’s amended False Claims Act, which encourages whistle-blowers to file claims of tax evasion against residents who they say are concealing where they actually live.”

“Colorado’s Weed Market Is Coming Down Hard And It’s Making Other States Nervous” (Politico). “What once was a success story has now left a trail of failed businesses and cash-strapped entrepreneurs in its wake. Regulatory burdens, an oversaturated market and increasing competition from nearby states have all landed major blows, leaving other states with newer marijuana markets scrambling to avoid the same mistakes.”

“A Researcher Fired By OpenAI Published A 165-Page Essay On What To Expect From AI In The Next Decade. We Asked GPT-4 To Summarize It.” (Business Insider). “Leopold Aschenbrenner, a researcher fired from OpenAI in April, published his thoughts on the AI revolution in an epic 165-page treatise…Aschenbrenner's essay doesn't appear to include sensitive details about OpenAI. Instead, as Aschenbrenner writes on the dedication page, it’s based on ‘publicly available information, my own ideas, general field knowledge, or SF gossip.’”

“Why You Shouldn’t Obsess About The National Debt” (Paul Krugman). “First, while $34 trillion is a very large figure, it’s a lot less scary than many imagine if you put it in historical and international context. Second, to the extent debt is a concern, making debt sustainable wouldn’t be at all hard in terms of the straight economics; it’s almost entirely a political problem. Finally, people who claim to be deeply concerned about debt are, all too often, hypocrites — the level of their hypocrisy often reaches the surreal.”

“Gold Is Getting Harder To Find As Miners Struggle To Excavate More, World Gold Council Says” (CNBC). “The gold mining industry is struggling to sustain production growth as deposits of the yellow metal become harder to find, according to the World Gold Council. ‘We’ve seen record first quarter mine production in 2024 up 4% year on year. But the bigger picture, I think about mine production is that, effectively, it plateaued around 2016, 2018 and we’ve seen no growth since then,’ WGC Chief Market Strategist John Reade said.”

What we’re reading (6/8)

“Why The Pandemic Probably Started In A Lab, In 5 Key Points” (New York Times). “[A] growing volume of evidence — gleaned from public records released under the Freedom of Information Act, digital sleuthing through online databases, scientific papers analyzing the virus and its spread, and leaks from within the U.S. government — suggests that the pandemic most likely occurred because a virus escaped from a research lab in Wuhan, China. If so, it would be the most costly accident in the history of science.”

“The Unexpected Origins Of A Modern Finance Tool” (MIT News). “Discounting calculations are ubiquitous today — thanks partly to the English clergy who spread them amid turmoil in the 1600s, an MIT scholar shows.”

“Beneath The Calm Market, Stocks Are Going Haywire” (Wall Street Journal). “It is easy to look at the piddling daily moves in the S&P 500 and think the market has been oh-so-boring recently. There hasn’t been a 2% move since February and the VIX gauge of expected volatility is only up a bit from the postpandemic low reached last month. Under the calm surface, however, there is furious paddling. Only once in the past 25 years have stocks swung about like this while the overall market stayed so placid. Traders in the options markets are betting on its continuing: Prices indicate the biggest swings in stocks for at least 10 years relative to the prevailing calm for the S&P 500.”

“Zombies: Ranks Of World’s Most Debt-Hobbled Companies Are Soaring, And Not All Will Survive” (Associated Press). “They are called zombies, companies so laden with debt that they are just stumbling by on the brink of survival, barely able to pay even the interest on their loans and often just a bad business hit away from dying off for good. An Associated Press analysis found their numbers have soared to nearly 7,000 publicly traded companies around the world — 2,000 in the United States alone — whiplashed by years of piling up cheap debt followed by stubborn inflation that has pushed borrowing costs to decade highs. And now many of these mostly small and mid-sized walking wounded could soon be facing their day of reckoning, with due dates looming on hundreds of billions of dollars of loans they may not be able to pay back.”

“Celebrating The Glamorous Heyday Of The Department Store” (Washington Post). “Convinced that top-notch service was key to their success, department stores offered their employees handsome salaries and often provided their staff with in-house health care and even resorts. They could take free courses in interior design and merchandising at New York University. The stores were, Satow posits in several compelling ways, a way for women to get ahead when few professional avenues were available to them.”

What we’re reading (6/7)

“Keith Gill’s Riotous Return To YouTube Had Beer, Charts And A GameStop Pep Talk” (Wall Street Journal). “Keith Gill’s livestream Friday had many of the same ingredients as the 2021 videos that made him a legend to scores of everyday investors eager to strike it big in the stock market. He donned sunglasses. He spoke from his signature red gaming chair. He poured a beer, cracked jokes and cheered on the Celtics. He even had a few props, including his Magic 8 Ball. ‘It’s five o’clock somewhere,’ Gill said. The crowd loved it.”

“Roaring Kitty Rambled About Memes, Guzzled A Beer, And Revealed His E-Trade Account In A Long-Awaited Livestream. It Couldn’t Reverse A 41% Decline In The Stock.” (Business Insider). “Gill also revealed his portfolio, which was worth $350 million as of 1 p.m. ET on Friday. Apart from talking about GameStop, Gill confirmed that he's behind all of his social-media accounts and that he did not sell any, as some on the internet had speculated. Gill told viewers that only his money was behind his $350 million position in GameStop and that he's not working with anyone else.”

“‘Everything Is Not Going to Be OK’ In Private Equity, Apollo’s Co-President Says” (Bloomberg). “‘I’m here to tell you everything is not going to be ok,’ the Apollo co-president said in a session at the SuperReturn International conference in Berlin on Wednesday. ‘The types of PE returns it enjoyed for many years, you know, up to 2022, you’re not going to see that until the pig moves through the python. And that is just the reality of where we are.’ Private equity firms didn’t take significant markdowns during the recent period of rapid rate hikes which means that ‘investors of all sorts are going to have swallow the lump moving through the system,’ he said, referring to assets that private equity firms bought up until 2022. Funds are now holding on to these companies and will eventually have to refinance at higher rates.”

“The Slow Death Of A Fabled Media Empire” (New York Times). “Because Paramount Global’s ownership structure gives all power to its largest voting shareholder, the company’s future comes down to the whims of just one person: the 70-year-old heiress Shari Redstone. She chose to put Paramount on the block, and she alone is deciding between a buyer whose strategy could very well further weaken, or kill, these cultural icons — and one that at least allows for some hope of a creative revival. She could, of course, reject both options, and try to maintain what’s left of the status quo. Is this how we want our cultural future to be decided?”

“Procyclical Stocks Earn Higher Returns” (William Goetzmann, Akiko Watanabe, and Masahiro Watanabe). “We find that procyclical stocks, whose returns comove with business cycles, earn higher average returns than countercyclical stocks. We use almost a three-quarter century of real GDP growth expectations from economists’ surveys to determine forecasted economic states. This approach largely avoids the confounding effects of econometric forecasting model error. The loading on the expected real GDP growth rate is a priced risk measure. A fully tradable, ex-ante portfolio formed on this loading generates a procyclicality premium that is statistically significant, economically large, long-lasting over a few years, and independent of the size, book-to-market, and momentum effects.”

What we’re reading (6/3)

“NYSE Says Technical Issue That Caused Berkshire Hathaway To Be Displayed Down 99% Is Fixed” (CNBC). “A technical issue on Monday caused the A-class shares of Warren Buffett’s Berkshire Hathaway to appear to be down nearly 100% on the New York Stock Exchange for most of the morning trading period. Trading was halted in those shares, as well as in Barrick Gold and Nuscale Power, which had also seen dramatic falls. All three stocks have since resumed trading.”

“‘Roaring Kitty’ Post Seems To Show Trader Held Onto Giant GameStop Stake After Monday’s Rally” (CNBC). “Gill, whose handle is ‘DeepF------Value’ on Reddit and ‘Roaring Kitty’ on YouTube and X, posted another screenshot of his portfolio showing the same common stock and call option holdings Monday after the stock market closed as those he shared Sunday evening. He still owned 5 million shares of GameStop and 120,000 call options with a strike price of $20 that expire on June 21, the screenshot showed. The post on Reddit’s r/SuperStonk forum could not be independently verified by CNBC. “

“E*Trade Considers Kicking Meme-Stock Leader Keith Gill Off Platform” (Wall Street Journal). “Shortly before Gill reignited a meme-stock craze in May, he bought a large volume of GameStop options on E*Trade, the people said. This week, Gill posted screenshots of an E*Trade account showing he owns GameStop shares now valued at $140 million and a new set of options that expire later this month. His total gains on the positions were at $85.5 million, he posted late Monday, showing his account remained in operation. The stock of GameStop surged again on his posts, showing the power Gill, also known as Roaring Kitty and DeepF—Value, has as an influencer. GameStop shares, up 21% on Monday, have risen more than 60% since he reappeared.”

“Oil And Gas Companies Are Trying to Rig The Marketplace” (New York Times). “[Y]ou might reasonably conclude that the market is pivoting, and the end for fossil fuels is near. But it’s not. Instead, fossil fuel interests — including think tanks, trade associations and dark money groups — are often preventing the market from shifting to the lowest cost energy.”

“Wealth Inequality In A Low Rate Environment” (Matthieu Gomez, Econometrica). “We study the effect of interest rates on wealth inequality. While lower rates decrease the growth rate of rentiers, they also increase the growth rate of entrepreneurs by making it cheaper to raise capital. To understand which effect dominates, we derive a sufficient statistic for the effect of interest rates on the Pareto exponent of the wealth distribution: it depends on the lifetime equity and debt issuance rate of individuals in the right tail of the wealth distribution. We estimate this sufficient statistic using new data on the trajectory of top fortunes in the U.S. Overall, we find that the secular decline in interest rates (or more generally of required rates of returns) can account for about 40% of the rise in Pareto inequality; that is, the degree to which the super rich pulled ahead relative to the rich.”

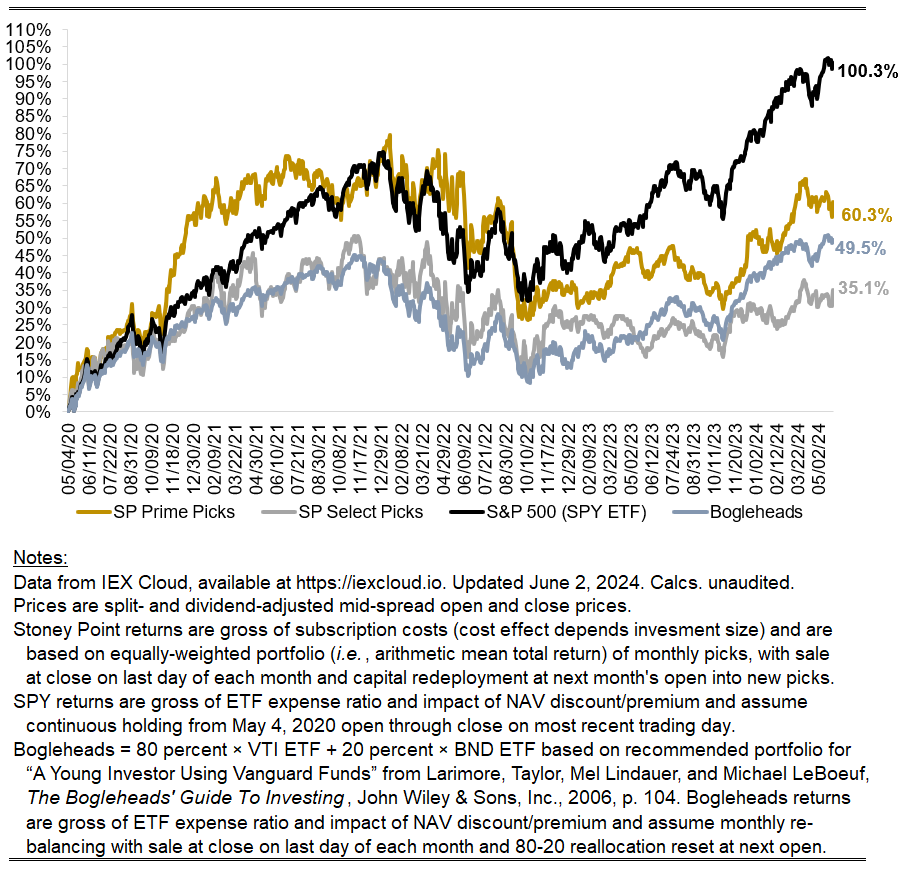

May performance update

Here with a May performance update:

Prime: +1.33%

Select: +3.38%

SPY ETF: +5.18%

Bogleheads portfolio (80% VTI, 20% BND): 4.15%

A fine month overall for the Stoney Point strategies, and one that historically would be considered quite strong. But the market overall continues to perform even better, with an extraordinarily good month. Qualitatively, AI hopes appear to continue to power the S&P higher. I posted an article a few days ago highlighting that four companies now represent nearly 40% of the S&P index. Unsurprisingly, these are all AI giants. Time will tell whether the commercial opportunity for that will live up to the hype, but so far it seems to be a good bet.